Академический Документы

Профессиональный Документы

Культура Документы

TH TH

Загружено:

Welcome 1995Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

TH TH

Загружено:

Welcome 1995Авторское право:

Доступные форматы

TAX

Member of primitive communities used to render voluntary services for the support of

Government. Later on, revenues such as “tributes” earnings of mines and other enterprises were

earmarked for maintenance of State, as was the practice in Athens. Ancient States considered

taxation as a minor source of revenue, levied mainly on property, inheritance and commodities.

“the small size of expenditure of ancient States did not require extensive systems of taxation”

(Buchler in his book ‘Public Finance’)

According to Prof.Plehn, the origin of tax system of modern States is found in “Feudal

Practices”. After the fall of Rome, rules were supported by their own lands and compulsory dues

from their subjects. Before the advent of money, feudal market dues, tolls for protection and use

of roads, bridges and ferries, land rent and other payments were in goods or kind. With the rise

of money economy, all such payments were gradually commuted into money payments or Taxes.

Kings started preferring payments in money and the subjects also preferred to pay money rather

than goods or services.

With the Industrial revolution, new forms of wealth arose. New Industries were started.

Land tax, excise, customs duties, market tax, toll taxes on personal goods and other taxes were

imposed by the States. Thus, the old Feudal revenue system gradually changed to give way to

taxation.

The growing needs of modern States and increasing public expenditure have made new

sources of revenues essential. They were found in imposing tax upon new business activities,

articles of consumption and properties. In the 19th and 20th centuries, Income tax and Inheritance

tax have gained prominence. With the World War I which imposed heavy financial burden on

most of the States, new general sales taxes and capital levies were devised for additional

revenues.

Changing economic, political and social conditions have led to the process of

reconstruction in ‘Fiscal system’. In the second half of 20th century, Government outlay on social

sectors like public health, education , water supply support to weaker sections and other

infrastructural needs have made all government to look for various sources of revenues.

Naturally, taxation has become the biggest and the principal source of revenue to raise the

colossal sums needed by the modern Government. Various types of taxes like direct and indirect

taxes on individuals, goods and services are levied to raise the needed resources. In fact every

citizen of a country, rich or poor, pays taxes in some form or the other.

Вам также может понравиться

- Detroit ManualДокумент435 страницDetroit Manualvictorhernandezrega50% (2)

- J. Dimaampao Notes PDFДокумент42 страницыJ. Dimaampao Notes PDFAhmad Deedatt Kalbit100% (1)

- Taxation Principles and TheoriesДокумент68 страницTaxation Principles and TheoriesJoana Damayan100% (6)

- Essay One: Background On TaxationДокумент20 страницEssay One: Background On TaxationEmz Mostafa100% (1)

- The Development of Public Finance InstitutionsДокумент49 страницThe Development of Public Finance InstitutionsPeo Batangasph100% (3)

- Management by ObjectivesДокумент30 страницManagement by ObjectivesJasmandeep brar100% (4)

- Indirect Taxes 1,2,3Документ34 страницыIndirect Taxes 1,2,3Welcome 1995Оценок пока нет

- NammalvarДокумент22 страницыNammalvarPranesh Brisingr100% (1)

- 2018Документ51 страница2018Tj Cabacungan100% (1)

- Local Government Taxation in The Philippines 1220413948637399 9Документ38 страницLocal Government Taxation in The Philippines 1220413948637399 9Jojo PalerОценок пока нет

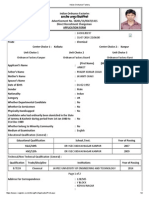

- Indian Ordnance FactoryДокумент2 страницыIndian Ordnance FactoryAniket ChakiОценок пока нет

- Lesson For SpreadsheetsДокумент69 страницLesson For SpreadsheetsCrisna Rivera PundanoОценок пока нет

- History of Public Fiscal AdministrationДокумент13 страницHistory of Public Fiscal AdministrationRonna Faith Monzon100% (1)

- Local Government TaxationДокумент16 страницLocal Government TaxationReychelle Marie BernarteОценок пока нет

- HRM Final Ass Apple Human Resource Management AssesmentДокумент8 страницHRM Final Ass Apple Human Resource Management AssesmentAditya Nandi Vardhana100% (1)

