Академический Документы

Профессиональный Документы

Культура Документы

Issuance of Share and Debentures

Загружено:

hamdanИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Issuance of Share and Debentures

Загружено:

hamdanАвторское право:

Доступные форматы

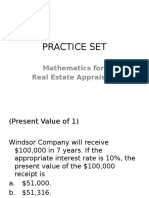

Q#01) Pre-closing Trial Balance of ABC Ltd. on Dec.

31, 2010 was as follows:

Debit Balance Credit Balance

Preliminary Expense Rs. 4,000 Capital Rs. 50,000

Furniture Rs. 35,000 Premium on shares Rs. 2,000

Merchandise Inventory Rs. 7,000 Retained Earnings Rs. 4,000

Accounts Receivable Rs. 20,000 Mortgage Debenture Rs. 15,000

Cash Rs. 21,000 Accounts Payable Rs. 6,000

Purchases Rs. 80,000 Allowance for Depreciation(Fur) Rs. 8,000

Salaries expense Rs. 5,000 Allowance for Bad Debts Rs. 2,000

Rent expense Rs. 3,600 Sales Revenue Rs. 93,000

Depreciation Expense Rs. 3,000

Bad Debt Expense Rs. 1,400

Merchandise Inventory on Dec. 31, 2010 was valued at Rs. 9,000. The authorised capital of the

company is Rs. 300,000 divided into 30,000 ordinary shares of Rs. 10 each.

Required

Prepare:

a) Income Statement for the year ended Dec. 31, 2010.

b) Balance Sheet as of Dec. 31, 2010 in Classified Form.

Q#02) Brotherhood Company Limited was registered with a Capital of Rs. 500,000 divided into

50,000 ordinary shares of Rs. 10 each. It completed the following transactions:

i) Issued to public 10,000 ordinary shares of Rs. 10 each, at a premium of Rs.2 per share. The

shares were fully subscribed and paid for.

ii) Purchased a plot of land worth Rs. 200,000 and in consideration, issued to the vendors 18,000

ordinary shares of Rs. 10 each. Each share has a market value of Rs. 12.

iii) Purchased a machine and in consideration, issued 20,000 ordinary shares of Rs. 10 each.

Compiled by: Sir Waseem Uddin Page 1

Each share has a market value of Rs. 12.

iv) Issued 5,000 mortgage debenture of Rs. 20 each, redeemable after 10 years at Rs. 22 each.

v) Paid Rs. 5,000 for preliminary expense.

Required

i) Give entries in General Journal to record the above transaction.

Q#03) The following information relates to accounts and operations of Decent Company Limited

on Dec. 31, 2010:

Authorised capital; 500,000 Ordinary Shares of Rs. 10 each Rs. 5,000,000. Issued, subscribed

and paid up capital; 200,000 Ordinary shares of Rs. 10 each fully paid up Rs. 2,000,000,

Retained Earnings Rs. 300,000.

Credit balance in the Income Summary was Rs. 285,000 which is transfered to retained earnings

accounts.At the meeting of the Board of Directors, the following decisions were taken:

i) To make the following appropriations:

Rs. 60,000 for Plant Expansion

Rs. 50,000 for Contigencies

ii) To declare a 20% Cash Dividend.

Required

i) Entries in the General Journal to give effect to the above decision of the board of Directors and

their postings in relevant accounts.

ii) Partial Balance Sheet of the Company showing relevant items therein.

Q#04) The following transactions were completed by Ashraf Limited.

i) Purchase machinery with listed price of Rs. 150,000 and in consideration issued own 14,800

ordinary shares of Rs. 10 each.

ii) Purchased a plot of land and issued 15,000 ordinary shares of Rs. 10 each as purchase price.

Compiled by: Sir Waseem Uddin Page 2

Each share has intrinsic value of Rs. 12.

iii) Purchased a runni8ng business by acquiring net assets of Rs. 60,000 and issued to the

vendours 6,200 ordinary shares of Rs. 10.

iv) Received Rs. 250,000 on the issue of 25,000 mortgage debentures of Rs. 10 each redeemable

after 10 years at Rs. 12 each.

v) Received cash Rs. 90,000 against the issue of 10,000 ordinary debentures of Rs. 10

each.Redeemable after five years at Rs. 12 each.

Required

Give entries in the General Journal to record the above transactions.

