Академический Документы

Профессиональный Документы

Культура Документы

March, 2005 Q.P.

Загружено:

M JEEVARATHNAM NAIDUИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

March, 2005 Q.P.

Загружено:

M JEEVARATHNAM NAIDUАвторское право:

Доступные форматы

1

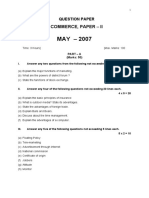

QUESTION PAPER

COMMERCE, PAPER – II

MARCH – 2005

Time: 3 Hours] [Max. Marks: 100

PART – A

(Marks: 50)

I. Answer any TWO of the following questions not exceeding 40

lines each:

2 x 10 = 20

(a) Explain the services rendered by wholesaler to manufacturers, retailer and

society.

(b) Explain the machinery established to protect the consumer rights at various

levels.

(c) What is “Listing”? What are the requirements of listing?

II. Answer any FOUR of the following questions not

exceeding 20 lines each:

4 x 5 = 20

(a) Explain the differences between Life Insurance & Fire Insurance.

(b) What are the advantages and disadvantages of Television advertising?

(c) Explain the differences between Customs duty and Excise duty.

(d) Explain any five functions of Stock Exchange.

(e) What are the characteristics of a successful entrepreneur?

(f) Explain the advantages of Computer.

III. Answer any FIVE of the following questions not exceeding

5 lines each:

5 x 2 = 10

(a) Voyage policy

2

(b) Bonded warehouses

(c) Show any two demerits of Advertising

(d) What are the reasons for the backwardness of Consumer movement in India?

(e) Bill of lading

(f) Ex-dividend

(g) Personality

(h) E- Commerce

PART – B

(Marks: 50)

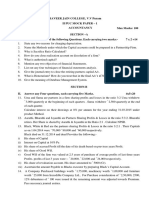

IV. Answer the following question: 1 X 20 = 20

Rao, Reddy & Naidu are the partners in a firm sharing profits f& losses in the

ratio of 3:2:1. Their Balance Sheet as on 31-12-2006:

Balance Sheet as on 31-12-2006

Liabilities Rs. Assets Rs.

Creditors 34,000 Cash in hand 24,000

Reserve Fund 6,000 Cash at Bank 16,000

Capitals: Debtors 40,000

Rao 1,60,000 Stock of goods 80,000

Reddy 1,20,000 Machinery 60,000

Naidu 80,000 3,60,000 Buildings 1,80,000

4,00,000 4,00,000

Naidu retired from the firm on the following conditions:

(a) Goodwill of the firm be valued at Rs.30, 000

(b) Buildings will be appreciated by 20%

(c) Machinery is depreciated by 10%, and stock is depreciated by 5%

(d) Create 5% provision for doubtful debts on debtors.

Pass necessary entries, necessary ledger accounts and prepare New Balance

Sheet of the firm as on 1-1-2006.

V. Answer any ONE of the following questions: 1 X 10 = 10

(a) Baswaraj of Bhadrachalam consigned 200 calculators costing Rs.400 each to

Vijayender Reddy of Vidyanagar at an invoice price of Rs.500 each. He paid

3

carriage Rs.600 and insurance Rs.400, Vijayender Reddy sent an Account

sales showing that he sold 150 claculators for Rs.600 each and his expenses

are Rs.800 and commission 5%. He deducted them and sent the Bank Draft

for the balance. Show the necessary ledger accounts in the books of

Baswaraj.

(b) From the following Receipts and Payments a/c. of Tendulkar Sports Club of

Hyderabad, prepare Income and Expenditure account for the year ended on

31-12-2006.

Receipts and Payments a/c for the year ended on 31-12-2006

Receipts Rs. Payments Rs.

To Subscriptions 10,500 By Tournament Expenses 6,800

(including Rs.500 for 2007)

To Tournament receipts 8,000 By Staff Salaries 4,400

To Entrance fees 2,000 By Rent 1,200

To Interest on investment 800 By Gardening 500

To Sale of grass 400 By Investments 4,000

By Balance c/d 4,800

21,700 21,700

Adjustments:

(1) Subscriptions receivable for 2006 Rs.1, 000

(2) Outstanding salaries Rs.600

(3) ½ of the entrance fees to be capitalized.

VI.Answer any FIVE of the following questions:

5 X 2 = 10

(a) Renewal of Bill

(b) Cost of the Machine Rs.18,000, Installation charges Rs.3,000, Scrap value

Rs.1, 000, Life Period of Machinery 10 years. Calculate Annual Depreciation.

(c) What is Average due date?

(d) Balance of Products 2,16,500. Rate of interest 5%. Calculate interest in

products method.

(e) Write the differences between Consignment & Sale.

(f) Write any two errors disclosed by Trial Balance.

4

(g) Calculate the capital fund of Udatabhanu Trust from the following balances as

on 31-3-2006:

Buildings Rs.35, 000

Outstanding subscriptions Rs.800

Prepaid Insurance Rs.400

Reserve Fund Rs.3, 000

Outstanding Salaries Rs.1, 800

(h) Swetha & Swathi are the partners sharing the profits in the ratio of 3:2. They

admitted Sneha for ¼ share in the business. Calculate new profit sharing

ratio of the partners.

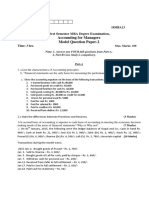

VII. Answer any TWO of the following

2 x 5 = 10

(a) Rectify the following errors:

(i) Amount received from Mamatha Rs.1, 500, entered in Samatha Account.