- VAT (Chapter 8 Compilation of Summary)Документ36 страницVAT (Chapter 8 Compilation of Summary)Dianne LontacОценок пока нет

- Event MCQДокумент9 страницEvent MCQpralay ganguly50% (2)

- MF 660Документ7 страницMF 660Sebastian Vasquez OsorioОценок пока нет

- Importance of Team Work in An OrganizationДокумент10 страницImportance of Team Work in An OrganizationMohammad Sana Ur RabОценок пока нет

- 1 History and Development of TaxationДокумент4 страницы1 History and Development of TaxationSenan MurselliОценок пока нет

- Edited MBA 4 ThesisДокумент43 страницыEdited MBA 4 ThesisMichael Yeboah100% (1)

- Tax AdministrationДокумент62 страницыTax Administrationabdussemd2019Оценок пока нет

- AnalysisДокумент5 страницAnalysis2301106378Оценок пока нет

- Word Eric It AssignДокумент11 страницWord Eric It Assigngatete samОценок пока нет

- Taxation System in The WorldДокумент11 страницTaxation System in The WorldQurat Ul AinОценок пока нет

- Chapter 2Документ10 страницChapter 2Jimmy LojaОценок пока нет

- Taxation Unit TwoДокумент24 страницыTaxation Unit TwoHabibuna MohammedОценок пока нет

- TAx 2Документ75 страницTAx 2Felomina AycoОценок пока нет

- TAXATIONДокумент14 страницTAXATIONAllora AguinaldoОценок пока нет

- History of TaxationДокумент2 страницыHistory of TaxationTeweldebrhan MamoОценок пока нет

- The Evolution of IncomeДокумент4 страницыThe Evolution of IncomesoujnyОценок пока нет

- Unit ThreeДокумент14 страницUnit ThreeBethelhem MesfinОценок пока нет

- Rosa LuxembergДокумент156 страницRosa LuxembergMihai IovanelОценок пока нет

- TaxationДокумент13 страницTaxationMichaela AndresОценок пока нет

- Tax System and Procedure in USA, UK, India by Simon (BUBT)Документ165 страницTax System and Procedure in USA, UK, India by Simon (BUBT)Simon HaqueОценок пока нет

- Taxation 1Документ217 страницTaxation 1Lea RatayОценок пока нет

- CHAPTERДокумент58 страницCHAPTERAwinash ChowdaryОценок пока нет

- Taxation 1Документ218 страницTaxation 1Kent DasallaОценок пока нет

- Pointers To Review (4 Quarter Exam) : Lectures by Ms. FundimeraДокумент82 страницыPointers To Review (4 Quarter Exam) : Lectures by Ms. FundimeraAr-Ar FundimeraОценок пока нет

- Taxation Laws Module 1: Introduction To Taxation in India: CS Sangeeta BaggaДокумент16 страницTaxation Laws Module 1: Introduction To Taxation in India: CS Sangeeta BaggaBhanu Pratap SinghОценок пока нет

- History of TaxationДокумент11 страницHistory of TaxationJonela LazaroОценок пока нет

- The Evolution of Taxation What Is Taxation?Документ4 страницыThe Evolution of Taxation What Is Taxation?Sophia Ivy E. ServidadОценок пока нет

- Taxation EvolutionДокумент7 страницTaxation EvolutionSherry Mhay BongcayaoОценок пока нет

- BPA120Документ2 страницыBPA120sharief.aa90Оценок пока нет

- 23 UgsthbДокумент84 страницы23 UgsthbChawla DimpleОценок пока нет

- Summer Internship ReportДокумент47 страницSummer Internship ReportBijal Mehta43% (7)

- Monopoly Money The State As A Price SetterДокумент20 страницMonopoly Money The State As A Price SetterHasan MahfoozОценок пока нет

- ECONOMIAДокумент8 страницECONOMIAdafer_daniОценок пока нет

- ProjectДокумент36 страницProjectpandeyaman7608Оценок пока нет

- Notes in TAXATIONДокумент25 страницNotes in TAXATIONDarleneОценок пока нет

- Government Revenues (Taxation and Non - Tax Revenues)Документ22 страницыGovernment Revenues (Taxation and Non - Tax Revenues)Anonymous DbjsDYASОценок пока нет

