Академический Документы

Профессиональный Документы

Культура Документы

Impact of Fdi Fpi and Mutual Funds On Ni PDF

Загружено:

meenakshishrm250Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Impact of Fdi Fpi and Mutual Funds On Ni PDF

Загружено:

meenakshishrm250Авторское право:

Доступные форматы

International Journal of Research in Economics and Social Sciences (IJRESS)

Available online at: http://euroasiapub.org

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939 |

IMPACT OF FDI, FPI AND MUTUAL FUNDS ON NIFTY STOCK RETURNS

Ms. Parul Kumar1

Assistant Professor

Maharaja Agrasen Institute of Management Studies

Ms. Rupal Saini2

B.COM(H) – Final Year Student

Vivekananda Institute of Professional Studies, Delhi

Abstract

FDI & FPI are becoming an important source of finance in developing countries including India. In

India, the top three investor classes are Foreign Portfolio Investment, Foreign Direct Investment,

and the Mutual funds. The current study explores the relationship between Mutual Funds, Foreign

Portfolio Investors, Foreign Direct investment, and the nifty returns by way of regression analysis.

In this paper, the impact of all these variables is collectively analyzed on the nifty returns for the

period of 2012 – 2016. Finding highlighted that Nifty returns are affected by FDI, FPI and the

mutual funds as well its own lagged value and that of mutual funds. The study also concluded that

Nifty returns impact foreign portfolio investment coming to India. Mutual funds are seen

impacting the FDI but not the FPI to India. Overall all the variables are together significant in

impacting each of the other variables with the highest impact on nifty returns as compared to

other investments.

Keywords: Regression, Mutual Fund, Foreign Portfolio Investment, Foreign Direct Investment,

Asset under custody.

International Journal of Research in Economics & Social Sciences 345

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

International Journal of Research in Economics and Social Sciences (IJRESS)

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939

Introduction

With the economic reforms of 19, greater and better avenues to attract the foreign funds in the

Indian stock market have been opened. Foreign investment is an investment which flows from

one country into the other. Foreign investors invest in India through capital market route i.e.

buying shares of firms. Reserve Bank of India (RBI) allowed Securities and Exchange Board of

India (SEBI) to register Foreign Institutional Investment to invest in the primary and secondary

capital markets in India through the portfolio investment scheme. Since 2014 regulation, Foreign

Institutional Investors are now known as Foreign Portfolio Investment (FPI). The investments

made by non-residents in Indian shares, government bonds, corporate bonds, convertible

securities, infrastructure securities and others is known as FPI. Foreign Direct Investment (FDI)

is an investment made in one country in business interests of another country by a company or

individual. With unparalleled globalizations, countries have witnessed double digit economic

growth which in turn resulted in fierce competition and expedited innovation. Hence due to this

surge in many countries, the inflow of Foreign Direct Investments has become an extraordinary

measure of economic development. Through FDI in India, foreign companies invest directly in

fast-growing private Indian businesses to take benefits of cheaper wages and changing business

environment. A Mutual Fund (MF) is a pool of money from various investors who wish to save or

make money. Investing in a mutual fund can be a lot easier than buying and selling individual

stocks and bonds. In this, money is collected from various investors and then clubbed together for

investing in capital market instruments such as shares, debentures and other securities. The

income earned through these investments and the capital appreciations realized are shared by

the unit holder in proportion to the number of units owned by each of them. The mutual fund

enables a common man to invest in a diversified and professionally managed basket of securities,

at a relatively low cost.

Investments by the FPIs are termed as the critical component of the Indian economy while the

mutual funds, insurance companies, hedge funds and other domestic institutional investors

channelize the domestic savings into the financial market. Mukherjee and Roy (2011) concluded

that FPI and Mutual fund’s trading pattern are different. Above and beyond, institutional

investment activities are expected to play a significant role to influence the financial market, as

well as the macro economy as a whole and the stock market movement, is thought to be driven by

the trading behavior of institutional investors (Naik & Padhi, 2014).

In the light of the discussion above, this study is to analyze the relationship between FDI, FPI, MF

and also Insurance companies and their impact on Nifty returns. The structure of the paper is as

follows: the Introduction is followed by literature review, then by research methodology. The last

two sections deal with analysis and conclusion respectively.

International Journal of Research in Economics & Social Sciences 346

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

International Journal of Research in Economics and Social Sciences (IJRESS)

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939

Literature Review

Most of the studies in this area analyzed the particular relation among the FPI and the returns;

FDI and returns and likewise Mutual funds and returns. There is a dearth of studies covering all

the variables together i.e. the impact of these investments collectively on the nifty returns.

