Академический Документы

Профессиональный Документы

Культура Документы

Questions Group Project June 2020 PDF

Загружено:

Muhammad Saiful Islam MusaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Questions Group Project June 2020 PDF

Загружено:

Muhammad Saiful Islam MusaАвторское право:

Доступные форматы

CONFIDENTIAL 1 JUNE 2020/TAX667/GROUP PROJECT

GROUP PROJECT/ ASSIGNMENT

COURSE : ADVANCED TAXATION

COURSE CODE : TAX 667

EXAMINATION : JUNE 2020

TIME : 2 WEEKS

INSTRUCTIONS TO CANDIDATES

1. This is a group project/ assignment.

2. Students are required to form a group of 4 persons for this project/ assignment.

3. This question paper consists of three (3) questions.

4. Answer ALL questions. Start each answer on a new page.

5. The report (answer) must be submitted within 2 weeks.

This examination paper consists of 5 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 JUNE 2020/TAX667/GROUP PROJECT

QUESTION 1

A new manufacturing company, ICON Sdn Bhd (ICON) was awarded a contract to supply

product X (a promoted product) to all government hospitals in Malaysia. The company has

forecasted minor losses in the first 4 years of operation (YA 2016 to YA 2019) and a small

profit in the 5th year (YA 2020). It is a capital-intensive kind of business as such it is expected

that the company will incur approximately RM40 million and RM3 million for purchase of

machineries and raw material respectively prior to commencement of manufacturing process.

In addition to business income, the company is also expected to earn other income comprising

rental and interest income. The rental income is expected to be quite substantial as it is derived

from renting out 5 blocks of apartment to its factory workers whereas the interest income would

be paid by its subsidiary, Levi Sdn Bhd (Levi). The fund for the construction of the 5 blocks of

apartment is internally generated whereas loan given to Levi is borrowed from financial

institutions whereby ICON have to pay interest at market rate which is much higher than the

interest rate charged by ICON to Levi. Levi is expected to have a current year loss of RM300,

000 annually from YA 2018 to YA 2020.

Some of the machineries are expected to be disposed after several years of usage and this

will give rise to a huge profit on disposal of fixed assets as these assets have a very high resale

value. The company has yet to decide as to whether to dispose these assets to its subsidiary

Textwood Sdn Bhd (Textwood) which is a loss making company or to a third party. Textwood

is forecasted to have a current year loss of RM800,000 annually from YA 2018 to YA 2020.

Another subsidiary, Jean Sdn Bhd (Jean) is a profitable company which provides management

service to all government hospitals. The company’s capital allowances claimed is expected to

be small amount as its nature of business does not require it to incur a huge amount of capital

expenditure. Its forecasted aggregate income is approximately RM1 million per annum from

YA 2018 onwards.

ICON’s percentage of shareholding in its subsidiaries is as follows: -

a. 60% in Levi Sdn Bhd

b. 75% in Textwood Sdn Bhd

c. 73% in Jean Sdn Bhd

Required:

You are required to advise ICON Sdn Bhd on tax planning opportunities for all the companies

in its group to minimize the tax liabilities for ICON group of companies. Your answer should

cover the following areas: -

a) ITA or Pioneer Status, choose the best option.

b) Commencement of business- minimize non allowable expenses

c) Leasing or outright purchase of assets for assets not qualified under ITA (e.g. motor

vehicles), choose the best option.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 3 JUNE 2020/TAX667/GROUP PROJECT

d) Interest restriction- ICON, Financial Institution and Levi.

e) Tax planning on disposal of fixed assets.

f) Group relief- ICON, Textwood, Levi and Jean.

(10 marks)

QUESTION 2

Spark Sdn Bhd is a manufacturer of electrical goods. For the financial year ended 30 June

2019, its Statement of Profit or Loss showed the following:

Note RM’000 RM”000

Turnover 6,500

Less: Cost of sales 1 (4,225)

Gross Profit 2,275

Add: Other income:

Dividend (single tier) 2 250

Interest 3 65

Rental 92

Profit on sale of fixed assets 45 452

2,727

Less: Operating expenses

Lease rentals 4 48

Marketing and selling 5 48

Staff remuneration 6 720

Director’s remuneration 170

Professional fees & subscriptions 7 175

Provision for doubtful debts 8 124

Repairs and maintenance 9 140 (1,425)

Net profit before taxation 1,302

Notes

1. Cost of sales

Included in the cost of sales figure were the following: RM’000

- Depreciation of plant and machinery 75

- Provision for warranty 48.5

[warranty payments made during the year were RM44,500]

- Compensation received from a supplier for damaged goods (110)

- Marine insurance for the import of raw materials paid to Malaysian 28

incorporated insurance companies

2. Dividend

The dividend income was derived from investment in stock and shares of Malaysian

resident companies.

