Академический Документы

Профессиональный Документы

Культура Документы

BSP M-2020-020 PDF

Загружено:

Raine Buenaventura-EleazarИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BSP M-2020-020 PDF

Загружено:

Raine Buenaventura-EleazarАвторское право:

Доступные форматы

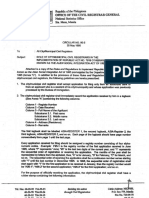

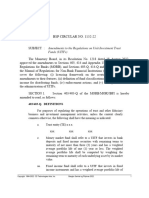

OFFICE OF THE GOVERNOR

MEMORANDUM NO. M-2020-020

To : All Stand-Alone Thrift Banks, Rural Banks and

Cooperative Banks

Subject : Reduction in the Minimum Liquidity Ratio in response

to COVID-19

Pursuant to Monetary Board Resolution No. 427.B dated 26 March 2020, the

minimum liquidity ratio (MLR) for stand-alone thrift banks, rural banks and

cooperative banks, as set out in Section 145 of the Manual of Regulations for Banks,

is hereby reduced from 20 percent (20%) to 16 percent (16%). Covered banks shall

likewise be guided by the following:

The BSP recognizes that the COVID-19 outbreak and community quarantine

implemented to combat the spread of the disease has elevated the liquidity risk

exposures of banks arising primarily from higher demand for funds by depositors,

borrowers or both. Owing to the BSP’s adoption of liquidity standards, banks are

largely seen to have entered this stress situation in a strong liquidity position, with

buffers ready to absorb the recent and coming liquidity shocks.

As the liquidity buffers are designed to be used in periods of stress, stand-

alone thrift banks, rural banks, and cooperative banks may draw on their stock of

liquid assets to meet liquidity demands to respond to the current circumstances,

remaining cognizant of the MLR of 16 percent (16%).

A bank that has recorded a shortfall in the stock of eligible liquid assets on

three banking days within any two-week rolling calendar period, thereby causing the

MLR to fall below 16 percent (16%) must notify the BSP of such breach on the

banking day immediately following the occurrence of the third liquidity shortfall.

The reduction in the MLR and the arrangements set forth in this

memorandum shall be effective until 31 December 2020, unless otherwise revoked

by the BSP.

BENJAMIN E. DIOKNO

Governor

7 April 2020

A. Mabini St., Malate 1004 Manila, Philippines * (632) 708-7701* www.bsp.gov.ph* bspmail@bsp.gov.ph

Вам также может понравиться

- A. Mabini ST., Malate 1004 Manila, Philippines (632) 8708-7701 WWW - Bsp.gov - PH Bspmail@bsp - Gov.phДокумент1 страницаA. Mabini ST., Malate 1004 Manila, Philippines (632) 8708-7701 WWW - Bsp.gov - PH Bspmail@bsp - Gov.phYel GonzalesОценок пока нет

- BSP Memorandum No. M-2020-032 (Amendment To Regulatory Relief)Документ1 страницаBSP Memorandum No. M-2020-032 (Amendment To Regulatory Relief)Yel GonzalesОценок пока нет

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingДокумент10 страницU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseОценок пока нет

- BSP Memorandum No. M-2020-011Документ3 страницыBSP Memorandum No. M-2020-011Yel GonzalesОценок пока нет

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingДокумент16 страницU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseОценок пока нет

- Subiect: of WithДокумент3 страницыSubiect: of WithCarlos JesenaОценок пока нет

- Types of Deposit Accounts and List of Thrift BanksДокумент12 страницTypes of Deposit Accounts and List of Thrift BanksDianne SegunialОценок пока нет

- Msme Reserve Bank of India PDFДокумент6 страницMsme Reserve Bank of India PDFAbhishek Singh ChauhanОценок пока нет

- CII BWR ReportДокумент27 страницCII BWR ReportBalakrishna DammatiОценок пока нет

- M-2022-004 - Extension of BSP Prudential Relief MeasuresДокумент3 страницыM-2022-004 - Extension of BSP Prudential Relief Measureswilma balandoОценок пока нет

- RBI Notice - CAIIB - BFMДокумент8 страницRBI Notice - CAIIB - BFMSATISHОценок пока нет

