Академический Документы

Профессиональный Документы

Культура Документы

Chapter 11-MA (Garrison)

Загружено:

Zaira Pangesfan0 оценок0% нашли этот документ полезным (0 голосов)

59 просмотров2 страницыResponsibility accounting

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документResponsibility accounting

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

59 просмотров2 страницыChapter 11-MA (Garrison)

Загружено:

Zaira PangesfanResponsibility accounting

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

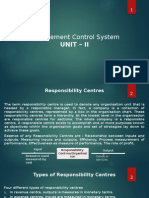

Chapter 11 operating assets.

An alternative is to use the

Performance Measurement in Decentralized gross cost of the asset, which ignores

Organizations accumulated depreciation.

Cost Center *Excessive funds tied up in operating assets

-manager has control over costs depress turnover and lower ROI.

- examples: servicing departments such as

accounting, financing, general administration, *ROI can be compared to the returns of other

legal and personnel investment centers in the organization, the

-the managers are expected to minimize costs returns of other companies in the industry, and

while providing the level of products and to the past returns of the investment center

services demanded by other parts of itself.

organizations

-standard costs variances and flexible budget Residual Income (RI) is the met operating

variances are often used to evaluate cost income that an investment center earns above

centers. the minimum required return on its operating

assets.

Profit Center

-manager has control over both costs and RI= NOI – (Average OA x Minimum required

revenue Rate or return)

-the managers are often evaluated by

comparing actual profit to targeted or budgeted Economic Value Added (EVA)- is an adaptation

profit of residual income that has been adopted by

many companies.

Investment Center

-manager has control over cost, revenue, and *When residual income or EVA is used to

investments in operating assets measure performance, the objective is to

-managers are often evaluated using ROI or maximize the total amount of residual income

Residual income measures or EVA, not to maximize ROI.

-responsible for earning adequate ROI

*Residual income approach has one major

*The higher a business segment’s ROI, the disadvantage. It can’t be used to compare the

greater the profit earned per dollar invested in performance of divisions of different sizes.

the segment’s operating assets.

Delivery Cycle Time

Net Operating Income (NOI) is income before -the amount of time from when a customer

interest and taxes and sometimes referred to as order is received to when the completed order

EBIT. NOI is used in the formula because the is shipped.

base consists of operating assets.

Delivery Cycle Time= Wait time + Throughput

Operating assets include cash, A/R, inventory, time

PPE and all other assets held for operating

purposes. Most companies use the net book Throughput (Manufacturing Cycle) Time

value of depreciable assets to calculate average

-the amount of time required to turn raw

materials into completed products.

*Manufacturing cycle time is composed of:

A. Process time- amount of time work is actually

done on the product

B. Inspection time- amount of time spent

ensuring that the product is not defective

C. Move time- time required to move materials

or partially completed products from

workstation to workstation

D. Queue time- amount of time a product

spends waiting to be worked on, to be moved,

to be inspected, or to be shipped.

Manufacturing Cycle Time (MCE)

MCE= Process time

Throughput time

Financial measures such as ROI and residual

income, and operating measures may be

included in a balanced scorecard.

Balance Scorecard

-consists of integrated set of performance

measures that are derived from and support a

company’s strategy.

Вам также может понравиться

- MAS 2 Responsibility Accounting Part 1Документ4 страницыMAS 2 Responsibility Accounting Part 1Jon garciaОценок пока нет

- Dinda Putri Novanti - Summary Measuring and Controlling Asset EmployedДокумент5 страницDinda Putri Novanti - Summary Measuring and Controlling Asset EmployedDinda Putri NovantiОценок пока нет

- FinalДокумент32 страницыFinalreegup0% (1)

- MS 08 Responsibility Accounting Transfer Pricing TheoriesДокумент4 страницыMS 08 Responsibility Accounting Transfer Pricing TheoriesQueenie DomingoОценок пока нет

- Performance MeasurementДокумент6 страницPerformance Measurementcherrymia canomayОценок пока нет

- MIDTERM-MAS Responsibility Accounting Transfer PricingДокумент9 страницMIDTERM-MAS Responsibility Accounting Transfer PricingbangtansonyeondaОценок пока нет

- Mas 08Документ9 страницMas 08Christine Jane AbangОценок пока нет

- Responsibility AccountingДокумент20 страницResponsibility AccountingaddityarajОценок пока нет

- Responsibility AccountingДокумент7 страницResponsibility AccountingJade Berlyn AgcaoiliОценок пока нет

- Divisional MeasurementДокумент29 страницDivisional MeasurementNagaraj UpparОценок пока нет

- Responsibility Acctg SummaryДокумент1 страницаResponsibility Acctg SummarymnohairahОценок пока нет

- Responsibility Accounting, Transfer Pricing & Balanced ScorecardДокумент11 страницResponsibility Accounting, Transfer Pricing & Balanced Scorecardmartinfaith958Оценок пока нет

