Академический Документы

Профессиональный Документы

Культура Документы

Exercises Direction: Read and Understand Each of The Statements Given. Write Only Your Final Answer and Send It As A Private

Загружено:

Amethyst JordanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Exercises Direction: Read and Understand Each of The Statements Given. Write Only Your Final Answer and Send It As A Private

Загружено:

Amethyst JordanАвторское право:

Доступные форматы

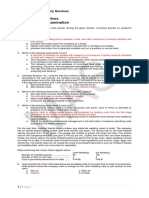

STANDARD COSTING Chapter 3

Exercises

Direction: Read and understand each of the statements given. Write only your final answer and send it as a private

message through messenger. If you are using Google forms, choose the option that best corresponds to your answer. For

supply the answer questions, write only the final answer. Keep your solutions with you. We will compare it with the

solution that I will send you after your submission. Theory questions (1 point) Problem solving multiple choices and

supply the answer (2 points)

1. Agree or Disagree? I have read and understood the lesson about standard costing.

2. Agree or Disagree? I answer all the activities on my own with complete solution per each problem.

3. Both standard costs and budgeted costs are used for controlling costs. However, the two terms are not the same.

Standard costs differ from budgeted costs in that standard costs

a. Are based on engineering studies while budgeted costs are historical costs

b. Costs that were incurred for actual production, while budgeted costs are costs that should have been incurred for

such production

c. Are costs that should have been incurred for actual production, while budgeted costs are costs that should be

incurred for budgeted or planned production

d. Are always expressed in total amounts, while budgeted costs are always expressed in per-unit amounts

4. The following describe ideal standards, except

a. Currently attainable standards

b. Theoretical or maximum-efficiency standards

c. Make no allowance for waste, machine downtime, and spoilage

d. Perfection standards

5. A standard cost is an estimate of what a cost should be under normal operating conditions. In establishing standard

costs, the following organizational personnel may be involved, except

a.

b. Top management d. Quality control personnel

c. Budgetary accountants e. Industrial engineers

Questions 6 to 8 are based on the following information.

Burger Queen uses a standard costing system in the manufacture of its single product. The 35,000 units of raw material in

inventory were purchased for P 105,000, and two units of raw materials are required to produce one unit of final product.

In November, the company produced 12,000 units of product. The standard allowed for material was P 60,000, and there

was an unfavorable quantity variance of P 2,500.

6. Burger Queen’s standard price for one unit of materials is

a. P 2.50 b. P 3.00 c. P 5.00 d. P 6.00

7. The units of material used to produce November output totaled

a. 12,000 units b. 23,000 units c. 24,000 units d. 25,000 units

8. The materials price variance for the units used in November was

a. P 2,500 unfavorable c. P 12,500 unfavorable

b. P 15,000 unfavorable d. P 2,500 favorable

9. In a standard costing system, actual costs are compared with standard costs. The difference or variance is determined,

and responsibility for such variance is assigned or identified to a particular person or department, in order to

a. Determine who is at fault and render the appropriate punishment

b. Be able to set the correct selling price of the product

c. Use the knowledge about the variances to promote learning and continuous improvement in the manufacturing

operations

d. Trace the variances to the proper inventory accountants so that they may be valued at actual costs

10. The materials mix variance for a product is P 450 unfavorable and the materials yield variance is P 150 unfavorable.

This means that

a. The materials price variance is P 600 unfavorable

b. The materials quantity variance is P 600 unfavorable

Standard Costing Page 1

c. The total materials cost variance is definitely P 600 unfavorable

d. The materials price variance is also unfavorable, but the amount cannot be determined from the given

information

11. Variable overhead is applied on the basis of standard direct labor hours. If for a given period, the direct labor

efficiency variance is favorable, the variable overhead efficiency variance will be

a. Favorable c. Zero

b. Unfavorable d. The same amount as the labor efficiency variance

12. Under a standard cost system, the materials efficiency variances are the responsibility of

a. Production and industrial engineering c. Purchasing and sales

b. Purchasing and industrial engineering d. Sales and industrial engineering

13. A favorable materials price variance coupled with an unfavorable materials usage variance would most likely result

from

a. Machine efficiency problems

b. Product mix production changes

c. Labor efficiency problems

d. The purchase of lower-than-standard-quality materials

14. Which of the following is the most probable reason a company would experience an unfavorable labor rate variance

and a favorable labor efficiency variance?

