Академический Документы

Профессиональный Документы

Культура Документы

A Study On Consumer Satisfaction Towards E - Banking" With Special Reference To Syndicate Bank, Vidya Nagara, Shivamogga

Загружено:

Shiva KumarОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

A Study On Consumer Satisfaction Towards E - Banking" With Special Reference To Syndicate Bank, Vidya Nagara, Shivamogga

Загружено:

Shiva KumarАвторское право:

Доступные форматы

Consumer Satisfaction Towards E-Banking

A STUDY ON CONSUMER SATISFACTION

TOWARDS E-BANKING WITH SPECIAL REFERENCE TO

SYNDICATE BANK, VIDYANGARA, SHIVAMOGGA.

CONTENTS

Sl Chapter Name Page No.

No.

1. Introduction 01-07

Need for the Study

Objectives of the Study

Scope of the Study

Research Methodology

Limitation of the study

2. Industry Profile 08-18

Introduction

History of Banking

Definition and Features of Banking

Nature of the Industry

Functions of banks

Conclusion

3. Company and Product Profile 19-31

History of the company

Other present information about company

Facilities provided by bank to customer

Conclusion

Sahyadri Commerce and Management College, Shivamogga Page No.1

Consumer Satisfaction Towards E-Banking

4. Survey Analysis and Interpretation 32-45

5. Major Findings, Suggestion, Conclusion 46-49

Annexure 50-55

Questionnaire

Bibliography

Sahyadri Commerce and Management College, Shivamogga Page No.2

Consumer Satisfaction Towards E-Banking

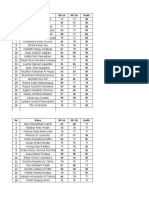

LIST OF FIGURES

Fig Title Page No.

No

.

1 Graph showing the Respondents gender 32

2 Graph showing the occupation of respondents 33

3 Graph showing the age of respondents 34

4 Graph showing of marital status of respondents 35

5 Graph showing respondents monthly income 36

6 Graph showing use of e banking by respondents 37

7 Graph showing respondents satisfaction of e baking services 38

8 Graph Showing Frequency of transaction in e banking by respondents 39

9 Graph showing Service charges for e banking is fair 40

10 Graph showing respondents know about e banking in the way of 41

following

11 Graph showing E banking replace traditional banking method 42

12 Graph showing Main reason to use e banking 43

13 Graph showing Customer using the services 44

14 Graph showing Facing a problem in e banking 45

Sahyadri Commerce and Management College, Shivamogga Page No.3

Consumer Satisfaction Towards E-Banking

LIST OF TABLE

Tabl Title Page No.

e No.

1 Table showing the Respondents gender 32

2 Table showing the occupation of respondents 33

3 Table showing the age of respondents 34

4 Table showing of marital status of respondents 35

5 Table showing respondents monthly income 36

6 Table showing use of e banking by respondents 37

7 Table showing respondents satisfaction of e baking services 38

8 Table Showing Frequency of transaction in e banking by respondents 39

9 Table showing Service charges for e banking is fair 40

10 Table showing respondents know about e banking in the way of 41

following

11 Table showing E banking replace traditional banking method 42

12 Table showing Main reason to use e banking 43

13 Table showing Customer using the services 44

14 Table showing Facing a problem in e banking 45

Sahyadri Commerce and Management College, Shivamogga Page No.4

Consumer Satisfaction Towards E-Banking

CHAPTER - 01

INTRODUCTION

Introduction

Need for the study

Objectives of the study

Scope of the study

Research methodology

Limitation of the study

Sahyadri Commerce and Management College, Shivamogga Page No.5

Consumer Satisfaction Towards E-Banking

Introduction

The study on consumer satisfaction towards e-banking with special reference of

Syndicate Bank, Vidyanagara, Shivamogga, has been brought out to know the reprocess

implication analysis and consumer opinion about e banking.

The banking industry has been rapidly developing the use of e banking as on efficient and

viable tool to create customer value.

The way of banking used to be done has changed it the past couple of years. And these

years have witness to the computerization of bank.

E banking is one of the popular service offered by the traditional banks to provide

speeder and reliable services to online users. With the rapid development of computer

technology as a commercial tool.

This project is an earnest effort to put the reactivates which have converted the old

branch banking toe airs to banking with the help of technology this is also an effort to make the

banking a subject which consists of not only the online banking but on subject of much wider

scope consisting of all the technological initiative that go into making a bank e bank.

Need for the study

The needs of the current study is to examine the consumer satisfaction towards e banking.

the present study also help in examining the e banking statement to know and understanding

the consumer position and performance of e banking. The current study helps to understand the

various system on practiced by the e banking to manage its day to day affairs.

Objectives of the study

To make detailed study of e banking.

To study the technological changes in banking.

Also study the changes in banking.

To know the actual process of the banking in e banking.

Sahyadri Commerce and Management College, Shivamogga Page No.6

Consumer Satisfaction Towards E-Banking

To establishment growth and progress of customers service provided by e banking.

To study the problems relating to e banking.

To know the performance of the e banking.

Scope of the study

The study of consumer satisfaction towards e banking with special reference of syndicate

bank, Vidya nagara ,Shivamogga.

This project report help to know the awareness level of customers regarding the e

banking service. Along with the satisfaction level of the customers in the e banking and the

customer perception regarding the e banking service.

Research methodology

For the purpose of study of this project, for this both primary and secondary data has

been collected from the manger of the branch personally to elicit information about the banking

system on sample basis was conducted ascertain the information about banking system. For this

purpose 50 customers were selected as sample and they we interviewed with the help of

questionnaires and personal interviews to elicit the valuable information from them.

Secondary data collected from various published sources like books, google etc….,,

Limitation of the study

the syndicate bank Vidya Nagara branch Shivamogga is having number of customers. All

the customers of The e banking are not contracted for purpose of this project.

The accuracy of this project depends on the information supplied by the customers.

Time constraint is important factor influencing the project report accuracy of this project

report may very due to constraint.

Technology is changing in a matter of time, there may be new technological initiative

soon, this information is fresh when the project to print.

The scope of this study limited to Shivamogga city only.

Sahyadri Commerce and Management College, Shivamogga Page No.7

Consumer Satisfaction Towards E-Banking

CHAPTER - 02

INDUSTRY PROFILE

Introduction

History of Banking

Definition and Features of Banking

Nature of the Industry

A .Service

b. B2B & B2C

c. Nature of the Competition

d. Contribution to GDP

Functions of banks

Conclusion

Sahyadri Commerce and Management College, Shivamogga Page No.8

Consumer Satisfaction Towards E-Banking

Introduction

A bank is a financial institution that accepts deposits from their customers and creates

credit.

The banking system in India is significantly different from that of others Asian nations

because of the country’s unique geographic ,social, and economic characteristics. India has a

large population and land size, a diverse culture, and extreme disparities in income ,which are

marked among its regions. There are high levels of illiteracy among a large percentage of its

population but, at the same time, the country has a large reservoir of managerial and

technologically advance talents.

The Indian banking industry has its foundations in the 18 th century, and has had a bumpy

revolutionary growth path since then. The industry in recent times has recognised the importance

of private and foreign players in a competitive scenario and has moved towards greater

liberalisation. Indian banks have mobilised around 80% of funding from deposits. Thus their

ability to win market share profitability is key to stock return.

