Академический Документы

Профессиональный Документы

Культура Документы

BKNC3 - Activity 1 - Review Exam

Загружено:

Dhel CahiligОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BKNC3 - Activity 1 - Review Exam

Загружено:

Dhel CahiligАвторское право:

Доступные форматы

Colegio de San Gabriel Arcangel

PACUCOA Accredited – Level 1 Status

City of San Jose del Monte, Bulacan

BOOKKEEPING NC III

Activity No. 1 – Review Exam

I. Definition of Terms:

1. Accounting

2. Debit

3. Credit

II. Enumeration

1. Elements of balance sheet

2. Elements of income statement

3. Complete accounting cycle

4. Functions of accounting

5. Forms of Business Organization

6. Types of Business

III. Problem Solving

1. Jose Masipag, a local CPA, completed the following transactions during January 2017. The following account

titles are to be used:

Cash – 101 Accounts payable – 203 Insurance expense – 507

Accounts receivable – 103 Jose Masipag, Capital – 301 Light & water expense – 508

Office supplies – 105 Jose Masipag, Drawing – 303 Rent expense – 509

Office equipment – 121 Fees earned – 401 Salary expense – 510

Office furniture – 122 Communication expense – 501 Taxes and licenses – 511

Notes payable – 201 Gas and oil expense – 504

Jan 1 Jose Masipag made an initial investment of P25,000.

2 Paid rent for the month of January, P4,000.

2 Paid fire insurance for the month of January, P300.

3 Received from George Jimenez P750 for services rendered.

3 Borrowed P5,000 from the bank giving a 60-day note.

4 Paid membership dues to PICPA, P500.

5 Tomas Buena paid P950 for services rendered to him.

5 Bought for cash a new desk and table for the office, P5,500.

6 Paid business license fee to the city, P1,000.

8 Received a check from Ben Hardin for services rendered, P850.

9 Billed Susan Salgado P5,000 for services rendered.

10 Jose Masipag withdrew P2,500 for personal use.

11 Paid P600 for the gasoline used in business.

11 Received P650 from Wilfred Arietta for services rendered.

14 Paid the secretary’s salary for January 1 to 15, P2,500.

15 Purchased a computer and printer giving a note for P30,000.

16 Bought office supplies from Golden Bell Co. on account, P600.

17 Billed Samuel Donate P5,200 for services rendered.

18 Collected P3,000 from Susan Salgado to apply on her account.

19 Received cash from Fortune Company P4,750 for services rendered.

21 Paid Golden Bell Co. for office supplies purchased on January 16.

22 Jose Masipag made an additional investment of P10,000.

23 Received partial payment of P2,500 from Samuel Donate.

24 Paid the note issued on January 15.

25 Received P7,000 from Bell Company for services rendered.

28 Paid for January light and water bill, P1,200.

29 Paid the secretary’s salary for January 16 to 31, P2,500.

30 Paid Shell Service Station, P1,200 for gas and oil.

31 Paid PLDT Co. for telephone bills, P800.

Required:

a. Journalize the above transactions in the general journal.

b. Prepare the T accounts and post each entry to the T accounts.

c. Prepare a Trial Balance.

d. Prepare the following financial statements for the month of January 2017.

Statement of Comprehensive Income

Statement of Changes in Equity

Statement of Financial Position

Statement of Cash Flows

2. Shown below is the Trial Balance of RM Repair Shop for the current year.

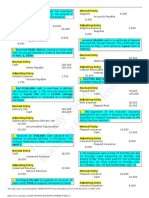

RM Repair Shop

Trial Balance

December 31, 2017

Account Title Debit Credit

Cash P 81,180.00

Accounts Receivable 25,650.00

Prepaid Insurance 3,600.00

Shop Supplies 16,400.00

Equipment 84,000.00

Accumulated Depreciation P 8,400.00

Accounts Payable 32,640.00

Loans Payable 50,000.00

Ramon Marcos, Capital 77,000.00

Ramon Marcos, Drawing 36,000.00

Service Income 191,940.00

Salaries Expense 64,500.00

Rent Expense 28,000.00

Utilities Expense 13,150.00

Miscellaneous Expense 7,500.00

Totals P 359,980.00 P 359,980.00

RM Repair Shop is on its second year of operations. Ramon Marcos Capital at the beginning of the current year

was P57,000. Below are the data that needed for adjustments:

The two-year P3,600 insurance was paid on January 1 of the current year.

Shop rental of P6,000 for three months starting December 1 was debited to Rent Expense.