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 4 JUNE 2020/TAX667/GROUP PROJECT

3. Interest

Interest income derived from fixed deposits placed in local financial institutions.

4. Lease rentals

Included in the expenses were lease rentals in respect of a motor car for director’s use,

that was leased at a monthly rate of RM4,000 since January 2019. The cost of the car

was RM160,000.

5. Marketing and selling

The expenses included an expenditure of RM20,000 for holding a dinner for its supplier.

The dinner was also attended by its employees.

6. Staff remuneration

During the year, a disabled individual was employed as a telephone operator at a

monthly salary of RM800.

7. Professional fees and subscriptions

The amount included cash donation of RM20,000 to an approved institution and five

cartons of cooking oils worth RM3,000 to some charitable institutions.

8. Provision for doubtful debts

The provision includes RM92,000 which was written off as bad debts and a general

provision for doubtful debts for the year amounted to RM12,000.

9. Repairs and maintenance

Included in the above were:

RM’000

New display shelves 5

Rewiring 6

Depreciation 45

Repairs of shop houses (rented out) 15

Maintenance of motor vehicles 15

Additional notes:

The current year and balance brought forward capital allowances for the company’s non-

current assets amounted to RM95,000 and RM50,000 respectively. The company’s

balancing charge for the year was RM45,000.

Required:

i. Explain the effect on the income tax liability of Spark Sdn Bhd if the company is

to lease a motor car that cost RM90,000 instead of RM160,000.

(2 marks)

ii. Based on the above information, propose three tax planning strategies that would

reduce the income tax liability of Spark Sdn Bhd in future years.

(3 marks)

(Total: 5 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 5 JUNE 2020/TAX667/GROUP PROJECT

QUESTION 3

A) AB Sdn Bhd carries on a business of selling software in Malaysia. It has a website hosted

on a server located outside Malaysia. The website allows customers to identify products,

answer queries on its products, order the products online and make payments for the

purchase. The website also allows the downloading of the software in digitized format.

Apart from these functions performed by the website, all business activities of the company

such as procurement of software, the supply of information for the website, the storage of

software, the physical delivery of software (compact disc) and the maintenance of the

website are carried on in Malaysia.

Required:

Explain whether the income from selling of the compact disc is taxable in Malaysia.

(1.5 marks)

B) CD Sdn Bhd carries on a business selling clothes online in Malaysia. Its website is hosted

on server outside Malaysia. The website allows customers to identify the clothes, answer

queries on the product, order the products online and make payments for the purchase.

CD Sdn Bhd’s business activities include sourcing for contents/ procurement of clothes,

promotions and advertisement, selling and arranging for delivery of the products in

Malaysia.

Required:

Explain whether the income from selling of the clothes is taxable in Malaysia.

(2 marks)

C) XY Limited, a resident company in Indonesia, carries on a business selling home

appliances through internet. Its website which is hosted on a server in Malaysia allows

customers to identify the products and make the order and pay for it online. The company

also has a branch in Malaysia which deals with the selling, marketing, servicing, delivering

the products and providing technical support of the website.

Required:

Explain whether income of XY Limited and its branch are taxable in Malaysia.

