Академический Документы

Профессиональный Документы

Культура Документы

Commissioner of Internal Revenue

Загружено:

Mariel CabubunganОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Commissioner of Internal Revenue

Загружено:

Mariel CabubunganАвторское право:

Доступные форматы

Commissioner of Internal Revenue (CIR) vs.

Enron Subic Power Corporation - 576 SCRA 212 Case Digest

FACTS: 1997, Enron Subic Power Corporation received a pre-assessment notice from the Bureau of Internal Revenue

(BIR). Enron allegedly had a tax deficiency of P2.8 million for the year 1996. Enron filed a protest. In 1999, Enron received a

final assessment notice (FAN) from the BIR for the same amount of tax deficiency.

Enron however assailed the FAN because according to Enron the FAN is not compliant with Section 228 of the National

Internal Revenue Code (NIRC) which provides that the legal and factual bases of the assessment must be contained in the

FAN. The FAN issued to Enron only contained the computation of its alleged tax liability.

The Commissioner of Internal Revenue (CIR) admitted that the FAN did not contain the legal and factual bases of the

assessment however, the CIR insisted that the same has been substantially complied with already because during the pre-

assessment stage, the representative of Enron has been advised of the said factual and legal bases of the assessment.

ISSUE: Whether or not there is a valid final assessment notice issued to Enron.

HELD: No. The wording of Section 228 of the NIRC provides:

The taxpayer shall be informed in writing of the law and the facts on which the assessment is made; otherwise the

assessment shall be void.

The word “shall” is mandatory. The law requires that the legal and factual bases of the assessment be stated in the formal

letter of demand and assessment notice. It cannot be substituted by other notices or advisories issued or delivered to the

taxpayer during the preliminary stage.

ALLIED BANKING CORPORATION v. CIR, GR No. 175097, 2010-02-05

Facts:

(BIR) issued a Preliminary Assessment Notice (PAN) to petitioner Allied Banking Corporation for deficiency Documentary Stamp Tax (DST).

Petitioner received the PAN on May 18, 2004 and filed a protest against it on May 27, 2004. The BIR wrote a Formal Letter of Demand with

Assessment Notices to petitioner,... that the above deficiency tax be paid immediately

This is our final decision based on investigation.

disagree, you may appeal the final decision... petitioner filed a Petition for Review[10] with the CTA... petitioner failed to file an administrative

protest on the formal letter of demand with the corresponding assessment notices.

the assessments did not become disputed assessments. The Petition for Review is hereby DISMISSED for lack of jurisdiction.

The CTA En Banc declared that it is absolutely necessary for the taxpayer to file an administrative protest in order for the CTA to acquire

jurisdiction.

Issues:

whether the Formal Letter of Demand dated July 16, 2004 can be construed as a final decision of the CIR appealable to the CTA under RA

9282.

Ruling:

The word "decisions" in the above quoted provision of RA 9282 has been interpreted to mean the decisions of the CIR on the protest of the

taxpayer against the assessments.

petitioner timely filed a protest after receiving the PAN. In response thereto, the BIR issued a Formal Letter of Demand with Assessment

Notices.

the proper recourse of petitioner was to dispute the assessments by filing... an administrative protest within 30 days from receipt thereof.

it filed a Petition for Review with the CTA.

the instant case is an exception to the rule on exhaustion of administrative remedies, i.e., estoppel on the part of the administrative agency...

concerned.

we find the CIR estopped from claiming that the filing of the Petition for Review was premature because petitioner failed to exhaust all

administrative remedies.

It appears from the foregoing demand letter that the CIR has already made a final decision on the matter and that the remedy of petitioner is

to appeal the final decision within 30 days.

records show that petitioner disputed the PAN but not the Formal Letter of Demand with Assessment Notices.

we cannot blame petitioner for not filing a protest against the Formal Letter of Demand with Assessment Notices since the language used and

the... tenor of the demand letter indicate that it is the final decision of the respondent

Viewed in the light of the foregoing, respondent is now estopped from claiming that he did not intend the Formal Letter of Demand with

Assessment

Notices to be a final decision.

under Section 228 of the NIRC, the terms "protest", "reinvestigation" and "reconsideration" refer to the... administrative remedies a taxpayer

may take before the CIR, while the term "appeal" refers to the remedy available to the taxpayer before the CTA.

As we see it then, petitioner in appealing the Formal Letter of Demand with Assessment Notices to the CTA merely took the cue from

respondent.