Sahyadri Commerce and Management College, Shivamogga Page No.9

Consumer Satisfaction Towards E-Banking

History of Banking

The history of banking began with the first prototype banks which were the merchants of

the world, who made grain loans to farmers and traders who carried goods between cities. This

was around 2000 BC in Assyria, India and Sumeria. Later, in ancient Greece and during the

Roman Empire, lenders based in temples made loans, while accepting deposits and performing

the change of money. Archaeology from this period in ancient China and India also shows

evidence of money lending.

Many histories position the crucial historical development of a banking system to

medieval and Renaissance Italy and particularly the affluent cities of Florence, Venice and

Genoa. The Bardi and Peruzzi Families dominated banking in 14th century Florence,

establishing branches in many other parts of Europe.[1] The most famous Italian bank was the

Medici bank, established by Giovanni Medici in 1397.[2] The oldest bank still in existence is

Banca Monte dei Paschi di Siena, headquartered in Siena, Italy, which has been operating

continuously since 1472.

The development of banking spread from northern Italy throughout the Holy Roman

Empire, and in the 15th and 16th century to northern Europe. This was followed by a number of

important innovations that took place in Amsterdam during the Dutch Republic in the 17th

century, and in London since the 18th century. During the 20th century, developments in

telecommunications and computing caused major changes to banks' operations and let banks

dramatically increase in size and geographic spread. The financial crisis of 2007–2008 caused

many bank failures, including some of the world's largest banks, and provoked much debate

about bank regulation.

Sahyadri Commerce and Management College, Shivamogga Page No.10

Consumer Satisfaction Towards E-Banking

Definition of a Bank

Oxford Dictionary defines a bank as "an establishment for custody of money, which it

pays out on customer's order."

Characteristics / Features of a Bank

1. Dealing in Money

Bank is a financial institution which deals with other people's money i.e. money given by

depositors.

2. Individual / Firm / Company

A bank may be a person, firm or a company. A banking company means a company

which is in the business of banking.

3. Acceptance of Deposit

A bank accepts money from the people in the form of deposits which are usually

repayable on demand or after the expiry of a fixed period. It gives safety to the deposits of its

customers. It also acts as a custodian of funds of its customers.

4. Giving Advances

A bank lends out money in the form of loans to those who require it for different

purposes.

5. Payment and Withdrawal

A bank provides easy payment and withdrawal facility to its customers in the form of

cheques and drafts, It also brings bank money in circulation. This money is the form of cheques,

drafts etc.,

6. Agency and Utility Services

A bank provides various banking facilities to its customers. They include general utility

services and agency services.

Sahyadri Commerce and Management College, Shivamogga Page No.11

Consumer Satisfaction Towards E-Banking

7. Profit and Service Orientation

A bank is a profit seeking institution having service oriented approach.

8. Ever increasing Functions

Banking is an evolutionary concept. There is continuous expansion and diversification as

regards the functions, services and activities of a bank.

9. Connecting Link

A bank acts as a connecting link between borrowers and lenders of money. Banks collect

money from those who have surplus money and give the same to those who are in need of

money.

10. Banking Business

A bank's main activity should be to do business of banking which should not be

subsidiary to any other business.

11. Name Identity

A bank should always add the word "bank" to its name to enable people to know that it is

a bank and that it is dealing in money.

Nature of the industry

a bank is a financial institution that provides banking and other financial service to their

customers. A bank is generally understood as an institution which provides fundamental banking

service such as accepting deposits and providing loans.

A bank is a service industry

It is a financial institution that provides banking and other financial service to their

customers. A bank is generally understood as an institution which provides fundamental banking

service such as accepting deposits and providing loans. banks are subset of the financial service

industry. Almost in any country. banks represent main pillar of financial stability. Bank also

provide the information to customer this is also a service.

Sahyadri Commerce and Management College, Shivamogga Page No.12

Consumer Satisfaction Towards E-Banking

Banking system is B2B and B2C two side working business to business and business to

customers. banking product and service as deposits, remittance, credit cards etc..bank provide the

service direct to customer in the way of collect the deposits and providing loan to customers.

B2B & B2C

Bank also working business to business this form of electronic banking is for transacting

inter bank transactions such as money at call. also bank contract with other business also it

provides service to business.

A banking industry is also a business. in every business had a competition .competitive

nature of a bank is based on size of bank ,capital, size of deposits, mobilised by banks, trust on

ability of banks to fulfil the deposits obligations . service offered by a bank in competition.

Contribution to GDP

The Indian banking industry is currently worth Rs 81 trillion roughly. the contribution of

the banking sector to GDP is about 7.7% of GDP. Banking sector has generated employment in

the economy for about 1.5 million people.

Functions of banks

A. Primary functions of banks

The primary functions of a bank are also known as banking functions. they are the main

functions of bank. These primary functions of banks are explained below.

1. Accepting deposits

The banks collects deposits from the public. These deposits can be of different types,

such as:

a. Saving deposits

b. Fixes deposits

c. Current deposits

d. Recurring deposits

Sahyadri Commerce and Management College, Shivamogga Page No.13

Consumer Satisfaction Towards E-Banking

a. Saving Deposits:

This type of deposits encourages saving habit of among the public. The rate of interest is

low. Withdrawals of deposits are allowed subject to certain restrictions. This account is suitable

to salary and wages earners. This account can be opened in single name or in joint names.

b. Fixed Deposits:

Lump sum amount is deposited at one for a specific period. Higher rate of interest is paid,

which varies with the period of deposit. Withdrawals are not allowed before the expiry of the

period. Those who have surplus funds go for fixed deposit.

c. Current Deposits:

This type of accounts is operated by businessmen. Withdrawals are freely allowed. no

interest paid. In fact, there are service charges. The account holders can get the benefit of

overdraft facility.

d. Recurring Deposits:

This type of accounts is operated by salaried persons and petty traders. A certain sum of

money is periodically deposited into the bank. Withdrawals are permitted only after the expiry of

certain period. A higher rate of interest is paid.

2. Granting of Loans and Advances

The bank advances loans to the business community and other members of the public.

The rate charged is higher than what it pays on deposits. The different in the interest rates

(lending rate and the deposit rate) is its profit.

The types of bank loans and advances are :

a. Overdraft

b. Cash credits

c. Loans

d. Discounting of bill of exchange

Sahyadri Commerce and Management College, Shivamogga Page No.14

Consumer Satisfaction Towards E-Banking

a. Overdraft

This type of advances are given to current account holders. No separate amount is

maintained. All entries are made in current account. A certain amount is sanctioned as overdraft

which can be withdrawn within a certain period of time say three months or so. Interest is

charged on actual amount withdrawn. An overdraft facility is granted against a collateral

security. It is sanctioned to businessman and firms.

b. Cash Credits

The client allowed cash credit up to a specific limit fixed in advance. It can be given to

current account holders as well as to others who do not have an account with bank. Separate ach

credit account is maintained. Interest is charged on the amount withdrawn in excess of limit. The

cash credit is given against the security of tangible asset and / or sanctioned than overdraft.

c. Loans

It is normally for short term say period of one year or medium term say a period of five

years. Now-a-days, banks do lend money for long term. Repayment of money can be in the form

of instalments spread over a period of time or in a lump sum amount. Interest is charged on the

actual amount sanctioned, whether withdrawn or not. The rate of interest may be slightly lower

than what is charged on overdraft and cash credits. Loans are normally secured against tangible

assets of the company.

B. Secondary functions of banks

The bank performs a number secondary functions, also called as non-banking functions.

