Академический Документы

Профессиональный Документы

Культура Документы

Impact of Goods and Service Tax (GST) On Manufacturing Sector

Загружено:

Varinder Pal SinghОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Impact of Goods and Service Tax (GST) On Manufacturing Sector

Загружено:

Varinder Pal SinghАвторское право:

Доступные форматы

International Journal of Economics & Finance Research & Applications

Vol. 2, Issue 1 - 2018

IMPACT OF GOODS AND SERVICE TAX (GST) ON

MANUFACTURING SECTOR

H YASMEEN SULTANA*

ABSTRACT

India is emerging as the one of the growing economies in the world. India is

currently Asia’s third largest economy by GDP. The share of services sector is

57 per cent (in 2013), followed by industrial sector at 25 per cent, and

agriculture sector at 18 per cent. Industrial sector is generally accepted as the

vibrant and leading sector in an economy that enables economic development

by utilizing the deposited resources, fulfilling the needs of the society,

augmenting international trade and laying an effective path to reach the

sustainable development. The Government of Indian recognizes the

consequence of the manufacturing sector in the country’s economic growth

and development. The government also understands that becoming a

manufacturing hub will have to need numerous strategic reforms to make

simpler manufacturing in India. Make in India and the implementation of the

GST is one of the proposed reforms thus leading to manufacturing synergy in

India. The GST has already been introduced in nearly 160 countries of the

world and France was the first to introduce GST in the year 1954. The journey

of introduction of GST in India has been long and was a culmination of the

efforts of many political leaders and officers of the Centre and State

Governments. The 101st Amendment of constitution empowers the centre

and state to levy and collect the GST at uniform rate except Alcoholic liquor

for human consumption. GST as a historic tax reform is expected transform

the indirect taxation in India came into effect from 1st July, 2017. The impact

of GST on manufacturing sector is to be positive, on the other hand, India’s

manufacturing performance has been uninspiring. Therefore this paper made

an attempt to assess the impact of GST on manufacturing sector.

KEYWORDS: Goods and Services Tax (GST), Gross Domestic Product (GDP),

Gross Value Added (GVA), Manufacturing Sector.

INTRODUCTION

India is emerging as the one of the growing followed by industrial sector at 25 per cent, and

economies in the world. India is currently Asia’s agriculture sector at 18 per cent. Industrial

third largest economy by GDP. The share of sector is generally accepted as the vibrant and

services sector is 57 per cent (in 2013), leading sector in an economy that enables

*

Assistant Professor, Department of Economics, Pondicherry University, Puducherry - 605014.

Correspondence E-mail Id: editor@eurekajournals.com

© Eureka Journals 2018. All Rights Reserved. ISSN: 2581-4249

International Journal of Economics & Finance Research & Applications

27 Vol. 2, Issue 1 - 2018

economic development by utilizing the powers to both parliament and state legislature

deposited resources, fulfilling the needs of the to make laws with respect to GST. However,

society, augmenting international trade and clause 2 of Article 246A read with Article 269A

laying an effective path to reach the sustainable provides exclusive power to the Parliament to

development. Hence, industrial development is legislate with respect to inter-state trade or

considered as an important instrument that commerce. The taxable event under GST is the

drives socio-economic development of a nation. supply of goods and/or services. CGST and SGST

Honourable Prime Minister Narendra Modi are levied on intra-state supplies with IGST is

launched the Make in India initiative in the year levied on inter-state supplies.

2014, with the primary goal of making India a

global manufacturing hub. BRIEF HISTORY OF GST

GOODS AND SERVICES TAX (GST) The GST has already been introduced in nearly

160 countries of the world and France was the

Good and Services Tax (GST) which is shortly first to introduce GST in the year 1954. The

know as GST is a proposed system of Indirect journey of introduction of GST in India has been

Taxes in India merging most of the existing long and was a culmination of the efforts of

taxes into single system of taxation. The many political leaders and officers of the Centre

constitution of India (One hundred and first and State Governments. The ideas of the GST

amendment) Act, 2016 was passed by Lok was first mooted in the year 2000 during the

Sabha and passed by Rajya Sabha on August Prime Minister ship of Mr. Atal Bihari Vajpayee

2016. GST was launched at the stroke of and committee was set up headed by Mr. Asim

midnight hour of June 30 - July 1, 2017.GST is a Dasgupta (West Bengal Finance Minister) to

tax on goods and services with comprehensive design a GST Model. In 2003, Prime Minister

and continuous chain of set-off benefits up to ship of Mr. Atal Bihari Vajpayee set up another

the retailer level. It is essentially a tax only on task force under Mr. Vijay Kelker to

value addition at each stage, and a supplier at recommend tax reforms. On February 28, 2006

each stage is permitted to set-off, through a tax the Union Finance Minister in his Budget 2006-

credit mechanism, the GST paid on the 2007 proposed GST would be introduced from

purchase of goods and services. Ultimately, the 1st April, 2010. Mr. Nandan Nilekani released

burden of GST is borne by the end-user (i.e., Information Technology Strategy for GST in

final consumer) of the commodity/services. 2011. With several years of political stage show,

