Академический Документы

Профессиональный Документы

Культура Документы

A Study On Financial Derivatives With Reference To Tata Motors Limited, Chittoor District of Ap, India

Загружено:

Abdullah HashimИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

A Study On Financial Derivatives With Reference To Tata Motors Limited, Chittoor District of Ap, India

Загружено:

Abdullah HashimАвторское право:

Доступные форматы

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/326058177

A STUDY ON FINANCIAL DERIVATIVES WITH REFERENCE TO TATA MOTORS

LIMITED, CHITTOOR DISTRICT OF AP, INDIA

Article · June 2018

CITATIONS READS

0 3,046

1 author:

Santhapalii Gautami

Sri Venkateswara College of Engineering, Tirupati

13 PUBLICATIONS 4 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Nonperforming Assets View project

Nonperforming Assets View project

All content following this page was uploaded by Santhapalii Gautami on 29 June 2018.

The user has requested enhancement of the downloaded file.

IF : 5.156 | IC Value : 85.78 VOLUME-7, ISSUE-4, APRIL-2018 • ISSN No 2277 - 8160

Original Research Paper Management

A STUDY ON FINANCIAL DERIVATIVES WITH REFERENCE TO

TATA MOTORS LIMITED, CHITTOOR DISTRICT OF AP, INDIA

Associate Professor Department of Management Studies Sri Venkateswara College

Dr. S. Gautami of Engineering Karakambadi Road, Tirupati-517507

Assistant Professor Department of Management Studies Sri Venkateswara College

Dr. Nalla Bala Kalyan of Engineering Karakambadi Road, Tirupati-517507

ABSTRACT As part of nancial market reforms, new instruments and nancial reengineering have been introduced in India

since 1991. One area where the growth and innovation is slow is in the introduction of derivatives. In India, the

appearance and enlargement of derivatives market is moderately a recent phenomenon. Since its beginning in June 2000, derivatives

market has exhibited exponential enlargement both in terms of volume and number of traded contracts. The term derivatives, refers to a

broad class of nancial instruments which mainly include options and futures. These instruments derive their value from the price and other

related variables of the underlying asset. They do not have worth of their own and derive their value from the claim they give to their owners

to own some other nancial assets or security. The present study is deliberate to examine the nancial derivatives with reference to Tata

Motors Limited.

KEYWORDS : Derivatives, Features, Options, Tata Motors Limited

1. INTRODUCTION committed themselves to doing something. Whereas it costs

Finance is the life blood of any business organization. Just as nothing (except margin requirement) to enter into a futures

Circulation of blood is necessary in the human body to maintain life contracts, the purchase of an option requires as up-front payment.

so is nance very essential to the business organization for smooth Option is a type of contract between two persons where one grants

running of the business. Financial management involves the other the right to buy a speci c asset at a speci c price within a

Managerial activities concerned with the acquisition of fund for the speci c time period. Alternatively the contract gives the other

business purpose. The Finance Function does with procurement of person the right to sell a speci c asset at a speci c price within a

money taking into consideration of today as well as future need and speci c time period, in order to have this right. The option buyer has

nance is required to purchase need and nance is required to to pay the seller of the option premium. The assets on which option

purchase a machinery and raw materials, to pay salaries and wages can be derived are stocks, commodities, indexes etc. If the

and also for day to day expenses. In nance, a derivative is an underlying asset is the nancial asset, then the option are nancial

agreement based on an underlying asset. Instead of exchanging the option like stock options, currency options, index options etc., and if

actual asset, agreements are made to exchange cash or other assets options like commodity option.

for the underlying asset within a speci ed timeframe. As the value of

the underlying asset changes, so does the value of the derivative. 2. RESEARCH METHODOLOGY

2.1 NEED FOR THE STUDY

1.1 Futures Derivatives help to reduce the risk (or) transfer the risk. It also helps

Futures markets were designed to solve the problems that exist in to the investors to get more returns with less risk. Therefore the

forward markets. A futures contract is an agreement between two present study has been undertaken to understand the derivatives

parties to buy or sell an asset as a certain time in the future at a market with special reference to Tata Motors Ltd., for a period of 45

certain price. But unlike forward contract, the futures contracts are days.

standardized and exchange traded. To facilitate liquidity in the

futures contract, the exchange speci es certain standard 2.2 SCOPE OF THE STUDY

underlying instrument, a standard quantity and quality of the The Study is limited to “Derivatives” with special reference to Futures

underlying instrument that can be delivered, (or which can be used and Options of Tata Motors Ltd., in the Indian context and the Inter-

for reference purpose in settlement) and a standard timing of such Connected Stock Exchange has been taken as a representative

settlement. A futures contract should be offset prior to maturity by sample for the study. The study is limited to nancial derivatives

entering into an equal and opposite transaction. More than 90% of with special reference to futures options in the India Info line

futures transactions are offset this way. A future contract is an Limited has been taken as representative sample for the study.

agreement between two parties to buy or sell an asset at a certain

time in the future at a certain price. Futures contracts are special 2.3 OBJECTIVES OF THE STUDY

types of forward contracts in the sense that the former are 1. To analyze the operations of futures and options with reference

standardized exchange-traded contracts. to Tata Motors Ltd.,

2. To nd the pro t/loss position of futures buyer and also the

The standardized items in a futures contract are: option writer and option holder

Ÿ Quantity of the underlying 3. To suggest measures about futures and options

Ÿ Quality of the underlying 4. To understand the concept of the nancial derivatives such as

Ÿ The date and the month of delivery futures & options.

