Академический Документы

Профессиональный Документы

Культура Документы

The Measurement of Income, Prices, and Unemployment

Загружено:

Eri Buwono0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров18 страницОригинальное название

Macro 1B

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

8 просмотров18 страницThe Measurement of Income, Prices, and Unemployment

Загружено:

Eri BuwonoАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 18

Chapter 2

The

Measurement of

Income, Prices,

and

Unemployment

Copyright © 2009 Pearson Addison-Wesley. All rights reserved.

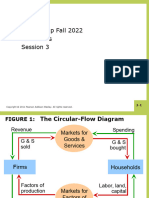

The Circular Flow of Income and

Expenditure

• The circular flow of income and expenditure model

is a simple representation of the macro economy

• In the following graphs, convince yourself that:

– The value of output produced by firms equals the value

of expenditures by participants in the economy

– The value of output produced by firms equals the total

income generated in the economy

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-2

Figure 2-1 The Circular Flow of Income and

Consumption Expenditures

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-3

Defining GDP

• GDP (Y) is the value of all final goods and

services that are currently produced and

sold (but not resold) through the market

during the current time period

– The GDP of a country is often referred to as the

country’s output and/or income

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-4

Keeping Track of GDP and other U.S.

Data

• The National Income and Product Accounts (NIPA) is

the official U.S. government accounting of all the U.S. flows

of income and expenditures.

• The “Big Three” agencies for U.S. economic data

– The Bureau of Economic Analysis (BEA)

– The Bureau of Labor Statistics (BLS)

– The Federal Reserve Board (Fed)

• Other sources of data

– The Bureau of the Census

– International data: OECD, the World Bank, and the IMF

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-5

Types of Investment (I)

• Inventory Investment is the change in the

stock of raw materials, parts, and finished

products held by businesses.

– Any goods that are unsold automatically are counted as

part of unplanned inventory investment.

• Fixed Investment includes all final goods

(mainly structures and equipment) purchased

by businesses not intended for resale.

– Houses and condominiums owned by households are

also counted as fixed investment.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-6

Relation of Investment and Saving

• Personal Saving (S) is that part of personal income that is

not consumed or paid out in taxes

– Also referred to as Private Saving

– Algebraically: S = (Y-T) - C (where T = Net Taxes)

• Funds from savings are channeled to firms in two basis

ways:

– Households buy bonds and stocks issued by firms

– Households deposit savings in banks and other financial

institutions that in turn lend money to firms

• Firms use the money channeled from savings to buy

investment goods

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-7

Figure 2-2 Introduction of Saving and

Investment to the Circular Flow Diagram

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-8

Net Exports and Net Foreign

Investment

• Exports are goods produced within one country

and shipped to another

• Imports are goods consumed within one country

but produced in another country

• Net Exports (NX) are equal to the excess of

exports over imports

• Net Foreign Investment (NFI) is equal to U.S.

purchases of foreign financial assets minus foreign

purchases of U.S. financial assets

– Interesting connection: NX = NFI

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-9

The Government Sector

• Government Purchases (G) is the value of

goods and services purchased by the government

at the federal, state and local levels

• Transfer Payments (F) are payments from the

government to households that do not require the

recipient to provide a service in return

– Examples: Social Security, Medicare, and Food Stamps

• Government Spending = G + F

• The Government pays for its spending by collecting

Taxes (R) or by borrowing and/or printing money

• Net Taxes (T) = R – F

• Budget Surplus = T – G

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-10

Figure 2-3 Introduction of Taxation, Government

Spending, and the Foreign Sector to the Circular Flow

Diagram

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-11

Deriving the “Magic” Equation

• The income accounting identity states that an economy’s

(1)

income must equal its expenditures:

Y ≡ E è Y = C + I + G + NX

• Now, use the fact that household income must equal (2)

household outlays (and recall that T = R - F):

Y+F=C+S+Rè Y=C+S+T

• Equating (1) and (2) yields the “Magic Equation”

C + S + T = C + I + G + NX

è S + T = I + G + NX

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-12

Interpreting the “Magic Equation”

Recall the “Magic Equation:” S + T = I + G + NX

• Leakages (S + T) describe the portion of total

income that is not available for consumption

• Injections (I + G + NX) is a term for

nonconsumption expenditures

• The “Magic Equation” shows how leakages and

injections are connected by definition!

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-13

Table 2-1 Households Get

What Remains After All the Leakages

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-14

“Magic Equation” Application: Twin

Deficits

Recall the “Magic Equation”: S + T = I + G + NX (1)

• Rearranging (1) yields è T - G = (I + NX) – S

– If T - G < 0 è possibly NX < 0

– This suggests that a budget deficit and trade deficit

might be observed at the same time!

