Академический Документы

Профессиональный Документы

Культура Документы

Information Classification: General

Загружено:

Anton De la GarzaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Information Classification: General

Загружено:

Anton De la GarzaАвторское право:

Доступные форматы

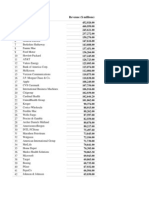

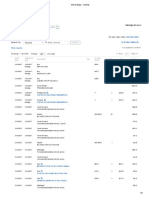

Fund Name: SPDR® Portfolio S&P 500® Growth ETF

Ticker Symbol: SPYG

Holdings: As of 12-May-2020

Name Ticker Identifier SEDOL

Microsoft Corporation MSFT 59491810 2588173

Apple Inc. AAPL 03783310 2046251

Amazon.com Inc. AMZN 02313510 2000019

Facebook Inc. Class A FB 30303M10 B7TL820

Alphabet Inc. Class A GOOGL 02079K30 BYVY8G0

Alphabet Inc. Class C GOOG 02079K10 BYY88Y7

Visa Inc. Class A V 92826C83 B2PZN04

Mastercard Incorporated Class A MA 57636Q10 B121557

NVIDIA Corporation NVDA 67066G10 2379504

Netflix Inc. NFLX 64110L10 2857817

Home Depot Inc. HD 43707610 2434209

Adobe Inc. ADBE 00724F10 2008154

Procter & Gamble Company PG 74271810 2704407

PayPal Holdings Inc PYPL 70450Y10 BYW36M8

Johnson & Johnson JNJ 47816010 2475833

salesforce.com inc. CRM 79466L30 2310525

Intel Corporation INTC 45814010 2463247

Thermo Fisher Scientific Inc. TMO 88355610 2886907

JPMorgan Chase & Co. JPM 46625H10 2190385

Walt Disney Company DIS 25468710 2270726

Merck & Co. Inc. MRK 58933Y10 2778844

Broadcom Inc. AVGO 11135F10 BDZ78H9

American Tower Corporation AMT 03027X10 B7FBFL2

Abbott Laboratories ABT 00282410 2002305

Lockheed Martin Corporation LMT 53983010 2522096

Comcast Corporation Class A CMCSA 20030N10 2044545

QUALCOMM Incorporated QCOM 74752510 2714923

PepsiCo Inc. PEP 71344810 2681511

Starbucks Corporation SBUX 85524410 2842255

AbbVie Inc. ABBV 00287Y10 B92SR70

Amgen Inc. AMGN 03116210 2023607

Bristol-Myers Squibb Company BMY 11012210 2126335

Costco Wholesale Corporation COST 22160K10 2701271

Charter Communications Inc. Class A CHTR 16119P10 BZ6VT82

Accenture Plc Class A ACN G1151C10 B4BNMY3

NIKE Inc. Class B NKE 65410610 2640147

Intuit Inc. INTU 46120210 2459020

Eli Lilly and Company LLY 53245710 2516152

S&P Global Inc. SPGI 78409V10 BYV2325

Vertex Pharmaceuticals Incorporated VRTX 92532F10 2931034

Linde plc LIN G5494J10 BZ12WP8

Coca-Cola Company KO 19121610 2206657

ServiceNow Inc. NOW 81762P10 B80NXX8

Information Classification: General

Oracle Corporation ORCL 68389X10 2661568

Union Pacific Corporation UNP 90781810 2914734

Texas Instruments Incorporated TXN 88250810 2885409

Danaher Corporation DHR 23585110 2250870

Advanced Micro Devices Inc. AMD 00790310 2007849

Intuitive Surgical Inc. ISRG 46120E60 2871301

NextEra Energy Inc. NEE 65339F10 2328915

Zoetis Inc. Class A ZTS 98978V10 B95WG16

McDonald's Corporation MCD 58013510 2550707

Booking Holdings Inc. BKNG 09857L10 BDRXDB4

Fiserv Inc. FISV 33773810 2342034

Equinix Inc. EQIX 29444U70 BVLZX12

Lowe's Companies Inc. LOW 54866110 2536763

TJX Companies Inc TJX 87254010 2989301

Northrop Grumman Corporation NOC 66680710 2648806

Air Products and Chemicals Inc. APD 00915810 2011602

Micron Technology Inc. MU 59511210 2588184

Applied Materials Inc. AMAT 03822210 2046552

Philip Morris International Inc. PM 71817210 B2PKRQ3

Dollar General Corporation DG 25667710 B5B1S13

ConocoPhillips COP 20825C10 2685717

Sherwin-Williams Company SHW 82434810 2804211

Edwards Lifesciences Corporation EW 28176E10 2567116

Raytheon Technologies Corporation RTX 75513E10 BM5M5Y3

Honeywell International Inc. HON 43851610 2020459

Moody's Corporation MCO 61536910 2252058

Stryker Corporation SYK 86366710 2853688

L3Harris Technologies Inc LHX 50243110 BK9DTN5

Autodesk Inc. ADSK 05276910 2065159

Analog Devices Inc. ADI 03265410 2032067

Target Corporation TGT 87612E10 2259101

Automatic Data Processing Inc. ADP 05301510 2065308

Estee Lauder Companies Inc. Class A EL 51843910 2320524

DexCom Inc. DXCM 25213110 B0796X4

Roper Technologies Inc. ROP 77669610 2749602

Lam Research Corporation LRCX 51280710 2502247

Crown Castle International Corp CCI 22822V10 BTGQCX1

Prologis Inc. PLD 74340W10 B44WZD7

Caterpillar Inc. CAT 14912310 2180201

American Express Company AXP 02581610 2026082

CME Group Inc. Class A CME 12572Q10 2965839

SBA Communications Corp. Class A SBAC 78410G10 BZ6TS23

eBay Inc. EBAY 27864210 2293819

Marsh & McLennan Companies Inc. MMC 57174810 2567741

Ross Stores Inc. ROST 77829610 2746711