Ÿ The units of price quotation and minimum price change

Ÿ Location of settlement 2.4 DATABASE

The primary data is collected directly with the concerned

1.2 Options professional trade members and online transaction on the day from

Options are fundamentally different from forward and futures NSE India. The secondary data is the data which is gathered from

contracts. An option gives the holder of the option the right to do books, records, Journals, Magazines, Reports and Newspapers. This

something. The holder does not have to exercise this right. In analysis is based on sample data taken from Tata Motors Limited.

contrast, in a forward or futures contract, the two parties have

430 X GJRA - GLOBAL JOURNAL FOR RESEARCH ANALYSIS

VOLUME-7, ISSUE-4, APRIL-2018 • ISSN No 2277 - 8160 IF : 5.156 | IC Value : 85.78

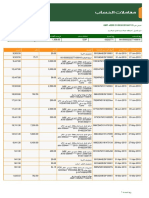

Table3 Spot and Future Prices from12 Juneto18th June 2017

th

The lot size of Tata Motors is 2000, the time period in which this

analysis done is from 02-06-2017 to 27-06-2017.

TATA MOTORS LIMITED

DATE(1) PRICE(2)

3. DATA ANALYSIS & INTERPRETATION

SPOT FUTURE

The Objective of this analysis is to evaluate the pro t/loss position of

futures and options. This analysis is based on sample data taken 12-June-17 300.70 302.50

from Tata Motors Limited. The lot size of Tata Motors is 2000, the 13-June-17 301.35 307.00

time period in which this analysis done is from 02-06-2017 to 27- 16-June-17 309.75 310.10

06-2017. 17-June-17 319.25 318.00

18-June-17 316.65 316.70

Table 1 Spot and Future Prices from02nd Juneto07th June 2017 Graph 3

TATA MOTORS LIMITED

DATE(1) PRICE(2)

SPOT FUTURE

2-June-17 276.80 280.00

3- June -17 281.25 283.20

7- June -17 278.55 280.06

Graph 1

Interpretation

Ÿ The above table shows that opening and closing prices of Tata

Motors Ltd during the week (from 12thJune to 18thJune).

Ÿ The spot market of Tata Motors Ltd opened its price with

Rs.300.70 and it increased to Rs.319.25 and nally it closed at

Rs.316.65.

Ÿ The future market of Tata Motors Ltd opened its price with

Interpretation Rs.302.50 and it increased to Rs.318.00 and nally it closed at

Ÿ The above table shows that opening and closing prices of Tata Rs.316.70.

Motors Ltd during the three days (from 02ndJune to 07thJune). Ÿ During this week Tata Motors Ltd showed positive sign in the

Ÿ The spot market of Tata Motors Ltd opened its price with market.

Rs.276.80 and it increased to Rs.281.25 and nally it closed at

Rs.278.55. Table 4 Spot and Future Prices from19th Juneto25th June 2017

Ÿ The future market of Tata Motors Ltd opened its price with TATA MOTORS LIMITED

Rs.280.00 and it increased to Rs.283.20 and nally it closed at DATE(1) PRICE(2)

Rs.280.05.

SPOT FUTURE

Ÿ During this week Tata Motors Ltdshowed positive sign in the

19-June-17 309.75 310.95

market.

20-June-17 311.85 312.35

23-June-17 313.95 313.05

Table 2 Spot and Future Prices from 05thJuneto11th June 2017

27-June-17 312.10 310.95

TATA MOTORS LIMITED 25-June-17 312.65 310.25

DATE(1) PRICE(2)

Graph 4

SPOT FUTURE

05- June -17 275.6 276.65

06- June -17 283.75 285.25

09- June -17 283.05 283.65

10- June -17 286.20 286.95

11- June -17 289.30 290.75

Graph 2

Interpretation

Ÿ The above table shows that opening and closing prices of Tata

Motors Ltd during the week (from 19th June to 25th June).

Ÿ The spot market of Tata Motors Ltd opened its price with

Rs.309.75 and it increased to Rs.313.95 and nally it closed at

Rs.312.65.

Ÿ The future market of Tata Motors Ltd opened its price with

Interpretation Rs.310.95 and it increased to Rs.313.05 and nally it closed at

Ÿ The above table shows that opening and closing prices of Tata Rs.310.25.

Motors Ltd during the week (from 05thJune to 11thJune). Ÿ During this week Tata Motors Ltd showed positive sign in the

Ÿ The spot market of Tata Motors Ltd opened its price with market.