These important secondary functions of banks are explained below.

1. Agency functions

The bank acts as an agent of its customer. The bank performs a number of agency

functions which includes:

a. Transfer of funds

b. Collection of cheques

c. Periodic payments

Sahyadri Commerce and Management College, Shivamogga Page No.15

Consumer Satisfaction Towards E-Banking

d. Portfolio management

e. Periodic collection

f. Other agency function

a. Transfer of funds

The bank transfer funds from the one branch to another or one place to another.

b. Collection of cheques

The bank collects the money of the cheque through clearing section of its customers. The

bank also collects money of the bills of the bill of exchange.

c. Periodic payments

On standing instructions of the client, the bank makes periodic payments in respect of

electricity bills, rent, etc.

d. Portfolio management

The banks also undertakes to purchase and sell the shares and debentures on behalf of the

clients and accordingly debits or credits the account. This facility called portfolio management.

e. Periodic collection

The bank collects salary, pension, dividend and such other periodic collections on behalf

of the client.

f. Other agency function

They act as trustee, executors, advisers and administrators on behalf its clients. They act

as representatives of clients to deal with other banks and institutions.

2. General utility functions

The bank also performs general utility functions, such as :

a. Issue of drafts, letter of credits, etc.

b. Locker facility

Sahyadri Commerce and Management College, Shivamogga Page No.16

Consumer Satisfaction Towards E-Banking

c. Underwriting of shares

d. Dealing in foreign exchange

e. Projects reports

f. Social welfare programmes

g. Other utility functions

a. Issue of drafts and letter of credits

Banks issue drafts for transferring money from the one place to another. It also issues

letter of credits, especially in case of import trade. It also issues travellers cheques.

b. Locker facility

The bank provides a locker facility for the safe custody of valuable documents, gold

ornaments and other valuables.

c. Underwriting of shares

The bank underwrites shares and debentures through its merchant banking division.

d. Dealing in foreign exchange

The commercial banks are allowed by RBI to deal in foreign exchange.

e. Projects reports

The bank may also undertake to prepare project reports on behalf of its clients.

f. Social welfare programmes

It undertakes social welfare programmes, such as adult literacy programmes, public

welfare campaigns, etc.

g. Other utility functions

It acts as a reference to financial standing of customers. It collects creditworthiness

information about clients of its customers. It provides market information to its customers, etc. It

provides traveller cheque facility.

Sahyadri Commerce and Management College, Shivamogga Page No.17

Consumer Satisfaction Towards E-Banking

Conclusion

Banking system have been with us for us long as people have been using money. Banks

and other financial institutions provide security for individual, business and government alike.

In general what banks do is pretty easy to figure out. For the average person banks accept

deposits, make loans, provide a safe place for money and valuables and act as payment agents

between merchants and banks.

Banks are quite important to the economy and are involved in such economic activities as

issuing money, setting payment, credit intermediation, maturity transformation and money

creation in the form of fractional reserve banking.

To make money, banks use deposits and whole sale deposits, share equity and fees and

interest from debt, loan and consumer lending, such as credit card and, bank fees.

In addition to fees and loans, banks are also involved in various other type of lending and

operation including buy/hold securities ,non interest income, insurance and leasing and

payment treasury services.

History has proven banks to be vulnerable to many risks. however, including credit,

liquidity , market operating, interesting rate and legal risks, many global crises have the result of

such vulnerabilities and this has led to the strict regulation of state and national banks.

Sahyadri Commerce and Management College, Shivamogga Page No.18

Consumer Satisfaction Towards E-Banking

CHAPTER - 03

COMPANY AND PRODUCT PROFILE

History of the company

Other present information about company

Facilities provided by bank to customer

Savings account

Current account

Fixed deposit

Advances / loans

NRI banking

E banking facility

Conclusion

Sahyadri Commerce and Management College, Shivamogga Page No.19

Consumer Satisfaction Towards E-Banking

HISTORY OF THE COMPANY

Syndicate bank was established in 1925 in Udupi in coastal Karnataka, as Canara

industrial and banking syndicate limited. With a capital of Rs.8000 by three visionaries – Sri

Upendra ananth Pai, a business man, Sri Vaman srinivas Kudva, an engineer and Dr. TMA Pai,

a Physician – who shared a strong commitment to social welfare.

Dr. TMA Pai

Upendra Ananth Pai

Sahyadri Commerce and Management College, Shivamogga Page No.20

Consumer Satisfaction Towards E-Banking

Vaman Srinivas Kudva

The objective was primarily to extend financial assistance to the local weavers who were

crippled by a crisis in the handloom industry through mobilising small savings from the

communities. The bank collected as low 2 annas daily at the door steps of the depositors through

its agents under its pigmy deposit scheme started 1928. Thanks to this syndicate bank was known

as “small man’s big bank”.

The bank renamed as the syndicate bank limited in 1954; also, the head office moved to

Manipal. In 19 July 1969, the bank was nationalised along with 13 other bank

The logo has changed through the years, the dog in the logo become more prominent,

and the colour palette changed to orange.

Sahyadri Commerce and Management College, Shivamogga Page No.21

Consumer Satisfaction Towards E-Banking

Syndicate Bank Old Logo

Syndicate Bank New Logo

The dog in the logo is in sync with syndicate banks motto-‘faithful and friendly’, the

orange colour indicates the banks vibrancy. competency and confidence to the next horizon of

business; yellow indicates innovation, banking the vibrancy and quick decisions through

collective work and thinking.

Other present information about company

The bank is well equipped to meet the challenges of the 21 st century in the areas of

information technology, knowledge and competition. IT skills and knowledge of the banks

personnel are being upgraded through a variety of programmes to promote customer delight in

every sphere of this activity the bank is pioneer among public sector banks on launching

centralised banking solution (CBS) and the bank is 100% CBS enabled.

Present the bank as 4103 branches spreads across India and 88 out of these 4103 branches

were opened recently. Syndicate bank has one branch in London, United Kingdom. The bank

sponsored many rural banks and has thus contributed to the development of india at the grass

root level.

Sahyadri Commerce and Management College, Shivamogga Page No.22

Consumer Satisfaction Towards E-Banking

The CEO of the syndicate bank Mrutynjay Mahapatra.

Present revenue of the bank as per the financial year 2017-18 ` 6,913.09 crore

Operating income as per financial year 2017-18 ` 1,514 crore

Net income as per the financial year 2017-18 ` 359 crore

Total asset of the bank ` 299,073.34 crore

Capital ratio (2017) 12.03%

Facilities provided by bank to customers

Syndicate bank provide many facilities to customers. The following facilities provide to

customers

Deposits

Deposits is a saving account, current account or any other type of bank account that

allows many to deposited and withdrawn by the account holder. These transactions are record on

the bank books, and the resulting balance is recorded as a liability for the bank and represents

the amount owed by the bank to the customer. Banks may charge a fee for the service, while

other pay the customer interest on the funds deposited.

Savings bank account

These account are designed to help the individuals(personal customers ) to inculcate

habit of saving money and to meet their requirement of money. Amounts can be

deposited/withdrawn from these accounts by way of cheques/withdrawal slips. It helps to the

customers to keep minimum cash at home besides earning interest. The account holder is

require to maintain certain monthly average balance in the account. Bank they give 3.5%

interest to saving bank account holder.

