Академический Документы

Профессиональный Документы

Культура Документы

Intermediate Accounting Exercise 2 Finals

Загружено:

June Maylyn MarzoИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Intermediate Accounting Exercise 2 Finals

Загружено:

June Maylyn MarzoАвторское право:

Доступные форматы

NATIONAL UNIVERSITY – Manila

Intermediate Accounting 2

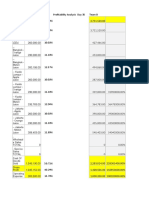

LAND, BUILDING AND MACHINERY

1. Noeme Company commenced operations at the beginning of the current year. The following costs are

incurred by the entity.

Payment for land and an old building which is to be demolished 1,000,000

Payment of property taxes in arrears 130,000

Title search and insurance 50,000

Option paid for an alternative land which was not acquired 30,000

Cost of relocating squatters 10,000

Special assessment for city improvements on water and sewer system 150,000

Demolition of old building, net of salvage of P10,000 100,000

Survey before construction of new building 60,000

Contract price for factory building 5,000,000

Architect Fee 230,000

Building permit or payment to city hall for approval of building construction 120,000

Excavation before new construction 110,000

Liability insurance during construction 55,000

Safety fence around construction site 35,000

Safety inspection on building 30,000

Removal of safety fence after completion of factory building 20,000

New fence surrounding the factory 80,000

Driveways, parking bays and safety lighting 550,000

Cost of trees, shrubs and other landscaping 250,000

What amount should be reported respectively as initial measurement of the land and building?

2. During the current year, Jocelyn Company purchased a second hand machine at a price of P5,000,000.

A cash payment of P1,000,000 was made and a two-year, noninterest bearing note was issued for the

balance of P4,000,000. Recent transactions involving similar machine indicate that the used machine has

a second hand market value of P4,500,000. A new machine would cost of P6,500,000. The following

costs were incurred during the year.

Cost of removing old machine that is replaced 350,000

Cash proceeds from the sale of the old machine replaced 100,000

Cost of hauling the machine from vendor to entity premises 40,000

Overhaul and repairs to recondition machine prior to use 220,000

Cost of Installation 190,000

Cost of testing machine prior to use 150,000

Safety device added to the machine 300,000

Cost of spare parts to cover breakdowns 80,000

Cost of repairing damage to machine caused when the machine was dropped

During installation 150,000

Repairs incurred during the first year of operation 160,000

Cost of training workers to operate the machine 25,000

What total amount should be capitalized as cost of the second hand machine?

3. Paula Company acquired at the beginning of the current year.

Cash paid for machine, including VAT of P96,000 896,000

Cost of transporting machine 30,000

Labor cost of installation by expert fitter 50,000

Labor cost of testing machine 40,000

Cost of safety rails and platform surrounding machine 60,000

Cost of water device to keep machine cool 80,000

Cost of adjustment to machine to make it operate more efficiently 75,000

Estimated dismantling cost to be incurred as required by contract 65,000

Insurance cost for the current year 15,000

Cost of training personnel who will use the machine 25,000

What total amount should be capitalized as cost of the machine?

Вам также может понравиться

- Far 6673Документ4 страницыFar 6673Marinel Felipe0% (1)

- PPE Government Grant Borrowing Cost Intangible AssetsДокумент7 страницPPE Government Grant Borrowing Cost Intangible AssetsLian Garl100% (4)

- Far Eastern University - Makati: Discussion ProblemsДокумент2 страницыFar Eastern University - Makati: Discussion ProblemsMarielle SidayonОценок пока нет

- Chap 013Документ667 страницChap 013Rhaine ArimaОценок пока нет

- Cengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaДокумент32 страницыCengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaArcy LeeОценок пока нет

- Accounting - Inventory Test BankДокумент3 страницыAccounting - Inventory Test BankAyesha RGОценок пока нет

- Quiz m2.5g HomeworkДокумент10 страницQuiz m2.5g HomeworkMarie MagallanesОценок пока нет

- Basic Accounting Final - QuestionДокумент6 страницBasic Accounting Final - QuestionEdaОценок пока нет