Boston Scientific Corporation BSX 10113710 2113434

O'Reilly Automotive Inc. ORLY 67103H10 B65LWX6

Regeneron Pharmaceuticals Inc. REGN 75886F10 2730190

Information Classification: General

Boeing Company BA 09702310 2108601

United Parcel Service Inc. Class B UPS 91131210 2517382

MSCI Inc. Class A MSCI 55354G10 B2972D2

Charles Schwab Corporation SCHW 80851310 2779397

Aon Plc Class A AON G0403H10 BLP1HW5

Illumina Inc. ILMN 45232710 2613990

Intercontinental Exchange Inc. ICE 45866F10 BFSSDS9

Illinois Tool Works Inc. ITW 45230810 2457552

BlackRock Inc. BLK 09247X10 2494504

Colgate-Palmolive Company CL 19416210 2209106

Altria Group Inc MO 02209S10 2692632

KLA Corporation KLAC 48248010 2480138

Progressive Corporation PGR 74331510 2705024

Yum! Brands Inc. YUM 98849810 2098876

Dow Inc. DOW 26055710 BHXCF84

Amphenol Corporation Class A APH 03209510 2145084

CSX Corporation CSX 12640810 2160753

Ecolab Inc. ECL 27886510 2304227

Global Payments Inc. GPN 37940X10 2712013

AutoZone Inc. AZO 05333210 2065955

IDEXX Laboratories Inc. IDXX 45168D10 2459202

Deere & Company DE 24419910 2261203

ResMed Inc. RMD 76115210 2732903

Synopsys Inc. SNPS 87160710 2867719

Norfolk Southern Corporation NSC 65584410 2641894

Chipotle Mexican Grill Inc. CMG 16965610 B0X7DZ3

Kimberly-Clark Corporation KMB 49436810 2491839

PACCAR Inc PCAR 69371810 2665861

Cadence Design Systems Inc. CDNS 12738710 2302232

Motorola Solutions Inc. MSI 62007630 B5BKPQ4

Waste Management Inc. WM 94106L10 2937667

ANSYS Inc. ANSS 03662Q10 2045623

Marriott International Inc. Class A MAR 57190320 2210614

Microchip Technology Incorporated MCHP 59501710 2592174

FleetCor Technologies Inc. FLT 33904110 B4R28B3

Baxter International Inc. BAX 07181310 2085102

Fortinet Inc. FTNT 34959E10 B5B2106

T. Rowe Price Group TROW 74144T10 2702337

IHS Markit Ltd. INFO G4756710 BD0Q558

Hilton Worldwide Holdings Inc HLT 43300A20 BYVMW06

MarketAxess Holdings Inc. MKTX 57060D10 B03Q9D0

Keysight Technologies Inc KEYS 49338L10 BQZJ0Q9

AMETEK Inc. AME 03110010 2089212

Electronic Arts Inc. EA 28551210 2310194

Verisk Analytics Inc VRSK 92345Y10 B4P9W92

Emerson Electric Co. EMR 29101110 2313405

Incyte Corporation INCY 45337C10 2471950

Cintas Corporation CTAS 17290810 2197137

Information Classification: General

Monster Beverage Corporation MNST 61174X10 BZ07BW4

Copart Inc. CPRT 21720410 2208073

IQVIA Holdings Inc IQV 46266C10 BDR73G1

Phillips 66 PSX 71854610 B78C4Y8

TransDigm Group Incorporated TDG 89364110 B11FJK3

D.R. Horton Inc. DHI 23331A10 2250687

STATE STREET INSTITUTIONAL LIQ STATE STR 70286227 70286227 Unassigned

Fastenal Company FAST 31190010 2332262

Teleflex Incorporated TFX 87936910 2881407

Sempra Energy SRE 81685110 2138158

Take-Two Interactive Software Inc. TTWO 87405410 2122117

Cummins Inc. CMI 23102110 2240202

Old Dominion Freight Line Inc. ODFL 67958010 2656423

Align Technology Inc. ALGN 01625510 2679204

CDW Corp. CDW 12514G10 BBM5MD6

Domino's Pizza Inc. DPZ 25754A20 B01SD70

EOG Resources Inc. EOG 26875P10 2318024

Ball Corporation BLL 05849810 2073022

Agilent Technologies Inc. A 00846U10 2520153

Tiffany & Co. TIF 88654710 2892090

Paychex Inc. PAYX 70432610 2674458

Hershey Company HSY 42786610 2422806

Kansas City Southern KSU 48517030 2607647

Vulcan Materials Company VMC 92916010 2931205

Xilinx Inc. XLNX 98391910 2985677

Cerner Corporation CERN 15678210 2185284

Alexion Pharmaceuticals Inc. ALXN 01535110 2036070

Paycom Software Inc. PAYC 70432V10 BL95MY0

Rockwell Automation Inc. ROK 77390310 2754060

CBRE Group Inc. Class A CBRE 12504L10 B6WVMH3

Zebra Technologies Corporation Class A ZBRA 98920710 2989356

Willis Towers Watson Public Limited Company WLTW G9662910 BDB6Q21

CarMax Inc. KMX 14313010 2983563

Brown-Forman Corporation Class B BF.B 11563720 2146838

TE Connectivity Ltd. TEL H8498910 B62B7C3

Arista Networks Inc. ANET 04041310 BN33VM5

Public Storage PSA 74460D10 2852533

Qorvo Inc. QRVO 74736K10 BR9YYP4

Hess Corporation HES 42809H10 2023748

FMC Corporation FMC 30249130 2328603

Garmin Ltd. GRMN H2906T10 B3Z5T14

VeriSign Inc. VRSN 92343E10 2142922

Trane Technologies plc TT G8994E10 BK9ZQ96

Masco Corporation MAS 57459910 2570200

Sysco Corporation SYY 87182910 2868165

Akamai Technologies Inc. AKAM 00971T10 2507457

Cboe Global Markets Inc CBOE 12503M10 B5834C5

Skyworks Solutions Inc. SWKS 83088M10 2961053