a. The mix of workers assigned to the particular job was heavily weighted towards the use of highly paid

experienced individuals

b. The mix of workers assigned to the particular job was heavily weighted towards the use of new relatively low

paid unskilled workers

c. Because of the production schedule workers from other production areas were assigned to assist this particular

process

d. Defective materials caused more labor to be used in order to produce a standard unit

15. A debit balance in the labor efficiency variance indicates that

a. Standard hours exceed actual hours

b. Actual hours exceed standard hours

c. Standard rate and standard hours exceed actual rate and actual hours

d. Actual rate and actual hours exceed standard rate and standard hours

16. Under the three variance method for analyzing factory overhead, which of the following is used in the computation of

the spending variance?

Budget allowance based on standard hours Factory overhead applied to production

a. Yes Yes

b. Yes No

c. No Yes

d. No No

17. What is the normal year end treatment of immaterial variances recognized in a cost accounting system using standard

costs?

a. Reclassified as deferred charges until all related production is sold

b. Allocated among cost of goods manufactured and ending work in process inventory

c. Closed to cost of goods sold in the period in which they arose

d. Capitalized as a cost of ending finished goods inventory

For questions 18 to 25

Villaverde Corporation’s standard cost system contains the following overhead costs, computed based on a monthly

normal volume of 25,000 units or 50,000 direct labor hours:

Variable factory overhead P 12 per unit

Fixed factory overhead 8 per unit

Total P 20

The following information pertains to the month of April 2014:

Actual FOH costs incurred: Variable P 316,680

Fixed 225,000

Actual production 26,000 units

Actual direct labor hours worked 54,600 hours

Standard Costing Page 2

18. The total FOH cost variance is

a. P 25,000 unfavorable c. P 21,680 unfavorable

b. P 17,000 unfavorable d. P 4,680 unfavorable

19. The variable overhead variance amounts to

a. P 25,000 unfavorable c. P 283,320 favorable

b. P 16,680 unfavorable d. P 4,680 unfavorable

20. The variable overhead spending variance is

a. P 16,680 unfavorable c. P 10,920 favorable

b. P 4,680 unfavorable d. P 12,000 unfavorable

21. The variable overhead efficiency variance is

a. P 15,600 unfavorable c. P 4,680 unfavorable

b. P 10,920 favorable d. P 12,000 unfavorable

22. The fixed overhead variance amounts to

a. P 25,000 unfavorable c. P 8,000 unfavorable

b. P 17,000 unfavorable d. P 6,600 unfavorable

23. The fixed overhead budget or spending variance amounts to

a. P 0 c. P 17,000 unfavorable

b. P 8,000 unfavorable d. P 25,000 unfavorable

24. The fixed overhead volume or capacity variance amounts to

a. P 8,000 favorable c. P 25,000 unfavorable

b. P 8,000 unfavorable d. P 25,000 favorable

25. Using the two-variance method, the controllable variance is

a. P 21,680 unfavorable c. P 29,680 unfavorable

b. P 4,680 unfavorable d. P 15,600 unfavorable

26. The following information is available from the Faith Company:

Actual factory overhead P 15,000

Fixed overhead expenses, actual P 7,200

Fixed overhead expenses, budgeted P 7,000

Actual hours 3,500

Standard hours 3,800

Variable overhead rate per DLH P 2.50

Assuming that Faith uses a three-way analysis of overhead variances, what is the spending variance?

27. Information on Kenon Company’s direct material costs is as follows:

Standard unit price P 3.60

Actual quantity purchased 1,600

Standard quantity allowed for actual production 1,450

Materials purchase price variance – favorable P 240

What was the actual purchase price per unit, rounded to the nearest cent?

28. For the month of April, Thorp Company’s records disclose the following data relating to direct labor:

Actual cost P 10,000

Rate variance 1,000 favorable

Efficiency variance 1,500 unfavorable

Standard cost P 9,500

For the month of April,, actual direct labor hours amounted to 2,000. In April, Thorp’s standard direct labor rate per

hour was _____.

Standard Costing Page 3

29. Sullivan Corporation’s direct labor costs for the month of March were as follows:

Standard direct labor hours 42,000

Actual direct labor hours 40,000

Direct labor rate variance – favorable P 8,400

Standard direct labor rate per hour P 6.30

What was Sullivan’s total direct labor payroll for the month of March?

