Академический Документы

Профессиональный Документы

Культура Документы

Contact Persons & Nos:: Grasim Industries Limited

Загружено:

biswasdipankar05Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Contact Persons & Nos:: Grasim Industries Limited

Загружено:

biswasdipankar05Авторское право:

Доступные форматы

Doc.No.

PUR-D-07 PURCHASE ORDER

Vendor Code: C2620

Please Reply to Factory Address PO No.: MM/252-G10054 00 PO Date: 17/06/2020

M/s CONTINENTAL VALVE LTD.

PLOT NO. 2 AND 10,

Bill to/Ship to -

ROZKA MEO INDL. AREA,

(Please Quote In All Correspondence)

P.O. SOHNA - 122 103 GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers Your Ref.: CVLS/20-21/QTN-026

DISTT. MEWAT (HR)

122103 State : As per delivery term and all relevant correspondence

GSTIN : Refer to table of GSTIN as per

GST Regn No : 06AABCC2904M1ZT term Page No. : 1 of 5

Contact Persons & Nos:

Please supply the Equipment/Material specified below, subject to all terms and condition incorporated herein/on the reverse/attached to this Purchase

Item-Code Description

Quantity UOM Unit Rate Discount IGST CGST SGST UGST CESS Basic Value

PO/Equipment Desc : Actuator Diaphragm

785117112 ACTUATOR DIAPHRAGM FOR 03-PV-10 VALVE SR. NO-

1205A ACTUATOR MODEL-GA/1.31/5G

1.000 NO 8500.00 0.00 18.00 % 0.00 % 0.00 % 0.00 % 0.00 % 8500.00

785117113 ACTUATOR DIAPHRAGM FOR 03-TV-30 VALVE SR.NO-

2314 A CTUATOR MODEL-GA/1.31/5G

1.000 NO 8500.00 0.00 18.00 % 0.00 % 0.00 % 0.00 % 0.00 % 8500.00

785117114 ACTUATOR DIAPHRAGM FOR 03-TV-20 VALVE SR. NO-

2441 ACTUATOR MODEL-P462

1.000 NO 20350.00 0.00 18.00 % 0.00 % 0.00 % 0.00 % 0.00 % 20350.00

785117115 ACTUATOR DIAPHRAGM FOR 03-LV-46 VALVE SR. NO-

2445 ACTUATOR MODEL-GA/1.31/7G

1.000 NO 8500.00 0.00 18.00 % 0.00 % 0.00 % 0.00 % 0.00 % 8500.00

785117116 ACTUATOR DIAPHRAGM FOR 02-XV-109 VALVE SR.

NO-2841 ACTUATOR MODELP460

1.000 NO 20350.00 0.00 18.00 % 0.00 % 0.00 % 0.00 % 0.00 % 20350.00

Basic Value of Items : 66200.00

Discount 0.00

Net Order Value 66200.00

IGST 11916.00

Total Order Value : 78116.00

RUPEES SEVENTY EIGHT THOUSAND ONE HUNDRED SIXTEEN ONLY

SPECIAL TERMS : a. Material to be dispatched as per Offer Ref: CVLS/20-21/QTN-026

dt 13.06.2020.

TERMS & CONDITIONS :

1 DELIVERY DATE : Latest by 30/08/2020

2 PRICE BASIS : FOR Destination

3 PACKING & FORWARDING : Inclusive

GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers

CIN : L17124MP1947PLC000410

Factory: P. O. Jagdishpur Industrial Area, Distt. Amethi-227817 (U. P.) India | T: +91 5361 270032-38 | E: igfl@adityabirla.com | W: www.grasim.com

Lucknow Office: 14-A/5, Park Road, Lucknow-226001 (U. P.) India | T: +91 522 2235183 | E: igf_lko.admin@adityabirla.com

Delhi Office: 312-A, World Trade Centre, Barakhamba Lane, New Delhi-110001, India | T: +91 11 23411268 / 23411345 | F: + 91 11 23414398

NOIDA Office: C-32, 4th Floor, KRBL Building, Institutional Area, Sector-62, Distt. Gautam Budh Nagar, NOIDA-201301 (U. P.) India | T: +91 120 4559867

Regd. Office: P. O. Birlagram, Nagda, Distt. Ujjain-456331 (M. P.) India

Company confidential Contact Person : Sangram Keshari Nayak E-Mail : sangram.nayak@adityabirla.c ()

Doc.No.PUR-D-07 PURCHASE ORDER

Vendor Code: C2620

Please Reply to Factory Address PO No.: MM/252-G10054 00 PO Date: 17/06/2020

M/s CONTINENTAL VALVE LTD.

PLOT NO. 2 AND 10,

Bill to/Ship to -

ROZKA MEO INDL. AREA,

(Please Quote In All Correspondence)

P.O. SOHNA - 122 103 GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers Your Ref.: CVLS/20-21/QTN-026

DISTT. MEWAT (HR)

122103 State : As per delivery term and all relevant correspondence

GSTIN : Refer to table of GSTIN as per

GST Regn No : 06AABCC2904M1ZT term Page No. : 2 of 5

4 INVOICING / BILL TO : Grasim Industries Limited - Unit: Indo Gulf Fertilisers, Purchase Department, P.O. Jagdishpur

Industrial Area-227 817, Distt. Amethi (U.P.) - India. GSTIN: 09AAACG4464B3ZU.

5 CONSIGNEE / SHIP TO : Grasim Industries Limited - Unit: Indo Gulf Fertilisers, P.O. Jagdishpur Industrial Area-227 817, Distt.

Amethi (U.P.) - India.