Warther (1995) studied the relationship between aggregate mutual fund cash flows and security

returns. The study concluded that aggregate security returns were highly correlated with

concurrent unexpected cash flows into mutual funds but unrelated to concurrent expected flows.

Results of the study supported the popular belief that fund inflows and returns were positively

related. However, the results rejected both sides of a feedback trading model, which means that

security returns neither lag nor lead mutual fund flows. Fortune (1998) used VAR models to

examine the relationship between fund flows and returns. The study concluded the evidence of

positive correlation between fund flows and contemporaneous returns. The researcher concluded

the existence of feedback trading. The results of Fortune (1998) are in strong contrast with the

conclusions of Warther that flows do not appear to be affected by past security returns.

Kumar (2001) investigated the effects of FPI inflows on the Indian stock market represented by

the Sensex using monthly data from January 1993 to December 1997. With Sensex as the

dependent variable the lag of one month of NFI became significant, i.e. there was causality from

FPI to Sensex. Mukherjee, Bose, and Coondoo (2002), explored the relationship of foreign

institutional investment flows to Indian equity market with its possible covariates. The study was

based on daily data for the period Jan. 1999 to May 2002. Correlation and Regression were used

to analyze the relationship, and by employing Granger Causality Test, the result stated that the

FPI net inflows correlate with the return in Indian equity market. The study also revealed that in

the post-Asian crisis, return in the Indian capital market was the sole driver of the FPI inflows.

Also, during the pre-Asian crisis period, other covariates were also found to be correlated with

FPI net flows. Pal, (2005) investigated the effect of withdrawal of foreign portfolio capital in the

post-election phase on the price and equity holding pattern of different Sensex companies. The

study found that the FPIs were the major players in the domestic stock market in India, and their

influence on the domestic markets was also growing. The study also concluded that FPI had high

control of the companies listed on Sensex. Babu & Prabheesh (2008) found that there existed a bi-

directional causality between FPIs investment and stock returns between Jan 2003 – Feb 2007.

With the help of VAR and Granger Causality test, the researcher concluded that FPIs investment

flows were more stock return driven. Rajput & Thaker (2008) analyzed the relation between FPI

investments and NIFTY performance. The study found that the Nifty returns were significantly

affected by the FPIs and also they were one of the principal driving forces of the stock market. The

study also proved that FPI and Nifty have a positive correlation and there were other factors also

International Journal of Research in Economics & Social Sciences 347

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

International Journal of Research in Economics and Social Sciences (IJRESS)

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939

which affected Nifty returns. Sehgal and Tripathi (2009) compare the investment behavior of

domestic mutual funds and FIIs and conduct a causality analysis between stock market return and

institutional fund flows, separately, using monthly data. The study concluded that while returns

cause FIIs inflows, no causal relationship exist between FIIs outflows and stock market returns. It

was also found that while FII inflows cause domestic mutual fund flows, a feedback relationship

exists between FII outflows and mutual fund outflows. This study concluded that domestic

institutional investors react late to the market movement as compare to FIIs.

Using daily data Mukherjee and Roy (2011) also compare the investment behavior of mutual

funds and FIIs. The study found that mutual funds influence the decision of FIIs when they invest

in equity whereas FIIs decision is opposite to mutual funds. Results also indicated unidirectional

causality from stock market returns to FII investment, and bi-directional causality existed

between mutual fund investment and stock market returns. Paliwal and Vashishtha (2011)

estimated the direction of causality between FPI and BSE returns with Granger causality test. The

study found that there was a positive correlation between FPI and BSE returns and both FPI and

BSE Granger cause each other. Bose (2012) examined the impact of mutual fund flows, and FIIs

fund flows collectively on the stock market returns for 2008 to 2012. The study found a negative

relationship between net investment of mutual funds and FIIs. Also, there was the existence of

unidirectional causality from FII investment to mutual funds investment. The study also

concluded that stock returns were impacted by its own past values and lagged FIIs investment but

not by mutual funds. Sultana & Pardhasaradhi (2012) found a significant impact of the flow of FDI

& FPI on Indian stock market. The study also concluded that there was a significant strong positive

correlation between FDI & Sensex and FDI & Nifty. Moderate positive correlation between FPI &

Sensex and FPI & Nifty was found although that was insignificant. Kapoor & Sachan (2015)

analyzed the trend and patterns of FDI & FPI along with their impact on SENSEX and Nifty. The

study found a weak positive correlation between FDI & Sensex and FDI & Nifty while strong

positive correlation was found between FPI & Sensex and FPI & Nifty.