Interest of 18% per annum on P50,000 one-year bank loan granted on July 1, has accrued.

Advertising placement of P1,800 for three months effective October 1 was still unpaid.

P7,500 was collected in advance on December 30 for repair services to be rendered next year.

Shop supplies inventory at the end of December amounted to P6,860.

Equipment has an estimated useful life of ten years.

Required:

a. Prepare the adjusting entries.

b. Prepare a Statement of Comprehensive Income for the year ended December 31.

c. Prepare a Statement of Changes in Equity for the year ended December 31.

d. Prepare a Statement of Financial Position as of December 31.

3. Below are the unadjusted general ledger account balances of the Modern Appliance Store for the current year.

Cash 255,430 Sales Returns and Allowances 37,500

Notes Receivable 60,000 Sales Discounts 50,650

Accounts Receivable 275,000 Purchases 2,625,250

Merchandise Inventory 1,578,650 Purchase Returns & Allowances 26,250

Prepaid Insurance 12,000 Purchase Discounts 40,560

Office Supplies 6,250 Transportation-In 60,250

VAT Input Tax 22,400 Sales Salaries Expense 215,675

Delivery Equipment 500,000 Advertising Expense 33,000

Acc. Depreciation 50,000 Commission Expense 75,250

Store Equipment 150,000 Delivery Expense 112,500

Acc. Depreciation 15,000 Misc. Selling Expense 12,450

Office Equipment 50,000 Office Salaries Expense 125,900

Acc. Depreciation 10,000 Rent Expense 110,000

Accounts Payable 945,650 Insurance Expense 12,000

Notes Payable 100,000 Office Supplies Expense 16,000

VAT Output Tax 30,800 Tax Expense 10,250

Mary Modern, Capital 1,505,945 Misc. General Expense 6,200

Mary Modern, Drawing 60,000 Interest Income 1,200

Sales 3,760,600 Interest Expense 12,000

Modern Appliance Store is on its second year of operations. Mary Modern, Capital at the beginning of the current

year was P1,405,945. Below are the data needed for adjustments at December 31:

The physical inventory of merchandise as of December 31 amounted to P1,650,620.

Interest at 12% per annum on the P60,000 Notes Receivable dated October 1, was due.

The four-month P12,000 prepaid insurance was paid on Nov. 2 of the current year.

Supplies inventory at the end of December amounted to P4,850.

Delivery and Store Equipment has an estimated useful life of ten years.

Office Equipment has an estimated useful life of five years.

Accrued Sundry Payables as of December 31 were as follows:

o Unpaid Sales Salaries, P10,000

o Unpaid Office Salaries, P5,000

o Accrued Advertising Expense, P3,000

o Accrued Store Rental, P10,000

It is estimated that 1% of sales will be uncollectible.

VAT Input Tax and VAT Output Tax are to be closed to determine the VAT Payable at December 31.

Required:

a. Prepare the adjusting entries.

b. Prepare a Statement of Comprehensive Income for the year ended December 31.

c. Prepare a Statement of Changes in Equity for the year ended December 31.

d. Prepare a Statement of Financial Position as of December 31.

4. Shown below are different freight terms: Required: Indicate on the blank space provided whether it is the BUYER

or the SELLER

Who should shoulder

Freight Terms Who will pay

the freight

a. FOB – Shipping Point – Freight Collect

b. FOB – Shipping Point – Freight Prepaid

c. FOB – Destination – Freight Collect

d. FOB – Destination – Freight Prepaid

– END –

Mr. Rodel E. Cahilig

Instructor

Вам также может понравиться

- Module 1 JournalizingДокумент6 страницModule 1 JournalizingDianne CabilloОценок пока нет

- Joannamarie Uy ProblemДокумент1 страницаJoannamarie Uy ProblemFeiya Liu50% (2)

- Cabutotan Jennifer 2AДокумент12 страницCabutotan Jennifer 2AJennifer Mamuyac CabutotanОценок пока нет

- Accbp100 2nd Exam Part 1Документ2 страницыAccbp100 2nd Exam Part 1emem resuento100% (1)

- Additional InformationДокумент2 страницыAdditional InformationKailaОценок пока нет

- Theories of AccountingДокумент4 страницыTheories of AccountingShanine BaylonОценок пока нет

- Moises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CRДокумент5 страницMoises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CR버니 모지코Оценок пока нет

- ACEFIAR Quiz No. 7Документ2 страницыACEFIAR Quiz No. 7Marriel Fate CullanoОценок пока нет

