Академический Документы

Профессиональный Документы

Культура Документы

AT - CDrill9 - Simulated Examination DIY PDF

Загружено:

MaeОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

AT - CDrill9 - Simulated Examination DIY PDF

Загружено:

MaeАвторское право:

Доступные форматы

Since 1977

AUDITING THEORY L. R. CABARLES/J.M. D. MAGLINAO

AT.CDrill9—Simulated Examination (DIY) MAY 2020

The Practitioner’s Engagements 9. Which of the following is not a financial statement

1. Which of the following services is the broadest and assertion relating to account balances?

most inclusive? a. Completeness. c. Rights and obligations.

a. Audit c. Assurance b. Existence. d. Valuation and competence.

b. Attestation d. Compliance

10. Which of the following is true concerning audit risk?

2. Which one of the following is not a key attribute a. Audit risk is a function of only inherent risk and

needed to perform assurance? control risk.

a. Subject matter knowledge b. Audit risk includes the risk that the auditor might

b. An assurance service provide and its independence express an opinion that the financial statements

c. Established criteria or standards are materially misstated when they are not.

d. Accounting skills c. Audit risk includes the auditor’s business risks,

such as losses from litigation.

3. Which of the following services would be most likely to d. Audit risk is a function of the risks of material

be structured as an assurance engagement? misstatement and detection risk.

a. Advocating a client’s position in tax matter.

b. A consulting engagement to develop a new data Audit Evidence and Documentation: The Framework

base system for the revenue cycle. 11. Identify the nature of the evidential matter, (AR for

c. An engagement to issue a report addressing an accounting records, OI for other information)

entity’s compliance with requirements of specified • Lawyer’s reply on status of legal cases

laws. • Minutes of board and stockholders meetings

d. The compilation of a client’s forecast information. • Worksheets in support of cost allocations

• Benchmarking

Auditing: An Overview • Invoices, paid checks, vouchers

Auditing in General The following are the respective nature of evidential

4. The main objective of operations auditing is matter:

a. To verify fulfillment of plans and sound business a. OI, AR, OI, AR, AR c. OI, OI, AR, OI, AR

requirements. b. AR, OI, AR, OI, AR d. AR, AR, OI, AR, AR

b. To evaluate the integrity of accounting information.

c. To measure and evaluate the effectiveness of 12. Reperformance

controls. a. Consists of looking at a process or procedure being

d. To produce results as desired or directed. performed by others.

b. Consists of seeking information of knowledgeable

5. What of the following is the criteria used in a persons, both financial and non-financial,

compliance audit? throughout the entity or outside the party.

a. Effectiveness and efficiency c. Company policies c. Is the process of obtaining a representation of

b. Rules and regulations d. Both B and C information or of an existing condition directly from

a third party.

F/S Audit d. Is the auditor’s independent execution of

6. According to PSAs, because there are inherent procedures or controls that were originally

limitations in an audit that affect the auditor’s ability to performed as part of the entity’s internal control.

detect material misstatements, the auditor is

a. A guarantor but not an insurer of the FSs 13. Which statement is incorrect regarding inspection as

b. An insurer but not a guarantor of the FSs an audit procedure?

c. Both a guarantor and an insurer of the FSs a. Inspection consists of examining records or

d. Neither a guarantor nor an insurer of the FSs documents or physical examination of assets.

b. Inspection of tangible assets may provide reliable

7. Management of a company is responsible for audit evidence with respect to their existence and

a. Hiring the auditor about the entity’s rights and obligations on the

b. Preparing the financial statements assets.

c. The audit workpapers c. Inspection of individual inventory items ordinarily

d. Independence and obtaining evidence accompanies the observation of inventory

counting.

8. Which of the following most accurately defines d. Some documents represent direct audit evidence

professional skepticism as it is used in auditing of the existence of an asset.

standards?

a. It either assumes management is honest or slightly 14. Which of the following is not a primary purpose of

dishonest, but neither all the time. audit working papers?

b. It neither assumes that management is dishonest a. To coordinate the examination.

nor assumes unquestioned honesty. b. To assist in preparation of the audit report.

c. It assumes management is honest most of the c. To support the financial statements.

time. d. To provide evidence of the audit work performed.

d. It assumes that management is dishonest in only

rare instances.

Page 1 of 10 www.prtc.com.ph AT.CDrill9

EXCEL PROFESSIONAL SERVICES, INC.

15. The permanent files included as part of audit b. Assess the control risk at the maximum level and

documentation do not normally include: perform a primarily substantive audit

a. a copy of the current and prior years’ audit c. Decline to accept or perform the audit

programs. d. Modify the scope of the audit to reflect an

b. copies of articles of incorporation, bylaws and increased risk of material misstatement due to

contracts. fraud

c. information related to the understanding of

internal control. Planning an Audit

d. results of analytical procedures from prior years. 22. Which of the following procedures would an auditor

ordinarily perform during an audit planning?

16. Working papers prepared by a CPA in connection with a. Review the client’s bank reconciliation

an audit engagement are owned by the CPA, subject to b. Obtain client’s representation letter

certain limitations. The rationale for this rule is to c. Obtain understanding of the client’s business and

a. Protect the working papers from being industry

subpoenaed. d. Review and evaluate client’s internal control

b. Provide the basis for excluding admission of the

working papers as evidence because of the 23. Which of the following procedures is not performed as

privileged communication rule. a part of planning an audit engagement?

c. Provide the CPA with evidence and documentation a. Performing analytical procedures

which may be helpful in the event of a lawsuit. b. Reviewing the working papers of the prior year

d. Establish a continuity of relationship with the client c. Designing an overall audit strategy and audit

whereby indiscriminate replacement of CPAs is program/plan

discouraged. d. Testing of controls

Performing Preliminary Engagement Activities 24. A listing of all the things which the auditor will do to

17. Which of the following factors most likely would cause gather sufficient, competent evidence is the:

a CPA to not accept a new audit engagement? a. Audit strategy c. Audit procedure

a. The prospective client has fired its prior auditor. b. Audit program d. Audit risk model

b. The CPA lacks a thorough understanding of the

prospective client's operations and industry. Determining Materiality

c. The CPA is unable to review the predecessor 25. When planning an examination, an auditor should

auditor's working papers. a. Consider whether the extent of substantive tests

d. The prospective client is unwilling to make financial may be reduced based on the results of the

records available to the CPA or is unwillingness to internal control questionnaire.

permit inquiry of its legal counsel. b. Make preliminary judgments about materiality

levels for audit purposes.

18. Before accepting an engagement to audit a new client, c. Conclude whether changes in compliance with

a CPA is required to obtain prescribed control procedures justifies reliance on

a. A preliminary understanding of the prospective them

client’s industry and business. d. Prepare a preliminary draft of the management

b. The prospective client’s signature to the representation letter.

engagement letter.

c. An understanding of the prospective client’s control 26. Since materiality is relative, it is necessary to have

environment. bases for establishing whether misstatements are

d. A representation letter from the prospective client. material. Normally, the most common base for

deciding materiality is:

19. Before accepting an audit engagement, a successor a. Net income before taxes c. Working capital

auditor should make specific inquiries of the b. Net income after taxes d. Total assets

predecessor auditor regarding the predecessor’s

a. opinion of any subsequent events occurring since 27. Only the amount of misstatements need to be

the predecessor’s audit report was issued considered in assessing materiality.

b. understanding as to the reasons for the change of

auditors Both the amount and nature of misstatements need to

c. awareness of the consistency in the application of be considered in assessing materiality.

