Академический Документы

Профессиональный Документы

Культура Документы

Quiz of Dividend

Загружено:

Nouman MujahidИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Quiz of Dividend

Загружено:

Nouman MujahidАвторское право:

Доступные форматы

Quiz

Question #1

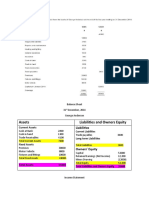

Milwaukee Tool has the following stockholders’ equity account. The firm’s common stock

currently sells for $4 per share.

Preferred stock $ 100,000

Common stock (400,000 shares at $1 par) 400,000

Paid-in capital in excess of par 200,000

Retained earnings 320,000

Total stockholders’ equity $1,020,000

a. Show the effects on the firm of a cash dividend of $0.01, $0.05, $0.10, and $0.20 per share.

b. Show the effects on the firm of a 1%, 5%, 10%, and 20% stock dividend.

c. Compare the effects in parts a and b. What are the significant differences between the two

methods of paying dividends?

Question #2

The board of Wicker Home Health Care, Inc., is exploring ways to expand the number of shares

outstanding in an effort to reduce the market price per share to a level that the firm considers

more appealing to investors. The options under consideration are a 20% stock dividend and,

alternatively, a 5-for-4 stock split. At the present time, the firm’s equity account and other per-

share information are as follows:

Preferred stock $ 0

Common stock (100,000 shares at $1 par) 100,000

Paid-in capital in excess of par 900,000

Retained earnings 700,000

Total stockholders’ equity $1,700,000

Price per share $30.00

Earnings per share $3.60

Dividend per share $1.08

a. Show the effect on the equity accounts and per-share data of a 20% stock dividend.

b. Show the effect on the equity accounts and per-share data of a 5-for-4 stock split.

c. Which option will accomplish Wicker’s goal of reducing the current stock price while

maintaining a stable level of retained earnings?

d. What legal constraints might encourage the firm to choose a stock split over a stock dividend?

Вам также может понравиться

- Tutorial 8Документ2 страницыTutorial 8phil0% (1)

- Why Moats Matter: The Morningstar Approach to Stock InvestingОт EverandWhy Moats Matter: The Morningstar Approach to Stock InvestingРейтинг: 4 из 5 звезд4/5 (3)

- Chapter 14 SolutionsДокумент10 страницChapter 14 SolutionsAmanda Ng100% (1)

- Chap 15 Problem SolutionsДокумент32 страницыChap 15 Problem SolutionsAarif Hossain100% (3)

- Equity PricingДокумент4 страницыEquity PricingMichelle ManuelОценок пока нет

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Документ4 страницыPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangОценок пока нет

- Tutorial 4 - Dividend and Distribution Decision - QuestionsДокумент1 страницаTutorial 4 - Dividend and Distribution Decision - QuestionskhalidОценок пока нет

- Copfin 1B April 2019Документ4 страницыCopfin 1B April 2019tawandaОценок пока нет

- Diluted Earnings Per Share QДокумент2 страницыDiluted Earnings Per Share Qjano_art210% (4)

- Dividends ERДокумент11 страницDividends ERMarian Salinas DacuroОценок пока нет

- AFA QuizДокумент15 страницAFA QuizNoelia Mc DonaldОценок пока нет

- Operating and Financial LeverageДокумент3 страницыOperating and Financial LeverageperiОценок пока нет

- Accounting Textbook Solutions - 70Документ19 страницAccounting Textbook Solutions - 70acc-expertОценок пока нет

- Gleim Questions 2020: Study Unit 4: Valuation Methods and Cost of Capital - Subunit 1: Stock Valuation MethodsДокумент53 страницыGleim Questions 2020: Study Unit 4: Valuation Methods and Cost of Capital - Subunit 1: Stock Valuation MethodsMohamedОценок пока нет

- 7 - 19 - Dividends and Other Payouts PDFДокумент2 страницы7 - 19 - Dividends and Other Payouts PDFPham Ngoc VanОценок пока нет

- Corporations: Organization, Stock Transactions, and DividendsДокумент37 страницCorporations: Organization, Stock Transactions, and Dividendsjoseph christopher vicenteОценок пока нет

- The Corporate Form of OrganizationДокумент7 страницThe Corporate Form of OrganizationRabie HarounОценок пока нет