- Eco Tax ProjectДокумент23 страницыEco Tax ProjectRishi RameshОценок пока нет

- Local Government Taxation in The Philippines: A Report PaperДокумент11 страницLocal Government Taxation in The Philippines: A Report PaperNaruse JunОценок пока нет

- Chapter Ii The Development of Public FinanceДокумент28 страницChapter Ii The Development of Public FinancePeter AquinoОценок пока нет

- Part (A) : Theoretical Background of TaxationДокумент6 страницPart (A) : Theoretical Background of TaxationSarang FatikОценок пока нет

- History of Taxation PRE - 1922: TH TH TH THДокумент5 страницHistory of Taxation PRE - 1922: TH TH TH THbhavsarsonal09Оценок пока нет

- Unit 3 and 4Документ5 страницUnit 3 and 4Jeymi GalindoОценок пока нет

- Fis AssДокумент7 страницFis AssNusrat ShatyОценок пока нет

- Analysis Paper History TaxationДокумент6 страницAnalysis Paper History TaxationKai V LenciocoОценок пока нет

- Lesson 13, Taxation, READINGS IN THE PHILIPPINE HISTORYДокумент6 страницLesson 13, Taxation, READINGS IN THE PHILIPPINE HISTORYMa Bernadeth C RodoyОценок пока нет

- History of Taxation and Tax ManagementДокумент8 страницHistory of Taxation and Tax ManagementchitraОценок пока нет

- Taxation 101: Basic Rules and Principles in Philippine TaxationДокумент8 страницTaxation 101: Basic Rules and Principles in Philippine Taxationbee tifulОценок пока нет

- Importance of Taxation: Sir Arman S. PascualДокумент36 страницImportance of Taxation: Sir Arman S. PascualJesse OcampoОценок пока нет

- NeoLiberalism and The Counter-EnlightenmentДокумент26 страницNeoLiberalism and The Counter-EnlightenmentvanathelОценок пока нет

- Historical Development of of Taxation Principles and Law in KenyaДокумент17 страницHistorical Development of of Taxation Principles and Law in KenyaJustus AmitoОценок пока нет

- History of Direct TaxationДокумент15 страницHistory of Direct Taxationjesal makwanaОценок пока нет

- Taxation 101: Basic Rules and Principles in Philippine TaxationДокумент8 страницTaxation 101: Basic Rules and Principles in Philippine TaxationZamZamieОценок пока нет

- Module 1 TaxationДокумент5 страницModule 1 TaxationQueenel MabbayadОценок пока нет

- Powers of Customs OfficernДокумент1 страницаPowers of Customs OfficernWelcome 1995Оценок пока нет

- Transaction Value of Identical GoodsДокумент1 страницаTransaction Value of Identical GoodsWelcome 1995Оценок пока нет

- Prohibition and Regulation of Drawback in Certain CasesДокумент1 страницаProhibition and Regulation of Drawback in Certain CasesWelcome 1995Оценок пока нет

- Transaction Value of Identical GoodsДокумент1 страницаTransaction Value of Identical GoodsWelcome 1995Оценок пока нет

- Drawback Allowable On ReДокумент1 страницаDrawback Allowable On ReWelcome 1995Оценок пока нет

- Permission For Deposit of Goods in A Warehouse UnderДокумент1 страницаPermission For Deposit of Goods in A Warehouse UnderWelcome 1995Оценок пока нет

- Rate of Duty and Tariff ValuationДокумент1 страницаRate of Duty and Tariff ValuationWelcome 1995Оценок пока нет

- Transaction Value of Identical GoodsДокумент1 страницаTransaction Value of Identical GoodsWelcome 1995Оценок пока нет

- Clearance of Goods For Home ConsumptionДокумент1 страницаClearance of Goods For Home ConsumptionWelcome 1995Оценок пока нет

- Exemption by Special OrderДокумент1 страницаExemption by Special OrderWelcome 1995Оценок пока нет

- Valuation of Goods Under Customs ActДокумент1 страницаValuation of Goods Under Customs ActWelcome 1995Оценок пока нет