Information Classification: General

Otis Worldwide Corporation OTIS 68902V10 BK531S8

Parker-Hannifin Corporation PH 70109410 2671501

Equifax Inc. EFX 29442910 2319146

PPG Industries Inc. PPG 69350610 2698470

McCormick & Company Incorporated MKC 57978020 2550161

Martin Marietta Materials Inc. MLM 57328410 2572079

American Water Works Company Inc. AWK 03042010 B2R3PV1

Mettler-Toledo International Inc. MTD 59268810 2126249

Gartner Inc. IT 36665110 2372763

Ameriprise Financial Inc. AMP 03076C10 B0J7D57

NVR Inc. NVR 62944T10 2637785

Church & Dwight Co. Inc. CHD 17134010 2195841

V.F. Corporation VFC 91820410 2928683

Alexandria Real Estate Equities Inc. ARE 01527110 2009210

Broadridge Financial Solutions Inc. BR 11133T10 B1VP7R6

Synchrony Financial SYF 87165B10 BP96PS6

Celanese Corporation CE 15087010 B05MZT4

Allegion PLC ALLE G0176J10 BFRT3W7

Las Vegas Sands Corp. LVS 51783410 B02T2J7

Citrix Systems Inc. CTXS 17737610 2182553

Pioneer Natural Resources Company PXD 72378710 2690830

Tyson Foods Inc. Class A TSN 90249410 2909730

Cooper Companies Inc. COO 21664840 2222631

Arthur J. Gallagher & Co. AJG 36357610 2359506

United Rentals Inc. URI 91136310 2134781

First Republic Bank FRC 33616C10 B4WHY15

NRG Energy Inc. NRG 62937750 2212922

Western Union Company WU 95980210 B1F76F9

Republic Services Inc. RSG 76075910 2262530

Carrier Global Corp. CARR 14448C10 BK4N0D7

Realty Income Corporation O 75610910 2724193

Essex Property Trust Inc. ESS 29717810 2316619

Discover Financial Services DFS 25470910 B1YLC43

Wynn Resorts Limited WYNN 98313410 2963811

Dover Corporation DOV 26000310 2278407

Hologic Inc. HOLX 43644010 2433530

NortonLifeLock Inc. NLOK 66877110 BJN4XN5

Corning Inc GLW 21935010 2224701

Jack Henry & Associates Inc. JKHY 42628110 2469193

Waters Corporation WAT 94184810 2937689

Fortune Brands Home & Security Inc. FBHS 34964C10 B3MC7D6

PulteGroup Inc. PHM 74586710 2708841

Freeport-McMoRan Inc. FCX 35671D85 2352118

STERIS Plc STE G8473T10 BFY8C75

Duke Realty Corporation DRE 26441150 2284084

Seagate Technology PLC STX G7945M10 B58JVZ5

Simon Property Group Inc. SPG 82880610 2812452

Leidos Holdings Inc. LDOS 52532710 BDV82B8

Information Classification: General

Expeditors International of Washington Inc. EXPD 30213010 2325507

Ulta Beauty Inc ULTA 90384S30 B28TS42

Maxim Integrated Products Inc. MXIM 57772K10 2573760

Extra Space Storage Inc. EXR 30225T10 B02HWR9

Tractor Supply Company TSCO 89235610 2900335

Xylem Inc. XYL 98419M10 B3P2CN8

IDEX Corporation IEX 45167R10 2456612

Avery Dennison Corporation AVY 05361110 2066408

Varian Medical Systems Inc. VAR 92220P10 2927516

Nasdaq Inc. NDAQ 63110310 2965107

PerkinElmer Inc. PKI 71404610 2305844

Mid-America Apartment Communities Inc. MAA 59522J10 2589132

SVB Financial Group SIVB 78486Q10 2808053

Ingersoll Rand Inc. IR 45687V10 BL5GZ82

Healthpeak Properties Inc. PEAK 42250P10 BJBLRK3

ABIOMED Inc. ABMD 00365410 2003698

UDR Inc. UDR 90265310 2727910

J.B. Hunt Transport Services Inc. JBHT 44565810 2445416

Boston Properties Inc. BXP 10112110 2019479

Cabot Oil & Gas Corporation COG 12709710 2162340

Lamb Weston Holdings Inc. LW 51327210 BDQZFJ3

NetApp Inc. NTAP 64110D10 2630643

MGM Resorts International MGM 55295310 2547419

Huntington Ingalls Industries Inc. HII 44641310 B40SSC9

DENTSPLY SIRONA Inc. XRAY 24906P10 BYNPPC6

Darden Restaurants Inc. DRI 23719410 2289874

Campbell Soup Company CPB 13442910 2162845

LKQ Corporation LKQ 50188920 2971029

Live Nation Entertainment Inc. LYV 53803410 B0T7YX2

Cincinnati Financial Corporation CINF 17206210 2196888

Xerox Holdings Corporation XRX 98421M10 BJJD5G3

FLIR Systems Inc. FLIR 30244510 2344717

IPG Photonics Corporation IPGP 44980X10 2698782

Apache Corporation APA 03741110 2043962

Rollins Inc. ROL 77571110 2747305

Leggett & Platt Incorporated LEG 52466010 2510682

Howmet Aerospace Inc. HWM 44320110 BKLJ8V2

Federal Realty Investment Trust FRT 31374720 2333931

Quanta Services Inc. PWR 74762E10 2150204

National Oilwell Varco Inc. NOV 63707110 2624486

Coty Inc. Class A COTY 22207020 BBBSMJ2

U.S. Dollar CASH_USD CASH_USD Unassigned

This analysis or any portion thereof may not be revised or changed in any way, reprinted, sold or redistributed without the w

Portfolio holdings, allocations and weightings are as of the date indicated, are subject to change and should not be conside

visit www.ssga.com.