- RBI Notification 310320Документ2 страницыRBI Notification 310320Moneylife FoundationОценок пока нет

- Bangladesh Banking Sector Report: Key HighlightsДокумент49 страницBangladesh Banking Sector Report: Key Highlightsimrul khanОценок пока нет

- BSP Memorandum No. M-2020-008Документ4 страницыBSP Memorandum No. M-2020-008Yel GonzalesОценок пока нет

- BSP Memorandum No. M-2020-015 PDFДокумент1 страницаBSP Memorandum No. M-2020-015 PDFYel GonzalesОценок пока нет

- Memorandum No. 2020-039Документ2 страницыMemorandum No. 2020-039Aika Reodica AntiojoОценок пока нет

- Republic OF THE Philippines Department OF Budget AND ManagementДокумент2 страницыRepublic OF THE Philippines Department OF Budget AND ManagementFerdinand LabaniegoОценок пока нет

- Adv RTP 20Документ38 страницAdv RTP 20Pawan AgrawalОценок пока нет

- SOCA2021 Feb10 5amДокумент28 страницSOCA2021 Feb10 5amGayeGabrielОценок пока нет

- RBI Circulars On COVIDДокумент10 страницRBI Circulars On COVIDASHWINОценок пока нет

- BSP PresentationДокумент27 страницBSP PresentationMika AlimurongОценок пока нет

- m057 PDFДокумент3 страницыm057 PDFnetortizОценок пока нет

- AssignmentДокумент1 страницаAssignmentRyan Dave MalnegroОценок пока нет

- 1 Moze A 2020001Документ46 страниц1 Moze A 2020001DeonОценок пока нет

- Jan19 PDFДокумент20 страницJan19 PDFJatin ValechaОценок пока нет

- 3MC01072019Документ17 страниц3MC01072019Devishka ShahОценок пока нет

- Priority Sector LendingДокумент27 страницPriority Sector LendingAbinash Mandilwar100% (1)

- Deloitte Mauritius Covid Measures-Unlocked PDFДокумент14 страницDeloitte Mauritius Covid Measures-Unlocked PDFAvnish BassantОценок пока нет

- Reserve Bank of IndiaДокумент1 страницаReserve Bank of IndiaRao TvaraОценок пока нет

- Office of The Deputy Governor Financial Supervision Sector MEMORANDUM NO.: M-2020Документ8 страницOffice of The Deputy Governor Financial Supervision Sector MEMORANDUM NO.: M-2020netortizОценок пока нет

- CAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020Документ15 страницCAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020SATISHОценок пока нет

- CL No. 2020-10Документ5 страницCL No. 2020-10Marvin BesanaОценок пока нет

- A STUDY ON ReviewДокумент28 страницA STUDY ON Reviewaurorashiva1Оценок пока нет

- Bangko Sentral NG Pilipinas Media and Research - 7Документ2 страницыBangko Sentral NG Pilipinas Media and Research - 7Carlos JesenaОценок пока нет

- The Economic Impact 0f Covid-19Документ3 страницыThe Economic Impact 0f Covid-19Jahid Hasan MenonОценок пока нет

- Banks As Sponsors To Infrastructure Debt Funds (IDFs)Документ3 страницыBanks As Sponsors To Infrastructure Debt Funds (IDFs)coolspanky_227053Оценок пока нет

- Republic OF THE Philippines Department OF Budget AND ManagementДокумент2 страницыRepublic OF THE Philippines Department OF Budget AND ManagementFerdinand LabaniegoОценок пока нет

- Individual Assignment - Fin 360Документ7 страницIndividual Assignment - Fin 360Muhamad syahiir syauqii Mohamad yunus80% (5)

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingДокумент16 страницU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseОценок пока нет

- Performance of Banking Industry: Exhibit 1: Government Initiatives To Support Businesses & Strengthening Banks' LiquidityДокумент2 страницыPerformance of Banking Industry: Exhibit 1: Government Initiatives To Support Businesses & Strengthening Banks' LiquiditynasirОценок пока нет

- Department OF Budget AND Management: ,'ODG FДокумент3 страницыDepartment OF Budget AND Management: ,'ODG FFerdinand LabaniegoОценок пока нет