- Segmented Reporting, Investment Center Evaluation, and Transfer PricingДокумент3 страницыSegmented Reporting, Investment Center Evaluation, and Transfer Pricingeskelapamudah enakОценок пока нет

- STRATEGIC COST MANAGEMENT - Responsibility Accounting and Transfer Pricing - ConceptsДокумент7 страницSTRATEGIC COST MANAGEMENT - Responsibility Accounting and Transfer Pricing - ConceptsVanna AsensiОценок пока нет

- RiskДокумент5 страницRiskPaw AdanОценок пока нет

- Responsibility CentersДокумент33 страницыResponsibility Centersritesh2030Оценок пока нет

- Lecture 4Документ54 страницыLecture 4premsuwaatiiОценок пока нет

- Summary PERFORMANCE MEASUREMENT IN DECENTRALIZED ORGANIZATIONSДокумент9 страницSummary PERFORMANCE MEASUREMENT IN DECENTRALIZED ORGANIZATIONSliaОценок пока нет

- Chapter 8 - Divisional Perfomance and BudgetingДокумент34 страницыChapter 8 - Divisional Perfomance and BudgetingJeremiah NcubeОценок пока нет

- Unit 12 Responsibility Accounting and Performance MeasuresДокумент16 страницUnit 12 Responsibility Accounting and Performance Measuresestihdaf استهدافОценок пока нет

- Segment Reporting, Decentralization, and The Balanced ScorecardДокумент36 страницSegment Reporting, Decentralization, and The Balanced ScorecardiamnumberfourОценок пока нет

- Mcs AssignmentДокумент14 страницMcs Assignmentyadavmihir63Оценок пока нет

- ACCOUNTINGДокумент8 страницACCOUNTINGRijohnna Moreen RamosОценок пока нет

- MAS Handout - Responsibility Accounting and Accounting For Decentralized Org, Balanced Scorecard and Transfer Pricing PDFДокумент5 страницMAS Handout - Responsibility Accounting and Accounting For Decentralized Org, Balanced Scorecard and Transfer Pricing PDFDivine VictoriaОценок пока нет

- Resume Chapter 10Документ7 страницResume Chapter 10Safira KhairaniОценок пока нет

- Responsibility CentreДокумент5 страницResponsibility CentreataulbariОценок пока нет

- Group 6 - Management Control System of Measurement and Control of Managed AssetsДокумент25 страницGroup 6 - Management Control System of Measurement and Control of Managed AssetsHernawatiОценок пока нет

- Investment Centers and Transfer PricingДокумент9 страницInvestment Centers and Transfer PricingMohammad Nurul AfserОценок пока нет

- Investment CentreДокумент27 страницInvestment CentreSiddharth SapkaleОценок пока нет

- Topic 6 (PMS 1)Документ40 страницTopic 6 (PMS 1)Thiba 2772Оценок пока нет

- Ellah F. Gedalanon BSA-IV: Return On Investment (ROI)Документ2 страницыEllah F. Gedalanon BSA-IV: Return On Investment (ROI)Ellah GedalanonОценок пока нет

- Cpar MAS: Decentralization and Performance EvaluationДокумент15 страницCpar MAS: Decentralization and Performance EvaluationAlliah Gianne Jacela100% (1)

- Difference Between EVA and ROIДокумент6 страницDifference Between EVA and ROINik PatelОценок пока нет

- Divisional Performance AppraisalДокумент5 страницDivisional Performance AppraisalManu VermaОценок пока нет

- 01 2 Metrics Best PrintedДокумент77 страниц01 2 Metrics Best PrintedRamesh Godkar100% (2)

- Responsibility Accounting, Transfer Pricing and Balance ScorecardДокумент9 страницResponsibility Accounting, Transfer Pricing and Balance ScorecardLobenia RenalynОценок пока нет

- ABO - Topic 3 Budgeting and Strategic Management of RevenuesДокумент22 страницыABO - Topic 3 Budgeting and Strategic Management of Revenuesjinman bongОценок пока нет

- Chapter III Lecture NoteДокумент22 страницыChapter III Lecture NoteKalkidan NigussieОценок пока нет

- Management Principles & Practices: Done By, Preethi, Reecha Jain, Sowmya .RДокумент8 страницManagement Principles & Practices: Done By, Preethi, Reecha Jain, Sowmya .RJaya Preethi DoraisamyОценок пока нет

- Responsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesДокумент3 страницыResponsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesAriel DicoreñaОценок пока нет

- Chapter 12Документ2 страницыChapter 12Faye GoodwinОценок пока нет

- Return On Investment (ROI)Документ2 страницыReturn On Investment (ROI)Ellah GedalanonОценок пока нет