Q#05) The following is the adjusted Trial Balance of National Co. Ltd. as on Dec. 31, 2009:

Debit Balance ……………………………. ….Credit Balances

Cash……………………….Rs. 15,000………Allowance for Bad Debts Rs. 2,000

Accounts Receivable……...Rs. 80,000………Allowance for Depreciation Rs. 6,000

Merchandise Inventory……Rs. 70,000………Accounts Payable Rs. 5,000

Furniture…………………..Rs. 60,000………Ordinary Debenture Rs. 20,000

Preliminary expenses………Rs. 20,000……..Share Capital Rs. 100,000

Cost of goods sold…………Rs. 120,000……Retained Earning Rs. 53,000

Salaries expense……………Rs. 12,000……..General Reserve Rs. 10,000

Auditors fee expense……….Rs. 10,000…….Salaes Revenue Rs. 200,000

Rent Expense ………………Rs. 5,000

Depreciation expense ………Rs. 3,000

Bad debts expense ………….Rs. 1,000

Rs.396,000……………………………….Rs. 396,000

The authorized capital of the Company is Rs. 500,000 divided into0 50,000 ordinary shares of

Rs. 10 each.

Required

a) Income Statement for the year ended Dec. 31, 2009.

b) Balance Sheet as of Dec. 31, 2009.

Compiled by: Sir Waseem Uddin Page 3

Q#05) The following transactions were completed by Al-Murtaza Company Limited:

i) Issued 50,000 ordinary shares of Rs. 10 each at Rs. 12.50 per share to the public payable in full

on application. The company received applications for 80,000 shares. The company allotted the

shares offered and refunded the amount received in excess.

ii) The Company issued to the public 50,000 ordinary shares of Rs. 10 each payable in full on

application. The entire issue was guaranteed by the underwriters. The company received

applications for 40,000 shares. As per agreement the underwriters subscribed the balance of the

issuance.

iii) The company purchased Machinery at a price of Rs. 450,000 and consideration issued to the

vendors its own 43,000 Ordinary Shares of Rs. 10 each.

iv) The Company issued 10,000 Debenture Bonds of Rs. 100 each redeemable at Rs. 105 per

debenture after five years. All the debentures were subscribed.

v) The Company issued 10,000 Debenture Bonds of Rs. 100 each at Rs. 95 per debenture. The

debentures are redeemable at par after five years. All the debentures were subscribed.

Required

Give entries in the General-Journal of the Company to record the above transactions.

Q#06) Afroz Ltd. issued Ordinary Shares (Rs. 10 par) during 2010, as noted below:

i) 10,000 shares of Rs. 14 each for cash.

ii) 4,000 shares of Rs. 9 each for cash.

iii) 5,000 shares for purchase of Machine (Market price of share being Rs. 13 each).

iv) 4,000 shares at par to the promoters, for services rendered.

v) 3,000 shares for purchase of Equipment having List Price of Rs. 32,000.

vi) 6,000 shares at par as Stock Dividend.

Required

Give entries in the General Journal of the company to record the above transactions (Show

computations, where necessary).

Q#07) On Jan. 1, 2008,Shah Company Ltd. was registered with an authorized capital of Rs.

1,200,000, divided into 6,000 10% preference shares of Rs. 100 each and 60,000 ordinary shares

Compiled by: Sir Waseem Uddin Page 4

of Rs. 10 each.

On Jan. 15, 2008,the Company offered 4,000 10% preference shares and 50,000 ordinary shares,

Payable in full with application.

On Jan. 25,2008, The Company’s bankers reported that Rs. 500,000 on 5,000 10% preference

shares and Rs. 400,000 on 40,000 ordinary shares were received with applications. The

remaining ordinary shares which were not taken to by the public were taken by the underwriters

under the agreement.

On Jan. 31, 2008,the Directors of the Company finalized the allotment of 4,000 10% preference

shares and 40,000 ordinary shares to the public and 10,000 ordinary shares to the underwriters

and directed the banker to refund the excess of application money.

On Feb. 10, 2008, the Company allotted 4,000 ordinary shares of Rs. 10 each in consideration of

purchase price of Machinery. The shares were issued at market price of Rs. 12.50 each.

Required

Give dated entries in the General Journal of the Company for the above transactions.

