Академический Документы

Профессиональный Документы

Культура Документы

Partnership Dissolution Effects

Загружено:

ShamИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Partnership Dissolution Effects

Загружено:

ShamАвторское право:

Доступные форматы

PARTNERSHIP DISSOLUTION It causes gain on realization

QUIZ

It is loss for the partner

1. Retirement and death of a partner:

is dissoluton of a firm

may or may not be a dissolution of

partnership

8. Loss on realization is distributed among

agreement

partners:

is dissolution of partnership agreement

According to income sharing ratio

According to capital ratio

2. If all the partners, but one are insolvent it is:

As decided among them

Dissolution of an agreement

9. Loss on realization is:

Dissolution of a firm Debited to partners capital account

Credited to partners capital account

May or may not cause dissolution

Debited to realization account

3. If all the partners, but one, are solvent it is:

10. When all the partners are insolvent accounts

Dissolution of partnership agreement payable will be:

dissolution of a firm Paid fully

may or may not cause dissolution Paid rateably

Taken over by partner

4. At the time of dissolution:

all the assets are transferred to realization

account

Only current assets are transfered to realization

Account.

Non-cash assets are tranferred to

realization account

5. At the time of dissolution non-cash assets are

credited with:

Market value

Book value

As the agreed amount among

partners

6. If a partner takes over an asset of the firm,

his capital account:

will be debited with the amount as agreed

will be credited with the market value of

the asset

will be debited with book value of asset

7. If a liability is settled at higher value than shown

on the balance sheet and a partner takes the

responsibility to pay that:

It causes a loss of realization

Вам также может понравиться

- Partnership Reviewer: True/False and Multiple Choice QuestionsДокумент14 страницPartnership Reviewer: True/False and Multiple Choice Questionsjano_art21Оценок пока нет

- Foreign Currency TransactionДокумент60 страницForeign Currency TransactionJoemar Santos TorresОценок пока нет

- Compound Financial Intruments PDFДокумент2 страницыCompound Financial Intruments PDFCeline Marie Libatique AntonioОценок пока нет

- 4 - Lecture Notes - Partnership DissolutionДокумент18 страниц4 - Lecture Notes - Partnership DissolutionNikko Bowie PascualОценок пока нет

- Advanced Accounting: An Introduction To Consolidated Financial StatementsДокумент57 страницAdvanced Accounting: An Introduction To Consolidated Financial StatementsgabiОценок пока нет

- AHM Chapter 4 - SolutionsДокумент24 страницыAHM Chapter 4 - SolutionsNitin KhareОценок пока нет

- Partnership Liquidation - SeatworkДокумент1 страницаPartnership Liquidation - SeatworkReymilyn SanchezОценок пока нет

- Key Quiz 2 2022 2023Документ4 страницыKey Quiz 2 2022 2023Leslie Mae Vargas ZafeОценок пока нет

- 2019 Sqe Reviewer - Fundamentals of Accounting Parts 1 and 2 PDFДокумент23 страницы2019 Sqe Reviewer - Fundamentals of Accounting Parts 1 and 2 PDFJohn Marfhel PrestadoОценок пока нет

- Accounting For Partnerships 2Документ35 страницAccounting For Partnerships 2Lazarus Henga100% (1)

- Chapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A FinalДокумент26 страницChapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A Finalrandom17341Оценок пока нет

- Notes On Partnership LiquidationДокумент3 страницыNotes On Partnership LiquidationJohn Alfred CastinoОценок пока нет

- Chapter 16 Dissolution and Liquidation of PartnershipДокумент14 страницChapter 16 Dissolution and Liquidation of Partnershipkp_popinjОценок пока нет

- Accounting 4 - EPS Title Under 40 CharactersДокумент4 страницыAccounting 4 - EPS Title Under 40 Charactersmaria evangelistaОценок пока нет

- Partnership Formation AccountingДокумент6 страницPartnership Formation AccountingHelena MontgomeryОценок пока нет

- Re BVPS EpsДокумент4 страницыRe BVPS EpsVeron BrionesОценок пока нет

- Ppe, Intangiblke InvestmentgfdgfdДокумент12 страницPpe, Intangiblke Investmentgfdgfdredearth2929Оценок пока нет

- First Semester Assiut University Partnership Accounting Test BankДокумент8 страницFirst Semester Assiut University Partnership Accounting Test BankAbanoub AbdallahОценок пока нет

- Concept Map - 1 To 4Документ4 страницыConcept Map - 1 To 4Roby Gerard Corpuz100% (1)

- PFRS 17 Insurance Contracts SummaryДокумент2 страницыPFRS 17 Insurance Contracts SummaryAnnie JuliaОценок пока нет

- Partnership Operations and Financial ReportingДокумент50 страницPartnership Operations and Financial ReportingMark Ambuang100% (1)

- Shareholder's Equity - Practice SetsДокумент6 страницShareholder's Equity - Practice SetsGian GarciaОценок пока нет

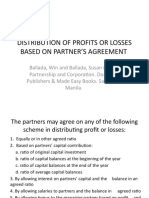

- Distribution of Partnership ProfitsДокумент20 страницDistribution of Partnership ProfitsJOANNA ROSE MANALOОценок пока нет

