Академический Документы

Профессиональный Документы

Культура Документы

Group 1 JetBlue X1 FAHAM ADEEL INAM FAWAD

Загружено:

Muhammad FahamАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Group 1 JetBlue X1 FAHAM ADEEL INAM FAWAD

Загружено:

Muhammad FahamАвторское право:

Доступные форматы

University of Central Punjab

Submitted by:

MUHAMMAD FAHAM L1S20MBAM0023

FAWAD ALI L1S20MBAM0037

INAM E ALI L1S20MBAM0035

ADEEL IMRAN L1S20MBAM0003

Submitted To:

Dr. Aitzaz Khursheed

Date of Submission: April 19, 2020

1. Identify the most important opportunities, Threats, strengths and

weaknesses of your case studies. (4 Marks)

Opportunities:

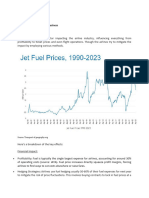

Lower fuel prices have helped airlines’ performance metrics.

Coach passenger revenue tends to account for 80% of all revenue generated

by air service companies.

Threats:

Ironically, it is often expensive to exit the industry, as airlines have long-term

lease agreements in place.

Aircraft fuel is JetBlue‘s largest expense category, representing 36% of total

operating expenses in 2014, compared to 38%in 2013.

Strengths:

JetBlue‘s traffic grew by 9.8% year-over-year for the first half of 2015.

JetBlue‘s traffic and capacity growth increased during January 2015 to record

the highest growth among its peers.

Weaknesses:

Compared to rival airlines, JetBlue‘s on-time arrivals and departures

underperformed on these metrics.

JetBlue‘s prices 25% higher than Spirit Air and other discount airlines.

2. W h i c h o p p o r t

improve its performance? (6 marks)

Coach passenger revenue tends to account for 80% of all revenue generated by

air service companies. This statement tells us that, there is a huge potential in

Coach passenger. The case study says that, only 10% passenger uses business

or elite class tickets to travel. This shows that there is a huge market of coach

passenger waiting for a company to grab. And in jetblue’s case, the 80% of the

revenue accounts from the coach passengers. So they can start new intercity

routes.

Aircraft fuel is JetBlue‘s largest expense category, representing 36% of total

operating expenses in 2014, compared to 38%in 2013. Now we know that, the

fuel is the major cost of the airline ticket. The price of ticket is much more elastic

to the price of fuel, which results, if the fuel prices goes up. Their business would

be at risk, as lesser number of people would be using their serves. So, we had

suggested that, the intercity new routes with more traffic would be beneficial, and

will serve with more revenues.

3. Suggest at least one strategy for the opportunity and one for the threat

identified in question numbered 2 for the firm to act upon. (10 marks)

JetBlue should start new coach passenger / economy class routes to new

location with more heavy traffic. The logic of this is that the revenue generated by

the coach passenger is 80% of the total revenue. The new coach passenger

intercity route will attract new customer, as people uses airlines for faster way

of transportation. This will also save fuel. And use the fuel more efficiently as

more people will be willing to travel in coach passenger seating. Moreover, the

biggest threat to JetBlue is the time management. People prefer airlines due to

faster mode of transportation. If JetBlue starts are new intercity route of heavy air

traffic, with the express lanes and express counters, so people would prefer

airlines instead of local transports and subways.

Вам также может понравиться

- Indigo Airline AnalysisДокумент10 страницIndigo Airline AnalysisChandra Kiran100% (2)

- Porter's FiveForces - VN Airline IndustryДокумент3 страницыPorter's FiveForces - VN Airline IndustryNgọc QuỳnhОценок пока нет

- Five Competitive ForcesДокумент8 страницFive Competitive ForcesNguyễn Tâm50% (2)

- 2009 H1 CS Q1Документ4 страницы2009 H1 CS Q1panshanren100% (1)

- Bargaining Power of Suppliers and Airline IndustryДокумент29 страницBargaining Power of Suppliers and Airline IndustryPurnendu Singh100% (14)

- JetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSДокумент6 страницJetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSMuhammad FahamОценок пока нет

- JetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSДокумент6 страницJetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSMuhammad FahamОценок пока нет

- JetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSДокумент6 страницJetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSMuhammad FahamОценок пока нет

- JetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSДокумент6 страницJetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSMuhammad FahamОценок пока нет

- JetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSДокумент6 страницJetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSMuhammad FahamОценок пока нет

- JetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSДокумент6 страницJetBlue Airways Corporation - 2015 SWOT Analysis SWOT MatiX TOWSMuhammad FahamОценок пока нет

- Indigo 5 ForcesДокумент3 страницыIndigo 5 Forcesipsa100% (1)

- Strategic Management at Emirates AirlinesДокумент26 страницStrategic Management at Emirates Airlineschubbypuff86% (28)