The current study explores the relationship between Mutual Funds, Foreign Portfolio Investors,

Foreign Direct Investment, Insurance companies and the nifty returns in the light of the literature

highlighted above. This study is an extension of the previous studies as here all the investments

are taken together to investigate the impact on returns. Also, the impact of lag relationship along

with highlighting the impact of nifty returns on all the variables is studied in the present paper.

Objectives

1. To analyze the patterns and trends of FPI, FDI, and Mutual Funds companies in the Indian

market.

International Journal of Research in Economics & Social Sciences 348

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

International Journal of Research in Economics and Social Sciences (IJRESS)

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939

2. To study the impact of the FPI, FDI, and Mutual Funds on Nifty returns.

3. To investigate the impact of Nifty returns on the FPI, FDI, and Mutual Funds.

Research Methodology

The present study analyzes the impact of FDI, FPI and Mutual Funds on Nifty Stock Returns. Nifty

Return is taken into account because it is one of the most popular indices of Indian Stock Market.

FPI, FDI, and Mutual Fund investment have been collected from National Securities Depository

Ltd (NSDL) website. The frequency of the data is monthly, and it starts from 2012 – 2016. Nifty

returns have been taken from National Stock Exchange website.

To test the series for the absence of unit root, Augmented Dickey-Fuller test has been used.

Regression has been applied to analyze the relationship between the variables as well as their

lagged terms. All the models are tested for absence of autocorrelation, heteroscedasticity &

multicollinearity by way of Breusch Pegan Godfrey method, Serial correlation LM test & Variance

Inflationary Factor (VIF).

Analysis & Findings

To study the objectives mentioned above the analysis is structured in three sections. The first

section highlights the pattern and the trend in the various types of investments i.e. FPI, FDI, and

MF. Second section focus on analyzing the impact of variables on the Nifty returns by way of

building a Regression model. The last section highlights the impact of nifty returns on FPI, FDI,

and MF.

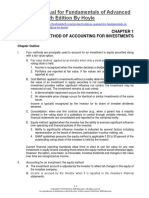

Chart 0: Comparison of %AUC of FPI with other Players in respect to Investment in Equity

70.0% FPI-Equity

Insurance-Equity

60.0% MF-Equity

FDI-Equity

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

Jan-12 Jun-12 Nov-12 Apr-13 Sep-13 Jan-14 Jun-14 Nov-14 Apr-15 Sep-15 Feb-16 Jul-16 Dec-16

Month & Year

International Journal of Research in Economics & Social Sciences 349

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

International Journal of Research in Economics and Social Sciences (IJRESS)

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939

The size and robustness of FPI’s role in Indian capital markets can be better understood by looking

at the assets in their custody as contrasted to other institutions and participants. Chart 1 amplifies

that the percentage shares of assets under custody (AUC) in equity, of major custodians namely

FPIs, mutual funds, Insurance Companies and Foreign Direct Investment. It emphasizes the fact

that FPIs have been the largest custodian of assets having their share ranging from 41 % to 65%

during 2012 to 2014. Although the share of FPIs has been fluctuating, yet their position in the

Indian capital market remained dominant as contrasted to other custodians.

Chart 2: Total % AUC of FPI as compared to Major players

60.0% FPI Insurance

MF FDI

50.0%

40.0%

30.0%

20.0%

10.0%

0.0%

Jan-12 Jun-12 Nov-12 Apr-13 Sep-13 Jan-14 Jun-14 Nov-14 Apr-15 Sep-15 Feb-16 Jul-16 Dec-16

Chart 2 explains the total percentage of assets under custody in several months starting from

January 2012 till January 2017 by the major players in the Indian market. Out of the total

investment made by all the category of investors on an average 40% of the investment came only

from the foreign portfolio investors, hence making them the major players in the Indian markets.

It can also analyze from the chart that in almost all the sample years, the investment by FPIs was

the highest & above 32%.

After analyzing the past & present trends in the asset under custody by a various group of

investors, the next section focuses on the analyzing the impact of these investments on the Nifty

returns. Table1 shows the stationarity test results of all the variables by ADF test. All the variables

are stationary at level (significant t statistics at 5% level of significance).

