Академический Документы

Профессиональный Документы

Культура Документы

CU v. State FOIA Docs (China-Biden-Baucus)

Загружено:

Citizens United0 оценок0% нашли этот документ полезным (0 голосов)

7K просмотров7 страницCU v. State FOIA Docs (China-Biden-Baucus)

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCU v. State FOIA Docs (China-Biden-Baucus)

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

7K просмотров7 страницCU v. State FOIA Docs (China-Biden-Baucus)

Загружено:

Citizens UnitedCU v. State FOIA Docs (China-Biden-Baucus)

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 7

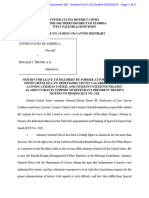

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No, C06762953 Date: 05/16/2019

RELEASE IN PART B6|

From: Baucus, Max (Beijing)

Sent: Sun, 25 Jan 2015 07:35:23 +0000

To: Baucus, Max(Beiing), 86

Subject: Fw:BHR Partners

From: Mit Datsopoulos

Sent: Saturday, January 24, 2015 08:09 AM

To: Baucus, Max (Beijing)

e tim

Subject: BHR Partners —

(On Behalf of

it Datsopoulos)

Mr. Ambassador (Max)

''m attaching a letter directed to you from Devon Archer, Vice Chairman of BHR Partners, a recently

‘created and funded investment vehicle who is targeting investments in companies other than natural

‘resource related companies in the United States. This investment has been funded and is actively

investing major sums in existing corporations.

lve requested that Devon Archer prepare a letter directed to you and include recent news articles that

provide documented information regarding the funding of their investment vehicle and the recent

Investment of 900 milion dollars as part ofa group of major investors that have invested 17.5 billion

dollars in the purchase of the retail unt of Sinopec.

| was introduced to Devon by a longtime Missoula friend, Bevan Cooney, who | believe you also met in

Missoula. 'm encouraged by Devon's commitment to participate in U.S. investments including projects

in Montana. The purpose of the company seems to be consistent with your philasophy of cross country

business investments and arrangements between China and the United States.

| was reluctant to write to you about the possiblity of arranging a meeting so that Devon and members

of his board could meet with you personally during their trip and board meeting in China. | believe this

could be a major opportunity to facilitate significant involvement by Chinese investment in U.S, business

enterprises.

| look forward to discussing Bohai and their mission regarding investments in the US. Ifyou have the

time, please give me a call. Thank you for reviewing the enclosures form Devon Archer and if there is

anything | can do to assist, please contact me.

With a Handshake,

Milt

Sarah Miles, Legal Assistant

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No. 06762853 Date: 05/16/2019

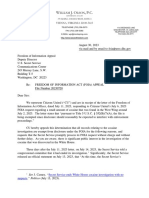

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No, C06762969 Date: 05/16/2019

DM@L

Daisopoulos, MacDonald & Lind,

201 W. Main Stoo, Suite 201 Missoula, MT'59002

Phone: 406.728.0840 | Fax 406.543.0134

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No. CO6762969 Date: 05/16/2019

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No, CO6762976 Date: 05/16/2019

BHR neat

pe ‘Chaoyang Ori Bing O00, China

20 January, 2015 [RELEASE IN PART BS)

Dear Honorable Ambassador Baucus,

Milton Datsopoulos suggested I reach out to you to arrange a meeting during my

next trip to Beijing.

‘This tip will correspond with our first quarter board meeting and I would like

to introduce you to our CEO, as well as to members of the Board of Directors

from Harvest Global and Bank of China.

Our fund is focused on both China outbound investing and opportunities

created by China’s Stated Owned Entity reforms. Indeed during the board

meeting we will be discussing our investment in the privatization of Sinopec

Marketing Co,, Led.

One of the fund’s Chinese constituents is Bohai Capital, which was established

as China’s first RMB private equity platform and has significant shareholders

from China’s financial institutions. The fund’s second Chinese constituent is

Harvest Fund Management, one of China’s largest fund managers, which has

established Shanghai Ample Financial Services as its altemative investment

platform.

‘You might be interested in the attached articles about the fund and the Sinopec

deal.

