Академический Документы

Профессиональный Документы

Культура Документы

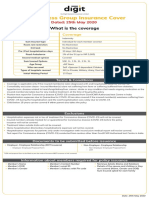

COVID-19 PRODUCTS - Expenses Incurred On Being Tested Positive To COVID-19 / Corona Virus Infection, Established & Confirmed From Registered ICMR Lab

Загружено:

Rushil GuptaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

COVID-19 PRODUCTS - Expenses Incurred On Being Tested Positive To COVID-19 / Corona Virus Infection, Established & Confirmed From Registered ICMR Lab

Загружено:

Rushil GuptaАвторское право:

Доступные форматы

COVID-19 PRODUCTS - Expenses incurred on being tested Positive to COVID-1

established & confirmed from registered ICMR Lab

Insurer Name Go-digit Universal Sompo

Type of Policy Base Base

Type of Cover Indemnity Plan Indemnity Plan

Named / Unnamed Named basis Named basis

Employer-Employee

Not required Required

Relation

If contractual/off roll

employees can be Yes Yes

covered

Minimum

Blue collar Job - 500 lives

Employeees / Minimum Premium - 10,000

White collar job - 100 lives

Premium

Self + Spouse + 2 Dependent

Family Definition Children + Parents or Parents Employee + Spouse only

in Law*

3 months - 60 years

Age Restriction 18 years -60 years

Child upto 18 years

1 Lac / 2 Lac / 3 Lac & 5 Lac -

Sum Insured (Non- White collar Job profile

50k, 1L, 1.5L, 2L, 2.5L, 3L

Floater) 25K / 50K/1 lac - Blue Collar

Job profile

Room rent of 2% & ICU 4% of

Base SI, maximum upto 5000

Room Rent Restriction No Restriction & 7500 respectively.

All charges to be paid in

proportion to room rent.

15 Days - Can be waived off

Initial Waiting Period 15 Days

with additional premium

Cashless and Re- Cashless and Re-

Claims pay-out

imbursement imbursement

Pre & Post 30 days respectively, Limited

30 & 60 days respectively

Hospitalisation to maximum upto 10% of SI

OPD cover within SI

Rs 2500 for SI 1 lac & 2 Lac

subject to Not Covered

Rs 5000 for SI 3 Lac & 5 Lac

hospitalisation

Quarantine Cover Not Covered Not Covered

For SI of 25K / 50K/ 1 Lac & 2

Lac - Rs 500/-day &

For SI 3 Lac & 5 Lac - Rs

Daily Cash If admitted

Not Covered 1000/- day, on completion of

in Govt Hospitals

24 hrs. of Quarantine /

Isolation per day, for a period

of Maximum of 7 days

Financial Protection

Not Covered Not Covered

against Loss of job

Ambulance Upto 1% of SI (upto INR 5000) Rs.3,000

Insured Member(s) is/are not

suffering from fever or

suffering /suffered from

Person with Co-Morbid

diabetes,

condition or Pre-existing

hypertension, disease related

Diseases – Like HTN/

to heart/lungs/kidney/liver,

Diabetes / Lung/ cardiac

Co-morbidity cancer, stroke or any

diseases etc. will be covered

condition / Exclusion condition that needs ongoing

under the policy , however the

medication or the

claim shall be paid only

insured members(s) is/are due

pertaining to COVID treatment

for any medical treatment, at

for such customers.

the time of buying this policy -

Can be waived with additional

premium

PED diseases of

symptoms of covid or

Person already

suspected or

quarantine prior to Not Covered Not Covered

inception of the policy

or within the initial

waiting period from

inception of the policy

Addition with annual Premium

for the balance period for new

Addition-Deletion Not Allowed

Joinees

Deletion not allowed

If the group members are

highly concentrated on any

containment zone area like

Dharavi Slums, Nizamuddin

etc, we should avoid. All

groups with more than 25% of

population concentrated on

red Zones declared by

Government of India, to be

avoided.