6 DESPATCH MODE : By Road. Mandatory documents required for vehicle entry at IGF - R.C., D.L., Insurance, Pollution,

Goods Carriage Permit, Fitness Certificate (for tanker). All documents should be valid & in original.

7 FREIGHT : By Purchaser.

8 TRANSPORTER : Gati-KWE on door delivery basis

9 E-WAY BILL (ROAD PERMIT) : Please ensure to generate the E-Way Bill before dispatch of material; and material should not be

moved without E-Way Bill from your premises, in any case. Any penalty or liability due to non-

compliance of E-Way Bill, will be to your account.

10 INSURANCE : By Purchaser.

11 PAYMENT TERMS : 100% payment on COD basis.

12 LIQUIDATED DAMAGES CLAUSE : Not applicable.

13 MSME CONFIRMATION : Please confirm & submit certificate, If you are registered under MSME act for updating in our record.

Also mention the MSME number in your all invoices.

1. Acceptance Criteria: Ordered materials may be subjected to Inspection/Testing as per relevant standard/specifications/sample before confirming the acceptance of

materials.

2. Except for above mentioned terms & conditions, unit rates are inclusive of all other taxes, duties and charges, if there is any .

3. Separate Bills/Invoices should be raised orderwise.

4. Seller's Acceptance : Pls. send order acceptance within 5 days. Absence of communication within specified time shall be treated as

acceptance of order at your end along with all Terms and Conditions.

5. Vendor should give undertaking that after completion of supply, confidential data is erased or destroyed or returned back to IGF

6. All account and access to system is closed (if allowed for performing the supply).

7. All resources whether IT related or non IT shared with vendor are returned.

State-wise IGF GST Nos

Trade Name State Name GST No

Grasim Industries Limited BIHAR 10AAACG4464B1ZD

Grasim Industries Limited GUJARAT 24AAACG4464B8ZX

Grasim Industries Limited HARAYANA 06AAACG4464B2Z1

Grasim Industries Limited HIMACHAL PRADESH 02AAACG4464B1ZA

Grasim Industries Limited JHARKHAND 20AAACG4464B4Z9

Grasim Industries Limited PUNJAB 03AAACG4464B4Z5

Grasim Industries Limited RAJASTHAN 08AAACG4464B7ZS

Grasim Industries Limited TELANGANA 36AAACG4464B3ZX

Grasim Industries Limited UTTAR PRADESH 09AAACG4464B3ZU

Grasim Industries Limited UTTARAKHAND 05AAACG4464B2Z3

Grasim Industried Limited WEST BENGAL 19AAACG4464B5ZR

GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers

CIN : L17124MP1947PLC000410

Factory: P. O. Jagdishpur Industrial Area, Distt. Amethi-227817 (U. P.) India | T: +91 5361 270032-38 | E: igfl@adityabirla.com | W: www.grasim.com

Lucknow Office: 14-A/5, Park Road, Lucknow-226001 (U. P.) India | T: +91 522 2235183 | E: igf_lko.admin@adityabirla.com

Delhi Office: 312-A, World Trade Centre, Barakhamba Lane, New Delhi-110001, India | T: +91 11 23411268 / 23411345 | F: + 91 11 23414398

NOIDA Office: C-32, 4th Floor, KRBL Building, Institutional Area, Sector-62, Distt. Gautam Budh Nagar, NOIDA-201301 (U. P.) India | T: +91 120 4559867

Regd. Office: P. O. Birlagram, Nagda, Distt. Ujjain-456331 (M. P.) India

Company confidential Contact Person : Sangram Keshari Nayak E-Mail : sangram.nayak@adityabirla.c ()

Doc.No.PUR-D-07 PURCHASE ORDER

Vendor Code: C2620

Please Reply to Factory Address PO No.: MM/252-G10054 00 PO Date: 17/06/2020

M/s CONTINENTAL VALVE LTD.

PLOT NO. 2 AND 10,

Bill to/Ship to -

ROZKA MEO INDL. AREA,

(Please Quote In All Correspondence)

P.O. SOHNA - 122 103 GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers Your Ref.: CVLS/20-21/QTN-026

DISTT. MEWAT (HR)

122103 State : As per delivery term and all relevant correspondence

GSTIN : Refer to table of GSTIN as per

GST Regn No : 06AABCC2904M1ZT term Page No. : 3 of 5

For : CONTINENTAL VALVE LTD. For GRASIM INDUSTRIES LIMITED

Date : Unit-Indo Gulf Fertilisers

Authorised Signatory Authorised Signatory

GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers

CIN : L17124MP1947PLC000410

Factory: P. O. Jagdishpur Industrial Area, Distt. Amethi-227817 (U. P.) India | T: +91 5361 270032-38 | E: igfl@adityabirla.com | W: www.grasim.com

Lucknow Office: 14-A/5, Park Road, Lucknow-226001 (U. P.) India | T: +91 522 2235183 | E: igf_lko.admin@adityabirla.com

Delhi Office: 312-A, World Trade Centre, Barakhamba Lane, New Delhi-110001, India | T: +91 11 23411268 / 23411345 | F: + 91 11 23414398

NOIDA Office: C-32, 4th Floor, KRBL Building, Institutional Area, Sector-62, Distt. Gautam Budh Nagar, NOIDA-201301 (U. P.) India | T: +91 120 4559867

Regd. Office: P. O. Birlagram, Nagda, Distt. Ujjain-456331 (M. P.) India

Company confidential Contact Person : Sangram Keshari Nayak E-Mail : sangram.nayak@adityabirla.c ()

Doc.No.PUR-D-07 PURCHASE ORDER

Vendor Code: C2620

Please Reply to Factory Address PO No.: MM/252-G10054 00 PO Date: 17/06/2020

M/s CONTINENTAL VALVE LTD.