Please let me know what 2 convenient date is for you between 26" January and

6* February 2015, and with whom to coordinate to arrange this meeting,

Youts Sincerely,

Devon Archer

Vice Chairman

28 yg + EM Shang 28 Hong Kong EES New Yr

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No. CO6762076 Date: 05/16/2019

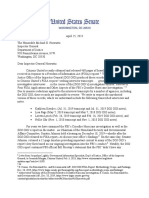

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No, C06762992 Date: 05/16/2019

RELEASE IN FULL|

WALL STREET JOURNAL

‘MARKETS

Bohai, Harvest and U.S. Investment Firms

Expand Target for Outbound Fund

Yuan-Denominated Portion to Be Converted to Dollars Via Shanghai's Free-

Trade Zone

SHANGHAI—A consortium of foreign and Chinese private-equity fiemsis aiming to caise about $1.5

billion to invest abroad, with the yuan-denominated portion of the fund to be converted to US. dollars

through Shanghai's free-trade zone,

‘The fund—launched by Chinese asset managers Bohai Industral Investment Fund Management Co, and

Harvest Fund Management Co. alongside US. investment and advisory fies Rosemont Seneca Partners

and Thomton Group LLC—started fundrsising in the second quarter, and has cased its target to $1.5

billion from an original $1 billion plan, @ spokesman at Bank of China Intemational Holdings Ltd, said.

BOC is one of the largest stakeholders in Bohai,

"The Bohai-Harvest fund is likely one of the biggest Sino-foreign collaborations in private equity to take

advantage of the free-trade zone's benefits in converting yuan to dollaes that can then be invested in

foreign companies. The funds ase casing a combination of yuan and US. dolla. The effort isthe latest

‘example private equity pushing boundaries in an acea that China hopes will help drive the country's

economic transformation. Nosmally, China restricts free conversion of its cuctency.

Bohai and its partners are expected to finish fundraising by the end of this yeas, sccording to BOCI's

spokesman and Lindsay Weight, co-chief executive officer of Harvest Capital Management Co, the

subsidiary under Harvest that will hold dicect stake in the joint fund,

Both declined to comment on how much has been raised so far. Rosemont confirmed the expansion of

the fund. Thomton didn't respond to requests for comment.

Covering 29-square kilometers in Shanghai's eastem Pudong region, the free-trade zone was created last

September as atest lab for China's economic reforms, including exchange-rate liberalization, Thousands

of companies, ranging from intemational banks to technology firms and investinent managers, have

registered to do business in the zone to benefit from the easing of Chinese financial and investment

segulations.

UNCLASSIFIED U.S. Department of Stato Caso No. F-2018-01904 Doc No, C06762992. Date: 05/16/2019

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No. C06762992 Date: 05/16/2019

Chinese investors usually need approval from several authorities for foreign buyouts, a lengthy process

that can make them less competitive abroad, But investing wa the fece-trade zone cuts down on that

time, Any project in the zone valued at $300 millon orless qualifies fora simpler filing, as long a itis't

considered a national secusity threst.

Homegrown peivate-equity fim Hong Capital Ld. was the frst among its peect to benefit froma

simplified administration approvals for outhound investmentsin Shanghai's free-tcade zone. Asan easly

registeant, the firm has completed two deals through the zone, teaming up with Suning Commerce

Group Co. to co-invest in Chinese video website PPTV in April and buying U.S. based production firm

STX Filmworks Inc. in March, according to a Hony spokeswoman, who declined to provide further

details.

“The fundraising by Bohai follows the registration of management firm Bohai Harvest RST (Shanghai)

Equity Investment Fund Management Co. in Shanghai's free-trade zone in December. The firm, beanded

under the English acronym for the owners—BHR Partners —originally et out ta raise thaee billion yuan

in the Chinese currency and $500 million in US. dollars, according, to its website,

Bohai is China's oldest private-equity firm, having launched the countrys frst yuan-denominated fund in

2006. Harvest Fund Management is one of China's largest asset managers, with previous private equity

ventures including with a jointly held fund investing in both domestic and overseas seal estat.

Rosenont Seneca is a Washington, D. C-based investment and advisory fim sun by Hunter Biden, the

son of US. Vice President Joe Biden, Thomton Group is a Boston-based cross-border investment

advisory fiem.

‘The oint fand will focus on cross-border merger and acquisition opportunities, focused in four

sectore—high-end manufactusing, financials, consumer, and enemgy and resources. Within the latte, the

fand will focus on natural gas, according to Ms. Weight.

Hunter Biden has experience in nabural gas, having joined the board of Ukrainian gxs producer Busisina

Holdings Ltd. eadlier this yea. Busisma is controlled by a former top security and energy official for

deposed President Viktor Yanukovych,

‘Bohai, Harvest, and Rosemont and Thomton as a pai each own 30% stake in the joint management

firm, according to Ms, Wright.