Rs.275.60 and it increased to Rs.289.30 and nally it closed at

Rs.289.30. Table 5 Spot and Future Prices from 26th June to27th June 2017

Ÿ The future market of Tata Motors Ltd opened its price with TATA MOTORS LIMITED

Rs.276.65 and it increased to Rs.290.75 and nally it closed at DATE(1) PRICE(2)

Rs.290.75. SPOT FUTURE

Ÿ During this week Tata Motors Ltd showed positive sign in the 26-June-17 313.10 312.75

market. 27-June-17 316.55 317.15

GJRA - GLOBAL JOURNAL FOR RESEARCH ANALYSIS X 431

VOLUME-7, ISSUE-4, APRIL-2018 • ISSN No 2277 - 8160 IF : 5.156 | IC Value : 85.78

Graph 5 Graph 6

Interpretation

Ÿ The above table shows that opening and closing prices of Tata INTERPRETATION

Motors Ltd during the two days of last week. (from 26th June to Ÿ The above table shows that call option and put option on spot

27th June) price of Tata Motors Ltd, during the three days. That is from

Ÿ The spot market of Tata Motors Ltd opened its price with 02ndJune to 07thJune. The above call option explains thata

Rs.313.10 and it increased to Rs.316.55 and nally it closed at majority of investors are interested to buy the stock where strike

Rs.316.55. price is greater than current market price. e.g: at 300 strike price

Ÿ The future market of Tata Motors Ltd opened its price with premium is decreased from Rs.8.65 to Rs.8.10 similarly at 320

Rs.312.75 and it increased to Rs.317.15 and nally it closed at and 370 strike prices premiums also decreased. The above put

Rs.317.15. option shows that a majority of investors are interested to sell

Ÿ During this week Tata Motors Ltd showed positive sign in the the stock where strike price is greater than current market price.

market. e.g: at 300 strike price premium is decreased from Rs.28.00 to

26.3 similarly at 280 and 260 strike prices premiums also

Table 6 decreased.

Ÿ The above table shows that call option and put option on spot

Tata Motors Limited (Options) Call Option and Put Option price of Tata Motors Ltd, during the week. That is from 05th June

Prices from 02nd June to 07th June 2017 to 11thJune. The above call option explains that a majority of

Call Option(2) Put Option (3) investors are interested to buy the stock where strike price is

Spot Price(1) greater than current market price. e.g: at 300 strike price

300 320 370 300 280 260

premium is increased from Rs.6.75 to Rs.12.55, similarly at 320

276.80 8.65 5.30 2.60 28.00 16.15 7.90

and 370 strike prices also increased. The above put option

281.25 9.30 6.05 2.95 25.15 17.15 6.70 shows that a majority of investors are interested to sell the stock

278.55 8.10 5.00 2.35 26.3 17.65 7.25 where strike price is greater than current market price. e.g: at

Tata Motors Limited (Options) Call Option And Put Option 300 strike price premium is decreased from Rs.27.55 to 18.50

Prices From 05th June To 11th June 2017 similarly at 280 and 260 strike prices premiums also decreased.

Call Option(2) Put Option(3) Ÿ The above table shows that call option and put option on spot

Spot Price(1) price of Tata Motors Ltd, during the week. That is from 12th June

300 320 370 300 280 260

to 18th June. The above call option explains that a majority of

275.60 6.75 2.80 1.5 27.55 15.2 8.30 investors are interested to buy the stock where strike price is less

283.75 9.70 7.25 2.60 22.95 13.70 5.55 than current market price also. e.g: at 300 strike price premium is

283.05 9.05 7.90 2.15 22.80 17.35 6.50 increased from Rs.17.50 to Rs.27.75, similarly at 320 and 370

286.20 9.85 5.30 2.30 20.60 11.10 7.05 strike prices also increased. The above put option shows that a

289.30 12.55 7.60 2.75 18.50 10.50 7.05 majority of investors are interested to sell the stock where strike

price is less than current market price. e.g: at 300 strike price

Tata Motors Limited (Options) Call Option And Put Option premium is decreased from Rs.17.90 to 7.65 similarly at 280 and

Prices From 12th June To 18th June 2017 260 strike prices premiums also decreased.

Spot Price Call Option(2) Put Option(3) Ÿ The above table shows that call option and put option on spot

(1) 300 320 370 300 280 260 price of Tata Motors Ltd, during the week i.e from 19th June to 25th

300.70 17.50 9.25 7.35 17.90 7.15 3.10 June. The above call option explains that a majority of investors

are interested to sell the stock where strike price is less than

301.35 17.10 8.70 7.00 17.15 6.60 2.55

current market price also. e.g: at 300 strike price premium is

309.75 20.65 10.60 5.15 10.70 7.85 2.00 decreased from Rs.20.00 to Rs.17.55, similarly at 320 and 370

319.25 26.00 13.80 6.70 8.05 3.50 1.35 strike prices also decreased, because settlement date happened

316.65 27.75 12.90 6.20 7.65 3.10 1.25 in this week. The above put option shows that a majority of

Tata Motors Limited (Options) Call Option And Put Option investors are interested to sell the stock where strike price is less

Prices From 19th June To 25th June 2017 than current market price. e.g: at 300 strike price premium is

decreased from Rs.9.15 to 7.50 similarly at 280 and 260 strike

Call Option(2) Put Option(3)

Spot Price(1) prices premiums also decreased.