Current account

Current account can be opened by individual partnership forms private and public

limited company, HUF/specified associated societies, trusts etc. The minimum balance

maintain in the account also the person requires to be introduced by somebody no

interest is paid on the credit balance of the current account.

Sahyadri Commerce and Management College, Shivamogga Page No.23

Consumer Satisfaction Towards E-Banking

The customer has to give a written declaration that he is not enjoying and credit

facility from other bank and if he does he has to furnish the details for the some.

Fixed deposit

A fixed deposit is a financial instrument provided by banks or NBFCS which

provides investor a higher rate of interest than a regular saving account until the given

maturity date. It may as may not require the certain of separate account.

Syndicate bank fixed scheme offers investors to deposit an amount for a fixed

period of time and interest on the amount. This the safest form of investment that earns

the investors a source of income

The syndicate bank fixed deposit rate are quite sought after because of the

profitable returns the account holder can apply for loan at syndicate bank against fixed

deposit up to 95%. Fixed deposit interest rate fixed on the basis of maturity period.

Advances/loans

The syndicate bank provides variety of loans to different customer according to their

needs and requirements. The following is the list of loans provided by the bank:

Synd saral- it is a personal loan provide to salaried and non salaried persons.

Synd connect- it is also personal loan, provide to salaried persons.

Synd senior- it is a personal loan, provide to pensioners.

Synd vahan- it is vehicle loan, provide to two wheeler and four wheeler vehicles.

Synd loan- it is housing loan, under this two scheme

-synd nivas+

-synd delight

Synd vidya- it is a education loan, under this

-synd abroad

-synd super vidya

Synd rent

Synd mortage

Synd swarna- it is a gold loan

Sahyadri Commerce and Management College, Shivamogga Page No.24

Consumer Satisfaction Towards E-Banking

Agriculture advances

SKCC- syndicate kisan credit card, it gives up to 300000, only 4%

interest.

Syndicate kisan swarna

Synd green house

Synd kisan tajkal

Synd form house

Short term agriculture loan

MSME- micro small medium enterprise (business loan)

Synd udyog

Synd vyapar

Synd doctor

Synd professional

Mudra loan-up to 100000

Stand up india (ST/SE for women)

NRI banking

The syndicate bank offers three types of investment plans for NRI customers

Non resident (external)

Rupee account (NRE)

Non resident ordinary

Rupee account (NRO)

Resident foreign currency account

(RFC account)

Fast Tag facility

Fast tag device there employs radio frequency identification (RFIDP) technology

for making tool payment directly from the prepaid or saving account linked to it. It is of

fixed on the windscreen of vehicle and enable to drive through toll plazas without

stopping for cash transactions.

Sahyadri Commerce and Management College, Shivamogga Page No.25

Consumer Satisfaction Towards E-Banking

Para Banking Product

Life insurance

General insurance

Mutual fund

Capital market/share market & etc..,

E banking

E banking facility introduce under the programme digital banking(Go digital).

Syndicate bank has specially carved out digital banking service to suit customer needs.

Bank ensures that have access to customer bank any time, anywhere-whether at have or

office or on the move. Use digital initiatives and transact easily via online, mobile and e

commerce service through internet banking. Mobile banking and debit card or credit card.

The following electronic banking facility provide by bank:

Debit card – syndicate bank offers syndicate bank global debit card cum ATM

card which holds all the features or a modern debit card. Customers can access

their account from anywhere and ant time and can transact in any currency but the

payment should always be Indian currency. It can be termed as a convenient e-

wallet. Minimum values of transaction should be ₹ 100 and maximum can be ₹

20000 ,at its own ATM maximum value of a transaction at outside india

₹10000,maximum value for student and minor is ₹ 5000.

Credit card – syndicate bank credit card are of great use and convenience to

customers. There cards given free for life i.e. no charges are taken in form of

finance charge annual fees or renewed fees.

Cash withdrawal can be done at all the syndicate bank ATM and others having the

VISA logo across the globe with cash limit up to 30000.

Purchase can be made at all the merchant establishments having VISA logo with

limit up to 700000.credit card period ranges from 20-50 days.

Synd e-passbook -it is a mobile application where customers can view the

electronic version of pass book for CASA accounts, online or offline in your

smart phone.

Sahyadri Commerce and Management College, Shivamogga Page No.26

Consumer Satisfaction Towards E-Banking

The features of synd e-passbook are as follows:

- account details

- passbook

- Account statement

- Account setting

- change MPIN

Customer can download the app from google play store and any

registration can made.

Synd UPI – it is a mobile application, that lets customers to make simple and

quick payment transactions using unified payments interface (UPI). Customer

can easily make direct bank to bank payments instantly and collect money

using just mobile number or payment address or account number and IFSC

code. service are as follows:

- send money

- collect money

- scan and pay

- transaction details

- beneficiary management

- virtual address and account management etc…,

Mobile banking – syndicate bank mobile banking application provides simpler and

convenient way to handle syndicate bank accounts. An mobile handset With synd mobile

applications you can safe and secure banking with the following services:

- Fund transfer using IMPS

- Fund transfer within syndicate bank account

- Debit card management

- Values added service and bill payment

- Balance enquiry and mini statement

- SMS and Email statement registration

- Adhaar seeding

- Request for cheque book

- View issued cheque starts and stop cheque payment etc

Sahyadri Commerce and Management College, Shivamogga Page No.27

Consumer Satisfaction Towards E-Banking

Per day up to ₹50000 can use in this facility

Internet banking – using internet banking services, customer can do normal banking

transactions online fund transfer between own accounts, third party transfers to accounts

maintained at any branch of the bank, interbank transfers to accounts with other bank,

online ticket booking for travel by road, rail and air, etc..,

It is a safe and secure banking. Internet banking helps to manage the bills online

payment, transfer money easily and get alerts if account balance is low.

If customer starting internet banking service need to account in the branch, also

need register for the internet banking service with the branch.

Internet banking need account number and IFSC code. Up to 400000 can use in

this facility.

Advantages of E-Banking : –

The main advantages of electronic banking are: –

The cost of operation per unit of services is lower for banks.

Offers convenience to customers since they are not required to go to the bank’s facilities.

There is a very low incidence of errors.

The customer can obtain funds at any time from ATMs.

Credit cards and debit cards allow customers to get discounts at points of sale.

The customer can easily transfer the funds from one place to another place electronically.

Sahyadri Commerce and Management College, Shivamogga Page No.28

Consumer Satisfaction Towards E-Banking

Conclusion

Bank do is pretty easy to figure out. for the average person banks accept deposit, make

loans, provide a safe place for money and valuables and act as a payment agent between

merchant and banks.

Banks are quite important to the economy and are involved in such economic activities as

issuing money, setting payments, credit intermediation and money creation in form of fractional

reserve banking.

In make money banks use deposits and whole sale deposits, share equity and fees and

interest from debt, loans and consumer lending such as credit cards and bank fess.

E banking has its own advantages. The main advantages of implementing e banking is an

increase customer satisfaction. This is because customer do jot have to go the branches in order

to access their accounts, make withdrawal and deposits. They can also check it anytime of the

day, a feature that physical branches do not offer thus creating a good relationship with the bank

and the customer. E banking is also advantageous not only for customer but also for the bank

because it reduces costs in setting up a branch and the resources to process transactions. all these

benefits are the reasons why many banks are already investing in e banking.

