Академический Документы

Профессиональный Документы

Культура Документы

Mountain Man Case Study

Загружено:

karthikawarrierОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mountain Man Case Study

Загружено:

karthikawarrierАвторское право:

Доступные форматы

Q: What has made MMBC a strong brand?

Great Product :

MMBC had made a quality product with attributes like smoothness, percentage of

water content and drinkability, added with distinctive bitterness and higher alcohol

content. This appealed to the previous generation of beer drinkers (now at the age of

45 and above) and contributed to the company's brand equity.

Good Product Positioning:

MMBC positioned the Mountain man Lager such that it appealed to their then core

customers - Blue collar working men in the age of 45 or above & customers in the

middle to lower income customers ).The label was designed such that it is related to

the core customers and was relevant to them.

Great brand reputation and Investment in brand equity:

Mountain Man Leger was regarded as West Virginia’s beer and had a very good

brand reputation owing to its history and its status as an independent family owned

brewery, creating an aura of authenticity.

Loyal customer base:

MMBC invested heavily on brand equity over the years and has built a very loyal

customer base ( the brand loyalty rate for mountain man lager was 53% which was

higher than the rate for competitive products).

Large enough market :

It had chartered to the needs of a large enough market.

Q: Despite being a strong brand what caused its decline?

Changing Consumer preference :

Change in beer drinkers preference.In the current beer market , light beer command

a market share of 50%, with the youth preferring light beer. The youth now occupied

27% of the total beer drinking population.

Increasing Competition due to changes in Law:

Competition in west Virginia market increased due to removal of the arcane law that

prevented retail stores from selling beer.Retailers now started selling beers at deep

discounts. MMBC, which concentrated its sales in retail and other off premise

locations was now facing competition from other brands sold at high discounts.

Pricing Competition from larger players:

MMBC did not have economies of scale in brewing, transportation etc, to match the

national beer companies and thus was pressurised by them.

Shrinking existing customer segment:

The premium lager segment was shrinking at a rate of 4% yearly and the aging

demography meant that the segment would continue to shrink as the youngsters

preferred light beer (now increasing at 4% yearly).

Weaker brand presence in potential areas of sales:

Mountain man’s core customers did not have any brand preference in on-premise ,

thus weakening its position weaker in on-premise.

Overall decrease in Beer market leading to reducing revenue:

Beer consumption per capita went down by 2.3% due Increase in federal tax in 2001,

competition from wine and spirits-based drinks, health concerns etc.

Q: Should MMBC introduce light beer?

Yes, MMBC must introduce light beer for the following reasons:

Light beer sales in the US has been growing at 4% annual rate and at the

same time, traditional beer sales in the US has been declining at 4%.

Light beer now commanded the majority market share with 50% and the

young population which consumed light beer spent twice as much per capita

on alcoholic beverages as compared to consumers over 35 years of age,who

appreciated the Mountain beer Lager.

The advantage of a large enough market, which MMBC had, is now eroding

due to aging population, meaning that the company would need to have a

foothold in new markets.

Young population does not have brand loyalty yet, and thus it gives the

company an opportunity to convert them into loyal customers especially

because they are well aware of the brand and because of its goodwill among

the young due to their “anti big business “ preference .

Young population prefers light beers, and thus a light beer from the MMBC

brand would allow conversion of youth into loyal consumers.

Q: Is ‘Mountain Man Light’ feasible?

Yes. Cost Analysis are as below:

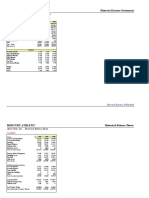

1. Light Beer Sales Evaluation Year

Year 2005 200 200 2008

6 7

Light Beer Consumption 18,744,303 19,494,075 20,273,838 21,084,792

Growth % 4% 4% 4% 4%

Estimated Growth (0.25 0 0.25 0.5 0.75

compounded annually)

Estimates Sales in barrels 48,735 101,369 158,136

Estimated revenue($97/ barrel) 4,727,295 9,832,793 15,339,192

2. Mountain Man Light Break-even analysis for Mountain Light beer(2006- 2007)

Variable Cost Calculations

Variable cost of MM $ 66.93

lager

Variable cost of MM light $ 66.93 + $ 4.69 = $71.62

Price/barrel $ 97

Net profit margin on Light $ 25.38 (97- 71.62)

