Академический Документы

Профессиональный Документы

Культура Документы

Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)

Загружено:

ignaciomannyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)

Загружено:

ignaciomannyАвторское право:

Доступные форматы

Oct 28 - Nov 01, 2019

VOL. VI NO. 44

ISSN 2013 - 1351

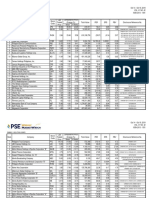

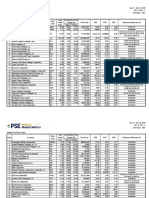

Weekly Top Price Gainers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

C07472-2019, CR06766-2019, C07516-2019,

C07517-2019, C07518-2019, CR06816-2019,

1 Suntrust Home Developers, Inc. SUN 1.71 36.80 94.32 319,149,250 36.72 0.05 7.82 CR06817-2019, C07522-2019, C07523-2019,

C07575-2019, C07576-2019, C07578-2019

2 F & J Prince Holdings Corporation "A" FJP 4.25 18.06 5.99 51,910 55.79 0.08 1.08 CR06769-2019

3 Asian Terminals, Inc. ATI 19.60 15.29 5.95 5,812,972 10.82 1.81 2.33 No Disclosure

4 Abra Mining and Industrial Corporation AR 0.0018 12.50 5.88 298,000 (110.99) (0.00002) 0.21 No Disclosure

C07519-2019, CR06839-2019, C07588-2019,

5 Philippine Infradev Holdings Inc. IRC 1.56 12.23 15.56 59,631,820 3.19 0.49 1.52 C07616-2019

6 MacroAsia Corporation MAC 20.60 10.75 9.34 82,126,644 29.90 0.69 5.88 C07459-2019, C07512-2019, C07550-2019

7 Global Ferronickel Holdings, Inc. FNI 1.88 9.30 13.25 226,601,310 16.94 0.11 1.61 CR06770-2019, CR06860-2019

8 Oriental Petroleum and Minerals Corporation "B" OPMB 0.012 9.09 9.09 21,985,000 29.75 0.0004 0.52 CR06765-2019

9 Empire East Land Holdings, Inc. ELI 0.490 8.89 10.11 43,418,760 12.92 0.04 0.28 CR06768-2019

10 2GO Group, Inc. 2GO 11.18 8.54 10.69 2,692,544 (15.87) (0.70) 6.42 No Disclosure