- Q2 FarДокумент2 страницыQ2 FarSHEОценок пока нет

- 4 Activity 5 PPEДокумент9 страниц4 Activity 5 PPEDaniella Mae ElipОценок пока нет

- MGMT 134 CA KeyДокумент4 страницыMGMT 134 CA KeyAnand KL100% (1)

- Additional Problems DepnRevaluation and ImpairmentДокумент2 страницыAdditional Problems DepnRevaluation and Impairmentfinn heartОценок пока нет

- HW 2. Problems Cash and Cash Equivalents - StudentДокумент2 страницыHW 2. Problems Cash and Cash Equivalents - StudentAngelo TipaneroОценок пока нет

- Adms 2510 Winter 2007 Final ExaminationДокумент11 страницAdms 2510 Winter 2007 Final ExaminationMohsin Rehman0% (1)

- Joint Product & By-Product ExamplesДокумент15 страницJoint Product & By-Product ExamplesMuhammad azeemОценок пока нет

- Assignment 4.2 Intangible Assets - ACCTG 018-ACTCY21S3 - Intermediate Accounting 2Документ4 страницыAssignment 4.2 Intangible Assets - ACCTG 018-ACTCY21S3 - Intermediate Accounting 2Maxine ConstantinoОценок пока нет

- Qualifying Examination: Financial Accounting 2Документ11 страницQualifying Examination: Financial Accounting 2Patricia ByunОценок пока нет

- D15Документ12 страницD15neo14Оценок пока нет

- A. Property, Plant and Equipment:: Current Appraised Value Seller's Original CostДокумент3 страницыA. Property, Plant and Equipment:: Current Appraised Value Seller's Original CostNORLYN CINCOОценок пока нет

- Process CostingДокумент3 страницыProcess CostingenzoОценок пока нет

- Conceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaДокумент2 страницыConceptual Framework and Accounting Standards Ms. Leslie Anne T. GandiaJm SevallaОценок пока нет

- Equity YyyДокумент33 страницыEquity YyyJude SantosОценок пока нет

- Examination About Investment 7Документ3 страницыExamination About Investment 7BLACKPINKLisaRoseJisooJennieОценок пока нет

- Problem 1Документ14 страницProblem 1Jerry DiazОценок пока нет

- Cost Accounting Chapter1Документ6 страницCost Accounting Chapter1Jhon Ariel JulatonОценок пока нет

- ReceivablesДокумент4 страницыReceivablesKentaro Panergo NumasawaОценок пока нет

- BACOSTMX Module 2 Learning Activity StudentsДокумент8 страницBACOSTMX Module 2 Learning Activity StudentsRodolfo Jr. LasquiteОценок пока нет

- Inventory - GP and Retail MethodДокумент2 страницыInventory - GP and Retail MethodFlorimar LagdaОценок пока нет

- Case Study 1Документ1 страницаCase Study 1Babu babuОценок пока нет

- DepletionДокумент6 страницDepletionjemjem14Оценок пока нет

- Answers - Chapter 1 Vol 2 2009Документ10 страницAnswers - Chapter 1 Vol 2 2009Shiela PilarОценок пока нет

- FAR 04-11.a Depletion of Mineral ResourcesДокумент4 страницыFAR 04-11.a Depletion of Mineral ResourcesAi NatangcopОценок пока нет

- Solution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Документ3 страницыSolution: LCNRV Cost Bags 550,000 Bags 800,000 Shoes 1,000,000 Shoes 1,000,000 Clothing 700,000 Clothing 700,000 Lingerie 350,000 Lingerie 500,00Christian Clyde Zacal ChingОценок пока нет

- MA CUP PracticeДокумент9 страницMA CUP PracticeFlor Danielle Querubin100% (1)

- Chapter 05 AnsДокумент12 страницChapter 05 AnsDave Manalo100% (1)

- Financial Management - Part 1 For PrintingДокумент13 страницFinancial Management - Part 1 For PrintingKimberly Pilapil MaragañasОценок пока нет

