Академический Документы

Профессиональный Документы

Культура Документы

Banks in One Form or Another Have Been Subject To The Following Non Exhaustive List of Regulatory Provisions

Загружено:

AshrafulОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Banks in One Form or Another Have Been Subject To The Following Non Exhaustive List of Regulatory Provisions

Загружено:

AshrafulАвторское право:

Доступные форматы

1.

Banks in one form or another have been subject to the following non exhaustive list of regulatory provisions:1) restrictions

on branching and new entry;2) restrictions on pricing (interest rate controls and other controls on prices or fees);3) line-of-

business restrictions and regulations on ownership linkages among financial institutions;4) restrictions on the portfolio of

assets that banks can hold (such as requirements to hold certain types of securities or requirements and/or not to hold

other securities, including requirements not to hold the control of non financial companies);5) compulsory deposit

insurance (or informal deposit insurance, in the form of an expectation that government will bail out depositors in the event

of insolvency);6) capital-adequacy requirements;7) reserve requirements (requirements to hold a certain quantity of the

liabilities of the central bank);8) requirements to direct credit to favored sectors or enterprises (in the form of either formal

rules, or informal government pressure);9) expectations that, in the event of difficulty, banks will receive assistance in the

form of “lender of last resort”;10) special rules concerning mergers (not always subject to a competition standard) or failing

banks (e.g., liquidation, winding up, insolvency, composition or analogous proceedings in the banking sector);

Вам также может понравиться

- ID#16102091 Pranta Sarker Accounting.Документ64 страницыID#16102091 Pranta Sarker Accounting.AshrafulОценок пока нет

- Definition of Corporate Finance: 2. Who Is The Head of Finance in Corporation?Документ12 страницDefinition of Corporate Finance: 2. Who Is The Head of Finance in Corporation?AshrafulОценок пока нет

- Oral Test of ELCT For Summer 2020 - Student ListДокумент20 страницOral Test of ELCT For Summer 2020 - Student ListAshrafulОценок пока нет

- Practicum Report (16202022)Документ88 страницPracticum Report (16202022)AshrafulОценок пока нет

- General Banking Activities of EXPORT Import (Exim) Bank Ltd-A Study On Paltan BranchДокумент60 страницGeneral Banking Activities of EXPORT Import (Exim) Bank Ltd-A Study On Paltan BranchAshrafulОценок пока нет

- HRD 01 003Документ1 страницаHRD 01 003AshrafulОценок пока нет

- The Impact of COVID-19 On The Cement IndustryДокумент8 страницThe Impact of COVID-19 On The Cement IndustryAshrafulОценок пока нет

- ART 103 Summer'2020 Sec DA - 1Документ5 страницART 103 Summer'2020 Sec DA - 1AshrafulОценок пока нет

- General Banking of EXPORT IMPORT BANK Bangladesh Limited (Exim Bank) and A Comparative Study Between Islami Banking and Conventional BankingДокумент64 страницыGeneral Banking of EXPORT IMPORT BANK Bangladesh Limited (Exim Bank) and A Comparative Study Between Islami Banking and Conventional BankingAshrafulОценок пока нет

- Human Resource Management: Senior Lecturer / College of Business AdministrationДокумент5 страницHuman Resource Management: Senior Lecturer / College of Business AdministrationAshrafulОценок пока нет

- RainbowДокумент15 страницRainbowAshrafulОценок пока нет

- Final Exam On Conflict Removed Summer-2020: September 06, 2020Документ4 страницыFinal Exam On Conflict Removed Summer-2020: September 06, 2020AshrafulОценок пока нет

- My SpeechДокумент2 страницыMy SpeechAshrafulОценок пока нет

- MahirДокумент1 страницаMahirAshrafulОценок пока нет

- Program: BBA, Course: Marketing Management, Code: MKT 301, Sec-B, Instructor: Kazi AhmedДокумент2 страницыProgram: BBA, Course: Marketing Management, Code: MKT 301, Sec-B, Instructor: Kazi AhmedAshrafulОценок пока нет

- Life Insurance: Financial Institution Savings MortgageДокумент2 страницыLife Insurance: Financial Institution Savings MortgageAshrafulОценок пока нет

- Abstract:: The Impact of Exchange Rate Fluctuations On Foreign Direct Investment in NigeriaДокумент7 страницAbstract:: The Impact of Exchange Rate Fluctuations On Foreign Direct Investment in NigeriaAshrafulОценок пока нет

- Xiaomi Ansoff Matrix - NAIMДокумент2 страницыXiaomi Ansoff Matrix - NAIMAshrafulОценок пока нет

- Swift Transportation Company Porter Five Forces AnalysisДокумент5 страницSwift Transportation Company Porter Five Forces AnalysisAshrafulОценок пока нет

- NaimДокумент2 страницыNaimAshrafulОценок пока нет

- HR Activities in Nitol Motors LTDДокумент19 страницHR Activities in Nitol Motors LTDAshrafulОценок пока нет

- A Summary On The Impacts of Exchange Rate On Economic Growth in CambodiaДокумент5 страницA Summary On The Impacts of Exchange Rate On Economic Growth in CambodiaAshrafulОценок пока нет

- MGT 403Документ2 страницыMGT 403AshrafulОценок пока нет

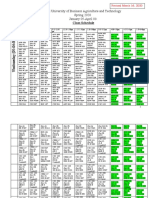

- IUBAT-International University of Business Agriculture and Technology Spring 2020 January 05-April 08Документ40 страницIUBAT-International University of Business Agriculture and Technology Spring 2020 January 05-April 08AshrafulОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)