Write to Chao Deng at Chao, Dengi@:com

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No. C06762992 Date: 05/16/2019

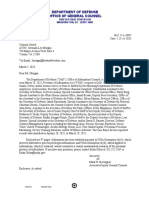

UNCLASSIFIED U.S, Department of State Case No. F-2018-01904 Doc No. C06762999 Date: 05/16/2019

REUTERS RELEASE IN FULL)

UPDATE 1-Sinopec sells $17.5 bin stake in retail

unit to investors

Se Sep 11204

* China pushing to restructure state-owned units

* Leading investors include Hacvest Fund Mgt, China Life Insucance, Tencent

* RRJ Capital among forcign investors (Adds details of retail unit, investors)

HONG KONG/BETJING, Sept 14 (Reuters) - Sinopec Cosp wil sell a 107.1 billion yuan.

(617.5 billion) stake in its retail unit to a group of 25 Chinese and foreign investors, Asia's

top oil refiner said in a statement on Sunday.

‘The sale, the country's biggest privatisation since president Xi Jinping came to power, comes

as China's government pushes to restructure its state-owned entesprises by bringing in

private capital and expertise.

Leading investors on the deal to buy a combined 29.99 percent of Sinopec include one of

China's biggest assct managers Harvest Fund Management Co Ltd taking 15 billion yuan

with its subsidiacy Hacvest Capital Management. China Life Insurance and a consortium that

includes People's Insurance Group of China Co Ltd and Tencent Holdings Ltd are each

taking 10 billion yuan stakes.

Other investors include Fosun Intecnational, China gas supplier ENN Energy Holdings Ltd

and white goods maker Haier Electronics Group Co Ltd.

Asia private equity firm RRJ Capital, founded by former Goldman Sachs and Hopu

Investment Management dealmaker Richard Ong, is among foreign investors in the deal

with a 3.6 billion yuan stake,

Sinopec's marketing and distribution unit, which includes a wholesale business, has more

than 30,000 petcol stations, over 23,000 convenience stores, as well as oil-product pipelines

and storage facilites

‘The deal will boost the value of the low-margin macketing business, bolster the group's

finances and reinforce investment in exploration and production.

Sinopec’s chaicman, Fu Chengyu, has previously said the investors are expected to bring in

expertise and ideas to improve non-fuel sales at its petrol stations.

Unlike in Western markets, where non-fuel businesses - convenience stores and things like

fast food or car washing - can account for more than half of a station's profits, more than 99

percent of Sinopec's cetal sales come feom peteol.

In the past few months Sinopec has signed agreements with multiple Chinese companies to

make mote use of its peteol stations and provide more services to consumers.

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No. C08762999 Date: 05/16/2019

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No. C06762999 Date: 05/16/2019

Tn August the company signed a preliminary deal with internet giant Tencent to introduce

digital commerce to the retail arm. (Reporting by Stephen Aldred in Hong Kong and Shea

Yan and Benjamin Kang Lim in Beijing; Editing by Michael Usquhazt)

UNCLASSIFIED U.S. Department of State Case No. F-2018-01904 Doc No. C06762999 Date: 05/16/2019

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- CU and CUF File Amicus Brief in Donald J. Trump v. United StatesДокумент42 страницыCU and CUF File Amicus Brief in Donald J. Trump v. United StatesCitizens UnitedОценок пока нет

- CU FOIA Production #2 (USSS - Cocaine Found at White House)Документ28 страницCU FOIA Production #2 (USSS - Cocaine Found at White House)Citizens UnitedОценок пока нет

- CU v. State FOIA Production (Mar. 2024 - Biden and Associates China-Ukraine)Документ185 страницCU v. State FOIA Production (Mar. 2024 - Biden and Associates China-Ukraine)Citizens UnitedОценок пока нет

- CU Submits Administrative Appeal To New York District Attorney's Office Over Non-Response To Freedom of Information RequestДокумент6 страницCU Submits Administrative Appeal To New York District Attorney's Office Over Non-Response To Freedom of Information RequestCitizens UnitedОценок пока нет

- CU and CUF Join AAF Amicus Brief in KC Transport v. Secretary of Labor (Chevron Deference)Документ32 страницыCU and CUF Join AAF Amicus Brief in KC Transport v. Secretary of Labor (Chevron Deference)Citizens UnitedОценок пока нет

- CU, CUF, TPC and Others File Amicus Brief in Fischer v. U.S. (SCOTUS)Документ37 страницCU, CUF, TPC and Others File Amicus Brief in Fischer v. U.S. (SCOTUS)Citizens UnitedОценок пока нет

- CU Files Amicus Brief in Trump v. U.S. (On Application For Stay of The Mandate To Be Issued by The United States Court of Appeals)Документ25 страницCU Files Amicus Brief in Trump v. U.S. (On Application For Stay of The Mandate To Be Issued by The United States Court of Appeals)Citizens UnitedОценок пока нет