- Merchandising Accounting (Erlinda See Chua)Документ1 страницаMerchandising Accounting (Erlinda See Chua)Shaira Nicole VasquezОценок пока нет

- Chapter 1 & 2Документ13 страницChapter 1 & 2Ali100% (1)

- Journalizing To Adjusting Entries QuizДокумент3 страницыJournalizing To Adjusting Entries QuizNemar Jay Capitania100% (1)

- Acctgchap 2Документ15 страницAcctgchap 2Anjelika ViescaОценок пока нет

- Business Transactions and Worksheet (Pio Baconga)Документ1 страницаBusiness Transactions and Worksheet (Pio Baconga)UnknownОценок пока нет

- Instructions: Do Not Put Centavos in Your Answers. No Need To Type Comma (,)Документ6 страницInstructions: Do Not Put Centavos in Your Answers. No Need To Type Comma (,)Victorino LopezОценок пока нет

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsДокумент6 страницAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- Economics PrelimsДокумент2 страницыEconomics PrelimsYannie Costibolo IsananОценок пока нет

- Paid and Not Currently Matched With EarningsДокумент46 страницPaid and Not Currently Matched With EarningsBruce SolanoОценок пока нет

- COSTCON Assignment2.5 Antony - KylaДокумент2 страницыCOSTCON Assignment2.5 Antony - KylaGabriel AfricaОценок пока нет

- 10-Column Worksheet FormДокумент1 страница10-Column Worksheet FormJewel CabigonОценок пока нет

- BA 1 Module 3 Trial Balance Errors DiscussionДокумент4 страницыBA 1 Module 3 Trial Balance Errors DiscussionLovely Rose VillarОценок пока нет

- Set IДокумент2 страницыSet IAdoree RamosОценок пока нет

- May 1 110 P100,000 310: W. Kayayan Accounting Firm General JournalДокумент14 страницMay 1 110 P100,000 310: W. Kayayan Accounting Firm General JournalShania ReighnОценок пока нет

- ProblemДокумент1 страницаProblemGemmie Barsobia100% (2)

- XYZ Company Sold10 Units F Goods With A Unit List Price of P 2Документ2 страницыXYZ Company Sold10 Units F Goods With A Unit List Price of P 2jude santos0% (1)

- Chapter 8-Problem 6Документ6 страницChapter 8-Problem 6kakaoОценок пока нет

- Quesada CleanersДокумент3 страницыQuesada CleanersAngel EstradaОценок пока нет

- UntitledДокумент7 страницUntitledKit BalagapoОценок пока нет

- Accounting 2Документ4 страницыAccounting 2Jocelyn Delacruz50% (2)

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeДокумент3 страницыActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiОценок пока нет

- Partnership FormationДокумент13 страницPartnership FormationPhilip Dan Jayson LarozaОценок пока нет

- Group Quiz 1Документ3 страницыGroup Quiz 1Joselito Marane Jr.Оценок пока нет

- Perpetual System, Problem #17Документ2 страницыPerpetual System, Problem #17Feiya LiuОценок пока нет

- Accounting Theory ReviewerДокумент4 страницыAccounting Theory ReviewerAlbert Sean LocsinОценок пока нет

- ABM+2 Learning+Material+No.+4Документ3 страницыABM+2 Learning+Material+No.+4Gelesabeth GarciaОценок пока нет

- ACCTG 1 Week 2-3 - Accounting in BusinessДокумент13 страницACCTG 1 Week 2-3 - Accounting in BusinessReygie FabrigaОценок пока нет

- Output Fabm1 Ladera, Rhealyn Patan-Ao Bsa-IДокумент9 страницOutput Fabm1 Ladera, Rhealyn Patan-Ao Bsa-IRhealyn Patan-ao LaderaОценок пока нет

- Act 110 Bonus Activity (Dimalawang)Документ10 страницAct 110 Bonus Activity (Dimalawang)Kilwa DyОценок пока нет

- CFAS Chapter 1 The Accountancy ProfessionДокумент1 страницаCFAS Chapter 1 The Accountancy ProfessionKaren CaelОценок пока нет

- MerchandisingДокумент11 страницMerchandisingAIRA NHAIRE MECATE100% (1)

- Group 6Документ6 страницGroup 6Love KarenОценок пока нет

- Adjusting Entries FarДокумент2 страницыAdjusting Entries FarKylha BalmoriОценок пока нет

- Elite AISДокумент70 страницElite AISDiana Rose OrlinaОценок пока нет

- Answer Q1 Job Order CostingДокумент5 страницAnswer Q1 Job Order CostingDiane Cris Duque100% (1)