- Residual Income and Business Unit Profitability AnalysisДокумент7 страницResidual Income and Business Unit Profitability AnalysisLealyn CuestaОценок пока нет

- Financial RatiosДокумент13 страницFinancial RatioscheeriosОценок пока нет

- ABO Week7 Financial Performance MeasurementДокумент30 страницABO Week7 Financial Performance Measurementjinman bongОценок пока нет

- Measuring and Controling Assets EmployedДокумент3 страницыMeasuring and Controling Assets EmployedTiaradipa AmandaОценок пока нет

- Responsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitДокумент2 страницыResponsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitFranz CampuedОценок пока нет

- Chap 013Документ49 страницChap 013palak32100% (1)

- Topic 6 (PMS 1)Документ41 страницаTopic 6 (PMS 1)Nero ShaОценок пока нет

- Business ValuationДокумент8 страницBusiness ValuationKomalОценок пока нет

- Management Control System Unit-2Документ10 страницManagement Control System Unit-2RenjiniChandranОценок пока нет

- Strategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingДокумент10 страницStrategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingAnnamarisse parungaoОценок пока нет

- Investment Centers and Transfer Pricing: Answers To Review QuestionsДокумент45 страницInvestment Centers and Transfer Pricing: Answers To Review QuestionsShey INFTОценок пока нет

- Responsibilityaccounting 160428005250Документ16 страницResponsibilityaccounting 160428005250RajanSharmaОценок пока нет

- New 1Документ3 страницыNew 1Md MamunОценок пока нет

- Performance Measurement, Compensation, and Multinational ConsiderationsДокумент9 страницPerformance Measurement, Compensation, and Multinational Considerationsclothing shoptalkОценок пока нет

- Cost Classification Part 2Документ10 страницCost Classification Part 2ytuber9895Оценок пока нет

- Responsibilitycentersfinal 130122112204 Phpapp01Документ47 страницResponsibilitycentersfinal 130122112204 Phpapp01yadavmihir63Оценок пока нет

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesОт EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesОценок пока нет

- SECTION 2 EditДокумент5 страницSECTION 2 EditZaira PangesfanОценок пока нет

- Ch02 Cost Terminology and Cost BehaviorsДокумент20 страницCh02 Cost Terminology and Cost BehaviorsZaira PangesfanОценок пока нет

- Benefits of Strategic Management: - Intrinsic Benefits - Financial Benefits - Nonfinancial BenefitsДокумент6 страницBenefits of Strategic Management: - Intrinsic Benefits - Financial Benefits - Nonfinancial BenefitsZaira PangesfanОценок пока нет

- Guest-229194234-Conceptual Framework - The QuizДокумент3 страницыGuest-229194234-Conceptual Framework - The QuizZaira PangesfanОценок пока нет

- Company Background: Page - 4Документ18 страницCompany Background: Page - 4Zaira PangesfanОценок пока нет

- Ch13 Responsibility Accounting and Transfer Pricing in Decentralized OrganizatioДокумент20 страницCh13 Responsibility Accounting and Transfer Pricing in Decentralized OrganizatioZaira PangesfanОценок пока нет

- Ch09 Break-Even Point and Cost-Volume Profit AnalysisДокумент19 страницCh09 Break-Even Point and Cost-Volume Profit AnalysisZaira PangesfanОценок пока нет

- Lex Mercatoria and The UNIDROIT Principles: A Shock or A New Chapter of Contemporary Private International Law?Документ14 страницLex Mercatoria and The UNIDROIT Principles: A Shock or A New Chapter of Contemporary Private International Law?Zaira PangesfanОценок пока нет

- Ch03 Predetermined Overhead Rates, Flexible Budgets, and AbsorptionVariable CostДокумент21 страницаCh03 Predetermined Overhead Rates, Flexible Budgets, and AbsorptionVariable CostZaira PangesfanОценок пока нет

- Ch06 Process CostingДокумент19 страницCh06 Process CostingZaira PangesfanОценок пока нет

- Resolutory ConditionДокумент2 страницыResolutory ConditionZaira PangesfanОценок пока нет

- Dura Lex Sed Lex-RevisedДокумент1 страницаDura Lex Sed Lex-RevisedZaira PangesfanОценок пока нет

- Ch18 Emerging Management PracticesДокумент21 страницаCh18 Emerging Management PracticesZaira PangesfanОценок пока нет

- Ch15 Management Costs and UncertaintyДокумент21 страницаCh15 Management Costs and UncertaintyZaira PangesfanОценок пока нет

- Toa-Current Labilities and ContingenciesДокумент19 страницToa-Current Labilities and ContingenciesZaira PangesfanОценок пока нет

- Ch14 Capital BudgetingДокумент20 страницCh14 Capital BudgetingZaira PangesfanОценок пока нет