According to clause 12A of Article 366 of the the Lok Sabha passed the 122nd Constitutional

constitution, goods and services tax means any Amendment Bill for GST in 2015. The 101st

tax on supply of goods, or services or both Amendment of constitution empowers the

except taxes on the supply of the alcoholic centre and state to levy and collect the GST at

liquor for human consumption. According to uniform rate except Alcoholic liquor for human

same Article, goods includes all materials, consumption. On the other hand five

commodities, and articles (clause 12), services petroleum products viz, Petroleum Crude,

means anything other than goods (clause 26A) Motor Sprit (Petrol), High speed diesel, natural

and state with reference to articles 246A, 268, gas and date from aviation turbine. GST as a

269A and Article 279A includes a Union historic tax reform is expected transform the

Territory with legislature (clause 26B). The indirect taxation in India came into effect from

power to levy GST is derived from Article 246A 1st July, 2017.

of the constitution which confers concurrent

© Eureka Journals 2018. All Rights Reserved. ISSN: 2581-4249

Impact of Goods and Service Tax (GST) on Manufacturing Sector

Yasmeen HS 28

ADVANTAGES OF GST Competitiveness Index published by Deloitte,

India is expected to set its global mark by

• Check post across the country were becoming the fifth largest manufacturing

abolished for free and fast movement of country in the world by the end of the year

goods 2020. In addition, the Government of India has

• It will inject the revenue of the state set an ambitious target of increasing the GDP

governments share of manufacturing industry from its

• The GST levied on petrol and petroleum current stagnant 16 per cent to 25 per cent by

products may curtail the income of the 2025.

higher groups and enhance the revenue of

the government POSITIVE IMPACT ON MANUFACTUR-

• The central government will compensate ING SECTOR

losses to be incurred from GST by the state

government for a period of five years. The global experiences have witnessed that GST

• The unique slogan in GST is to make India results in numerous benefits to all stakeholders.

one nation, one market and one tax. The major benefits of GST are:

• Cashless system will check corruption and • REDUCTION OF TRANSPORTATION COST

black money circulation in the country. AND TIME: GST will help in removing

multiple and checkpoints at state border.

DISADVANTAGES OF GST

This will auxiliary save the logistics time and

• The maximum rate of GST in China it is 17 effort and make sure faster delivery of

per cent, South Africa it is 14 per cent and goods.

Russia it is 8 per cent but it is 28 per cent in • REDUCTION IN RAW MATERIAL AND

India. PRODUCTION COST: The primary objective

• In current system, many products are of GST is to remove the cascading effect of

exempted from taxation, the GST proposes taxes and follow a uniformed tax regime in

to have minimal exemption list. India. Manufacturing sector will affect

• Currently, higher taxes are levied on fewer directly in a way those cost of raw materials

items, but with GST, lower taxes will be and production.

levied on almost all items. • EASY CREDIT MECHANISM: Unlike the

• GST is not applicable on liquor for human earlier taxation system, with the

consumption. implementation of GST, cost of any

• Stamp duty will not fall under the GST services, including logistics, will be

regime and will continue to the imposed by considered a value add, and the

states. manufacturer will get tax credit for the

service tax paid. Now service providers can

THE INDIAN MANUFACTURING also avail the credit of VAT/ GST paid on

INDUSTRY inputs procured, and it will eventually pass

on to the supply chain as cost savings.

The Indian manufacturing industry has emerged • IMPROVED CASH FLOWS: Under GST

as one of the high growth sectors in India, and regime, manufacturers can assert input tax

the launch of ‘Make in India’ initiative further credit on input goods, which leads to be a

propelled and gave this sector the necessary positive impact for cash flow. SMEs are

boost. According to the Global Manufacturing ardently observing the time difference

© Eureka Journals 2018. All Rights Reserved. ISSN: 2581-4249

International Journal of Economics & Finance Research & Applications

29 Vol. 2, Issue 1 - 2018

between input tax credit and the credit known to both the parties at the time of

being presented. supply or pre-supply and the proof of being

• SETUP OF LARGER WAREHOUSES: The known is the clause of discount must be

manufacturers can club their lesser location there either in contract or agreement or

warehouses into one for handling facilities offer etc.

and smooth functioning. • MATCHING CONCEPT OF RETURNS: In

• INDIA, A COMMON NATIONAL MARKET: current regime, if the tax has been made

GST will be levied only at the time of the purchaser to supplier then he is eligible

consumption, and not production. Earlier to take the Credit it is immaterial whether

VAT was levied at various points (from the same has been credited to Central

manufacturing to retail outlets). As a result, Government by the supplier or not. But in

retailers had to increase the final cost of GST Regime, the matching concept if tax

goods being sold to the end consumer. credit will be there, if credits pertaining to

With GST, economic distortions will be supplier does not match with purchaser

removed, leading to a common national than it will not be accepted in return unless

market. it is rectified by both the parties.

• NEGATIVE IMPACT ON MANUFACTURING • DENIAL OF CENVAT CREDIT ON

SECTOR PURCHASES MADE FROM UNORGANIZED/

• TIME OF SUPPLY: In current regime of tax UNREGISTERED PERSON: There is a

the time of duty on manufacture attracts at limitation in the implication that small

the time of removal where as in GST regime businesses may not for all time find it

it will earliest of the four such as (Date of feasible to purchase goods from registered

Issue of Invoice, Date of Payment, Date of vendors only.

Removal, Debit in the books of Receiver).