Sahyadri Commerce and Management College, Shivamogga Page No.29

Consumer Satisfaction Towards E-Banking

CHAPTER- 04

SURVEY ANALYSIS AND INTERPRETATION

Sahyadri Commerce and Management College, Shivamogga Page No.30

Consumer Satisfaction Towards E-Banking

CHAPTER- 04

SURVEY ANALYSIS AND INTERPRETATION

Survey

Survey means in depth study of any subject and controlling inner expression of

respondent for the purpose of knowing their attitude and satisfaction about which survey is

conducted.

Customer are faced with problem while dealing with banks. Therefore to study their

problems questionnaire was prepaid and given to selected customers. The area cannot be

classified as most of them are selected on the basis of their experience with bank they were also

selected on random basis and are given format of questionnaire and requested to fill it and return

to us. The survey has been successfully carried out and survey covered over so customer of

banks.

Data collected from two sources, they are primary data and secondary data. Primary data

is first hand data it is collected directly from bankers secondary data is the one which is already

collected by somebody, which get in books, websites.

From the survey so conducted it is possible for us to give clear picture of survey finding

customers satisfaction to e banking. In this survey we taken only 50 customers in shivamogga

city.

Sahyadri Commerce and Management College, Shivamogga Page No.31

Consumer Satisfaction Towards E-Banking

Table No. 1

Table showing the Respondents gender

Gender No of respondents Percentage

Male 20 40

Female 30 60

Total 50 100

Graph No. 1

Graph showing the Respondents gender

male

40%

female

60%

Sahyadri Commerce and Management College, Shivamogga Page No.32

Consumer Satisfaction Towards E-Banking

Table No. 2

Table showing the occupation of respondents

Occupation No of respondents Percentage

Business 8 16

Profession 12 24

Students 18 36

House wife 7 14

Others 5 10

Total 50 100

Graph No.2

Graph showing the occupation of respondents

20

18

16

14

No. of Respondents

12

10

8

6

4

2

0

business profession students house wife others

Occupation

Sahyadri Commerce and Management College, Shivamogga Page No.33

Consumer Satisfaction Towards E-Banking

Table No. 3

Table showing the age of respondents

Age group No of respondents Percentage

15-30 30 60

30-45 10 20

45-60 6 12

60 and above 4 8

Total 50 100

Graph No. 3

Graph showing the age of respondents

45-60 60 and above

12% 8%

30-45 15-30

20% 60%

Sahyadri Commerce and Management College, Shivamogga Page No.34

Consumer Satisfaction Towards E-Banking

Table No.4

Table showing of marital status of respondents

Marital status No of respondents Percentage

Married 13 26

Unmarried 37 74

Total 50 100

Graph No. 4

Graph showing of marital status of respondents

married

26%

unmarried

74%

Sahyadri Commerce and Management College, Shivamogga Page No.35

Consumer Satisfaction Towards E-Banking

Table No. 5

Table showing respondents monthly income

Monthly income No of respondents Percentage

Below 5000 27 54

5000-10000 4 8

10000-15000 7 14

15000-20000 8 16

Above 20000 4 8

Total 50 100

Graph No. 5

Graph showing respondents monthly income

30

25

20

No. of Respodents

15

10

0

Below 5000 5000-10000 10000-15000 15000-20000 Above 20000

Monthly Income

Sahyadri Commerce and Management College, Shivamogga Page No.36

Consumer Satisfaction Towards E-Banking

Table No. 6

Table showing use of e banking by respondents

No of years No of respondents Percentage

Less than 2 years 15 30

2-5 years 18 36

5-10 years 10 20

More than 10 years 7 14

Total 50 100

Graph No. 6

Graph showing use of e banking by respondents

20

18

16

14

No.of Respondents

12

10

0

less than 2 years 2-5 years 5-10 years more than 10 years

No.of Years

Most of the customers using e banking in 2-5 years, Some of the customers are using e banking

in less than two years, some of the customers using the e banking service in 5-10 years also less

customers using the e banking service in more than 10 years.

Sahyadri Commerce and Management College, Shivamogga Page No.37

Consumer Satisfaction Towards E-Banking

Table No. 7

Table showing respondents satisfaction of e baking services

Yes 45 95%

No 5 5%

Graph No. 7

Graph showing respondents satisfaction of e baking services

no

5%

yes

95%

in total customers most of the respondents satisfying the e banking service. Some of the

customers are not satisfying the service.

Sahyadri Commerce and Management College, Shivamogga Page No.38

Consumer Satisfaction Towards E-Banking

Table No. 8

Table Showing Frequency of transaction in e banking by respondents

Frequency No of respondents Percentage

2-3 times per week 10 20

Daily 8 16

Once per month 10 20

Once per week 22 44

Total 50 100

Graph No. 8

Graph Showing Frequency of transaction in e banking by respondents

25

20

No. of respondents

15

10

0

2-3 times per week daily once per month once per week

Frequency

Most of customers using the e banking facility weekly one time. Some of the customers are

using the e banking daily and also. Some of the customers are using the e banking once per

month also 2-3 times per week.

Sahyadri Commerce and Management College, Shivamogga Page No.39

Consumer Satisfaction Towards E-Banking

Table No.9

Table showing Service charges for e banking is fair

Yes 10 20%

No 40 80%

Graph No. 9

Graph showing Service charges for e banking is fair

Most

yes

20% of the

no

80%

customers opinion to e banking charges are not fair. Some of the customers opinion is it is fair.

Sahyadri Commerce and Management College, Shivamogga Page No.40

Consumer Satisfaction Towards E-Banking

Table No. 10

Table showing respondents know about e banking in the way of following

Way of know about e No of respondents Percentage

banking

Friends 15 30

Bankers 17 34

Relatives 10 20

Advertisements 2 4

Others 6 12

Total 50 100

Graph No. 10

Graph showing respondents know about e banking in the way of following

18

16

14

12

No. of Respondents

10

0

friends bankers relatives advertisements others

Way of know about e banking

The customers came to know about e banking from friends, relatives and bankers in personal

contact. Very less information through advertisements is available to them.

Sahyadri Commerce and Management College, Shivamogga Page No.41

Consumer Satisfaction Towards E-Banking

Table No. 11

Table showing E banking replace traditional banking method

Yes 13 26%

No 37 74%

Graph No. 11

Graph showing E banking replace traditional banking method

yes

26%

no

74%

Most of the customers opinion to e banking do not replace the traditional banking method. Some

customers opinion is e banking replacing the traditional banking method.

Table No.12

Sahyadri Commerce and Management College, Shivamogga Page No.42

Consumer Satisfaction Towards E-Banking

Table showing Main reason to use e banking

Reasons No of respondents Percentage

Better information 6 12

Simplification 9 18

24 hr. Service 10 20

Limited time available 25 50

Total 50 100

Table 12

Graph showing Main reason to use e banking

30

25

20

15

10

0

better information simplification 24 hr. Service limited time availablde

Most of the customers are using the e banking for time saving purpose, some customers

using the e banking for it provide the better information and e banking is a simple process and it

provides 24 hour service.

Table No. 13

Table showing Customer using the services

Sahyadri Commerce and Management College, Shivamogga Page No.43

Consumer Satisfaction Towards E-Banking

Services Yes No

Debit card 48 2

Credit card 16 34

Mobile banking 12 38

Internet banking 24 26

E passbook 11 39

Others 20 30

Graph No. 13

Graph showing Customer using the services

60

50

40

30 yes

no

20

10

0

debit card cret card mobile bankig internet banking e pass book others

Most of the respondents using e banking especially facility of debit card and internet

banking, customers also using the other e banking facility. Some customers also using the credit

card facility and mobile banking facility, very less customers using the e pass book.