CR06727-2019, C07473-2019, CR06731-2019,

11 Manila Broadcasting Company MBC 13.50 7.83 (5.33) 3,950 51.38 0.26 4.68 CR06732-2019, C07480-2019

12 Now Corporation NOW 3.53 7.29 26.52 123,940,560 651.89 0.01 3.82 C07481-2019, CR06740-2019

13 IPM Holdings, Inc. IPM 3.86 6.93 (0.77) 11,330 55.59 0.07 3.47 CR06781-2019

14 AgriNurture, Inc. ANI 13.38 6.70 (15.32) 32,811,612 (360.38) (0.04) 6.53 CR06803-2019

15 Metropolitan Bank & Trust Company MBT 67.60 6.61 12.34 1,220,413,189 12.65 5.34 1.03 No Disclosure

16 PetroEnergy Resources Corporation PERC 4.35 6.10 (2.25) 552,180 5.44 0.80 0.51 No Disclosure

17 Top Frontier Investment Holdings, Inc. TFHI 230.00 5.99 3.14 87,948,092 7.28 31.61 0.47 No Disclosure

18 Vitarich Corporation VITA 1.35 5.47 11.57 46,047,390 (21.42) (0.06) 3.15 CR06842-2019, CR06855-2019

19 Paxys, Inc. PAX 2.92 5.42 5.42 5,860 169.87 0.02 0.88 No Disclosure

19 Philippine Racing Club, Inc. PRC 9.14 5.42 5.18 3,414 8.35 1.09 1.29 No Disclosure

21 Coal Asia Holdings Incorporated COAL 0.295 5.36 7.27 144,050 (159.92) (0.002) 0.30 No Disclosure

22 Cirtek Holdings Philippines Corporation TECH 8.70 5.20 1.28 17,242,828 22.40 0.39 0.51 CR06822-2019

23 Acesite (Phils.) Hotel Corporation ACE 1.63 5.16 (0.61) 584,420 (1.56) (1.04) 0.48 CR06798-2019

24 NiHAO Mineral Resources International, Inc. NI 1.07 4.90 (5.31) 541,080 (24.83) (0.04) 1.21 CR06786-2019

C07469-2019, C07475-2019, C07477-2019,

25 BDO Unibank, Inc. BDO 154.90 4.80 7.94 1,458,793,878 17.09 9.07 1.94 C07479-2019, CR06767-2019, C07537-2019,

C07554-2019, CR06841-2019, C07606-2019

26 Oriental Peninsula Resources Group, Inc. ORE 0.89 4.71 (1.11) 644,970 (5.70) (0.16) 0.40 No Disclosure

27 Vantage Equities, Inc. V 1.14 4.59 (0.87) 1,140 6.44 0.18 0.51 No Disclosure

28 JG Summit Holdings, Inc. JGS 76.25 4.17 8.93 496,925,279 20.42 3.73 1.85 CR06793-2019

29 Global-Estate Resorts, Inc. GERI 1.27 4.10 7.63 1,427,900 8.64 0.15 0.52 CR06764-2019

30 Aboitiz Power Corporation AP 39.95 4.04 9.00 255,501,570 13.84 2.89 2.49 C07470-2019, CR06756-2019

Oct 28 - Nov 01, 2019

ATN Holdings, Inc. "B" VOL. VI NO. 44

TKC Metals Corporation ISSN 2013 - 1351

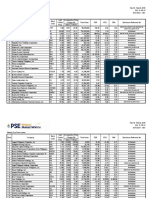

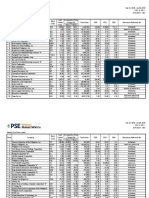

Weekly Top Price Losers

Last Comparative Price

Stock

Rank Company Traded Change (%) Total Value PER EPS PBV Disclosure Reference No.

Code

Price 1 Week 4 Weeks

1 Philippine Trust Company PTC 117.40 (9.76) (16.14) 271,604 377.33 0.31 4.78 C07544-2019

2 Anchor Land Holdings, Inc. ALHI 9.35 (7.79) (6.69) 125,795 12.37 0.76 1.29 No Disclosure

3 Concrete Aggregates Corporation "B" CAB 72.00 (6.13) (0.14) 166,041 57.65 1.25 6.71 No Disclosure

4 Chemical Industries of the Philippines, Inc. CIP 113.10 (5.75) (5.75) 47,234 (90.86) (1.24) 1.39 No Disclosure

5 Philippine Bank of Communications PBC 20.60 (5.29) (1.44) 51,690 10.92 1.89 0.91 C07590-2019, C07596-2019

6 Ferronoux Holdings, Inc. FERRO 4.50 (5.26) (3.23) 6,528,470 2,003.82 0.002 8.88 C07487-2019, C07490-2019

7 ISM Communications Corporation ISM 4.73 (5.21) (5.40) 54,084,110 (210.20) (0.02) 3.03 CR06854-2019

8 Manila Electric Company MER 338.40 (5.00) (7.79) 354,655,480 16.55 20.45 4.61 C07491-2019, C07492-2019, C07493-2019

9 Premiere Horizon Alliance Corporation PHA 0.485 (4.90) (4.90) 18,021,215 (2.98) (0.16) 4.58 CR06723-2019

10 Del Monte Pacific Limited DELM 5.32 (4.83) (9.83) 463,337 (9.69) (0.55) 0.39 No Disclosure

11 Republic Glass Holdings Corporation REG 2.80 (4.76) (1.75) 16,840 31.69 0.09 1.09 No Disclosure

12 Globe Telecom, Inc. GLO 1,824.00 (4.75) 2.30 334,266,220 11.73 155.53 3.08 C07453-2019, CR06735-2019

13 AbaCore Capital Holdings, Inc. ABA 0.82 (4.65) (2.38) 54,216,200 0.81 1.01 0.31 No Disclosure

14 Metro Alliance Holdings & Equities Corporation "A" MAH 1.05 (4.55) (7.08) 75,360 105.06 0.01 3.09 C07462-2019, CR06739-2019