PLOT NO. 2 AND 10,

Bill to/Ship to -

ROZKA MEO INDL. AREA,

(Please Quote In All Correspondence)

P.O. SOHNA - 122 103 GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers Your Ref.: CVLS/20-21/QTN-026

DISTT. MEWAT (HR)

122103 State : As per delivery term and all relevant correspondence

GSTIN : Refer to table of GSTIN as per

GST Regn No : 06AABCC2904M1ZT term Page No. : 4 of 5

GENERAL TERMS AND CONDITIONS OF THIS PURCHASE ORDER

Purchaser - GRASIM; shall mean Grasim Industries Limited - Unit : Indo Gulf Fertilisers

Seller/Supplier - Shall mean the person, firm or corporation on whom the order is placed.

a) Please mention Purchase Order No. on all challan/Invoice to facilitate co-relating the same in our system. Failure to do so may result in delay in processing documents &

payment for which supplier shall be solely responsible.

b) Order has been placed on the representations of the seller that the seller possesses the requisite ability to make the supplies as per the desired requirement, quality and

quantity and full satisfaction of GRASIM and within the agreed time frame.

c) Except as specifically mentioned in the purchase orders no other debts, obligations, contracts and liabilities of the Seller whatsoever are being assumed by GRASIM

prior or pursuant to this Order or otherwise unless specifically agreed to in writing by GRASIM

d) Delivery of material shall be accepted at the destined premises of GRASIM only, on working days.

e) IMPORTANT NOTE: Please ensure that all the fields in road permit (form-XXXVIII) to be filled by supplier as well as transporter are duly &

clearly filled. Do not allow the vehicle to leave your premises unless all details pertaining to supplier as well as transporter are completely

filled. Any penalty or liability arising on account of incomplete / improperly filled road permit (form-XXXVIII) shall be to your account.

GRASIM will not be liable / accountable for any such liabilities.

f) Delivery of the material shall be concluded in finality within specified delivery period. In case of delay in dispatch, GRASIM reserves the right to cancel the order and charge the

seller the extra cost incurred by GRASIM in procuring material from other sources. Any delay will result in liquidated damages @ 0.50% per week and up to a maximum of 5% of

the basic value of the Purchase Order payable by the supplier or as mutually agreed.

g) One Delivery Challan / Invoice should not contain material for more than one purchase order. Invoice and packing list or Invoice-cum-challan should be submitted in

duplicate.Invoice should contain HSN code for each material.

h) Excess quantity unless accepted, shall be liable to be rejected and returned at supplier / vendor’s cost.

i) The goods shall be safeguarded for any wear and tear by the supplier and the damaged goods shall not be accepted by GRASIM. The supplier shall be solely liable for any

damage on account of improper packing, mis-handling etc

j) Any loss due to disallowance of our claim of Modvat /Cenvat or any other statutory requirements due to incorrect/wrong documentation by the supplier, shall be the

responsibility of the supplier and GRASIM shall be entitled to recover any loss due to any such act from the supplier.

k) The prices indicated in the order as agreed are firm and final unless agreed specifically.

l) The goods supplied shall be guaranteed from the date of installation against any design, manufacturing and workmanship defect for a period 12 months, wherever applicable,

and the supplier shall undertake to repair / replace such defect / material free of cost / charges or as mutually agreed.

m) All supplies of equipments, raw material and instruments must accompany required Test / Performance certificate conforming relevant Indian / India standards.

n) Any shortage found at GRASIM, shall be deducted from the payment of supplier and GRASIM’s decision in this respect shall be final and binding.

o) Wherever required, supplier shall supply two sets of operational / maintenance manuals, catalogues and list of supplies along with the supply of equipments, instruments etc.

p) All cost due to rejection, being not in accordance with the approved sample and/ or specifications laid down in PO, shall be borne by the supplier including the loss, which

GRASIM may suffer due to inferior quality.

q) Supplier should ensure goods supplied are in conformity with applicable statutory regulations prevailing in the country at the time of supply.

r) GRASIM shall not be liable for any un toward outcome due to any unforeseen acts which may be beyond the control of GRASIM and not within the recognized Force

Majeure Clause.

s) GRASIM shall be legally entitled to withhold any payments for any deficiencies, loss or damage occurred due to the negligent acts of the supplier or breach of the terms and

conditions agreed upon.

t) All claims arising from the purchase order shall only be subjected to jurisdiction of Sultanpur (U.P.) Courts.

u) Any dispute arising out of the agreement shall be referred to a sole Arbitrator to be appointed by GRASIM and the decision of the said Arbitrator shall be final and binding

upon the parties. The venue of Arbitration shall be at Jagdishpur (U.P.)Performance of this order shall continue during arbitration and any subsequent proceedings.

v) For any changes / amendment in the order, GRASIM will issue subsequent order amendment. Changes mutually agreed upon as a Change shall constitute a part of this order,

and the provisions and conditions of the order shall apply to said changes / amendment.

w) Any new taxes by the State or Central Govt. will be applicable at the time of Invoice will be paid by GRASIM & any benefits due to reduction has to be passed back to

GRASIM

x) The supplier shall keep all information and other terms and conditions in relation to this Order and also in relation to GRASIM's confidential and shall not share / disclose /

divulge without the prior written consent of GRASIM unless required by order or law

y) Order Acceptance : Besides other means of communicating the acceptance of order, the acceptance on Duplicate copy / Photocopy o

the order should be duly signed & stamped and should be send to GRASIM by courier / email within FIVE days of receipt of Order else i

be presumed that the PO is accepted in total with all Terms & Conditions and the supply will be made in time.

z) The terms & condition mentioned in PO under the heading “special terms” will supersede any of the above terms as mentioned. With

acceptance of the Purchase Order and with all its terms & conditions the seller waives & considers as void all & any of the Seller’s gene

sales conditions.

GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers

CIN : L17124MP1947PLC000410

Factory: P. O. Jagdishpur Industrial Area, Distt. Amethi-227817 (U. P.) India | T: +91 5361 270032-38 | E: igfl@adityabirla.com | W: www.grasim.com

Lucknow Office: 14-A/5, Park Road, Lucknow-226001 (U. P.) India | T: +91 522 2235183 | E: igf_lko.admin@adityabirla.com

Delhi Office: 312-A, World Trade Centre, Barakhamba Lane, New Delhi-110001, India | T: +91 11 23411268 / 23411345 | F: + 91 11 23414398

NOIDA Office: C-32, 4th Floor, KRBL Building, Institutional Area, Sector-62, Distt. Gautam Budh Nagar, NOIDA-201301 (U. P.) India | T: +91 120 4559867

Regd. Office: P. O. Birlagram, Nagda, Distt. Ujjain-456331 (M. P.) India

Company confidential Contact Person : Sangram Keshari Nayak E-Mail : sangram.nayak@adityabirla.c ()

Doc.No.PUR-D-07 PURCHASE ORDER

Vendor Code: C2620

Please Reply to Factory Address PO No.: MM/252-G10054 00 PO Date: 17/06/2020

M/s CONTINENTAL VALVE LTD.

PLOT NO. 2 AND 10,

Bill to/Ship to -

ROZKA MEO INDL. AREA,

(Please Quote In All Correspondence)

P.O. SOHNA - 122 103 GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers Your Ref.: CVLS/20-21/QTN-026

DISTT. MEWAT (HR)

122103 State : As per delivery term and all relevant correspondence

GSTIN : Refer to table of GSTIN as per

GST Regn No : 06AABCC2904M1ZT term Page No. : 5 of 5

GST Clauses

A. Change in Law

Option 1 - (where the taxes and duties are on account of the Company): Save as otherwise specifically provided in this Agreement, all current or future duties, levies or

taxes (including any statutory variation therein), leviable on the services / supply / work undertaken as per this Agreement shall be to the account of the Company.

Option 2 - (where the taxes and duties are on account of the Vendor / Supplier): Save as otherwise specifically provided in this Agreement, all current or future duties,

levies or taxes (including any statutory variation therein), leviable on the services / supply / work undertaken as per this Agreement shall be to the account of the Vendor /

Supplier.

B. Anti-Profiteering

The Supplier / Vendor hereby covenants to comply with the applicable provisions of law, including but not limited to section 171 of the Central Goods and Services Tax

Act, 2017 or applicable section of IGST/UTGST/SGST law, and pass on to the Company all the benefits arising from any reduction in the rate of tax on any supply of

goods or services or both or the benefits of input tax credit, exemptions, concessions, rebate, set off, by way of reduction in the prices of the services / supply / work

undertaken by the Supplier / Vendor as per this Agreement.

C. Input Tax Credit

The Supplier / Vendor hereby covenants that it shall comply with the provisions of goods and services tax laws to ensure that the Company is able to avail the entire

eligible input tax credit on timely basis for the services / supply / work undertaken by the Supplier / Vendor as per this Agreement.

D. Reps, Warranties & Covenants to be given by Supplier/Service Provider

a. Supplier/Service Provider is duly registered with the appropriate authority under the applicable GST provisions and the registration number provided by Supplier/Service

Provider to the Company is true and accurate;

b. The tax invoice issued by Supplier/Service Provider to the Company is complete, true and accurate such that the Company is able to obtain input credit with respect to

the GST paid to Supplier/Service Provider for the services undertaken by Supplier/Service Provider as per the Agreement.

c. Supplier/Service Provider agrees to do all things, including providing invoices or other documentation in such form and detail that may be necessary to enable or assist

the Company to claim any input tax credit in relation to any GST amount payable under the Agreement. Company, shall not be under any obligations to make any

payment under the Agreement until the receipt of tax invoice from Supplier/Service Provider.

d. Supplier/Service Provider shall duly pay the applicable GST amount to the appropriate authority as per the provisions of the GST law after the receipt of the GST

amount from the Company and shall provide a challan to the Company evidencing the payment of said GST.

e. The Supplier / Vendor covenants to support and provide necessary assistance to the Company including in the form of necessary information / documentation in

relation to various aspects of goods and service tax law such as complying with the transition provisions, identifying the tax benefits or refunds as the case may be, that

may accrue on stocks, credits, taxes, etc. on the GST implementation appointed date, for passing of the benefits as mentioned in the anti-profiteering clause and so on.

The Supplier / Vendor agrees that this clause shall survive the termination / expiry of this Agreement, howsoever occurring.

E. Indemnity

In addition to the indemnities covered elsewhere in the Agreement, the Vendor / Supplier further agrees to indemnify and to keep the Company harmless from and against

any actual or potential liabilities, damages, interest, penalty and costs to the Company arising from breach of covenants relating clause [C] (Input tax credit) and clause

[B] (Anti-profiteering).

The Supplier / Vendor agrees that indemnity clause shall survive the termination / expiry of this Agreement, howsoever occurring.

F. Survival Clause

Without prejudice to the provisions of this Agreement, the obligations of the Supplier / Vendor to comply with the goods and services tax provisions in respect of the

services / supply / work undertaken by the Supplier / Vendor as per this Agreement, shall survive the termination / expiry of this Agreement, howsoever occurring.