3. Mountain Man Light Fixed cost calculations(without cannibalization)

Initial advertising campaign cost $750,000

Incremental SG&A cost (2006-07) $900,000*2= $18,00,000

Total fixed cost $2,550,000

Fixed cost calculations(with 20% cannibalization 2% loss)

Cost from cannibalization(22% for 2 $437,226+$341,036 =

years) $778,262

TFC(with cannibalization 22% for 2 $3,328,262

years)

4. Mountain Man light To breakeven

Total Breakeven volume = Fixed $2550000/$25.38 = 100,473 barrels

costs/Net profit margin

(without cannibalization)

Total breakeven revenue = Total $ 100,473 *$97 = $9,74,581 To

Breakeven volume * price/barrel breakeven (with cannibalization)

Total breakeven volume = Fixed costs/ $ 3328262/$25.38 = $131,137 barrels

net profit margin

(with cannibalization)

Total Breakeven revenue = Total $131,137*$97 = $12, 720,308

breakeven volume *price/barrel

5. Mountain Man Light Mountain Man Light beer will break even in both scenarios by

end of 2007

Revenue needed to breakeven (without cannibalization) $9,745,881

Revenue needed to breakeven(with cannibalization) $12,720,308

Estimated revenues for Mountain Man Light beer

For 2006 $ 4,727,295

For 2007 $ 9,832,793

Total revenues at the end of 2007 $ 14,560,088

Q: Should it be launched?

Yes. It should be launched for the following reasons :

A 0.5% capture of market share is possible by 2007 with the given market situation

considering 20% cannibalization of shares with 2% revenue loss (as mentioned in

feasibility study).

The Return on investment can be realised in 2 years (in accordance to CFO’s

requirement).

Chris should devise an effective marketing strategy using the 4-Ps mix to enhance

brand image and provide value to newer customers without losing focus on their core

customers. He must design the bottle and advertise the light beer to target the young

beer drinking population, just as the original Mountain Man lager bottle was designed

for its then core customers.

Focus should be on on-premise sales for light lager and off-premise for lager. This

is because while the youth (both men and women) frequented restaurants and bars,

the Core customers (older customers) predominantly purchased from off-premise

locations.

This would ensure less to no cannibalization.

The core customers were extremely loyal and as said by the 50 year old customer in

the focus group they are satisfied as long as the mountain man lager is not changed.

Вам также может понравиться

- Vora & Company case study analysisДокумент6 страницVora & Company case study analysisPrashant NarulaОценок пока нет

- GCP - Group 8Документ9 страницGCP - Group 8Anosh DoodhmalОценок пока нет

- Precise Software Solutions Case ROI and Pricing AnalysisДокумент2 страницыPrecise Software Solutions Case ROI and Pricing AnalysisRevappa YeddeОценок пока нет

- Strategy: Strategy and Tactics Differ Mainly Around Time ScaleДокумент18 страницStrategy: Strategy and Tactics Differ Mainly Around Time Scalemash68Оценок пока нет

- Dettol Marketing Research For Understanding Consumer Evaluations of Brand ExtensionsДокумент9 страницDettol Marketing Research For Understanding Consumer Evaluations of Brand ExtensionsNaveen OraonОценок пока нет

- TFC Scenario AnalysisДокумент3 страницыTFC Scenario AnalysisAshish PatelОценок пока нет

- Managing the commercialization of Kunst 1600 pumpsДокумент3 страницыManaging the commercialization of Kunst 1600 pumpskartikОценок пока нет

- Wildfang CalculationsДокумент2 страницыWildfang CalculationsGonçalo RodriguesОценок пока нет

- Case Study: Global Wine War 2009: Brandon Bullock Gabriel Esuola James Jennings Christa Thomas Richard ZerbeДокумент44 страницыCase Study: Global Wine War 2009: Brandon Bullock Gabriel Esuola James Jennings Christa Thomas Richard ZerbeMillena NascimentoОценок пока нет

- Nor'easter First SeasonДокумент7 страницNor'easter First SeasonploganОценок пока нет