15 Zeus Holdings, Inc. ZHI 0.220 (4.35) (4.76) 480,400 (935.57) (0.0002) 2,704.78 No Disclosure

16 Bright Kindle Resources & Investments Inc. BKR 1.11 (4.31) - 128,150 (12.32) (0.09) 1.87 No Disclosure

17 Pacific Online Systems Corporation LOTO 2.68 (4.29) (7.59) 705,110 219.59 0.01 1.43 CR06773-2019

18 Roxas Holdings, Inc. ROX 2.08 (4.15) (8.77) 547,890 (5.33) (0.39) 0.32 No Disclosure

19 Liberty Flour Mills, Inc. LFM 48.00 (4.00) 81.82 157,511 73.35 0.65 2.77 CR06797-2019

20 Robinsons Retail Holdings, Inc. RRHI 75.85 (3.99) (0.20) 277,819,272 28.08 2.70 1.71 CR06800-2019, CR06833-2019, C07565-2019

21 Alsons Consolidated Resources, Inc. ACR 1.29 (3.73) (0.77) 1,225,400 38.17 0.03 0.71 C07536-2019

22 DFNN, Inc. DFNN 5.30 (3.64) (12.40) 400,200 (90.62) (0.06) 1.57 No Disclosure

23 A Brown Company, Inc. BRN 0.81 (3.57) (1.22) 1,701,790 4.96 0.16 0.51 CR06721-2019

24 Centro Escolar University CEU 6.91 (3.36) (4.03) 15,897 26.34 0.26 0.61 CR06741-2019

25 International Container Terminal Services, Inc. ICT 118.70 (3.26) (1.90) 598,509,031 17.51 6.78 3.08 CR06713-2019, CR06823-2019

26 Cebu Holdings, Inc. CHI 6.10 (3.02) (3.17) 377,544 12.97 0.47 1.53 No Disclosure

27 Axelum Resources Corp. AXLM 3.89 (2.99) (17.06) 127,750,770 39.69 0.10 3.17 C07566-2019, C07577-2019

28 Seafront Resources Corporation SPM 2.34 (2.90) (4.10) 2,750,730 12.61 0.19 0.82 No Disclosure

29 Asiabest Group International Inc. ABG 13.02 (2.84) (1.51) 868,462 (1,632.57) (0.01) 14.66 CR06804-2019

30 COL Financial Group, Inc. COL 18.00 (2.81) (3.23) 5,386,850 16.98 1.06 5.36 No Disclosure

Oct 28 - Nov 01, 2019

VOL. VI NO. 44

ISSN 2013 - 1351

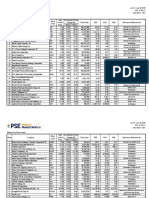

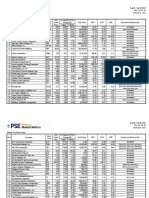

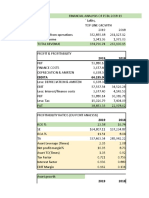

Weekly Market Statistics

(In pesos) October 21 - October 25 October 28 - November 01 Year-to-Date

Total Market Capitalization 16,862,247,163,284.80 16,958,941,282,690.00 16,958,941,282,690.00

Domestic Market Capitalization 14,289,993,015,000.60 14,349,617,749,554.30 14,349,617,749,554.30

Total Value Traded 26,227,594,514.20 26,259,780,544.36 1,514,208,238,304.02

Ave. Daily Value Traded 5,245,518,902.84 6,564,945,136.09 7,386,381,650.26

Foreign Buying 13,939,435,068.30 14,071,918,901.95 832,045,603,428.82

Foreign Selling 12,647,026,171.96 12,665,806,597.89 823,699,730,917.76

Net Foreign Buying/ (Selling) 1,292,408,896.34 1,406,112,304.06 8,345,872,511.07

% of Foreign to Total 51% 51% 55%

Number of Issues (Common shares):