- Review 105 - Day 15 P1Документ12 страницReview 105 - Day 15 P1John De Guzman100% (1)

- New Microsoft Office Excel WorksheetДокумент26 страницNew Microsoft Office Excel WorksheetMac Ferds100% (1)

- Problems 3 PRELIM TASK FINALДокумент4 страницыProblems 3 PRELIM TASK FINALJohn Francis RosasОценок пока нет

- ExamДокумент7 страницExamKristen WalshОценок пока нет

- RFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?Документ7 страницRFBT Quiz 1: Forgery. After Giving A Notice of Dishonor, Which of The Following Is Not Correct?cheni magsaelОценок пока нет

- Chapter 14Документ47 страницChapter 14darylleОценок пока нет

- June 9-Acquisition of PPEДокумент2 страницыJune 9-Acquisition of PPEJolo RomanОценок пока нет

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesДокумент20 страницIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieОценок пока нет

- Receivable Practice Problem 1Документ2 страницыReceivable Practice Problem 1ayeeeОценок пока нет

- Repair Cost Probabilit yДокумент2 страницыRepair Cost Probabilit yNicole AguinaldoОценок пока нет

- Pre-Test 5Документ3 страницыPre-Test 5BLACKPINKLisaRoseJisooJennieОценок пока нет

- Impairment of Asset: Cash Generating UnitДокумент28 страницImpairment of Asset: Cash Generating UnitLumongtadJoanMaeОценок пока нет

- 1Документ2 страницы1Your MaterialsОценок пока нет

- CE On PPE Acquisition and Depreciation CДокумент3 страницыCE On PPE Acquisition and Depreciation CRedОценок пока нет

- Zakaria Ch4Документ15 страницZakaria Ch4Zakaria Hasaneen0% (2)

- Semis Examination BДокумент12 страницSemis Examination BCHENG50% (2)

- Financial PositionДокумент4 страницыFinancial PositionBeth Diaz Laurente100% (2)

- ReviewerДокумент5 страницReviewermaricielaОценок пока нет

- ACC 301 CH 9 NO AnswersДокумент6 страницACC 301 CH 9 NO AnswersCarl Angelo0% (1)

- Machinery VergaraДокумент10 страницMachinery VergaraDarlianne Klyne BayerОценок пока нет

- 6905 - Land, Building and MachineryДокумент2 страницы6905 - Land, Building and MachineryAljur SalamedaОценок пока нет

- Machinery and Capitl ExpendituresДокумент18 страницMachinery and Capitl ExpendituresAnne Estrella0% (1)

- Practical Accounting 1 (Ppe)Документ9 страницPractical Accounting 1 (Ppe)Ivan Landaos100% (1)

- 3 HW On PPEДокумент3 страницы3 HW On PPENikko Bowie PascualОценок пока нет

- Internal Factor Evaluation Matrix IFE MATRIX DUCAДокумент3 страницыInternal Factor Evaluation Matrix IFE MATRIX DUCAJune Maylyn MarzoОценок пока нет

- BAINSADL Activity 2 FinalsДокумент2 страницыBAINSADL Activity 2 FinalsJune Maylyn MarzoОценок пока нет

- Online Activity 1 BASTATSL MarzoДокумент2 страницыOnline Activity 1 BASTATSL MarzoJune Maylyn MarzoОценок пока нет

- Age Gender State Children Salary OpinionДокумент2 страницыAge Gender State Children Salary OpinionJune Maylyn MarzoОценок пока нет

- Baseball Salaries With Team Info1Документ22 страницыBaseball Salaries With Team Info1June Maylyn MarzoОценок пока нет

- Midterm Exam WikaДокумент2 страницыMidterm Exam WikaJune Maylyn MarzoОценок пока нет

- COMPILATION of InsightsДокумент3 страницыCOMPILATION of InsightsJune Maylyn MarzoОценок пока нет

- Volleyball Official Hand Signals Volleyball Official Hand SignalsДокумент33 страницыVolleyball Official Hand Signals Volleyball Official Hand SignalsJune Maylyn MarzoОценок пока нет