300 320 370 300 280 260 Ÿ The above table shows that call option and put option on spot

309.75 20.00 10.35 7.65 9.15 3.85 1.50 price of Tata Motors Ltd, during the week i.e from 26th June to 27th

311.85 20.75 10.20 7.70 3.20 8.35 1.30 June. The above call option explains that a majority of investors

313.95 21.05 10.5 7.30 7.70 2.95 1.00 are interested to buy the stock where strike price is less than

312.10 18.05 8.35 3.20 7.65 2.50 1.05 current market price also. e.g: at 300 strike price premium is

increased from Rs.19.85 to Rs.22.15, similarly at 320 and 370

312.65 17.55 7.70 2.80 7.50 2.60 0.85

strike prices also increased. The above put option shows that a

Tata Motors Limited (Options) Call Option And Put Option majority of investors are interested to sell the stock where strike

Prices From 26th June To 27th June 2017 price is less than current market price. e.g: at 300 strike price

Call Option(2) Put Option(3) premium is decreased from Rs.6.90 to 5.25 similarly at 280 and

Spot Price(1) 260 strike prices premiums also decreased.

300 320 370 300 280 260

313.10 19.85 8.70 3.20 6.90 2.30 0.85

4. SUGGESTIONS

316.55 22.15 9.95 3.70 5.25 1.75 0.60

432 X GJRA - GLOBAL JOURNAL FOR RESEARCH ANALYSIS

VOLUME-7, ISSUE-4, APRIL-2018 • ISSN No 2277 - 8160 IF : 5.156 | IC Value : 85.78

Ÿ In the stock market when compared with, equity derivatives are

more pro table with less risk.

Ÿ In the equity market for the buying of shares, the investor has to

pay full amount but in the futures and options just he will pay

margins and premiums.

Ÿ If the investors short their shares in equity market, he has to

buyback on the day itself but in the futures and options there is a

period of 1 month to 3months contract.

Ÿ If the stock is going down, the investor will go for put option and

gets pro ts on that and similarly if stock is going up, he will go

for call option and gets pro ts on that.

5. CONCLUSION

Options, like futures, are also derivatives. An option is a legal

contract, which gives the holder the right to buy or sell the

underlying asset, at a speci ed price, on a speci ed date. Although it

gives the holder the right to buy or sell the underlying asset, he is not

obligated to do so. This is the basic difference between option and

futures. Derivatives Market has a signi cant role to play in the

economic expansion of a country. The objective of the study is to

examine the impact of nancial derivatives (futures and options) on

the underlying market volatility. From the above ndings it is

concluded that the Tata Motors Ltd. stock performance in spot

market and futures market is increased. The call options are

increased and put options are decreased over a period of one month

i.e. from 02nd June to 27th June 2017.It shows a positive sign in the

market. Now days, the investors know about the derivatives market

so they are attentive. As derivatives market offers more return, with

the prevarication of interest rate risk and swap over rate risk with

maximum pro ts and minimum loss. It has been noticed that there

has been attentiveness about derivatives trading amongst the

investors in India since last a few years.

6. REFERENCES

1. Asanna Chandra, (2008), “ nancial management”, Tata Mc Grew-hill publishing

company ltd. New Delhi.

2. Derivatives dealers’ module work book-Ncfm, 2017 India ltd.

3. Gifford Gomez, (2008) “ nancial markets, institutions and nancial services”, prentice

hall India ltd. New Delhi.

4. Vohra B R Badri, (2007), “futures and options”, Tata Mc Grew-hill publishing company

ltd. New Delhi.

5. Prakash Yalavatti. (2015, October) A Study on Strategic Growth in Indian Financial

Derivatives Market. International Journal of Recent Scienti cs Research, 6(10)

6. Dr. (Mrs.) KamleshGakhar; Ms. Meetu. (2013, March). Derivatives Market In India:

Evolution, Trading. International Journal of Marketing, Financial Services &

Management Research, 2, 38-50.

7. Bodla, B. S. and Jindal, K. (2008), ‘Equity Derivatives in India: Growth Pattern and

Trading Volume Effects’, The Icfai Journal of Derivatives Markets, Vol. V, No. 1, pp.62-82.

8. Kaur, P.(2004), ‘Financial derivatives: Potential of derivative market in India and

emerging derivatives market structure in India’

9. MisraDheeraj and MisraSangeeta D (2005), ‘Growth of Derivatives in the Indian Stock

Market: Hedging v/s Speculation’, The Indian Journal of Economics, Vol. LXXXV, No.

340.

10. Reddy, Y. V. and Sebastin, A. (2008), ‘Interaction between Equity and Derivatives

Markets in India: An Entropy Approach’, The Icfai Journal of Derivatives Markets, Vol. V,

No.1, pp.18-32.

