Академический Документы

Профессиональный Документы

Культура Документы

Absorption & Marginal Costing and Break Even Point Problems and Solutions - Morshedul Alam Sourav

Загружено:

Moon130Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Absorption & Marginal Costing and Break Even Point Problems and Solutions - Morshedul Alam Sourav

Загружено:

Moon130Авторское право:

Доступные форматы

BREAK EVEN POINT

Problem 1: The Monster Company manufactures three products – product X, product Y and product Z.

The variable expenses and sales prices of all the products are given below:

The total fixed expenses of the company are $50,000 per month. For the coming moth. Monster

expects the sale of three products in the following ratio:

Product X: 20%;

Product Y: 30%;

Product Z: 50%

Required: Compute the break-even point of Monster Company in units and dollars for the coming

month.

Solution: Monster Company sells three products and is, therefore, a multi-product company. Its

break-even point can be computed by applying the above formula:

Particulars Product X ($) Product Y ($) Product Z ($) Total

Sale per unit 200 100 50 350

Var. cost per unit (100) (75) (25) (200)

Contribution per 100 25 25 150

unit

Product mix 20% 30% 50% 100%

Weighted avg. 20 7.5 12.5 40

contribution margin

Total Fixed Cost $50,000

Break-even point in unit = = = 1250 units

Weighted avg.contribution margin 40

The company will have to sell 1,250 units to break-even. Now I would compute the number of units

of each product to be sold:

Product X (1,250 × 20%): 250 units

Product Y (1,250 × 30%): 375 units

Product Z (1,250 × 50%): 625 units

Total: 250 units + 375 units + 625 units = 1,250 units

As the number of units of each individual product to be sold have been computed, I can compute

the breakeven point in dollars as follows:

PREPARED BY: | MD. Morshedul Alam

The break-even point of Monster Company is $118,750. It can be verified by preparing

a contribution margin income as follows:

Problem 2

Belle Company manufactures and sells three products: Products A, B, and C. The following data has

been provided the company.

A B C

Selling price $100 $120 $50

Variable cost per unit 60 90 40

Contribution margin per unit 40 30 10

Contribution margin ratio 40% 25% 20%

The company sells 5 units of C for every unit of A and 2 units of B for every unit of A. The company

incurred in $120,000 total fixed costs. Calculated the break-even point in both units and sales amount.

Solution: Sales Mix: 1 : 2 : 5 = A : B : C

a. Computation of weighted average CM per unit:

∑(CM per unit x Unit sales mix ratio)

Product A ($40 x 1/8) $ 5.00

Product B ($30 x 2/8) 7.50

Product C ($10 x 5/8) 6.25

WA CM per unit $18.75

The weighted average CM may also be computed by dividing the total CM by the total number of

units.

WA CM per unit (40x1)+(30x2)+(10x5)

= = 18.75

8

1. Multi-product break-even point in units

BEP in units = Total fixed costs

Weighted average CM per unitt

$120,000

$18.75

PREPARED BY: | MD. Morshedul Alam

BEP in units =6,400 units

b. Breakdown of the break-even sales in units:

(B-E point x Unit sales mix ratio) Units Produced

Product A (6,400 units x 1/8) 800

Product B (6,400 units x 2/8) 1,600

Product C (6,400 units x 5/8) 4,000

Total 6,400 units

The company must produce and sell 800 units of Product A, 1,600 units of Product B, and 4,000 units

of Product C in order to break-even.

2. Multi-product break-even point in dollars

a. Computation of weighted average CM ratio:

The weighted average CM may also be computed by dividing the total CM by the total sales.

WA CM ratio = (40x1)+(30x2)+(10x5)

(100x1)+(120x2)+(50x5)

WA CM ratio = 25.4237%

BEP in dollars = Total fixed costs

Weighted average CM ratio

$120,000

25.4237%

BEP in dollars = $472,000

b. Breakdown of the break-even sales revenue:

Total sales = ($100 x 1) + ($120 x 2) + ($50 x 5) = $590

(B-E point x Sales revenue ratio)

Product A ($472,000 x 100/590) $ 80,000

Product B ($472,000 x 240/590) 192,000

Product C ($472,000 x 250/590) 200,000

Total $472,000

The company must generate sales of $80,000 for Product A, $192,000 for product B, and $200,000

for Product C, in order to break-even. Alternatively, these can be computed by multiplying the

individual break-even point in units for each product by their corresponding selling price, i.e. 800

units x $100 for Product A = $80,000, 1,600 units x $120 for Product B = $192,000, and 4,000 units x

$50 for Product C = $200,000.