- A Kaizen Improvement Plan Paper For National UniversityДокумент7 страницA Kaizen Improvement Plan Paper For National UniversityJune Maylyn MarzoОценок пока нет

- Analysis A. Summary of The Story The Little People by Maria Aleah G. TaboclaonДокумент4 страницыAnalysis A. Summary of The Story The Little People by Maria Aleah G. TaboclaonJune Maylyn MarzoОценок пока нет

- Questions:: June Maylyn D. MarzoДокумент1 страницаQuestions:: June Maylyn D. MarzoJune Maylyn MarzoОценок пока нет

- June Maylyn Topic 9 HW in FINMAXДокумент2 страницыJune Maylyn Topic 9 HW in FINMAXJune Maylyn MarzoОценок пока нет

- Hello Gab, Its Nice To See You Again! Here Is Some Short Activity For You and Just Take Your Time To AnswerДокумент4 страницыHello Gab, Its Nice To See You Again! Here Is Some Short Activity For You and Just Take Your Time To AnswerJune Maylyn MarzoОценок пока нет

- Company ProfileДокумент1 страницаCompany ProfileJune Maylyn MarzoОценок пока нет

- Reviewer For BAFACR4X Accounting Intermediate 3Документ1 страницаReviewer For BAFACR4X Accounting Intermediate 3June Maylyn MarzoОценок пока нет

- Self-Assessment: June Maylyn D. Marzo Advance Communication-2 Year BSAISДокумент2 страницыSelf-Assessment: June Maylyn D. Marzo Advance Communication-2 Year BSAISJune Maylyn MarzoОценок пока нет

- Loa NuДокумент1 страницаLoa NuJune Maylyn MarzoОценок пока нет

- Case Study Homework Income TaxДокумент3 страницыCase Study Homework Income TaxJune Maylyn Marzo100% (2)

- Palaris Cargo Handlers: - Rendering Logistic Services and Brokerage For Private Exporting and Importing CompaniesДокумент1 страницаPalaris Cargo Handlers: - Rendering Logistic Services and Brokerage For Private Exporting and Importing CompaniesJune Maylyn MarzoОценок пока нет

- NU-Long-Test-2-Rizal-for-ARC-and-ACT MarzoДокумент8 страницNU-Long-Test-2-Rizal-for-ARC-and-ACT MarzoJune Maylyn MarzoОценок пока нет

- National University: Labor Market and Income Inequality: What Are New Insights After Public ConsensusДокумент12 страницNational University: Labor Market and Income Inequality: What Are New Insights After Public ConsensusJune Maylyn MarzoОценок пока нет

- Day 18 Profitability Analysis Day 35 Team D 100.00%Документ8 страницDay 18 Profitability Analysis Day 35 Team D 100.00%June Maylyn MarzoОценок пока нет

- Rizal EssayДокумент1 страницаRizal EssayJune Maylyn MarzoОценок пока нет

- Green Activities & Classroom Resources: Reducing Trash, Litter & WasteДокумент3 страницыGreen Activities & Classroom Resources: Reducing Trash, Litter & WasteJune Maylyn MarzoОценок пока нет

- Architecture - November 2020Документ18 страницArchitecture - November 2020ArtdataОценок пока нет

- Cmci Cmci: Epoxy Grout System For Equipment BasesДокумент2 страницыCmci Cmci: Epoxy Grout System For Equipment Basespravi3434Оценок пока нет

- Sistema Hidraulico 320BДокумент2 страницыSistema Hidraulico 320BJuan Fer100% (16)

- A Civil Engg. Final Year Training Report On Residential Building Construction.Документ71 страницаA Civil Engg. Final Year Training Report On Residential Building Construction.Monu Khand84% (261)

- HAMPIДокумент16 страницHAMPIChanchal Soni100% (1)

- 80025376ipl - LoДокумент71 страница80025376ipl - LoAchmad SyafrudinОценок пока нет

- UOP FlangesДокумент122 страницыUOP Flangesamin100% (1)

- Steel StandardsДокумент29 страницSteel Standardssuvra100% (2)