International Journal of Research in Economics & Social Sciences 350

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

International Journal of Research in Economics and Social Sciences (IJRESS)

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939

Table 1: ADF test results

Variables Description At Level

t statistics

Nifty _ R Nifty Returns -8.127696*

FDI Foreign Direct Investment -8.852813*

FPI Foreign Portfolio Investment -6.961252*

MF Mutual Funds -7.474324*

IC Insurance Company -7.982036*

Source: Author Calculations

In the light to analyze the impact of FDI, FPI, and MF on the nifty returns regression modeling has

been used. Table 2 presents various models which highlight the relationship and impact of

variables on the Nifty returns. All the models were checked for seasonality and heteroskedasticity

and hence are found to be homoscedastic and not serially correlated. The first model presents the

impact of all the variables along with their lagged terms on the nifty returns. The value of R square

shows that the model explains 96.7% level of the variation for Nifty. Nifty lagged term significantly

impacts nifty returns along with the Foreign portfolio investment, Mutual funds, mutual funds last

three months lagged terms. The impact of FPI and MF is positive as against the adverse impact of

lagged nifty returns and the lagged mutual funds. FDI has no significant impact on the nifty

returns. Significant F statistic suggested that all the variables collectively impact the nifty returns

and also model has a good fit.

Model II, III, and IV explain the relation among the variables, and this has been done by way of

multiple regression analysis on the variables as well as their lagged terms. In Model II, FDI is

regressed on Nifty returns, Mutual Funds, FPI and lagged terms. FPI, MF, and their lagged terms

are positive significant in impacting the FDI coming to India. FDI is impacted negatively by its last

two months lagged terms and also nifty’s last two months returns. Overall variables can explain

50.58% of the variations in the FDI.

International Journal of Research in Economics & Social Sciences 351

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

International Journal of Research in Economics and Social Sciences (IJRESS)

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939

Table 2: Results of Multiple Regression

Model I Model II Model III Model IV

Variable Nifty_R FDI FPI MF

C -0.199791* -10.95419* 0.303520 0.132284

NIFTY_R - - 1.022701* 0.419352

NIFTY_R(-1) -0.131385* -9.222670* - -

NIFTY_R(-2) - -13.27216* - -

FDI -0.001830 - -0.004987 -0.005262

FDI(-1) - -0.824397* -0.010749* -

FDI(-2) - -0.364989* - -

FPI 0.716733* - - 0.462873*

FPI(-1) - 8.534409* 0.147219* -0.299765*

FPI(-2) - 12.36242* - -0.197833

FPI(-3) - -2.942831* - -

MF 0.197302* 1.945219* 0.073857 -

MF(-1) - 1.860889 - 0.388043*

MF(-2) -0.052719* - - 0.370199*

MF(-3) -0.074741* - - -

R-squared 0.967083 0.594024 0.948916 0.893975

Adjusted R-squared 0.959927 0.505768 0.943021 0.871416

F-statistic 135.1435 6.730716 160.9878 39.62905

Prob(F-statistic) 0.000000 0.000002 0.000000 0.000000

Source: Author Calculations

Model III highlights that nifty returns and FPI’s last month investment positively impacts the

foreign portfolio investment coming to India. Last month FDI investment negatively impacted the

FPI, but the magnitude is less as compared to the variables. The most prominent factor in

attracting FPI to India is nifty returns as compared to the others. Mutual funds are insignificant in

impacting FPI investment to India. Overall the model predictability is good with 94.30%

explanation of variation in the foreign portfolio investments. Model IV shows the relationship

between mutual funds and other variables. FPI positively and one month lagged FPI negatively

impact the mutual funds. Mutual funds are affected by its two months lagged flows. Overall the

model is a good fit as the f statistic is significant at 5% level of significance. 87% of the variations

in the mutual funds are explained by all the variables together.

International Journal of Research in Economics & Social Sciences 352

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

International Journal of Research in Economics and Social Sciences (IJRESS)

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939

Conclusion

The study is to analyze the relationship between FPI, FDI, MF and the Nifty returns. Majorly earlier

studies focused on analyzing the only relation of the different types of investments with the nifty

returns. The study concluded that FPI and Mutual Fund positively impacts the nifty returns. Three

months lagged mutual funds flow and one month lagged nifty return negatively impacted the nifty

returns. Other model established the relationship between all investment types with nifty returns

seen impacting the Foreign portfolio investments only. The lagged nifty returns negatively

influence the FDI coming to India; hence there is an existence of an inverse relationship among

them. The study also observed that FDI investment in India is positively influenced by the FPI

coming to India along with the last two months FPI. FDI shares a negative relation with its lagged

terms and positive relation with the Mutual Fund investment. With regard to mutual funds, only

FPI and mutual funds own lagged values have impacted the investment. All the models have the

proper fit with significant f statistic as well as the explanation power of the variation in dependent

variable by the independent variables together is quite high.

References

Babu, M. S., & Prabheesh, K. (2008). Causal relationships between Foreign Institutional

Investments and stock returns in India. International Journal of Trade and Global

Markets, 1(3), 259-265.

Bose, S. (2012, September). Mutual Fund Investments, FII Investments and Stock Market

Returns in India. ICRA Bulletin-Money & Finance, pp. 89-110.