• INCREASE IN WORKING CAPITAL: In GST SLOWED DOWN GROWTH IN EIGHT

regime of tax, stock transfer has been made CORE SECTORS

taxable, which requires the huge working

The eight core infrastructure sectors which are

capital because the realization of tax going

vital in the growth of the country are Coal,

to be on final supply tills that It may block

Crude Oil, Natural Gas, Refinery Products

the capital.

Fertilizers, Steel, Cement and Electricity. Official

• NO CREDIT OF PETROLEUM PRODUCT:

data regarding eight core sectors exhibited that

Petroleum Product has been kept out of

the growth rate decelerated down to 2.4 per

GST hence; the tax paid on Petroleum

cent in July due to contraction in output of

Product is not eligible as credit and same

crude oil, refinery products, fertilizer and

became the cost. Each industry requires the

cement. These sectors registered growth of 8.1

Petroleum Product such as Fertilizer

per cent last year.

Industry, Power Sector, and Logistic Sector

etc. The Index of Industrial Production (IIP) of eight

• INTRODUCTION OF REVERSE CHARGE ON core sectors account for 41 per cent to the total

GOODS: In current regime Of tax structure factory output which recorded a growth rate of

there was reverse charge on specified 0.8 in June 2017. The production of crude oil

services but in case of GST even the reverse declined to 0.2 per cent, fertilizer 0.3 per cent

charge will be applicable on goods. and cement 2 per cent, Coal output declined to

• POST SUPPLY DISCOUNT: If the discount 0.7 per cent against 4.1 per cent in July 2016.

has to be given post supply than it must be

© Eureka Journals 2018. All Rights Reserved. ISSN: 2581-4249

Impact of Goods and Service Tax (GST) on Manufacturing Sector

Yasmeen HS 30

National output increased to 6.6 per cent. Steel steel output increased relatively higher by 9.2

production and power generation increased to per cent to July 2017 against 5.8 per cent in July

9.2 per cent and 5.4 per cent respectively. Only 2016.

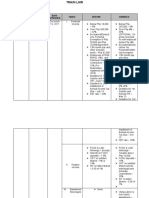

IMPACT OF GST ON VARIOUS SECTORS

S. No Industrial Categories June 2016-2017 June 2017-2018

(Quarter) (Quarter)

1 Financial Insurance, Real Estate, Professional Services 9.4 6.4

2 Electricity, Gas, Water Supply and Other Utility Services 10.3 7

3 Manufacturing Dipped 10.7 1.2

4 Agriculture, Forestry and Fishing 2.5 2.3

5 Construction Sector 3.1 2

The financial insurance, real estate and • AUTOMOBILE INDUSTRY: At presently

professional services has a growth of 9.4 per automobile industry payment of the tax

cent in the 2016-2017 (June-Quarter) which sum of 30 per cent to 47 per cent the effect

declined to 6.4 per cent 2017-2018. In case of of GST the tax rate decrease from 20 per

Electricity, Gas, Water Supply and Other utility cent to 22 per cent so at least the

services growth reduced from 10.3 per cent to consumer may get the benefits.

7 per cent. Manufacturing sector dipped from • CONSUMER AND DURABLE SECTOR:

10.7 per cent to 1.2 per cent and in Currently the consumer and durable

construction sector, the growth also dipped claiming revenue net tax total tax percent is

from 3.1per cent to 2 per cent in 2017-2018 7 to30, the sector had been exempted from

(June-Quarter). such taxes so the effect of GST, the industry

would have to get the benefits. The

THE EFFECT OF THE GST ON difference between organized and

MANUFACTURING INDUSTRY IN INDIA unorganized Sectors is that the rates gap

may sub sum. Warehousing and logistics

• CEMENT INDUSTRY: Cement industry is the

expenses may reduce C.G.C.E Havel, Voltas,

one of oldest manufacturing industry the

Blue star Bajaj electrical simfani, Hitachi,

industry has the greatest historical

etc companies are benefited by the effect

background. Where the civilization is there

of GST.

is role of the cement, make in India concept

• IT & ITES: In the India IT sector 50 percent

applicable for this industry. The industry

to 70 percent of the graduates depend on

has some indirect taxes. By the GST effect

the only IT sector. The net tax rate is 14 per

the cement industry has indirect tax which

cent. By the implementation of GST the tax

might be subsume as 16 per cent to 20 per

may be 18 per cent to20 per cent to

cent .currently tax burden of indirect taxes

increase. In IT sector the revenue is mainly

from 27 per cent to 32 per cent decrease of

depending on only export of IT products

tax rate as 16 per cent to 20 per cent it my

and services revenue of IT export exempted

create /facilitate as operating expenses

from the GST. So the GST effect is to be

such as transportation expenses benefits

Negative.

that the subsume of expenses the industry

• TELECOM SECTOR: The telecom sectors

can claim the above benefits in future.

presently the tax rate is 14%.By the causes

© Eureka Journals 2018. All Rights Reserved. ISSN: 2581-4249

International Journal of Economics & Finance Research & Applications

31 Vol. 2, Issue 1 - 2018

of GST the tax rate on telecom sector would companies are paying tax rate is 14 per

have to increase as 18%. So the result of cent to 15 per cent these two departmental

GST on telecom sector will be negative. The taxes are effect by the GST 18 per cent to

public sector is to be critical. In future the 20 per cent. Currently news and print

concept of “one tax and one nation” media has been exempted from that taxes,

caption is not suitable for Telecom sector. the GST prove to DTH and some Negative

• BANKING AND FINANCIAL SERVICES: to print media and broadcasting.