30. Mars Company ends the month with a volume variance of P 6,360 unfavorable. If budgeted fixed overhead was P

480,000, overhead was applied on the basis of 32,000 budgeted machine hours, and budgeted variable factory

overhead was P 170,000, what was the actual hours for the month?

31. Mola Company manufactures one product with a standard direct labor cost of 4 hours at P 12.00 per hour. During

June 1,000 units were produced using 4,100 hours at P 12.20 per hour. The unfavorable direct labor efficiency

variance was _____________.

32. New Technology Company uses a predetermined factory overhead application rate based on direct labor cost. For the

year ended December 31, Neil’s budgeted factory overhead was P 600,000, based on budgeted volume of 50,000

direct labor hours at a standard direct labor rate of P 6 per hour. Actual factory overhead amounted to P 620,000, with

actual direct labor cost of P 325,000. For the year, overapplied factory overhead was ___________.

33. In 7 to 10 sentences, synthesize what you have learned in this topic.(10 points)

Standard Costing Page 4

Вам также может понравиться

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageОт EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageРейтинг: 5 из 5 звезд5/5 (1)

- EXERCISESДокумент6 страницEXERCISESAngel Keith Mercado100% (3)

- Strat (Quiz)Документ10 страницStrat (Quiz)mariaravenjoy12Оценок пока нет

- Mas MockboardДокумент12 страницMas MockboardReynaldo corpuzОценок пока нет

- Ca 5107 - Cost Accounting & Control Quizzer - Standard CostingДокумент13 страницCa 5107 - Cost Accounting & Control Quizzer - Standard CostingAlexandra CruzОценок пока нет

- InstructionsДокумент36 страницInstructionsjhouvan50% (6)

- MAS 3104 Standard Costing and Variance Analysis MCQДокумент6 страницMAS 3104 Standard Costing and Variance Analysis MCQmonicafrancisgarcesОценок пока нет

- Cost2 - Finals SY 2020 21 PDFДокумент10 страницCost2 - Finals SY 2020 21 PDFshengОценок пока нет

- Cost2 - Finals SY 2020 21 PDFДокумент10 страницCost2 - Finals SY 2020 21 PDFshengОценок пока нет

- Answer Key Bacostmx-3tay2021-Finals Quiz 2Документ8 страницAnswer Key Bacostmx-3tay2021-Finals Quiz 2Marjorie Nepomuceno100% (1)

- Quiz Results: Week 12: Standard Costing and Variance AnalysisДокумент25 страницQuiz Results: Week 12: Standard Costing and Variance Analysismarie aniceteОценок пока нет

- University of Caloocan City Cost Accounting & Control Quiz No. 1Документ8 страницUniversity of Caloocan City Cost Accounting & Control Quiz No. 1Mikha SemañaОценок пока нет

- QUIZ 1 Absorption CostingДокумент1 страницаQUIZ 1 Absorption CostingJohn Carlo CruzОценок пока нет

- PRTC First PreboardДокумент17 страницPRTC First PreboardSelyn Padua100% (2)

- AF102 Final Exam, s2, 2017-FINALДокумент12 страницAF102 Final Exam, s2, 2017-FINALSHIKA PRASADОценок пока нет

- More Outputs With The Same InputsДокумент34 страницыMore Outputs With The Same InputsDrama SubsОценок пока нет

- Chapter 11 Testbank Solution Manual Management AccountingДокумент74 страницыChapter 11 Testbank Solution Manual Management AccountingTrinh LêОценок пока нет

- Cost Accounting Final ExaminationДокумент11 страницCost Accounting Final ExaminationAndrew wigginОценок пока нет

- Multiple Choice Questions Variable vs. Absorption CostingДокумент106 страницMultiple Choice Questions Variable vs. Absorption CostingNicole CapundanОценок пока нет

- Instruction: Encircle The Letter of The Correct Answer in Each of The Given QuestionДокумент6 страницInstruction: Encircle The Letter of The Correct Answer in Each of The Given QuestionMarjorie PalmaОценок пока нет

- Quiz1 - SET AДокумент8 страницQuiz1 - SET ACee Garcia100% (1)