– Note that the “magic equation” only suggests the

possible connections that may be observed in these

variables.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-15

Nominal GDP, Real GDP, and the

GDP Deflator

• Nominal GDP is the value of gross domestic product

in current (actual) prices.

• Real GDP is the measure of gross domestic product

using prices of an arbitrarily chosen base year.

• The GDP deflator is a price index that measures the

aggregate economy’s price level.

– Algebraically: GDP Def = Nominal GDP / Real GDP * 100

– The percentage change in the GDP deflator gives a measure of the

economy’s inflation rate.

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-16

Figure 2-4 Nominal GDP, Real GDP, and

the Implicit GDP Deflator, 1900–2007

Source: Appendix Table A-1.

See explanation in Appendix

C-4

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-17

Figure 2-5 Employment from the Household and

Payroll Survey, 1990–2007

Source: Bureau of Labor Statistics

Copyright © 2009 Pearson Addison-Wesley. All rights reserved. 2-18

Вам также может понравиться

- Capital Budgeting Idea For Netflix Inc.Документ26 страницCapital Budgeting Idea For Netflix Inc.PraОценок пока нет

- BFDP Monitoring Form 1Документ1 страницаBFDP Monitoring Form 1International Home Decors78% (9)

- Example: Majestic Mulch and Compost Company (MMCC)Документ8 страницExample: Majestic Mulch and Compost Company (MMCC)Franciska CiiОценок пока нет

- Local Government Units Public Financial Management Implementation StrategyДокумент47 страницLocal Government Units Public Financial Management Implementation StrategyDBM CALABARZONОценок пока нет

- 06 Overhead (OH) Costs - Allocations, Apportionment, Absorption CostingДокумент34 страницы06 Overhead (OH) Costs - Allocations, Apportionment, Absorption CostingAyushОценок пока нет

- Monetary Economics and Global Economy: Macroeconomics (7ed)Документ35 страницMonetary Economics and Global Economy: Macroeconomics (7ed)(K12HN) Nguyen Thuy LinhОценок пока нет

- Russian Language UrduДокумент38 страницRussian Language UrduMuhammad AreebОценок пока нет

- Why Do We Study The National Income Accounts?Документ36 страницWhy Do We Study The National Income Accounts?SiddharthОценок пока нет

- MacroeconomicsДокумент7 страницMacroeconomics2rmjОценок пока нет

- Text BookДокумент10 страницText BookHayamnotОценок пока нет

- Chapter - 02 National Income AccountingДокумент25 страницChapter - 02 National Income AccountingMarini WulandariОценок пока нет

- C2 Note ComprehensiveДокумент18 страницC2 Note ComprehensiveNadiahОценок пока нет

- WEEK 8b - NATIONAL INCOME ANALYSIS & InflationДокумент19 страницWEEK 8b - NATIONAL INCOME ANALYSIS & Inflationndagarachel015Оценок пока нет

- Agriculture and Fishery Arts Handout 7 PDFДокумент72 страницыAgriculture and Fishery Arts Handout 7 PDFLovely day ybanezОценок пока нет

- Drasan 16 3415 2 Lecture 03 Macro EconomicsДокумент5 страницDrasan 16 3415 2 Lecture 03 Macro EconomicsHabib urrehmanОценок пока нет

- CHAPTER 2 Eco211Документ67 страницCHAPTER 2 Eco211Amalin IlyanaОценок пока нет

- Measurement of Macroeconomic VariablesДокумент35 страницMeasurement of Macroeconomic VariablesRamadhan Der ErobererОценок пока нет

- Chapter 4 - National Income AccountingДокумент24 страницыChapter 4 - National Income AccountingChelsea Anne VidalloОценок пока нет

- 2.1 The Level of Overall Economic Activity (HL)Документ56 страниц2.1 The Level of Overall Economic Activity (HL)Shuchun YangОценок пока нет

- Measuring GDP and Economic Growth: Chapter 4 LectureДокумент33 страницыMeasuring GDP and Economic Growth: Chapter 4 LectureIfteakher Ibne HossainОценок пока нет

- Investment Is The Portion of Final Product That AddsДокумент15 страницInvestment Is The Portion of Final Product That Addsahmad7malikОценок пока нет

- Circular Flow of Income BmdsДокумент38 страницCircular Flow of Income BmdsBleh Bleh BlehОценок пока нет

- Chapter 22Документ14 страницChapter 22naolfekadu8Оценок пока нет

- Topic 2 National Accounting, The Keynesian Income-Expenditure Model and Fiscal PolicyДокумент62 страницыTopic 2 National Accounting, The Keynesian Income-Expenditure Model and Fiscal PolicyjoeybaggieОценок пока нет

- Chapter 2 - Data of MacroeconomicsДокумент23 страницыChapter 2 - Data of MacroeconomicsBenny TanОценок пока нет