GJRA - GLOBAL JOURNAL FOR RESEARCH ANALYSIS X 433

View publication stats

Вам также может понравиться

- MARKET TIMING FOR THE INVESTOR: Picking Market Tops and Bottoms with Technical AnalysisОт EverandMARKET TIMING FOR THE INVESTOR: Picking Market Tops and Bottoms with Technical AnalysisРейтинг: 2 из 5 звезд2/5 (2)

- A Survey On Stock Market Prediction Using Machine Learning TechniquesДокумент10 страницA Survey On Stock Market Prediction Using Machine Learning TechniquesharОценок пока нет

- Investment Decision Making Using Technical Analysis: A Study On Select Stocks in Indian Stock MarketДокумент10 страницInvestment Decision Making Using Technical Analysis: A Study On Select Stocks in Indian Stock MarketSachin AntonyОценок пока нет

- Technical Analysis of Selected Industry Leaders of Indian Stock Market Under The Cloud of Covid-19Документ19 страницTechnical Analysis of Selected Industry Leaders of Indian Stock Market Under The Cloud of Covid-19Pranjal PatilОценок пока нет

- Irjet V5i1216 PDFДокумент7 страницIrjet V5i1216 PDFthella deva prasadОценок пока нет

- Stocks ThesisДокумент4 страницыStocks Thesisafknqbqwf100% (2)

- A Study On Fundamental Analysis of Automobile Companies in IndiaДокумент6 страницA Study On Fundamental Analysis of Automobile Companies in Indiananalaptop.2002Оценок пока нет

- Deep LearningДокумент8 страницDeep Learningbhattacharyasayan605Оценок пока нет

- IJAEMAДокумент6 страницIJAEMAHimal ThapaОценок пока нет

- A Comparative Study On Risk Return Analysis of Sel PDFДокумент8 страницA Comparative Study On Risk Return Analysis of Sel PDFmahaОценок пока нет

- A Comparative Study On Risk & Return Analysis of Selected Stocks in IndiaДокумент8 страницA Comparative Study On Risk & Return Analysis of Selected Stocks in IndiamahaОценок пока нет

- Fundamental and Technical Analysis of Sharesof Automobile Industry - A Case StudyДокумент6 страницFundamental and Technical Analysis of Sharesof Automobile Industry - A Case StudyappachuОценок пока нет

- Project Report On Technical AnalysisДокумент56 страницProject Report On Technical AnalysisPrashant GaikarОценок пока нет

- The Technical Analysis For Gaining Profitability On Large Cap StocksДокумент7 страницThe Technical Analysis For Gaining Profitability On Large Cap StocksBhaskar PatilОценок пока нет

- A Study On Fundamental Analysis of Automobile Companies in IndiaДокумент6 страницA Study On Fundamental Analysis of Automobile Companies in Indiajunaid MullaОценок пока нет

- Mtlal ProjectДокумент8 страницMtlal ProjectSunny PalОценок пока нет

- Prediction of Stock Trend For Swing Trades Using Long Short Term Memory Neural Network ModelДокумент7 страницPrediction of Stock Trend For Swing Trades Using Long Short Term Memory Neural Network ModelDhanajiPatilОценок пока нет

- Ijirt161170 PaperДокумент4 страницыIjirt161170 Paperharisshaikh7070Оценок пока нет

- A Study On Technical Analysis of Selected Stocks in Indian Capital Market For Making Future DecisionsДокумент46 страницA Study On Technical Analysis of Selected Stocks in Indian Capital Market For Making Future DecisionsSharon ThomasОценок пока нет

- 18M183 Sharan Karvy SIP REPORTДокумент26 страниц18M183 Sharan Karvy SIP REPORTsharan ChowdaryОценок пока нет

- Equity Research Using Technical Analysis: July 2019Документ10 страницEquity Research Using Technical Analysis: July 2019Siva RajОценок пока нет

- AStudyonAnalysisofStockPricesofSelectedIndustries-research GateДокумент51 страницаAStudyonAnalysisofStockPricesofSelectedIndustries-research GateAvicena Ilham GhifarieОценок пока нет

- Major - Draft PaperДокумент7 страницMajor - Draft PaperAkshat UniyalОценок пока нет

- Research PaperДокумент6 страницResearch PaperAkshat UniyalОценок пока нет

- Impact of Stock Split Event On Share Price and Trading Volume: Evidence From Selected Companies of Indian Stock MarketДокумент7 страницImpact of Stock Split Event On Share Price and Trading Volume: Evidence From Selected Companies of Indian Stock MarketBhavdeepsinh JadejaОценок пока нет

- Synopsis of Risk Return AnalysisДокумент7 страницSynopsis of Risk Return AnalysisMohan Naidu100% (1)

- A Study On Ratio Analysis at Ultratech Cement Limited, TadipatriДокумент4 страницыA Study On Ratio Analysis at Ultratech Cement Limited, TadipatriEditor IJTSRDОценок пока нет