Sahyadri Commerce and Management College, Shivamogga Page No.44

Consumer Satisfaction Towards E-Banking

Table No. 14

Table showing Facing a problem in e banking

Yes 35 70%

No 15 30%

Graph No. 14

Graph showing Facing a problem in e banking

no

30%

yes

70%

Most of the customers are facing problem in e banking like server busy. Some time

internet banking is not working, some time debit card not working properly etc.

Sahyadri Commerce and Management College, Shivamogga Page No.45

Consumer Satisfaction Towards E-Banking

CHAPTER 5

MAJOR FINDINGS AND SUGGESTIONS

Sahyadri Commerce and Management College, Shivamogga Page No.46

Consumer Satisfaction Towards E-Banking

CHAPTER 5

MAJOR FINDINGS AND SUGGESTIONS

Major Findings

In this survey conducted to know the satisfaction customers and opinion of the customers

to e banking. We find the some problems faced by e banking.

Problems that the customers face while transaction in e banking.

lack of information

limited cash withdrawal

less acceptance in merchant establishment

lack of advertisement

closer ATM’s regularly

inadequate knowledge

inconvenience in operations

Fear of security to money

Sometimes server busy in e banking

Sahyadri Commerce and Management College, Shivamogga Page No.47

Consumer Satisfaction Towards E-Banking

Suggestion

Proper knowledge should be provided:

There should be some sound steps to improve the knowledge provision to the customers

through some guidelines to helps them deal with the problems they come up with during their

should be easily made understand operation in e banking through some charts on braches the

bank.

Inconvenience in operation:

Many faced inconvenience while doing business/transaction in e banking because of their

ignorance to handle sophisticated equipment in case ATM’s there should be some kind of

directions problem for the customers by the bank of to deal with the operations. There is a lack

of infrastructures like internet in e banking.

Lack of information should be reduced

The complaint of people about, the lack of information’s about the latest happening in

new technological advancement in its services or the technological initiatives should be taken

care there should be regular journals to inform about, the new developments.

Extension of cash withdrawal in limit:

There is a moderate demand for extension of cash limit withdrawal on e banking.

More collaborating with merchant establishment:

Except some restaurants and malls the debit card is not accepted anywhere else in

Shimoga. There should be some approach from bank to get more establishments to accept the

debit card.

Lack of advertisement:

The people who knew about e banking knew it by way of relatives, friends and by banker

directly than through advertisement. People are of the opinion that there should be some steps

taken in regard to advertisements at local level.

Sahyadri Commerce and Management College, Shivamogga Page No.48

Consumer Satisfaction Towards E-Banking

Conclusion

banking business has been an advisable part of economy in general and business in

particular matter of fact, banking has widened its services from tradition area to a number of

sophisticated areas like e banking, computerization, real time gross settlement(RTGS), Tele

banking whatever may by the area, banks flourish only when their activities are customer

oriented in order to achieve 100% customer orientation they should be aware of customer

demands.

Like dislike aspiration. Further should know the extent to which there points should have

been achieved. Therefore there continues research programmers. Showing the performance to be

achieved, problems in present strategies in marketing and operations of e banking should be

revised due to consideration from the competition from the private sector foreign banks.

The presence study deals with the activities of e banking, satisfaction towards e banking,

problems of e banking and suggestions in particular the analysis has been made in connection

with the perceptions called e banking and technological changes in banking. Further it portrays

the problems and inconvenience faced by them while availing of services, suggestions have been

given for improving strategy in connection with been give positive consideration to the

suggestions given the report. I am sure it may improve its strategy.

Sahyadri Commerce and Management College, Shivamogga Page No.49

Consumer Satisfaction Towards E-Banking

ANNEXURE

Questionnaire

Bibliography

Sahyadri Commerce and Management College, Shivamogga Page No.50

Consumer Satisfaction Towards E-Banking

ANNEXURE

QUESTIONNAIRE

Dear Respondent,

I am Athmiya .N. S, student of final year BBA, Sahyadri commerce and management

college, Shivamogga. I have undertaken a project work a study on “consumer satisfaction

towards e banking with special reference of syndicate bank, Vidhya Nagara, Shivamogga”.

Hence, I request you to kindly spare your valuable time to go through and fill in the

questionnaire.

Thanking you

Yours sincerely

Athmiya .N.S

1) Name :

2) Gender:

(a) Male ( )

(b) Female ( )

3) Occupation :

(a) Business ( )

(b) House wife ( )

(c) Profession ( )

(d) Student ( )

(e) Others ( )

Sahyadri Commerce and Management College, Shivamogga Page No.51

Consumer Satisfaction Towards E-Banking

4) Age:

(a) 15-30 ( )

(b) 30-45 ( )

(c) 45-60 ( )

(d) 60 and above ( )

5) Marital status :

(a) Married ( )

(b) Unmarried ( )

6) What is your monthly income

(a) Below 5000 ( )

(b) 5000-10000 ( )

(c) 10000-15000 ( )

(d) 15000-20000 ( )

(e) Above 20000 ( )

7) Do you have e banking facility for your account?

(a) Yes ( )

(b) No ( )

8) What are main reason that have not availed e banking facility

(a) Not aware ( )

(b) Don’t know operation ( )

(c) Difficulty ( )

(d) Others ( )

9) How did you come to know about e banking

(a) Friends ( )

(b) Bankers ( )

(c) Relatives ( )

(d) Advertisements ( )

(e) Others ( )

Sahyadri Commerce and Management College, Shivamogga Page No.52

Consumer Satisfaction Towards E-Banking

10) Which is the main reason for you to use e banking

(a) Better information ( )

(b) Simplification ( )

(c) 24 hr. service ( )

(d) Limited time available ( )

11) What are the e banking facility do you use

(a) Debit card ( )

(b) Credit card ( )

(c) Mobile banking ( )

(d) Internet banking ( )

(e) E-pass book ( )

(f) Others ( )

12) Since , how long do you use the e banking service

(a) Less than 2 years ( )

(b) 2-5 years ( )

(c) 5-10 years ( )

(d) More than 10 years ( )

13) Are you satisfied with e banking service

(a) Yes ( )

(b) No ( )

14) Frequency of transaction in e banking

(a) 2-3 times per week ( )

(b) Daily ( )

(c) Once per month ( )

(d) Once per week ( )

Sahyadri Commerce and Management College, Shivamogga Page No.53

Consumer Satisfaction Towards E-Banking

15) Do you think e banking replace traditional banking method

(a) Yes ( )

(b) No ( )

16) Do you face any problem in e banking

(a) Yes ( )

(b) No ( )

If yes specify __________________________________________

17) Are service charges for e banking fair ?

(a) Yes ( )

(b) No ( )

18) Any suggestions specify

Date :

Place : Signature

Sahyadri Commerce and Management College, Shivamogga Page No.54

Consumer Satisfaction Towards E-Banking

Bibliography

Books:

E-Banking & Financial Inclusion Litty Denis

Banking Theory, Law and Practice E .Gordon

K. Nagarajan

Management of Banking Operations Veershetty G. Rathod

Mamatha S. M.

Madhu M. C.

Maruthi S. M.

Manjappa R.