GRASIM INDUSTRIES LIMITED

Unit-Indo Gulf Fertilisers

CIN : L17124MP1947PLC000410

Factory: P. O. Jagdishpur Industrial Area, Distt. Amethi-227817 (U. P.) India | T: +91 5361 270032-38 | E: igfl@adityabirla.com | W: www.grasim.com

Lucknow Office: 14-A/5, Park Road, Lucknow-226001 (U. P.) India | T: +91 522 2235183 | E: igf_lko.admin@adityabirla.com

Delhi Office: 312-A, World Trade Centre, Barakhamba Lane, New Delhi-110001, India | T: +91 11 23411268 / 23411345 | F: + 91 11 23414398

NOIDA Office: C-32, 4th Floor, KRBL Building, Institutional Area, Sector-62, Distt. Gautam Budh Nagar, NOIDA-201301 (U. P.) India | T: +91 120 4559867

Regd. Office: P. O. Birlagram, Nagda, Distt. Ujjain-456331 (M. P.) India

Company confidential Contact Person : Sangram Keshari Nayak E-Mail : sangram.nayak@adityabirla.c ()

Вам также может понравиться

- Taiwan Association of Machinery IndustryДокумент8 страницTaiwan Association of Machinery IndustryMCS SBIОценок пока нет

- A 153Документ1 страницаA 153AnuranjanОценок пока нет

- Intersec Exhibitors List 2015Документ13 страницIntersec Exhibitors List 2015MOHAMED FAIZALОценок пока нет

- ListofTechnicalAgencies PDFДокумент4 страницыListofTechnicalAgencies PDFraj RajputОценок пока нет

- ContactДокумент5 страницContactKumari SnehОценок пока нет

- Advertising Firm (Service Renderer) 02 Unit: SL Name of Company Address BINДокумент6 страницAdvertising Firm (Service Renderer) 02 Unit: SL Name of Company Address BINuzzhoОценок пока нет

- Vendors List: LaminatesДокумент2 страницыVendors List: LaminatessenthilrajabeОценок пока нет

- Allied ProductsДокумент30 страницAllied ProductsS K SinghОценок пока нет

- Roof India Exhibition 2019Документ6 страницRoof India Exhibition 2019Jyotsna PandeyОценок пока нет

- Hunting ListДокумент10 страницHunting ListRuchi DreamОценок пока нет

- 2013 KshowДокумент3 страницы2013 KshowHD TalababuОценок пока нет

- M/s. Neil Extrulamipack Pvt. LTD.Документ9 страницM/s. Neil Extrulamipack Pvt. LTD.Ñïdhî AğģãrwàłОценок пока нет

- List of Empanlled - Warehouse Service ProvidersДокумент27 страницList of Empanlled - Warehouse Service ProvidersKalpana LahamageОценок пока нет

- AcarysilДокумент41 страницаAcarysildevthakkar58Оценок пока нет

- Guidelines & Application Form: 19 - 23 January 2024, BengaluruДокумент28 страницGuidelines & Application Form: 19 - 23 January 2024, BengaluruARVIND PALОценок пока нет

- Industries in GurgaonДокумент24 страницыIndustries in Gurgaonramjee prasad jaiswalОценок пока нет

- List of Certified Manufacturer'S Under "Tested Product Certificate (TPC) " CategoryДокумент4 страницыList of Certified Manufacturer'S Under "Tested Product Certificate (TPC) " CategoryArvind DharmarajОценок пока нет

- Pharma IndustriesДокумент12 страницPharma Industriesmarketing lakshОценок пока нет

- Water Manufacturer - KA - 05aug2011Документ20 страницWater Manufacturer - KA - 05aug2011Jayakumar SambandamurthyОценок пока нет

- Source of Import 31.10.2019Документ101 страницаSource of Import 31.10.2019sudhanshballal2442Оценок пока нет

- Factories in GoaДокумент47 страницFactories in Goakakababa117Оценок пока нет

- Show Catalogue: India's Leading Trade Fair For Organic ProductsДокумент58 страницShow Catalogue: India's Leading Trade Fair For Organic Productsudiptya_papai2007Оценок пока нет

- Approved List of Manufacturers: Line Pipes (Carbon/Alloy Steel)Документ6 страницApproved List of Manufacturers: Line Pipes (Carbon/Alloy Steel)Sourav Kumar Gupta100% (1)

- Ankleswar Compny Lists - RemovedДокумент26 страницAnkleswar Compny Lists - RemovedMAA ENGINEERINGОценок пока нет

- Tender Award For MOGE PDFДокумент21 страницаTender Award For MOGE PDFအမေ့သားОценок пока нет

- BMTPC Directory Emerging TechnologyДокумент160 страницBMTPC Directory Emerging TechnologyUday L0% (1)

- Bangalore CompaniesДокумент24 страницыBangalore CompaniesJEGAN RAJ NATARAJAN100% (1)

- 23.01.2023 Elecrama Invite - List 22 BtcbombayДокумент11 страниц23.01.2023 Elecrama Invite - List 22 BtcbombayTaherОценок пока нет

- Auto 2Документ10 страницAuto 2Thao NguyenОценок пока нет

- Accredited Consultants PDFДокумент152 страницыAccredited Consultants PDFUmesh MishraОценок пока нет

- Delegate List - 10th IMRC With Contact Details - Removed (1) - Removed (1) - RemovedДокумент100 страницDelegate List - 10th IMRC With Contact Details - Removed (1) - Removed (1) - RemovedSharon SusmithaОценок пока нет

- Chapter 1-Company Profile: 1.1 Vedanta GroupДокумент29 страницChapter 1-Company Profile: 1.1 Vedanta GroupArbaaz KhanОценок пока нет