Fortune, P. (1998). Mutual Funds Part II: Fund Flows and Securities Returns. New England

Economic Review, 3-22.

Kapoor, D. S., & Sachan, R. (2015, April). Impact of FDI & FPI on Indian Stock Markets.

International Journal of Research in Finance and Marketing, 5(4), 9-17.

Kumar, P., Gupta, S. K., & Sharma, R. (2016, July). Risk- Return Analysis of Mutual Fund Equity

Growth Schemes. Journal of Exclusive Management Science, 5(7), 32-48.

Kumar, S. (2001). Does the Indian Stock Market Play to the tune of FII Investments? An

Empirical Investigation. ICFAI Journal of Applied Finance, 7(3), 36-44.

Mukherjee, P., Bose, S., & Coondoo, D. (2002, Apr - Sep). Foreign Institutional Investment in the

Indian Equity Market: An Analysis of Daily Flows during January 1999-May 2002. Money

& Finance, pp. 21-51.

International Journal of Research in Economics & Social Sciences 353

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

International Journal of Research in Economics and Social Sciences (IJRESS)

Vol. 8 Issue 1, January- 2018

ISSN(o): 2249-7382 | Impact Factor: 6.939

Mukherjee, P.; Roy, M. (2011). The nature and determinants of investments by institutional

investors in the Indian stock market. Journal of Emerging Market Finance, 10(3), 253-

283.

Naik, P. K., & Padhi, P. (2014, August 2). The Dynamics of Institutional Investments and Stock

Market Volatility: Evidence from FIIs and Domestic Mutual Funds Equity Investment in

India. Munich Personal RePEc Archive (MPRA), pp. 1-30.

Pal, P. (2005). Recent Volatility in Stock Markets in India and Foreign Institutional Investors.

Economic & Political Weekly, 40, pp. 765-772.

Paliwal, M., & Vashishtha, S. (2011). FIIs and Indian Stock Market: A Causality Investigation.

Comparative Economic Research, 14(4), 5-24.

Rajput, A., & Thaker, K. (2008). Exchange Rate, FII and Stock Market Index. Vlakshan, XIMB

Journal of Management, V(I), 43-56.

Sehgal, S., & Tripathi, N. (2009, January - March). Investment Strategies of FIIs in the Indian

Equity Market. VISION-The Journal of Business Perspective, 13(1), 11-18.

Sultana, D. S., & Pardhasaradhi, P. S. (2012, July). Impact of Flow of FDI & FII on Indian Stock.

Finance Research, 3, 4-10.

Warther, V. (1995). Aggregate Mutual Fund Flows and Security Returns. Journal of Financial

Economics, 39(2), 209-223.

International Journal of Research in Economics & Social Sciences 354

Email:- editorijrim@gmail.com, http://www.euroasiapub.org

(An open access scholarly, peer-reviewed, interdisciplinary, monthly, and fully refereed journal.)

Вам также может понравиться

- FII and DII in Indian Stock Market: A Behavioural StudyДокумент9 страницFII and DII in Indian Stock Market: A Behavioural StudypritheshОценок пока нет

- Stock MarketДокумент10 страницStock Marketmanas choudhuryОценок пока нет

- Impact of Foreign Institutional Investment (FII) On Indian Stock MarketДокумент7 страницImpact of Foreign Institutional Investment (FII) On Indian Stock MarketDr. Sangeeta SahniОценок пока нет

- A Study of Impact of Fii'S On Indian Stock Market With Reference To BseДокумент8 страницA Study of Impact of Fii'S On Indian Stock Market With Reference To BseAnkit IwanatiОценок пока нет

- Determinants of Foreign Institutional Invest-Ment in India: The Role of Return, Risk, and InflationДокумент15 страницDeterminants of Foreign Institutional Invest-Ment in India: The Role of Return, Risk, and InflationRavi KumarОценок пока нет

- FII On SMДокумент31 страницаFII On SMSrijan KatarukaОценок пока нет

- SSRN Id2707461Документ11 страницSSRN Id2707461sahil dagarОценок пока нет

- Ijrfm Volume 2, Issue 4 (April 2012) (ISSN 2231-5985) Impact of Foreign Institutional Investor On The Stock MarketДокумент14 страницIjrfm Volume 2, Issue 4 (April 2012) (ISSN 2231-5985) Impact of Foreign Institutional Investor On The Stock MarketNaveen KumarОценок пока нет

- Vol 11 Iss 3 Paper 22Документ7 страницVol 11 Iss 3 Paper 22Prerna SocОценок пока нет

