Академический Документы

Профессиональный Документы

Культура Документы

Ricardo Pangan Activity

Загружено:

Danjie BarriosОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ricardo Pangan Activity

Загружено:

Danjie BarriosАвторское право:

Доступные форматы

The Dec.

31, 2013 post-closing trial balance for Ricardo Pangan Company follows:

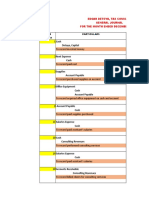

Ricardo Pangan Company

Post-Closing Trial Balance

Dec. 31, 2013

110 Cash P 240,000

120 Accounts Receivable 210,000

130 Merchandise Inventory 730,000

140 Prepaid Rent 90,000

150 Office Supplies 160,000

160 Office Equipment 1,000,000

165 Accumulated Depreciation P 250,000

210 Notes Payable 400,000

220 Accounts Payable 130,000

230 Salaries Payable

310 Pangan, Capital 1,650,000

320 Pangan, Withdrawal

330 Income Summary

410 Sales

420 Sales Return and Allowances

430 Sales Discounts

510 Purchases

520 Purchase Return and Allowances

530 Purchase Discounts

540 Transportation In

610 Salaries Expense

620 Rent Expense

630 Office Supplies Expense

640 Depreciation Expense

650 Interest Expense __________________________________

P 2,430,000 P 2,430,000

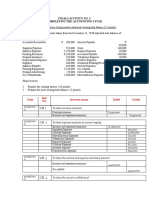

Accounts Receivable of P210,000 is related to a sale to R. Loyola on Dec. 28, 2013. All credit sales are 2/10, n/30. The accounts payable

balance of P130,000 is attributable to a purchase on Dec, 29, 2013 from E. Samonte Company. All credit purchases are 3/10, n/30.

During the month of Jan. 2014, the following transactions were completed:

Jan. 2 Sold merchandise on credit to B. Bandonell, P240,000. Invoice no. 316.

3 Purchased merchandise on account from T. Arenas Company, P90,000. Invoice dated Jan. 2.

4 Collected amount due from Dec. 28 sale to R. Loyola less discounts.

5 Sold merchandise for cash, P430,000.

7 Paid amount due to E. Samonte Company for the purchase of Dec. 29, 2013 less discounts. Issue Check no. 83.

8 Sold merchandise on account to G. Sevidal, P310,000. Invoice n. 317.

9 Returned merchandise purchased from T. Arenas Company, P10,000.

10 Collected amount due from B. Bandonell less discounts.

11 Purchased merchandise on account from L. Viray Company, P120,000. invoice dated Jan.10.

11 Paid T. Arenas Company amount due less returns and discounts. Issued check no. 84.

12 Purchased merchandise for cash, P70,000. issued check no. 85.

13 Sold merchandise on account to M. Cerda, P130,000. Invoice no. 318.

14 Paid interest on the note payable, P10,000. Issued check no. 86.

15 Paid Salaries, P80,000. Issued check no. 87.

17 Purchased merchandise on account from E. Samonte Company P190,000. Invoice dated Jan14.

18 Sold merchandise on account to R. Loyola, P460,000. Invoice no. 319

19 Pangan withdrew P100,000 from the business. Issued check no. 88.

21 Acquired office supplies for cash, P40,000. Issued check no. 89.

22 Paid freight charges on the merchandise purchased from E. Samonte Company on Jan. 17, P20,000. Issued check no. 90.

22 Collected amount due from M. Cerda less discounts.

23 Sold merchandise on credit to B. Bandonell, P110,000. Invoice No. 320.

24 Received returned merchandise from G. Sevidal, P30,000.

25 Received amount due from G. Sevidal, P30,000.

25 Purchased merchandise on account from A. Braganza Company, P340,000. Invoice dated Jan. 4.

26 Paid P90,000 to E. Samonte Company in partial payment of account. Issued check no. 91.

27 Received P170,000 loan from the First Morayta Bank and issued a note payable.

28 Purchased merchandise on account from L. Viray Company, P270,000. Invoice dated Jan. 27.

29 Sold merchandise on account to M. Cerda, P170,000. Invoice no. 321.

30 Purchased merchandise on account from T. Arenas Company, P360,000. Invoice dated Jan. 29.

30 Sold merchandise for cash, P1,310,000.

Required:

1. Record the transaction for the month of January.

2. Determine the balance in each account and prepare the unadjusted trial balance in the worksheet.

3. Prepared the following adjusting entries in the worksheet:

A. Prepaid rent of P30,000 has expired.

B. Office supplies at month-end amounted to P70,000.

C. Monthly Depreciation on the office equipment amounted to P10,000.

D. Salaries of P90,000 have accrued.

4. Completed the worksheet. The ending inventory amounted to P470,000.

5. Prepare the financial statements.

6. Provide a new Post-Closing Trial Balance for the month of Jan. 2014.

Вам также может понравиться

- Paid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Документ3 страницыPaid Amount Due To Sanny Co. For The Purchase of Dec. 29, 2019 Less Discounts. Issued Check No. 83Catherine Acutim100% (1)

- Finals Graded Exercises 005 OmarДокумент26 страницFinals Graded Exercises 005 OmarGarpt KudasaiОценок пока нет

- Comprehensive ProblemДокумент17 страницComprehensive ProblemVianca FernilleОценок пока нет

- AC1Документ1 страницаAC1Lyanna Mormont25% (4)

- Buenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaДокумент21 страницаBuenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaAnonnОценок пока нет

- Edgar Detoya Transactions ExerciseДокумент23 страницыEdgar Detoya Transactions ExerciseRica Joy BejaОценок пока нет

- Financial Statement Worksheet DetoyaДокумент8 страницFinancial Statement Worksheet Detoyasharon emailОценок пока нет

- Book 1Документ6 страницBook 1Aby de Leon100% (2)

- Edgar Detoya Tax Consultant (Acca101)Документ56 страницEdgar Detoya Tax Consultant (Acca101)Hannah Pearl Flores VillarОценок пока нет

- FS Mariano Lerin FinalДокумент15 страницFS Mariano Lerin FinalMaria Beatriz Aban Munda75% (4)

- Eva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Документ7 страницEva Cammayo Supply Company Journal Entry May 2021 Agnes Ramos Company Journal Entry May 2021Stephen ReloxОценок пока нет

- Accounting ProblemsДокумент3 страницыAccounting ProblemsKeitheia Quidlat67% (3)

- AIS Journal Entries and Adjusting EntriesДокумент2 страницыAIS Journal Entries and Adjusting EntriesIeva Francheska Agustin83% (6)

- Theories of AccountingДокумент4 страницыTheories of AccountingShanine BaylonОценок пока нет

- Mads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEДокумент3 страницыMads Rialubin Travel Agency WORKSHEET FS TRIAL BALANCEJowe Ringor Casignia100% (1)

- Additional InformationДокумент2 страницыAdditional InformationKailaОценок пока нет

- Acctg Assginment 4 Adjusting EntriesДокумент3 страницыAcctg Assginment 4 Adjusting EntriesDaisy Marie A. RoselОценок пока нет

- Exercise 3 Adjusting Entries - Service BusinessДокумент2 страницыExercise 3 Adjusting Entries - Service BusinessMarc Viduya75% (4)

- Accounting Assumptions: Introduction To Basic AccountingДокумент6 страницAccounting Assumptions: Introduction To Basic AccountingJon Nell Laguador Bernardo100% (1)

- Chapter 8-Problem 1Документ3 страницыChapter 8-Problem 1kakao100% (1)

- G e A e C A E: Merchandi at TH ND The PeriodДокумент8 страницG e A e C A E: Merchandi at TH ND The Periodkakao67% (3)

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Документ3 страницыNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- MerchandisingДокумент11 страницMerchandisingAIRA NHAIRE MECATE100% (1)

- WorksheetsДокумент2 страницыWorksheetsSarifeMacawadibSaid100% (5)

- Jose Rizal Heavy BombersДокумент10 страницJose Rizal Heavy BombersClaud NineОценок пока нет

- MerchandisingДокумент18 страницMerchandisinghamida sarip100% (2)

- Closing Entries (Step 7) & Post Closing Trial Balance (Step 8)Документ1 страницаClosing Entries (Step 7) & Post Closing Trial Balance (Step 8)Eunice Villacacan33% (3)

- Olson Sala Company Combination Journal For The Month Ended June 30, 2018Документ5 страницOlson Sala Company Combination Journal For The Month Ended June 30, 2018Zein GonzalezОценок пока нет

- Exercise 1 Merchandising UpdatedДокумент5 страницExercise 1 Merchandising UpdatedShiela RengelОценок пока нет

- Acctgchap 2Документ15 страницAcctgchap 2Anjelika ViescaОценок пока нет

- Answer Key Activity 39Документ15 страницAnswer Key Activity 39MAXINE CLAIRE CUTINGОценок пока нет