- HasbroPOX (A)Документ6 страницHasbroPOX (A)Parnamoy DuttaОценок пока нет

- Samantha Seetaram IENG3003 Assignment1Документ15 страницSamantha Seetaram IENG3003 Assignment1Samantha SeetaramОценок пока нет

- Process Selection and Design OptimizationДокумент34 страницыProcess Selection and Design OptimizationAlex Francis0% (1)

- Case 2 & 3 - Cashing Our & Indian Sugar IndustryДокумент8 страницCase 2 & 3 - Cashing Our & Indian Sugar Industrymohitrameshagrawal100% (2)

- MakeMyTrip Limited Porter Five (5) Forces & Industry Analysis (Strategy)Документ11 страницMakeMyTrip Limited Porter Five (5) Forces & Industry Analysis (Strategy)Tulika singhОценок пока нет

- B2B Marketing - Jyoti - Sagar - P19052Документ5 страницB2B Marketing - Jyoti - Sagar - P19052JYOTI TALUKDARОценок пока нет

- Mission-Driven Ice Cream StrategyДокумент20 страницMission-Driven Ice Cream StrategyVishalОценок пока нет

- Financial Management Project Group 7Документ8 страницFinancial Management Project Group 7Vivek RanaОценок пока нет

- BPCLДокумент17 страницBPCLTausif KhanОценок пока нет

- RIN Detergent Dilemma: Position vs RepositionДокумент7 страницRIN Detergent Dilemma: Position vs RepositionRakesh SahОценок пока нет

- Group 8 - Managing The CompetitionДокумент7 страницGroup 8 - Managing The CompetitionAshish DrawkcabОценок пока нет

- MGECДокумент8 страницMGECSrishtiОценок пока нет

- Metabical Demand/Pricing Formulation Executive Summary:: ST ND RD THДокумент5 страницMetabical Demand/Pricing Formulation Executive Summary:: ST ND RD THRizki EkaОценок пока нет

- Mountain Man Brewing Company Explores Brand ExtensionДокумент32 страницыMountain Man Brewing Company Explores Brand ExtensionRahul Goyal100% (1)

- 49615Документ17 страниц49615Deepak ChiripalОценок пока нет

- Colgate Strategy SheetДокумент3 страницыColgate Strategy SheetShubham PatelОценок пока нет

- FlareДокумент1 страницаFlareVeni Gupta0% (1)

- Vora and Company Case StudyДокумент4 страницыVora and Company Case StudyShubhajit Nandi100% (3)

- T8 RevivalДокумент6 страницT8 RevivalSumit AggarwalОценок пока нет

- Q2) List Out Problems Regarding: (A) Product Features and Benefits (B) Package (Material, DesignДокумент4 страницыQ2) List Out Problems Regarding: (A) Product Features and Benefits (B) Package (Material, Designrajesh shekarОценок пока нет

- Giant Consumer ProductsДокумент9 страницGiant Consumer ProductsPriyank BavishiОценок пока нет

- Ome Merged PDFДокумент311 страницOme Merged PDFNavya MohankaОценок пока нет

- Tanya: Product Life CycleДокумент8 страницTanya: Product Life CycleJoey G CirilloОценок пока нет

- Personal Development Plan for Public Policy Career GrowthДокумент7 страницPersonal Development Plan for Public Policy Career GrowthAlexander BelkinОценок пока нет

- 1 Sampling DistДокумент35 страниц1 Sampling DistYogeshОценок пока нет

- Case Analysis Managing The Competition: Category Captaincy On The Frozen Food AisleДокумент9 страницCase Analysis Managing The Competition: Category Captaincy On The Frozen Food AisleEina GuptaОценок пока нет

- Vanguard CaseДокумент6 страницVanguard CaseRachel LewisОценок пока нет

- Individual Write Up - MMBCДокумент5 страницIndividual Write Up - MMBCmradulraj50% (2)

- Fake Brand AssignmentДокумент5 страницFake Brand AssignmentMeetu RawatОценок пока нет

- Sol MicrosoftДокумент2 страницыSol MicrosoftShakir HaroonОценок пока нет

- Case-1 - MM1 - Vora and Company - Anirban Kar - EPGP-12A-022Документ6 страницCase-1 - MM1 - Vora and Company - Anirban Kar - EPGP-12A-022Anirban KarОценок пока нет