87 – 120 – 38 106 – 116 – 24 125 – 131 – 3

Gainers - Losers - Unchanged

Weekly Index Performance

Comparative Change (%) YTD Change

Close PER

1 Week 4 Weeks (%)

PSEi 7,977.12 0.69 3.54 6.85 17.03

All Shares Index 4,787.45 0.43 2.39 5.97 14.43

Financials Index 1,918.40 2.22 6.25 7.78 13.99

Industrial Index 10,470.94 0.01 (0.06) (4.39) 16.44

Holding Firms Index 7,830.30 1.10 3.69 6.65 14.81

Property Index 4,172.29 0.14 4.02 15.00 18.88

Services Index 1,513.05 (1.21) 0.16 4.88 15.69

Mining and Oil Index 9,216.52 0.08 4.22 12.39 16.71

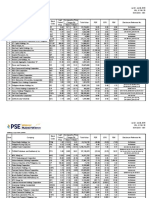

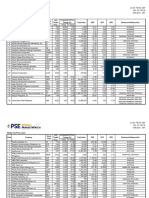

Notes:

- Top price gainers and losers only cover common shares.

- EPS (Earnings per Share) is computed as: Net Income

Outstanding Shares

PER (Price-Earnings Ratio) is computed as: Last Traded Price per Share

Earnings per Share

PBV (Price to Book Value Ratio) is computed as: Company Market Capitalization

Company Stockholders Equity (end of period)

EPS, PER and PBV use four-quarter trailing financial data.

- Total Value in Top Gainers and Losers tables refers to total value traded in the regular market.

- The disclosures cover those made from 3:31 pm, Friday of the previous week to 3:30 pm, Friday of the covered week. Information and disclosures made by the companies, as itemized in this report, may

be viewed by clicking on the links above. These may also be viewed in the “Disclosure” page of the company at the PSE website (www.pse.com.ph). To access the disclosure page, enter the stock symbol in

the symbol lookup field located at the upper right portion of the PSE website. The public is encouraged to regularly monitor subsequent developments as may be disclosed by the company in succeeding

weeks.

- Current week’s foreign transactions data are subject to amendments allowed until t+2. Previous week’s foreign transactions data have been adjusted accordingly for amendments.

- Domestic Market capitalization excludes the market capitalization of foreign domiciled companies.

The data contained in this file is collated by the Corporate Planning & Research Department of the Philippine Stock Exchange. The PSE does not make any representations or warranties, express or implied, on matters such as, but not limited to, the accuracy, timeliness, completeness, non-infringement, validity, merchantability or fitness for any particular purpose of the information and data herein contained. The PSE

assumes no liability and responsibility for any loss or damage suffered as a consequence of any errors or omissions in this file, or any decision made or action taken in reliance upon information contained herein. This document is for information purposes only, and does not constitute legal, financial or investment advice, nor intended to influence investment decisions. Independent assessment should be undertaken, and

advice from a securities professional is strongly recommended. For inquiries or suggestions on the PSE Weekly MarketWatch, you may call (632) 8688-7601 to 02, send a message through fax no. (632) 8688-8818 or email pirs@pse.com.ph.

Вам также может понравиться

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers and Losers in the PhilippinesДокумент3 страницыWeekly Top Price Gainers and Losers in the PhilippinesignaciomannyОценок пока нет

- Weekly Top Price Gainers and LosersДокумент3 страницыWeekly Top Price Gainers and LosersKristian AguilarОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarОценок пока нет

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Документ3 страницыWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyОценок пока нет

- Weekly Philippine stock market price gainers and losersДокумент5 страницWeekly Philippine stock market price gainers and losersignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент4 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Документ3 страницыWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyОценок пока нет

- Weekly Philippine Stock Price Gainers and LosersДокумент3 страницыWeekly Philippine Stock Price Gainers and LosersKristian AguilarОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarОценок пока нет

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Документ3 страницыWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Документ3 страницыWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers and LosersДокумент3 страницыWeekly Top Price Gainers and LosersKristian AguilarОценок пока нет

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Документ3 страницыWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Kristian AguilarОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент4 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVKristian AguilarОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers and LosersДокумент3 страницыWeekly Top Price Gainers and LosersKristian AguilarОценок пока нет

- WEEKLY PRICE MOVERSДокумент3 страницыWEEKLY PRICE MOVERScraftersxОценок пока нет