Banking is heart of financial India (wealth).

In India public and private banking industry CONCLUSION

is the reflection of mixed economy. The

The Government of Indian recognizes the

banking sector’s net tax rate is 14 per cent

consequence of the manufacturing sector in the

by the effect of GST the rate will be

country’s economic growth and development.

increased from 18 per cent to 20 per cent.

The government also understands that

That the differential tax rate causes as Loan

becoming a manufacturing hub will have to

fees, debt and credit charges, insurance

need numerous strategic reforms to make

premium, etc the financial services charges

simpler manufacturing in India. Make in India

burden on customers will increase. So the

and the implementation of the GST is one of

GST will also influence on customer

the proposed reforms thus leading to

purchasing power. In the banking business

manufacturing synergy in India. The impact of

transactions will have also effect on share

new GST regime would be a modern tax reform

market.

which will usher in opportunities for business in

• PHARMACY INDUSTRY: The pharmacy

India. There are high hopes that the new GST

sector are getting exemptions regional

system will lead to manufacturing sector by

wise. The excise tax rate is 6 per cent. Till

changing the cascading tax system to the goods

the end of the duration the subsidies will

and services tax. In addition, all major business

have to continue, then after that they will

dynamics will have to be thoroughly analysed

not available. The new tax pattern the

to review the impact of GST on business.

industry could not remain constant it is

considerable because the encouragement REFERENCES

of pharmacy sector.

• TEXTILE AND GARMENT INDUSTRY: [1]. Ahmad, E and N. Stern (1991). Theory and

Emerging industry has playing key role in Practice of Tax Reforms in Developing

textile and garments .That the industry has Countries, Cambridge University Press.

recipient of tax rate is currently from 6 per [2]. Cutt, James (1969). Taxation and

cent to 7 per cent that tax rate may or may Economic Development in India, New

not be continued it is clear in that process Delhi, Vikas Publications.

the output of tax rate may hick by the [3]. Cnossen, Sijbren (2013). ”Preparing the

effect of GST which is negative .the textile way for a modern GST in India” in

sector enjoy some of few companies like “International Tax and Public Finance”,

page industry, Aravind, Raymond etc. Aug 2013 Springer Science & Business

• DTH/MEDIA COMPANY: DTH and media Media (New York).

sector’s average tax payment rate presently [4]. Das-Gupta, Arindam; Gang, Ira N (2000).

19 per cent to 21 per cent apart from that “Decomposing Revenue Effects of Tax

service tax is 14 per cent, entertainment tax Evasion and Tax Structure Changes” in

is 5 per cent to 7 per cent Brad costing “International Tax and Public Finance”,

© Eureka Journals 2018. All Rights Reserved. ISSN: 2581-4249

Impact of Goods and Service Tax (GST) on Manufacturing Sector

Yasmeen HS 32

March, 2000, Springer Science & Business Science & Business Media (Deventer).

Media (New York). [14]. Indirect Taxes Committee (2015) Goods

[5]. Das-Gupta, Arindam; Ghosh, Shanto; and Service Tax (GST), Institute of

Mookherjee, Dilip, (2004). Tax Chartered Accountants of India.

Administration Reform and Taxpayer [15]. Kumar, Nitin (2014). Goods and Service

Compliance in India” in “International Tax Taxin India-A Way Forward. Global

and Public Finance”, September, 2004, Journal of Multidisciplinary Studies. Vol.

Springer Science & Business Media (New 3, Issue 6.

York). [16]. Jayaraman Vijayakumar; Rasheed, Abdul

[6]. Dash, Bharatee Bhusana; Raja, Angara A; Krishnan, V S (2005): “Corruption and

V(2013):”Intergovernmental Transfers taxation: lessons from the Indian

and Tax Collection in India: Does the experience” in “Journal of Public

Composition of Transfers Matter?” In Budgeting, Accounting & Financial

“Public Budgeting & Finance”, Blackwell Management”, Academics Press, Florida

Publishing Ltd (Maiden). Atlantic University (Boca Raton).

[7]. Eigner, Richard M (1959):” Business And [17]. Ketkar, Kusum W; Murtuza, Athar; Ketkar,

Economics–Public Finance, Taxation, Suhas L (2005),: ”Impact of corruption on

Political Science” in “National Tax foreign direct investment and tax

Journal”, June, 1959, National Tax revenues” in “Journal of Public Budgeting,

Association (Washington) Accounting & Financial Management”,

[8]. Ehtisham Ahamad and Satya Poddar Academics Press, Florida Atlantic

(2009). “Goods and Service Tax Reforms University (Boca Raton).

and Intergovernmental Consideration in [18]. Musgrave, Richard and Peggy Musgrave

India”, Asia Research Center, LSE, 2009. (1989). Public Finance in Theory and

[9]. Empowered Committee of State Finance Practice, New York: McGraw-Hill Book

Ministers (2008), A Model and Roadmap Company.

for Goods and Services Tax in India, New [19]. Nishita Gupta (2014), Goods and Services

Delhi. Tax: Its implementation on Indian

[10]. Garg, G. 2014. Basic Concepts and economy, CASIRJ Volume 5, Issue 3, Pg.