- Used Car Data Exploration: Fuel Type Impacts PriceДокумент9 страницUsed Car Data Exploration: Fuel Type Impacts PriceTime SaveОценок пока нет

- Storeking-Rural ConsumersДокумент10 страницStoreking-Rural Consumersprakhar guptaОценок пока нет

- Altius Excel DSДокумент6 страницAltius Excel DSShreya Gupta0% (1)

- Sticks Kebob Shop customer survey analysisДокумент2 страницыSticks Kebob Shop customer survey analysispdf pdfОценок пока нет

- DMB2B Assignment Shreya 2018PGP355Документ5 страницDMB2B Assignment Shreya 2018PGP355SHREYA PGP 2018-20 BatchОценок пока нет

- Cleanspritz ReДокумент2 страницыCleanspritz ReSiddharthОценок пока нет

- General Mills Yoplait Custard Style Yogurt Marketing Test OptionsДокумент2 страницыGeneral Mills Yoplait Custard Style Yogurt Marketing Test OptionsRitesh VermaОценок пока нет

- Walt Disney Company: The Entertainment King: Strategy FormulationДокумент20 страницWalt Disney Company: The Entertainment King: Strategy FormulationVaibhav Gupta0% (1)

- Group 10 - Sec D - MM ProjectДокумент12 страницGroup 10 - Sec D - MM ProjectRahul ChatterjeeОценок пока нет

- Kunst 1600 CANДокумент6 страницKunst 1600 CANRaghavendra AnnaОценок пока нет

- Analyzing Consumer PerceptionДокумент19 страницAnalyzing Consumer PerceptionRAJSHEKAR RAMPELLIОценок пока нет

- Beyond Market SegmentationДокумент12 страницBeyond Market SegmentationDr Rushen SinghОценок пока нет

- Maru Betting Center Excel SheetДокумент16 страницMaru Betting Center Excel SheetRohan ShahОценок пока нет

- Workshop 3Документ7 страницWorkshop 3freweight100% (1)

- Q.1) Despite Being A Strong Brand What Caused Its Decline?: AnswerДокумент2 страницыQ.1) Despite Being A Strong Brand What Caused Its Decline?: AnswerSuman ChandaОценок пока нет

- Mountain Man Brewing Company: Bringing The Brand To Light: Harvard Business School CaseДокумент28 страницMountain Man Brewing Company: Bringing The Brand To Light: Harvard Business School CaseAnkan MetyaОценок пока нет

- MMBC-Group 7Документ12 страницMMBC-Group 7Shashank BaranwalОценок пока нет

- Mountain Man BrewingДокумент3 страницыMountain Man BrewingAlfred EstacaОценок пока нет

- Pepperfry's Strategies to Drive Growth and Profitability in India's Furniture E-commerce MarketДокумент3 страницыPepperfry's Strategies to Drive Growth and Profitability in India's Furniture E-commerce MarketkarthikawarrierОценок пока нет

- Answering Key Blue Ocean Creations As Per The Blue Ocean Strategy ArticleДокумент2 страницыAnswering Key Blue Ocean Creations As Per The Blue Ocean Strategy ArticlekarthikawarrierОценок пока нет

- What Were The Strategic Challenges Facing Best Buy in 2012? Why Was The Company Finding Them Hard To Respond To?Документ2 страницыWhat Were The Strategic Challenges Facing Best Buy in 2012? Why Was The Company Finding Them Hard To Respond To?karthikawarrierОценок пока нет

- SweetWater AadharДокумент5 страницSweetWater AadharkarthikawarrierОценок пока нет

- Cloud Computing - Group10 - 4IRДокумент8 страницCloud Computing - Group10 - 4IRkarthikawarrierОценок пока нет

- Karthika PGPBL0147 Asg03Документ1 страницаKarthika PGPBL0147 Asg03karthikawarrierОценок пока нет

- Karthika PGPBL0147Документ1 страницаKarthika PGPBL0147karthikawarrierОценок пока нет

- PPBM Group3 SweetWaterДокумент5 страницPPBM Group3 SweetWaterkarthikawarrierОценок пока нет