- 3 Ijafmrdec20183Документ10 страниц3 Ijafmrdec20183TJPRC PublicationsОценок пока нет

- Impt of FiiДокумент5 страницImpt of FiiBrock LoganОценок пока нет

- The Impact of FII Investment On Indian - Dr. Ranjan Jaykant Sabhaya & Falguni H. Pandya-Vol. - VII Issue I Jan - Jun 2014 PDFДокумент10 страницThe Impact of FII Investment On Indian - Dr. Ranjan Jaykant Sabhaya & Falguni H. Pandya-Vol. - VII Issue I Jan - Jun 2014 PDFAditya JambagiОценок пока нет

- A Study On Impact of Fiis On Indian Stock MarketДокумент12 страницA Study On Impact of Fiis On Indian Stock MarketagsanyamОценок пока нет

- Fii ImpactДокумент9 страницFii Impactankursolanki13Оценок пока нет

- Research Paper On Impact of Fii On Indian Stock MarketДокумент6 страницResearch Paper On Impact of Fii On Indian Stock Marketcar93zdyОценок пока нет

- A Research Paper by Mayur ShahДокумент9 страницA Research Paper by Mayur Shahmk singhОценок пока нет

- Research Paper On FIIДокумент7 страницResearch Paper On FIIchitkarashellyОценок пока нет

- Effect of FII and Foreing Exchnage On Indain Stock Exchange by Vijay GДокумент10 страницEffect of FII and Foreing Exchnage On Indain Stock Exchange by Vijay GhhhhhhhОценок пока нет

- SynopsisДокумент3 страницыSynopsisHelnakОценок пока нет

- Market Timing Skill of Foreign Portfolio Investors - 2020 - IIMB Management RevДокумент15 страницMarket Timing Skill of Foreign Portfolio Investors - 2020 - IIMB Management RevAnkit PashteОценок пока нет

- Comparative Study of Fdis and Fiis in THДокумент4 страницыComparative Study of Fdis and Fiis in THuyОценок пока нет

- FII Equity Investment and Indian Capital Market - An Empirical InvestigationДокумент8 страницFII Equity Investment and Indian Capital Market - An Empirical Investigation90vijayОценок пока нет

- FII Investment Analysis Across Different Sectors of Indian EconomyДокумент30 страницFII Investment Analysis Across Different Sectors of Indian EconomyAmit TiwariОценок пока нет

- What Is Better For IndiaДокумент5 страницWhat Is Better For IndiaKunal ShahОценок пока нет

- Impact of FII On Indian EconomyStock MarketДокумент5 страницImpact of FII On Indian EconomyStock MarketInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Modified FDI & FII in India - A Comparative AnalysisДокумент90 страницModified FDI & FII in India - A Comparative AnalysisKewal JaganiОценок пока нет

- ImpactFII AmityBusinessReviewДокумент26 страницImpactFII AmityBusinessReviewLelouchОценок пока нет

- Fii & Fdi Investment Pattern and It's Impact On Indian Equity MarketДокумент11 страницFii & Fdi Investment Pattern and It's Impact On Indian Equity MarketSwapnil ZaveriОценок пока нет

- Foreign Institutional Investment in India: Determinants and The Impact of CrisesДокумент28 страницForeign Institutional Investment in India: Determinants and The Impact of CrisesVivek KansalОценок пока нет

- Significance of FDI and FII For The Economic Growth of India: Statistical Analysis 2001-2015Документ5 страницSignificance of FDI and FII For The Economic Growth of India: Statistical Analysis 2001-2015deepakadhanaОценок пока нет

- Role of Foreign Direct Investment (FDI) in Different SectorsДокумент6 страницRole of Foreign Direct Investment (FDI) in Different SectorsSantosh SinghОценок пока нет

- Impact of Real Exchange Rate On Foreign DirectДокумент13 страницImpact of Real Exchange Rate On Foreign DirectADE FEBRI YANTIОценок пока нет

- 11 X October 2023Документ7 страниц11 X October 2023sadananddubey1987Оценок пока нет

- Articulo TCДокумент12 страницArticulo TClikas likasОценок пока нет

- Impact of Foreign Institutional Investment in Indian Stock MarketДокумент6 страницImpact of Foreign Institutional Investment in Indian Stock Marketravi sharmaОценок пока нет

- Major Project Role of Domestic Institutional Investors On Indian Capital MarketДокумент11 страницMajor Project Role of Domestic Institutional Investors On Indian Capital MarketAbhimanyuBhardwajОценок пока нет

- Foreign Fund Flows and Stock Returns: Evidence From IndiaДокумент44 страницыForeign Fund Flows and Stock Returns: Evidence From IndiaVBОценок пока нет