- Problem Set 1Документ5 страницProblem Set 1Lawly GinОценок пока нет

- The Stockholders Equity Section of The Balance Sheet For GatorДокумент1 страницаThe Stockholders Equity Section of The Balance Sheet For Gatortrilocksp SinghОценок пока нет

- Copfin 1B August Block 2018Документ4 страницыCopfin 1B August Block 2018tawandaОценок пока нет

- Dividend Policy - Solutions To Selected ProblemsДокумент6 страницDividend Policy - Solutions To Selected ProblemsMarina AfrinОценок пока нет

- Ratios AssignmentДокумент3 страницыRatios AssignmentDiana SaidОценок пока нет

- FRДокумент66 страницFRKy DulzОценок пока нет

- Finance QuizДокумент2 страницыFinance QuizSatyajitОценок пока нет

- Dividend QuestionsДокумент6 страницDividend QuestionsperiОценок пока нет

- CH 13 5Документ2 страницыCH 13 5Meghna CmОценок пока нет

- B. Revising The Estimated Life of Equipment From 10 Years To 8 YearsДокумент4 страницыB. Revising The Estimated Life of Equipment From 10 Years To 8 YearssilviabelemОценок пока нет

- GS1129 SBS Tutorial 3 - Dividends and Shares 19 PDFДокумент2 страницыGS1129 SBS Tutorial 3 - Dividends and Shares 19 PDFSetsuna TeruОценок пока нет

- Tutorial 6 - Cost of Capital PDFДокумент2 страницыTutorial 6 - Cost of Capital PDFChamОценок пока нет

- BT ThêmДокумент2 страницыBT ThêmBách BáchОценок пока нет

- Acct C.H.10Документ6 страницAcct C.H.10j8noelОценок пока нет

- Dividends and Other PayoutsДокумент3 страницыDividends and Other PayoutsLinh HoangОценок пока нет

- Week 9Документ76 страницWeek 9BookAddict721Оценок пока нет

- CH 14Документ7 страницCH 14AnsleyОценок пока нет

- MAN 321 Corporate Finance Final Examination: Fall 2001Документ8 страницMAN 321 Corporate Finance Final Examination: Fall 2001Suzette Faith LandinginОценок пока нет

- Intro To Company Accounts HWK AnsДокумент2 страницыIntro To Company Accounts HWK AnsCharisma CharlesОценок пока нет

- Different Types of Payouts: - Many Companies Pay A Regular Cash DividendДокумент27 страницDifferent Types of Payouts: - Many Companies Pay A Regular Cash DividendMuhammad Mazhar Younus100% (1)

- BU340 Managerial FinanceДокумент58 страницBU340 Managerial FinanceG JhaОценок пока нет

- Problem Set 1Документ5 страницProblem Set 1okmokmОценок пока нет

- Cost of Cap More QuestionsДокумент4 страницыCost of Cap More QuestionsAnipa HubertОценок пока нет

- Topic 4 - Practice QuestionsДокумент2 страницыTopic 4 - Practice QuestionsDr-Wasim Abbas ShaheenОценок пока нет

- Questions F9 Ipass PDFДокумент60 страницQuestions F9 Ipass PDFAmir ArifОценок пока нет

- Post Quiz 8-AF101Документ12 страницPost Quiz 8-AF101Moira Emma N. EdmondОценок пока нет

- Self-Study Exercise 1Документ3 страницыSelf-Study Exercise 1chanОценок пока нет

- BF 320114152Документ5 страницBF 320114152Kelvin Lim Wei LiangОценок пока нет

- Final Requirement ProblemsДокумент5 страницFinal Requirement ProblemsYoite MiharuОценок пока нет

- CF Tutorial 9 - SolutionsДокумент9 страницCF Tutorial 9 - SolutionschewОценок пока нет

- Fundamentals of Capital StructureДокумент42 страницыFundamentals of Capital StructureSona Singh pgpmx 2017 batch-2Оценок пока нет

- Practice Session 4 Cost of CapitalДокумент1 страницаPractice Session 4 Cost of CapitalSafi SheikhОценок пока нет

- ACCT 424 Midterm ExamДокумент12 страницACCT 424 Midterm ExamDeVryHelpОценок пока нет

- Michelle G. Miranda Multiple Choice-Dividends and Dividend PolicyДокумент4 страницыMichelle G. Miranda Multiple Choice-Dividends and Dividend PolicyMichelle MirandaОценок пока нет