- Pangan CompanyДокумент18 страницPangan CompanyWendy Lupaz80% (5)

- Noel Hungria, Adjusting EntriesДокумент1 страницаNoel Hungria, Adjusting EntriesFeiya Liu100% (4)

- Pasahol-Far - Adusting Entries - Assignment 2Документ5 страницPasahol-Far - Adusting Entries - Assignment 2Angel PasaholОценок пока нет

- Ricardo Pangan Company Journals FrenzairenДокумент15 страницRicardo Pangan Company Journals FrenzairenRain Marie DumasОценок пока нет

- Teresita Buenaflor Shoes Worksheet 1 RegineДокумент24 страницыTeresita Buenaflor Shoes Worksheet 1 RegineBaby Babe100% (1)

- Advance Payment of Revenues: Liability MethodДокумент9 страницAdvance Payment of Revenues: Liability MethodDan Ryan100% (1)

- Chapter 9 Special and Combination Journals, and Voucher SystemДокумент3 страницыChapter 9 Special and Combination Journals, and Voucher SystemZyrene Kei Reyes100% (3)

- Recording Transactions in A Financial Transaction WorksheetДокумент1 страницаRecording Transactions in A Financial Transaction WorksheetSHEОценок пока нет

- Illustration Chapter 1 1Документ7 страницIllustration Chapter 1 1PrincesipieОценок пока нет

- Lucero - Jose - Rizal - Heavy - Bombers - Statement - of - Cash - FlowsДокумент1 страницаLucero - Jose - Rizal - Heavy - Bombers - Statement - of - Cash - FlowsKemerut100% (1)

- Lumen AlmacharДокумент21 страницаLumen AlmacharbelliissiimmaaОценок пока нет

- WORKSHEETДокумент36 страницWORKSHEETNe Il100% (3)

- Activity 25 - Journal Entry To Post-ClosingДокумент23 страницыActivity 25 - Journal Entry To Post-ClosingAdam Cuenca100% (1)

- Wawa Trading EditedДокумент22 страницыWawa Trading EditedAngela Dane JavierОценок пока нет

- Chapter 6 Win Ballada 2019Документ7 страницChapter 6 Win Ballada 2019Rea Mariz JordanОценок пока нет

- Edgar Detoya-Answer KeyДокумент14 страницEdgar Detoya-Answer KeyAMBER GAMERОценок пока нет

- Of The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesДокумент5 страницOf The Account Would Be Recorded.: Instructions. Identify The Manner in Which The Each of The Increases or DecreasesLoriОценок пока нет

- The Accounting CycleДокумент34 страницыThe Accounting CycleMarriel Fate CullanoОценок пока нет

- Comprehensive ProblemДокумент14 страницComprehensive ProblemMarian Augelio PolancoОценок пока нет

- AdjustingДокумент39 страницAdjustingRica mae camon100% (1)

- PostingandTrialBalance Kareen LeonДокумент7 страницPostingandTrialBalance Kareen LeonMerdwindelle AllagonesОценок пока нет

- Ricard PangabnДокумент15 страницRicard PangabnTey-yah Malumbres100% (5)

- Problem 5xДокумент4 страницыProblem 5xMAXINE CLAIRE CUTINGОценок пока нет

- Chapter 8-Problem 9Документ4 страницыChapter 8-Problem 9kakaoОценок пока нет

- Journal (Remedios Palaganas)Документ2 страницыJournal (Remedios Palaganas)Mika CunananОценок пока нет

- Journal Entries: Edgar DetoyaДокумент17 страницJournal Entries: Edgar DetoyaAntonОценок пока нет

- Accounting Activities - MerchandisingДокумент6 страницAccounting Activities - MerchandisingJoyОценок пока нет

- Ricardo PanganДокумент3 страницыRicardo PanganNej NejОценок пока нет

- Finals Graded Exercises 005 Journalizing Under Merchandising Concern With Vat Answer KeyДокумент20 страницFinals Graded Exercises 005 Journalizing Under Merchandising Concern With Vat Answer KeyGarpt KudasaiОценок пока нет

- Microsoft OneDrive Batch 5Документ84 страницыMicrosoft OneDrive Batch 5Danjie BarriosОценок пока нет

- MICROSOFT OFFICE 365 POWERPOINT - Sir KentДокумент52 страницыMICROSOFT OFFICE 365 POWERPOINT - Sir KentDanjie BarriosОценок пока нет