Special conditions NA

If the group members are

highly concentrated on any

containment zone area like

Dharavi Slums, Nizamuddin

etc, we should avoid. All

groups with more than 25% of

population concentrated on

red Zones declared by

Government of India, to be

avoided.

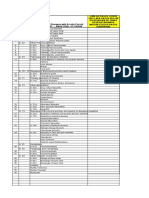

ested Positive to COVID-19 / Corona Virus infection ,

from registered ICMR Lab

Reliance Chola MS

Base Base

Benefit Plan Benefit Plan

Named basis Named basis

Employer-Employee- subject

to underwriting Required - Product subject to

Non Employer-Employee - underwriting

Pre-underwritten

Not covered, Only available for

No

Permanent Employees

100 insured persons 7 Employees

Self + Spouse + 2 Dependent

Self only

Children + Parents

3 months - 60 years 3 months - 60 years

Child upto 18 years Child upto 25 years

25K, 50K, 1L, 2L Rs. 10K, 20K, 30K, 40K, 50K

Not Applicable Not Applicable

15 Days 16 days

Not Applicable Not Applicable

Not covered Not covered

Not covered Not covered

Optional add on cover:

Inurer will pay 50% of Sum

Insured, if Insured Person is

Quarantined* or 14

Not Covered

consecutive days due to

diagnosis/suspected of

coronavirus Disease (COVID

19)

Optional add on cover:

Rs.250/-, Rs. 500/-, Rs.750/-,

Optional add on cover: If Rs.1000/- per day maximium upto

Covid-19 quaratine / treatment 15 Days

for 14 consecutive days, leads This benefit is over and above the

to loss of pay, Insured gets a base Sum Insured

daily benefit amount of 2% Daily Cash benefit opted shall be

Per Day for maximum 30 days applicable at policy level and shall

not vary for the individual covered

under a single policy.

Optional add on cover: Loss

of Job cover - 50% of Sum Optional add on cover: 50% of

Insured - If the Insured suffers the chosen base Sum Insured per

unemployment due to the month upto a maximum of 3

diagnosis or Quarantine for months towards Loss of Job due

COVID-19, they get 50% of to Diagnosis or Quarantine for

the SI for each opted month confirmed COVID-19

for maximum upto 2 months

Not covered Not covered

Not Applicable Not Applicable

Not Covered Not Covered

Not Allowed On Pro-rata basis

1. Persons who have travelled

to the travel-restricted

countries in 45 days

immediately precedding the

NA

certificate period start date

2. Any Quarantine or

Diagnosis during Lockdown

period is not covered

Вам также может понравиться

- Gordon's 11 Functional Health Patterns AssessmentДокумент2 страницыGordon's 11 Functional Health Patterns Assessmentmtuckrn84% (37)

- Maybury ManualДокумент55 страницMaybury ManualFriends of MayburyОценок пока нет

- FWD Life Insurance ProductsДокумент65 страницFWD Life Insurance ProductsBilly Maravillas Dela CruzОценок пока нет

- Albumin Drug StudyДокумент1 страницаAlbumin Drug StudyMaine Concepcion100% (1)

- Adderall-Safer Than AspirinДокумент2 страницыAdderall-Safer Than AspirinChristopher RhudyОценок пока нет

- Pharmacology of Phenadoxone dN-Morpholino 4:4 Diphenyl: HydrochlorideДокумент17 страницPharmacology of Phenadoxone dN-Morpholino 4:4 Diphenyl: Hydrochlorideisaev201Оценок пока нет

- Biology Project Report: Submitted To: Submitted byДокумент19 страницBiology Project Report: Submitted To: Submitted byNIKHIL SINGH89% (28)

- How To Survive Hospital StayДокумент38 страницHow To Survive Hospital StayLaurentiu M.Оценок пока нет

- Sahi ExportДокумент8 страницSahi ExportHeena ChoudharyОценок пока нет

- Benefits Silver GoldДокумент4 страницыBenefits Silver GoldMitra LalОценок пока нет

- UNITY GMC - RFQ With DataДокумент27 страницUNITY GMC - RFQ With DataBOC ClaimsОценок пока нет