PREPARED BY: | MD. Morshedul Alam

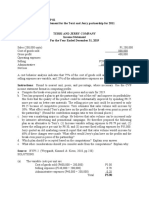

PROBLEM 3

Hawaiian Candy Company is a wholesale distributor of candy. Small but steady growth in sales has

been achieved by the company over the past few years while candy prices have been increasing. The

company is manufacturing its plans for the coming fiscal year. Presented below are the data used to

project income of $184,000.

Expected annual sales volume (390,000 boxes) $1,560,000

Required:

(i) What is Hawaiian Candy Company’s breakeven point in boxes of candy and in dollar amount for the

current year?

(ii) Calculate margin of safety and degree of operating leverage of the current year.

PROBLEM 4:

A company manufactures and sells 5000 units of product X per year. Suppose one unit of product X

requires the following costs:

Direct materials: $5 per unit

Direct labor: $4 per unit

Variable manufacturing overhead: $1 per unit

Fixed manufacturing overhead: $20,000 per year

Required: Calculated the unit cost under both absorption costing and variable costing method.

Solution: Unit product cost of the company is computed as follows:

Absorption Costing: $5 + $4 + $1 + $4* = $14

Variable Costing: $5 + $4 + $1 = $10

*Fixed O/H rate per unit = $20,000 / 5,000 = $4

Notice that the fixed manufacturing overhead cost has not been included in the unit cost under

variable costing system but it has been included in the unit cost under absorption costing system.

This is the primary difference between variable and absorption costing.

PREPARED BY: | MD. Morshedul Alam

PROBLEM 5: Sunshine Company produces and sells only washing machines. The company uses

variable costing for internal reporting and absorption costing for external reporting. The data for

the year 2016 is given below:

Direct materials: $150/unit

Direct labor: $45/unit

Variable manufacturing overhead: $25/unit

Fixed manufacturing overhead: $160,000 per year

Fixed marketing and administrative expenses: $110,000 per year

Variable marketing and administrative expenses: $15/unit sold

Company produced and sold 8,000 machines during the year 2016.

Required: Compute the unite product cost under variable costing and absorption costing.

Solution:

** Fixed O/H Cost per Unit = $160,000 / 8,000 Units = $20

Note: Marketing and administrative expenses are period costs and are not relevant in the

computation of unit product cost.

PREPARED BY: | MD. Morshedul Alam

PROBLEM 5:

Solution:

PREPARED BY: | MD. Morshedul Alam

Under the absorption costing, notice that all production costs, variable and fixed, are included when

determining the unit product cost. Thus if the company sells a unit of product and absorption costing

is being used, then $12 (consisting of $7 variable cost and $5 fixed cost) will be deducted on the

income statement as cost of goods sold. Similarly, any unsold units will be carried as inventory on the

balance sheet at $12 each.

Under variable costing, notice that all variable costs of production are included in product costs. Thus

if the company sells a unit of product, only $7 will be deducted as cost of goods sold, and unsold units

will be carried in the balance sheet inventory account at only $7.

PROBLEM 6:

Slim and Trim produces frozen yoghurt, a low-fat dairy dessert. The product is sold in five-litre

containers and had the following price and variable costs per unit in the current year:

Budgeted fixed overhead for the current year was $600,000, which was equal to actual fixed

overhead. Actual production was 150,000 five-litre containers, which was equal to the budgeted level

of production, but only 125,000 containers were sold. Slim and Trim incurred the following selling and

administrative expenses:

Required:

(i) Calculate the cost per unit under variable and absorption costing.

(ii) Prepare income statements for the current year using:

Absorption costing;

Variable costing.

Solution:

PREPARED BY: | MD. Morshedul Alam

Вам также может понравиться

- Application of Marginal Costing in Decision Making-Questions Example 1: Make or BuyДокумент3 страницыApplication of Marginal Costing in Decision Making-Questions Example 1: Make or BuyDEVINA GURRIAHОценок пока нет

- Ch4 LimitFactor QДокумент6 страницCh4 LimitFactor QFatikoОценок пока нет

- 04 Marginal CostingДокумент67 страниц04 Marginal CostingAyushОценок пока нет

- Horngren ch06Документ45 страницHorngren ch06Moataz MaherОценок пока нет

- Advanced Cost and MGMT ControlДокумент4 страницыAdvanced Cost and MGMT ControlGetachew Mulu100% (1)

- Corporate Financial Analysis with Microsoft ExcelОт EverandCorporate Financial Analysis with Microsoft ExcelРейтинг: 5 из 5 звезд5/5 (1)