- Role and Impact of Fiis On Indian Capital MarketДокумент78 страницRole and Impact of Fiis On Indian Capital MarketFarhan KhanОценок пока нет

- SSRN Id3320672Документ8 страницSSRN Id3320672HarmeetОценок пока нет

- Finance Desertation On Economic Scenario in India: Assessing The Influence of Exchange Rate Fluctuations On Stock Market VolatilityДокумент8 страницFinance Desertation On Economic Scenario in India: Assessing The Influence of Exchange Rate Fluctuations On Stock Market VolatilityHarshita GuptaОценок пока нет

- Foreign Institutional Investment (Fii) Impact On Indian Stock Market and Its Investment Behavior (Fin)Документ79 страницForeign Institutional Investment (Fii) Impact On Indian Stock Market and Its Investment Behavior (Fin)khareanurag49100% (4)

- Journal of International Trade Law and Policy: Emerald Article: Determinants of Foreign Direct Investment in IndiaДокумент20 страницJournal of International Trade Law and Policy: Emerald Article: Determinants of Foreign Direct Investment in IndiaRahmii Khairatul HisannОценок пока нет

- JMRA - Vol 2 (1) - 1-23Документ23 страницыJMRA - Vol 2 (1) - 1-23Yashika TpОценок пока нет

- Incn15 Fin 059 PDFДокумент15 страницIncn15 Fin 059 PDFchirag_nrmba15Оценок пока нет

- Factors Affecting Foreign Direct Investment in IndonesiaДокумент10 страницFactors Affecting Foreign Direct Investment in IndonesiaLlintang WidayantoОценок пока нет

- ProjectДокумент8 страницProjectananyaОценок пока нет

- Chapter - 1 (Introduction)Документ59 страницChapter - 1 (Introduction)Rahul RajОценок пока нет

- ResearchonmutualfundДокумент14 страницResearchonmutualfundsejal ambetkarОценок пока нет

- A Study On Empirical Analysis of Relationship Between FPI and NIFTY ReturnsДокумент20 страницA Study On Empirical Analysis of Relationship Between FPI and NIFTY ReturnsDr Bhadrappa HaralayyaОценок пока нет

- Determinants of FII in India - Econometric ModelДокумент14 страницDeterminants of FII in India - Econometric ModelNikhil TamtaОценок пока нет

- Impact of Institutional Investors On Nifty Volatility With Special Reference To Foreign Institutional Flows and Mutual Fund FlowsДокумент70 страницImpact of Institutional Investors On Nifty Volatility With Special Reference To Foreign Institutional Flows and Mutual Fund FlowsgaganОценок пока нет

- ECON3110 Group Project - FDIДокумент22 страницыECON3110 Group Project - FDIMohamed Ahmed aliОценок пока нет

- The Role of Foreign Direct Investment (FDI) in India-An OverviewДокумент10 страницThe Role of Foreign Direct Investment (FDI) in India-An OverviewLikesh Kumar MNОценок пока нет

- Research Paper On FdiДокумент10 страницResearch Paper On FdichitkarashellyОценок пока нет

- Project Report On "ANALYTICAL STUDY OF IMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIS) ON EXCHANGE RATE AND VALUE OF INDIAN NATIONAL RUPEE (INR) IN TERMS OF VOLATILITY"Документ93 страницыProject Report On "ANALYTICAL STUDY OF IMPACT OF FOREIGN INSTITUTIONAL INVESTORS (FIIS) ON EXCHANGE RATE AND VALUE OF INDIAN NATIONAL RUPEE (INR) IN TERMS OF VOLATILITY"Jayantkumar Kumbhare92% (12)

- Impact of FDI and FII On India MehulДокумент26 страницImpact of FDI and FII On India MehulpparijaОценок пока нет

- Role of Foreign Direct Investment (Fdi) in India's Economic Development-An AnalysisДокумент13 страницRole of Foreign Direct Investment (Fdi) in India's Economic Development-An Analysispandurang parkarОценок пока нет

- Stock Market and Foreign Exchange Market: An Empirical GuidanceОт EverandStock Market and Foreign Exchange Market: An Empirical GuidanceОценок пока нет

- PartIstatitistics2018 PДокумент81 страницаPartIstatitistics2018 Pmeenakshishrm250Оценок пока нет

- Bulletin November 2015Документ91 страницаBulletin November 2015meenakshishrm250Оценок пока нет

- Estelar: Impact of Foreign Institutional Investment Flow On Indian Stock MarketДокумент16 страницEstelar: Impact of Foreign Institutional Investment Flow On Indian Stock Marketmeenakshishrm250Оценок пока нет