GAAP between periods a. True, True c. False, False

d. evaluation of all matters of continuing accounting b. False, True d. True, False

significance

Understanding the Entity and its Environment

20. Before performing any audit procedures. The auditor 28. Of the following procedures, which is not considered

and the client should agree on the part of “obtaining an understanding of the client’s

environment?”

Type of opinion to be Terms of the a. Examining trade publications to gain a better

expressed engagement understanding of the client's industry.

a. Yes Yes b. Confirming customer accounts receivable for

b. No Yes existence and valuation.

c. No Yes c. Touring the client's manufacturing and

d. Yes Yes warehousing facilities to gain a clearer

understanding of operations.

21. If the auditor believes that an understanding with the d. Studying the internal controls over cash receipts

client has not been established, he or she should and disbursements.

ordinarily

a. Perform the audit with increased professional

skepticism

Page 2 of 10 www.prtc.com.ph AT.CDrill9

EXCEL PROFESSIONAL SERVICES, INC.

29. Analytical procedures are used for the following properly approved shipping order and bill of lading

purposes except signed by the carrier.

a. To assist the auditor in planning the nature, timing d. Forward a copy a the signed bill of lading to the

and extent of other auditing procedures. stores manager.

b. As a substantive test to obtain evidential matter

about a particular assertion related to account 35. The accounts payable department generally should

balances or classes of transactions. a. Cancel supporting documentation after a cash

c. As an overall review of financial information in the payment is mailed

final review stage of the audit. b. Approve the price and quantity of each purchase

d. To evaluate the effectiveness of the client’s requisition

internal control. c. Assure that the quantity ordered is omitted from

the receiving department’s copy of the purchase

Understanding the Entity’s Internal Control order

30. The following are the components of the internal d. Agree the vendor’s invoice with the receiving

control, except report and purchase order

a. Risk assessment process

b. Monitoring 36. With regard to the physical count of inventory,

c. Control activities necessary control procedures include:

d. Control risk a. proper instructions for the physical count.

b. independent third-party verification of the counts.

31. Management philosophy and operating style most c. third-party reconciliations of the physical counts

likely would have a significant influence on an entity's with perpetual inventory master files.

control environment when d. counting the inventory only on the year-end date.

a. The internal auditor reports directly to

management. 37. In meeting the control objective of safeguarding of

b. Management is dominated by one individual. assets, which department should be responsible for

c. Accurate management job descriptions delineate Distribution of Custody of

specific duties. paychecks unclaimed paychecks

d. The audit committee actively oversees the financial a. Treasurer Treasurer

reporting process. b. Payroll Treasurer

c. Treasurer Payroll

32. Incompatible duties most likely would not be d. Payroll Payroll

considered an inherent limitation of the potential

effectiveness of an entity’s internal control. 38. Responsibility for the issuance of new notes payable

should be vested in the:

Mistakes in judgment most likely would not be a. board of directors.

considered an inherent limitation of the potential b. purchasing department.

effectiveness of an entity’s internal control. c. accounting department.

d. accounts payable department.

Collusion among employees most likely would not be

considered an inherent limitation of the potential 39. It should ordinarily be unnecessary to examine

effectiveness of an entity’s internal control. supporting documentation for each addition to

a. first statement is not correct; the second and third property, plant, and equipment, but it is customary to

statements are correct. verify:

b. all above statements are correct. a. all large transactions.

c. first statement is correct; the second and third b. all unusual transactions.

statements are not correct. c. a representative sample of typical additions.

d. second statement is correct; the first and third d. all three of the above.

statements are not correct.

Identifying and Assessing ROMM

33. The performance of walkthroughs provides the auditor 40. Inherent risk is _______ related to detection risk and

with primary evidence to _______ related to the amount of audit evidence.

Evaluate the Confirm whether controls a. directly, inversely c. inversely, inversely

effectiveness of the have been placed in b. directly, directly d. inversely, directly

design of controls operation

a. Yes Yes 41. An auditor assesses control risk because it

b. Yes No a. Is relevant to the auditor's understanding of the

c. No Yes control environment.

d. No No b. Provides assurance that the auditor's materiality

levels are appropriate.

Internal Control—Transaction Cycles c. Indicates to the auditor where inherent risk may

34. The most effective control to prevent unbilled and be the greatest.

unrecorded shipments of finished goods is to d. Affects the level of detection risk that the auditor

a. Require all outgoing shipments to be accompanied may accept.

by a prenumbered shipping order and bill of lading

(signed by the carrier). Forward a copy of these 42. In an audit of a company’s financial statements, the

documents to accounting, to be placed in an open auditors identify significant risks. These risks often

file awaiting receipt of the customer invoice copy. a. Involve routine, high-volume transactions.

b. Forward a copy of the shipping order and bill of b. Do not require special audit attention.

lading to billing. c. Involve items with lower levels of inherent risk.

c. Implement a policy that prevents sales invoices d. Involve judgmental matters.

from being mailed to customers in the absence of a

Page 3 of 10 www.prtc.com.ph AT.CDrill9

EXCEL PROFESSIONAL SERVICES, INC.

Responding to Assessed Risks 50. An auditor who uses statistical sampling for attributes

43. Shown below (1 through 5) are the five types of tests in testing internal controls should increase the

which auditors use to determine whether financial assessed level of control risk (CR is high) when the

statements are fairly stated. Which three are a. Sample rate of deviation is less than the expected

substantive tests? rate of deviation used in planning the sample.

1. procedures to obtain an understanding of internal b. Tolerable rate less the allowance for sampling risk

control exceeds the sample rate of deviation.

2. tests of controls c. Sample rate of deviation plus the allowance for

3. tests of transactions sampling risk exceeds the tolerable rate.

4. analytical procedures d. Sample rate of deviation plus the allowance for

5. tests of details of balances sampling risk equals the tolerable rate.

a. 1, 2, and 3. c. 2, 3, and 5.

b. 3, 4, and 5. d. 2, 3, and 4. 51. Which of the following methods of sample selection are

acceptable when using statistical sampling in an audit

44. The extent of procedures is affected mostly by which of of financial statements?

the following factors? a. Haphazard selection only

a. the sheer volume of procedures to be applied by b. Random selection, systematic selection, and

the auditor. haphazard sampling only

b. the time of year in which the client takes a physical c. Random selection and systematic selection only

inventory in the warehouse. d. Random selection only

c. the auditor's judgment that misstatements are

probable in certain balances. 52. In applying variables sampling, an auditor attempts to

d. the availability of the client's staff at or near the a. Estimate a qualitative characteristic of interest

balance sheet date. b. Determine various rates of occurrence for specified

attributes

Determining the Extent of Testing c. Discover at least one instance of a critical error

45. Which of the following best illustrates the concept of d. Predict monetary population value within a range

sampling risk? of precision

a. A randomly chosen sample may not be

representative of the population as a whole on the 53. The advantage of systematic sample selection is that:

characteristic of interest. a. it is easy to use.

b. An auditor may select audit procedures that are b. there is limited possibility of it being biased.

not appropriate to achieve the specific objective. c. it is unnecessary to determine if the population is

c. An auditor may fail to recognize errors in the arranged randomly.

documents examined for the chosen sample. d. it automatically selects items material to the

d. The documents related to the chosen sample may financial statements.

not be available for inspection.