- Lecture Guide-Sources of ObligationsДокумент37 страницLecture Guide-Sources of ObligationsZaira PangesfanОценок пока нет

- Navigation Course: Introduction To Navigation in SAP Solutions and ProductsДокумент19 страницNavigation Course: Introduction To Navigation in SAP Solutions and ProductsZaira PangesfanОценок пока нет

- Title II - ContractsДокумент2 страницыTitle II - ContractsZaira PangesfanОценок пока нет

- Aa 3HM1Документ2 страницыAa 3HM1LunaОценок пока нет

- Math11 Q3Wk7a FABM1Документ6 страницMath11 Q3Wk7a FABM1Marlyn LotivioОценок пока нет

- Ecole de Cuisine v. Renaud Cointreau, 697 SCRA 346 (2013)Документ9 страницEcole de Cuisine v. Renaud Cointreau, 697 SCRA 346 (2013)149890Оценок пока нет

- Chapter 2 Master BudetДокумент16 страницChapter 2 Master BudetBenol MekonnenОценок пока нет

- EABD MCQs DIMRДокумент37 страницEABD MCQs DIMRAkshada BidkarОценок пока нет

- Case StudyДокумент4 страницыCase StudyAZAR DANFUDI NAMAZIОценок пока нет

- Basics On Income Tax PDFДокумент10 страницBasics On Income Tax PDFHannan Mahmood TonmoyОценок пока нет

- Cisco Data Analysis Course WeekДокумент5 страницCisco Data Analysis Course WeekRaja RamОценок пока нет

- 07 - Creating Brand EquityДокумент29 страниц07 - Creating Brand EquityIbrahim Ahmed FurrukhОценок пока нет

- New BalanceДокумент14 страницNew BalanceSimerjit SainiОценок пока нет

- Jan 2022 Bus Unit 4 MSДокумент14 страницJan 2022 Bus Unit 4 MSAlia MohamedAmin MemonОценок пока нет

- Annual Report 2020 2021 Info EdgeДокумент718 страницAnnual Report 2020 2021 Info EdgeA. DivyaОценок пока нет

- Pre Finals - ORGMANДокумент3 страницыPre Finals - ORGMANMarvin PameОценок пока нет

- Week 9 QuizДокумент8 страницWeek 9 QuizWang ChoiОценок пока нет

- IFRS 16 Sale and Leaseback AccountingДокумент3 страницыIFRS 16 Sale and Leaseback AccountingBeta ProfessionalsОценок пока нет

- Aroma NB119C Carter - 36 Hours Playtime Bluetooth Neckband Bluetooth HeadsetДокумент1 страницаAroma NB119C Carter - 36 Hours Playtime Bluetooth Neckband Bluetooth HeadsetSANJUKTA SahuОценок пока нет

- StrategikonДокумент7 страницStrategikonspoilt_dhruvОценок пока нет

- 5 Pillars of A Great ReleaseДокумент7 страниц5 Pillars of A Great ReleaseSagarShah100% (1)

- Operational Management of TescoДокумент7 страницOperational Management of Tescofilfilahmir0% (1)

- Iprospect DigitalPerformanceReport Q12019 PDFДокумент27 страницIprospect DigitalPerformanceReport Q12019 PDFtheghostinthepostОценок пока нет

- BCom 6th Sem - AuditingДокумент46 страницBCom 6th Sem - AuditingJibin SamuelОценок пока нет

- Rec Letter ExamplesДокумент2 страницыRec Letter ExamplesJames ClarksonОценок пока нет

- Maximization: Ivy Lorraine B. Pastor BSA-2B Jenne Mae E. Labitoria April C. TadeoДокумент3 страницыMaximization: Ivy Lorraine B. Pastor BSA-2B Jenne Mae E. Labitoria April C. TadeoIvy Lorraine PastorОценок пока нет

- Chapter 06.Документ10 страницChapter 06.maria zaheerОценок пока нет

- дам Father of the feel-good factoryДокумент1 страницадам Father of the feel-good factoryАнастасияОценок пока нет

- 4 Budget and Budgetary Control SolutionsДокумент74 страницы4 Budget and Budgetary Control SolutionsRahul SinghОценок пока нет

- Gaya Hidup Mahasiswa Akibat Adanya Online Shop: Intitut Agama Islam Negeri KudusДокумент10 страницGaya Hidup Mahasiswa Akibat Adanya Online Shop: Intitut Agama Islam Negeri KudusJihan OktavianiОценок пока нет

- Forrester CIAMДокумент17 страницForrester CIAMSameer SamarthОценок пока нет

- Module-1 Chapter-4: HR Planning & RecruitingДокумент43 страницыModule-1 Chapter-4: HR Planning & Recruitingmehul75% (4)

- 05 Activity 1 BALAДокумент3 страницы05 Activity 1 BALAPola PolzОценок пока нет