- Advacc Final Exam Answer KeyДокумент7 страницAdvacc Final Exam Answer KeyRIZLE SOGRADIELОценок пока нет

- AFAR-01 (Partnership Formation & Operations)Документ7 страницAFAR-01 (Partnership Formation & Operations)Jennelyn CapenditОценок пока нет

- Partnership Problems Partnership Problems: Accountancy (La Consolacion College) Accountancy (La Consolacion College)Документ35 страницPartnership Problems Partnership Problems: Accountancy (La Consolacion College) Accountancy (La Consolacion College)Jay Ann DomeОценок пока нет

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap016 PDFДокумент50 страницSolution Manual Advanced Financial Accounting 8th Edition Baker Chap016 PDFYopie ChandraОценок пока нет

- AFAR Test BankДокумент57 страницAFAR Test BankandengОценок пока нет

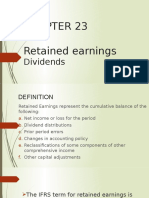

- Understanding Retained EarningsДокумент72 страницыUnderstanding Retained EarningsItronix MohaliОценок пока нет

- Joint Arrangements Lecture NotesДокумент3 страницыJoint Arrangements Lecture NotesMila MercadoОценок пока нет

- Debt Securities Drill AnswersДокумент7 страницDebt Securities Drill AnswersJoy RadaОценок пока нет

- Diagnostic Test CashДокумент2 страницыDiagnostic Test CashJoannah maeОценок пока нет

- Week 05 - 02 - Module 11 - Investment in Equity InstrumentsДокумент10 страницWeek 05 - 02 - Module 11 - Investment in Equity Instruments지마리Оценок пока нет

- Partnership DissolutionДокумент3 страницыPartnership DissolutionTon Martinez Arcenas0% (1)

- Ias 23 - Borrowing CostДокумент11 страницIas 23 - Borrowing CostATIFREHMANWARRIACHОценок пока нет

- Accounting Quiz 2Документ8 страницAccounting Quiz 2Camille G.Оценок пока нет

- This Study Resource Was: Profit Loss Profit LossДокумент9 страницThis Study Resource Was: Profit Loss Profit LossrogealynОценок пока нет

- Chapter 10 PAS 28 INVESTMENT IN ASSOCIATESДокумент2 страницыChapter 10 PAS 28 INVESTMENT IN ASSOCIATESgabriel ramosОценок пока нет

- RetainedДокумент66 страницRetainedJhonalyn Montimor GaldonesОценок пока нет

- Partnership Accounting Processes and Profit DistributionДокумент12 страницPartnership Accounting Processes and Profit DistributionJean Pierre IsipОценок пока нет

- Acctg7-MIDTERM REVIERДокумент9 страницAcctg7-MIDTERM REVIERDave ManaloОценок пока нет

- 8th PICPA National Accounting Quiz ShowdownДокумент28 страниц8th PICPA National Accounting Quiz Showdownrcaa04Оценок пока нет

- Stockholders' Equity by J. GonzalesДокумент7 страницStockholders' Equity by J. GonzalesGonzales JhayVeeОценок пока нет

- Chapter 3 Teachers Manual Afar Part 1Документ16 страницChapter 3 Teachers Manual Afar Part 1Princess Grace Baarde CastroОценок пока нет

- AFAR - Partnership OperationДокумент21 страницаAFAR - Partnership OperationReginald ValenciaОценок пока нет

- Book Value and Earnings Per ShareДокумент3 страницыBook Value and Earnings Per ShareAlejandrea LalataОценок пока нет

- Module No. 1 - Week 1 Businessn CombinationДокумент5 страницModule No. 1 - Week 1 Businessn CombinationJayaAntolinAyusteОценок пока нет

- Finacct Mock Exam 1Документ7 страницFinacct Mock Exam 1Joseph Gerald M. ArcegaОценок пока нет

- Consolidated Financial Statements for Purchase-Type Business CombinationsДокумент158 страницConsolidated Financial Statements for Purchase-Type Business CombinationsSassy OcampoОценок пока нет

- Module 06 - PPE, Government Grants and Borrowing CostsДокумент24 страницыModule 06 - PPE, Government Grants and Borrowing Costspaula manaloОценок пока нет

- Afar 106 - Home Office and Branch Accounting PDFДокумент3 страницыAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesОценок пока нет

- Quiz2 ParCorДокумент8 страницQuiz2 ParCorStephanie gasparОценок пока нет

- Standard Cost Variances ExplainedДокумент17 страницStandard Cost Variances ExplainedJesselle Marie SalazarОценок пока нет

- Chapter 13 Property Plant and Equipment Depreciation and deДокумент21 страницаChapter 13 Property Plant and Equipment Depreciation and deEarl Lalaine EscolОценок пока нет

- Midterm Exam Accntg For Special TransactionsДокумент8 страницMidterm Exam Accntg For Special TransactionsJustine Flores100% (1)