- Topic 5 Theory of National Income DeterminationДокумент13 страницTopic 5 Theory of National Income DeterminationPoh WanyuanОценок пока нет

- Macroeconomics Assignment TWOДокумент3 страницыMacroeconomics Assignment TWOአኒቶ መንገሻОценок пока нет

- IS-LM FrameworkДокумент54 страницыIS-LM FrameworkLakshmi NairОценок пока нет

- C13 Eng.Документ51 страницаC13 Eng.hdz4k4jgsvОценок пока нет

- MACRO Chapter 2 (Part 1)Документ14 страницMACRO Chapter 2 (Part 1)zeyad GadОценок пока нет

- Document 2Документ26 страницDocument 2YASAAAОценок пока нет

- Macroeconomics ReviewerДокумент50 страницMacroeconomics ReviewerPrincess-Diana Tomas CorpuzОценок пока нет

- National - Income (1) - Circular FlowДокумент6 страницNational - Income (1) - Circular Flowaparnah_83Оценок пока нет

- Revision 3 Phase MacroДокумент44 страницыRevision 3 Phase MacroSagar SunuwarОценок пока нет

- Policy and Monetary Policy Solutions (PLG 2)Документ9 страницPolicy and Monetary Policy Solutions (PLG 2)Agastya SenОценок пока нет

- Ch08 - National Income AccountingДокумент58 страницCh08 - National Income AccountingDhruv PandeyОценок пока нет

- Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldДокумент41 страницаPrepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldIand Novian NurtanioОценок пока нет

- Macro Economics CH 1 & 2Документ156 страницMacro Economics CH 1 & 2Asadullah LohachОценок пока нет

- DDP's National Income (Youtube)Документ15 страницDDP's National Income (Youtube)Rahul MajumdarОценок пока нет

- Macroeconomics: Principles ofДокумент56 страницMacroeconomics: Principles ofKogo VickОценок пока нет

- Macroeconomics Adel LauretoДокумент66 страницMacroeconomics Adel Lauretomercy5sacrizОценок пока нет

- ECON102 - Intro To Macro Data by Veronica GuerrieriДокумент51 страницаECON102 - Intro To Macro Data by Veronica GuerrieriWalijaОценок пока нет

- MEP The Income and Output of NationsДокумент23 страницыMEP The Income and Output of NationsviswaОценок пока нет

- Measuring National IncomeДокумент13 страницMeasuring National IncomeNoor EylianaОценок пока нет

- Chapter 2 - National IncomeДокумент71 страницаChapter 2 - National IncomeRia Athirah100% (1)

- Chapter 2: National Income Accounting: Two-Sector EconomyДокумент3 страницыChapter 2: National Income Accounting: Two-Sector Economyben10Оценок пока нет

- BEC Notes Chapter 2Документ7 страницBEC Notes Chapter 2cpacfa100% (10)

- Econotes 8 - Measuring Economic ActivityДокумент4 страницыEconotes 8 - Measuring Economic ActivityTumblr_userОценок пока нет

- Lesson 2Документ5 страницLesson 2Maurice AgbayaniОценок пока нет

- Chapter 1.1 National Income & The Circular Flow of IncomeДокумент10 страницChapter 1.1 National Income & The Circular Flow of Incomedianime OtakuОценок пока нет

- Circular Flow of IncomeДокумент46 страницCircular Flow of IncomeSumit PoojaraОценок пока нет

- Chapter 13 National Income Accounting and The Balance of PaymentsДокумент51 страницаChapter 13 National Income Accounting and The Balance of PaymentsBill BennttОценок пока нет

- Reviewer in Social Science 3RD GradingДокумент7 страницReviewer in Social Science 3RD GradingCarlos, Jolina R.Оценок пока нет

- Circular Flow On IncomeДокумент13 страницCircular Flow On IncomeAnkur ChoudharyОценок пока нет

- ch23 GDPДокумент42 страницыch23 GDPfbm2000Оценок пока нет

- Обзорная Лекция МФФ 2022 МакроДокумент73 страницыОбзорная Лекция МФФ 2022 МакроМФФ18-4КОценок пока нет

- Summaries MacroДокумент12 страницSummaries MacroRiccardo PicciulinОценок пока нет

- Chap 3 National IncomeДокумент36 страницChap 3 National Incomeinamk334Оценок пока нет

- Index: Economics For FinanceДокумент32 страницыIndex: Economics For FinanceJoseph PrabhuОценок пока нет

- The Circular Flow of IncomeДокумент24 страницыThe Circular Flow of IncomeoceanpearlsОценок пока нет

- National Income AccountingДокумент42 страницыNational Income Accountingraemu26Оценок пока нет

- Minggu 2 & 3: Ekonomi MakroДокумент12 страницMinggu 2 & 3: Ekonomi MakroClaudia EdelineОценок пока нет