- Tax System India Before and After GSTДокумент4 страницыTax System India Before and After GSTmeenakshishrm250Оценок пока нет

- Collective Investment SchemeДокумент3 страницыCollective Investment SchemeParas MittalОценок пока нет

- UK-US Negotions On Investment Chapter in Futrure FTAДокумент7 страницUK-US Negotions On Investment Chapter in Futrure FTAbi2458Оценок пока нет

- Finance Career Guide Ebook by IMS ProschoolДокумент138 страницFinance Career Guide Ebook by IMS ProschoolNaman0% (1)

- Ch02 Beams12ge SMДокумент27 страницCh02 Beams12ge SMWira Moki100% (3)

- Event - Global Pe-Final Empea - WK - 5709Документ113 страницEvent - Global Pe-Final Empea - WK - 5709amitsh20072458Оценок пока нет

- Solution Manual For Fundamentals of Advanced Accounting 7th Edition by HoyleДокумент44 страницыSolution Manual For Fundamentals of Advanced Accounting 7th Edition by HoyleJuana Terry100% (33)

- Business Idea Generation ProcessДокумент24 страницыBusiness Idea Generation Processសរ ឧត្តមОценок пока нет

- Project Report MohitДокумент76 страницProject Report MohitRajeev MaheshwariОценок пока нет

- Disclosures and DetailsДокумент1 страницаDisclosures and DetailsJose CamposОценок пока нет

- The Importance of Introducing Electronic Accounting Disclosure Using The XBRL Language in Activating 2018Документ19 страницThe Importance of Introducing Electronic Accounting Disclosure Using The XBRL Language in Activating 2018HayderAlTamimiОценок пока нет

- t3b Leaflet LRДокумент2 страницыt3b Leaflet LRsjmuneer9389Оценок пока нет

- Quality Dividend Yield Stocks - 301216Документ5 страницQuality Dividend Yield Stocks - 301216sumit guptaОценок пока нет

- Bond Market in IndiaДокумент27 страницBond Market in Indiashahbinal17Оценок пока нет

- Using Fundamental Analysis - Fundamental Analysis Explained - TradeKingДокумент6 страницUsing Fundamental Analysis - Fundamental Analysis Explained - TradeKingdippuneОценок пока нет

- SEBI Role & FunctionsДокумент27 страницSEBI Role & FunctionsGayatri MhalsekarОценок пока нет

- CrunchBase - Global Innovation Investment Report 2016 PDFДокумент74 страницыCrunchBase - Global Innovation Investment Report 2016 PDFDaniel KnobelsdorfОценок пока нет

- 10 Things You Must Do Before Buying An IPO, But Nobody Tells You About ThemДокумент11 страниц10 Things You Must Do Before Buying An IPO, But Nobody Tells You About ThemRanjit SahooОценок пока нет

- Aarti Industries LTDДокумент5 страницAarti Industries LTDViju K GОценок пока нет

- Warren Buffett Presentation v3Документ25 страницWarren Buffett Presentation v3Sisi Ye50% (2)

- Finance Project TitlesДокумент8 страницFinance Project TitlesArjun Mv100% (1)

- Project Report On STUDY OF RISK PERCEPTIДокумент58 страницProject Report On STUDY OF RISK PERCEPTIGanesh TiwariОценок пока нет

- Quiz in Investment AnswersДокумент7 страницQuiz in Investment AnswersElaine Fiona Villafuerte100% (1)

- Understanding Debt Vs Equity FinancingДокумент4 страницыUnderstanding Debt Vs Equity FinancingAlexandru HifsbtfОценок пока нет

- B2B - Group 15 Sec - AДокумент10 страницB2B - Group 15 Sec - AAbhishekSagarОценок пока нет

- University of Lay Adventists of Kigali (Unilak)Документ7 страницUniversity of Lay Adventists of Kigali (Unilak)Mugabo Romeo ChristianОценок пока нет

- Melrose 1Документ54 страницыMelrose 1Eriq GardnerОценок пока нет

- SPDR Barclays Capital Short Term Corporate Bond ETF 1-3YДокумент2 страницыSPDR Barclays Capital Short Term Corporate Bond ETF 1-3YRoberto PerezОценок пока нет

- The British Accounting Review: Peter F. PopeДокумент15 страницThe British Accounting Review: Peter F. Popeanon_654417955Оценок пока нет

- Acco 400 Final NotesДокумент53 страницыAcco 400 Final NotesMichael Di MonacoОценок пока нет

- Analysis of Investment Pattern of Different Class of People: A ReviewДокумент7 страницAnalysis of Investment Pattern of Different Class of People: A ReviewVandita KhudiaОценок пока нет