54. The process which requires the calculation of an

46. In assessing sampling risk, the risk of assessing interval and then selects the items based on the size of

control risk too high (under reliance) and risk of the interval is:

incorrect rejection relate to the a. statistical sampling.

a. Efficiency of the audit. b. random sample selection.

b. Effectiveness of the audit. c. systematic sample selection.

c. Selection of the sample. d. computerized sample selection.

d. Audit quality controls.

Considering Fraud and Error, and NOCLAR

47. An advantage of using statistical over nonstatistical Fraud and Error

sampling methods in tests of controls is that the 55. Which statement is (are) incorrect regarding fraud?

statistical methods a. Auditors make legal determinations of whether

a. Can more easily convert the sample into a dual- fraud has actually occurred

purpose test useful for substantive testing. b. Fraud involving one or more members of

b. Eliminate the need to use judgment in determining management or those charged with governance is

appropriate sample sizes. referred to as “employee fraud”

c. Afford greater assurance than a nonstatistical sam- c. Fraud involving only employees of the entity is

ple of equal size. referred to as “management fraud”

d. Provide an objective basis for quantitatively evalu- d. All of the above

ating sample risk.

56. Fraudulent financial reporting is often called:

48. One cause of nonsampling risk is: a. management fraud. c. defalcation.

a. ineffective use of audit procedures. b. theft of assets. d. embezzlement.

b. testing less than the entire population.

c. use of extensive tests of controls. 57. In general, material fraud perpetrated by which of the

d. the possibility that a properly-selected sample still following are most difficult to detect?

may not be representative. a. Cashier. c. Keypunch operator.

b. Internal auditor. d. Controller.

49. To determine the sample size for a test of control, an

auditor should consider the tolerable rate of deviation, 58. The most difficult type of misstatement to detect is

the allowable risk of assessing control risk too low, and fraud based on

the a. The overrecording of transactions.

a. Expected deviation rate b. The nonrecording of transactions.

b. Upper precision limit c. Recorded transactions in subsidiaries or incorrect

c. Risk of incorrect acceptance postings of recorded transactions.

d. Risk of incorrect rejection d. Related-party receivables.

Page 4 of 10 www.prtc.com.ph AT.CDrill9

EXCEL PROFESSIONAL SERVICES, INC.

59. The primary responsibility for the prevention and NOCLAR

detection of fraud and error rests with. 67. When the auditor becomes aware of information

a. Auditor c. TCWG concerning a possible noncompliance to laws or

b. Management d. Both b and c regulations, the auditor should appropriately:

a. Obtain an understanding of the nature of the act

60. Which of the following is not a category of fraud risk and the circumstances in which it has occurred,

factors (whose presence often has been observed in and evaluate the possible effect on the financial

circumstances where frauds have occurred) in relation statements.

to misstatements arising from misappropriation of b. Discuss his suspicion with the management.

assets and fraudulent financial reporting? c. Ask management to determine whether a violation

a. Attitudes/Rationalizations c. Opportunities is really committed.

b. Pressures/Incentives d. Controls d. Consult with the entity’s legal counsel as to what

appropriate action the auditor should do.

61. The following are examples of circumstances that may

indicate the possibility that the financial statements 68. Most illegal acts affect the financial statements:

may contain a material misstatement resulting from a. directly.

fraud, except b. only indirectly.

a. Fewer responses to confirmations than anticipated c. both directly and indirectly.

or a greater number of responses than anticipated. d. materially if direct; immaterially if indirect.

b. Large numbers of debit entries and other

adjustments made to accounts receivable records. 69. The following are conditions that non-compliance may

c. Missing inventory or physical assets of significant have occurred, except

magnitude. a. Payments for unspecified services or loans to

d. Unusual discrepancies between the entity's records consultants, related parties, employees or

and confirmation replies. government employees

b. Existence of an accounting system which fails,

62. Which of the following could indicate that the risk of whether by design or by accident, to provide an

fraud and other irregularities perpetrated by senior adequate audit trail or sufficient evidence.

management is higher than normal? c. Unusual payments in cash, purchases in the form

a. There are very few related party transactions. of cashiers’ cheques payable to bearer or transfers

b. The auditor has not audited this client before. to numbered bank accounts.

c. Management turnover is unusually high. d. Sales commissions or agent's fees that appear

d. The auditor discovers a GAAP departure during the reasonable in relation to those ordinarily paid by

audit. the entity or in its industry or to the services

actually received.

63. Which of the following risks of fraud should ordinarily

be presumed on a financial statement audit by the Considering Work of Other Practitioners

audit team? 70. If the independent auditors decide that the work

a. Chief financial officer misappropriation of funds. performed by the internal auditor may have a bearing

b. Misapplication of revenue recognition principles. on their own procedures, they should consider the

c. Management's inappropriate use of reserves. internal auditor's

d. Lack of expenses related to stock options. a. Competence and objectivity.

b. Efficiency and experience.

64. Which of the following is least likely to be required on c. Independence and review skills.

an audit in accordance with PSAs? d. Training and supervisory skills.

a. Test appropriateness of journal entries and

adjustment. 71. During an audit, the auditor may need the assistance

b. Review accounting estimates for biases. of an expert in obtaining sufficient appropriate

c. Evaluate the business rationale for significant evidence. A common example is

unusual transactions. a. Determining the sufficiency and appropriateness of

d. Make a legal determination of whether fraud has evidential matter obtained.

occurred. b. Evaluating the potential financial statements effect

of an employee fraud.

65. What is the best method an auditor may use to detect c. Evaluating the integrity of management.

fraud in the financial statements of clients? d. Determination of amounts using actuarial

a. Use professional skepticism. computations.

b. Understand and properly apply Generally Accepted

Accounting Standards. Considering Certain F/S Items

c. Brainstorm with the client to find the types of fraud 72. Which of the following is true concerning the audit of

occurring. the cash account?

d. Actively search for all errors in the financial a. A recommended audit step in the audit of cash

statements. accounts is to verify all adjusting entries and year-

end accruals.

66. The most effective way to prevent and deter fraud is b. There are no disclosure requirements for the cash

to: account, since the amount is already stated at its

a. implement programs and controls that are based fair market value.

on core values embraced by the company. c. Valuation is only an issue if there is a foreign

b. hire highly ethical employees. currency account.

c. communicate expectations to all employees on an d. The most important assertion for the cash account

annual basis. is accuracy.

d. terminate employees who are suspected of

committing fraud.

Page 5 of 10 www.prtc.com.ph AT.CDrill9

EXCEL PROFESSIONAL SERVICES, INC.

73. Which of the following statements about confirmations 79. Which of the following audit procedures would provide

that traditionally been used to verify bank balances the least reliable evidence that the client has legal title

and accounts receivable is true? to inventories?

a. Confirmations are expensive and so are often not a. Confirmation of inventories at locations outside the

used. client’s facilities

b. Confirmations may inconvenience those asked to b. Analytical review of inventory balances compared

supply them, but they are widely used. to purchasing and sales activities

c. Confirmations are sometimes not reliable and so c. Observation of physical inventory counts

auditors use them only as necessary and properly d. Examination of paid vendor’s invoices

controlled.

d. Confirmations are required for several balance 80. An auditor would be least likely to use confirmations in

sheet accounts but no income statement accounts. connection with the examination of:

a. inventories.