- Somalia Export DataДокумент12 страницSomalia Export DataSingh PushpanjaliОценок пока нет

- Odd 3Документ4 страницыOdd 3jeet rogerОценок пока нет

- Pharma Companis in Mumbai UpdateДокумент8 страницPharma Companis in Mumbai UpdateSuraj ChavanОценок пока нет

- Mid CapДокумент82 страницыMid CapKiran KudtarkarОценок пока нет

- SL No 2Документ3 страницыSL No 2Chakravarthi NagaОценок пока нет

- Acma List of PublicationsДокумент1 страницаAcma List of PublicationsSaksham TharejaОценок пока нет

- Scrap DBДокумент24 страницыScrap DByogitaanosalesОценок пока нет

- Super Bond Adhesives Private LimitedДокумент22 страницыSuper Bond Adhesives Private Limitedvikasaggarwal01Оценок пока нет

- Delegate List - 10th IMRC With Contact Details - Removed (1) - RemovedДокумент306 страницDelegate List - 10th IMRC With Contact Details - Removed (1) - RemovedSharon SusmithaОценок пока нет

- RFP For Maharashtra State Power Generation Company Limited (MSPGCL)Документ3 страницыRFP For Maharashtra State Power Generation Company Limited (MSPGCL)Dhruv KumarОценок пока нет

- District Industrial Profile: Government of India Ministry of MSMEДокумент20 страницDistrict Industrial Profile: Government of India Ministry of MSMEPabboji SreenuОценок пока нет

- Latest Title Deed ProposalNote 5371Документ82 страницыLatest Title Deed ProposalNote 5371pranayvigОценок пока нет

- O&G Companies India-1Документ5 страницO&G Companies India-1Abhishek PandeyОценок пока нет

- LIST OF FILED From 2021-01-25 To 2021-01-25Документ43 страницыLIST OF FILED From 2021-01-25 To 2021-01-25SAGAR SONARОценок пока нет

- Fastener Manufacturers in IndiaДокумент8 страницFastener Manufacturers in IndiaKaloti IndiaОценок пока нет

- Acma IndustriesДокумент33 страницыAcma IndustriesAbhishekОценок пока нет

- Idk FiitjeeДокумент2 страницыIdk FiitjeePranshu VatsaОценок пока нет

- Gift Expo Past Exhibitor ListДокумент10 страницGift Expo Past Exhibitor ListLavkesh SinghОценок пока нет

- 01-Directory of Chemical Units (Large and Medium Scale Units) - 2017-18Документ68 страниц01-Directory of Chemical Units (Large and Medium Scale Units) - 2017-18Uday kumarОценок пока нет

- Iepr1358odi 0114Документ9 страницIepr1358odi 0114Najeem ThajudeenОценок пока нет

- HAL Engine Test Bed ResearchДокумент84 страницыHAL Engine Test Bed ResearchwinmanjuОценок пока нет

- Cbs e VendorsДокумент4 страницыCbs e VendorssunilОценок пока нет

- Quasem Industries Limited - Annual Report 2019Документ122 страницыQuasem Industries Limited - Annual Report 2019JayedОценок пока нет

- Atma-Automotive Tyre MfrsДокумент3 страницыAtma-Automotive Tyre MfrsjayveeОценок пока нет

- 2016CompositeList Web 197Документ1 страница2016CompositeList Web 197AnuranjanОценок пока нет

- Indicative List of MS Pipe Vendors Approved by NTPCДокумент1 страницаIndicative List of MS Pipe Vendors Approved by NTPCpukhrajsoniОценок пока нет

- Purchase Order: CIN NO:L24119CH1975PLC00360Документ1 страницаPurchase Order: CIN NO:L24119CH1975PLC00360Tejas MohanОценок пока нет

- IVAMA Association - Chairman's Letter For MembershipДокумент1 страницаIVAMA Association - Chairman's Letter For Membershipbiswasdipankar05Оценок пока нет

- T70 Quick Exhaust Valves: Medium: Operating Pressure: Port Size: Mounting: Ambient/Media Temperature: MaterialsДокумент2 страницыT70 Quick Exhaust Valves: Medium: Operating Pressure: Port Size: Mounting: Ambient/Media Temperature: Materialsbiswasdipankar05Оценок пока нет

- Chemical Industries in IndiaДокумент10 страницChemical Industries in Indiabiswasdipankar05Оценок пока нет

- InformationДокумент2 страницыInformationbiswasdipankar05Оценок пока нет

- Notice Inviting Tender (Nit) - E-TenderДокумент2 страницыNotice Inviting Tender (Nit) - E-Tenderbiswasdipankar05Оценок пока нет

- NAMUR Proximity Switches: Connection DiagramsДокумент1 страницаNAMUR Proximity Switches: Connection Diagramsbiswasdipankar05Оценок пока нет

- EOI For FILTERSДокумент7 страницEOI For FILTERSbiswasdipankar05Оценок пока нет

- RedBus TicketДокумент1 страницаRedBus Ticketbiswasdipankar05Оценок пока нет

- 6 5"4-4Wt 1treir TTR West BengalДокумент6 страниц6 5"4-4Wt 1treir TTR West Bengalbiswasdipankar05Оценок пока нет

- Precision & Heavy Duty Limit SwitchesДокумент6 страницPrecision & Heavy Duty Limit Switchesbiswasdipankar05Оценок пока нет

- Continental Valves LimitedДокумент19 страницContinental Valves Limitedbiswasdipankar05Оценок пока нет

- DG/Enlist - Rules/29 Corrigendum Dated 01.09.2017Документ4 страницыDG/Enlist - Rules/29 Corrigendum Dated 01.09.2017biswasdipankar05Оценок пока нет