- Investor Digest: Equity Research - 25 June 2020Документ7 страницInvestor Digest: Equity Research - 25 June 2020Nabil FathurОценок пока нет

- Chap 5Документ18 страницChap 5Jpgl DiscoverОценок пока нет

- Prioritysectoradvances 170116140912Документ22 страницыPrioritysectoradvances 170116140912SanjidaОценок пока нет

- Rural Banking (Unit 13 - 15)Документ19 страницRural Banking (Unit 13 - 15)dubakoor dubakoorОценок пока нет

- Published: Philippine Star, August 11, 2020 Business World, August 11, 2020Документ1 страницаPublished: Philippine Star, August 11, 2020 Business World, August 11, 2020mi4keeОценок пока нет

- Corporate Training & Development Institute (Ctdi) : ContemporaryДокумент20 страницCorporate Training & Development Institute (Ctdi) : Contemporarynavneet gauravОценок пока нет

- FMI Updates 2021 MainsДокумент13 страницFMI Updates 2021 MainsGarima LohiaОценок пока нет

- News 3Документ3 страницыNews 3Althea CagakitОценок пока нет

- Debt Market Yearbook 2020Документ11 страницDebt Market Yearbook 2020JayОценок пока нет

- Greater Mekong Subregion COVID-19 Response and Recovery Plan 2021–2023От EverandGreater Mekong Subregion COVID-19 Response and Recovery Plan 2021–2023Оценок пока нет

- Credit Policy Review - May 2020Документ5 страницCredit Policy Review - May 2020Sanjay SharmaОценок пока нет

- Individual Assignment - Fin 365Документ9 страницIndividual Assignment - Fin 365syahiir syauqiiОценок пока нет

- Note of Outrage - FMOДокумент2 страницыNote of Outrage - FMOvarticumleОценок пока нет

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingДокумент10 страницU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseОценок пока нет

- MB Closes Cooperative Bank of Aurora PDIC To Pay All Valid Insured Deposit ClaimsДокумент13 страницMB Closes Cooperative Bank of Aurora PDIC To Pay All Valid Insured Deposit ClaimsRuffa CayabyabОценок пока нет

- Stimulus Package: For Covid 19 Pandemic by Susmit SahaДокумент8 страницStimulus Package: For Covid 19 Pandemic by Susmit SahaYandex PrithuОценок пока нет

- DBM REGIONAL OFFICE V - Regional Advisory 2020-2Документ1 страницаDBM REGIONAL OFFICE V - Regional Advisory 2020-2Monica B. AsebuqueОценок пока нет

- Who Are BeneficiariesДокумент2 страницыWho Are BeneficiariesSomil GuptaОценок пока нет

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaОт EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaОценок пока нет

- Office of The Civil Registrar Circular No. 95-5 (IRR of RA 7919)Документ9 страницOffice of The Civil Registrar Circular No. 95-5 (IRR of RA 7919)Raine Buenaventura-EleazarОценок пока нет

- Eo No. 1008Документ4 страницыEo No. 1008Raine Buenaventura-EleazarОценок пока нет

- SEC 2019 Opinion No. 19-57Документ3 страницыSEC 2019 Opinion No. 19-57Raine Buenaventura-EleazarОценок пока нет

- POEA Resolution No. 13-2019Документ3 страницыPOEA Resolution No. 13-2019Raine Buenaventura-EleazarОценок пока нет

- SEC 2019 Opinion No 19-58Документ4 страницыSEC 2019 Opinion No 19-58Raine Buenaventura-EleazarОценок пока нет

- Nasugbu Batangas Revenue Code of 2003Документ91 страницаNasugbu Batangas Revenue Code of 2003Raine Buenaventura-EleazarОценок пока нет

- BSP Cir. No. 1152 (2022)Документ20 страницBSP Cir. No. 1152 (2022)Raine Buenaventura-EleazarОценок пока нет

- Doj Opinion No. 21 S 2022Документ7 страницDoj Opinion No. 21 S 2022Raine Buenaventura-EleazarОценок пока нет

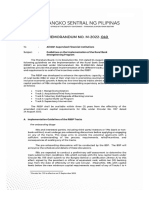

- BSP Memo No. M-2022-040Документ29 страницBSP Memo No. M-2022-040Raine Buenaventura-EleazarОценок пока нет