- Cost AccountingДокумент9 страницCost AccountingCyndy VillapandoОценок пока нет

- Midterm MasДокумент6 страницMidterm MasDymphna Ann CalumpianoОценок пока нет

- 19 ACDCExerciseIIДокумент14 страниц19 ACDCExerciseIIJohnnoff BagacinaОценок пока нет

- Far Eastern Univrsity Cost Accounting CanvassДокумент8 страницFar Eastern Univrsity Cost Accounting CanvassSharmaine FranciscoОценок пока нет

- Strategic Cost Management Final ExamДокумент8 страницStrategic Cost Management Final Examrizzamaybacarra.birОценок пока нет

- MSQ-01 - Standard Costs and Variance AnalysisДокумент14 страницMSQ-01 - Standard Costs and Variance Analysismimi supasОценок пока нет

- Multiple ChoiceДокумент4 страницыMultiple ChoiceCarlo ParasОценок пока нет

- Mas 02 - Variable Absorption Costing & BudgetingДокумент11 страницMas 02 - Variable Absorption Costing & BudgetingCriane DomineusОценок пока нет

- MAS - Variance AnalysisДокумент13 страницMAS - Variance AnalysisGhaill CruzОценок пока нет

- Mas 2Документ10 страницMas 2Krishia GarciaОценок пока нет

- Bacostmx-3tay2021-Quiz 1Документ10 страницBacostmx-3tay2021-Quiz 1Marjorie Nepomuceno100% (1)

- Multiple ChoiceДокумент16 страницMultiple ChoiceChristian Kim MedranoОценок пока нет

- Prelim Mas 1-TestДокумент16 страницPrelim Mas 1-TestChrisОценок пока нет

- MSQ-01 - Standard Costs and Variance AnalysisДокумент13 страницMSQ-01 - Standard Costs and Variance AnalysisacyОценок пока нет

- ACT23 Exam FinalsДокумент9 страницACT23 Exam FinalsLim JugyeongОценок пока нет

- CELAДокумент66 страницCELAXha100% (1)

- Cost ConceptДокумент39 страницCost ConceptChreazel RemigioОценок пока нет

- Cost Final Exam ReviewerДокумент8 страницCost Final Exam ReviewerAlliana CunananОценок пока нет

- Theory Standard Costing and Variance AnalysisДокумент6 страницTheory Standard Costing and Variance AnalysisFranklin Galope100% (1)

- Multiple ChoiceДокумент16 страницMultiple ChoiceChristian Kim MedranoОценок пока нет

- Standard Costing Multiple ChoiceДокумент11 страницStandard Costing Multiple ChoiceRuiz, CherryjaneОценок пока нет

- Process CostingДокумент6 страницProcess Costingbae joohyun0% (2)

- Acc 213 3e Q2Документ6 страницAcc 213 3e Q2Rogel Dolino67% (3)

- Standard Costing Quiz Highlighted AnswersДокумент9 страницStandard Costing Quiz Highlighted AnswersPatrick SalvadorОценок пока нет

- Standard Costing Multiple ChoiceДокумент8 страницStandard Costing Multiple ChoiceMae Ann AvenidoОценок пока нет

- Standard Costs and Variance Analysis MCQs by Hilario TanДокумент17 страницStandard Costs and Variance Analysis MCQs by Hilario TanJoovs Joovho100% (1)

- Multiple ChoiceДокумент15 страницMultiple ChoiceChristian Kim MedranoОценок пока нет

- Multiple ChoiceДокумент15 страницMultiple ChoiceChristian Kim MedranoОценок пока нет

- Abs and VarДокумент7 страницAbs and VarChloe Chiong50% (2)

- Management Accounting Information For Activity and Process DecisionsДокумент30 страницManagement Accounting Information For Activity and Process DecisionsCarmelie CumigadОценок пока нет

- ExercisesДокумент8 страницExercisesSTREAM EPIPHANYОценок пока нет

- Fin5 Comprehensive ExamДокумент9 страницFin5 Comprehensive ExamEmma Mariz GarciaОценок пока нет

- 4BSA MAS SET A No Answer 1 PDFДокумент9 страниц4BSA MAS SET A No Answer 1 PDFLayca Clarice BrimbuelaОценок пока нет

- Standard Costing EditedДокумент13 страницStandard Costing Editedking justinОценок пока нет

- Final Examination - Management AccountingДокумент13 страницFinal Examination - Management AccountingJoshua UmaliОценок пока нет