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Документ3 страницыWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Nylinad Calubayan EstrellaОценок пока нет

- wk38 Sep2022mktwatchДокумент3 страницыwk38 Sep2022mktwatchcraftersxОценок пока нет

- wk05 Jan2024mktwatchДокумент3 страницыwk05 Jan2024mktwatchMacxie Baldonado QuibuyenОценок пока нет

- Fundcard: Franklin India Smaller Companies FundДокумент4 страницыFundcard: Franklin India Smaller Companies FundChiman RaoОценок пока нет

- 2019 11 20 PH D PDFДокумент5 страниц2019 11 20 PH D PDFJОценок пока нет

- Dividende estimare 2019 companii listate BVBДокумент4 страницыDividende estimare 2019 companii listate BVBBogdan BoicuОценок пока нет

- Transactions Inquiry - Main File 01.08.17 To 02.07.19Документ45 страницTransactions Inquiry - Main File 01.08.17 To 02.07.19amit kadamОценок пока нет

- Investment GuideДокумент2 страницыInvestment Guidegundam busterОценок пока нет

- India's most valuable companies ranked by average market capitalisationДокумент15 страницIndia's most valuable companies ranked by average market capitalisationHarsh DabasОценок пока нет

- Data Excel Ke Spss 3Документ8 страницData Excel Ke Spss 3Wawan JayanetОценок пока нет

- Wirdawati-B2092221017-Tugas Statistik Untuk BisnisДокумент5 страницWirdawati-B2092221017-Tugas Statistik Untuk BisnisEMI PURWANIОценок пока нет

- AFSAДокумент17 страницAFSAshreya sarkarОценок пока нет

- GST Invoice Register with Supplier and Purchaser DetailsДокумент5 страницGST Invoice Register with Supplier and Purchaser DetailsUtopia Instrumentation AutomationОценок пока нет

- Hours & EarningsДокумент1 страницаHours & EarningsDan PattisОценок пока нет

- Ev-Ebitda Oil CompaniesДокумент2 страницыEv-Ebitda Oil CompaniesArie Yetti NuramiОценок пока нет

- QuarterlyTop50 1Q 2008Документ5 страницQuarterlyTop50 1Q 2008Franz Carla NavarroОценок пока нет

- Top Stories:: TUE 17 AUG 2021Документ14 страницTop Stories:: TUE 17 AUG 2021Elcano MirandaОценок пока нет

- Amwatch: Stock Focus of The DayДокумент4 страницыAmwatch: Stock Focus of The DayBrian StanleyОценок пока нет

- WEEKLY TOP MOVERSДокумент3 страницыWEEKLY TOP MOVERScraftersxОценок пока нет

- Top Stories:: THU 19 AUG 2021Документ7 страницTop Stories:: THU 19 AUG 2021Elcano MirandaОценок пока нет

- IPO and Disinvestment in Covid-19: Group Number 8Документ13 страницIPO and Disinvestment in Covid-19: Group Number 8Raksha ShettyОценок пока нет

- UTIMCO Feb2023Документ36 страницUTIMCO Feb2023Manish Singh100% (3)

- Bank reports 55% rise in Q1 net profit to Rs. 6,504 croresДокумент2 страницыBank reports 55% rise in Q1 net profit to Rs. 6,504 croresPrateek WadhwaniОценок пока нет

- GR I Crew XV 2018 TcsДокумент79 страницGR I Crew XV 2018 TcsMUKESH KUMARОценок пока нет

- Impact of Liquidity On Profitability in Telecom Companies: Dr. Mohmad Mushtaq Khan Dr. K. Bhavana RajДокумент11 страницImpact of Liquidity On Profitability in Telecom Companies: Dr. Mohmad Mushtaq Khan Dr. K. Bhavana RajSavy DhillonОценок пока нет

- QuarterlyTop50 4Q 2009Документ5 страницQuarterlyTop50 4Q 2009Franz Carla NavarroОценок пока нет

- Fundcard: HDFC Top 100 FundДокумент4 страницыFundcard: HDFC Top 100 FundLahoty Arpit ArunkumarОценок пока нет