Compiled by: Sir Waseem Uddin Page 5

Вам также может понравиться

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)От EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- Itemized Deductions - Taxes Paid 2021Документ2 страницыItemized Deductions - Taxes Paid 2021Finn KevinОценок пока нет

- NY CA 01-01-1953 9984 TXPRДокумент98 страницNY CA 01-01-1953 9984 TXPRAdmin OfficeОценок пока нет

- Coffee House Business PlanДокумент59 страницCoffee House Business PlanHawk Eyes100% (1)

- Bookkeeping AssessmentДокумент6 страницBookkeeping AssessmentGeraldОценок пока нет

- Shapiro CHAPTER 3 Altered SolutionsДокумент17 страницShapiro CHAPTER 3 Altered SolutionsNimi KhanОценок пока нет

- 2402 Corporate LiquidationДокумент7 страниц2402 Corporate LiquidationFernando III PerezОценок пока нет

- SAP For HospitalsДокумент11 страницSAP For Hospitalsjayasree012754Оценок пока нет

- Practice SetДокумент39 страницPractice SetDionico O. Payo Jr.Оценок пока нет

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsОт EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsОценок пока нет

- Company Issuance of SharesДокумент8 страницCompany Issuance of Sharesubbi123Оценок пока нет

- First Semester MBA Degree Examination, May/June 2010: Accounting For ManagersДокумент4 страницыFirst Semester MBA Degree Examination, May/June 2010: Accounting For Managersnitte5768Оценок пока нет

- Ca QP ModelДокумент3 страницыCa QP Modelmahabalu123456789Оценок пока нет

- Bonus Issue PDFДокумент6 страницBonus Issue PDFSinsОценок пока нет

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksДокумент3 страницыSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelОценок пока нет

- 3df8f Grade 12 AccountДокумент7 страниц3df8f Grade 12 AccountRit ShresthaОценок пока нет

- Business Law RTP of IcaiДокумент66 страницBusiness Law RTP of IcaitpsbtpsbtpsbОценок пока нет

- Class 11 Accounts Half Yearly SPДокумент9 страницClass 11 Accounts Half Yearly SPRakesh AgarwalОценок пока нет

- Corporate Accounting QUESTIONSДокумент4 страницыCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Corrporate ModelДокумент10 страницCorrporate Modelnithinjoseph562005Оценок пока нет

- Revision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For DepartmentsДокумент153 страницыRevision Test Paper: Cap-Ii: Advanced Accounting: Questions Accounting For Departmentsshankar k.c.Оценок пока нет

- RTP June 2018 QnsДокумент14 страницRTP June 2018 QnsbinuОценок пока нет

- XII AccountancyДокумент4 страницыXII AccountancyAahna AcharyaОценок пока нет

- IPCC MTP2 AccountingДокумент7 страницIPCC MTP2 AccountingBalaji SiddhuОценок пока нет

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingДокумент27 страницQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarОценок пока нет

- Test Paper 11Документ8 страницTest Paper 11Sukhjinder SinghОценок пока нет

- Account Question 12Документ5 страницAccount Question 12Kapildev SubediОценок пока нет

- SAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Документ16 страницSAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Shreya PalejkarОценок пока нет

- Corporate Accounting - I Semester ExaminationДокумент7 страницCorporate Accounting - I Semester ExaminationVijay KumarОценок пока нет

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Документ4 страницыPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameОценок пока нет

- MKGM Accounts Question Papers ModelДокумент101 страницаMKGM Accounts Question Papers ModelSantvana ChaturvediОценок пока нет

- Company AccountsДокумент3 страницыCompany AccountsYATTIN KHANNAОценок пока нет

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Документ7 страницCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsОценок пока нет

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsДокумент158 страницRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.Оценок пока нет

- Extra AfaДокумент5 страницExtra AfaJesmon RajОценок пока нет

- 4 MarksДокумент4 страницы4 MarksEswari GkОценок пока нет

- Advanced AccountingДокумент68 страницAdvanced AccountingOsamaОценок пока нет

- Advanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversityДокумент13 страницAdvanced Accounting: Computer Lab - Practical Question Bank Faculty of Commerce, Osmania UniversitySaif Uddin33% (3)

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Документ20 страницClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatОценок пока нет

- 16482issue of ShareДокумент7 страниц16482issue of ShareirmaОценок пока нет

- RE Exam FA Sem I MFM MMM MHRDMДокумент4 страницыRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGОценок пока нет

- Revision Test Paper CAP II Dec 2017Документ163 страницыRevision Test Paper CAP II Dec 2017Dipen AdhikariОценок пока нет

- RTP Dec 2017 QnsДокумент12 страницRTP Dec 2017 Qnsbinu0% (1)

- June 2019Документ182 страницыJune 2019shankar k.c.Оценок пока нет

- RTP June 19 QnsДокумент15 страницRTP June 19 QnsbinuОценок пока нет

- Al-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsДокумент3 страницыAl-Umar College of Lahore: ABC Co. Ltd. Rs. XYZ Co. Ltd. RsXaXim XhxhОценок пока нет