It is the Formal Letter of Demand and Assessment Notice that must be administratively protested... or disputed within 30 days, and not the

PAN.

the counting of the 30 days within which to institute an appeal in the CTA... commences from the date of receipt of the decision of the CIR on

the disputed assessment, not from the date the assessment was issued.

Вам также может понравиться

- Abu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationДокумент27 страницAbu Hamza Al Masri Wolf Notice of Compliance With SAMs AffirmationPaulWolfОценок пока нет

- Apm p5 Course NotesДокумент267 страницApm p5 Course NotesMusumbulwe Sue MambweОценок пока нет

- CA Inter Group 1 Book November 2021Документ251 страницаCA Inter Group 1 Book November 2021VISHAL100% (2)

- Missouri Courts Appellate PracticeДокумент27 страницMissouri Courts Appellate PracticeGeneОценок пока нет

- Allied Banking Corporation v. CIR (Exception To Requisite of Filing An Admin Protest Before Appeal To CTA)Документ11 страницAllied Banking Corporation v. CIR (Exception To Requisite of Filing An Admin Protest Before Appeal To CTA)kjhenyo218502Оценок пока нет

- Allied Bank Vs CIR, GR 175097Документ2 страницыAllied Bank Vs CIR, GR 175097katentom-1Оценок пока нет

- CIR vs. Eron Subic Power CorporationДокумент5 страницCIR vs. Eron Subic Power CorporationJohn FerarenОценок пока нет

- CIR v. ENRONДокумент3 страницыCIR v. ENRONsherry sakuraiОценок пока нет

- Allied Bank v. CIR Case DigestДокумент4 страницыAllied Bank v. CIR Case DigestCareenОценок пока нет

- Case No. 1 - Cir Vs Eron Subic CorporationДокумент1 страницаCase No. 1 - Cir Vs Eron Subic CorporationGrazielОценок пока нет

- G.R. No. 166387 January 19, 2009 Commissioner of Internal Revenue, Petitioners, vs. Enron Subic Powercorporation, RespondentsДокумент3 страницыG.R. No. 166387 January 19, 2009 Commissioner of Internal Revenue, Petitioners, vs. Enron Subic Powercorporation, RespondentsbowbingОценок пока нет

- En Banc G.R. No. 166387 January 19, 2009 Commissioner OF Internal REVENUE, Petitioners, Enron Subic Powercorporation, Respondents. Resolution Corona, J.Документ4 страницыEn Banc G.R. No. 166387 January 19, 2009 Commissioner OF Internal REVENUE, Petitioners, Enron Subic Powercorporation, Respondents. Resolution Corona, J.Eunice NavarroОценок пока нет

- CIR V Eron Subic PowerДокумент5 страницCIR V Eron Subic PowerYoo Si JinОценок пока нет

- Cir Vs Enron DigestДокумент2 страницыCir Vs Enron Digestjanpaul12Оценок пока нет

- Cir Vs EnronДокумент4 страницыCir Vs EnronWinnie Ann Daquil Lomosad-MisagalОценок пока нет

- 1.) Cir V Bpi 521 Scra 373Документ9 страниц1.) Cir V Bpi 521 Scra 373Charles BusilОценок пока нет

- Tax CasesДокумент16 страницTax Casesnicole5anne5ddddddОценок пока нет

- CIR V Enron Subic Power CorporationДокумент1 страницаCIR V Enron Subic Power CorporationiciamadarangОценок пока нет

- CIR vs. ENRON Subic Power Corp, GR No. 166368, January 19, 2009Документ2 страницыCIR vs. ENRON Subic Power Corp, GR No. 166368, January 19, 2009Aldrin TangОценок пока нет

- G.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.Документ2 страницыG.R. No. 175097 Allied Banking Corporation, Petitioner, vs. Commissioner of Internal Revenue, Respondent. Del Castillo, J.thelionleo1Оценок пока нет

- CIR Vs Enron Subic Power G.R. No. 166387Документ6 страницCIR Vs Enron Subic Power G.R. No. 166387Ahmad Israfil PiliОценок пока нет

- Par B 9 CIR vs. United Salvage Tower PhilsДокумент4 страницыPar B 9 CIR vs. United Salvage Tower PhilsCyruz TuppalОценок пока нет

- G.R. No. 166387 January 19, 2009Документ5 страницG.R. No. 166387 January 19, 2009Rache BaodОценок пока нет

- Tax Remedies Under The NircДокумент41 страницаTax Remedies Under The NircCecille BautistaОценок пока нет