Websites:

www.paisabazar.com

www.syndicatebank.com

www.thebusinssquiz.com

Sahyadri Commerce and Management College, Shivamogga Page No.55

Вам также может понравиться

- Regional Rural Banks of India: Evolution, Performance and ManagementОт EverandRegional Rural Banks of India: Evolution, Performance and ManagementОценок пока нет

- A Comparative Study On SBI and HDFC in Ambala City Ijariie5997Документ11 страницA Comparative Study On SBI and HDFC in Ambala City Ijariie5997vinayОценок пока нет

- A Study On E-Banking Services by Commercial Banks in Madurai DistrictДокумент16 страницA Study On E-Banking Services by Commercial Banks in Madurai DistrictSandyОценок пока нет

- 80 Pages ProjectДокумент80 страниц80 Pages ProjectR AdenwalaОценок пока нет

- ProjectДокумент50 страницProjectkomalpreetdhirОценок пока нет

- Review of LiteratureДокумент4 страницыReview of Literaturemaha lakshmiОценок пока нет

- A Comparative Study On Customer Satisfaction Towards Online Banking Services With Reference To Icici and HDFC Bank in LucknowДокумент7 страницA Comparative Study On Customer Satisfaction Towards Online Banking Services With Reference To Icici and HDFC Bank in LucknowChandan Srivastava100% (1)

- Digitalization and Security of Online Banking in J&K BankДокумент80 страницDigitalization and Security of Online Banking in J&K BankSyed Mehrooj QadriОценок пока нет

- Black Book ProjectДокумент23 страницыBlack Book ProjectAtharv KoyandeОценок пока нет

- A Comparative Study of E-Banking in Public andДокумент10 страницA Comparative Study of E-Banking in Public andanisha mathuriaОценок пока нет

- Comparative Study of Sbi & IciciДокумент4 страницыComparative Study of Sbi & Icicikamal paridaОценок пока нет

- Review of Literature HDFCДокумент2 страницыReview of Literature HDFCaaravubОценок пока нет

- Comparative Study On E-Banking of Icici and HDFC BankДокумент63 страницыComparative Study On E-Banking of Icici and HDFC BankAbhi KengaleОценок пока нет

- Customer Perception Towards Internet Banking PDFДокумент17 страницCustomer Perception Towards Internet Banking PDFarpita waruleОценок пока нет

- A Study On E-Banking System in Syndicate BankДокумент80 страницA Study On E-Banking System in Syndicate BankMaa Maa100% (1)

- Customer Satisfaction Regarding HDFC BankДокумент104 страницыCustomer Satisfaction Regarding HDFC BankAmarkant0% (1)

- Establishing A Strong Digital FootprintДокумент10 страницEstablishing A Strong Digital FootprintTANVIОценок пока нет

- "Project On E - Banking": Ankita Sandesh ChikaneДокумент48 страниц"Project On E - Banking": Ankita Sandesh ChikaneKirti JaiswalОценок пока нет

- Analysis of Major Segments For Current Account Business: Project Report OnДокумент9 страницAnalysis of Major Segments For Current Account Business: Project Report OnAman NostalgicОценок пока нет

- Internet Banking Advantages MBA ProjectДокумент85 страницInternet Banking Advantages MBA ProjectVishal Sanjay SamratОценок пока нет

- Online Banking Project FinalДокумент55 страницOnline Banking Project FinalSANTOSH GAIKWADОценок пока нет

- Research ProposalДокумент3 страницыResearch ProposalAniket GangurdeОценок пока нет

- e Banking ReportДокумент40 страницe Banking Reportleeshee351Оценок пока нет

- Questionnaire On Internet BankingДокумент4 страницыQuestionnaire On Internet Bankingcena2115Оценок пока нет

- A Study On Customer Awareness Towards e Banking.. B. GopichandДокумент11 страницA Study On Customer Awareness Towards e Banking.. B. Gopichandaurorashiva1Оценок пока нет

- Project On E-BankingДокумент64 страницыProject On E-BankingRamandeep Singh50% (2)

- Retail Banking and Its Pdts Service QuestionnaireДокумент3 страницыRetail Banking and Its Pdts Service QuestionnaireKiruthika SubramaniОценок пока нет

- Customer Satisfaction in The Indian Banking SectorДокумент69 страницCustomer Satisfaction in The Indian Banking SectorKpramod YadavОценок пока нет

- Introduction of E CommerceДокумент2 страницыIntroduction of E CommerceAkanksha KadamОценок пока нет

- Project Report On CORPORATE GovernanceДокумент28 страницProject Report On CORPORATE GovernanceS G KОценок пока нет

- Banking ProjectДокумент56 страницBanking ProjectViki Sakpal100% (1)

- Importance of IT in BankingДокумент55 страницImportance of IT in BankingMoinuddin BaigОценок пока нет

- ReportДокумент120 страницReportAman Prakash100% (2)

- ABDUL RAHMAN - Role of ItДокумент20 страницABDUL RAHMAN - Role of ItMOHAMMED KHAYYUM100% (1)

- Customers Satisfaction On ATMДокумент33 страницыCustomers Satisfaction On ATMabdullahi shafiuОценок пока нет

- A Study On Customers Satisfaction Towards Public Distribution SystДокумент7 страницA Study On Customers Satisfaction Towards Public Distribution SystRamasamy VelmuruganОценок пока нет

- CP ProjectДокумент63 страницыCP ProjectJITENDRA VISHWAKARMAОценок пока нет

- Comparison of Sbi Internet Banking Facilities With Icici BankДокумент7 страницComparison of Sbi Internet Banking Facilities With Icici BankEkta KhoslaОценок пока нет

- A Study On Consumer Perception Towards Mobile Banking Services of State Bank of IndiaДокумент45 страницA Study On Consumer Perception Towards Mobile Banking Services of State Bank of IndiaVijaya Anandhan100% (1)

- "Adaptability of E-Banking - A Case Study of Jalandhar": A Final Research Report OnДокумент44 страницы"Adaptability of E-Banking - A Case Study of Jalandhar": A Final Research Report OnRavinder KaurОценок пока нет

- Jayesh Black Book ProjectДокумент80 страницJayesh Black Book Projectnishanth naik100% (1)

- Technology in BankingДокумент98 страницTechnology in BankingkarenОценок пока нет

- Customer Satisfaction Regarding Internet BankingДокумент21 страницаCustomer Satisfaction Regarding Internet BankingAditi AroraОценок пока нет

- A Study On Consumer'S Perception Towards Net Banking Services of Axis BankДокумент102 страницыA Study On Consumer'S Perception Towards Net Banking Services of Axis BankVIKASH GARGОценок пока нет

- BRM Project On Online Banking Customer SatisfactionДокумент43 страницыBRM Project On Online Banking Customer Satisfactionprathamesh tawareОценок пока нет

- Retail Banking Literature ReviewДокумент1 страницаRetail Banking Literature ReviewAsh Jerk100% (1)

- I.T. in Banking IndustryДокумент102 страницыI.T. in Banking Industryshahin14380% (5)

- HDFC: Bank's Focus Area, Marketing or OperationsДокумент48 страницHDFC: Bank's Focus Area, Marketing or OperationsShubham SinghalОценок пока нет

- Project Report On Mobile Banking: Rayat Bahra University - Mohali (Usms)Документ43 страницыProject Report On Mobile Banking: Rayat Bahra University - Mohali (Usms)AnkitОценок пока нет