- A Project On Equity AnalysisДокумент93 страницыA Project On Equity AnalysisAjith CherloОценок пока нет

- 6 RTApril 2020 RathetalДокумент5 страниц6 RTApril 2020 RathetalSBA CriticОценок пока нет

- Project On Impact of Currency Derivative On Investors in Indian Capital MarketДокумент60 страницProject On Impact of Currency Derivative On Investors in Indian Capital MarketMurthyОценок пока нет

- Technical Analysis of Indian Stock MarketДокумент62 страницыTechnical Analysis of Indian Stock MarketPritesh PuntambekarОценок пока нет

- Commodity Market With Marwadi Shares & Finance LTD by Rohit ParmarДокумент72 страницыCommodity Market With Marwadi Shares & Finance LTD by Rohit ParmarCharanjit Singh SainiОценок пока нет

- A Study On Risk and Return Analysis of Selected Stocks in IndiaДокумент5 страницA Study On Risk and Return Analysis of Selected Stocks in IndiarajathОценок пока нет

- Technical IndicatorsДокумент54 страницыTechnical IndicatorsRavee MishraОценок пока нет

- Varshini EquityresearchusingtechnicalanalysisДокумент10 страницVarshini EquityresearchusingtechnicalanalysisNeeraj KumarОценок пока нет

- Prashant Shinde - SIP PROJECTДокумент69 страницPrashant Shinde - SIP PROJECTshubhamare11Оценок пока нет

- Tata Motors Project ReportДокумент63 страницыTata Motors Project ReportMahi SharmaОценок пока нет

- Vikram DixitДокумент63 страницыVikram Dixityuvrajtaji6Оценок пока нет

- Stock Market Prediction Using Machine Learning: Gareja Pradip, Chitrak Bari, J. Shiva NandhiniДокумент4 страницыStock Market Prediction Using Machine Learning: Gareja Pradip, Chitrak Bari, J. Shiva NandhiniAkash GuptaОценок пока нет

- Part 2 SipДокумент24 страницыPart 2 SipGAURAV MANSHANIОценок пока нет

- A Study On Comparative Analysis of Tata Consultancy Service and Infosys On The Basis of Their Capital Market PerformancesДокумент19 страницA Study On Comparative Analysis of Tata Consultancy Service and Infosys On The Basis of Their Capital Market PerformancesAprameya TОценок пока нет

- Derivatives AS Hedging Technique (Analysis On Oil Sector)Документ12 страницDerivatives AS Hedging Technique (Analysis On Oil Sector)Rajen AnikeОценок пока нет

- DERIIIIДокумент11 страницDERIIII45 ANIVESH KUMAR SINGHОценок пока нет

- Final HC (Combined Fles)Документ41 страницаFinal HC (Combined Fles)kevingoyalОценок пока нет

- Valuation ProjectДокумент9 страницValuation ProjectMohit BatraОценок пока нет

- Genesis of The Report: Equity Research of Infrastructure SectorДокумент40 страницGenesis of The Report: Equity Research of Infrastructure Sectorsandesh1986Оценок пока нет

- Trading Stock Exchange: Presentation On Sip Project ReportДокумент20 страницTrading Stock Exchange: Presentation On Sip Project ReportJayanta 1Оценок пока нет

- Perception of Investors Towards Indian Commodity Derivative Market With Inferential Analysis in Chennai CityДокумент10 страницPerception of Investors Towards Indian Commodity Derivative Market With Inferential Analysis in Chennai CitySanjay KamathОценок пока нет

- Project Report Submitted To Savitribai Phule Pune University in Partial Fulfillment of Requirement For The Award ofДокумент73 страницыProject Report Submitted To Savitribai Phule Pune University in Partial Fulfillment of Requirement For The Award ofVishal SutharОценок пока нет

- Ijirt155690 PaperДокумент6 страницIjirt155690 PaperraghavОценок пока нет

- Satyam Final MRPДокумент32 страницыSatyam Final MRPRahul RahulОценок пока нет

- JETIR1902533Документ13 страницJETIR1902533sharfuddinОценок пока нет

- Empirical Research NiftyДокумент13 страницEmpirical Research NiftyappuОценок пока нет

- Fundamental Analysis of Automobile Sector in IndiaДокумент6 страницFundamental Analysis of Automobile Sector in IndiaTUSHAR MANDALEОценок пока нет

- End-Sem Report - Tushit - 2013B3A8376H PDFДокумент16 страницEnd-Sem Report - Tushit - 2013B3A8376H PDFTushit ThakkarОценок пока нет

- Investor Preferances DerivativesДокумент14 страницInvestor Preferances DerivativesKannan SrinivasanОценок пока нет

- 3 PDFДокумент11 страниц3 PDFSarthak ChavanОценок пока нет

- Assessment of Listed Cement Companies in India With Reference To Specific Valuation ParametersДокумент5 страницAssessment of Listed Cement Companies in India With Reference To Specific Valuation ParametersEditor IJTSRDОценок пока нет