Features of Good and Service Tax in India. No.126-133.

International Journal of scientific [20]. Pinki, Supriya Kamna, Richa Verma

research and management (IJSRM) (2014). “Good and Service Tax-Panacea

Volume 2, Issue 2, Pp 542-548. For Indirect Tax System In India”, “Tactful

[11]. Goode, Richard (1956):”Report of the Management Research Journal”, Vol.2,

India taxation enquiry commission” in Issue 10.

“National Tax Journal”, June, 1956, [21]. Sury, M.M (1987). Excise Concessions to

National Tax Association (Washington) Small Scale Industries in India: Some

[12]. Government of India, Ministry of Finance, Issues, Small Industry Bulletin for Asia

Budget Papers (various years) and the Pacific, United Nations, ESCAP,

[13]. Har Govind (2005):”Important Fiscal Bangkok, No.22.

Changes and Tax Developments in India [22]. World Bank (2015), Fiscal Policy for

through the Finance Act 2005” in Equitable Growth, India Development

”Intertax”, November, 2005, Springer Report.

© Eureka Journals 2018. All Rights Reserved. ISSN: 2581-4249

International Journal of Economics & Finance Research & Applications

33 Vol. 2, Issue 1 - 2018

APPENDIX-A

CONSTITUTIONAL PROVISIONS PERTAINING TO TAXES

Article Brief Description

27 Freedom as to payment of taxes for promotion of any particular religion

246 Subject-matter (including taxes) of laws made by Parliament and by the Legislatures of

States

246A Special provisions with respect to Goods and Services Tax (GST)

248 Residuary powers of legislation, including taxes

265 No tax shall be levied or collected except by authority of law

268 Duties levied by the union but assigned to the states

269 Taxes levied and collected by the union but assigned to the states

269A Levy and collection of Goods and Services Tax (GST) in the course of inter-state trade

or commerce

270 Taxes and duties levied and collected by the Union but distributed between the Union

and the states

271 Surcharges on certain duties and taxes for the purpose of the Union

276(2) Monetary limit on taxes on professions, trade, calling or employment

279A Goods and Service Tax Council (GST Council)

285(1) Exemption of property of the Union from state taxation

286 Restriction on states to impose tax on the supply of goods or services or both, where

such supply takes place: a) Outside the state or b) In the course of import of goods or

services or both into or export of goods and services or both out of, the territory of

India.

287 Exemption from state taxes on electricity consumed by the Government of India

289 Exemption of property and income of a state from union taxation

244(2) and Powers of District Councils to levy taxes in tribal areas

275(1)

366(12) Definition of goods

366(12A) Definition of goods and services tax

366(26A) Definition of services

366(26B) Definition of state with reference to Articles 246A, 268, 269, 269A and 279A

APPENDIX-B

Constitutional Definitions

GOODS: According to clause 12 of Article 366 of the Constitution, goods include all materials,

commodities and articles.

GOODS AND SERVICES TAX: According to clause 12A (11) of Article 366 of the constitution, goods

and services tax means any tax on supply of goods, or services or both.

SERVICES: According to clause 26A (12) of Article 366 of the Constitution, services means anything

other than goods.

STATE: According to clause 26B (13) of Article 366 of the Constitution, state with reference to

Articles 246A, 268, 269, 269A and 279A includes a Union Territory with legislature.

© Eureka Journals 2018. All Rights Reserved. ISSN: 2581-4249

Вам также может понравиться

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyОт EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyРейтинг: 5 из 5 звезд5/5 (1)

- Insights Into Yojana: August 2017: Goods and Services Tax (GST)Документ14 страницInsights Into Yojana: August 2017: Goods and Services Tax (GST)Abhishek SinghОценок пока нет

- 'SWOT' Analysis On Goods and Services Tax (GST) in IndiaДокумент4 страницы'SWOT' Analysis On Goods and Services Tax (GST) in IndiaInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- An Impact of GST On Textile Industry in IndiaДокумент6 страницAn Impact of GST On Textile Industry in IndiaEditor IJTSRDОценок пока нет

- The Impact of GST On Construction Industry: June 2019Документ12 страницThe Impact of GST On Construction Industry: June 2019AVS YASHWINОценок пока нет

- ReportДокумент5 страницReportsvijayambikeОценок пока нет

- A Review On GST Execution and Its Effect PDFДокумент9 страницA Review On GST Execution and Its Effect PDFAsma KhanОценок пока нет

- Goods and Services Tax (GST) in India - An Overview and ImpactДокумент3 страницыGoods and Services Tax (GST) in India - An Overview and Impactsamar sagarОценок пока нет

- GSTДокумент15 страницGSTNausheen MerchantОценок пока нет

- An Overview of GST in India (Content To Be Take From The 20 Articles)Документ67 страницAn Overview of GST in India (Content To Be Take From The 20 Articles)BADDAM PARICHAYA REDDYОценок пока нет

- A Comprehensive Analysis of Goods and Services Tax (GST) in IndiaДокумент8 страницA Comprehensive Analysis of Goods and Services Tax (GST) in IndiaBasavarajОценок пока нет