- Final PreBoard Examination MASДокумент9 страницFinal PreBoard Examination MASErina AusriaОценок пока нет

- God of AllДокумент9 страницGod of AllRaphael Dean Vitug DesturaОценок пока нет

- Chapter 18tstanДокумент21 страницаChapter 18tstanGhaill CruzОценок пока нет

- Monthly Calendar Pink Brush 2020 All Months PDF SaturdayGiftДокумент12 страницMonthly Calendar Pink Brush 2020 All Months PDF SaturdayGiftAmethyst JordanОценок пока нет

- BBS STS Reviewer Part 2Документ7 страницBBS STS Reviewer Part 2Amethyst JordanОценок пока нет

- Accounting MerchandisingДокумент2 страницыAccounting MerchandisingAmethyst JordanОценок пока нет

- BSMA - 2201: Monda Y Tuesda Y Wednes DAY Thursd AY FridayДокумент2 страницыBSMA - 2201: Monda Y Tuesda Y Wednes DAY Thursd AY FridayAmethyst JordanОценок пока нет

- Sales Letter Template 01Документ2 страницыSales Letter Template 01Joan Marie AgnesОценок пока нет

- NotesДокумент5 страницNotesAmethyst JordanОценок пока нет

- Food Name 2Документ1 страницаFood Name 2Amethyst JordanОценок пока нет

- Quarantine CertificationДокумент1 страницаQuarantine CertificationAmethyst JordanОценок пока нет

- Accounting: An Art: Apply Practical Knowledge, Experience andДокумент1 страницаAccounting: An Art: Apply Practical Knowledge, Experience andAmethyst JordanОценок пока нет

- Evangelium Vitae: (1995) - John Paul IIДокумент9 страницEvangelium Vitae: (1995) - John Paul IIAmethyst JordanОценок пока нет

- Double The EffectДокумент6 страницDouble The EffectAmethyst JordanОценок пока нет

- The Essence of Technology Is by No Means Anything Technological.Документ9 страницThe Essence of Technology Is by No Means Anything Technological.Amethyst JordanОценок пока нет

- Articles of Partnership PDFДокумент4 страницыArticles of Partnership PDFDswdCoaОценок пока нет

- Work OutДокумент2 страницыWork OutAmethyst JordanОценок пока нет

- Food Name 2Документ1 страницаFood Name 2Amethyst JordanОценок пока нет

- BBS STS Reviewer Part 2Документ7 страницBBS STS Reviewer Part 2Amethyst JordanОценок пока нет

- KambalДокумент1 страницаKambalAmethyst JordanОценок пока нет

- Presentation 1Документ1 страницаPresentation 1Amethyst JordanОценок пока нет

- Art Appreciation: You Can Rest But You Can't StopДокумент1 страницаArt Appreciation: You Can Rest But You Can't StopAmethyst JordanОценок пока нет

- College Books: For BS Management Accounting and BS AccountancyДокумент1 страницаCollege Books: For BS Management Accounting and BS AccountancyAmethyst JordanОценок пока нет

- Law 3Документ3 страницыLaw 3Amethyst JordanОценок пока нет

- The Essence of Technology Is by No Means Anything Technological.Документ9 страницThe Essence of Technology Is by No Means Anything Technological.Amethyst JordanОценок пока нет

- Law 2Документ2 страницыLaw 2Amethyst JordanОценок пока нет

- Law 1Документ3 страницыLaw 1Amethyst Jordan60% (5)

- Corporation Law Memory Aid San BedaДокумент20 страницCorporation Law Memory Aid San BedaStephanie Valentine100% (10)

- Law 4Документ3 страницыLaw 4Amethyst Jordan0% (1)

- Oblicon Legal NotesДокумент24 страницыOblicon Legal NotesKarinaYapОценок пока нет

- Partnership de Leon PDFДокумент54 страницыPartnership de Leon PDFClaribelle Dianne Rosales Manrique82% (17)

- SocratesДокумент11 страницSocratesAmethyst JordanОценок пока нет

- Bes 303 Mathematics For Economist Ii 2021Документ4 страницыBes 303 Mathematics For Economist Ii 2021KAMENYA SAMWEL D191/16827/2019Оценок пока нет

- Plant ModuleДокумент26 страницPlant ModuleHitesh JainОценок пока нет

- Q4 Week 3 Lesson 4-GenyoДокумент55 страницQ4 Week 3 Lesson 4-GenyoNORIELIE RODRIGUEZОценок пока нет