- Syllabus: Diploma in Entrepreneurship Development and Small Business Management (DEDSBM)Документ5 страницSyllabus: Diploma in Entrepreneurship Development and Small Business Management (DEDSBM)biswasdipankar05Оценок пока нет

- Positioner SpecsДокумент1 страницаPositioner Specsbiswasdipankar05Оценок пока нет

- Yoga For DiabetesДокумент3 страницыYoga For Diabetesbiswasdipankar05Оценок пока нет

- Cvts - Tag No. Mpt-tv-4161Документ2 страницыCvts - Tag No. Mpt-tv-4161biswasdipankar05Оценок пока нет

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Документ1 страницаIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)biswasdipankar05Оценок пока нет

- Technical Compliance Sheet Butterfly ValveДокумент5 страницTechnical Compliance Sheet Butterfly Valvebiswasdipankar05Оценок пока нет

- Sov - 1Документ1 страницаSov - 1biswasdipankar05Оценок пока нет

- Document Required For Enhancement of Enlistment-IndigenousДокумент1 страницаDocument Required For Enhancement of Enlistment-Indigenousbiswasdipankar05Оценок пока нет

- Minutes of Meeting: Agenda Points Details Discussed / Improvements / Decisions Finalised Responsibility / Target Date A)Документ1 страницаMinutes of Meeting: Agenda Points Details Discussed / Improvements / Decisions Finalised Responsibility / Target Date A)biswasdipankar05Оценок пока нет

- West Bengal Board of Secondary Education Madhyamik ParikshaДокумент2 страницыWest Bengal Board of Secondary Education Madhyamik Parikshabiswasdipankar05Оценок пока нет

- Lifting The Corporate Veil Assignment by Pratham Sapra 4052Документ17 страницLifting The Corporate Veil Assignment by Pratham Sapra 4052Pratham SapraОценок пока нет

- OCA v. CLERK OF COURT II MICHAEL S. CALIJAДокумент11 страницOCA v. CLERK OF COURT II MICHAEL S. CALIJAFaustina del RosarioОценок пока нет

- Contract To Sell (Revised As of 8 April 2021)Документ4 страницыContract To Sell (Revised As of 8 April 2021)Zhanika CarbonellОценок пока нет

- Presentment of Negotiable InstrumentДокумент16 страницPresentment of Negotiable InstrumentRahul Paliya83% (6)

- Ckla g3 More Classic Tales SWB-FKBДокумент115 страницCkla g3 More Classic Tales SWB-FKBОльга КотлячковаОценок пока нет

- Dwnload Full Foundations of Maternal Newborn and Womens Health Nursing 6th Edition Murray Test Bank PDFДокумент23 страницыDwnload Full Foundations of Maternal Newborn and Womens Health Nursing 6th Edition Murray Test Bank PDFroxaneblyefx100% (12)

- City of Tshwane Land Use Management By-Law, 2016Документ174 страницыCity of Tshwane Land Use Management By-Law, 2016SammyОценок пока нет

- LAWS1052 Introducing Law and Justice T1 2022Документ4 страницыLAWS1052 Introducing Law and Justice T1 2022lauraОценок пока нет

- Benjamin and Sonia Mamaril VДокумент3 страницыBenjamin and Sonia Mamaril VAnnievin HawkОценок пока нет

- Q - A Revision Guide Equity and Trusts 2012 and 2013Документ281 страницаQ - A Revision Guide Equity and Trusts 2012 and 2013Aan RiazОценок пока нет

- Special - New - Consortium Application Form - 11192018Документ9 страницSpecial - New - Consortium Application Form - 11192018mikko alibinОценок пока нет

- Civil Suit 8 of 2020Документ12 страницCivil Suit 8 of 2020wanyamaОценок пока нет

- Elcox Vs HillДокумент3 страницыElcox Vs HillRoseve BatomalaqueОценок пока нет

- WESM Audit ManualДокумент35 страницWESM Audit ManualALDJON KENNETH YAPОценок пока нет

- de Borja vs. Gella, L-18330 July 31, 1963Документ4 страницыde Borja vs. Gella, L-18330 July 31, 1963Khenlie VillaceranОценок пока нет

- Law of Treaties 2020 NotesДокумент85 страницLaw of Treaties 2020 NotesSufyan Wafiq100% (1)

- Full Download World Regions in Global Context People Places and Environments 6th Edition Marston Test BankДокумент23 страницыFull Download World Regions in Global Context People Places and Environments 6th Edition Marston Test Bankschietolicos100% (28)

- G.R. No. 127316Документ6 страницG.R. No. 127316Jolina LunaОценок пока нет

- Case Law AnalysisДокумент3 страницыCase Law AnalysisAadyaОценок пока нет

- Llepublft Of: Tbe Ftbilippine QC - OurtДокумент10 страницLlepublft Of: Tbe Ftbilippine QC - OurtVanillaSkyIIIОценок пока нет

- HDFC Life Sanchay Plus - Retail - Brochure - Final - CTCДокумент17 страницHDFC Life Sanchay Plus - Retail - Brochure - Final - CTCK chandra sekharОценок пока нет

- Professional Regulation Commission: June 28, 2019 (AM) - PRC Lucena - OR: - Amount: PHP - Reference No: Reels35OxlcjДокумент1 страницаProfessional Regulation Commission: June 28, 2019 (AM) - PRC Lucena - OR: - Amount: PHP - Reference No: Reels35Oxlcjalejandra mapoyОценок пока нет

- Kathikkal Tea Plantations v. State Bank of India, 2009 SCC OnLine Mad 1250Документ15 страницKathikkal Tea Plantations v. State Bank of India, 2009 SCC OnLine Mad 1250Dakshita DubeyОценок пока нет