- PDF Afar Week1 Compiled Questions CompressДокумент78 страницPDF Afar Week1 Compiled Questions CompressIo AyaОценок пока нет

- Chapter 3 Partnership Liquidation and IncorporationДокумент73 страницыChapter 3 Partnership Liquidation and IncorporationHarry J Gartlan100% (1)

- FAR Test BankДокумент34 страницыFAR Test BankRaamah DadhwalОценок пока нет

- Accounting For Partnership DissolutionДокумент19 страницAccounting For Partnership DissolutionMelanie kaye ApostolОценок пока нет

- Afar ToaДокумент22 страницыAfar ToaVanessa Anne Acuña DavisОценок пока нет

- PartnershipДокумент6 страницPartnershipJoanne TolentinoОценок пока нет

- 74626bos60479-fnd-cp10-u6Документ49 страниц74626bos60479-fnd-cp10-u6vijay sainiОценок пока нет

- Multinational Capital BudgetingДокумент26 страницMultinational Capital BudgetingDishaОценок пока нет

- Examples of Insider Trading and Market ManipulationДокумент9 страницExamples of Insider Trading and Market ManipulationPan CorreoОценок пока нет

- Lanka IOC PLC Annual Report 2018/19 Path of ResilienceДокумент164 страницыLanka IOC PLC Annual Report 2018/19 Path of ResilienceudaraОценок пока нет

- Audit 3 Midterm Exam (CH 17,18,19,20 Cabrera)Документ3 страницыAudit 3 Midterm Exam (CH 17,18,19,20 Cabrera)Roldan Hiano ManganipОценок пока нет

- Trustee's Responsibilities Under the Trust DeedДокумент47 страницTrustee's Responsibilities Under the Trust DeedElekwachikenОценок пока нет

- Trading Journal TemplateДокумент39 страницTrading Journal TemplateVariety VideosОценок пока нет

- MEGHMANI ANNUAL REPORTДокумент254 страницыMEGHMANI ANNUAL REPORTmredul sardaОценок пока нет

- Chapter 18Документ6 страницChapter 18Xynith Nicole RamosОценок пока нет

- GEN008 QuizДокумент8 страницGEN008 QuizKathleen Tabasa ManuelОценок пока нет

- HДокумент4 страницыHPrashant Sagar GautamОценок пока нет

- Nestle Financial AnalysisДокумент35 страницNestle Financial AnalysisAisha Chohan100% (1)

- 2023 CPA Study PlanДокумент8 страниц2023 CPA Study PlanDaryl Mae Mansay100% (1)

- Budgeting 101: By: Limheya Lester Glenn National University-ManilaДокумент42 страницыBudgeting 101: By: Limheya Lester Glenn National University-ManilaXXXXXXXXXXXXXXXXXXОценок пока нет

- IAS 21 Foreign SubsidiaryДокумент14 страницIAS 21 Foreign SubsidiaryRoqayya FayyazОценок пока нет

- Chapter 15Документ21 страницаChapter 15?????Оценок пока нет

- Click On Below Image To Join Our ChannelДокумент191 страницаClick On Below Image To Join Our Channelanshuno247Оценок пока нет

- The New Government Accounting System: (NGAS)Документ78 страницThe New Government Accounting System: (NGAS)Red YuОценок пока нет

- Loan Functions Importance Credit Analysis /TITLEДокумент22 страницыLoan Functions Importance Credit Analysis /TITLEWilliamae FriasОценок пока нет

- NCFM Model TestДокумент15 страницNCFM Model TestAnonymous 3rDDX3Оценок пока нет

- Board Structures in Asia - One-Tier vs Two-Tier ModelsДокумент34 страницыBoard Structures in Asia - One-Tier vs Two-Tier ModelsHoangОценок пока нет

- MN4001 Week 1 (Lecture)Документ20 страницMN4001 Week 1 (Lecture)Gabriele KaubryteОценок пока нет

- Financial Performance Analysis of Christ BankДокумент53 страницыFinancial Performance Analysis of Christ BankOne's JourneyОценок пока нет

- Top Glove Q1 2022 Profit Down Due to Lower RevenueДокумент17 страницTop Glove Q1 2022 Profit Down Due to Lower RevenueCheah ChenОценок пока нет

- Arvind Mills AnalysisДокумент18 страницArvind Mills AnalysisAnup AgarwalОценок пока нет

- NAPOLEON COMPANY MARKETABLE SECURITIES AND INVESTMENT IN VOSP CORPORATIONДокумент7 страницNAPOLEON COMPANY MARKETABLE SECURITIES AND INVESTMENT IN VOSP CORPORATIONJaylord PidoОценок пока нет

- PT Bank Mega TBK - Billingual - 31 Des 2021 - ReleasedДокумент195 страницPT Bank Mega TBK - Billingual - 31 Des 2021 - ReleasedDharma Triadi YunusОценок пока нет

- Fabm 2 SG 12 Q2 0801Документ25 страницFabm 2 SG 12 Q2 0801Meriel Stephanie ZaragozaОценок пока нет

- Dissolution Revision FinalДокумент9 страницDissolution Revision FinalAnish MohantyОценок пока нет