- Quezon City Ordinance No. SP-3127 S-2022Документ18 страницQuezon City Ordinance No. SP-3127 S-2022Raine Buenaventura-EleazarОценок пока нет

- CMC 58 2022 Philippine Economic Zone Authority PolicyДокумент6 страницCMC 58 2022 Philippine Economic Zone Authority PolicyRaine Buenaventura-EleazarОценок пока нет

- China Chiang Jiang vs. CIAC and Baranda CA GR No. SP No. 38834 (Parlade 2001)Документ3 страницыChina Chiang Jiang vs. CIAC and Baranda CA GR No. SP No. 38834 (Parlade 2001)Raine Buenaventura-EleazarОценок пока нет

- BSP Cir. No. 1153Документ15 страницBSP Cir. No. 1153Raine Buenaventura-EleazarОценок пока нет

- Cmo-18-2021-Revised Rules and Regulation On The Opening and Utilization of Prepayment AccountsДокумент7 страницCmo-18-2021-Revised Rules and Regulation On The Opening and Utilization of Prepayment AccountsRaine Buenaventura-EleazarОценок пока нет

- Department of Finance: Republic of The PhilippinesДокумент6 страницDepartment of Finance: Republic of The PhilippinesJoy Camille GomezОценок пока нет

- Cmc-86-2021-Clarification On Authenticated Certificate of Origin For Importers of Motor VehiclesДокумент2 страницыCmc-86-2021-Clarification On Authenticated Certificate of Origin For Importers of Motor VehiclesRaine Buenaventura-EleazarОценок пока нет

- CMC No 102 2021Документ6 страницCMC No 102 2021Raine Buenaventura-EleazarОценок пока нет

- Atc Resolution No. 17 (2021)Документ6 страницAtc Resolution No. 17 (2021)Raine Buenaventura-EleazarОценок пока нет

- P. (/ ( /SL//,/..// /t... /,// (T..//T) : T.T /L) 'Hot (t1'/'Документ4 страницыP. (/ ( /SL//,/..// /t... /,// (T..//T) : T.T /L) 'Hot (t1'/'Raine Buenaventura-EleazarОценок пока нет

- Cmc-104-2021-Executive Order No 130 Amending Section 4 of EO No 79Документ5 страницCmc-104-2021-Executive Order No 130 Amending Section 4 of EO No 79Raine Buenaventura-EleazarОценок пока нет

- Cmo-19-2021-Amendment To CMO-10-2021 On-Working Hours Re IAMS ImplementationДокумент2 страницыCmo-19-2021-Amendment To CMO-10-2021 On-Working Hours Re IAMS ImplementationRaine Buenaventura-EleazarОценок пока нет

- MC 21-12 SignedДокумент5 страницMC 21-12 SignedRaine Buenaventura-EleazarОценок пока нет

- Atc Resolution No. 16 (2021)Документ4 страницыAtc Resolution No. 16 (2021)Raine Buenaventura-EleazarОценок пока нет

- $ Upreme Qi:Ourt: 3republic of TL) E FlfjilippinesДокумент19 страниц$ Upreme Qi:Ourt: 3republic of TL) E FlfjilippinesHuey CalabinesОценок пока нет

- 218502-2019-Amendments To Rule 5.8.2 of The Investment20190402-5466-1mss8w PDFДокумент1 страница218502-2019-Amendments To Rule 5.8.2 of The Investment20190402-5466-1mss8w PDFcool_peachОценок пока нет

- Create LawДокумент46 страницCreate LawKimberly Claire CaoileОценок пока нет

- Central Office: Department of Public Works and HighwaysДокумент3 страницыCentral Office: Department of Public Works and HighwaysRaine Buenaventura-EleazarОценок пока нет

- OMNIBUS Guidelines With Amendments As of February 18 2021Документ27 страницOMNIBUS Guidelines With Amendments As of February 18 2021Linda Himoldang MarcaidaОценок пока нет

- PPP GuidelinesДокумент59 страницPPP GuidelinesyonportesОценок пока нет

- ContractДокумент4 страницыContractJenzineОценок пока нет