- Allied Banking Corporation vs. Commissioner of Internal Revenue, 611 SCRA 692, February 05, 2010Документ12 страницAllied Banking Corporation vs. Commissioner of Internal Revenue, 611 SCRA 692, February 05, 2010j0d3Оценок пока нет

- Commissioner vs. Enron Subic Power CorporationДокумент2 страницыCommissioner vs. Enron Subic Power CorporationMaricar Corina CanayaОценок пока нет

- CIR vs. BPI, 17 April 2007 G.R. No. 134062Документ3 страницыCIR vs. BPI, 17 April 2007 G.R. No. 134062Nathalie YapОценок пока нет

- G.R. No. 166387Документ9 страницG.R. No. 166387Amicus CuriaeОценок пока нет

- Allied Banking Corporation vs. CIRДокумент1 страницаAllied Banking Corporation vs. CIRBobbyОценок пока нет

- CIR Vs PAL - ConstructionДокумент8 страницCIR Vs PAL - ConstructionEvan NervezaОценок пока нет

- MannasoftДокумент6 страницMannasoftnorieОценок пока нет

- Allied Bank VS CirДокумент2 страницыAllied Bank VS CirPaulo VillarinОценок пока нет

- CIR vs. Enron Subic Power CorporationДокумент1 страницаCIR vs. Enron Subic Power CorporationArthur Archie TiuОценок пока нет

- Supreme Court: Factual AntecedentsДокумент33 страницыSupreme Court: Factual AntecedentsCarmelie CumigadОценок пока нет

- Allied Banking Corporation v. CIR, G.R. No. 175097, 2010Документ3 страницыAllied Banking Corporation v. CIR, G.R. No. 175097, 2010Michael TampengcoОценок пока нет

- 147 - CIR Vs EnronДокумент5 страниц147 - CIR Vs EnronCollen Anne PagaduanОценок пока нет

- Case Digests On Tax Remedies and JurisdictionsДокумент36 страницCase Digests On Tax Remedies and JurisdictionsNurul-Izza A. Sangcopan100% (2)

- CTA Case Digests - 03.12.2021Документ4 страницыCTA Case Digests - 03.12.2021Emrico CabahugОценок пока нет

- Cases On Tax RemediesДокумент9 страницCases On Tax Remediessei1davidОценок пока нет

- Allied Banking Corporation vs. CIRДокумент2 страницыAllied Banking Corporation vs. CIRMANUEL QUEZONОценок пока нет

- Tax Remedies Digest 62 70Документ12 страницTax Remedies Digest 62 70Christine Angelus MosquedaОценок пока нет

- TaxДокумент6 страницTaxChristian GonzalesОценок пока нет

- Bpi V Cir DigestДокумент3 страницыBpi V Cir DigestkathrynmaydevezaОценок пока нет

- CIR v. ENRON SUBIC POWER CORPORATION, GR No. 166387, 2009-01-19 FactsДокумент5 страницCIR v. ENRON SUBIC POWER CORPORATION, GR No. 166387, 2009-01-19 FactsluckyОценок пока нет

- CIR Vs Enron SubicДокумент2 страницыCIR Vs Enron SubicArnold JoseОценок пока нет

- 08 - G.R. No. 169225Документ4 страницы08 - G.R. No. 169225masterlazarusОценок пока нет

- Court Oft Ax Appeals: ResolutionДокумент7 страницCourt Oft Ax Appeals: Resolutionchris cardinoОценок пока нет

- 2 CIR VS PascorДокумент6 страниц2 CIR VS PascorNaomi Jean TaotaoОценок пока нет

- CIR V Fitness by DesignДокумент3 страницыCIR V Fitness by Designsmtm06100% (4)

- Lascona Land Co. Inc. v. Commissioner of Internal Revenue, G.R. No. 171251, 05 March 2012Документ10 страницLascona Land Co. Inc. v. Commissioner of Internal Revenue, G.R. No. 171251, 05 March 2012Bernadette Luces BeldadОценок пока нет

- G.R. No. 134062 April 17, 2007 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentДокумент7 страницG.R. No. 134062 April 17, 2007 Commissioner of Internal Revenue, Petitioner, Bank of The Philippine Islands, RespondentternoternaОценок пока нет

- Supreme Court: Factual AntecedentsДокумент9 страницSupreme Court: Factual Antecedentspoloy6200Оценок пока нет

- CIR V Enron DigestДокумент2 страницыCIR V Enron DigestDianne Lorraine LutakoОценок пока нет

- Commissioner of Internal Revenue vs. First Express Pawnshop G.R. Nos.Документ8 страницCommissioner of Internal Revenue vs. First Express Pawnshop G.R. Nos.4bn77yn8dkОценок пока нет