(1.5 marks)

(Total: 5 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Movie Review EpulДокумент3 страницыMovie Review EpulMuhammad Saiful Islam MusaОценок пока нет

- Introduction - Zakat ProjectДокумент2 страницыIntroduction - Zakat ProjectMuhammad Saiful Islam MusaОценок пока нет

- Questions Group Project June 2020 PDFДокумент5 страницQuestions Group Project June 2020 PDFMuhammad Saiful Islam MusaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Psa ReportДокумент3 страницыPsa ReportMuhammad Saiful Islam MusaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- InvoiceДокумент1 страницаInvoiceIslamic PrincessОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Multinational Corporation Curse or BoonДокумент38 страницMultinational Corporation Curse or BoonShubhangi GhadgeОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Predictive Analytics Approach For Demand ForecastingДокумент22 страницыA Predictive Analytics Approach For Demand ForecastingmonicaОценок пока нет

- Human-Rights-Policy - DR Reddy'sДокумент2 страницыHuman-Rights-Policy - DR Reddy'sEsha ChaudharyОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Dead Companies Walking - Scott Fearon - Review and Summary - ValueVirtuoso ... Contrarian Value InvestingДокумент9 страницDead Companies Walking - Scott Fearon - Review and Summary - ValueVirtuoso ... Contrarian Value InvestingBanderlei SilvaОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Excel 1 Akuntansi DagangДокумент14 страницExcel 1 Akuntansi DagangAhmad Rayhan Faizul HaqОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Increase SalesДокумент10 страницIncrease SalesAbe ManОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Accounts Outsourcing, Outsourced Accounting and Bookkeeping ServicesДокумент16 страницAccounts Outsourcing, Outsourced Accounting and Bookkeeping ServicespoortiОценок пока нет

- Wipo Pub Gii 2021Документ226 страницWipo Pub Gii 2021AK Aru ShettyОценок пока нет

- PT. Makmur Berkat Solusi: Company Profile 2020Документ19 страницPT. Makmur Berkat Solusi: Company Profile 2020Dea Candra Ivana PutriОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Mock Test 1 - MST AY2020.21s26Документ6 страницMock Test 1 - MST AY2020.21s26xa. vieОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Market StructureДокумент15 страницMarket StructureLyka UrmaОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Shuman CДокумент8 страницShuman CHitesh YadavОценок пока нет

- BSBMKG555 Assessment 2Документ33 страницыBSBMKG555 Assessment 2Bright Lazy100% (2)

- Nestlé Case StudyДокумент7 страницNestlé Case StudyAli Alkharassani100% (1)

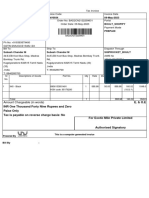

- Exotic Mile Private Limited BINV0934 09-May-2023 Boult - ShopifyДокумент1 страницаExotic Mile Private Limited BINV0934 09-May-2023 Boult - ShopifyMellodie GamingОценок пока нет

- A Survey To Study Consumer Satisfaction Towards Samsung Smart Watches in Varanasi CityДокумент12 страницA Survey To Study Consumer Satisfaction Towards Samsung Smart Watches in Varanasi CityinfoОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Lista de Precios de Tuberia 23-7-21 ITECOДокумент4 страницыLista de Precios de Tuberia 23-7-21 ITECOfelipeОценок пока нет

- Research Notes and Commentaries Doing Well by Doing Good-Case Study: Fair & Lovely' Whitening CreamДокумент7 страницResearch Notes and Commentaries Doing Well by Doing Good-Case Study: Fair & Lovely' Whitening CreamMuqadas JavedОценок пока нет

- Project 요약Документ36 страницProject 요약sjcgraceОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Rahul Dissertation ReportДокумент37 страницRahul Dissertation ReportGauravChhokarОценок пока нет

- Individual Assignment - EffaДокумент16 страницIndividual Assignment - EffayuhanaОценок пока нет

- Chapter 01 E1-7 Accounting in BusinessДокумент4 страницыChapter 01 E1-7 Accounting in BusinessSharmi laОценок пока нет

- EmperadorДокумент2 страницыEmperadorRena Jocelle NalzaroОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Navin Fluorine International LTD 532504 March 2006Документ83 страницыNavin Fluorine International LTD 532504 March 2006Sanjeev Kumar SinghОценок пока нет

- Merger and Acquisition ResumeДокумент7 страницMerger and Acquisition Resumeafiwhhioa100% (2)

- Edcoin: - Project OverviewДокумент10 страницEdcoin: - Project OverviewEnitan BelloОценок пока нет

- Leave Summary-VapДокумент1 страницаLeave Summary-VapSuresh MeenaОценок пока нет

- Indian Oil 17Документ2 страницыIndian Oil 17Ramesh AnkithaОценок пока нет

- Study Plan 2Документ3 страницыStudy Plan 2LilyОценок пока нет