- The Impact of GST On Manufacturing Sector in India: Vol 11, Issue 7, July/ 2020 ISSN NO: 0377-9254Документ6 страницThe Impact of GST On Manufacturing Sector in India: Vol 11, Issue 7, July/ 2020 ISSN NO: 0377-9254Rohit MuleyОценок пока нет

- Swot 2 Eco 2Документ6 страницSwot 2 Eco 2Amrutha GayathriОценок пока нет

- Internal - I: Name - Ayush Kumar Singh PRN - 18010126240 Div - CДокумент6 страницInternal - I: Name - Ayush Kumar Singh PRN - 18010126240 Div - CAyush singhОценок пока нет

- Impact and Challenges of GST in India With Reference To Media Entertainment Sector - An InsightДокумент17 страницImpact and Challenges of GST in India With Reference To Media Entertainment Sector - An InsightHJ ManviОценок пока нет

- GST and Its Impact 3 PDFДокумент3 страницыGST and Its Impact 3 PDFanushka kashyapОценок пока нет

- GST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Документ8 страницGST Towards A Rational and Simple Indirect Tax Structure - IJREAMV04I023802Rashmi Ranjan PanigrahiОценок пока нет

- 2 Internal Assignment: NAME-Rachit Arya - 17010125059 SEM - 8 Div-A B.A L.L. B (Hons.)Документ6 страниц2 Internal Assignment: NAME-Rachit Arya - 17010125059 SEM - 8 Div-A B.A L.L. B (Hons.)Ayush singhОценок пока нет

- Original DocumentДокумент55 страницOriginal DocumentBADDAM PARICHAYA REDDYОценок пока нет

- Continuous Evaluation Project Taxation Law II 18B176Документ15 страницContinuous Evaluation Project Taxation Law II 18B176un academyОценок пока нет

- Impact of GST On Manufacturers, Distributors and RetailersДокумент6 страницImpact of GST On Manufacturers, Distributors and Retailershemant rajОценок пока нет

- The GST and Economic GrowthДокумент4 страницыThe GST and Economic GrowthEditor IJTSRDОценок пока нет

- An Exploratory Study of Problems and Prospects of Goods and Service Tax Post Implementation in IndiaДокумент7 страницAn Exploratory Study of Problems and Prospects of Goods and Service Tax Post Implementation in Indiashyaan ramОценок пока нет

- GST Search Dimensions Original ArticleДокумент17 страницGST Search Dimensions Original Articleratneet_dhaliwalОценок пока нет

- Impact of GST On Indian Economy PaperДокумент10 страницImpact of GST On Indian Economy PaperKetan YadavОценок пока нет

- An Exploratory Study On Evolution & Implementation of GST in IndiaДокумент5 страницAn Exploratory Study On Evolution & Implementation of GST in IndiaRajeswari DeviОценок пока нет

- Industry Internship ReportДокумент28 страницIndustry Internship ReportDIP SHROTОценок пока нет

- Impact of GST On Automobile Industry inДокумент12 страницImpact of GST On Automobile Industry inakshay chavanОценок пока нет

- Project ReportДокумент24 страницыProject ReportanilОценок пока нет

- Eco Project Draft 1Документ11 страницEco Project Draft 1abcОценок пока нет

- IMPACT OF GST ON INDIAN ECONOMY CovidДокумент6 страницIMPACT OF GST ON INDIAN ECONOMY CovidArushi GuptaОценок пока нет

- GST Project Raghav, Shubham, KanavДокумент5 страницGST Project Raghav, Shubham, KanavRAGHAV JAGGAОценок пока нет

- A Research Paper On 'Œimpact of GST On Service Sector of India'Документ4 страницыA Research Paper On 'Œimpact of GST On Service Sector of India'Editor IJTSRDОценок пока нет

- GSTДокумент7 страницGSTStudy AllyОценок пока нет

- Ijm - 08!04!002 GST ArticleДокумент8 страницIjm - 08!04!002 GST ArticleAnand JaiswalОценок пока нет

- Project ReportДокумент42 страницыProject ReportRahul KumarОценок пока нет

- Impact of GST in Foreign Trade ProjectДокумент7 страницImpact of GST in Foreign Trade ProjectkiranОценок пока нет

- A Study On Impact of GST On Indian Economy: Chirag RanaДокумент4 страницыA Study On Impact of GST On Indian Economy: Chirag RanaPratyasha SarkarОценок пока нет

- GST: Impact On Indian Economy: PallavikapilaДокумент3 страницыGST: Impact On Indian Economy: PallavikapilaVishal kumarОценок пока нет

- Implementation of Goods and Services Tax (GST)Документ11 страницImplementation of Goods and Services Tax (GST)NATIONAL ATTENDENCEОценок пока нет

- Impact of GST On Indian EconomyДокумент10 страницImpact of GST On Indian Economybijay2022Оценок пока нет

- O Y G S T:: Dr. Ram Manohar Lohiya National Law University, LucknowДокумент13 страницO Y G S T:: Dr. Ram Manohar Lohiya National Law University, LucknowDeepak RavОценок пока нет

- Research On An Impact of Goods and Service Tax (GST) On Indian EconomyДокумент4 страницыResearch On An Impact of Goods and Service Tax (GST) On Indian EconomyEditor IJTSRDОценок пока нет