- User Manual-1Документ10 страницUser Manual-1Ansh BhardwajОценок пока нет

- Mediclaim Policy Terms & Conditions For 2022-23 PDFДокумент11 страницMediclaim Policy Terms & Conditions For 2022-23 PDFravinder.singh19853857Оценок пока нет

- GMC Benefit Manual - 22Документ28 страницGMC Benefit Manual - 22SwaОценок пока нет

- Parental Policy BenefitsДокумент2 страницыParental Policy Benefitssiva kumarОценок пока нет

- Star Family Health Optima 2020 PDFДокумент1 страницаStar Family Health Optima 2020 PDFRajat GuptaОценок пока нет

- HFFP-2015 Revised ProspectusДокумент25 страницHFFP-2015 Revised Prospectuspooja singhalОценок пока нет

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithДокумент4 страницыBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithursvinciОценок пока нет

- IDA Policy - DetailsДокумент3 страницыIDA Policy - DetailsRavinderОценок пока нет

- Royal Sundaram General Insurance Co. Limited (Formerly Known As Royal Sundaram Alliance Insurance Company Limited)Документ2 страницыRoyal Sundaram General Insurance Co. Limited (Formerly Known As Royal Sundaram Alliance Insurance Company Limited)Abhijit MohantyОценок пока нет

- Health Assure Insurance POLICYДокумент2 страницыHealth Assure Insurance POLICYRISHAB CHETRIОценок пока нет

- GMC - First Policy - 2023-2024Документ18 страницGMC - First Policy - 2023-2024neethinathan.citrusОценок пока нет

- Benefits Summary IndiaДокумент9 страницBenefits Summary IndiaABHISHEK BAGHОценок пока нет

- Star Health Assure - One Pager - Version 1.0 - May - 22Документ2 страницыStar Health Assure - One Pager - Version 1.0 - May - 22ksreddy618Оценок пока нет

- Healthy You One Pager - 21-04-20Документ2 страницыHealthy You One Pager - 21-04-20Anu PriyaОценок пока нет

- FHO - Revised - One PagerДокумент1 страницаFHO - Revised - One Pagersurya100% (1)

- FHO - One Pager - Version 1.0 - Oct 2020Документ2 страницыFHO - One Pager - Version 1.0 - Oct 2020naval730107100% (1)

- PDF Document Icici Midi ClamДокумент48 страницPDF Document Icici Midi Clam3sanjaypatilОценок пока нет

- Star Women Care Insurance Policy: FeaturesДокумент2 страницыStar Women Care Insurance Policy: FeaturesAnoop AravindОценок пока нет

- Star Health Insurance - MediclaimДокумент4 страницыStar Health Insurance - MediclaimYugandhar SalviОценок пока нет

- Roduct BookletДокумент11 страницRoduct BookletDeepak MoreОценок пока нет

- Family Health Optima Insurance PlanДокумент16 страницFamily Health Optima Insurance PlanvedavathiОценок пока нет

- RB Health Plan One PagerДокумент2 страницыRB Health Plan One PagersoniОценок пока нет

- Health Advantage BrochureДокумент11 страницHealth Advantage BrochurevenkatОценок пока нет

- MEDICLASSIC Gold One PagerДокумент1 страницаMEDICLASSIC Gold One Pagerjaluku jinОценок пока нет

- Star Fho One Page Feb 2020Документ2 страницыStar Fho One Page Feb 2020suryaОценок пока нет

- Family Health Optima Insurance PlanДокумент16 страницFamily Health Optima Insurance Planujjal deyОценок пока нет

- FHO - One Pager - Version 1.1 - MayДокумент2 страницыFHO - One Pager - Version 1.1 - MaySakshi Jain50% (2)

- Employee Benefit Manual - C&W Group - 2022-23Документ34 страницыEmployee Benefit Manual - C&W Group - 2022-23Shubham GargОценок пока нет

- GMC Policy Terms and ConditionsДокумент12 страницGMC Policy Terms and Conditionssomya89Оценок пока нет