- DM No. 165 S. 2021 Addendum Corrigendum To Division Memorandum No. 83 S. 2021 Entitled Ranking of Internal Applicants For Senior High School Teaching PositionsДокумент7 страницDM No. 165 S. 2021 Addendum Corrigendum To Division Memorandum No. 83 S. 2021 Entitled Ranking of Internal Applicants For Senior High School Teaching PositionsDanjie BarriosОценок пока нет

- Microsoft Educator Community PDFДокумент40 страницMicrosoft Educator Community PDFDanjie BarriosОценок пока нет

- DM NO. 124, S. 2020 - Addendum To 0365 Webinar How To Teach Online Batch 2Документ10 страницDM NO. 124, S. 2020 - Addendum To 0365 Webinar How To Teach Online Batch 2Danjie BarriosОценок пока нет

- Microsoft Teams Ver 2Документ65 страницMicrosoft Teams Ver 2Danjie BarriosОценок пока нет

- DM NO. 329, S. 2020 - Year-End In-Service Training of Teachers 2020Документ1 страницаDM NO. 329, S. 2020 - Year-End In-Service Training of Teachers 2020Danjie BarriosОценок пока нет

- DM NO. 141, S. 2020 - Online Training of Teachers For Remote Teaching and LearningДокумент2 страницыDM NO. 141, S. 2020 - Online Training of Teachers For Remote Teaching and LearningDanjie BarriosОценок пока нет

- Department of Education: Division of Lapu-Lapu CityДокумент1 страницаDepartment of Education: Division of Lapu-Lapu CityDanjie BarriosОценок пока нет

- Department of Education: Division of Lapu-Lapu CityДокумент1 страницаDepartment of Education: Division of Lapu-Lapu CityDanjie BarriosОценок пока нет

- DM NO. 135, S. 2020 - Addendum To 0365 Webinar, How To Teach Online Batch 5Документ10 страницDM NO. 135, S. 2020 - Addendum To 0365 Webinar, How To Teach Online Batch 5Danjie BarriosОценок пока нет

- DM NO. 124, S. 2020 - Addendum To 0365 Webinar How To Teach Online Batch 2Документ10 страницDM NO. 124, S. 2020 - Addendum To 0365 Webinar How To Teach Online Batch 2Danjie BarriosОценок пока нет

- Department of Education: Division of Lapu-Lapu CityДокумент2 страницыDepartment of Education: Division of Lapu-Lapu CityDanjie BarriosОценок пока нет

- Tips To Write A Module Teachnical AssistanceДокумент9 страницTips To Write A Module Teachnical AssistanceDanjie BarriosОценок пока нет

- LESSON 1: Introduction: The Concepts of Politics and GovernanceДокумент28 страницLESSON 1: Introduction: The Concepts of Politics and GovernanceJohn Dave RacuyaОценок пока нет

- Department of Education: Division of Lapu-Lapu CityДокумент2 страницыDepartment of Education: Division of Lapu-Lapu CityDanjie BarriosОценок пока нет

- Tips To Write A Module Teachnical AssistanceДокумент9 страницTips To Write A Module Teachnical AssistanceDanjie BarriosОценок пока нет

- List of Social Sciences Subjects With MELCS and Timeframe DeliverableДокумент1 страницаList of Social Sciences Subjects With MELCS and Timeframe DeliverableDanjie BarriosОценок пока нет

- Weddings R UsДокумент1 страницаWeddings R UsDanjie Barrios67% (3)

- Plagiarism and Most Frequently Asked Questions (Faqs) From The Bureau of Learning Resources (BLR), Deped Central OfficeДокумент9 страницPlagiarism and Most Frequently Asked Questions (Faqs) From The Bureau of Learning Resources (BLR), Deped Central OfficeDanjie BarriosОценок пока нет

- List of Social Sciences Subjects With MELCS and Timeframe DeliverableДокумент1 страницаList of Social Sciences Subjects With MELCS and Timeframe DeliverableDanjie BarriosОценок пока нет

- Ricardo Pangan ActivityДокумент1 страницаRicardo Pangan ActivityDanjie Barrios50% (2)

- LESSON 1: Introduction: The Concepts of Politics and GovernanceДокумент28 страницLESSON 1: Introduction: The Concepts of Politics and GovernanceJohn Dave RacuyaОценок пока нет

- Weddings R UsДокумент1 страницаWeddings R UsDanjie Barrios67% (3)

- Acar 07-Use of Cot in RpmsДокумент33 страницыAcar 07-Use of Cot in RpmsDanjie BarriosОценок пока нет

- Cordova Public CollegeДокумент2 страницыCordova Public CollegeDanjie BarriosОценок пока нет