74. On the last day of the fiscal year, the cash b. long-term debt.

disbursements clerk drew a company check on bank A c. property, plant, and equipment.

and deposited the check in the company account in d. stockholders’ equity.

bank B to cover a previous theft of cash. The

disbursement has not been recorded. The auditor will 81. In evaluating the reasonableness of an entity's

best detect this form of kiting by: accounting estimates, an auditor normally would be

a. examining the composition of deposits in both concerned about assumptions that are

bank A and bank B subsequent to year-end. a. Susceptible to bias.

b. examining paid checks returned with the bank b. Consistent with prior periods.

statement of the next account period after year- c. Insensitive to variations.

end. d. Similar to industry guidelines.

c. preparing, from the cash disbursements records, a

summary of bank transfers for one week prior to 82. Which of the following statements is correct concerning

and subsequent to year-end. related-party transactions?

d. comparing the detail of cash receipts as shown by a. In the absence of evidence to the contrary,

the client’s cash receipts records with the detail on related-party transactions should be assumed to

the confirmed duplicate deposit tickets for three be outside the ordinary course of business.

days prior to and subsequent to year-end. b. An auditor should determine whether a particular

transaction would have occurred if the parties had

75. The cashier of Brooke Company covered a shortage in not been related.

the cash working fund with cash obtained on December c. An auditor should substantiate that related-party

31 from a local bank by cashing, but not recording, a transactions were consummated on terms

check drawn on the Company's out-of-town bank. How equivalent to those that prevail in arm’s-length

would the auditor discover this manipulation? transactions.

a. Confirming all December 31 bank balances d. The audit procedures directed toward identifying

b. Counting the cash working fund at the close of related-party transactions should include

business on December 31 considering whether transactions are occurring,

c. Preparing independent bank reconciliations as of but are not being given proper accounting

December 31 recognition.

d. Preparing and detail testing a bank transfer

schedule 83. The auditor should carry out procedures in order to

become aware of any litigation and claims involving

76. An auditor is examining accounts receivable. What is the entity which may have a material effect on the

the most competent type of evidence in this situation? financial statements. Such procedures least likely

a. Interviewing the personnel who record accounts include

receivable. a. Making appropriate inquiries of management

b. Verifying that postings to the receivable account including obtaining representations.

from journals have been made. b. Reviewing board minutes and correspondence with

c. Receipt by the auditor of a positive confirmation. the entity’s lawyers.

d. No response received for a request for a negative c. Examining interest expense accounts.

confirmation. d. Using any information obtained regarding the

entity’s business including information obtained

77. An auditor concluded that no excessive costs for idle from discussions with any in-house legal

plant were charged to inventory. This conclusion most department.

likely related to the auditor's objective to obtain

evidence about the financial statement assertions 84. Which of the following statements extracted from a

regarding inventory, including presentation and client's lawyer's letter concerning litigation, claims, and

disclosure and assessments most likely would cause the auditor to

a. Valuation. c. Existence. request clarification?

b. Completeness. d. Rights. a. "I believe that the possible liability to the company

is nominal in amount."

78. Which of the following statements relates to the b. "I believe that the action can be settled for less

ownership assertion? than the damages claimed."

a. Inventory listings are accurately included in the c. "I believe that the plaintiff's case against the

inventory accounts. company is without merit."

b. Inventory excludes items billed to customers. d. "I believe that the company will be able to defend

c. Inventory is properly classified as a current asset. this action successfully."

d. Inventory is properly stated at cost.

Page 6 of 10 www.prtc.com.ph AT.CDrill9

EXCEL PROFESSIONAL SERVICES, INC.

85. If the auditor concludes that there may be a going disclaimer of opinion.

concern problem, the auditor should do which of the b. A material departure from PFRS results in either a

following? qualified or adverse opinion.

a. withdraw from the engagement. c. A client’s refusal to furnish written representations

b. issue a qualified or adverse opinion. generally results in a disclaimer of opinion.

c. identify and assess management's plan to d. The omission of a statement of cash flows may

overcome the problem. result in a qualified opinion.

d. communicate this fact with management one level

above the controller. 93. An auditor includes a separate paragraph in an

otherwise unmodified report to emphasize that the

Completing the Audit and Considering Post-audit entity being reported on had significant transactions

Responsibilities with related parties. The inclusion of this separate

86. If the balance sheet of a company is dated December paragraph

31, 2018, the audit report is dated February 8, 2019, a. Is considered an “except for” qualification of the

and both are released on February 15, 2019, this opinion.

indicates that the auditor has searched for subsequent b. Violates PSAs if this information is already

events that occurred up to: disclosed in notes to the financial statements.

a. December 31, 2018. c. February 8, 2019. c. Necessitates a revision of the opinion paragraph to

b. January 1, 2019. d. February 15, 2019. include the phrase “with the foregoing

explanation”.

87. Which one of the following is not a key condition d. Is appropriate and would not negate the

indicating doubt regarding an entity's ability to unqualified opinion.

continue as a going-concern?

a. Adverse key financial ratios. 94. Which of the following statements with respect to

b. Employee strike that halts operations for several comparative financial statements is true?

months. a. The auditor’s report must always refer to each

c. Company has not paid dividends to date. period for which financial statements are

d. Default on bank debt. presented.

b. The auditor’s report must refer to each period for

88. It is an accepted practice for external auditors to which financial statements are presented and on

request letter of representation from their clients. A which an audit opinion is expressed.

principal purpose of a letter of representation form the c. The auditor’s report must refer to each period for

client is to which financial statements are presented only

a. Discharge the auditor from legal liability of his when the comparative period was audited by

examination. another auditor.

b. Confirm in writing management’s approval of d. The auditor’s report must refer to both the current

limitations on the scope of audit. and comparative figures for non-listed entities, but

c. Serve as an introduction to company’s personnel refers only to the current year figures for listed

and authorization to examine the records. entities.

d. Remind management for its primary responsibility

for financial statements. 95. The expression of a qualified opinion means that the

financial statements, taken as a whole, in all material

89. Which of the following matters would an auditor most respects, are

likely include in a management representation letter? a. materially misstated.

a. Communications with the audit committee con- b. materially misleading.

cerning weaknesses in internal control. c. present fairly.

b. The completeness and availability of minutes of d. do not present fairly.

stockholders' and directors' meetings.

c. Plans to acquire or merge with other entities in the Performing and Reporting on Specialized Audit

subsequent year. Engagements

d. Management's acknowledgment of its responsibility 96. CPAs issue several types of “special audit reports.”

for the detection of employee fraud. Which of the following circumstances would not require

the issuance of a special audit report?

Forming the Auditor's Opinion and Report Contents a. The client’s financial statements are prepared

90. PSAs require the auditor to communicate all using the cash basis.

management frauds and illegal acts to the audit b. The client’s financial statements are prepared

committee: using the accrual basis.

a. only if the act is immaterial. c. The CPA has been retained to audit only the

b. only if the act is material. current assets.

c. only if the act is highly material. d. The CPA has been retained to review the internal

d. regardless of materiality. control system, not the financial statements.