- GST Effect On Manufacturing Industry - India: Dr. P. MahenderДокумент3 страницыGST Effect On Manufacturing Industry - India: Dr. P. MahenderVarinder Pal SinghОценок пока нет

- Impact of GST On The Indian EconomyДокумент16 страницImpact of GST On The Indian EconomySandeep TomarОценок пока нет

- An Analysis of GST Collection of India SДокумент6 страницAn Analysis of GST Collection of India SAditi ChandraОценок пока нет

- GST in India: A Key Tax Reform: ManagementДокумент9 страницGST in India: A Key Tax Reform: ManagementmainakroniОценок пока нет

- GST in India: A Key Tax Reform: ManagementДокумент9 страницGST in India: A Key Tax Reform: ManagementChandan SinghОценок пока нет

- The Social & Economical Impact of GST On Indian EconomyДокумент12 страницThe Social & Economical Impact of GST On Indian EconomyThe IjbmtОценок пока нет

- GSTpublishedpaper Pages 18 23Документ7 страницGSTpublishedpaper Pages 18 23Departmental FestОценок пока нет

- GST Impact and Implications On Various Industries in Indian EconomyДокумент9 страницGST Impact and Implications On Various Industries in Indian EconomyshaktiОценок пока нет

- GST Implementation and Its Impact On Indian EconomyДокумент4 страницыGST Implementation and Its Impact On Indian EconomyarcherselevatorsОценок пока нет

- Shodhsancharbulletinjanuarytomarch2020g P DangДокумент12 страницShodhsancharbulletinjanuarytomarch2020g P Dangakhileshyadav3794186Оценок пока нет

- Assignment - TaxationДокумент7 страницAssignment - TaxationTarique AzizОценок пока нет

- Introduction of GST in IndiaДокумент14 страницIntroduction of GST in IndiaPritam AnantaОценок пока нет

- Impact of GST On Indian Economy PaperДокумент10 страницImpact of GST On Indian Economy PaperDevil DemonОценок пока нет

- Impact of GST On GDPДокумент9 страницImpact of GST On GDPAnshaj GuptaОценок пока нет

- GST - International TaxationДокумент6 страницGST - International TaxationAnkita ThakurОценок пока нет

- Basic Concepts and Features of Goods and Service Tax in IndiaДокумент3 страницыBasic Concepts and Features of Goods and Service Tax in Indiamansi nandeОценок пока нет

- 23019-Article Text-34692-1-10-20200612Документ13 страниц23019-Article Text-34692-1-10-20200612Varinder Pal SinghОценок пока нет

- Emerald - MIP - MIP571966 691..706Документ16 страницEmerald - MIP - MIP571966 691..706Varinder Pal SinghОценок пока нет

- Tax Reformation in IndiaДокумент15 страницTax Reformation in IndiaVarinder Pal SinghОценок пока нет

- European Management Journal: Justin PaulДокумент14 страницEuropean Management Journal: Justin PaulVarinder Pal SinghОценок пока нет

- Sample Budget Template-Reception: DateДокумент4 страницыSample Budget Template-Reception: DateVarinder Pal SinghОценок пока нет

- Journal of Retailing and Consumer Services: Ajay Kumar, Justin Paul, Slađana Star Cevi CДокумент12 страницJournal of Retailing and Consumer Services: Ajay Kumar, Justin Paul, Slađana Star Cevi CVarinder Pal SinghОценок пока нет

- Event Planning Template 07Документ14 страницEvent Planning Template 07Varinder Pal SinghОценок пока нет

- IC Party Budget TemplateДокумент10 страницIC Party Budget Template12345maОценок пока нет

- By: Haley Kusak, Oliver Lauro, Allie Dethmers, Jillian Koehnken, Jamie KopackaДокумент21 страницаBy: Haley Kusak, Oliver Lauro, Allie Dethmers, Jillian Koehnken, Jamie KopackaVarinder Pal SinghОценок пока нет

- The Impact of GST On Indian ManufacturinДокумент11 страницThe Impact of GST On Indian ManufacturinVarinder Pal SinghОценок пока нет

- Event Planning Template 39Документ14 страницEvent Planning Template 39Varinder Pal SinghОценок пока нет

- Lime Case StudyДокумент5 страницLime Case StudyHarshit SinghОценок пока нет

- GST Effect On Manufacturing Industry - India: Dr. P. MahenderДокумент3 страницыGST Effect On Manufacturing Industry - India: Dr. P. MahenderVarinder Pal SinghОценок пока нет

- F12010486S419Документ4 страницыF12010486S419Varinder Pal SinghОценок пока нет

- Sample SOPs For FMSДокумент4 страницыSample SOPs For FMSVinay Yevatkar25% (4)

- Gstnew 161202103127 PDFДокумент16 страницGstnew 161202103127 PDFVarinder Pal SinghОценок пока нет

- Gstnew 161202103127 PDFДокумент16 страницGstnew 161202103127 PDFVarinder Pal SinghОценок пока нет

- Profile Summary Core Competencies: Santhosh NayakДокумент4 страницыProfile Summary Core Competencies: Santhosh NayakVarinder Pal SinghОценок пока нет

- Risk Assessment - Zone 2 (ABU) : S. No. Zone Process/OperationДокумент8 страницRisk Assessment - Zone 2 (ABU) : S. No. Zone Process/OperationVarinder Pal SinghОценок пока нет