- QB Ii PDFДокумент45 страницQB Ii PDFabid hussainОценок пока нет

- 438Документ6 страниц438Rehan AshrafОценок пока нет

- 2015 12 SP Accountancy Unsolved 07Документ6 страниц2015 12 SP Accountancy Unsolved 07BhumitVashishtОценок пока нет

- CPT Mock Question PaperДокумент40 страницCPT Mock Question PaperbaburamОценок пока нет

- Pccquestionpapers (2008)Документ20 страницPccquestionpapers (2008)Samenew77Оценок пока нет

- Sample Paper (Cbse) - 2009 Accountancy - XiiДокумент5 страницSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoОценок пока нет

- 20092018090907893chapter18 RedemptionofPreferenceSharesДокумент2 страницы20092018090907893chapter18 RedemptionofPreferenceSharesAbdifatah SaidОценок пока нет

- Accounting Equations ProblemsДокумент3 страницыAccounting Equations Problemsmaheshbendigeri5945Оценок пока нет

- CM11 3C CacДокумент2 страницыCM11 3C CacHaRiPrIyA JaYaKuMaRОценок пока нет

- Accountancy Assignment Grade 12Документ4 страницыAccountancy Assignment Grade 12sharu SKОценок пока нет

- LHU8Q Olopr DaisyAcountXIДокумент35 страницLHU8Q Olopr DaisyAcountXIDido MuczОценок пока нет

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Документ3 страницыJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalОценок пока нет

- 18u3cm06 CC06Документ8 страниц18u3cm06 CC06Manoj MJОценок пока нет

- Master Budget .. Feb 2020Документ9 страницMaster Budget .. Feb 2020신두Оценок пока нет

- Revision Test Paper: Cap Ii (June 2017)Документ12 страницRevision Test Paper: Cap Ii (June 2017)binuОценок пока нет

- Revision - Test - Paper - CAP - II - June - 2017 9Документ181 страницаRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariОценок пока нет

- 18CR1007 December 2020 Iii Semester Branch:Corporate Secretaryship Corporate Accounting-I CUCOR-7 (2008-09 TO 2018-19) Time: 3 Hrs Max Marks: 75Документ5 страниц18CR1007 December 2020 Iii Semester Branch:Corporate Secretaryship Corporate Accounting-I CUCOR-7 (2008-09 TO 2018-19) Time: 3 Hrs Max Marks: 75Athira VelayudhanОценок пока нет

- Issue of Debentures Collage SPCC Term 2Документ4 страницыIssue of Debentures Collage SPCC Term 2Taaran ReddyОценок пока нет

- Issue of DebenturesДокумент15 страницIssue of DebenturesKrish BhargavaОценок пока нет

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportОт EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportОценок пока нет

- Movie Review: DescriptionДокумент3 страницыMovie Review: DescriptionhamdanОценок пока нет

- Project Concept Statement Template - Final (5130)Документ5 страницProject Concept Statement Template - Final (5130)hamdanОценок пока нет

- VLE Activity: AMIR ALI 10555Документ8 страницVLE Activity: AMIR ALI 10555hamdanОценок пока нет

- Sibgha 10626 Intro EntroДокумент1 страницаSibgha 10626 Intro EntrohamdanОценок пока нет

- Term Project Report ON "Camay Soap" Reported To: Professor MR - Hammad-Ur-RehmanДокумент24 страницыTerm Project Report ON "Camay Soap" Reported To: Professor MR - Hammad-Ur-RehmanhamdanОценок пока нет

- Q. 1) Why Study Economics? Page 36: Assignment No: 1Документ3 страницыQ. 1) Why Study Economics? Page 36: Assignment No: 1hamdanОценок пока нет

- Department of Business Administration: Final Exam (Take Home) - Spring 2020Документ13 страницDepartment of Business Administration: Final Exam (Take Home) - Spring 2020hamdanОценок пока нет

- Department of Business Administration: Final Exam (Take Home) - Spring 2020Документ18 страницDepartment of Business Administration: Final Exam (Take Home) - Spring 2020hamdanОценок пока нет

- Name: Maham Iqbal REG. NO: 10086 Independent Sample: Strength Brand A Brand B Brand A Brand BДокумент10 страницName: Maham Iqbal REG. NO: 10086 Independent Sample: Strength Brand A Brand B Brand A Brand BhamdanОценок пока нет

- Matthew Eliot: Web Developer - 09/2015 To 05/2019 Luna Web Design, New YorkДокумент1 страницаMatthew Eliot: Web Developer - 09/2015 To 05/2019 Luna Web Design, New YorkAnonymous gXZy9sP4Оценок пока нет

- Group Members: Registration NO#Документ18 страницGroup Members: Registration NO#hamdanОценок пока нет