- Air DeccanДокумент8 страницAir Deccanprateekbapna90Оценок пока нет

- Business ReportДокумент4 страницыBusiness Reportariel4869Оценок пока нет

- HarveyTurnbull 2020 - Is Ryanair The Southwest Airlines of EuropeДокумент10 страницHarveyTurnbull 2020 - Is Ryanair The Southwest Airlines of EuropeShahryarОценок пока нет

- 5 Forces and Diamond ModelДокумент23 страницы5 Forces and Diamond ModelMohammad Imad Shahid KhanОценок пока нет

- Marketing Audit Revised 2 EditedДокумент22 страницыMarketing Audit Revised 2 EditedMarta Shymonyak100% (2)

- Emirates Is An Aircraft Situated in DubaiДокумент8 страницEmirates Is An Aircraft Situated in DubaiSumit KumarОценок пока нет

- Bandera, V. N. NEP As An Economic SystemДокумент16 страницBandera, V. N. NEP As An Economic SystemIcaroRossignoliОценок пока нет

- An Analysis of Delta Air Lines - Based OnДокумент5 страницAn Analysis of Delta Air Lines - Based OnYan FengОценок пока нет

- Competition & Strategy: Indigo AirlinesДокумент21 страницаCompetition & Strategy: Indigo AirlinesAhmed Dam100% (1)

- Strategic Management at Emirates AirlinesДокумент27 страницStrategic Management at Emirates AirlinesYalda Kaviani100% (2)

- IB Case StudyДокумент4 страницыIB Case StudyManisha TripathyОценок пока нет

- Emirates Customer ServiceДокумент20 страницEmirates Customer ServiceAjay Padinjaredathu AppukuttanОценок пока нет

- Airline IndustryДокумент8 страницAirline IndustryKrishnaPranayОценок пока нет

- Competition and Strategy Indigo AirlinesДокумент15 страницCompetition and Strategy Indigo AirlinesSuraj DubeyОценок пока нет

- Introduction To AviationДокумент4 страницыIntroduction To AviationKiran SidhuОценок пока нет

- Panaroma 2014 AviationДокумент3 страницыPanaroma 2014 AviationShubham AroraОценок пока нет

- Rescuing The Airline Industry - What's The Government's Role - Business LineДокумент2 страницыRescuing The Airline Industry - What's The Government's Role - Business Lineswapnil8158Оценок пока нет

- Case Group 6Документ7 страницCase Group 6Israt ShoshiОценок пока нет

- Emirates Paper-Libre PDFДокумент9 страницEmirates Paper-Libre PDFnuwanchanaka9Оценок пока нет

- Summarize The Case in 300 To Max 400 Words. (5 Marks)Документ7 страницSummarize The Case in 300 To Max 400 Words. (5 Marks)writer topОценок пока нет

- Emirates Airlines StrategyДокумент9 страницEmirates Airlines StrategyAloha Pn100% (1)

- Accenture Rail 2020 IndustryДокумент8 страницAccenture Rail 2020 Industrybenoit.lienart7076Оценок пока нет

- Airline Industry Term PaperДокумент7 страницAirline Industry Term Paperc5qe3qg3100% (1)

- Shri Ram Case Competition 2016 Prelim - 1Документ9 страницShri Ram Case Competition 2016 Prelim - 1Sourav SharmaОценок пока нет

- University of Liberal Arts Bangladesh (ULAB) : Course Title: Strategic Management Course Code: BUS 307 Section: 03Документ23 страницыUniversity of Liberal Arts Bangladesh (ULAB) : Course Title: Strategic Management Course Code: BUS 307 Section: 03Dhiraj Chandro RayОценок пока нет

- Ryanair (Ireland) and Easy Jet (UK)Документ8 страницRyanair (Ireland) and Easy Jet (UK)theyaga_gОценок пока нет

- Ryan AirДокумент15 страницRyan Airsushil.saini8667% (6)

- Name: Billy Gao Student ID: 18046536 Words: 1783Документ10 страницName: Billy Gao Student ID: 18046536 Words: 1783高一辰Оценок пока нет

- Airline TechnologyДокумент2 страницыAirline Technologymariamali87Оценок пока нет

- Case Study Supporting DetailsДокумент9 страницCase Study Supporting DetailsMichael Paul GabrielОценок пока нет

- Industry AnalysisДокумент16 страницIndustry AnalysisShashwat MishraОценок пока нет

- Challenges Faced by Airlines SectorДокумент2 страницыChallenges Faced by Airlines SectorTanoj PandeyОценок пока нет

- WestJet Charles ProjectДокумент27 страницWestJet Charles Projectinderdhindsa100% (2)

- The Factors Effecting Airline BusinessДокумент5 страницThe Factors Effecting Airline BusinessnajumОценок пока нет