- APU All IncludedДокумент69 страницAPU All IncludedEnxzol KehhОценок пока нет

- Daily Report 192 27-08-2021Документ176 страницDaily Report 192 27-08-2021jay ResearchОценок пока нет

- Characteristics of Business Economics1Документ6 страницCharacteristics of Business Economics1ihavenoidea33Оценок пока нет

- Accounts Suggested Ans CAF Nov 20Документ25 страницAccounts Suggested Ans CAF Nov 20Anshu DasОценок пока нет

- Analisis Kinerja Keuangan PT - Bank Mandiri Syariah, TBK Periode 2016-2020 Menggunakan Metode Du Pont SystemДокумент7 страницAnalisis Kinerja Keuangan PT - Bank Mandiri Syariah, TBK Periode 2016-2020 Menggunakan Metode Du Pont SystemJasika Jurnal Sistem Informasi AkuntansiОценок пока нет

- Takeover and AcquisitionsДокумент42 страницыTakeover and Acquisitionsparasjain100% (1)

- Priority Sector LendingДокумент21 страницаPriority Sector LendingPrathap G MОценок пока нет

- Financial LiteracyДокумент22 страницыFinancial LiteracyRio Albarico100% (1)

- FGE Chapterr 1 PPTXДокумент53 страницыFGE Chapterr 1 PPTXDEREJEОценок пока нет

- Enterpernurship NotesДокумент85 страницEnterpernurship NotesSaaid ArifОценок пока нет

- Introduction TABДокумент2 страницыIntroduction TABShreshtha ShahОценок пока нет

- Chapter 5: Strategic Capacity Planning For Products and ServicesДокумент17 страницChapter 5: Strategic Capacity Planning For Products and ServicesAliah RomeroОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)RehanОценок пока нет

- Basics of Accounting in Small Business NewДокумент50 страницBasics of Accounting in Small Business NewMohammed Awwal NdayakoОценок пока нет

- CGISA and Board Prescribed Textbooks 2023Документ5 страницCGISA and Board Prescribed Textbooks 2023MichaelОценок пока нет

- Business 9 Week 1 2nd Term Chapter 1 Part 3Документ17 страницBusiness 9 Week 1 2nd Term Chapter 1 Part 3cecilia capiliОценок пока нет

- Auditing The Investing and Financing Cycles PDFДокумент6 страницAuditing The Investing and Financing Cycles PDFGlenn TaduranОценок пока нет

- Ministry of Education: Teaching Syllabus For Financial Accounting (SHS 1 - 3)Документ79 страницMinistry of Education: Teaching Syllabus For Financial Accounting (SHS 1 - 3)Kingsford DampsonОценок пока нет

- Institutional Membership FormДокумент2 страницыInstitutional Membership Formdhruvi108Оценок пока нет

- Non Taxable Income, Income From Salary and Income From HPДокумент35 страницNon Taxable Income, Income From Salary and Income From HPAnonymous ckTjn7RCq8Оценок пока нет

- Revenue Regulations No. 02-40Документ39 страницRevenue Regulations No. 02-40saintkarri92% (12)

- A Study On Technical Analysi in Selected Sectors at Karvy Stock Broking LTD., HubliДокумент81 страницаA Study On Technical Analysi in Selected Sectors at Karvy Stock Broking LTD., HublighbdgbgdbОценок пока нет

- AcquisiShares - Sinar MekarДокумент3 страницыAcquisiShares - Sinar Mekarnickong53Оценок пока нет

- Cost Behaviour & Decision Making - HodДокумент65 страницCost Behaviour & Decision Making - Hodsrimant100% (2)

- May 2019 Professional Examinations Public Sector Accounting & Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeДокумент24 страницыMay 2019 Professional Examinations Public Sector Accounting & Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeMahama JinaporОценок пока нет

- Understanding Margins PDFДокумент23 страницыUnderstanding Margins PDFDiego BittencourtОценок пока нет

- E) Growth and Survival of FirmsДокумент6 страницE) Growth and Survival of FirmsRACSO elimuОценок пока нет

- SOLVED - IAS 7 Statement of Cash FlowsДокумент16 страницSOLVED - IAS 7 Statement of Cash FlowsMadu maduОценок пока нет

- 6582 The Australians LLC 20141231Документ2 страницы6582 The Australians LLC 20141231Angelo PuraОценок пока нет

- Problem 1-1: Problem 1-2 Cash and Cash EquivalentsДокумент14 страницProblem 1-1: Problem 1-2 Cash and Cash EquivalentsAcissejОценок пока нет