Академический Документы

Профессиональный Документы

Культура Документы

Nse 500

Загружено:

Ayush Tandon0 оценок0% нашли этот документ полезным (0 голосов)

13 просмотров12 страницОригинальное название

nse500

Авторское право

© © All Rights Reserved

Доступные форматы

XLSX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

13 просмотров12 страницNse 500

Загружено:

Ayush TandonАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате XLSX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 12

Company Name (M.

Cap) Is it a CMP Price Market 52W

Indian Bank(M) Very Good 59 1.20% 6,584 214

Future Consumer Ltd.(S) Not Good 10.15 4.64% 1,863 36

Century Textiles & Industries Ltd.(S) Not Good 305.5 0.31% 3,402 986.5

Spicejet Ltd.(S) Not Good 48.9 1.98% 2,877 152.6

IIFL Finance Ltd.(S) Somewhat 71.2 1.06% 2,665 212.8

IIFL Finance Ltd.(S) Somewhat 71.35 1.28% 2,665 212.8

IIFL Finance Ltd.(S) Somewhat 71.5 1.49% 2,665 212.8

Lemon Tree Hotels Ltd.(S) Somewhat 23.9 2.14% 1,854 69

Sunteck Realty Ltd.(S) Not Good 177.7 1.40% 2,564 487.4

DCB Bank Ltd.(S) Very Good 79.75 1.59% 2,437 218.5

Sunteck Realty Ltd.(S) Not Good 179 2.17% 2,564 487.4

Himatsingka Seide Ltd.(S) Somewhat 63 1.61% 610 166

Delta Corp Ltd.(S) Not Good 88.75 3.20% 2,311 224.8

Sobha Ltd.(S) Somewhat 230 0.39% 2,173 561

Canara Bank(M) Not Good 101.2 0.85% 14,579 243.8

Union Bank Of India(M) Not Good 29.85 2.23% 18,708 71.65

Bank Of Baroda(L) Somewhat 47.7 1.92% 21,624 113

Shriram City Union Finance Ltd.(S) Very Good 674.2 0.66% 4,421 1,572

Indiabulls Ventures Ltd.(M) Not Good 113.8 3.17% 6,052 265

Aditya Birla Fashion and Retail Ltd.(M) Somewhat 125.2 1.91% 10,615 285.3

Aditya Birla Fashion and Retail Ltd.(M) Somewhat 126 2.65% 10,615 285.3

General Insurance Corporation of India Ltd.(L) Somewhat 147.8 0.68% 25,755 333.9

Prestige Estate Projects Ltd.(M) Somewhat 194.8 0.70% 7,753 426.1

Indiabulls Real Estate Ltd.(S) Not Good 52.25 0.77% 2,357 113

Karur Vysya Bank Ltd.(S) Very Good 30.9 0.82% 2,450 66.45

L&T Finance Holdings Ltd.(M) Somewhat 62.45 3.05% 12,160 134

Punjab National Bank(L) Not Good 33 2.64% 30,255 70.25

IFB Industries Ltd.(S) Very Good 377 0.87% 1,514 798.1

IDFC Ltd.(S) Somewhat 19.6 2.08% 3,065 40.5

Adani Power Ltd.(M) Not Good 35.7 0.56% 13,692 73.75

Nava Bharat Ventures Ltd.(S) Somewhat 47.25 0.96% 825 97.6

The Indian Hotels Company Ltd.(M) Somewhat 79.2 0.51% 9,371 162.9

Aditya Birla Capital Ltd.(M) Somewhat 56.8 0.35% 13,662 115.3

Aditya Birla Capital Ltd.(M) Somewhat 56.95 0.62% 13,662 115.3

Kolte Patil Developers Ltd.(S) Not Good 143.1 1.49% 1,069 288

VRL Logistics Ltd.(S) Somewhat 150.2 0.91% 1,344 300.1

The Karnataka Bank Ltd.(S) Somewhat 42.85 0.94% 1,320 84.55

Edelweiss Financial Services Ltd.(M) Somewhat 77.25 4.18% 6,933 151.8

LIC Housing Finance Ltd.(M) Very Good 274.6 2.29% 13,548 526

India Tourism Development Corporation Ltd.(S) Not Good 219 1.15% 1,857 419.3

Bandhan Bank Ltd.(L) Very Good 341.5 0.31% 54,822 650

The South Indian Bank Ltd.(S) Somewhat 6.98 2.20% 1,236 13.25

VIP Industries Ltd.(S) Very Good 276.8 0.34% 3,898 519.9

Elgi Equipments Ltd.(S) Somewhat 166.3 0.70% 2,618 309.6

Shriram Transport Finance Company Ltd.(M) Very Good 721 3.24% 17,673 1,332

Vakrangee Ltd.(S) Not Good 30.25 2.72% 3,120 55.5

State Bank Of India(L) Very Good 192.2 1.43% 169,077 351

VenkyS (India) Ltd.(S) Not Good 1,068 1.34% 1,485 1,943

VenkyS (India) Ltd.(S) Not Good 1,069 1.41% 1,485 1,943

Brigade Enterprises Ltd.(S) Not Good 140.5 0.36% 2,861 255

Brigade Enterprises Ltd.(S) Not Good 141 0.71% 2,861 255

Ujjivan Small Finance Bank Ltd.(M) Somewhat 35.05 1.30% 5,980 62.8

Jindal Saw Ltd.(S) Not Good 57.45 3.33% 1,778 102.7

Mahindra CIE Automotive Ltd.(S) Not Good 105 1.06% 3,936 187

ABB India Ltd.(M) Somewhat 890.4 -0.42% 18,948 1,584

The Federal Bank Ltd.(M) Somewhat 56.2 1.17% 11,075 98.6

Security And Intelligence Services India Ltd.(M) Somewhat 358 1.45% 5,175 624.1

Vardhman Textiles Ltd.(S) Somewhat 637 0.33% 3,652 1,105

Avanti Feeds Ltd.(M) Somewhat 444 2.03% 5,929 769.9

Axis Bank Ltd.(L) Very Good 442.4 1.24% 123,323 765.9

Axis Bank Ltd.(L) Very Good 443.4 1.46% 123,323 765.9

Rajesh Exports Ltd.(M) Not Good 464.9 0.31% 13,682 802

Care Ratings Ltd.(S) Somewhat 443 0.45% 1,299 760.4

KEI Industries Ltd.(S) Somewhat 359.2 2.57% 3,134 614.7

JSW Energy Ltd.(M) Somewhat 46.8 3.88% 7,401 80

TV Today Network Ltd.(S) Somewhat 203.8 2.16% 1,190 345.4

Cholamandalam Financial Holdings Ltd.(M) Somewhat 335.8 1.18% 6,229 568.2

Bank Of India(M) Not Good 47.35 3.50% 14,992 79.8

BEML Ltd.(S) Somewhat 663 1.57% 2,718 1,108

Larsen & Toubro Ltd.(L) Somewhat 930.2 1.88% 128,188 1,554

IIFL Wealth Management Ltd.(M) NA 993.6 1.55% 8,534 1,659

BEML Ltd.(S) Somewhat 663.8 1.69% 2,718 1,108

Phoenix Mills Ltd.(M) Somewhat 588.8 0.90% 8,955 979.5

Coal India Ltd.(L) Very Good 131.8 0.92% 80,485 217.9

Symphony Ltd.(M) Very Good 862.6 2.03% 5,915 1,407

KPR Mill Ltd.(S) Somewhat 438.1 0.65% 2,995 714.2

Bombay Dyeing & Manufacturing Company Ltd.(S) Not Good 62.5 0.40% 1,286 101.8

Nippon Life India Asset Management Ltd.(M) Somewhat 279 0.78% 16,947 452.9

Asahi India Glass Ltd.(S) Somewhat 170.7 2.34% 4,055 276.9

Bajaj Finserv Ltd.(L) Very Good 6,369 0.50% 100,848 10,297

NMDC Ltd.(L) Somewhat 87.95 3.47% 26,026 139.5

Cholamandalam Investment & Finance Company Ltd.Very Good 220.7 2.53% 17,642 348.9