- Summary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionОт EverandSummary of David A. Moss's A Concise Guide to Macroeconomics, Second EditionОценок пока нет

- Principles SSG Ch19Документ10 страницPrinciples SSG Ch19Eri BuwonoОценок пока нет

- Macro 2CДокумент31 страницаMacro 2CEri BuwonoОценок пока нет

- Chapter 29/30: Monetary PolicyДокумент14 страницChapter 29/30: Monetary PolicyEri BuwonoОценок пока нет

- Macro 2aДокумент58 страницMacro 2aEri BuwonoОценок пока нет

- 1A. Mention and Describe All of The Research Types Available Out ThereДокумент9 страниц1A. Mention and Describe All of The Research Types Available Out ThereEri BuwonoОценок пока нет

- Writing Directly and IndirectlyДокумент106 страницWriting Directly and IndirectlyEri BuwonoОценок пока нет

- Hotel Profit & Loss Statement: Website: Write Us: OfficesДокумент1 страницаHotel Profit & Loss Statement: Website: Write Us: OfficesJocky AryantoОценок пока нет

- Capital Budgeting - Project Cash Flow - NPV: AssumptionsДокумент6 страницCapital Budgeting - Project Cash Flow - NPV: AssumptionsBijay DharОценок пока нет

- Chapter 2 Enterpise Structure & Global SettingsДокумент31 страницаChapter 2 Enterpise Structure & Global SettingsHasan Babu KothaОценок пока нет

- ICGFM Compilation Guide To Financial Reporting by GovernmentsДокумент58 страницICGFM Compilation Guide To Financial Reporting by GovernmentsAndy Wynne100% (1)

- Barangay Arzadon Office of The Sangguniang BarangayДокумент31 страницаBarangay Arzadon Office of The Sangguniang BarangayMark Francis SecretarioОценок пока нет

- Top Secret: Department of The Air Force United States of AmericaДокумент12 страницTop Secret: Department of The Air Force United States of AmericabilygoteОценок пока нет

- Intermediate MicroeconomicsДокумент3 страницыIntermediate MicroeconomicsSaad MalikОценок пока нет

- Disinvestment Objectives: 9 Objectives of Disinvestment in IndiaДокумент4 страницыDisinvestment Objectives: 9 Objectives of Disinvestment in IndiakanishkОценок пока нет

- Cost II FInal ExamДокумент4 страницыCost II FInal ExamAbaas AhmedОценок пока нет

- University Day Care Center: The Crimson Press Curriculum Center The Crimson Group, IncДокумент6 страницUniversity Day Care Center: The Crimson Press Curriculum Center The Crimson Group, IncRiaОценок пока нет

- Macroeconomics Course Outline 2015Документ4 страницыMacroeconomics Course Outline 2015prashantgargindia_93Оценок пока нет

- Capital Expenditures BudgetДокумент4 страницыCapital Expenditures BudgetDawit AmahaОценок пока нет

- Critically Assess The Problems of Budget Implementation in NigeriaДокумент5 страницCritically Assess The Problems of Budget Implementation in NigeriaOketa Daniel83% (6)

- DraftARDSAgriculture and Rural Development Strategy PDFДокумент78 страницDraftARDSAgriculture and Rural Development Strategy PDFridwansuronoОценок пока нет

- DISINVESTMENTДокумент14 страницDISINVESTMENTPranita ChavanОценок пока нет

- Master BudgetДокумент4 страницыMaster BudgetFawad Khan Waseem0% (1)

- Chapter 6 Flexible Budgets and Variance AnalysisДокумент16 страницChapter 6 Flexible Budgets and Variance Analysismilky makiОценок пока нет

- To View and Download Complete Report Subscribe .: TodayДокумент8 страницTo View and Download Complete Report Subscribe .: TodayLuis_G_CondeОценок пока нет

- Unit 1 - Part 1Документ105 страницUnit 1 - Part 1YELLANKI SAI MEGHANAОценок пока нет

- Capital Budgeting BSNLДокумент10 страницCapital Budgeting BSNLAşhwįnį GawasОценок пока нет

- Restaurant Feasibility ReportДокумент7 страницRestaurant Feasibility ReportJoneric RamosОценок пока нет

- 243 PGTRB Economics Study Material 2 1Документ8 страниц243 PGTRB Economics Study Material 2 1Chella PandiОценок пока нет

- Self-Government em KeralaДокумент97 страницSelf-Government em Keralacarolis.omsОценок пока нет

- Absorption CostingДокумент76 страницAbsorption CostingMustafa KamalОценок пока нет

- Phillip Joiner Ethics ComplaintДокумент5 страницPhillip Joiner Ethics ComplaintMilledgeville EthicsОценок пока нет