- NBC NormsДокумент32 страницыNBC NormsArathi KОценок пока нет

- Ashrae 2019 SmokeДокумент30 страницAshrae 2019 Smokeسيف الدين أحمد محمد عمرОценок пока нет

- Sesión 3 - Metso Outotec Filtros PFДокумент82 страницыSesión 3 - Metso Outotec Filtros PFEyner GonzalesОценок пока нет

- Steel Design 9 Nov 2020 PDFДокумент1 страницаSteel Design 9 Nov 2020 PDFJustine Ejay MoscosaОценок пока нет

- Boiler Performance ImproveДокумент5 страницBoiler Performance Improvehwang2Оценок пока нет

- Civil Breadth Mor Questions 3Документ47 страницCivil Breadth Mor Questions 3JR ZunigaОценок пока нет

- PalDuct PIR Datasheet ME EN 04 15Документ2 страницыPalDuct PIR Datasheet ME EN 04 15Leonardo PimentelОценок пока нет

- 0901d196808e5f7c PDF Preview MediumДокумент2 страницы0901d196808e5f7c PDF Preview MediumSanjanОценок пока нет

- Semiahmoo Town Centre RedevelopmentДокумент27 страницSemiahmoo Town Centre RedevelopmentPaulОценок пока нет

- ITS Webinar - Tantangan Pada Pelaksanaan (01.10.2022)Документ23 страницыITS Webinar - Tantangan Pada Pelaksanaan (01.10.2022)Destra Dwi Falah SetyamaОценок пока нет

- Module 7 (Maintenance Practices) Sub Module 7.15 (Welding, Brazing, Soldering and Bonding) PDFДокумент14 страницModule 7 (Maintenance Practices) Sub Module 7.15 (Welding, Brazing, Soldering and Bonding) PDFAamir JavaidОценок пока нет

- Experimental Seismic Performance Evaluation of Isolation-Restraint Systems For Mechanical Equipment Part I - Heavy Equipment StudyДокумент178 страницExperimental Seismic Performance Evaluation of Isolation-Restraint Systems For Mechanical Equipment Part I - Heavy Equipment StudyGabriel Cifuentes RosenkranzОценок пока нет

- Da 20Документ43 страницыDa 20Prasath SivaОценок пока нет

- SOUTHERN CABLE Fire Resistant CableДокумент12 страницSOUTHERN CABLE Fire Resistant Cabletanmeng96Оценок пока нет

- Design of Self Supported Steel ChimneyДокумент27 страницDesign of Self Supported Steel ChimneyAlok JhaОценок пока нет

- Assignment: - Seismic Design of StructuresДокумент5 страницAssignment: - Seismic Design of StructuresSultanОценок пока нет

- Technical-Manual AGS-CW150CurtainWall Capral 2020 06 01Документ87 страницTechnical-Manual AGS-CW150CurtainWall Capral 2020 06 01LEONARDOОценок пока нет

- (E) FlowPlumb Wichtech Sales BrochureДокумент17 страниц(E) FlowPlumb Wichtech Sales BrochureNwachukwu UmehОценок пока нет

- Electrical Estimator ManualДокумент48 страницElectrical Estimator Manualjanmczeal100% (3)

- Dave Chan_ International Conference on Soft Soil Engineering. _4, 2006, Vancouver, British Columbia_gt-Soft Soil Engineering _ Proceedings of the Fourth International Conference on Soft Soil EngineeriДокумент754 страницыDave Chan_ International Conference on Soft Soil Engineering. _4, 2006, Vancouver, British Columbia_gt-Soft Soil Engineering _ Proceedings of the Fourth International Conference on Soft Soil EngineeriWubetie Mengist0% (1)

- Installation, Operation, & Maintenance Manual FOR Nov D285P Linear Motion Shale ShakerДокумент32 страницыInstallation, Operation, & Maintenance Manual FOR Nov D285P Linear Motion Shale Shakerfrancisco hurtadoОценок пока нет

- Apartment Hunting ChecklistДокумент1 страницаApartment Hunting ChecklistTime Warner Cable NewsОценок пока нет