- CH 22 Exercises ProblemsДокумент3 страницыCH 22 Exercises ProblemsAhmed El Khateeb100% (1)

- Absorption Costing Vs Variable CostingДокумент2 страницыAbsorption Costing Vs Variable Costingneway gobachew100% (1)

- Agricultural Project Chapter 4Документ73 страницыAgricultural Project Chapter 4Milkessa SeyoumОценок пока нет

- Cost AccountingДокумент21 страницаCost Accountingabdullah_0o0Оценок пока нет

- Lecture 2 BEP Numericals AnswersДокумент16 страницLecture 2 BEP Numericals AnswersSanyam GoelОценок пока нет

- Chapter 3 System Design Job Order Costing SystemДокумент76 страницChapter 3 System Design Job Order Costing SystemMulugeta GirmaОценок пока нет

- Ma Bep01Документ4 страницыMa Bep01Grace SimonОценок пока нет

- Marginal CostingДокумент13 страницMarginal CostingKUNAL GOSAVIОценок пока нет

- 3 - Cost Volume Profit AnalysisДокумент1 страница3 - Cost Volume Profit AnalysisPattraniteОценок пока нет

- Chapter 6 CostДокумент144 страницыChapter 6 CostMaria LiОценок пока нет

- Bab Vii BalandcorcardДокумент17 страницBab Vii BalandcorcardCela Lutfiana100% (1)

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFДокумент22 страницы05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalОценок пока нет

- Ch. 3 Flexible Budgets&Standard Cost SystemДокумент27 страницCh. 3 Flexible Budgets&Standard Cost Systemsolomon adamuОценок пока нет

- AMA Suggested Telegram Canotes PDFДокумент427 страницAMA Suggested Telegram Canotes PDFAnmol AgalОценок пока нет

- Chapter 3 SolutionsДокумент72 страницыChapter 3 SolutionsAshishpal SinghОценок пока нет

- Project Appraisal 1Документ23 страницыProject Appraisal 1Fareha RiazОценок пока нет

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionДокумент9 страницMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionCHAU Nguyen Ngoc BaoОценок пока нет

- 4 Learning CurvesДокумент8 страниц4 Learning Curvessabinaeghan1Оценок пока нет

- Demonstration ProblemsДокумент3 страницыDemonstration Problemsnega guluma100% (1)

- Cost - Volume - ProfitДокумент52 страницыCost - Volume - ProfitsueernОценок пока нет

- Budgeting and Variance AnalysisДокумент43 страницыBudgeting and Variance AnalysisADITYAROOP PATHAKОценок пока нет

- Solution Manual For Book CP 4Документ107 страницSolution Manual For Book CP 4SkfОценок пока нет

- Flexible Budgets and Overhead Analysis: True/FalseДокумент69 страницFlexible Budgets and Overhead Analysis: True/FalseRv CabarleОценок пока нет

- Humble Company Has Provided The Following Budget Information For TheДокумент2 страницыHumble Company Has Provided The Following Budget Information For TheAmit PandeyОценок пока нет

- The Purpose of Cost SheetДокумент5 страницThe Purpose of Cost SheetRishabh SinghОценок пока нет

- Market Share and Market Size VarianceДокумент1 страницаMarket Share and Market Size VarianceMohammedYousifSalihОценок пока нет

- Question 1 Hatem MasriДокумент5 страницQuestion 1 Hatem Masrisurvivalofthepoly0% (1)

- Costing Prob FinalsДокумент52 страницыCosting Prob FinalsSiddhesh Khade100% (1)

- Shukrullah Assignment No 2Документ4 страницыShukrullah Assignment No 2Shukrullah JanОценок пока нет

- Problem Solving 16Документ11 страницProblem Solving 16Ehab M. Abdel HadyОценок пока нет

- Financial and Managerial ExercisesДокумент5 страницFinancial and Managerial ExercisesBedri M Ahmedu50% (2)

- Case 1. Landers CompanyДокумент3 страницыCase 1. Landers CompanyMavel DesamparadoОценок пока нет

- Job Order, Operation and Life Cycle Costing Job Order CostingДокумент19 страницJob Order, Operation and Life Cycle Costing Job Order Costingjessa mae zerdaОценок пока нет

- Chap 005Документ214 страницChap 005deepak_baid100% (4)

- Solution Manual08Документ66 страницSolution Manual08yellowberries100% (2)

- Blocher8e EOC SM Ch04 FinalДокумент46 страницBlocher8e EOC SM Ch04 FinalDiah ArmelizaОценок пока нет