Bharat Heavy Electricals Ltd.(M) Not Good 38.8 3.47% 13,058 61.3

Aavas Financiers Ltd.(M) Somewhat 1,318 -0.52% 10,376 2,078

Wockhardt Ltd.(S) Somewhat 261.1 1.48% 2,849 411.6

Power Finance Corporation Ltd.(L) Very Good 84.6 4.00% 21,477 133.3

GHCL Ltd.(S) Somewhat 145 2.80% 1,340 227

Gulf Oil Lubricants India Ltd.(S) Somewhat 587 1.45% 2,900 900.5

Vodafone Idea Ltd.(L) Not Good 8.23 2.11% 23,161 12.62

Bliss GVS Pharma Ltd.(S) Somewhat 106.3 1.00% 1,086 162.9

Bliss GVS Pharma Ltd.(S) Somewhat 106.6 1.23% 1,086 162.9

JK Paper Ltd.(S) Not Good 99.75 2.73% 1,714 151.9

REC Ltd.(M) Very Good 103.5 3.19% 19,808 157.2

VST Industries Ltd.(S) Very Good 3,211 0.36% 4,940 4,856

Bharti Infratel Ltd.(L) Very Good 196.4 3.07% 35,244 295.8

Schneider Electric Infrastructure Ltd.(S) Not Good 75.7 0.73% 1,797 113.9

Minda Industries Ltd.(M) Somewhat 283.9 0.82% 7,384 425.9

GAIL (India) Ltd.(L) Very Good 98.9 1.33% 44,019 148.1

GAIL (India) Ltd.(L) Very Good 99.05 1.49% 44,019 148.1

Lakshmi Machine Works Ltd.(S) Very Good 2,950 0.64% 3,131 4,410

Bajaj Finance Ltd.(L) Very Good 3,300 1.87% 195,181 4,923

Bata India Ltd.(M) Very Good 1,275 1.57% 16,134 1,897

Adani Transmission Ltd.(L) Not Good 246.1 4.55% 25,890 365.8

Adani Transmission Ltd.(L) Not Good 246.2 4.57% 25,890 365.8

Bata India Ltd.(M) Very Good 1,277 1.73% 16,134 1,897

Zensar Technologies Ltd.(S) Very Good 156 3.28% 3,405 229.8

Central Bank Of India(M) Not Good 17.6 4.45% 9,621 25.8

IFCI Ltd.(S) Not Good 6.37 1.59% 1,189 9.31

Tata Steel BSL Ltd.(S) Not Good 22.3 3.00% 2,367 32.55

Cochin Shipyard Ltd.(S) Somewhat 340.7 2.16% 4,387 491.1

Trent Ltd.(M) Very Good 559.7 1.78% 19,548 804

Adani Green Energy Ltd.(L) Not Good 339 0.37% 52,825 486.6

Adani Green Energy Ltd.(L) Not Good 339.2 0.43% 52,825 486.6

Polycab India Ltd.(M) Somewhat 822.8 2.22% 11,989 1,180

Adani Green Energy Ltd.(L) Not Good 340.6 0.83% 52,825 486.6

NHPC Ltd.(L) Somewhat 20.35 0.49% 20,341 29

Grasim Industries Ltd.(L) Very Good 620 3.96% 39,232 875

Godrej Industries Ltd.(M) Not Good 360.6 1.18% 11,994 507.6

Castrol India Ltd.(M) Very Good 115.6 2.35% 11,172 162.1

Suzlon Energy Ltd.(S) Not Good 4.47 3.23% 3,562 6.19

Tata Power Company Ltd.(M) Somewhat 49.7 1.02% 13,307 68.8

MMTC Ltd.(S) Not Good 19.15 2.13% 2,813 26.5

Aegis Logistics Ltd.(M) Somewhat 192.9 -2.03% 6,688 266.9

Finolex Industries Ltd.(M) Very Good 459.4 2.10% 5,584 635

ITC Ltd.(L) Very Good 196.7 0.64% 240,321 271

Indoco Remedies Ltd.(S) Very Good 207 0.75% 1,893 285

Relaxo Footwears Ltd.(M) Very Good 603 0.61% 14,877 830.1

Westlife Development Ltd.(M) Very Good 363.9 3.31% 5,483 499.9

Gujarat Narmada Valley Fertilizers & Chemicals Ltd.(SSomewhat 163.8 2.34% 2,488 224.4