- Airline and Airport Dissertation IdeasДокумент8 страницAirline and Airport Dissertation IdeasWritingPaperServicesCanada100% (1)

- Jet AirwaysДокумент11 страницJet AirwaysAnonymous tgYyno0w6Оценок пока нет

- How Attractive Is The European Airline Industry in 2012Документ8 страницHow Attractive Is The European Airline Industry in 2012Askar SerekeОценок пока нет

- Marketing PPT-EmiratesДокумент53 страницыMarketing PPT-EmiratesAashish SinghОценок пока нет

- Porter's Five Force Model MASДокумент6 страницPorter's Five Force Model MASDaeng BireleyОценок пока нет

- Threat of New Entrants (Barriers To Entry)Документ4 страницыThreat of New Entrants (Barriers To Entry)Sena KuhuОценок пока нет

- 3.0 Internal and External Factor AnalysisДокумент3 страницы3.0 Internal and External Factor AnalysislindaОценок пока нет

- Assignment 2 (21330)Документ6 страницAssignment 2 (21330)Prasansha ShresthaОценок пока нет

- Proposed Business Strategy For British AirwaysДокумент21 страницаProposed Business Strategy For British AirwaysLucas Salam0% (1)

- SM Air Industry and Porter 5 ForcesДокумент7 страницSM Air Industry and Porter 5 ForcesMuhammad Umair RajputОценок пока нет

- Economics-Aviation 19.08.18 FinalДокумент11 страницEconomics-Aviation 19.08.18 FinalyogeshОценок пока нет

- Aviation IndustryДокумент5 страницAviation IndustrySu WenОценок пока нет

- Low Cost Carrier Marketing in AsiaДокумент5 страницLow Cost Carrier Marketing in AsiaKumar MОценок пока нет

- The USA Airline Industry and Porter's Five ForcesДокумент5 страницThe USA Airline Industry and Porter's Five ForcesSena KuhuОценок пока нет

- ACGT Term PaperДокумент11 страницACGT Term PaperHiếu Nguyễn Minh HoàngОценок пока нет

- Marketing Plan AirlinesДокумент11 страницMarketing Plan AirlinesSourav SinhaОценок пока нет

- EMIRATES AIRLINES Marketing and BusinessДокумент15 страницEMIRATES AIRLINES Marketing and BusinessRiezal BintanОценок пока нет

- Cruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityОт EverandCruising to Profits, Volume 1: Transformational Strategies for Sustained Airline ProfitabilityОценок пока нет

- Group 1 JetBlue X1 FAHAM ADEEL INAM FAWADДокумент3 страницыGroup 1 JetBlue X1 FAHAM ADEEL INAM FAWADMuhammad FahamОценок пока нет

- A. Case Abstract: Federal Express (Fedex) Corporation - 2015Документ4 страницыA. Case Abstract: Federal Express (Fedex) Corporation - 2015Muhammad FahamОценок пока нет

- Defination of M.EДокумент6 страницDefination of M.EGhulam AliОценок пока нет

- Factors Influencing Human Behavior To Adopt Smoking: Professor Salman IqbalДокумент22 страницыFactors Influencing Human Behavior To Adopt Smoking: Professor Salman IqbalMuhammad FahamОценок пока нет

- A. Case Abstract: Federal Express (Fedex) Corporation - 2015Документ4 страницыA. Case Abstract: Federal Express (Fedex) Corporation - 2015Muhammad FahamОценок пока нет

- Unilever Case Study Brazil Ariel SolvedДокумент10 страницUnilever Case Study Brazil Ariel SolvedMuhammad FahamОценок пока нет

- Entre Market Entrepreneurship UCPДокумент2 страницыEntre Market Entrepreneurship UCPMuhammad FahamОценок пока нет

- Defination of M.EДокумент6 страницDefination of M.EGhulam AliОценок пока нет

- Factors Influencing Human Behavior To Adopt Smoking: Professor Salman IqbalДокумент22 страницыFactors Influencing Human Behavior To Adopt Smoking: Professor Salman IqbalMuhammad FahamОценок пока нет

- Gaps To Find in The Project Barber Shop PakistanДокумент2 страницыGaps To Find in The Project Barber Shop PakistanMuhammad FahamОценок пока нет

- PEL Internship Report 2019 PakistanДокумент14 страницPEL Internship Report 2019 PakistanMuhammad FahamОценок пока нет

- Integrated Marketing Communication AssignmentДокумент1 страницаIntegrated Marketing Communication AssignmentMuhammad FahamОценок пока нет

- OutfittersДокумент15 страницOutfittersMuhammad FahamОценок пока нет

- OutfittersДокумент15 страницOutfittersMuhammad FahamОценок пока нет

- 21St Century Music Appreciation (3) : FALL 2019 - CA 142 C900Документ1 страница21St Century Music Appreciation (3) : FALL 2019 - CA 142 C900Tom StephenОценок пока нет