- Tatva Chintan Pharma Chem LTD ReportДокумент8 страницTatva Chintan Pharma Chem LTD Reportshivkumar singhОценок пока нет

- Reporte de Timbrado de Nomina 2019Документ3 страницыReporte de Timbrado de Nomina 2019SERGIO LOPEZОценок пока нет

- TabulasiДокумент2 страницыTabulasivtzgnvy7jhОценок пока нет

- Top Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupДокумент4 страницыTop Story:: AEV: JERA Deal Gives AP A Competent Technical Partner, Opens Up Investment Opportunities For The GroupkristineОценок пока нет

- DCF AnalysisДокумент7 страницDCF AnalysisRiazul Islam TuhinОценок пока нет

- Fund Performance ActiveДокумент12 страницFund Performance ActiveFortuneОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- LRWC-SEC 17C - Financial Highlights of Q1 2022Документ4 страницыLRWC-SEC 17C - Financial Highlights of Q1 2022ignaciomannyОценок пока нет

- Response To PSE Query 07 September 2022Документ1 страницаResponse To PSE Query 07 September 2022ignaciomannyОценок пока нет

- QUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODEДокумент73 страницыQUARTERLY REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODEignaciomannyОценок пока нет

- CNVRG Performance PlummetsДокумент7 страницCNVRG Performance PlummetsignaciomannyОценок пока нет

- AbacusShortTakes 08232022Документ7 страницAbacusShortTakes 08232022ignaciomannyОценок пока нет

- Annual Report of The Keepers Holdings. Inc. For Cy 2021Документ201 страницаAnnual Report of The Keepers Holdings. Inc. For Cy 2021ignaciomannyОценок пока нет

- Disclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)Документ3 страницыDisclosure 2022-09-09 PSE Approval of AREIT Shares Lodgement (SEC-PSE)ignaciomannyОценок пока нет

- AbacusShortTakes 09212022Документ5 страницAbacusShortTakes 09212022ignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент4 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- AbacusShortTakes 10262022Документ6 страницAbacusShortTakes 10262022ignaciomannyОценок пока нет

- AbacusShortTakes 09092022Документ6 страницAbacusShortTakes 09092022ignaciomannyОценок пока нет

- wk26 Jun2019mktwatchДокумент3 страницыwk26 Jun2019mktwatchignaciomannyОценок пока нет

- AbacusShortTakes 09082022Документ7 страницAbacusShortTakes 09082022ignaciomannyОценок пока нет

- Power sector pairs trading: AP favored over FGENДокумент6 страницPower sector pairs trading: AP favored over FGENignaciomannyОценок пока нет

- REIT Plan - FinalДокумент1 701 страницаREIT Plan - FinalChristian John RojoОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Top Gainer 02.18.2017Документ3 страницыTop Gainer 02.18.2017ignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент4 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Philippine stock market price gainers and losersДокумент5 страницWeekly Philippine stock market price gainers and losersignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент4 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Документ3 страницыWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyОценок пока нет

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Документ3 страницыWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyОценок пока нет

- Weekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVДокумент3 страницыWeekly Top Price Gainers Total Value PER EPS Comparative Price Change (%) Rank Company Stock Code Last Traded Price Disclosure Reference No. PBVignaciomannyОценок пока нет

- wk26 Jun2019mktwatchДокумент3 страницыwk26 Jun2019mktwatchignaciomannyОценок пока нет

- Weekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)Документ3 страницыWeekly Top Price Gainers Rank Company Stock Code Last Traded Price Disclosure Reference No. PBV Total Value PER EPS Comparative Price Change (%)ignaciomannyОценок пока нет

- Schneider Electric Strategy PresentationДокумент10 страницSchneider Electric Strategy PresentationDeepie KaurОценок пока нет

- Lincoln's Last Trial by Dan AbramsДокумент6 страницLincoln's Last Trial by Dan AbramsdosatoliОценок пока нет

- Reserve Management Parts I and II WBP Public 71907Документ86 страницReserve Management Parts I and II WBP Public 71907Primo KUSHFUTURES™ M©QUEENОценок пока нет

- Chapter 2 Phil. HistoryДокумент4 страницыChapter 2 Phil. HistoryJaylene AlbayОценок пока нет