Eris Lifesciences Ltd.(M) Very Good 434.8 1.16% 5,836 593.4

Mishra Dhatu Nigam Ltd.(S) NA 203.8 0.52% 3,797 278

Rites Ltd.(M) Somewhat 242.8 0.48% 6,041 331

Astral Poly Technik Ltd.(M) Very Good 928 0.86% 13,863 1,265

JSW Steel Ltd.(L) Somewhat 218.4 1.53% 51,994 296.6

JSW Steel Ltd.(L) Somewhat 218.8 1.74% 51,994 296.6

Tata Steel Ltd.(L) Somewhat 373.6 4.27% 43,150 505.9

Glenmark Pharmaceuticals Ltd.(M) Somewhat 423.3 0.58% 11,875 572.7

Affle (India) Ltd.(S) Somewhat 1,700 0.19% 4,326 2,296

UPL Ltd.(L) Very Good 458.5 2.16% 34,289 617.5

Godrej Properties Ltd.(L) Not Good 883 0.36% 22,179 1,188

Akzo Nobel India Ltd.(M) Somewhat 1,871 0.46% 8,482 2,515

Akzo Nobel India Ltd.(M) Somewhat 1,871 0.46% 8,482 2,515

Adani Ports and Special Economic Zone Ltd.(L) Somewhat 320.5 0.61% 64,721 428.9

Ratnamani Metals & Tubes Ltd.(S) Somewhat 1,039 0.66% 4,824 1,384

Star Cement Ltd.(S) Somewhat 85 0.41% 3,491 113

Endurance Technologies Ltd.(M) Somewhat 905.5 1.90% 12,500 1,202

Birla Corporation Ltd.(S) Somewhat 609 0.42% 4,670 807.6

PTC India Ltd.(S) Somewhat 52.75 0.67% 1,551 68.45

JK Lakshmi Cement Ltd.(S) Not Good 300.1 2.70% 3,439 389.4

Godrej Agrovet Ltd.(M) Somewhat 461.2 0.38% 8,826 598

Allcargo Logistics Ltd.(S) Somewhat 94.65 0.53% 2,313 122.7

Sudarshan Chemical Industries Ltd.(S) Very Good 390.4 1.35% 2,667 505.9

Indian Overseas Bank(M) Not Good 10.7 2.59% 17,144 13.83

Bosch Ltd.(L) Very Good 13,264 0.48% 38,934 17,137

Strides Pharma Science Ltd.(S) Not Good 428.1 3.67% 3,698 547.4

ICRA Ltd.(S) Very Good 2,538 1.48% 2,414 3,227

Trident Ltd.(S) Not Good 6.67 3.89% 3,272 8.45

Jindal Stainless (Hisar) Ltd.(S) Somewhat 72.65 2.04% 1,680 91.35

La Opala RG Ltd.(S) Very Good 185.6 0.46% 2,050 233

Petronet LNG Ltd.(L) Very Good 241.3 2.94% 35,168 302

KRBL Ltd.(M) Somewhat 253.2 1.14% 5,894 316.6

Balmer Lawrie & Company Ltd.(S) Not Good 113.1 1.71% 1,902 141.3

Pidilite Industries Ltd.(L) Very Good 1,370 1.14% 68,829 1,710

Abbott India Ltd.(L) Very Good 14,878 -0.13% 31,656 18,569

Voltas Ltd.(M) Very Good 594 2.29% 19,214 740.5

Adani Gas Ltd.(M) Somewhat 156.6 7.15% 16,074 194.6

Mahanagar Gas Ltd.(M) Very Good 1,010 0.97% 9,877 1,247

Aarti Industries Ltd.(M) Very Good 966.8 -0.36% 16,906 1,192

Garden Reach Shipbuilders & Engineers Ltd.(S) NA 202.8 2.94% 2,256 249.4

Sun Pharma Advanced Research Company Ltd.(S) Not Good 172 1.87% 4,425 210.7

Indostar Capital Finance Ltd.(S) Not Good 262.4 0.98% 3,201 319.8

ACC Ltd.(L) Very Good 1,405 0.35% 26,285 1,708

AIA Engineering Ltd.(M) Very Good 1,650 -0.39% 15,624 1,985

Heidelberg Cement India Ltd.(S) Somewhat 181.6 2.57% 4,012 217.8

Firstsource Solutions Ltd.(S) Not Good 46.6 2.98% 3,141 55.3

L&T Technology Services Ltd.(M) Very Good 1,500 3.14% 15,199 1,780

Power Grid Corporation Of India Ltd.(L) Very Good 182.5 0.39% 95,110 216.2

Advanced Enzyme Technologies Ltd.(S) Very Good 175 1.77% 1,920 206.8

Glaxosmithkline Pharmaceuticals Ltd.(L) Very Good 1,488 1.76% 24,771 1,745

3M India Ltd.(L) Very Good 21,536 0.12% 24,231 25,209

Advanced Enzyme Technologies Ltd.(S) Very Good 176.8 2.79% 1,920 206.8