Important Risk Information

Information Classification: General

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the

returns.

Intellectual Property Information: Standard & Poor's®, S&P® and SPDR® are registered trademarks of Standard & Poor

Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices

Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow J

parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in re

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA (https://www.sipc.org/), SIPC (https://ww

References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide serv

FINRA, is the distributor for DIA, MDY and SPY, all unit investment trusts. ALPS Portfolio Solutions Distributor, Inc., membe

and ALPS Portfolio Solutions Distributor, Inc. are not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds' investment objectives, risks, charges and expenses. To obtain a prospectus

www.ssga.com. Read it carefully.

Not FDIC Insured • No Bank Guarantee • May Lose Value

2529657.1.1.AM.RTL

SPD001889

Information Classification: General

Weight Sector Shares Held Local Currency

10.011786 Information Technology 3977829.000 USD

9.352484 Information Technology 2177788.000 USD

7.058054 Consumer Discretionary 217148.000 USD

3.635031 Communication Services 1254594.000 USD

2.962841 Communication Services 156232.000 USD

2.956212 Communication Services 155819.000 USD

2.208254 Information Technology 892233.000 USD

1.736176 Information Technology 462669.000 USD

1.372702 Information Technology 318936.000 USD

1.359990 Communication Services 228378.000 USD

1.296022 Consumer Discretionary 403519.000 USD

1.270093 Information Technology 252258.000 USD

1.190462 Consumer Staples 753601.000 USD

1.189816 Information Technology 611772.000 USD

1.168638 Health Care 575931.000 USD

1.131551 Information Technology 462167.000 USD

1.040146 Information Technology 1291746.000 USD

0.955216 Health Care 208810.000 USD

0.941271 Financials 784272.000 USD

0.825719 Communication Services 572648.000 USD

0.776236 Health Care 729212.000 USD

0.764877 Information Technology 206609.000 USD

0.736933 Real Estate 230644.000 USD

0.690399 Health Care 533726.000 USD

0.661555 Industrials 129266.000 USD

0.645288 Communication Services 1323687.000 USD

0.642809 Information Technology 594397.000 USD

0.638831 Consumer Staples 348459.000 USD

0.630439 Consumer Discretionary 614870.000 USD

0.608946 Health Care 488139.000 USD

0.596974 Health Care 182492.000 USD

0.586326 Health Care 671141.000 USD

0.570299 Consumer Staples 135660.000 USD

0.565896 Communication Services 81755.000 USD

0.534920 Information Technology 208858.000 USD

0.528894 Consumer Discretionary 434536.000 USD

0.526404 Information Technology 135514.000 USD

0.526129 Health Care 241895.000 USD

0.526051 Financials 127489.000 USD

0.510018 Health Care 133770.000 USD

0.501207 Materials 198506.000 USD

0.496138 Consumer Staples 802698.000 USD

0.494923 Information Technology 98164.000 USD

Information Classification: General

0.487630 Information Technology 676487.000 USD

0.475560 Industrials 223941.000 USD

0.464518 Information Technology 301585.000 USD

0.463237 Health Care 209591.000 USD

0.451154 Information Technology 608537.000 USD

0.435520 Health Care 60401.000 USD

0.424632 Utilities 135093.000 USD

0.423734 Health Care 247775.000 USD

0.419749 Consumer Discretionary 172412.000 USD

0.416900 Consumer Discretionary 21813.000 USD

0.410807 Information Technology 297090.000 USD

0.406076 Real Estate 44370.000 USD

0.403623 Consumer Discretionary 263109.000 USD

0.399761 Consumer Discretionary 630728.000 USD

0.367482 Industrials 81864.000 USD

0.364138 Materials 114675.000 USD

0.362715 Information Technology 575660.000 USD

0.346628 Information Technology 480324.000 USD

0.344727 Consumer Staples 357772.000 USD

0.331628 Consumer Discretionary 132326.000 USD

0.328997 Energy 573758.000 USD

0.326761 Materials 42812.000 USD

0.325279 Health Care 108462.000 USD

0.316241 Industrials 404299.000 USD

0.300720 Industrials 170910.000 USD

0.293439 Financials 84947.000 USD

0.286496 Health Care 110405.000 USD

0.286124 Industrials 114877.000 USD

0.285299 Information Technology 114318.000 USD

0.283352 Information Technology 192748.000 USD

0.279507 Consumer Discretionary 169764.000 USD

0.272357 Information Technology 139347.000 USD

0.268610 Consumer Staples 115562.000 USD

0.267938 Health Care 47296.000 USD

0.267438 Industrials 54322.000 USD

0.267199 Information Technology 75692.000 USD

0.266365 Real Estate 125244.000 USD

0.255684 Real Estate 220145.000 USD

0.246687 Industrials 170364.000 USD

0.239738 Financials 209097.000 USD

0.236314 Financials 95636.000 USD

0.233078 Real Estate 58448.000 USD

0.231691 Consumer Discretionary 400019.000 USD

0.229842 Financials 159796.000 USD

0.226455 Consumer Discretionary 189577.000 USD

0.219607 Health Care 430626.000 USD