- Star Health Assure - One Pager - Version 1.0 - April - 2022Документ3 страницыStar Health Assure - One Pager - Version 1.0 - April - 2022Shihb100% (1)

- Star Health Assure One Pager Version 10 April 202 221117 113317Документ4 страницыStar Health Assure One Pager Version 10 April 202 221117 113317ApnerОценок пока нет

- YSI One Pager Version 1.0 Feb 21Документ2 страницыYSI One Pager Version 1.0 Feb 21Prasad.MОценок пока нет

- Daleel E PDFДокумент44 страницыDaleel E PDFNumair AshrafОценок пока нет

- FHO One Pager Version 1.0 Oct 2020Документ2 страницыFHO One Pager Version 1.0 Oct 2020Darsh TalwadiaОценок пока нет

- Rapyuta Robotics PVT LTD - GMC Renewal Quote - 28th Dec2022Документ1 страницаRapyuta Robotics PVT LTD - GMC Renewal Quote - 28th Dec2022nagarajgnairyОценок пока нет

- GMC 2023-24 Terms and Conditions: Group Health InsuranceДокумент3 страницыGMC 2023-24 Terms and Conditions: Group Health InsurancesandeshlikesОценок пока нет

- Employee Policy ConditionsДокумент33 страницыEmployee Policy ConditionsParesh ShrivastavaОценок пока нет

- Benefit ManualДокумент29 страницBenefit ManualSüññy MäñèОценок пока нет

- Sampoorna Arogya - Onepager - 22042022Документ2 страницыSampoorna Arogya - Onepager - 22042022adiguptaОценок пока нет

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithДокумент4 страницыBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithlawrenziОценок пока нет

- FWD CI First EngBrochureДокумент13 страницFWD CI First EngBrochurehafizuddinrazaliОценок пока нет

- Young Star - One Pager - Version 1.2 - August 2021Документ1 страницаYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelОценок пока нет

- Super Surplus Insurance Policy, Top Up Health InsДокумент2 страницыSuper Surplus Insurance Policy, Top Up Health InsAVNEESHОценок пока нет

- YSI One Pager Version 1.0 Oct 2020Документ1 страницаYSI One Pager Version 1.0 Oct 2020naval730107Оценок пока нет

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Документ1 страницаYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadОценок пока нет

- Family Health Optima Insurance Plan NewДокумент8 страницFamily Health Optima Insurance Plan NewNeeraj NemaОценок пока нет

- Chola 230515 114142Документ7 страницChola 230515 114142Prashanth G.P.Оценок пока нет

- One Pager For YOUNG STARДокумент1 страницаOne Pager For YOUNG STARVivek Sharma100% (1)

- HFF-2015 Pol PDFДокумент31 страницаHFF-2015 Pol PDFAmit RajОценок пока нет

- Benefits ManualДокумент34 страницыBenefits ManualRupayan DuttaОценок пока нет

- Diamond LeafletДокумент6 страницDiamond Leafletjinna kvpОценок пока нет

- Star Health Assure - One Pager - Version 1.0 - April - 2022Документ2 страницыStar Health Assure - One Pager - Version 1.0 - April - 2022Rohit kanyalОценок пока нет

- Group PolicyДокумент14 страницGroup PolicyMahesh DivakarОценок пока нет

- Virtusa Policy Benefit1Документ1 страницаVirtusa Policy Benefit1Venkatesh KumarОценок пока нет

- Digit Illness Group Insurance Cover: What Is The CoverageДокумент2 страницыDigit Illness Group Insurance Cover: What Is The CoverageRushil GuptaОценок пока нет

- Alliance Corporate Presentation 2020-21Документ15 страницAlliance Corporate Presentation 2020-21Rushil GuptaОценок пока нет

- New - Initiatives-Status ReportДокумент3 страницыNew - Initiatives-Status ReportRushil GuptaОценок пока нет

- DEV (AutoRecovered)Документ4 страницыDEV (AutoRecovered)Rushil GuptaОценок пока нет

- GMC, Gpa RFQДокумент8 страницGMC, Gpa RFQRushil Gupta100% (1)