Swan Energy Ltd.(S) Somewhat 133.4 1.14% 3,223 154.6

Sumitomo Chemical India Ltd.(M) NA 274.5 0.64% 13,614 317.4

Tata Elxsi Ltd.(M) Very Good 952.8 3.26% 5,746 1,099

Colgate-Palmolive (India) Ltd.(L) Very Good 1,430 2.78% 37,850 1,641

Bharat Dynamics Ltd.(M) Somewhat 397.2 2.53% 7,100 454.2

Amber Enterprises India Ltd.(S) Somewhat 1,484 0.36% 4,649 1,690

Hindustan Aeronautics Ltd.(L) Very Good 909 0.77% 30,163 1,028

Caplin Point Laboratories Ltd.(S) Very Good 404.4 2.56% 2,983 456

Torrent Pharmaceuticals Ltd.(L) Very Good 2,378 3.78% 38,764 2,679

Indian Energy Exchange Ltd.(M) Very Good 180.7 3.14% 5,247 203.4

Chambal Fertilisers & Chemicals Ltd.(M) Not Good 165.6 0.85% 6,832 186

Supreme Industries Ltd.(M) Very Good 1,259 3.11% 15,511 1,414

Lupin Ltd.(L) Very Good 857.6 1.89% 38,143 955.9

NIIT Technologies Ltd.(M) Somewhat 1,848 4.61% 10,699 2,057

Astrazeneca Pharma India Ltd.(M) Not Good 3,337 0.95% 8,265 3,700

Galaxy Surfactants Ltd.(M) Somewhat 1,617 0.47% 5,706 1,790

Apollo Hospitals Enterprise Ltd.(L) Very Good 1,639 2.44% 22,260 1,814

E.I.D. Parry (India) Ltd.(M) Not Good 284.4 0.60% 5,003 313.8

Jindal Steel & Power Ltd.(M) Not Good 184.1 0.55% 18,676 202.4

Bayer CropScience Ltd.(L) Very Good 5,785 0.71% 25,816 6,342

CCL Products (India) Ltd.(S) Somewhat 238.2 1.06% 3,136 260.5

Eicher Motors Ltd.(L) Very Good 21,500 2.07% 57,516 23,428

SRF Ltd.(L) Somewhat 3,921 4.00% 21,672 4,259

Sanofi India Ltd.(M) Very Good 7,855 3.61% 17,461 8,528

Dixon Technologies (India) Ltd.(M) Somewhat 7,247 2.46% 8,184 7,810

Dabur India Ltd.(L) Very Good 487.5 2.69% 83,908 525.3

Essel Propack Ltd.(M) Somewhat 201.2 0.83% 6,296 216.6

Kaveri Seed Company Ltd.(S) Very Good 596 3.54% 3,472 638.7

Cadila Healthcare Ltd.(L) Very Good 359.9 0.71% 36,578 384.7

Ajanta Pharma Ltd.(M) Very Good 1,479 2.65% 12,573 1,578

Coromandel International Ltd.(L) Very Good 778.5 0.39% 22,732 829.9

Ajanta Pharma Ltd.(M) Very Good 1,481 2.81% 12,573 1,578

Coromandel International Ltd.(L) Very Good 779.1 0.48% 22,732 829.9

Atul Ltd.(M) Very Good 5,120 0.36% 15,133 5,447

Divis Laboratories Ltd.(L) Very Good 2,396 2.25% 62,199 2,538

Alembic Pharmaceuticals Ltd.(M) Very Good 986.5 1.03% 18,408 1,044

Balkrishna Industries Ltd.(L) Very Good 1,253 0.89% 24,011 1,325

Britannia Industries Ltd.(L) Very Good 3,798 0.62% 90,829 4,015

Balkrishna Industries Ltd.(L) Very Good 1,257 1.21% 24,011 1,325

Manappuram Finance Ltd.(M) Very Good 184.7 1.18% 15,424 194.6

Ipca Laboratories Ltd.(L) Very Good 1,761 1.62% 21,894 1,844

Natco Pharma Ltd.(M) NA 720.4 0.40% 13,064 752.4

ITI Ltd.(M) Not Good 138.5 1.88% 12,577 144.3

Aurobindo Pharma Ltd.(L) Somewhat 813.5 2.83% 46,354 845.6

Sun Pharmaceutical Industries Ltd.(L) Very Good 493.4 2.27% 115,768 512.5

PI Industries Ltd.(L) Very Good 1,780 1.23% 26,676 1,836

Tata Consumer Products Ltd.(L) Somewhat 425.6 3.08% 38,046 437.8

Navin Fluorine International Ltd.(M) Somewhat 1,862 1.04% 9,117 1,914

Tata Communications Ltd.(M) Not Good 717.1 2.98% 19,847 735.5

Cipla Ltd.(L) Very Good 679.1 2.48% 53,434 696.2