- Macro USMAN Final FixДокумент17 страницMacro USMAN Final FixhamdanОценок пока нет

- Financial StatementДокумент18 страницFinancial StatementhamdanОценок пока нет

- DANISH Experience Certificate Template 04Документ1 страницаDANISH Experience Certificate Template 04hamdanОценок пока нет

- Department of Business Administration: Final Exam (Take Home) - Spring 2020Документ12 страницDepartment of Business Administration: Final Exam (Take Home) - Spring 2020hamdanОценок пока нет

- Analyzing The Marketing Strategy of Pepsico: Saif Rehman KhanДокумент10 страницAnalyzing The Marketing Strategy of Pepsico: Saif Rehman KhanhamdanОценок пока нет

- At Age 5 His Father DiedДокумент2 страницыAt Age 5 His Father DiedhamdanОценок пока нет

- Residential Status: Project Report OnДокумент6 страницResidential Status: Project Report OnTarun Inder KaurОценок пока нет

- AL Malkawi 2007Документ28 страницAL Malkawi 2007Yolla Monica Angelia ThenuОценок пока нет

- CLASSIFICIATION OF ACCOUNTS - QuestionsДокумент2 страницыCLASSIFICIATION OF ACCOUNTS - QuestionsRohit ChandraОценок пока нет

- Puertorico SR 2015Документ51 страницаPuertorico SR 2015Jeffrey YanОценок пока нет

- Pestel BangladeshДокумент28 страницPestel BangladeshRazaali Mukadam100% (1)

- Delaware Administrative Code Banking 1114Документ17 страницDelaware Administrative Code Banking 1114tarun.mitra19854923Оценок пока нет

- A Linear ProgramДокумент58 страницA Linear Programgprakash_mОценок пока нет

- Income Tax Law & Practice Code: BBA-301 Unit - 1: Ms. Manisha Sharma Asst. ProfessorДокумент60 страницIncome Tax Law & Practice Code: BBA-301 Unit - 1: Ms. Manisha Sharma Asst. ProfessorVasu NarangОценок пока нет

- C W C F S A (A) : Ostco Holesale Orporation Inancial Tatement NalysisДокумент26 страницC W C F S A (A) : Ostco Holesale Orporation Inancial Tatement NalysisExen Hawer PinzonОценок пока нет

- Encircle The Letter of The Correct AnswerДокумент2 страницыEncircle The Letter of The Correct AnswerAnonymous EvbW4o1U7Оценок пока нет

- Strengthening Our Core: Reliance Steel & Aluminum Co. 2017 Annual ReportДокумент32 страницыStrengthening Our Core: Reliance Steel & Aluminum Co. 2017 Annual ReportShreeyaОценок пока нет

- Managerial Accounting 10th Edition Crosson Test Bank 1Документ80 страницManagerial Accounting 10th Edition Crosson Test Bank 1casey100% (50)

- Intercontinental Bank Debunks Akingbola's Claims - 101010Документ2 страницыIntercontinental Bank Debunks Akingbola's Claims - 101010ProshareОценок пока нет

- Common Stock Financing ProblemsДокумент7 страницCommon Stock Financing ProblemsSoo CealОценок пока нет

- Deed of Absolute Sale Annex AДокумент3 страницыDeed of Absolute Sale Annex ABryan CuaОценок пока нет

- Soft Skills TNA All Topics For ReviewsДокумент25 страницSoft Skills TNA All Topics For Reviewsjohncaulfield0% (1)

- Introduction To Financial Statements: Kimmel Weygandt Kieso Accounting, Sixth EditionДокумент31 страницаIntroduction To Financial Statements: Kimmel Weygandt Kieso Accounting, Sixth EditionJoonasОценок пока нет

- Chapter 1 - Introduction: Code - 1 (A) - (F), (I) A. Orientation The Tax Practitioner's Tools (P. 1-11, 24-30, 42-46)Документ40 страницChapter 1 - Introduction: Code - 1 (A) - (F), (I) A. Orientation The Tax Practitioner's Tools (P. 1-11, 24-30, 42-46)Lauren PoelingОценок пока нет

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetДокумент8 страницJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganОценок пока нет

- 01 Capitalstructure Lecture AДокумент76 страниц01 Capitalstructure Lecture AKatarina SusaОценок пока нет

- Mcs QДокумент52 страницыMcs QNabeel GondalОценок пока нет

- BA291-1 Sumo Sam Foods Inc Case StudyДокумент6 страницBA291-1 Sumo Sam Foods Inc Case StudyJed Estanislao100% (3)