- Commissioner of Internal Revenue Vs First Express PawnshopДокумент3 страницыCommissioner of Internal Revenue Vs First Express PawnshopJennilyn Gulfan YaseОценок пока нет

- CIR v. First Express PawnshopДокумент14 страницCIR v. First Express PawnshopMi-young SunОценок пока нет

- Fitness by Design Vs CIRДокумент4 страницыFitness by Design Vs CIRGavin Reyes CustodioОценок пока нет

- Tax 1 - Dean's Circle 2019 22Документ1 страницаTax 1 - Dean's Circle 2019 22Romeo G. Labador Jr.Оценок пока нет

- Roshan Gupta v. The State of Bihar & OrsДокумент16 страницRoshan Gupta v. The State of Bihar & OrsHARSH KUMARОценок пока нет

- Cir VS BpiДокумент2 страницыCir VS BpiCelinka ChunОценок пока нет

- RemediesДокумент36 страницRemediesDaryll Gayle AsuncionОценок пока нет

- National Power Corporation vs. The Provincial Treasurer of Benguet, Et Al Supreme Court Third Division, GR No. 209303 Promulgated 14 November, 2016Документ10 страницNational Power Corporation vs. The Provincial Treasurer of Benguet, Et Al Supreme Court Third Division, GR No. 209303 Promulgated 14 November, 2016Kriezl Nierra JadulcoОценок пока нет

- Introduction to Negotiable Instruments: As per Indian LawsОт EverandIntroduction to Negotiable Instruments: As per Indian LawsРейтинг: 5 из 5 звезд5/5 (1)

- Kilosbayan V. Morato G.R. No. 118910 November 16, 1995 FactsДокумент13 страницKilosbayan V. Morato G.R. No. 118910 November 16, 1995 FactsMariel CabubunganОценок пока нет

- Commissioner of Internal RevenueДокумент2 страницыCommissioner of Internal RevenueMariel CabubunganОценок пока нет

- Cabubungan, Mariel Assign2Документ15 страницCabubungan, Mariel Assign2Mariel CabubunganОценок пока нет

- G.R. No. L-24756 October 31, 1968 CITY OF BAGUIO, Plaintiff-Appellee, FORTUNATO DE LEON, Defendant-Appellant. Fernando, J.Документ2 страницыG.R. No. L-24756 October 31, 1968 CITY OF BAGUIO, Plaintiff-Appellee, FORTUNATO DE LEON, Defendant-Appellant. Fernando, J.Mariel CabubunganОценок пока нет

- 17 20 MANAOG GONO - PhilAm MatalinДокумент6 страниц17 20 MANAOG GONO - PhilAm MatalinMariel CabubunganОценок пока нет

- Vat 1-3Документ5 страницVat 1-3Mariel CabubunganОценок пока нет

- Tax Full TextДокумент43 страницыTax Full TextMariel CabubunganОценок пока нет

- Bacar Vs de GuzmanДокумент17 страницBacar Vs de GuzmanMariel CabubunganОценок пока нет

- Skunac Corp v. SyliantengДокумент1 страницаSkunac Corp v. SyliantengMariel CabubunganОценок пока нет

- Specpro Digest Rule 80-86Документ21 страницаSpecpro Digest Rule 80-86Mariel Cabubungan100% (1)

- 1-6 DigestДокумент4 страницы1-6 DigestMariel CabubunganОценок пока нет

- Medicard Philippines, Inc., Petitioner, vs. Commissioner of Internal Revenue, Respondent. DecisionДокумент27 страницMedicard Philippines, Inc., Petitioner, vs. Commissioner of Internal Revenue, Respondent. DecisionMariel CabubunganОценок пока нет

- Ponce Enrile, Cayetano, Reyes & Manalastas Law Offices For PetitionerДокумент12 страницPonce Enrile, Cayetano, Reyes & Manalastas Law Offices For PetitionerMariel CabubunganОценок пока нет

- Parulan vs. Director of Prisons (DIGEST)Документ1 страницаParulan vs. Director of Prisons (DIGEST)Mariel Cabubungan100% (1)

- La Mesa Water Level Hits Five-Year LowДокумент5 страницLa Mesa Water Level Hits Five-Year LowMariel CabubunganОценок пока нет

- Cabubungan, Mariel New Era University College of LawДокумент13 страницCabubungan, Mariel New Era University College of LawMariel CabubunganОценок пока нет

- Part II - 1 To 3Документ6 страницPart II - 1 To 3Mariel CabubunganОценок пока нет