0.214257 Consumer Discretionary 39402.000 USD

0.213678 Health Care 27791.000 USD

Information Classification: General

0.212845 Industrials 123257.000 USD

0.211702 Industrials 165335.000 USD

0.210563 Financials 43987.000 USD

0.206679 Financials 436688.000 USD

0.206069 Financials 77336.000 USD

0.204644 Health Care 46150.000 USD

0.204129 Financials 159937.000 USD

0.198292 Industrials 92941.000 USD

0.195604 Financials 31212.000 USD

0.191223 Consumer Staples 201751.000 USD

0.189795 Consumer Staples 381452.000 USD

0.187755 Information Technology 82230.000 USD

0.185993 Financials 186827.000 USD

0.183626 Consumer Discretionary 158517.000 USD

0.180934 Materials 388288.000 USD

0.180475 Information Technology 155298.000 USD

0.180231 Industrials 203698.000 USD

0.179508 Materials 67028.000 USD

0.178218 Information Technology 77237.000 USD

0.177841 Consumer Discretionary 12322.000 USD

0.177380 Health Care 44484.000 USD

0.173918 Industrials 96974.000 USD

0.172731 Health Care 74935.000 USD

0.171460 Information Technology 78411.000 USD

0.169898 Industrials 73865.000 USD

0.169700 Consumer Discretionary 13234.000 USD

0.167357 Consumer Staples 88055.000 USD

0.166624 Industrials 180768.000 USD

0.164442 Information Technology 147123.000 USD

0.161693 Information Technology 89347.000 USD

0.160491 Industrials 118379.000 USD

0.158925 Information Technology 44360.000 USD

0.155158 Consumer Discretionary 141827.000 USD

0.147884 Information Technology 124708.000 USD

0.143518 Information Technology 45553.000 USD

0.142372 Health Care 120200.000 USD

0.141728 Information Technology 74263.000 USD

0.141254 Financials 90846.000 USD

0.140966 Industrials 152886.000 USD

0.136602 Consumer Discretionary 147844.000 USD

0.134560 Financials 19604.000 USD

0.134412 Information Technology 98442.000 USD

0.133488 Industrials 119769.000 USD

0.130101 Communication Services 81070.000 USD

0.128361 Industrials 59438.000 USD

0.127082 Industrials 172440.000 USD

0.124044 Health Care 92980.000 USD

0.123460 Industrials 43513.000 USD

Information Classification: General

0.122290 Consumer Staples 133974.000 USD

0.121523 Industrials 106794.000 USD

0.120397 Health Care 64766.000 USD

0.117974 Energy 116344.000 USD

0.117560 Industrials 25871.000 USD

0.114144 Consumer Discretionary 175808.000 USD

0.113221 Unassigned 8210096.500 USD

0.112180 Industrials 209547.000 USD

0.112142 Health Care 23901.000 USD

0.111477 Utilities 66592.000 USD

0.108029 Communication Services 59517.000 USD

0.106451 Industrials 50252.000 USD

0.105856 Industrials 49670.000 USD

0.105440 Health Care 37035.000 USD

0.105437 Information Technology 74972.000 USD

0.104510 Consumer Discretionary 20052.000 USD

0.104306 Energy 152124.000 USD

0.103486 Materials 121172.000 USD

0.101490 Health Care 92166.000 USD

0.099563 Consumer Discretionary 56563.000 USD

0.098960 Information Technology 112072.000 USD

0.095543 Consumer Staples 52300.000 USD

0.095066 Industrials 52157.000 USD

0.094855 Materials 69668.000 USD

0.094425 Information Technology 81533.000 USD

0.094336 Health Care 103302.000 USD

0.094181 Health Care 67186.000 USD

0.092375 Information Technology 25426.000 USD

0.090228 Industrials 34697.000 USD

0.089987 Real Estate 175411.000 USD

0.089662 Information Technology 28244.000 USD

0.089195 Financials 32212.000 USD

0.088404 Consumer Discretionary 85725.000 USD

0.087731 Consumer Staples 95335.000 USD

0.086463 Information Technology 87800.000 USD

0.086414 Information Technology 28341.000 USD

0.085671 Real Estate 34809.000 USD

0.084208 Information Technology 60656.000 USD

0.083551 Energy 135236.000 USD

0.083174 Materials 67661.000 USD

0.082378 Consumer Discretionary 75215.000 USD

0.082353 Information Technology 28592.000 USD

0.082322 Industrials 77768.000 USD

0.082269 Industrials 148584.000 USD

0.081688 Consumer Staples 120201.000 USD

0.080164 Information Technology 60704.000 USD

0.077808 Financials 57632.000 USD

0.077625 Information Technology 52047.000 USD

Information Classification: General

0.077267 Industrials 112689.000 USD

0.077035 Industrials 36580.000 USD

0.076719 Industrials 38243.000 USD

0.076435 Materials 63250.000 USD

0.075876 Consumer Staples 32630.000 USD

0.075764 Materials 32424.000 USD

0.075695 Utilities 46886.000 USD

0.075436 Health Care 7927.000 USD

0.074575 Information Technology 46574.000 USD

0.072392 Financials 43330.000 USD

0.070949 Consumer Discretionary 1788.000 USD

0.070553 Consumer Staples 69720.000 USD

0.070105 Consumer Discretionary 91120.000 USD

0.069514 Real Estate 34013.000 USD

0.068496 Information Technology 42146.000 USD

0.068325 Financials 291787.000 USD

0.068059 Materials 63394.000 USD

0.067255 Industrials 48906.000 USD

0.063955 Consumer Discretionary 100905.000 USD

0.062645 Information Technology 30936.000 USD

0.062020 Energy 53520.000 USD

0.061417 Consumer Staples 74128.000 USD