91. If the audit team encounters difficulties in performing 97. An auditor's special report on financial statements

an audit, such matters must be communicated to prepared in conformity with the cash basis of

which party? accounting should include a separate explanatory

a. the SEC paragraph that

b. the audit committee a. Justifies the reasons for departing from generally

c. management accepted accounting principles.

d. the PCAOB b. States whether the financial statements are fairly

presented in conformity with another

92. Which of the following statements is incorrect? comprehensive basis of accounting.

a. Because of inadequate disclosures of material c. Refers to the note to the financial statements that

information, an auditor most likely would issue a describes the basis of accounting.

Page 7 of 10 www.prtc.com.ph AT.CDrill9

EXCEL PROFESSIONAL SERVICES, INC.

d. Explains how the results of operations differ from Code of Ethics for Professional Accountants

financial statements prepared in conformity with 106. The underlying reason for a code of professional

generally accepted accounting principles. conduct for any profession is:

a. the need for public confidence in the quality of

Performing Review and Other Assurance service of the profession.

Engagements b. that it provides a safeguard to keep unscrupulous

98. Which of the following procedures is not included in a people out.

review engagement on a nonpublic entity? c. that it is required by federal legislation.

a. Inquiries of management. d. that it allows licensing agencies to have a yardstick

b. Inquiries regarding events subsequent to the to measure deficient behavior.

balance sheet date.

c. Any procedures designed to identify relationships 107. Society has attached a special meaning to the term

among data that appear to be unusual. “professional.” A professional is:

d. A study and evaluation of internal control a. someone who has passed a qualifying exam to

structure. enter the job market.

b. a person who is expected to conduct himself or

99. Which of the following would be associated with a herself at a higher level than the requirements of

review engagement? society’s laws or regulations.

a. Substantive and compliance testing c. any person who receives pay for the services

b. Notice to reader report performed.

c. Conformity with GAAP and GAAS d. someone who has both an education in the trade

d. Negative assurance and on-the-job experience received under an

experienced supervisor.

100. Which of the following is a prospective financial

statement for general use upon which an accountant 108. A challenge associated with the Ethical Principles

may appropriately report? stated in the Code of Professional Conduct is:

a. Financial projection c. Pro forma FSs a. the emphasis on positive activities.

b. Partial presentation d. Financial forecasts b. that they identify ideal conduct.

c. the difficulty of enforcing principles, or general

Performing Related Services Engagements ideals.

101. An accountant’s report of factual findings is a form d. that there are too many to remember.

of report that is most likely to be issued in conjunction

with which of the following engagements a CPA may 109. In order to achieve the objectives of the

perform for a client? accountancy profession, professional accountants have

a. Engagement to perform agreed-upon procedures to observe a number of prerequisites or fundamental

b. Attest engagement principles. The fundamental principles include the

c. Assurance engagement following, except

d. Compilation engagement a. Professional behavior c. Independence

b. Confidentiality d. Objectivity

102. An accountant who is not independent may issue a

a. Compilation report. c. Comfort letter. 110. The principle of integrity imposes an obligation on

b. Review report. d. Qualified opinion. professional accountants to

a. Comply with relevant laws and regulations

Professional Standards, Quality Control, and b. Avoid any action that may bring discredit to the

Professional Liabilities profession

103. The least important evidence of a public accounting c. Both a and b

firm's evaluation of its system of quality controls would d. Neither a nor b

concern the firm's policies and procedures with respect

to 111. The principle of objectivity imposes which of the

a. Employment (hiring). following obligations on professional accountants?

b. Confidentiality of audit engagements. a. To maintain professional knowledge and skill at the

c. Assigning personnel to audit engagements. level required to ensure that clients or employers

d. Determination of audit fees. receive competent professional advice

b. To refrain from disclosing confidential information

104. Reviewing and coaching the work of less obtained as a result of professional and business

experienced team members should be performed by relationships

______ experienced engagement team members. c. To comply with relevant laws and regulations and

a. Less avoid any situation that may bring discredit to the

b. More profession

c. Equally d. Not to compromise professional or business

d. None of the above judgment because of bias, conflict of interest or

undue influence of others

105. An engagement quality control review is normally

done by the: 112. Confidential client information may be disclosed in

a. The engagement partner thefollowing circumstances, except

b. The chief technical partner of the office conducting a. When disclosure is authorized.

the audit b. When disclosure is required by law.

c. A partner not otherwise assigned to the c. When the relationship between the client and the

engagement auditor ceases.

d. The engagement manager d. When there is a professional duty or right to

disclose.

Page 8 of 10 www.prtc.com.ph AT.CDrill9

EXCEL PROFESSIONAL SERVICES, INC.

113. Based on the Code of Ethics for Professional 120. When performing a review engagement, the

Accountants, threats to compliance with fundamental following should be independent of the client

principles arise from all of the following except: a. b. c. d.

a. Self interest. c. Advocacy. The members of the Yes Yes Yes Yes

b. The audit relationship. d. Intimidation. assurance team

The firm Yes Yes No No

114. Which of the following is an example of a Network firms Yes No No Yes

safeguard implemented by the client that might

mitigate a threat to compliance with fundamental 121. Which of the following is a “self review” threat to

principles? engagement team member’s compliance with

a. Required continuing education for all attest fundamental principles?

engagement team members. a. An engagement team member has a spouse that

b. An effective corporate governance structure. serves as CFO of the attest client.

c. Required second partner review of an attest b. A second partner review is required on all attest

engagement. engagements.

d. Management selection of the CPA firm. c. An engagement team member prepares invoices

for the attest client.

115. Using the same lead engagement partner on an d. An engagement team member has a direct

audit over a prolonged period may most likely create financial interest in the attest client.

a. Self-interest threat c. Intimidation threat

b. Self-review threat d. Familiarity threat 122. Which of the following is a misunderstanding

created by the use of the word “independence?”

116. Examples of circumstances that may create a. A person exercising professional judgment should

familiarity threat include be free from all economic, financial and other

I. A member of the assurance team having an relationships.

immediate family member or close family member b. Possessing the ability to act with integrity and

who is a director or officer of the assurance client. objectivity.

II. Dealing in, or being a promoter of, share or other c. Independence precludes relationships that may

securities in an assurance client. appear to impair objectivity in rendering assurance

III. Threat of replacement over a disagreement with services.

the application of an accounting principle. d. Possessing the ability to express a conclusion

IV. Potential employment with an assurance client. without being affected by influences that

V. Long association of a senior member of the compromise professional judgment.

assurance team with the assurance client.

a. I, IV and V only 123. When CPAs are able to maintain their actual

b. II and V only independence, it is referred to as independence in:

c. II, III and IV only a. conduct. c. fact.

d. I and V only b. appearance. d. total.