- Comparative Study of Working Capital Management of Tata Motors and Maruti SuzukiДокумент11 страницComparative Study of Working Capital Management of Tata Motors and Maruti Suzukivinayghatode54Оценок пока нет

- AStudyonWCMofIndianSteelIndustry GJOMДокумент12 страницAStudyonWCMofIndianSteelIndustry GJOMShikha MishraОценок пока нет

- Benchmarking Culture and Its Impact On Operational Performance: A Field Study On Industrial Companies in JordanДокумент16 страницBenchmarking Culture and Its Impact On Operational Performance: A Field Study On Industrial Companies in JordanAbdullah HashimОценок пока нет

- Electronic Journal of Research in Educational Psychology 1696-2095Документ22 страницыElectronic Journal of Research in Educational Psychology 1696-2095Abdullah HashimОценок пока нет

- Gazi Üniversitesi Ticaret Ve Tur: L) P (÷LWLP) DN OWHVL UG'Ro'U %Dúnhqwhqlyhuvlwhvl6Rv/Do%Lolpohu0Hvohn Nvhnrnxoxg÷U - UДокумент32 страницыGazi Üniversitesi Ticaret Ve Tur: L) P (÷LWLP) DN OWHVL UG'Ro'U %Dúnhqwhqlyhuvlwhvl6Rv/Do%Lolpohu0Hvohn Nvhnrnxoxg÷U - UAbdullah HashimОценок пока нет

- Analysis of Competitive Advantage in The Perspective Of: Resources Based ViewДокумент20 страницAnalysis of Competitive Advantage in The Perspective Of: Resources Based ViewAbdullah HashimОценок пока нет

- Benchmarking Impact On Organizational PerformaceДокумент12 страницBenchmarking Impact On Organizational PerformaceGil DudezОценок пока нет

- An Evaluation of Performance Using The Balanced Scorecard Model For The University of Malawi's PolytechnicДокумент10 страницAn Evaluation of Performance Using The Balanced Scorecard Model For The University of Malawi's PolytechnicAbdullah HashimОценок пока нет

- Drawing Robot 5 Steps With PicturesДокумент5 страницDrawing Robot 5 Steps With PicturesxiaoboshiОценок пока нет

- Ajkfluids2015-28124: Optimization of Looped Airfoil Wind Turbine (Lawt) Design Parameters For Maximum Power GenerationДокумент7 страницAjkfluids2015-28124: Optimization of Looped Airfoil Wind Turbine (Lawt) Design Parameters For Maximum Power GenerationAbdullah HashimОценок пока нет

- Benchmarking: Full Length Research PaperДокумент4 страницыBenchmarking: Full Length Research PaperAbdullah HashimОценок пока нет

- A Case Study of Workplace CommunicationДокумент18 страницA Case Study of Workplace CommunicationSyahirah Rashid100% (3)

- The Resource-Based View in Entrepreneurship: A Content-Analytical Comparison of Researchers' and Entrepreneurs' ViewsДокумент23 страницыThe Resource-Based View in Entrepreneurship: A Content-Analytical Comparison of Researchers' and Entrepreneurs' ViewsAbdullah HashimОценок пока нет

- Powder Metallurgy PDFДокумент160 страницPowder Metallurgy PDFmiroslav sabljo0% (1)

- Assessment of Energy Conservation in Egypt's Electric SystemДокумент7 страницAssessment of Energy Conservation in Egypt's Electric SystemAbdullah HashimОценок пока нет

- Drawing RobotДокумент9 страницDrawing Robotmarius_danila8736100% (1)

- GprsДокумент5 страницGprsAbdullah HashimОценок пока нет

- Practical Assignment 19MECH20HДокумент3 страницыPractical Assignment 19MECH20HAbdullah HashimОценок пока нет

- EASJDOM 15 83-85 CДокумент4 страницыEASJDOM 15 83-85 CAbdullah Hashim100% (1)

- Business - Strategy 4 Sustainable DevelopmentДокумент19 страницBusiness - Strategy 4 Sustainable DevelopmentMikeОценок пока нет

- PDFДокумент2 страницыPDFAbdullah HashimОценок пока нет

- The Importance of The Financial Derivatives Markets To Economic Development in The World's Four Major EconomiesДокумент18 страницThe Importance of The Financial Derivatives Markets To Economic Development in The World's Four Major EconomiesHimani RawatОценок пока нет

- Certification of LAWДокумент6 страницCertification of LAWAbdullah HashimОценок пока нет

- International BusinessДокумент6 страницInternational BusinessAbdullah HashimОценок пока нет

- Lubricants For Compaction of P/M ComponentsДокумент10 страницLubricants For Compaction of P/M ComponentsAbdullah HashimОценок пока нет

- Total English Placement Test: Choose The Best Answer. Mark It With An X. If You Do Not Know The Answer, Leave It BlankДокумент6 страницTotal English Placement Test: Choose The Best Answer. Mark It With An X. If You Do Not Know The Answer, Leave It BlankMỹ Dung PntОценок пока нет