- Full Download Solutions For Intermediate Accounting 15th Edition by Kieso PDF Full ChapterДокумент36 страницFull Download Solutions For Intermediate Accounting 15th Edition by Kieso PDF Full Chapterpledgerzea.rus7as100% (21)

- A Transfer tax-WPS OfficeДокумент2 страницыA Transfer tax-WPS OfficeAnn StylesОценок пока нет

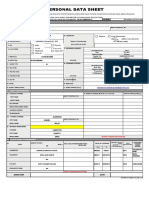

- CS Form No. 212 Revised Personal Data Sheet - NewДокумент4 страницыCS Form No. 212 Revised Personal Data Sheet - NewCharity Lumactod AlangcasОценок пока нет

- Reversal Form FNBДокумент2 страницыReversal Form FNBRoro SokoОценок пока нет

- Case # 5 Calatagan Golf Club vs. Sixto ClementeДокумент3 страницыCase # 5 Calatagan Golf Club vs. Sixto ClementePola StarОценок пока нет

- Ko Vs MaderamenteДокумент2 страницыKo Vs MaderamenteAngelica SegueОценок пока нет

- Rent AgreementДокумент5 страницRent AgreementAjinkya BagadeОценок пока нет

- Sodium Bicarbonate: Nature's Unique First Aid RemedyОт EverandSodium Bicarbonate: Nature's Unique First Aid RemedyРейтинг: 5 из 5 звезд5/5 (21)

- Guidelines for Chemical Process Quantitative Risk AnalysisОт EverandGuidelines for Chemical Process Quantitative Risk AnalysisРейтинг: 5 из 5 звезд5/5 (1)

- Process Plant Equipment: Operation, Control, and ReliabilityОт EverandProcess Plant Equipment: Operation, Control, and ReliabilityРейтинг: 5 из 5 звезд5/5 (1)

- Well Control for Completions and InterventionsОт EverandWell Control for Completions and InterventionsРейтинг: 4 из 5 звезд4/5 (10)

- An Applied Guide to Water and Effluent Treatment Plant DesignОт EverandAn Applied Guide to Water and Effluent Treatment Plant DesignРейтинг: 5 из 5 звезд5/5 (4)

- Distillation Design and Control Using Aspen SimulationОт EverandDistillation Design and Control Using Aspen SimulationРейтинг: 5 из 5 звезд5/5 (2)

- Piping Engineering Leadership for Process Plant ProjectsОт EverandPiping Engineering Leadership for Process Plant ProjectsРейтинг: 5 из 5 звезд5/5 (1)

- Process Steam Systems: A Practical Guide for Operators, Maintainers, and DesignersОт EverandProcess Steam Systems: A Practical Guide for Operators, Maintainers, and DesignersОценок пока нет

- Lees' Process Safety Essentials: Hazard Identification, Assessment and ControlОт EverandLees' Process Safety Essentials: Hazard Identification, Assessment and ControlРейтинг: 4 из 5 звезд4/5 (4)

- Functional Safety from Scratch: A Practical Guide to Process Industry ApplicationsОт EverandFunctional Safety from Scratch: A Practical Guide to Process Industry ApplicationsОценок пока нет

- Troubleshooting Vacuum Systems: Steam Turbine Surface Condensers and Refinery Vacuum TowersОт EverandTroubleshooting Vacuum Systems: Steam Turbine Surface Condensers and Refinery Vacuum TowersРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Coupled CFD-DEM Modeling: Formulation, Implementation and Application to Multiphase FlowsОт EverandCoupled CFD-DEM Modeling: Formulation, Implementation and Application to Multiphase FlowsОценок пока нет

- The Perfumed Pages of History: A Textbook on Fragrance CreationОт EverandThe Perfumed Pages of History: A Textbook on Fragrance CreationРейтинг: 4 из 5 звезд4/5 (1)

- Fundamentals of Risk Management for Process Industry EngineersОт EverandFundamentals of Risk Management for Process Industry EngineersОценок пока нет

- A New Approach to HAZOP of Complex Chemical ProcessesОт EverandA New Approach to HAZOP of Complex Chemical ProcessesОценок пока нет

- The Periodic Table of Elements - Halogens, Noble Gases and Lanthanides and Actinides | Children's Chemistry BookОт EverandThe Periodic Table of Elements - Halogens, Noble Gases and Lanthanides and Actinides | Children's Chemistry BookОценок пока нет

- Coulson and Richardson’s Chemical Engineering: Volume 2B: Separation ProcessesОт EverandCoulson and Richardson’s Chemical Engineering: Volume 2B: Separation ProcessesAjay Kumar RayОценок пока нет

- Pulp and Paper Industry: Emerging Waste Water Treatment TechnologiesОт EverandPulp and Paper Industry: Emerging Waste Water Treatment TechnologiesРейтинг: 5 из 5 звезд5/5 (1)

- Fun Facts about Carbon : Chemistry for Kids The Element Series | Children's Chemistry BooksОт EverandFun Facts about Carbon : Chemistry for Kids The Element Series | Children's Chemistry BooksОценок пока нет

- Handbook of Cosmetic Science: An Introduction to Principles and ApplicationsОт EverandHandbook of Cosmetic Science: An Introduction to Principles and ApplicationsH. W. HibbottРейтинг: 4 из 5 звезд4/5 (6)

- Cathodic Protection: Industrial Solutions for Protecting Against CorrosionОт EverandCathodic Protection: Industrial Solutions for Protecting Against CorrosionОценок пока нет

- Bioinspired Materials Science and EngineeringОт EverandBioinspired Materials Science and EngineeringGuang YangОценок пока нет