0.061052 Health Care 14586.000 USD

0.059641 Financials 49693.000 USD

0.059510 Industrials 39166.000 USD

0.058698 Financials 43016.000 USD

0.058109 Utilities 131392.000 USD

0.057087 Information Technology 219373.000 USD

0.055778 Industrials 50401.000 USD

0.055326 Industrials 225386.000 USD

0.055183 Real Estate 77444.000 USD

0.055102 Real Estate 17380.000 USD

0.055098 Financials 101923.000 USD

0.054511 Consumer Discretionary 50252.000 USD

0.054048 Industrials 45184.000 USD

0.053902 Health Care 75325.000 USD

0.053471 Information Technology 186412.000 USD

0.053229 Information Technology 189115.000 USD

0.052834 Information Technology 20680.000 USD

0.052783 Health Care 20975.000 USD

0.052351 Industrials 73228.000 USD

0.051747 Consumer Discretionary 133584.000 USD

0.050496 Materials 422336.000 USD

0.049723 Health Care 24176.000 USD

0.049476 Real Estate 113356.000 USD

0.048992 Information Technology 73068.000 USD

0.048170 Real Estate 64044.000 USD

0.048138 Information Technology 34938.000 USD

Information Classification: General

0.046884 Industrials 46211.000 USD

0.046846 Consumer Discretionary 16031.000 USD

0.046732 Information Technology 62649.000 USD

0.046068 Real Estate 39158.000 USD

0.045684 Consumer Discretionary 30750.000 USD

0.045511 Industrials 55869.000 USD

0.045417 Industrials 22242.000 USD

0.045019 Materials 31251.000 USD

0.042336 Health Care 25783.000 USD

0.042189 Financials 28196.000 USD

0.041042 Health Care 32755.000 USD

0.040829 Real Estate 27227.000 USD

0.040819 Financials 17427.000 USD

0.040641 Industrials 107320.000 USD

0.036665 Real Estate 121181.000 USD

0.035935 Health Care 13622.000 USD

0.035739 Real Estate 71729.000 USD

0.035703 Industrials 25936.000 USD

0.035608 Real Estate 32780.000 USD

0.035220 Energy 134418.000 USD

0.033863 Consumer Staples 42170.000 USD

0.032844 Information Technology 55348.000 USD

0.031656 Consumer Discretionary 165858.000 USD

0.031280 Industrials 13072.000 USD

0.031239 Health Care 61256.000 USD

0.028420 Consumer Discretionary 29307.000 USD

0.028072 Consumer Staples 38848.000 USD

0.028038 Consumer Discretionary 83840.000 USD

0.026024 Communication Services 49452.000 USD

0.025711 Financials 36237.000 USD

0.022747 Information Technology 97604.000 USD

0.021779 Information Technology 34188.000 USD

0.020277 Information Technology 9704.000 USD

0.019828 Energy 121950.000 USD

0.019769 Industrials 34829.000 USD

0.017042 Consumer Discretionary 45584.000 USD

0.015591 Industrials 101672.000 USD

0.015081 Real Estate 15073.000 USD

0.014506 Industrials 32965.000 USD

0.011185 Energy 62924.000 USD

0.004367 Consumer Staples 73136.000 USD

-0.091738 Unassigned -6652305.000 USD

ld or redistributed without the written consent of SSGA.

nge and should not be considered a recommendation to buy individual securities. For most recent information

Information Classification: General

e at prices above or below the ETFs net asset value. Brokerage commissions and ETF expenses will reduce

rademarks of Standard & Poor’s Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow

use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street

or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such

r do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

www.sipc.org/), SIPC (https://www.sipc.org/), an indirect wholly owned subsidiary of State Street Corporation.

ate Street affiliates provide services and receive fees from the SPDR ETFs. ALPS Distributors, Inc., member

lutions Distributor, Inc., member FINRA, is the distributor for Select Sector SPDRs. ALPS Distributors, Inc.

ors Funds Distributors, LLC.

ses. To obtain a prospectus which contains this and other information, call 1-866-787-2257 or visit

Value

Information Classification: General

Вам также может понравиться

- Holdings Daily Us en SpyДокумент32 страницыHoldings Daily Us en SpyAnonymous MF1enDO9Оценок пока нет

- Holdings Daily Us en SlyДокумент30 страницHoldings Daily Us en SlySeni PeniОценок пока нет

- Ticker Company Name ISIN CodeДокумент13 страницTicker Company Name ISIN CodeshoaibОценок пока нет

- Soeiro/w8 RefinitiveДокумент213 страницSoeiro/w8 RefinitiveAntónio SoeiroОценок пока нет

- Pivot DataДокумент80 страницPivot Dataprachi bajpaiОценок пока нет

- BD Epa-3Документ186 страницBD Epa-3ALEJANDRO GUERRERO ARANGOОценок пока нет

- MXWD As of Jun 28 20221Документ124 страницыMXWD As of Jun 28 20221Wei Xiang TanОценок пока нет

- DB 9Документ20 страницDB 9Kunal SinghalОценок пока нет

- Term Project ADRs FIN401 SP2013Документ212 страницTerm Project ADRs FIN401 SP2013Muhammed RafiudeenОценок пока нет

- CIO DataДокумент20 страницCIO Dataronak shah0% (1)

- India CIO DataДокумент21 страницаIndia CIO DatabharatОценок пока нет

- 50 StocksДокумент2 страницы50 StocksMichael MirandaОценок пока нет

- Fundamental Analysis of StocksДокумент12 страницFundamental Analysis of Stocksverma vikasОценок пока нет