- PGPBL: Doesn't This Pose A Chicken & Egg Problem?Документ1 страницаPGPBL: Doesn't This Pose A Chicken & Egg Problem?karthikawarrierОценок пока нет

- Can We Make Our Robots Less Biased Than We Are - The New York TimesДокумент8 страницCan We Make Our Robots Less Biased Than We Are - The New York TimeskarthikawarrierОценок пока нет

- Brand Characteristics: Trendy - Declining Market Savvy Mojo 300 250 Pros Moon 570 510 Comp Was 516Документ2 страницыBrand Characteristics: Trendy - Declining Market Savvy Mojo 300 250 Pros Moon 570 510 Comp Was 516karthikawarrierОценок пока нет

- Value Proposition Canvas-Amazon: August 2020Документ7 страницValue Proposition Canvas-Amazon: August 2020karthikawarrierОценок пока нет

- KW Session18 ClassbookДокумент3 страницыKW Session18 ClassbookkarthikawarrierОценок пока нет

- © 2015 Belithe, IncДокумент36 страниц© 2015 Belithe, InckarthikawarrierОценок пока нет

- Group 10's Case Analysis: Digital Transformation at GEДокумент13 страницGroup 10's Case Analysis: Digital Transformation at GEkarthikawarrier100% (2)

- Group4 SectionB NucorAtCrossroadsДокумент3 страницыGroup4 SectionB NucorAtCrossroadskarthikawarrier100% (1)

- PGPBL assignment questions analysisДокумент6 страницPGPBL assignment questions analysiskarthikawarrierОценок пока нет

- Karthika Warrier - PGPBL0147 - Blue - Strategy PDFДокумент15 страницKarthika Warrier - PGPBL0147 - Blue - Strategy PDFkarthikawarrierОценок пока нет

- BrandproДокумент5 страницBrandprokarthikawarrierОценок пока нет

- PGPBL Group 07 Report on Warehousing Options for Scientific Glassware CompanyДокумент4 страницыPGPBL Group 07 Report on Warehousing Options for Scientific Glassware CompanykarthikawarrierОценок пока нет

- Mercury Athletic Footwear: Joel L. Heilprin Harvard Business School © 59 Street Partners LLCДокумент15 страницMercury Athletic Footwear: Joel L. Heilprin Harvard Business School © 59 Street Partners LLCkarthikawarrierОценок пока нет

- PGPBL Group 07 Report on Warehousing Options for Scientific Glassware CompanyДокумент4 страницыPGPBL Group 07 Report on Warehousing Options for Scientific Glassware CompanykarthikawarrierОценок пока нет

- Crown Cork Seal SolutionДокумент6 страницCrown Cork Seal SolutionkarthikawarrierОценок пока нет

- Mercury Athletic Historical Income StatementsДокумент18 страницMercury Athletic Historical Income StatementskarthikawarrierОценок пока нет

- John Connelly's Role in Transforming CCS Through Lean Reorganization and Strategic GrowthДокумент1 страницаJohn Connelly's Role in Transforming CCS Through Lean Reorganization and Strategic GrowthkarthikawarrierОценок пока нет

- Brighter Smiles Showdown - Colgate vs. P&GДокумент4 страницыBrighter Smiles Showdown - Colgate vs. P&GkarthikawarrierОценок пока нет

- Is It Advantageous For A Company To Be Part of RPG Enterprise? Why and How? What Are The Concerns Being Addressed or Not Addressed?Документ2 страницыIs It Advantageous For A Company To Be Part of RPG Enterprise? Why and How? What Are The Concerns Being Addressed or Not Addressed?karthikawarrier100% (1)

- Case Q-UberДокумент2 страницыCase Q-UberkarthikawarrierОценок пока нет

- Starbucks: Q1. What Is The Industry of Starbucks?Документ3 страницыStarbucks: Q1. What Is The Industry of Starbucks?karthikawarrierОценок пока нет

- Let's Konfer With WIM - Iimk: Panel and HackathonДокумент18 страницLet's Konfer With WIM - Iimk: Panel and HackathonkarthikawarrierОценок пока нет

- Warehouse SimulationДокумент14 страницWarehouse SimulationRISHAB KABDI JAINОценок пока нет