- Https Doc 0k 0s Apps Viewer - GoogleusercontentДокумент4 страницыHttps Doc 0k 0s Apps Viewer - GoogleusercontentAnuranjan Tirkey0% (1)

- 2009-02-05 171631 Lynn 1Документ13 страниц2009-02-05 171631 Lynn 1Ashish BhallaОценок пока нет

- Case 11-55Документ3 страницыCase 11-55HETTYОценок пока нет

- Hilton Chapter 14 Adobe Connect LiveДокумент18 страницHilton Chapter 14 Adobe Connect LiveGirlie Regilme BalingbingОценок пока нет

- Brkeven Ex2 PDFДокумент1 страницаBrkeven Ex2 PDFSsemakula Frank0% (1)

- Module 3 - CVP AnalysisДокумент2 страницыModule 3 - CVP AnalysisJoshua CabinasОценок пока нет

- Job and Batch CostingДокумент7 страницJob and Batch CostingDeepak R GoradОценок пока нет

- CHAPTER 6 ExercisesДокумент15 страницCHAPTER 6 ExercisesMoshir Aly100% (1)

- Short-Run Decision Making and CVP AnalysisДокумент43 страницыShort-Run Decision Making and CVP AnalysisHy Tang100% (1)

- Ch5-Limiting FactorsДокумент19 страницCh5-Limiting FactorsAdam Aliu100% (1)

- Chap 018Документ43 страницыChap 018josephselo100% (1)

- 2012 EE enДокумент76 страниц2012 EE enDiane MoutranОценок пока нет

- Chapter 8Документ30 страницChapter 8carlo knowsОценок пока нет

- Test: Managerial Accounting Chapter 10 - QuizletДокумент4 страницыTest: Managerial Accounting Chapter 10 - Quizletariel4869Оценок пока нет

- Value Chain Management Capability A Complete Guide - 2020 EditionОт EverandValue Chain Management Capability A Complete Guide - 2020 EditionОценок пока нет

- Multi-Product Break-Even Point Formula: Margin and Weighted Average Contribution Margin Ratio Are UsedДокумент2 страницыMulti-Product Break-Even Point Formula: Margin and Weighted Average Contribution Margin Ratio Are UsedSayadi AdiihОценок пока нет

- Break-Even Analysis With Multiple ProductsДокумент7 страницBreak-Even Analysis With Multiple ProductsFassikaw EjjiguОценок пока нет

- Contribution Margin Practice SolutionsДокумент4 страницыContribution Margin Practice Solutionskljasdf lkjasdf;lljОценок пока нет

- Hint: Certificate Is Valid, Moosa Goolam Ariff Vs Ebrahim Goolam AriffДокумент13 страницHint: Certificate Is Valid, Moosa Goolam Ariff Vs Ebrahim Goolam AriffM Tariqul Islam MishuОценок пока нет

- GE 05 Mock-1 (Ethics & Business, Ethical Conflict & Corporate Governance)Документ1 страницаGE 05 Mock-1 (Ethics & Business, Ethical Conflict & Corporate Governance)Moon130Оценок пока нет

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Документ20 страницEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Azizul AviОценок пока нет

- GE 02 Mock-1 (Cost Concept & Cost Behavior, Absorption Vs Marginal Costing & Pricing)Документ2 страницыGE 02 Mock-1 (Cost Concept & Cost Behavior, Absorption Vs Marginal Costing & Pricing)Moon130Оценок пока нет

- How Do I Write A Killer Proposal On Upwork As A Newbie - QuoraДокумент4 страницыHow Do I Write A Killer Proposal On Upwork As A Newbie - QuoraMoon130100% (3)

- Philip KotlerДокумент3 страницыPhilip KotlerMoon130Оценок пока нет

- World at A GlanceДокумент2 страницыWorld at A GlanceMoon130Оценок пока нет

- Speaking BooksДокумент53 страницыSpeaking BooksMoon130Оценок пока нет

- Changes: Paige VestДокумент190 страницChanges: Paige VestsimplyshellsОценок пока нет

- Success Center Accounting Tips and Practice Sheet Building Blocks To A General Journal Entry and T-AccountДокумент2 страницыSuccess Center Accounting Tips and Practice Sheet Building Blocks To A General Journal Entry and T-AccountThe PsychoОценок пока нет

- Winning in The Marketplace: Coffee House Taste by The Cup™Документ13 страницWinning in The Marketplace: Coffee House Taste by The Cup™Lilac CocoОценок пока нет

- Coursera - IESE Foundations of Management SpecializationДокумент2 страницыCoursera - IESE Foundations of Management SpecializationEnrique EgeaОценок пока нет