- It FinalsДокумент11 страницIt FinalsHea Jennifer AyopОценок пока нет

- WorksheetДокумент3 страницыWorksheetRonnie Lloyd Javier100% (3)

- Chart of Accounts Assets: LiabilitiesДокумент50 страницChart of Accounts Assets: LiabilitiesDiana Rose Orlina100% (1)

- Accounting Cycle 1 768 290 Worksheet BSДокумент27 страницAccounting Cycle 1 768 290 Worksheet BSKylene Edelle LeonardoОценок пока нет

- CFAS - Chapter 3: IdentificationДокумент1 страницаCFAS - Chapter 3: Identificationagm25Оценок пока нет

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Документ6 страницMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsОценок пока нет

- Guide Questions For Chapter 2Документ5 страницGuide Questions For Chapter 2Kathleen Mangual0% (1)

- Cfas ReviewerДокумент7 страницCfas ReviewerDarlene Angela IcasiamОценок пока нет

- CH 1 - Exercises & ProblemsДокумент4 страницыCH 1 - Exercises & ProblemsMhico MateoОценок пока нет

- Group B Teresita Buenaflor ShoesДокумент38 страницGroup B Teresita Buenaflor ShoesAlexandrea San Buenaventura BaayОценок пока нет

- Caselet 3 Comprehensive Evaluation GamespanelaquitevisrapadasalgadoДокумент18 страницCaselet 3 Comprehensive Evaluation GamespanelaquitevisrapadasalgadoPANELA, Jericho F.Оценок пока нет

- Assignment Module 5Документ2 страницыAssignment Module 5Hazel Jane MejiaОценок пока нет

- Accounting 1 ReviewДокумент13 страницAccounting 1 ReviewAlyssa Lumbao100% (1)

- Assets: Tamala & Estrabilla Tuna Fish Buy and Sell Statement of Financial Position As of July 1, 20AДокумент2 страницыAssets: Tamala & Estrabilla Tuna Fish Buy and Sell Statement of Financial Position As of July 1, 20AAdam CuencaОценок пока нет

- Icb 1Документ9 страницIcb 1Diana GallardoОценок пока нет

- Exercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessДокумент4 страницыExercise 5 - Completing The Accounting Cycle For Merchandising and Service BusinessShiela Rengel0% (2)

- Lesson 3 - Quiz No. 4Документ1 страницаLesson 3 - Quiz No. 4Dhel CahiligОценок пока нет

- Lesson 1 - Quiz No. 1Документ2 страницыLesson 1 - Quiz No. 1Dhel CahiligОценок пока нет

- Colegio de San Gabriel ArcangelДокумент4 страницыColegio de San Gabriel ArcangelDhel CahiligОценок пока нет

- Lesson 2 - Quiz No. 2Документ2 страницыLesson 2 - Quiz No. 2Dhel CahiligОценок пока нет

- Lesson 3 - Quiz No. 4Документ1 страницаLesson 3 - Quiz No. 4Dhel CahiligОценок пока нет

- BKNC3 - Activity 1 - Review ExamДокумент3 страницыBKNC3 - Activity 1 - Review ExamDhel Cahilig0% (1)

- Colegio de San Gabriel ArcangelДокумент4 страницыColegio de San Gabriel ArcangelDhel CahiligОценок пока нет

- Lesson 1 - Quiz No. 1Документ2 страницыLesson 1 - Quiz No. 1Dhel CahiligОценок пока нет

- The Effectiveness of Free Anti-Rabies Program To Convince Patient To Adhere On VaccinationДокумент9 страницThe Effectiveness of Free Anti-Rabies Program To Convince Patient To Adhere On VaccinationDhel CahiligОценок пока нет

- Lesson 2 - Quiz No. 2Документ2 страницыLesson 2 - Quiz No. 2Dhel CahiligОценок пока нет

- 2018MandatoryDisclosureFormforNon StockCorporationsДокумент6 страниц2018MandatoryDisclosureFormforNon StockCorporationsWillie Mae CarandangОценок пока нет

- Customer Refund: Responsibility: Yodlee US AR Super User Navigation: Transactions TransactionsДокумент12 страницCustomer Refund: Responsibility: Yodlee US AR Super User Navigation: Transactions TransactionsAziz KhanОценок пока нет

- This Study Resource Was: Interactive Reading QuestionsДокумент3 страницыThis Study Resource Was: Interactive Reading QuestionsJoshua LagonoyОценок пока нет