- Arkay IndustriesДокумент2 страницыArkay IndustriesVishal PandeyОценок пока нет

- HDFC BankДокумент79 страницHDFC BankAnkit YadavОценок пока нет

- Comparative Study of HDFC and SbiДокумент53 страницыComparative Study of HDFC and SbiABHISHEK RAWATОценок пока нет

- THEJASWINI ProjectДокумент112 страницTHEJASWINI Projectswamy yashuОценок пока нет

- Minor Project Report ON 'Plastic Money of HDFC Bank''Документ37 страницMinor Project Report ON 'Plastic Money of HDFC Bank''ankushbabbarbcomОценок пока нет

- Pooja Patel 70Документ93 страницыPooja Patel 70Mohd Saad HamidaniОценок пока нет

- Project Report on"CASA" in HDFCДокумент42 страницыProject Report on"CASA" in HDFCRoshan Friendsforever100% (5)

- Mayuresh Marathe Roll No. 2010490Документ100 страницMayuresh Marathe Roll No. 2010490RoneОценок пока нет

- Roshani Raj SinghДокумент34 страницыRoshani Raj Singhrupendratripathi2019Оценок пока нет

- A Study On Customer Awareness Towards E-Banking Services in Coimbatore CityДокумент4 страницыA Study On Customer Awareness Towards E-Banking Services in Coimbatore Cityaurorashiva1Оценок пока нет

- "Student Notifying SystemДокумент42 страницы"Student Notifying SystemShiva KumarОценок пока нет

- Breast Fibroadenomas in AdolescentsДокумент27 страницBreast Fibroadenomas in AdolescentsShiva KumarОценок пока нет

- Main Report PHOTONIC CRYSTALДокумент34 страницыMain Report PHOTONIC CRYSTALShiva KumarОценок пока нет

- Large Hadron Collider EraДокумент28 страницLarge Hadron Collider EraShiva KumarОценок пока нет

- 1.1 Radiation: Interaction of Radiation With MatterДокумент49 страниц1.1 Radiation: Interaction of Radiation With MatterShiva KumarОценок пока нет

- 2 ContentДокумент1 страница2 ContentShiva KumarОценок пока нет

- List of Tables: Sl. No Content Page NoДокумент2 страницыList of Tables: Sl. No Content Page NoShiva KumarОценок пока нет

- Coco-Cola BBM ReportДокумент76 страницCoco-Cola BBM ReportShiva KumarОценок пока нет

- Consumer Satisfaction Towards The Service of St. Milagres Credit Souhardha Co-Operative Ltd. - With Special Reference To Sagar BranchДокумент87 страницConsumer Satisfaction Towards The Service of St. Milagres Credit Souhardha Co-Operative Ltd. - With Special Reference To Sagar BranchShiva Kumar100% (1)

- Introduction of Pond Ecosystem111Документ31 страницаIntroduction of Pond Ecosystem111Shiva Kumar100% (1)

- Contracts 2 Special ContractsДокумент11 страницContracts 2 Special ContractsAbhikaamОценок пока нет

- Capstone Report FormatДокумент11 страницCapstone Report FormatAnkush PalОценок пока нет

- The Gower Handbook of Project Management: Part 1: ProjectsДокумент2 страницыThe Gower Handbook of Project Management: Part 1: ProjectschineduОценок пока нет

- Oldham Rules V3Документ12 страницOldham Rules V3DarthFooОценок пока нет

- ReadingДокумент2 страницыReadingNhư ÝОценок пока нет

- Ma HakalaДокумент3 страницыMa HakalaDiana Marcela López CubillosОценок пока нет

- Research PresentationДокумент11 страницResearch PresentationTeano Jr. Carmelo C.Оценок пока нет

- Upload A Document To Access Your Download: The Psychology Book, Big Ideas Simply Explained - Nigel Benson PDFДокумент3 страницыUpload A Document To Access Your Download: The Psychology Book, Big Ideas Simply Explained - Nigel Benson PDFchondroc11Оценок пока нет

- Effect of Intensive Health Education On Adherence To Treatment in Sputum Positive Pulmonary Tuberculosis PatientsДокумент6 страницEffect of Intensive Health Education On Adherence To Treatment in Sputum Positive Pulmonary Tuberculosis PatientspocutindahОценок пока нет

- LittorinidaeДокумент358 страницLittorinidaeSyarif Prasetyo AdyutaОценок пока нет

- Sumit Kataruka Class: Bcom 3 Yr Room No. 24 Roll No. 611 Guide: Prof. Vijay Anand SahДокумент20 страницSumit Kataruka Class: Bcom 3 Yr Room No. 24 Roll No. 611 Guide: Prof. Vijay Anand SahCricket KheloОценок пока нет

- University of Dar Es Salaam MT 261 Tutorial 1Документ4 страницыUniversity of Dar Es Salaam MT 261 Tutorial 1Gilbert FuriaОценок пока нет

- The Biofloc Technology (BFT) Water Quality, Biofloc Composition, and GrowthДокумент8 страницThe Biofloc Technology (BFT) Water Quality, Biofloc Composition, and GrowthHafez MabroukОценок пока нет

- Biosphere Noo Sphere Infosphere Epistemo PDFДокумент18 страницBiosphere Noo Sphere Infosphere Epistemo PDFGeorge PetreОценок пока нет

- AdvacДокумент13 страницAdvacAmie Jane MirandaОценок пока нет

- Risteski Space and Boundaries Between The WorldsДокумент9 страницRisteski Space and Boundaries Between The WorldsakunjinОценок пока нет

- Dark Witch Education 101Документ55 страницDark Witch Education 101Wizard Luxas100% (2)

- Multiple Linear RegressionДокумент26 страницMultiple Linear RegressionMarlene G Padigos100% (2)

- Chapter 12 NotesДокумент4 страницыChapter 12 NotesIvanTh3Great100% (6)

- Thesis Statement VampiresДокумент6 страницThesis Statement Vampireslaurasmithdesmoines100% (2)

- Chapter 3 - the-WPS OfficeДокумент15 страницChapter 3 - the-WPS Officekyoshiro RyotaОценок пока нет

- Reported SpeechДокумент2 страницыReported SpeechmayerlyОценок пока нет

- Trigonometry Primer Problem Set Solns PDFДокумент80 страницTrigonometry Primer Problem Set Solns PDFderenz30Оценок пока нет

- EIS Summary NotsДокумент62 страницыEIS Summary NotsKESHAV DroliaОценок пока нет

- Mat Clark - SpeakingДокумент105 страницMat Clark - SpeakingAdiya SОценок пока нет

- Physics - TRIAL S1, STPM 2022 - CoverДокумент1 страницаPhysics - TRIAL S1, STPM 2022 - CoverbenОценок пока нет

- CogAT 7 PlanningImplemGd v4.1 PDFДокумент112 страницCogAT 7 PlanningImplemGd v4.1 PDFBahrouniОценок пока нет

- Introduction To Public HealthДокумент54 страницыIntroduction To Public HealthKristelle Marie Enanoria Bardon50% (2)

- 2,3,5 Aqidah Dan QHДокумент5 страниц2,3,5 Aqidah Dan QHBang PaingОценок пока нет

- Seismic Response of Elevated Liquid Storage Steel Tanks Isolated by VCFPS at Top of Tower Under Near-Fault Ground MotionsДокумент6 страницSeismic Response of Elevated Liquid Storage Steel Tanks Isolated by VCFPS at Top of Tower Under Near-Fault Ground MotionsciscoОценок пока нет