Navin Fluorine International Ltd.(M) Somewhat 1,870 1.49% 9,117 1,914

IRB Infrastructure Developers Ltd.(S) Not Good 125.5 2.95% 4,286 128.4

National Fertilizers Ltd.(S) Not Good 43.9 4.15% 2,068 44.85

Garware Technical Fibres Ltd.(S) Very Good 1,703 2.06% 3,652 1,737

Syngene International Ltd.(M) Very Good 466 2.29% 18,222 474.8

Wipro Ltd.(L) Very Good 276.5 0.38% 157,405 281.5

Multi Commodity Exchange Of India Ltd.(M) Very Good 1,712 0.41% 8,697 1,730

Infibeam Avenues Ltd.(M) Not Good 77.65 1.17% 5,102 77.85

Deepak Nitrite Ltd.(M) Somewhat 632 2.66% 8,397 623.5

Right Stock? Change Cap (Cr) High

52W ROE P/E P/BV EV/ (high-CMP)/CMP*100

41.7 3.57 7.64 0.28 - 263

5.44 2.7 0 1.38 29.74 255

220.1 22.27 9.37 0.96 5.15 223

30.8 116.4 0 -5.94 38.98 212

58.15 4.17 99.86 0.74 - 199

58.15 4.17 99.86 0.74 - 198

58.15 4.17 99.86 0.74 - 198

13.8 5.54 0 1.2 17.71 189

145 10.15 20.38 1.32 12.83 174

58.1 11.16 7.21 0.77 - 174

145 10.15 20.38 1.32 12.83 172

43 13.29 46.07 0.45 5.55 163

54 6.63 23.61 1.2 9.47 153

117.9 13.19 7.51 0.95 4.6 144

73.85 -6.12 0 0.41 - 141

22.6 -10.56 0 0.56 - 140

36.05 0.93 39.59 0.3 - 137

617 14.72 4.42 0.61 - 133

63.6 2.9 24.51 1.29 - 133

97.05 24.93 0 5.1 20.69 128

97.05 24.93 0 5.1 20.69 126

81.7 10.15 0 1.13 - 126

133.8 6.14 29.55 1.47 18.95 119

36.85 1.5 0 0.37 - 116

18.15 3.32 10.42 0.37 - 115

46 12.22 9.36 0.83 - 115

26.3 0.72 69 0.51 - 113

232.1 10.05 55.25 2.35 11.09 112

13.4 0.23 0 0.37 - 107

24.3 -7.61 0 1.91 - 107

32.4 5.54 6.29 0.28 4.29 107

62.1 6.67 23.35 2.04 14.14 106

37.45 6.58 14.85 1.09 - 103

37.45 6.58 14.85 1.09 - 102

103.1 8.28 10.72 1.18 7.32 101

120.5 0 0 0- 100

34.2 7.94 2.91 0.23 - 97

29.9 14.38 0 1.13 - 97

186 15.89 5.64 0.74 - 92

105 7.96 58.92 5.8 79.42 91

152.3 0 0 0- 90

4.85 4.9 10.94 0.24 - 90

187.9 25.13 34.88 6.42 12.94 88

102.2 13.32 26.07 3.69 18.36 86

428.7 14.67 7.03 0.9 - 85

17.1 0.67 74.78 1.2 - 83

149.6 7.16 11.67 0.81 - 83

580 21.83 0 1.78 5.14 82

580 21.83 0 1.78 5.14 82

90.7 9.93 10.97 1.12 9.62 81

90.7 9.93 10.97 1.12 9.62 81

23 0 0 0- 79

40 7.18 2.99 0.26 4.75 79

59.05 7.72 0 0.85 5.41 78

722.5 10 83.76 5.29 30.24 78

35.7 10.97 6.86 0.73 - 75

323.9 15.1 22.95 3.8 11.1 74

592.9 12.41 9.52 0.65 4.87 73

250 23.51 17.11 4.22 12.54 73

285 2.15 90.06 1.43 - 73

285 2.15 90.06 1.43 - 73

458 10.18 33.93 2.77 7.17 73

236.4 21.68 16.14 2.44 6.39 72

208.4 28.96 12.23 2.08 7.52 71

34.75 9.03 6.73 0.64 5.47 71

128.3 17.06 8.37 1.36 4.46 69

222 7.64 74.76 5.57 - 69

30.45 -7.77 0 0.39 - 69

369.6 3 39.75 1.2 12.47 67

661 11.32 24.06 2.45 19.39 67

710 15.61 42.42 2.85 14.15 67

369.6 3 39.75 1.2 12.47 67

466.2 11.73 26.75 2.41 12.71 66

119.2 74.93 4.82 2.5 2.02 65

690 13.84 32.5 9.26 43.45 63

316.9 19.84 7.95 1.61 6.15 63

36.2 272.86 7.52 -18.36 16.41 63

201 18.42 40.81 6.7 27.54 62

118.4 16.94 25.36 3.02 10.62 62

3,986 21.78 26.97 3.04 - 62

62 18.31 7.28 0.94 3.14 59

117.4 14.72 16.76 2.17 - 58

19.2 3.66 0 0.45 - 58

845.8 12.72 41.66 4.97 - 58

147.2 -3.15 0 1.08 23.83 58

74.2 17.33 3.8 0.48 - 58

68.8 19.41 4.3 0.62 3.38 57

450 0 0 0- 53