- BetterInvesting Weekly Stock Screen 1-27-2020Документ3 страницыBetterInvesting Weekly Stock Screen 1-27-2020BetterInvestingОценок пока нет

- Nbim Data DumpДокумент462 страницыNbim Data DumpJohn LeclairОценок пока нет

- List of UN Secretariat Registered - 01apr21Документ706 страницList of UN Secretariat Registered - 01apr21Wilfried P. Hermann KinayaОценок пока нет

- DownloadДокумент6 страницDownloadAryaman JainОценок пока нет

- Ces16 Exhibitor List 12-11-2015Документ129 страницCes16 Exhibitor List 12-11-2015Jason GarrettОценок пока нет

- List of Stocks Down More Than 20Документ4 страницыList of Stocks Down More Than 20Keshav KhetanОценок пока нет

- List of Databases and SamplesДокумент340 страницList of Databases and Samplesbrainindiask100% (1)

- Top 500 Non Individual Taxpayers in 2011 (From BIR)Документ8 страницTop 500 Non Individual Taxpayers in 2011 (From BIR)RHEAОценок пока нет

- SEC Rule 15c2-11restricted Securities: New AmendmentsДокумент49 страницSEC Rule 15c2-11restricted Securities: New AmendmentsGeoff MaudeОценок пока нет

- Fortune 100 Companies ListДокумент46 страницFortune 100 Companies Listsayeedkhan007Оценок пока нет

- Generation Investment Management LLP 13F-HR Effective 11/10/09, For 9/30/09, On 11/10/09Документ1 страницаGeneration Investment Management LLP 13F-HR Effective 11/10/09, For 9/30/09, On 11/10/09api-19882241Оценок пока нет

- 200 Top ImporterДокумент7 страниц200 Top ImportersriduraiОценок пока нет

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Документ1 страницаArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)AlexHunterОценок пока нет

- PhotoДокумент8 страницPhotoPrasad GopiОценок пока нет

- Fintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)Документ2 страницыFintech Innovation (ARKF) HOLDINGS: Company Ticker Cusip Shares Market Value ($) Weight (%)hkm_gmat4849Оценок пока нет

- Bse DataДокумент21 страницаBse DataVinod MaliОценок пока нет

- LinkedIn ListДокумент9 страницLinkedIn ListShafi MuhimtuleОценок пока нет

- Code Search Assignment 1Документ6 страницCode Search Assignment 1Jackie BeadmanОценок пока нет

- List of Multinational CorporationsДокумент19 страницList of Multinational CorporationsniviphОценок пока нет

- PCMCДокумент19 страницPCMCVipul TiwariОценок пока нет

- Ind Nifty50listДокумент4 страницыInd Nifty50listSubrata PaulОценок пока нет

- Nbim Data DumpДокумент370 страницNbim Data Dumpcoxeh99865Оценок пока нет

- Icici Prudential Smallcap FundДокумент9 страницIcici Prudential Smallcap Fundmadhavlohiya12gОценок пока нет

- Annex Table A.I.11. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2004Документ3 страницыAnnex Table A.I.11. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2004Ramona PalaghianuОценок пока нет

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Документ1 страницаArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)minikompoОценок пока нет

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Документ2 страницыArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Senap StylianОценок пока нет

- Vendor - Id Vendor - Name Current Days - 1-15Документ4 страницыVendor - Id Vendor - Name Current Days - 1-15sobin johnОценок пока нет

- VWRA Holding DetailsДокумент177 страницVWRA Holding DetailsRamdisaОценок пока нет

- Client ID SA0726 Eq Holdings Statement As On 2020-08-31Документ6 страницClient ID SA0726 Eq Holdings Statement As On 2020-08-31hidulfiОценок пока нет

- Annex Table 24. The World'S Top 100 Non-Financial Mnes, Ranked by Foreign Assets, 2016Документ3 страницыAnnex Table 24. The World'S Top 100 Non-Financial Mnes, Ranked by Foreign Assets, 2016Ramona PalaghianuОценок пока нет

- Top Organizaciones Por IngresosДокумент10 страницTop Organizaciones Por Ingresoseminem240Оценок пока нет

- Company Name 17-Aug-11 17-Aug-21 10 Year CAGR HPR HPY AhprДокумент2 страницыCompany Name 17-Aug-11 17-Aug-21 10 Year CAGR HPR HPY AhprAbdus Samad AzamОценок пока нет

- Ark Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Документ1 страницаArk Space Exploration & Innovation Etf (Arkx) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)minikompoОценок пока нет

- CIO DataДокумент21 страницаCIO DatasanthoshОценок пока нет

- Ark Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Документ2 страницыArk Autonomous Technology & Robotics Etf (Arkq) Holdings: Company Ticker Cusip Shares Market Value ($) Weight (%)Senap StylianОценок пока нет

- Obtain The City and Survey Number Based On The Pin Code SelectedДокумент13 страницObtain The City and Survey Number Based On The Pin Code SelectedKorra JagadeeshwarОценок пока нет

- Ces19 Exhibitor List 12-21-2018Документ166 страницCes19 Exhibitor List 12-21-2018Daniel Martins0% (1)

- Top CompaniesДокумент27 страницTop CompaniesmazenlabbanОценок пока нет

- The Top 100 Non-Financial TNCs From Developing and Transition Economies, Ranked by Foreign AssetsДокумент3 страницыThe Top 100 Non-Financial TNCs From Developing and Transition Economies, Ranked by Foreign Assetsth_razorОценок пока нет

- Advanced Pivot Tables 2Документ22 страницыAdvanced Pivot Tables 2Vaishnavi ReddyОценок пока нет