- Payment Processs ComparisonДокумент4 страницыPayment Processs Comparisonanilthakur30111983Оценок пока нет

- Carsen Company Produces Handcrafted Pottery That Uses Two Inputs MaterialsДокумент1 страницаCarsen Company Produces Handcrafted Pottery That Uses Two Inputs MaterialsAmit PandeyОценок пока нет

- đề thi 20%Документ13 страницđề thi 20%16. Nguyễn Thị Thúy KiềuОценок пока нет

- This Mark Has A Record of Prior UsageДокумент18 страницThis Mark Has A Record of Prior UsageROHITОценок пока нет

- Unit 8: Marketing: Case Study: Wincote International P.80 - P.81Документ53 страницыUnit 8: Marketing: Case Study: Wincote International P.80 - P.81ANH LÊ ĐỨCОценок пока нет

- POP QUIZ Event AdvertisementДокумент6 страницPOP QUIZ Event AdvertisementVania AureliaОценок пока нет

- Upvc FittingsДокумент2 страницыUpvc FittingsMurtuza khan TkОценок пока нет

- Tugas ManPro Group 1Документ2 страницыTugas ManPro Group 1Salshadina SundariОценок пока нет

- Ayman Shafaat: ProfileДокумент3 страницыAyman Shafaat: ProfileM Noaman AkbarОценок пока нет

- Chapter 1Документ3 страницыChapter 1Jesel CatchoniteОценок пока нет

- Karanvir Singh, TYBBI, AДокумент86 страницKaranvir Singh, TYBBI, AAniket PashteОценок пока нет

- SOP For Fixed Assets MainagementДокумент12 страницSOP For Fixed Assets MainagementJAK Group100% (1)

- The Organization of International BusinessДокумент42 страницыThe Organization of International Businesshesham meckawyОценок пока нет

- Contribution Under LLP Act: Partner's CapitalДокумент2 страницыContribution Under LLP Act: Partner's CapitalDhwani GogriОценок пока нет

- Investment Pattern Of Investors QuestionnaireДокумент19 страницInvestment Pattern Of Investors QuestionnaireVinita Solanki 24Оценок пока нет

- Analyses of The Financial Statements: Dr. Rakesh Kumar SharmaДокумент33 страницыAnalyses of The Financial Statements: Dr. Rakesh Kumar Sharmarakeshsharmarv3577Оценок пока нет

- What Is The Planning Process?: ViewsДокумент2 страницыWhat Is The Planning Process?: ViewsKim Gabriel OañaОценок пока нет

- Allama Iqbal Open University Islamabad (Department of Business Administration)Документ8 страницAllama Iqbal Open University Islamabad (Department of Business Administration)Ali AsadОценок пока нет

- Hospitality Management: Assignment Submission Cover SheetДокумент17 страницHospitality Management: Assignment Submission Cover SheetSaiful Islam TareqОценок пока нет

- Finance Business PartneringДокумент26 страницFinance Business PartneringPaulОценок пока нет

- QuizletДокумент4 страницыQuizletJaceОценок пока нет

- Worksheet 1 - Trends and FadsДокумент4 страницыWorksheet 1 - Trends and FadsCris Paolo CorneliaОценок пока нет

- Amazon FBA Vs Drop Shipping - What's Better For BeginnersДокумент19 страницAmazon FBA Vs Drop Shipping - What's Better For Beginnersalami chaouni achrafОценок пока нет

- Inclusive Green GrowthДокумент192 страницыInclusive Green GrowthLiz Yoha AnguloОценок пока нет

- NIGERIAN CONTENT COMPLIANCE CERTIFICATEДокумент4 страницыNIGERIAN CONTENT COMPLIANCE CERTIFICATEDarlingtonОценок пока нет

- Paula Perna Answer With HSTДокумент2 страницыPaula Perna Answer With HSTJulia TrincaОценок пока нет

- Castrol Marketing StratigyДокумент11 страницCastrol Marketing StratigykhansharibaliОценок пока нет

- Soltion of Chemalite BДокумент13 страницSoltion of Chemalite BAITHARAJU SAI HEMANTHОценок пока нет

- Ship 30 For 30Документ661 страницаShip 30 For 30Alexandre SantosОценок пока нет