2.61 -35 0 4.34 34.35 53

73.9 9.67 11.76 1.59 11.15 53

73.9 9.67 11.76 1.59 11.15 53

62.2 23.22 3.48 0.72 2.77 52

79 17.31 4.05 0.56 - 52

2,550 37.46 16.25 6.28 10.01 51

121.2 10.3 16.61 2.4 9.5 51

58 -74.34 0 -290.6 74.29 50

209.3 18.34 47.65 4.07 11.32 50

65.7 14.28 6.65 1.05 4.56 50

65.7 14.28 6.65 1.05 4.56 50

2,001 1.92 266.28 1.91 - 49

1,783 19.13 42.19 6.01 - 49

1,017 18.26 49.05 8.52 17.89 49

147.5 13.62 34.9 4.96 11.9 49

147.5 13.62 34.9 4.96 11.9 49

1,017 18.26 49.05 8.52 17.89 49

63.7 16.27 12.99 1.57 7.16 47

10.2 -6.53 0 0.52 - 47

3.1 -9.93 0 0.28 - 46

15.25 10.04 0 0.13 4.51 46

209 14.51 6.94 1.18 3.39 44

367.6 6.07 126.46 7.82 32.86 44

42.55 41.85 0 69.21 38.38 44

42.55 41.85 0 69.21 38.38 43

525 23.33 16.15 3.05 10.15 43

42.55 41.85 0 69.21 38.38 43

15.15 8.52 6.53 0.65 7.3 43

380 6.05 8.87 0.69 6.98 41

234 1.85 389.28 7.37 47.58 41

89.65 65.56 14.55 7.58 8.83 40

1.65 220.24 0 -0.37 - 38

27 4.85 13.08 0.74 8.2 38

9.9 6.59 50.21 1.89 19.19 38

108.1 16.92 67.16 4.04 17.64 38

283 13.49 17.22 2.89 8.97 38

134.9 22 16.8 3.62 12.85 38 120936 12,573

133.1 -0.37 78.07 2.78 27.89 38

400.1 18.39 65.76 11.69 45.69 38

257.2 5.99 0 9.5 44.29 37

95.7 15.2 4.99 0.48 2.82 37

341.1 26.99 19.7 4.5 16.47 36

108.5 0 0 0- 36

191 19.74 9.81 2.29 4.47 36

747.6 16.77 55.92 9.23 36.44 36

132.5 18.29 14.04 1.37 7.02 36

132.5 18.29 14.04 1.37 7.02 36

250.9 15.3 6.4 0.58 3.46 35

168 12.69 15.3 1.96 9.7 35

751 69.23 66.03 18.88 59.64 35

240.3 15.83 19.31 1.78 14.93 35

505.9 7.26 70.9 4.41 73.08 35

1,654 16.04 35.73 6.86 23.58 34

1,654 16.04 35.73 6.86 23.58 34

203.4 19.74 17.2 2.53 12.24 34

715.5 16.49 15.69 2.82 11.19 33

56 18.67 12.23 1.88 7.47 33

562 21.36 22.1 4.16 11.21 33

372.5 5.44 9.24 0.97 8.25 33

32.4 7.97 4.85 0.44 5.87 30

179.8 3.81 14.62 2.01 11.26 30

265.1 17.93 28.82 4.81 19.26 30

51.5 11.54 10.37 1.08 5.93 30

286.2 16.87 18.45 4.44 14.29 30

6.17 -29.85 0 1.26 - 29

7,874 16.99 66.58 4.2 17.02 29

271 3.69 33.11 1.16 27.66 28

1,968 14.77 27.66 3.61 17.01 27

3.05 10.8 14.39 1.08 5.88 27

30.4 21.57 4.28 0.74 3.86 26

131.5 13.71 24.33 3.76 17.2 26

170.8 20.47 13.04 3.21 9.47 25

91.25 20.35 10.54 1.89 8.48 25

69.85 13.72 10.73 1.44 6.91 25

1,186 22.52 61.65 15.45 49.03 25

8,300 24.13 53.39 13.02 49.26 25

428 11.27 37.15 4.49 27.09 25

76.7 33.55 36.84 10.93 27.55 24

666.4 24.45 12.45 3.35 10.03 23

662 23.31 31.54 5.68 19.17 23

105.3 10.8 13.8 2.17 6.29 23

81 -60.03 0 -281 - 23

166 9.71 0 0.9 - 22

895.5 12.2 22.47 2.21 8.96 22

1,111 14.43 26.46 4.22 21.68 20

120 19.87 16.86 2.94 8.67 20

20.65 8.15 17.26 1.53 11.6 19

995 29.27 21.53 5.63 13.95 19

129.8 20.75 10.42 1.48 8.02 18

91.05 16.95 14.85 2.3 8.56 18

1,046 13.31 265.77 13.61 35.38 17

15,686 14.52 110.66 11.68 54.18 17

91.05 16.95 14.85 2.3 8.56 17

97 -0.69 780 3.35 74.29 16

152.5 17.36 66.21 11.26 - 16

501 24.31 20.8 4.96 14.93 15

1,065 53.63 46.36 23.73 31.15 15

147 0 0 0- 14

750 9.77 29.35 4.12 22.5 14

448 22.31 10.41 2.27 7.69 13

180 33.84 13.87 3.42 11.91 13

1,555 19.82 37.83 8.04 20.24 13

111 42.71 29.49 13.44 24.19 13