- 09 User Guide Xentry Diagnosis Kit 4 enДокумент118 страниц09 User Guide Xentry Diagnosis Kit 4 enDylan DY100% (2)

- Geometry First 9 Weeks Test Review 1 2011Документ6 страницGeometry First 9 Weeks Test Review 1 2011esvraka1Оценок пока нет

- Phonetics Exercises PDFДокумент2 страницыPhonetics Exercises PDFShanti YuliastitiОценок пока нет

- Leanplum - Platform Data SheetДокумент10 страницLeanplum - Platform Data SheetKiran Manjunath BesthaОценок пока нет

- Week 10 8th Grade Colonial America The Southern Colonies Unit 2Документ4 страницыWeek 10 8th Grade Colonial America The Southern Colonies Unit 2santi marcucciОценок пока нет

- Deep Work Book - English ResumoДокумент9 страницDeep Work Book - English ResumoJoão Pedro OnozatoОценок пока нет

- Hamodia Parsonage ArticleДокумент2 страницыHamodia Parsonage ArticleJudah KupferОценок пока нет

- Old Testament Books Bingo CardsДокумент9 страницOld Testament Books Bingo CardsSiagona LeblancОценок пока нет

- Shell Rimula R7 AD 5W-30: Performance, Features & Benefits Main ApplicationsДокумент2 страницыShell Rimula R7 AD 5W-30: Performance, Features & Benefits Main ApplicationsAji WibowoОценок пока нет

- Christian Ministry Books: 00-OrientationGuideДокумент36 страницChristian Ministry Books: 00-OrientationGuideNessieОценок пока нет

- Symbiosis Law School ICE QuestionsДокумент2 страницыSymbiosis Law School ICE QuestionsRidhima PurwarОценок пока нет

- 41720105Документ4 страницы41720105renu tomarОценок пока нет

- Valmet - S Waste To Energy SolutionsДокумент14 страницValmet - S Waste To Energy SolutionsNardo LlanosОценок пока нет

- The Art of Communication PDFДокумент3 страницыThe Art of Communication PDFHung Tran JamesОценок пока нет

- Multiple Choice Questions Class Viii: GeometryДокумент29 страницMultiple Choice Questions Class Viii: GeometrySoumitraBagОценок пока нет

- PB13MAT - 13 Project Stakeholder ManagementДокумент30 страницPB13MAT - 13 Project Stakeholder ManagementYudhi ChristianОценок пока нет

- F77 - Service ManualДокумент120 страницF77 - Service ManualStas MОценок пока нет

- Nursing ManagementДокумент14 страницNursing ManagementNolan Ivan EudinОценок пока нет

- ĐỀ MINH HỌA 15-19Документ25 страницĐỀ MINH HỌA 15-19Trung Vũ ThànhОценок пока нет

- Hold-Up?" As He Simultaneously Grabbed The Firearm of Verzosa. WhenДокумент2 страницыHold-Up?" As He Simultaneously Grabbed The Firearm of Verzosa. WhenVener MargalloОценок пока нет

- Clinical Skills Resource HandbookДокумент89 страницClinical Skills Resource Handbookanggita budi wahyono100% (1)

- Pengayaan Inisiasi 6-SynonymyДокумент35 страницPengayaan Inisiasi 6-SynonymyAriОценок пока нет

- June 1997 North American Native Orchid JournalДокумент117 страницJune 1997 North American Native Orchid JournalNorth American Native Orchid JournalОценок пока нет

- Kamencak D Dip LiteraturaДокумент2 страницыKamencak D Dip Literaturaprodaja47Оценок пока нет

- Smart Irrigation System With Lora & Recording of Lora Broadcast Using RTL-SDR Dongle For Spectrum AnalyzationДокумент4 страницыSmart Irrigation System With Lora & Recording of Lora Broadcast Using RTL-SDR Dongle For Spectrum AnalyzationInternational Journal of Innovative Science and Research TechnologyОценок пока нет

- Tentative Quotation For Corporate Video (5 Minutes)Документ2 страницыTentative Quotation For Corporate Video (5 Minutes)Lekha JauhariОценок пока нет