117. Occurs when a professional accountant promotes a 124. CPAs are required to act with integrity and

position or opinion to the point that subsequent objectivity for which of the following engagements?

objectivity may be compromised a. tax preparation

a. Self-interest threat c. Advocacy threat b. financial statement review services

b. Self-review threat d. Familiarity threat c. financial statement audits

d. all engagements

118. There are fundamental principles that the

professional accountant has to observe when 125. For which of the following professional services

performing assurance engagements. The requirement must CPAs be independent?

of which principle is of particular importance in an a. Management advisory services.

assurance engagement in ensuring that the conclusion b. Audits of financial statements.

of the professional accountant has value to the c. Preparation of tax returns.

intended user? d. All three of the above.

a. Integrity c. Confidentiality

b. Professional competence d. Objectivity Setting-Up a Public Accounting Practice

126. The Accountancy Law provided that a CPA

119. In which of the following may confidential certificate may be suspended or revoked on grounds

information not be disclosed? except

a. To comply with the quality review of a member a. Immoral or dishonorable conduct.

body or professional body b. Gross negligence or incompetence in the practice of

b. To submit evidence in the course of legal profession.

proceedings c. Refusal to accept an audit engagement with a

c. Acquiring information in the course performing government corporation.

professional services and use that information for d. Conduct discreditable to the accounting profession

personal advantages

d. When consent to disclose information is given by 127. Which of the following is not included in the seal

the client used by a CPA?

a. Professional tax receipt number

b. Name of the CPA

c. Registration number

d. The title “CPA”

Page 9 of 10 www.prtc.com.ph AT.CDrill9

EXCEL PROFESSIONAL SERVICES, INC.

128. Who has the power to suspend or remove any 133. The following statements relate to CPA

member of the Board of Accountancy? examination ratings. Which of the following is

a. The President of the Philippines incorrect?

b. The Chairman of the PRC a. To pass the examination, candidates should obtain

c. The Chairman of the FRSC a general weighted average of 75% and above,

d. The Chairman of the AASC with no rating in any subject less than 65%.

b. Candidates who obtain a rating of 75% and above

129. An applicant for the CPA licensure examination in at least four subjects shall receive a conditional

should meet the following requisites, except credit for the subjects passed.

a. A Filipino citizen c. Candidates who failed in four complete

b. Of good moral character examinations shall no longer be allowed to take

c. A holder of the degree of Bachelor of Science in the examinations the fifth time.

Accountancy d. Conditioned candidates shall take an examination

d. Has not been convicted of any crime. in the remaining subjects within two years from

the preceding examination.

130. A CPA shall not practice under a firm name that

includes or indicates the following except 134. The Board, subject to the approval of the

a. Fictitious name Commission, may revise or exclude any of the subjects

b. Specialization and their syllabi, and add new ones as the need arises.

c. Misleading as to the type of the organization Provided that the change shall not be more often than

d. Name(s) of past partner(s) in the firm name of every

successor partnership a. 2 years c. 4 years

b. 3 years d. 5 years

131. Are the following CPAs required to comply with the

requirements on continuing professional education? 135. The following statements relate to RA 9298 and its

a b c d IRRs. Which statement(s) is (are) true?

CPAs in Public Accountancy Yes Yes Yes Yes I. A meaningful experience shall be considered as

CPAs in Commerce and Yes Yes No No satisfactory compliance if it is earned in Public

Industry Practice and shall include at least one year as audit

CPAs in Education/Academe Yes Yes Yes No assistant and at least two years as auditor in

CPAs in Government Yes No Yes No charge of the audit engagement covering full audit

functions of significant clients.

132. A person whose CPA certificate has been revoked II. Individual CPAs, Firms or Partnerships of CPAs,

a. can no longer be reinstated as a CPA. including partners and staff members thereof shall

b. is automatically reinstated as a CPA by the PRC register with the BOA and the PRC. If the

after two years if he has acted in an exemplary application for registration of AB and Co., CPAs

manner. was approved on August 30, 2018, its registration

c. may be reinstated as a CPA by the PRC after two will expire on September 30, 2020.

years if he has acted in an exemplary manner a. I and II c. II only

d. may be reinstated as a CPA by the Board of b. I only d. Neither I nor II

Accountancy after two years if he has acted in an

exemplary manner. J - done - J

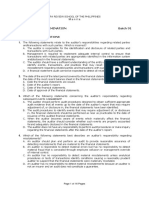

Answers:

1. C 2. D 3. C 4. A 5. D 6. D 7. B 8. B 9. D 10. D

11. C 12. D 13. B 14. C 15. A 16. C 17. D 18. A 19. B 20. B

21. C 22. C 23. D 24. B 25. B 26. A 27. B 28. B 29. D 30. D

31. B 32. C 33. A 34. A 35. D 36. D 37. A 38. A 39. D 40. D

41. D 42. D 43. B 44. C 45. A 46. A 47. D 48. A 49. A 50. C

51. C 52. D 53. A 54. C 55. D 56. A 57. D 58. B 59. D 60. D

61. B 62. C 63. B 64. D 65. A 66. A 67. A 68. B 69. D 70. A

71. D 72. C 73. B 74. B 75. D 76. C 77. A 78. B 79. B 80. C

81. A 82. D 83. C 84. B 85. C 86. C 87. C 88. D 89. B 90. D

91. B 92. A 93. D 94. B 95. C 96. B 97. C 98. D 99. D 100. D

101. A 102. A 103. D 104. B 105. C 106. A 107. B 108. C 109. C 110. D

111. D 112. C 113. B 114. B 115. D 116. D 117. C 118. D 119. C 120. B

121. C 122. A 123. C 124. D 125. B 126. C 127. A 128. A 129. D 130. D

131. A 132. D 133. C 134. B 135. B

Page 10 of 10 www.prtc.com.ph AT.CDrill9

Вам также может понравиться

- Auditing final preboard since 1977Документ7 страницAuditing final preboard since 1977Floriza Cuevas Ragudo100% (1)

- A. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientДокумент7 страницA. B. C. D. A. B. C. D.: ANSWER: Review Prior-Year Audit Documentation and The Permanent File For The ClientRenОценок пока нет

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryДокумент18 страницColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryFeelingerang MAYoraОценок пока нет

- Preboard Exam - AuditДокумент10 страницPreboard Exam - AuditLeopoldo Reuteras Morte IIОценок пока нет

- AT.2813 - Determining The Extent of Testing PDFДокумент7 страницAT.2813 - Determining The Extent of Testing PDFMaeОценок пока нет

- Reviewer in AuditngДокумент32 страницыReviewer in AuditngHazel MoradaОценок пока нет

- Auditing Concepts Psa Based QuestionsДокумент665 страницAuditing Concepts Psa Based QuestionsMae Danica CalunsagОценок пока нет

- Lspu - Audit Final ExamДокумент10 страницLspu - Audit Final ExamJamie Rose AragonesОценок пока нет

- Afar 1stpb Exam-5.21Документ7 страницAfar 1stpb Exam-5.21Emmanuel TeoОценок пока нет

- Assertions Audit Objectives Audit Procedures: Audit of Intangible AssetsДокумент12 страницAssertions Audit Objectives Audit Procedures: Audit of Intangible AssetsUn knownОценок пока нет

- ACCTG. 323 QUIZДокумент4 страницыACCTG. 323 QUIZHanna Lyn BaliscoОценок пока нет

- Auditing Multiple ChoicesДокумент8 страницAuditing Multiple ChoicesyzaОценок пока нет

- AT-06 (FS Audit Processs - Pre-Engagement)Документ2 страницыAT-06 (FS Audit Processs - Pre-Engagement)Bernadette PanicanОценок пока нет

- AT Quizzer 6 - Planning and Risk Assessment PDFДокумент18 страницAT Quizzer 6 - Planning and Risk Assessment PDFJimmyChao0% (1)

- Aud Plan 123Документ7 страницAud Plan 123Mary GarciaОценок пока нет

- SW - Code of EthicsДокумент1 страницаSW - Code of EthicsJudy Ann ImusОценок пока нет

- Auditing Payroll CycleДокумент14 страницAuditing Payroll CycleVernadette De GuzmanОценок пока нет