- Sales Planning List For MumbaiДокумент39 страницSales Planning List For MumbaiPrateek KumarОценок пока нет

- Security Name Industry Close Price Index McapДокумент22 страницыSecurity Name Industry Close Price Index McapmuralyyОценок пока нет

- Merrill Edge - Merrill Lynch Portfolio - Rachel Sakhi December 19th 2107 Tuesday - EBAY ShareholdersДокумент3 страницыMerrill Edge - Merrill Lynch Portfolio - Rachel Sakhi December 19th 2107 Tuesday - EBAY ShareholdersRachel SakhiОценок пока нет

- Stone Mountain Capital Partners DDQДокумент30 страницStone Mountain Capital Partners DDQapi-276349208Оценок пока нет

- Robinhood Response To Feb 2 LetterДокумент195 страницRobinhood Response To Feb 2 LetterFOX BusinessОценок пока нет

- PrinciplesofFinance WEBДокумент643 страницыPrinciplesofFinance WEBGLADYS JAMES100% (2)

- Rehypothecation in The Shadow Banking SystemДокумент16 страницRehypothecation in The Shadow Banking SystemJaphy100% (1)

- AgostoДокумент6 страницAgostothebailarina manОценок пока нет

- Australian Rates Strategy: Back To The Belly - Looking To Receive 2-5-10s, 2y/2y AU vs. UKДокумент5 страницAustralian Rates Strategy: Back To The Belly - Looking To Receive 2-5-10s, 2y/2y AU vs. UKDylan AdrianОценок пока нет

- U.S. Bancorp Investments Client Relationship Summary: What Investment Services and Advice Can You Provide Me?Документ23 страницыU.S. Bancorp Investments Client Relationship Summary: What Investment Services and Advice Can You Provide Me?Rodrigo SantosОценок пока нет

- UBS WM - Equity Model Portfolios - What's Changing - June 2019Документ3 страницыUBS WM - Equity Model Portfolios - What's Changing - June 2019Blue RunnerОценок пока нет

- Ticker: CTM AU Cash 3Q20: US$27m Project: Jaguar Market Cap: A$200m Price: A$0.615/sh Country: BrazilДокумент5 страницTicker: CTM AU Cash 3Q20: US$27m Project: Jaguar Market Cap: A$200m Price: A$0.615/sh Country: BraziltomОценок пока нет

- Account Transfer Form (ACAT)Документ6 страницAccount Transfer Form (ACAT)dveikusОценок пока нет

- MS ClientStatements 9239 202312Документ10 страницMS ClientStatements 9239 202312honglu.cheng.pubОценок пока нет

- Securities and Exchange Commission: Vol. 78 Wednesday, No. 162 August 21, 2013Документ95 страницSecurities and Exchange Commission: Vol. 78 Wednesday, No. 162 August 21, 2013MarketsWikiОценок пока нет

- Nutmeg Securities LTD Business Continuity PlanningДокумент71 страницаNutmeg Securities LTD Business Continuity Planningapi-3801982Оценок пока нет

- Industry Update H2 2021 in Review: Fairmount PartnersДокумент13 страницIndustry Update H2 2021 in Review: Fairmount PartnersWilliam HarrisОценок пока нет

- An Impressive Start To The Year For Nickel As It Hits 10-Year HighДокумент7 страницAn Impressive Start To The Year For Nickel As It Hits 10-Year HighOwm Close CorporationОценок пока нет

- Statement: February 2023Документ13 страницStatement: February 2023Fiona FiaseuОценок пока нет

- Personal Net Worth Worksheet: Cash and Cash EquivalentsДокумент2 страницыPersonal Net Worth Worksheet: Cash and Cash Equivalentsmeftahul arnobОценок пока нет

- Chapter 3 - Investment Banking: StudentДокумент10 страницChapter 3 - Investment Banking: StudentDyenОценок пока нет

- September 30, 2021, Quarter-To-Date Statement: Do Not Use For Account Transactions PO BOX 3009 MONROE, WI 53566-8309Документ10 страницSeptember 30, 2021, Quarter-To-Date Statement: Do Not Use For Account Transactions PO BOX 3009 MONROE, WI 53566-8309vagabondstar100% (1)

- Cash App March 2024 Account StatementДокумент3 страницыCash App March 2024 Account Statementmatthewrussell661Оценок пока нет

- Investor Response To Online Stock Trading: A Study Using Q MethodologyДокумент12 страницInvestor Response To Online Stock Trading: A Study Using Q MethodologyeswarОценок пока нет

- Market Internals v2 PDFДокумент30 страницMarket Internals v2 PDFJayBajrangОценок пока нет

- Your Account Value:: Fidelity Rollover Ira David Moriarty - Rollover Ira - Fidelity Management Trust Co - CustodianДокумент6 страницYour Account Value:: Fidelity Rollover Ira David Moriarty - Rollover Ira - Fidelity Management Trust Co - CustodianMarcus GreenОценок пока нет

- The Thinks You Can Think!Документ48 страницThe Thinks You Can Think!api-26032005Оценок пока нет

- Captial Bank PDFДокумент6 страницCaptial Bank PDFayaОценок пока нет

- Mastering The Market Cycle Notes and TakeawaysДокумент12 страницMastering The Market Cycle Notes and TakeawaysGeneralmailОценок пока нет

- Gic WeeklyДокумент12 страницGic WeeklycampiyyyyoОценок пока нет

- Stifel Inc&Exp 2016Документ27 страницStifel Inc&Exp 2016Norris BattinОценок пока нет

- Global FX StrategyДокумент4 страницыGlobal FX StrategyllaryОценок пока нет