- Executive Summary MuftiДокумент6 страницExecutive Summary MuftiAbdullah HashimОценок пока нет

- LUBRICANTS (Use in Report Writing)Документ16 страницLUBRICANTS (Use in Report Writing)Abdullah HashimОценок пока нет

- Role of Lubrication (Use in Report Writing)Документ4 страницыRole of Lubrication (Use in Report Writing)Abdullah HashimОценок пока нет

- K. Marx, F. Engels - The Communist Manifesto PDFДокумент77 страницK. Marx, F. Engels - The Communist Manifesto PDFraghav vaid0% (1)

- Jio Fiber Tax Invoice TemplateДокумент5 страницJio Fiber Tax Invoice TemplatehhhhОценок пока нет

- Shimoga TourДокумент180 страницShimoga Tourb_csr100% (1)

- Goals of Financial Management-Valuation ApproachДокумент9 страницGoals of Financial Management-Valuation Approachnatalie clyde matesОценок пока нет

- AIS Cycle PDFДокумент25 страницAIS Cycle PDFWildan RahmansyahОценок пока нет

- Profit CentersДокумент13 страницProfit CentersRuturaj SawantОценок пока нет

- Simulation of A Sustainable Cement Supply Chain Proposal Model ReviewДокумент9 страницSimulation of A Sustainable Cement Supply Chain Proposal Model Reviewbinaym tarikuОценок пока нет

- Event Marketing Manager Specialist in Cincinnati KY Resume Kim ThompsonДокумент2 страницыEvent Marketing Manager Specialist in Cincinnati KY Resume Kim ThompsonKimThompsonОценок пока нет

- Ipo Note Oimex Electrode LimitedДокумент7 страницIpo Note Oimex Electrode LimitedSajjadul MawlaОценок пока нет

- BAPTC Mock TradingДокумент6 страницBAPTC Mock TradingNgan TuyОценок пока нет

- Gandhian Philosophy of Wealth Management BBA N107 UNIT IVДокумент20 страницGandhian Philosophy of Wealth Management BBA N107 UNIT IVAmit Kumar97% (29)

- Sohail Copied Black Book ProjectДокумент84 страницыSohail Copied Black Book ProjectSohail Shaikh64% (14)

- Slides On Bangladesh Labor Standards.Документ16 страницSlides On Bangladesh Labor Standards.Md. Jahid Hasan ShawonОценок пока нет

- Module 6 - Donor's TaxationДокумент14 страницModule 6 - Donor's TaxationLex Dela CruzОценок пока нет

- Theory Base of AccountingДокумент4 страницыTheory Base of AccountingNoman AreebОценок пока нет

- Module 3 - Depreciation and DepletionДокумент39 страницModule 3 - Depreciation and DepletionCharles Allen ZamoraОценок пока нет

- Lecture 31 - 32 - 33 - 34 - Oligopoly MarketДокумент8 страницLecture 31 - 32 - 33 - 34 - Oligopoly MarketGaurav AgrawalОценок пока нет

- Accounting of Clubs & SocietiesДокумент13 страницAccounting of Clubs & SocietiesImran MulaniОценок пока нет

- Corporate Social Responsibility in Emerging Market Economies - Determinants, Consequences, and Future Research DirectionsДокумент53 страницыCorporate Social Responsibility in Emerging Market Economies - Determinants, Consequences, and Future Research DirectionsJana HassanОценок пока нет

- Case 1: Robin Hood: Archana Warrier BPS 4305 - 007 BochlerДокумент2 страницыCase 1: Robin Hood: Archana Warrier BPS 4305 - 007 BochlerchenlyОценок пока нет

- The Fundamental Concepts of Macroeconomics: Erandathie PathirajaДокумент69 страницThe Fundamental Concepts of Macroeconomics: Erandathie PathirajaDK White LionОценок пока нет

- 2018 BS by ExcelДокумент6 страниц2018 BS by ExcelAnonymous IPF2SEmHОценок пока нет

- 10 Axioms of FinManДокумент1 страница10 Axioms of FinManNylan NylanОценок пока нет

- International: Financial ManagementДокумент26 страницInternational: Financial Managementmsy1991Оценок пока нет

- AbujaMasterPlanReview FinalReportДокумент20 страницAbujaMasterPlanReview FinalReportADEWALE ADEFIOLAОценок пока нет

- BBM 215 - Financial Management IДокумент97 страницBBM 215 - Financial Management Iheseltine tutu100% (1)

- Conceptual Framework: Amendments To IFRS 3 - Reference To TheДокумент3 страницыConceptual Framework: Amendments To IFRS 3 - Reference To TheteguhsunyotoОценок пока нет

- Ac3143 ch1-4 PDFДокумент62 страницыAc3143 ch1-4 PDFNero PereraОценок пока нет

- FCT IPO - Investor PresentationДокумент21 страницаFCT IPO - Investor PresentationbandaliumОценок пока нет

- An Introduction To Supply Chainmanagement: William J. StevensonДокумент7 страницAn Introduction To Supply Chainmanagement: William J. StevensonpraveenОценок пока нет