- Successor Auditor ResponsibilitiesДокумент5 страницSuccessor Auditor ResponsibilitiesVergel MartinezОценок пока нет

- Fraud Error NoclarДокумент17 страницFraud Error NoclarChixNaBitterОценок пока нет

- FINALS - Auditing TheoryДокумент8 страницFINALS - Auditing TheoryAngela ViernesОценок пока нет

- Quiz 1. Special Revenue RecognitionДокумент6 страницQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.Оценок пока нет

- Auditing Theory Review Course Pre-Board Exam - FinalДокумент11 страницAuditing Theory Review Course Pre-Board Exam - FinalROMAR A. PIGAОценок пока нет

- Gramling 9e Auditing Solman Audit SamplingДокумент29 страницGramling 9e Auditing Solman Audit Samplingkimjoonmyeon22100% (1)

- Auditing Theory Auditing ConceptsДокумент15 страницAuditing Theory Auditing ConceptsEllah MaeОценок пока нет

- Auditing Theory - MockДокумент10 страницAuditing Theory - MockCarlo CristobalОценок пока нет

- IAT 2020 Final Preboard (Source SimEx4 RS)Документ15 страницIAT 2020 Final Preboard (Source SimEx4 RS)Mary Yvonne AresОценок пока нет

- ASR Quizzer 6 - Planning and Risk AssessmenttДокумент18 страницASR Quizzer 6 - Planning and Risk AssessmenttInsatiable LifeОценок пока нет

- Ra 9298Документ14 страницRa 9298Errah Jenn CajesОценок пока нет

- AUD Final Preboard Examination QuestionnaireДокумент16 страницAUD Final Preboard Examination QuestionnaireJoris YapОценок пока нет

- RDC Review School Accountancy Audit QuizДокумент16 страницRDC Review School Accountancy Audit QuizKIM RAGAОценок пока нет

- CHAP 10. Internal Control and Control RiskДокумент27 страницCHAP 10. Internal Control and Control RiskNoro100% (1)

- Auditing Theory - Key Concepts and Financial Statement AssertionsДокумент11 страницAuditing Theory - Key Concepts and Financial Statement AssertionsJeric TorionОценок пока нет

- GAMS Quiz Results Provides 30% ScoreДокумент15 страницGAMS Quiz Results Provides 30% Scoremarie aniceteОценок пока нет

- Intro To IA Quiz 1Документ16 страницIntro To IA Quiz 1Jao FloresОценок пока нет

- AT 04 Practice and Regulation of The ProfessionДокумент6 страницAT 04 Practice and Regulation of The ProfessionEira ShaneОценок пока нет

- Chapter 05 - Audit Evidence and DocumentationДокумент44 страницыChapter 05 - Audit Evidence and DocumentationALLIA LOPEZОценок пока нет

- Chapter 7 Control Activities MCQsДокумент20 страницChapter 7 Control Activities MCQsPhoebe LanoОценок пока нет

- Attestation Services 2Документ8 страницAttestation Services 2sana olОценок пока нет

- Test Bank-Auditing Theory Chapter 9Документ6 страницTest Bank-Auditing Theory Chapter 9Michael CarlayОценок пока нет

- Excel Professional Services, Inc.: Discussion QuestionsДокумент7 страницExcel Professional Services, Inc.: Discussion QuestionskæsiiiОценок пока нет

- 2022 - April-AUD - Preboard PDFДокумент12 страниц2022 - April-AUD - Preboard PDFVianney Claire RabeОценок пока нет

- 0310 TX Final PreboardДокумент5 страниц0310 TX Final PreboardAlvin John San JuanОценок пока нет

- At5906 Audit ReportДокумент8 страницAt5906 Audit ReportImelda leeОценок пока нет

- Department of Accountancy: Page - 1Документ5 страницDepartment of Accountancy: Page - 1NoroОценок пока нет

- Multiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationДокумент14 страницMultiple Choice. Select The Letter That Corresponds To The Best Answer. This ExaminationBella ChoiОценок пока нет

- Test Bank Cis Part 2Документ31 страницаTest Bank Cis Part 2Cindy Dawn AmaradoОценок пока нет

- Understanding Entity EnvironmentДокумент4 страницыUnderstanding Entity EnvironmentKathleenОценок пока нет

- Preliminary Audit Engagement ActivitiesДокумент4 страницыPreliminary Audit Engagement ActivitiesMadelyn Jane IgnacioОценок пока нет

- At.3006-Planning An Audit of Financial StatementsДокумент5 страницAt.3006-Planning An Audit of Financial StatementsSadAccountantОценок пока нет

- Reviewer For Auditing TheoryДокумент10 страницReviewer For Auditing TheoryMharNellBantasanОценок пока нет

- Aud Module 1-5Документ23 страницыAud Module 1-5yaanvinaОценок пока нет

- COSO IC-IF and ISO Standards for Internal AuditorsДокумент6 страницCOSO IC-IF and ISO Standards for Internal AuditorsRenelle HabacОценок пока нет

- Cis Psa 401Документ74 страницыCis Psa 401Angela PaduaОценок пока нет

- HshshjaaДокумент6 страницHshshjaaPaula Villarubia0% (1)

- Accountancy Review Center (ARC) of The Philippines Inc.: First Preboard ExamДокумент3 страницыAccountancy Review Center (ARC) of The Philippines Inc.: First Preboard ExamCarlo AgravanteОценок пока нет

- AT.3004-Nature and Type of Audit Evidence PDFДокумент6 страницAT.3004-Nature and Type of Audit Evidence PDFSean SanchezОценок пока нет

- At Quiz 2 - October 2019Документ3 страницыAt Quiz 2 - October 2019Mitchiejash CruzОценок пока нет

- AAP ReviewerДокумент14 страницAAP ReviewerJadon MejiaОценок пока нет

- Audit principles, standards and proceduresДокумент3 страницыAudit principles, standards and proceduresALLYSON BURAGAОценок пока нет

- AT.2903 - Audit Evidence and Documentation - The FrameworkДокумент5 страницAT.2903 - Audit Evidence and Documentation - The FrameworkBryan Christian MaragragОценок пока нет

- Learning Delivery Modality Decision Tree: YES Limited NOДокумент2 страницыLearning Delivery Modality Decision Tree: YES Limited NOMae98% (52)

- Deductions and Exemptions: Tel. Nos. (043) 980-6659Документ22 страницыDeductions and Exemptions: Tel. Nos. (043) 980-6659MaeОценок пока нет

- Management Consultancy Areas and SkillsДокумент5 страницManagement Consultancy Areas and SkillsGeraldОценок пока нет

- Other Percentage TaxДокумент7 страницOther Percentage TaxJudeBragaisОценок пока нет

- GROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659Документ24 страницыGROSS INCOME Inclusions and Exclusions: Tel. Nos. (043) 980-6659MaeОценок пока нет

- Basic Tax Principles ExplainedДокумент46 страницBasic Tax Principles Explained在于在Оценок пока нет

- Computer TechnologyДокумент3 страницыComputer TechnologyMaeОценок пока нет

- Topic Do Not Forget To Use Atleast 3-5 Citations Maximum of 3 Pages OnlyДокумент21 страницаTopic Do Not Forget To Use Atleast 3-5 Citations Maximum of 3 Pages OnlyMaeОценок пока нет