- Indigenous Religious Beliefs of The PhilippinesДокумент3 страницыIndigenous Religious Beliefs of The PhilippinesDwin AguilarОценок пока нет

- Bangalore Water Supply V A Rajappa - Brief FactДокумент3 страницыBangalore Water Supply V A Rajappa - Brief FactarunОценок пока нет

- Speech 99999Документ28 страницSpeech 99999Mikasa HarryОценок пока нет

- Outcomes of Cabinet Meeting Chaired by President Uhuru Kenyatta at State House, Nairobi On Thursday 10th September, 2020.Документ3 страницыOutcomes of Cabinet Meeting Chaired by President Uhuru Kenyatta at State House, Nairobi On Thursday 10th September, 2020.State House KenyaОценок пока нет

- Assignment 2b Approaches To Learning and TeachingДокумент2 страницыAssignment 2b Approaches To Learning and Teachingapi-272547134Оценок пока нет

- Women's Metaphor - From Glass Ceiling' To Labyrinth' - Santovec - 2010 - Women in Higher Education - Wiley Online LibraryДокумент5 страницWomen's Metaphor - From Glass Ceiling' To Labyrinth' - Santovec - 2010 - Women in Higher Education - Wiley Online LibraryVERONICA AKOURYОценок пока нет

- Yibltal Tsegaw MSC Thesis Proposal EditedДокумент35 страницYibltal Tsegaw MSC Thesis Proposal EditedYibeltalОценок пока нет

- Reliable and Unreliable SourcesДокумент10 страницReliable and Unreliable SourcesSherlyn L. YaunОценок пока нет

- Fighting Cartels in Europe and The US: Different Systems, Common GoalsДокумент7 страницFighting Cartels in Europe and The US: Different Systems, Common GoalsAndrea AndreeaОценок пока нет

- Two Seasons Coron Island ResortДокумент3 страницыTwo Seasons Coron Island ResortDevie FilasolОценок пока нет

- Nikita Elmadianti - Assignment 3Документ2 страницыNikita Elmadianti - Assignment 3NIKITA ELMADIANTIОценок пока нет

- Authentic AssessmentДокумент11 страницAuthentic AssessmentjayОценок пока нет

- Sa8000 NutshellДокумент3 страницыSa8000 Nutshellnallasivam v100% (4)

- Information Sheet Pr-1.1-1 "Introduction To Personality: " Learning ObjectivesДокумент8 страницInformation Sheet Pr-1.1-1 "Introduction To Personality: " Learning ObjectivesRusselle CalitisОценок пока нет

- The FanaleДокумент17 страницThe FanaleJemar WasquinОценок пока нет

- Brigada Pagbasa 2021 Time Table: Time Frame Activities StrategiesДокумент2 страницыBrigada Pagbasa 2021 Time Table: Time Frame Activities StrategiesMarvin LontocОценок пока нет

- Disaster Readiness and Risk ReductionДокумент7 страницDisaster Readiness and Risk ReductionLouise Arellano100% (3)

- Number of Students Who Does/doesn't Plays Clash of Clans: Boys Girls Yes NoДокумент3 страницыNumber of Students Who Does/doesn't Plays Clash of Clans: Boys Girls Yes NoJerick Enrique FegaridoОценок пока нет

- Chapter # 2 Historical Perspective of ManagementДокумент5 страницChapter # 2 Historical Perspective of ManagementDK BalochОценок пока нет

- COMMONWEALTH ACT No 473Документ5 страницCOMMONWEALTH ACT No 473Ramon GarciaОценок пока нет

- Rabor Vs CSCДокумент2 страницыRabor Vs CSCGladys Bustria OrlinoОценок пока нет

- Summative Test in Understanding Culture, Society and Politics (UCSP)Документ2 страницыSummative Test in Understanding Culture, Society and Politics (UCSP)AehilmorsyОценок пока нет

- Politicising Feminist Discourse LazarusДокумент2 страницыPoliticising Feminist Discourse LazarusHayacinth EvansОценок пока нет

- CAO - IRI Part - MДокумент102 страницыCAO - IRI Part - MDariush ShОценок пока нет

- Cambridge International General Certificate of Secondary EducationДокумент8 страницCambridge International General Certificate of Secondary EducationCherry BerryОценок пока нет

- Art of GardeningДокумент2 страницыArt of GardeningT CОценок пока нет

- The Role of Hungarian Capital in Foreign MediaДокумент39 страницThe Role of Hungarian Capital in Foreign MediaatlatszoОценок пока нет

- IGCSE Economics-Do Consumers Benefit From Horizontal MergersДокумент1 страницаIGCSE Economics-Do Consumers Benefit From Horizontal MergersSmart Exam ResourcesОценок пока нет