- Transaction Value of Similar GoodsДокумент1 страницаTransaction Value of Similar GoodsWelcome 1995Оценок пока нет

- Transaction Value of Identical GoodsДокумент1 страницаTransaction Value of Identical GoodsWelcome 1995Оценок пока нет

- Deductive Value MethodДокумент1 страницаDeductive Value MethodWelcome 1995Оценок пока нет

- Residual MethodДокумент1 страницаResidual MethodWelcome 1995Оценок пока нет

- Different Types of Customs Dutie1Документ1 страницаDifferent Types of Customs Dutie1Welcome 1995Оценок пока нет

- Product Not Covered SR - No Classification Description of GoodsДокумент2 страницыProduct Not Covered SR - No Classification Description of GoodsWelcome 1995Оценок пока нет

- Mysuru Royal Institute of Technology. Mandya: Question Bank-1Документ2 страницыMysuru Royal Institute of Technology. Mandya: Question Bank-1chaitragowda213_4732Оценок пока нет

- Chapter 01Документ26 страницChapter 01zwright172Оценок пока нет

- Group H Macroeconomics Germany InflationДокумент13 страницGroup H Macroeconomics Germany Inflationmani kumarОценок пока нет

- Nature Hill Middle School Wants To Raise Money For A NewДокумент1 страницаNature Hill Middle School Wants To Raise Money For A NewAmit PandeyОценок пока нет

- Ababio v. R (1972) 1 GLR 347Документ4 страницыAbabio v. R (1972) 1 GLR 347Esinam Adukpo100% (2)

- Schema Elctrica Placa Baza Toshiba A500-13wДокумент49 страницSchema Elctrica Placa Baza Toshiba A500-13wnicmaxxusОценок пока нет

- Virtual Machine Functionalism (VMF)Документ52 страницыVirtual Machine Functionalism (VMF)Cássia SiqueiraОценок пока нет

- Routing Fundamentals: How A Juniper Device Makes Forwarding DecisionsДокумент8 страницRouting Fundamentals: How A Juniper Device Makes Forwarding DecisionsLarsec LarsecОценок пока нет

- Product Information DIGSI 5 V07.50Документ56 страницProduct Information DIGSI 5 V07.50g-bearОценок пока нет

- Nishith Desai Associates - Alternative Investment Funds - SEBI Scores Half Century On DebutДокумент2 страницыNishith Desai Associates - Alternative Investment Funds - SEBI Scores Half Century On DebutRajesh AroraОценок пока нет

- Stps 20 H 100 CTДокумент8 страницStps 20 H 100 CTPablo Cruz ArchundiaОценок пока нет

- Baling Press: Model: LB150S Article No: L17003 Power SupplyДокумент2 страницыBaling Press: Model: LB150S Article No: L17003 Power SupplyNavaneeth PurushothamanОценок пока нет

- Pivacare Preventive-ServiceДокумент1 страницаPivacare Preventive-ServiceSadeq NeiroukhОценок пока нет

- IMO Publication Catalogue List (June 2022)Документ17 страницIMO Publication Catalogue List (June 2022)Seinn NuОценок пока нет

- Trahar (2013) - Internationalization of The CurriculumДокумент13 страницTrahar (2013) - Internationalization of The CurriculumUriel TorresОценок пока нет

- Data Loss PreventionДокумент20 страницData Loss Preventiondeepak4315Оценок пока нет

- UT Dallas Syllabus For cs4341.001.09s Taught by (Moldovan)Документ4 страницыUT Dallas Syllabus For cs4341.001.09s Taught by (Moldovan)UT Dallas Provost's Technology GroupОценок пока нет

- Kajian Sistematik: Strategi Pembelajaran Klinik Di Setting Rawat JalanДокумент5 страницKajian Sistematik: Strategi Pembelajaran Klinik Di Setting Rawat JalanrhiesnaОценок пока нет

- Execution Lac 415a of 2006Документ9 страницExecution Lac 415a of 2006Robin SinghОценок пока нет

- 036 ColumnComparisonGuideДокумент16 страниц036 ColumnComparisonGuidefarkad rawiОценок пока нет