- Nike Strategic Problems and SolutionsДокумент8 страницNike Strategic Problems and SolutionsMaeОценок пока нет

- Taxation Under The Train Law: 1 - PageДокумент30 страницTaxation Under The Train Law: 1 - PageMae50% (2)

- RFBT Answer Key Drill - 2020 RДокумент4 страницыRFBT Answer Key Drill - 2020 RPhoeza Espinosa VillanuevaОценок пока нет

- Cabria CPA Review Center's Property Plant and Equipment LectureДокумент9 страницCabria CPA Review Center's Property Plant and Equipment LectureMaeОценок пока нет

- FEASIBILITY - STUDY v1Документ24 страницыFEASIBILITY - STUDY v1MaeОценок пока нет

- The Legislative DepartmentДокумент20 страницThe Legislative DepartmentMaeОценок пока нет

- CABRIA CPA REVIEW CENTER PERCENTAGE TAXESДокумент12 страницCABRIA CPA REVIEW CENTER PERCENTAGE TAXESMaeОценок пока нет

- 9 - Introduction To Business Taxation PDFДокумент2 страницы9 - Introduction To Business Taxation PDFMaeОценок пока нет

- Far.118 Sharholders-EquityДокумент8 страницFar.118 Sharholders-EquityMaeОценок пока нет

- Corporation GPP Income Taxation PDFДокумент22 страницыCorporation GPP Income Taxation PDFMaeОценок пока нет

- CPA Review Center on Liabilities, Provisions and ContingenciesДокумент12 страницCPA Review Center on Liabilities, Provisions and ContingenciesMaeОценок пока нет

- Income Tax: Cabria Cpa Review CenterДокумент4 страницыIncome Tax: Cabria Cpa Review CenterMaeОценок пока нет

- FAR.115 - INTANGIBLE ASSETS With AnswerДокумент7 страницFAR.115 - INTANGIBLE ASSETS With AnswerMaeОценок пока нет

- BORROWING COSTS With AnswerДокумент3 страницыBORROWING COSTS With AnswerMaeОценок пока нет

- Non-Current Liabilities: Cabria Cpa Review CenterДокумент7 страницNon-Current Liabilities: Cabria Cpa Review CenterMaeОценок пока нет

- FAR.113 - INVESTMENT PROPERTY With Answer PDFДокумент5 страницFAR.113 - INVESTMENT PROPERTY With Answer PDFMaeОценок пока нет

- FAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerДокумент6 страницFAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerMaeОценок пока нет

- FAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerДокумент12 страницFAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerMae100% (1)

- FAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerДокумент6 страницFAR.112 - INVESTMENT IN ASSOCIATES AND JOINT VENTURES With AnswerMaeОценок пока нет

- Income Tax: Cabria Cpa Review CenterДокумент4 страницыIncome Tax: Cabria Cpa Review CenterMaeОценок пока нет

- Cabria CPA Review Center's Property Plant and Equipment LectureДокумент9 страницCabria CPA Review Center's Property Plant and Equipment LectureMaeОценок пока нет

- Non-Current Liabilities: Cabria Cpa Review CenterДокумент7 страницNon-Current Liabilities: Cabria Cpa Review CenterMaeОценок пока нет

- Factors for Credit Management Success in Cameroon BanksДокумент19 страницFactors for Credit Management Success in Cameroon BanksPelah Wowen DanielОценок пока нет

- 2021 Online Training Calendar Alpha Partnerspdf 1615477333Документ61 страница2021 Online Training Calendar Alpha Partnerspdf 1615477333Gp JamesОценок пока нет

- Ch.13 Accounting StandardsДокумент33 страницыCh.13 Accounting StandardsMalayaranjan PanigrahiОценок пока нет

- Core Concepts of Accounting Information Systems 12th Edition Simkin Solutions ManualДокумент12 страницCore Concepts of Accounting Information Systems 12th Edition Simkin Solutions ManualPatrickMathewspeagd100% (11)

- 2021 Resource Governance Index Scores Workbook EnglishДокумент6 903 страницы2021 Resource Governance Index Scores Workbook EnglishsafОценок пока нет

- Fe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityДокумент2 страницыFe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityJoanna PaulaОценок пока нет

- SaftДокумент20 страницSaftCarolinaCostaTeodoroОценок пока нет

- TUTORIAL SOLUTIONS (Week 2A)Документ3 страницыTUTORIAL SOLUTIONS (Week 2A)PeterОценок пока нет

- Information System Policy For BanksДокумент72 страницыInformation System Policy For BanksAshok JalagamОценок пока нет

- Chapter 1Документ68 страницChapter 1Merrill Ojeda SaflorОценок пока нет

- SAICA NOCLAR Overview SummaryДокумент50 страницSAICA NOCLAR Overview SummaryKathleen MarcialОценок пока нет

- Isa 500Документ7 страницIsa 500sumeer khan100% (1)

- UNISEM FinStatementДокумент32 страницыUNISEM FinStatementDeepak GhugardareОценок пока нет

- Core Vendor GuidelinesДокумент37 страницCore Vendor GuidelinesGurdeep SinghОценок пока нет

- IfДокумент6 страницIfCarlo ParasОценок пока нет

- Under Four Flags (Smith Bell)Документ6 страницUnder Four Flags (Smith Bell)marcheinОценок пока нет

- CA professional with 12+ years experience in auditing, risk consultingДокумент3 страницыCA professional with 12+ years experience in auditing, risk consultingKumaravel JaganathanОценок пока нет

- Fundamentals of Project Finance and ManagementДокумент4 страницыFundamentals of Project Finance and ManagementArushi JindalОценок пока нет

- AIS Chapter 6Документ5 страницAIS Chapter 6የሞላ ልጅОценок пока нет

- Unit 7Документ11 страницUnit 7Kundan SinhaОценок пока нет

- Vasan & Sampath - IntroductionДокумент5 страницVasan & Sampath - IntroductionominilightОценок пока нет

- Accounting For Not-for-Profit and Public Sector OrganizationsДокумент63 страницыAccounting For Not-for-Profit and Public Sector OrganizationsGillian Snelling100% (2)

- Reebok India CaseДокумент2 страницыReebok India CaseShivamPandeyОценок пока нет

- University Code PDFДокумент234 страницыUniversity Code PDFTidong Christian Bryann100% (2)

- Theoretical Triangulation and Pluralism in Research Methods in Organizational and Accounting ResearchДокумент32 страницыTheoretical Triangulation and Pluralism in Research Methods in Organizational and Accounting ResearchangelaОценок пока нет

- Auditing First 50 Question Chapter 1Документ8 страницAuditing First 50 Question Chapter 1Omnia HassanОценок пока нет

- Brickman & Joyner, Cpas Room Revenue Analytical: PurposeДокумент2 страницыBrickman & Joyner, Cpas Room Revenue Analytical: PurposeDendy BossОценок пока нет

- Philexport CPRS Accreditation Requirements For New ExportersДокумент1 страницаPhilexport CPRS Accreditation Requirements For New ExportersChasie Noro MelicorОценок пока нет

- Enms in Power PlantДокумент18 страницEnms in Power PlantNasional GotongroyongОценок пока нет

- AT - CDrill9 - Simulated Examination DIY PDFДокумент10 страницAT - CDrill9 - Simulated Examination DIY PDFMae100% (1)