- Financial Terms 2014 PDFДокумент112 страницFinancial Terms 2014 PDFChi100% (1)

- Sample SOPs For FMSДокумент4 страницыSample SOPs For FMSVinay Yevatkar25% (4)

- 1099 G 2018documentdownloadДокумент1 страница1099 G 2018documentdownloadKristine McVeighОценок пока нет

- FIFO LIFO PracticalДокумент16 страницFIFO LIFO Practicalkrishna aroraОценок пока нет

- Busi 3111 Group - hw1Документ3 страницыBusi 3111 Group - hw1Hakkı Anıl AksoyОценок пока нет

- Memorandum of AgreementДокумент4 страницыMemorandum of AgreementmbbdelenaОценок пока нет

- 2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmДокумент4 страницы2012 ITAD - BIR - Ruling - No. - 092 1220210505 11 1ig3ujmrian.lee.b.tiangcoОценок пока нет

- RMO No. 23-2018 DigestДокумент4 страницыRMO No. 23-2018 DigestMary Joy NavajaОценок пока нет

- The Final Guide To The 1099-MISC Form Online For The FreelancerДокумент4 страницыThe Final Guide To The 1099-MISC Form Online For The FreelancerJohn olsonОценок пока нет

- Invoice / Facture: Jen-I Chen Chris Lee 202-4545 AV COLOMB Brossard, Quebec, J4Z 3T2 CAДокумент1 страницаInvoice / Facture: Jen-I Chen Chris Lee 202-4545 AV COLOMB Brossard, Quebec, J4Z 3T2 CAChris LeeОценок пока нет

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As) Q&A No. 2018-14Документ9 страницPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As) Q&A No. 2018-14Mary Jo Lariz OcliasoОценок пока нет

- Additional Questions For PracticeДокумент7 страницAdditional Questions For Practicesanjay blakeОценок пока нет

- Chapter 16 Problem SolvingДокумент3 страницыChapter 16 Problem SolvingWeStan LegendsОценок пока нет

- Crystal Clear Cleaning Has Decided That in Addition To ProvidingДокумент1 страницаCrystal Clear Cleaning Has Decided That in Addition To Providinghassan taimourОценок пока нет

- Business and TRansfer Taxation Chapter 12 Discussion Question AnswersДокумент3 страницыBusiness and TRansfer Taxation Chapter 12 Discussion Question AnswersKarla Faye Lagang100% (1)

- Group 2 - FRA Assignment PDFДокумент29 страницGroup 2 - FRA Assignment PDFarsheenchughОценок пока нет

- EOLA's Equity Distribution - v4Документ18 страницEOLA's Equity Distribution - v4AR-Lion ResearchingОценок пока нет

- President Rodrigo Duterte: December 19, 2017Документ7 страницPresident Rodrigo Duterte: December 19, 2017Chelsy SantosОценок пока нет

- Chapter 18 MCQs On Trust TaxationДокумент7 страницChapter 18 MCQs On Trust TaxationEverpeeОценок пока нет

- House No 2, Street No 2, F-7/3, Islamabad Suriya Nauman Rehan & CoДокумент4 страницыHouse No 2, Street No 2, F-7/3, Islamabad Suriya Nauman Rehan & Cowaqas aliОценок пока нет

- House Property Declaration - 2011-12Документ2 страницыHouse Property Declaration - 2011-12Pradeep KumarОценок пока нет

- PAYE Return SampleДокумент42 страницыPAYE Return Sampleoyesigye DennisОценок пока нет

- Multiple Choice Questions 1 Which If Any of The Following StatementsДокумент2 страницыMultiple Choice Questions 1 Which If Any of The Following StatementsTaimour HassanОценок пока нет

- 08 Activity 1Документ2 страницы08 Activity 1Cj MoontonОценок пока нет

- Income Tax Rate Table For Individual Taxpayers in The PhilippinesДокумент1 страницаIncome Tax Rate Table For Individual Taxpayers in The PhilippinesJan Mae LumiaresОценок пока нет

- Pierre Boulez Case Tax InternationalДокумент7 страницPierre Boulez Case Tax InternationalPejalanbudgetОценок пока нет

- C 5 A J E: Djusting Ournal NtriesДокумент11 страницC 5 A J E: Djusting Ournal NtriesDainsel Tara LopezОценок пока нет

- Philippine Accountancy Review For Excellence: A. Format of Computation (Bir Form 1801)Документ17 страницPhilippine Accountancy Review For Excellence: A. Format of Computation (Bir Form 1801)beayaoОценок пока нет

- FABM2 Q2W4 TaxationДокумент9 страницFABM2 Q2W4 TaxationDanielle SocoralОценок пока нет

- MJ20 TX UK Sample - Suggested Solutions and Marking Schemes v1.0Документ8 страницMJ20 TX UK Sample - Suggested Solutions and Marking Schemes v1.0hfdghdhОценок пока нет

- Form 16-Part A - 2020-2021Документ2 страницыForm 16-Part A - 2020-2021Ravi S. Sharma100% (2)

- Fa#12 - Intro To Consumption TaxДокумент5 страницFa#12 - Intro To Consumption TaxAbigail VillalvaОценок пока нет