- Oleracea Contain 13.2% Dry Matter, 15.7% Crude Protein, 5.4% Ether ExtractionДокумент47 страницOleracea Contain 13.2% Dry Matter, 15.7% Crude Protein, 5.4% Ether ExtractionJakin Aia TapanganОценок пока нет

- Pace, ART 102, Week 6, Etruscan, Roman Arch. & SculpДокумент36 страницPace, ART 102, Week 6, Etruscan, Roman Arch. & SculpJason ByrdОценок пока нет

- Cofee Table Book - Hayyan - Alef GroupДокумент58 страницCofee Table Book - Hayyan - Alef GroupMustafa GelenovОценок пока нет

- Unit 2 Foundations of CurriculumДокумент20 страницUnit 2 Foundations of CurriculumKainat BatoolОценок пока нет

- Corporation Law Case Digests Philippines Merger and ConsolidationДокумент7 страницCorporation Law Case Digests Philippines Merger and ConsolidationAlpha BetaОценок пока нет

- Republic Vs CA - Land Titles and Deeds - GR No. 127060Документ3 страницыRepublic Vs CA - Land Titles and Deeds - GR No. 127060Maya Sin-ot ApaliasОценок пока нет

- CBSE Class 12 Business Studies Question Paper 2013 With SolutionsДокумент19 страницCBSE Class 12 Business Studies Question Paper 2013 With SolutionsManormaОценок пока нет

- Drug Distribution MethodsДокумент40 страницDrug Distribution MethodsMuhammad Masoom Akhtar100% (1)

- Elementary SurveyingДокумент19 страницElementary SurveyingJefferson EscobidoОценок пока нет

- The Integumentary System Development: Biene, Ellen Angelic Flores, Andrie BonДокумент29 страницThe Integumentary System Development: Biene, Ellen Angelic Flores, Andrie BonMu Lok100% (3)

- DUN Bukit Lanjan CNY Sponsorship Form2Документ1 страницаDUN Bukit Lanjan CNY Sponsorship Form2alamsekitarselangorОценок пока нет

- Spyderco Product Guide - 2016Документ154 страницыSpyderco Product Guide - 2016marceudemeloОценок пока нет

- GST 101 Exam Past QuestionsДокумент6 страницGST 101 Exam Past QuestionsBenjamin Favour100% (2)

- Ang Tibay Vs CAДокумент2 страницыAng Tibay Vs CAEarl LarroderОценок пока нет

- Spouses Aggabao V. Parulan, Jr. and Parulan G.R. No. 165803, (September 1, 2010) Doctrine (S)Документ9 страницSpouses Aggabao V. Parulan, Jr. and Parulan G.R. No. 165803, (September 1, 2010) Doctrine (S)RJОценок пока нет

- Resume Testing6+ SaptagireswarДокумент5 страницResume Testing6+ SaptagireswarSuresh RamasamyОценок пока нет

- OrthoДокумент22 страницыOrthosivaleela gОценок пока нет

- Creating Literacy Instruction For All Students ResourceДокумент25 страницCreating Literacy Instruction For All Students ResourceNicole RickettsОценок пока нет

- Mathematicaleconomics PDFДокумент84 страницыMathematicaleconomics PDFSayyid JifriОценок пока нет

- A Global StudyДокумент57 страницA Global StudyRoynal PasaribuОценок пока нет

- MISKДокумент134 страницыMISKmusyokaОценок пока нет

- Stroke Practice GuidelineДокумент274 страницыStroke Practice GuidelineCamila HernandezОценок пока нет

- FreeMarkets: Procurement & Outsourcing StrategiesДокумент44 страницыFreeMarkets: Procurement & Outsourcing StrategiesFarhaad MohsinОценок пока нет

- BSCHMCTT 101Документ308 страницBSCHMCTT 101JITTUОценок пока нет

- Lesson I. Background InformationДокумент21 страницаLesson I. Background InformationsuidivoОценок пока нет

- AS 1 Pretest TOS S.Y. 2018-2019Документ2 страницыAS 1 Pretest TOS S.Y. 2018-2019Whilmark Tican MucaОценок пока нет

- CDT 2019 - Dental Procedure Code - American Dental AssociationДокумент195 страницCDT 2019 - Dental Procedure Code - American Dental AssociationJack50% (2)

- "Shiksha Se Hi Suraksha": Literacy Campaign WeekДокумент4 страницы"Shiksha Se Hi Suraksha": Literacy Campaign WeekVaishali100% (1)