- CapitalizationДокумент41 страницаCapitalizationk,hbibk,nОценок пока нет

- Adjusted Feasibility Study of Kimcs AbujaДокумент64 страницыAdjusted Feasibility Study of Kimcs AbujaHomework PingОценок пока нет

- Onno Van Nijf The Social World of Roman Taxfarmers 2008Документ35 страницOnno Van Nijf The Social World of Roman Taxfarmers 2008OnnoОценок пока нет

- Q4 12 SHL 022013 Final PDFДокумент9 страницQ4 12 SHL 022013 Final PDFGeorge Khris DebbarmaОценок пока нет

- Juan Antonio Perez Search Warrant NDGAДокумент22 страницыJuan Antonio Perez Search Warrant NDGADan LehrОценок пока нет

- International Accounting 6Th International Student Edition Edition Timothy Doupnik Full ChapterДокумент67 страницInternational Accounting 6Th International Student Edition Edition Timothy Doupnik Full Chaptertimothy.parrott698100% (4)

- P5-2 Dan 3Документ5 страницP5-2 Dan 3ramaОценок пока нет

- Balaji Wafers PVT Ltd.Документ79 страницBalaji Wafers PVT Ltd.jagrutisolanki0189% (19)

- Sample Chart of Accounts: Account Name Code Financial Statement Group NormallyДокумент2 страницыSample Chart of Accounts: Account Name Code Financial Statement Group NormallyQamar ShahzadОценок пока нет

- AmalgamationДокумент4 страницыAmalgamationMadhura KhapekarОценок пока нет

- Practice Test 6.7 Revaluation and Impairment 945am Attempt ReviewДокумент8 страницPractice Test 6.7 Revaluation and Impairment 945am Attempt ReviewKRISTINA DENISSE SAN JOSEОценок пока нет

- Deductions ExamplesДокумент25 страницDeductions ExamplesKezОценок пока нет

- Fin0008 Managing Business Finance Formulae Sheet: N I, N 0 I, N N I, N 0 I, N N I, N 0 I, NДокумент2 страницыFin0008 Managing Business Finance Formulae Sheet: N I, N 0 I, N N I, N 0 I, N N I, N 0 I, NbnОценок пока нет

- 6e Brewer CH05 B EOCДокумент18 страниц6e Brewer CH05 B EOCLiyanCenОценок пока нет

- Important Tables in SAP FIДокумент9 страницImportant Tables in SAP FIPavan UlkОценок пока нет

- Paradise Island Resort A Completed Business PlanДокумент30 страницParadise Island Resort A Completed Business PlanMohdShahrukh100% (2)

- Ar 2020 BTPN Eng 14 AprilДокумент612 страницAr 2020 BTPN Eng 14 AprilklieindwrОценок пока нет

- The Civilisation of The Renaissance in Italy by Burckhardt, Jacob, 1818-1897Документ239 страницThe Civilisation of The Renaissance in Italy by Burckhardt, Jacob, 1818-1897Gutenberg.org100% (1)

- Eldama Ravine Technical: and Vocational CollegeДокумент2 страницыEldama Ravine Technical: and Vocational CollegeBen ChelagatОценок пока нет

- CORPORATE TAX PLANNING AND MANAGEMENT CiaДокумент4 страницыCORPORATE TAX PLANNING AND MANAGEMENT CiaAaronОценок пока нет

- GDBA505 Formula Sheet For ExamДокумент3 страницыGDBA505 Formula Sheet For ExamFLOREAROMEOОценок пока нет

- The Evolution of Accounting TheoryДокумент4 страницыThe Evolution of Accounting TheoryOwl100% (1)

- Habib Bank LimitedДокумент21 страницаHabib Bank LimitedbilalzuberiОценок пока нет

- BDM of 12.10.2015 - Buyback Program, Sell Up and PayoutДокумент5 страницBDM of 12.10.2015 - Buyback Program, Sell Up and PayoutBVMF_RIОценок пока нет

- Consti2Digest - Juan Luna Subdivisio, Inc. Vs M. Sarmiento, Et Al, GR L-3538, (28 May 1952Документ3 страницыConsti2Digest - Juan Luna Subdivisio, Inc. Vs M. Sarmiento, Et Al, GR L-3538, (28 May 1952Lu CasОценок пока нет

- Chapter 1 - Accounting For PartnershipДокумент13 страницChapter 1 - Accounting For PartnershipKim EllaОценок пока нет

- Diagnostic Exercises2Документ32 страницыDiagnostic Exercises2HanaОценок пока нет