- CU & CUF Join AAF Amicus Brief On Ozarks v. BidenДокумент24 страницыCU & CUF Join AAF Amicus Brief On Ozarks v. BidenCitizens UnitedОценок пока нет

- CU and CUF File Amicus Brief in United States of America v. Donald J. TrumpДокумент31 страницаCU and CUF File Amicus Brief in United States of America v. Donald J. TrumpCitizens UnitedОценок пока нет

- Trump v. Anderson SCOTUS Amicus Brief (CU, Meese, Mukasey, Barr, Calabresi, Lawson)Документ39 страницTrump v. Anderson SCOTUS Amicus Brief (CU, Meese, Mukasey, Barr, Calabresi, Lawson)Citizens UnitedОценок пока нет

- CU FOIA Production (USSS - Cocaine Found at White House)Документ116 страницCU FOIA Production (USSS - Cocaine Found at White House)Citizens UnitedОценок пока нет

- CU Amicus Brief - America First Legal Foundation v. U.S. Department of Agriculture (Presidential Communications Privilege)Документ29 страницCU Amicus Brief - America First Legal Foundation v. U.S. Department of Agriculture (Presidential Communications Privilege)Citizens UnitedОценок пока нет

- Citizen's Declaration Against Sanctuary Cities LetterДокумент1 страницаCitizen's Declaration Against Sanctuary Cities LetterCitizens UnitedОценок пока нет

- CU FOIA Appeal To U.S. Secret Service (White House Cocaine Investigation)Документ2 страницыCU FOIA Appeal To U.S. Secret Service (White House Cocaine Investigation)Citizens UnitedОценок пока нет

- Joe Biden Must Be Impeached - The People Have Seen Enough Petition LetterДокумент3 страницыJoe Biden Must Be Impeached - The People Have Seen Enough Petition LetterCitizens United0% (1)

- Sens. Ron Johnson and Charles Grassley Utilize CU FOIA Records in Letter To DOJ Inspector General Michael Horowitz Demanding TransparencyДокумент3 страницыSens. Ron Johnson and Charles Grassley Utilize CU FOIA Records in Letter To DOJ Inspector General Michael Horowitz Demanding TransparencyCitizens UnitedОценок пока нет

- CU FOIA Request To U.S. Secret Service (Cocaine Found at White House)Документ2 страницыCU FOIA Request To U.S. Secret Service (Cocaine Found at White House)Citizens UnitedОценок пока нет

- CU v. DOD FOIA Production (Austin Recusal)Документ98 страницCU v. DOD FOIA Production (Austin Recusal)Citizens UnitedОценок пока нет

- CU Amicus Brief - Groff v. DeJoy (Religious Liberty)Документ34 страницыCU Amicus Brief - Groff v. DeJoy (Religious Liberty)Citizens UnitedОценок пока нет

- CU v. DHS (Disinformation Governance Board - Production #2)Документ239 страницCU v. DHS (Disinformation Governance Board - Production #2)Citizens UnitedОценок пока нет

- Interior Dept. Voting EO FOIA Production #1Документ59 страницInterior Dept. Voting EO FOIA Production #1Citizens UnitedОценок пока нет

- CU-CUF-TPC File Amicus Brief in Arizona v. MayorkasДокумент37 страницCU-CUF-TPC File Amicus Brief in Arizona v. MayorkasCitizens UnitedОценок пока нет

- Interior Dept. Voting EO FOIA Production #3Документ18 страницInterior Dept. Voting EO FOIA Production #3Citizens UnitedОценок пока нет

- Citizens United Letter To Congress (COVID Origins)Документ2 страницыCitizens United Letter To Congress (COVID Origins)Citizens UnitedОценок пока нет

- CU v. DOJ IG Production #1Документ462 страницыCU v. DOJ IG Production #1Citizens United100% (1)

- The Biden Classified Documents: 35 Questions That Must Be AnsweredДокумент3 страницыThe Biden Classified Documents: 35 Questions That Must Be AnsweredCitizens UnitedОценок пока нет

- CU Amicus Brief - Biden v. Nebraska (Student Loan Cancellation)Документ36 страницCU Amicus Brief - Biden v. Nebraska (Student Loan Cancellation)Citizens UnitedОценок пока нет

- CU v. State (Hunter Biden - January 2023)Документ262 страницыCU v. State (Hunter Biden - January 2023)Citizens UnitedОценок пока нет

- Interior Dept. Voting EO FOIA Production #2Документ14 страницInterior Dept. Voting EO FOIA Production #2Citizens UnitedОценок пока нет

- CU-CUF FEC Technology Modernization CommentsДокумент14 страницCU-CUF FEC Technology Modernization CommentsCitizens UnitedОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)