- Verbal and Nonverbal CommunicationL2Документ10 страницVerbal and Nonverbal CommunicationL2margilyn ramosОценок пока нет

- Day 02 ESP Basic Design and Operational FactorsДокумент113 страницDay 02 ESP Basic Design and Operational FactorsMustafa Abdel-WahabОценок пока нет

- The National Academies Press: Space Nuclear Propulsion For Human Mars Exploration (2021)Документ93 страницыThe National Academies Press: Space Nuclear Propulsion For Human Mars Exploration (2021)Cable KurwitzОценок пока нет

- Difference Between Face To Face Communication and Telephone Conversation (With Table)Документ5 страницDifference Between Face To Face Communication and Telephone Conversation (With Table)Beki Ye Biriye LijОценок пока нет

- The Correlation of Social Anxiety Towards The Behaviour of Grade 12 Students in SJDM Cornerstone College Inc.Документ47 страницThe Correlation of Social Anxiety Towards The Behaviour of Grade 12 Students in SJDM Cornerstone College Inc.Mark The PainterОценок пока нет

- Physics Category 1 9th - 10th Grades SAMPLE TESTДокумент4 страницыPhysics Category 1 9th - 10th Grades SAMPLE TESTAchavee SukratОценок пока нет

- THINK - l2 Final Extension TestДокумент3 страницыTHINK - l2 Final Extension TestAngelinaKОценок пока нет

- Nygård 2019Документ9 страницNygård 2019Wágner B SilvaОценок пока нет

- Computational Workout Division Tables AsДокумент28 страницComputational Workout Division Tables AsRodney AstОценок пока нет

- CM2 CFS100 2002 04Документ32 страницыCM2 CFS100 2002 04Akmal ZuhriОценок пока нет

- Proposal of WritingДокумент22 страницыProposal of WritingMikias BelaynehОценок пока нет

- Henry Schein Brand CatalogДокумент1 024 страницыHenry Schein Brand CatalogHenry ScheinОценок пока нет

- 2223 S3 Longman Edge U4 SuppWSДокумент9 страниц2223 S3 Longman Edge U4 SuppWShexu wangОценок пока нет

- PPM Dashboard and Report Visuals TemplateДокумент31 страницаPPM Dashboard and Report Visuals TemplateTaha ShahzadОценок пока нет

- Worm Gear OilДокумент2 страницыWorm Gear OilDavidОценок пока нет

- Hydrosphere Class 7 NotesДокумент5 страницHydrosphere Class 7 NotesDEOHE BOTOKO GAMER100% (1)

- 11galilean RelativityДокумент5 страниц11galilean Relativitycastillo61Оценок пока нет

- Measuring Velocity of Moving Inertial FramesДокумент5 страницMeasuring Velocity of Moving Inertial FramesPhilip GarzaОценок пока нет

- Simon E3 CatalogueДокумент16 страницSimon E3 CataloguemarketingsneОценок пока нет

- Running Head: Case 2.1 Hector Gaming Company 1Документ4 страницыRunning Head: Case 2.1 Hector Gaming Company 1Pháp HuỳnhОценок пока нет

- Research 1st LectureДокумент23 страницыResearch 1st LectureJanee JaneОценок пока нет

- Department of Transport Merchant Shipping Notice No. M.1214Документ5 страницDepartment of Transport Merchant Shipping Notice No. M.1214Игорь БакановОценок пока нет

- Product Information: 2C-B (Hydrochloride)Документ1 страницаProduct Information: 2C-B (Hydrochloride)Captain KaswanОценок пока нет

- Numerical Simulation of Welding Distortions in Large Structures With A Simplified Engineering ApproachДокумент12 страницNumerical Simulation of Welding Distortions in Large Structures With A Simplified Engineering ApproachDebabrata PodderОценок пока нет

- Che 402: Analytical ChemistryДокумент12 страницChe 402: Analytical ChemistryKrizzete HernandezОценок пока нет

- 2.4 Electrical DrawingДокумент141 страница2.4 Electrical DrawingFurqoni Bulan RizkiОценок пока нет

- Attitudes and Job SatisfactionДокумент22 страницыAttitudes and Job Satisfactionchaudhary ahmadОценок пока нет