- MC For Test 1Документ13 страницMC For Test 1Michelle LamОценок пока нет

- Additional EPS Question and Its SolutionДокумент4 страницыAdditional EPS Question and Its SolutionchipsanddipsОценок пока нет

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachОт EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachОценок пока нет

- How to Create and Manage a Mutual Fund or Exchange-Traded Fund: A Professional's GuideОт EverandHow to Create and Manage a Mutual Fund or Exchange-Traded Fund: A Professional's GuideОценок пока нет

- Assignment On DepreciationДокумент4 страницыAssignment On DepreciationNouman MujahidОценок пока нет

- Assets Liabilities and Owners EquityДокумент9 страницAssets Liabilities and Owners EquityNouman MujahidОценок пока нет

- Merger: Acquiring CompanyДокумент3 страницыMerger: Acquiring CompanyNouman MujahidОценок пока нет

- Depreciation and Carrying AmountДокумент12 страницDepreciation and Carrying AmountNouman MujahidОценок пока нет

- Notes On Inventory ValuationДокумент7 страницNotes On Inventory ValuationNouman Mujahid100% (2)

- Dividends: Factors Affecting Dividend PolicyДокумент7 страницDividends: Factors Affecting Dividend PolicyNouman MujahidОценок пока нет

- Ebit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCДокумент6 страницEbit EBIT Q P-FC-VC Q: Find EBIT Price Quantity Sales - Fixed Cost - VC Per Unit Quantity TVCNouman MujahidОценок пока нет

- Bahvioral FinanceДокумент14 страницBahvioral FinanceNouman MujahidОценок пока нет

- Accounts Payable ManagementДокумент3 страницыAccounts Payable ManagementNouman MujahidОценок пока нет

- Breakeven Analysis: EBIT $0Документ5 страницBreakeven Analysis: EBIT $0Nouman MujahidОценок пока нет

- Gupta Macroeconomic (2013)Документ22 страницыGupta Macroeconomic (2013)Nouman MujahidОценок пока нет

- Notes On Working Capital ManagementДокумент11 страницNotes On Working Capital ManagementNouman MujahidОценок пока нет

- Averageinvestment Under Proposed /actual Plan (Total Variable Cost) / (Turnover of Accounts Receivable)Документ1 страницаAverageinvestment Under Proposed /actual Plan (Total Variable Cost) / (Turnover of Accounts Receivable)Nouman MujahidОценок пока нет

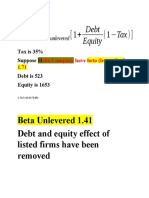

- Beta Levered and UnleveredДокумент3 страницыBeta Levered and UnleveredNouman MujahidОценок пока нет

- What Is Behavioral FinanceДокумент4 страницыWhat Is Behavioral FinanceNouman MujahidОценок пока нет

- How To Write Effective Introduction of An ArticleДокумент14 страницHow To Write Effective Introduction of An ArticleNouman MujahidОценок пока нет

- Finance Interview Questions: Carey CompassДокумент2 страницыFinance Interview Questions: Carey CompassNouman MujahidОценок пока нет

- Initial Cash FlowДокумент3 страницыInitial Cash FlowNouman Mujahid50% (2)

- Madina Medical StoreДокумент29 страницMadina Medical StoreNouman MujahidОценок пока нет

- Corporate Performance and Stakeholder Management: Balancing Shareholder and Customer Interests in The U.K. Privatized Water IndustryДокумент14 страницCorporate Performance and Stakeholder Management: Balancing Shareholder and Customer Interests in The U.K. Privatized Water IndustryNouman MujahidОценок пока нет

- Bundling Human Capital With Organizational Context: The Impact of International Assignment Experience On Multinational Firm Performance and Ceo PayДокумент20 страницBundling Human Capital With Organizational Context: The Impact of International Assignment Experience On Multinational Firm Performance and Ceo PayNouman MujahidОценок пока нет

- Cross - Iyears Companbs BI Dualitman - O Roa ROE SizeДокумент8 страницCross - Iyears Companbs BI Dualitman - O Roa ROE SizeNouman MujahidОценок пока нет

- Arbitrage Pricing TheoryДокумент5 страницArbitrage Pricing TheoryNouman MujahidОценок пока нет

- Org 4Документ34 страницыOrg 4Nouman MujahidОценок пока нет