- Plastivision Data-RushilДокумент11 страницPlastivision Data-RushilRushil GuptaОценок пока нет

- Plastivision Data-RushilДокумент11 страницPlastivision Data-RushilRushil GuptaОценок пока нет

- Feline Chronic Kidney Disease - Integrated ApproachДокумент12 страницFeline Chronic Kidney Disease - Integrated ApproachClara SanchezОценок пока нет

- Icd-10 Oktober 2021Документ9 страницIcd-10 Oktober 2021Nia KurniawatiОценок пока нет

- CDC 26714 DS1Документ383 страницыCDC 26714 DS1Joyce AngobungОценок пока нет

- 7 200320 HWCДокумент56 страниц7 200320 HWCParmar JigneshОценок пока нет

- Top10ReasonsToUseIVUS PDFДокумент71 страницаTop10ReasonsToUseIVUS PDFDiana PânteaОценок пока нет

- Analisis Kesesuaian Penggunaan Antiinfeksi Pada Infeksi Oportunistik Pasien Hiv/Aids Rawat Inap Di Rsup Dr. Sardjito YogyakartaДокумент7 страницAnalisis Kesesuaian Penggunaan Antiinfeksi Pada Infeksi Oportunistik Pasien Hiv/Aids Rawat Inap Di Rsup Dr. Sardjito YogyakartaindahОценок пока нет

- Hypertention and HypotentionДокумент46 страницHypertention and HypotentionAmanuel MaruОценок пока нет

- Case Conference Maternal HIV C Maternal Amphetamine Use PDFДокумент44 страницыCase Conference Maternal HIV C Maternal Amphetamine Use PDFPloyz NattidaОценок пока нет

- B Blab 6 Crossmatch SP 05Документ14 страницB Blab 6 Crossmatch SP 05Rutchelle Joyce PugoyОценок пока нет

- Third Quarter Science 10 - BiologyДокумент91 страницаThird Quarter Science 10 - BiologyApple ArellanoОценок пока нет

- Art Therapy What Is Art Therapy?Документ2 страницыArt Therapy What Is Art Therapy?rohit singhОценок пока нет

- Central Venous CatheterДокумент5 страницCentral Venous Catheterasmaa_gamal14Оценок пока нет

- COURSE OBJECTIVES or NursingДокумент5 страницCOURSE OBJECTIVES or NursingFil AquinoОценок пока нет

- 3-Ammar Notes (Ob - Gyn)Документ6 страниц3-Ammar Notes (Ob - Gyn)Dr-Hashem Al-ShareefОценок пока нет

- List of Top Level Categories: CHAPTER 01 Certain Infectious or Parasitic DiseasesДокумент148 страницList of Top Level Categories: CHAPTER 01 Certain Infectious or Parasitic Diseasesျပည္ စိုးОценок пока нет

- Blood Collection TubesДокумент1 страницаBlood Collection TubesMohammad Atiq100% (1)

- Diabetes and The Nutrition and Diets For Its PreveДокумент16 страницDiabetes and The Nutrition and Diets For Its PreveRam MОценок пока нет

- What Is A PsychiatristДокумент2 страницыWhat Is A Psychiatristmercy robinsonОценок пока нет

- Ballard Score Calculator: CalculatorsДокумент1 страницаBallard Score Calculator: Calculatorsbazlin syabrinaОценок пока нет

- A. Knowledge-WPS OfficeДокумент9 страницA. Knowledge-WPS Officeannabelle castanedaОценок пока нет

- Lecture 4 Diagnosis of Dental CariesДокумент12 страницLecture 4 Diagnosis of Dental CariesDt omarОценок пока нет

- Analise Dinamica Sorriso - Mudanças Com A IdadeДокумент2 страницыAnalise Dinamica Sorriso - Mudanças Com A IdadeCatia Sofia A PОценок пока нет

- Small Animal Surgery Internship - Proposed Program Description (2021)Документ4 страницыSmall Animal Surgery Internship - Proposed Program Description (2021)Shubham HarishОценок пока нет