- Paprintmariela HRkoДокумент11 страницPaprintmariela HRkoMariel CabubunganОценок пока нет

- Vicente Formoso, Jr. For Plaintiff-Appellee. Reyes and Pangalañgan For Defendants-Appellants. FourthДокумент6 страницVicente Formoso, Jr. For Plaintiff-Appellee. Reyes and Pangalañgan For Defendants-Appellants. FourthMariel CabubunganОценок пока нет

- Mid Term Exam 1Документ2 страницыMid Term Exam 1Anh0% (1)

- Digital LiteracyДокумент19 страницDigital Literacynagasms100% (1)

- What Is Retrofit in Solution Manager 7.2Документ17 страницWhat Is Retrofit in Solution Manager 7.2PILLINAGARAJUОценок пока нет

- Ss 7 Unit 2 and 3 French and British in North AmericaДокумент147 страницSs 7 Unit 2 and 3 French and British in North Americaapi-530453982Оценок пока нет

- BCG - Your Capabilities Need A Strategy - Mar 2019Документ9 страницBCG - Your Capabilities Need A Strategy - Mar 2019Arthur CahuantziОценок пока нет

- Newsletter 289Документ10 страницNewsletter 289Henry CitizenОценок пока нет

- Uppsc Ae GSДокумент18 страницUppsc Ae GSFUN TUBEОценок пока нет

- Linux For Beginners - Shane BlackДокумент165 страницLinux For Beginners - Shane BlackQuod Antichristus100% (1)

- Blade Torrent 110 FPV BNF Basic Sales TrainingДокумент4 страницыBlade Torrent 110 FPV BNF Basic Sales TrainingMarcio PisiОценок пока нет

- My CoursesДокумент108 страницMy Coursesgyaniprasad49Оценок пока нет

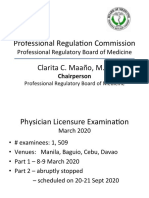

- Professional Regula/on Commission: Clarita C. Maaño, M.DДокумент31 страницаProfessional Regula/on Commission: Clarita C. Maaño, M.Dmiguel triggartОценок пока нет

- BASUG School Fees For Indigene1Документ3 страницыBASUG School Fees For Indigene1Ibrahim Aliyu GumelОценок пока нет

- Extent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home EconomicsДокумент47 страницExtent of The Use of Instructional Materials in The Effective Teaching and Learning of Home Home Economicschukwu solomon75% (4)

- QA/QC Checklist - Installation of MDB Panel BoardsДокумент6 страницQA/QC Checklist - Installation of MDB Panel Boardsehtesham100% (1)

- A320 Basic Edition Flight TutorialДокумент50 страницA320 Basic Edition Flight TutorialOrlando CuestaОценок пока нет

- Job Description For QAQC EngineerДокумент2 страницыJob Description For QAQC EngineerSafriza ZaidiОценок пока нет

- Vangood Quotation - Refrigerator Part - 2023.3.2Документ5 страницVangood Quotation - Refrigerator Part - 2023.3.2Enmanuel Jossue Artigas VillaОценок пока нет

- Hotel Reservation SystemДокумент36 страницHotel Reservation SystemSowmi DaaluОценок пока нет

- IdM11gR2 Sizing WP LatestДокумент31 страницаIdM11gR2 Sizing WP Latesttranhieu5959Оценок пока нет

- Powerpoint Presentation: Calcium Sulphate in Cement ManufactureДокумент7 страницPowerpoint Presentation: Calcium Sulphate in Cement ManufactureDhruv PrajapatiОценок пока нет

- Sterling B2B Integrator - Installing and Uninstalling Standards - V5.2Документ20 страницSterling B2B Integrator - Installing and Uninstalling Standards - V5.2Willy GaoОценок пока нет

- Peoria County Jail Booking Sheet For Oct. 7, 2016Документ6 страницPeoria County Jail Booking Sheet For Oct. 7, 2016Journal Star police documents50% (2)

- Electricity 10thДокумент45 страницElectricity 10thSuryank sharmaОценок пока нет

- Sweet Biscuits Snack Bars and Fruit Snacks in MexicoДокумент17 страницSweet Biscuits Snack Bars and Fruit Snacks in MexicoSantiagoОценок пока нет

- Unit 1Документ3 страницыUnit 1beharenbОценок пока нет

- A Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDДокумент3 страницыA Review Paper On Improvement of Impeller Design A Centrifugal Pump Using FEM and CFDIJIRSTОценок пока нет