95.25 22.36 5.58 1.74 12.44 12

791.1 24.88 33.32 7.13 18.26 12

505 -3.05 0 3.1 16 11

739 19.23 24.1 4.48 13.55 11

1,635 21.74 114.45 22.78 66.14 11

975 24.48 25.39 5.49 16.92 11

1,047 8.09 47.34 5.58 24.66 11

100 0.22 0 2.93 67.84 10

62.1 -2.04 289.42 0.58 6.91 10

2,952 23.33 54.41 10.04 33.94 10

137.2 32.54 18.07 3.88 17.75 9

12,460 19.49 31.47 5.8 23.72 9

2,492 22.41 22.25 4.63 18.91 9

5,610 19.56 42.93 7.03 24.48 9

1,831 17.81 67.91 15.12 60.82 8

385.1 26.24 58.07 12.7 47.95 8

78.85 13.73 59.53 9.04 36.64 8

274.1 18.96 13.36 3.62 14.03 7

206.4 18.56 31.09 3.53 14.65 7

840 17.09 26.88 4.84 18.07 7

336.5 30.08 18.14 4.99 13.06 7

840 17.09 26.88 4.84 18.07 7

336.5 30.08 18.14 4.99 13.06 7

3,257 21.58 24.12 4.75 17.16 6

1,467 20.98 45.19 8.51 31.95 6

436.1 28.67 18.83 5.24 16.53 6

677.6 16.66 25.41 4.78 19.55 6

2,101 31.13 53.51 18.49 49.5 6

677.6 16.66 25.41 4.78 19.55 5

75.6 22.43 10.51 2.68 - 5

844.2 15.84 33.56 5.97 31.51 5

450 19.14 27.53 3.38 15.99 4

44.9 5.29 83.37 362.4 - 4

281.1 13.82 24.75 3.56 20.99 4

315.2 8.79 30.75 2.56 17.88 4

973.7 18.37 58.42 5.78 45.75 3

214 7.17 72.67 3.51 45.24 3

570.2 14.91 22.8 6.56 40.09 3

205.7 0.49 95.06 2.48 16.07 3

356.8 12.03 23.05 3.07 20.52 3

570.2 14.91 22.8 6.56 40.09 2

46 10.73 15.35 1.67 21.16 2

15 13.96 13.86 0.92 10.28 2

872.5 18.96 20.52 4.72 20.51 2

201.7 16.88 45.85 8.31 29.71 2

159.6 16.76 16.19 2.73 10.68 2

779 9.04 39.82 5.45 - 1

26.55 3.43 33.06 1.82 28.43 0

256.9 42.84 15.43 5.63 10.69 -1

Low EBITDA

Вам также может понравиться

- Anamika Same Day Costume ChangeДокумент1 страницаAnamika Same Day Costume ChangeAyush TandonОценок пока нет

- Current Job OpeningsДокумент10 страницCurrent Job OpeningsCF forumОценок пока нет

- 1 1.2m Soft White 150-200 12 Office, Pantry, Store Etc. 400mm Dia Collector and Lightpipe - LPR 400Документ3 страницы1 1.2m Soft White 150-200 12 Office, Pantry, Store Etc. 400mm Dia Collector and Lightpipe - LPR 400Ayush TandonОценок пока нет

- Guidelines For Conduct of General Election, By-Election During COVID-19Документ16 страницGuidelines For Conduct of General Election, By-Election During COVID-19NDTVОценок пока нет

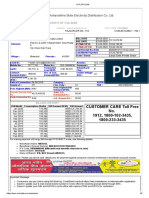

- Bill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDДокумент2 страницыBill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDAyush TandonОценок пока нет

- StocksДокумент7 страницStocksAyush TandonОценок пока нет

- Bill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDДокумент2 страницыBill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDAyush TandonОценок пока нет

- Bill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDДокумент2 страницыBill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDAyush TandonОценок пока нет

- 2018 Closing Ranks R1 and R2Документ2 страницы2018 Closing Ranks R1 and R2Harish IncogОценок пока нет

- Maharashtra State Electricity Distribution Co. LTD.: Bill of Supply For The Month ofДокумент2 страницыMaharashtra State Electricity Distribution Co. LTD.: Bill of Supply For The Month ofAyush TandonОценок пока нет

- StocksДокумент7 страницStocksAyush TandonОценок пока нет

- Color Legend: Section Sub TotalДокумент3 страницыColor Legend: Section Sub TotalAyush TandonОценок пока нет

- Green Steam Supply ITC Munger Dairy DivisionДокумент2 страницыGreen Steam Supply ITC Munger Dairy DivisionAyush TandonОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Labor Code Art.-89Документ16 страницLabor Code Art.-89Joanne LeenОценок пока нет

- 03 - UndercityДокумент28 страниц03 - UndercityJames Bayhylle100% (1)

- Evidence Cases Feb 11Документ45 страницEvidence Cases Feb 11Josh CelajeОценок пока нет

- Contrast and Compare Napoleon (Animal Farm) and Big Brother (1984) Characters in George Orwell's MasterpiecesДокумент2 страницыContrast and Compare Napoleon (Animal Farm) and Big Brother (1984) Characters in George Orwell's MasterpiecesTogay Balik100% (1)

- Liquidity Risk Management Framework For NBFCS: Study NotesДокумент5 страницLiquidity Risk Management Framework For NBFCS: Study NotesDipu PiscisОценок пока нет

- Management Decision Case: Restoration HardwaДокумент3 страницыManagement Decision Case: Restoration HardwaRishha Devi Ravindran100% (5)

- Sherwood (1985) - Engels, Marx, Malthus, and The MachineДокумент30 страницSherwood (1985) - Engels, Marx, Malthus, and The Machineverdi rossiОценок пока нет

- Auguste Comte - PPT PresentationДокумент61 страницаAuguste Comte - PPT Presentationmikeiancu20023934100% (8)

- Against Open Merit: Punjab Public Service CommissionДокумент2 страницыAgainst Open Merit: Punjab Public Service CommissionSohailMaherОценок пока нет

- Analysis Essay of CPSДокумент6 страницAnalysis Essay of CPSJessica NicholsonОценок пока нет

- Poli TipsДокумент83 страницыPoli TipsJoyae ChavezОценок пока нет

- Athet Pyan Shinthaw PauluДокумент6 страницAthet Pyan Shinthaw PaulupurifysoulОценок пока нет

- BARD 2014 Product List S120082 Rev2Документ118 страницBARD 2014 Product List S120082 Rev2kamal AdhikariОценок пока нет

- Talavera, Nueva EcijaДокумент2 страницыTalavera, Nueva EcijaSunStar Philippine NewsОценок пока нет

- Invited Discussion On Combining Calcium Hydroxylapatite and Hyaluronic Acid Fillers For Aesthetic IndicationsДокумент3 страницыInvited Discussion On Combining Calcium Hydroxylapatite and Hyaluronic Acid Fillers For Aesthetic IndicationsChris LicínioОценок пока нет

- Meaningful Use: Implications For Adoption of Health Information Technology (HIT) Tamela D. Yount HAIN 670 10/17/2010Документ10 страницMeaningful Use: Implications For Adoption of Health Information Technology (HIT) Tamela D. Yount HAIN 670 10/17/2010Tammy Yount Di PoppanteОценок пока нет

- How To Survive Economic CollapseДокумент4 страницыHow To Survive Economic CollapseZub AleandruОценок пока нет

- Letter OДокумент17 страницLetter ObontalampasОценок пока нет

- Causes of UnemploymentДокумент7 страницCauses of UnemploymentBishwaranjan RoyОценок пока нет

- Part II. Market Power: Chapter 4. Dynamic Aspects of Imperfect CompetitionДокумент9 страницPart II. Market Power: Chapter 4. Dynamic Aspects of Imperfect Competitionmoha dahmaniОценок пока нет

- Affidavit of GC - Reject PlaintДокумент9 страницAffidavit of GC - Reject PlaintVishnu R. VenkatramanОценок пока нет

- Fungal Infections: September 2021Документ270 страницFungal Infections: September 2021NormanОценок пока нет

- Jazzed About Christmas Level 2-3Документ15 страницJazzed About Christmas Level 2-3Amanda Atkins64% (14)

- Auditing Unit - 5 by Anitha RДокумент16 страницAuditing Unit - 5 by Anitha RAnitha RОценок пока нет

- The Effect of Celebrity Endorsement On Customer Usage Behavior in The Case of Dashen Bank - Copy (Repaired)Документ78 страницThe Effect of Celebrity Endorsement On Customer Usage Behavior in The Case of Dashen Bank - Copy (Repaired)Eyuael SolomonОценок пока нет

- CCP Motivation Letter 2022Документ3 страницыCCP Motivation Letter 2022mohammed ahmed0% (1)

- Ephesians 5.32-33Документ2 страницыEphesians 5.32-33Blaine RogersОценок пока нет

- Hispanic Heritage MonthДокумент2 страницыHispanic Heritage Monthapi-379690668Оценок пока нет

- First Aid Is The Provision of Initial Care For An Illness or InjuryДокумент2 страницыFirst Aid Is The Provision of Initial Care For An Illness or InjuryBasaroden Dumarpa Ambor100% (2)

- Cosmetics & Toiletries Market Overviews 2015Документ108 страницCosmetics & Toiletries Market Overviews 2015babidqn100% (1)