(ii) Purchase book is undercast by Rs.400

(iii) Goods purchased from Gopikrishna on credit Rs.2, 400 was entered in

the books as Rs.4, 200.

(iv) Amount paid for repairs to machinery Rs.600 was entered in Salaries

Account.

(v) Salaries paid to Shriya Rs.4, 000 entered in her personal account.

(b) Pavithra sold goods to Sandhya on credit worth Rs.6,000 on 1-7-2006 and

draws a 3 months bill on her. After one month she discounted the bill with her

bank @ 5%. On the due date the bill was dishonoured. Pass the entries in

the books of both parties.

(c) What is depreciation? Explain the causes for depreciation.

(d) From the following transactions calculate the Average due date.

Due Date Amount Rs.

10-2-2006 500

16-3-2006 400

2-4-2006 600

28-4-2006 800

5-5-2006 700

5

*********

Вам также может понравиться

- March, 2006 Q.P.Документ4 страницыMarch, 2006 Q.P.M JEEVARATHNAM NAIDUОценок пока нет

- May, 2005 Q.P.Документ4 страницыMay, 2005 Q.P.M JEEVARATHNAM NAIDUОценок пока нет

- June, 2004 Q.PДокумент4 страницыJune, 2004 Q.PM JEEVARATHNAM NAIDUОценок пока нет

- May. 2007 Q.P.Документ4 страницыMay. 2007 Q.P.M JEEVARATHNAM NAIDUОценок пока нет

- Inter May, 2008Документ4 страницыInter May, 2008M JEEVARATHNAM NAIDUОценок пока нет

- March, 2007 QuestionssДокумент4 страницыMarch, 2007 QuestionssM JEEVARATHNAM NAIDUОценок пока нет

- Inter-II QP 2008Документ4 страницыInter-II QP 2008M JEEVARATHNAM NAIDUОценок пока нет

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Документ4 страницыPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameОценок пока нет

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Документ7 страницCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickОценок пока нет

- March, 2004, Q.P.Документ4 страницыMarch, 2004, Q.P.M JEEVARATHNAM NAIDUОценок пока нет

- Part - A (: Time Allowed: 3 Hours Maximum Marks: 90Документ4 страницыPart - A (: Time Allowed: 3 Hours Maximum Marks: 90NameОценок пока нет

- 2015 Accountancy Question PaperДокумент4 страницы2015 Accountancy Question PaperJoginder SinghОценок пока нет

- RE Exam FA Sem I MFM MMM MHRDMДокумент4 страницыRE Exam FA Sem I MFM MMM MHRDMPARAM CLOTHINGОценок пока нет

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Документ15 страниц13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliОценок пока нет

- Mock TestДокумент7 страницMock TestShivaji hariОценок пока нет

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Документ5 страницBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarОценок пока нет

- 12th Accountacy Model Test PaperДокумент5 страниц12th Accountacy Model Test PaperJas Singh DevganОценок пока нет

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Документ20 страницClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatОценок пока нет

- Class 12 Account Set 2 Grade Increment Examination Question PaperДокумент10 страницClass 12 Account Set 2 Grade Increment Examination Question PaperPrem RajwanshiОценок пока нет

- Instant Paper Commerce Paper - IiДокумент3 страницыInstant Paper Commerce Paper - IiM JEEVARATHNAM NAIDUОценок пока нет

- Financial Management - II CA QPДокумент4 страницыFinancial Management - II CA QPSivaramkrishna KasilingamОценок пока нет

- Accountancy Auditing 2020Документ6 страницAccountancy Auditing 2020Abdul basitОценок пока нет

- Accounts..std 12Документ3 страницыAccounts..std 12Abhishek SharmaОценок пока нет

- II Puc Acc Mid Term MQP - 2Документ5 страницII Puc Acc Mid Term MQP - 2parvathis2606Оценок пока нет

- First Semester MBA Degree Examination, May/June 2010: Accounting For ManagersДокумент4 страницыFirst Semester MBA Degree Examination, May/June 2010: Accounting For Managersnitte5768Оценок пока нет

- Corrporate ModelДокумент10 страницCorrporate Modelnithinjoseph562005Оценок пока нет

- Bcom TaxДокумент6 страницBcom TaxAditya .cОценок пока нет

- Null 7Документ8 страницNull 7ruv.asn17Оценок пока нет

- Ayeesha - Principles of Management AccountingДокумент5 страницAyeesha - Principles of Management AccountingMahesh KumarОценок пока нет

- Practice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsДокумент4 страницыPractice Paper Accountancy Class - XI: Time-3 Hours MM-90 General InstructionsSNPS BhadraОценок пока нет

- 1e710c6f-4b3e-4b03-943f-11430d867f0e-Документ30 страниц1e710c6f-4b3e-4b03-943f-11430d867f0e-angela antoniaОценок пока нет

- Jaya College of Arts and Science Department of ManagДокумент4 страницыJaya College of Arts and Science Department of ManagMythili KarthikeyanОценок пока нет

- Paper 16Документ5 страницPaper 16VijayaОценок пока нет

- FINANCIAL MANAGEMENT October 20172016 PatternSemester IIДокумент4 страницыFINANCIAL MANAGEMENT October 20172016 PatternSemester IISwati DafaneОценок пока нет

- BBM 310Документ4 страницыBBM 310Kimondo KingОценок пока нет

- S.6 Ent 2Документ5 страницS.6 Ent 2danielzashleybobОценок пока нет

- RAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteДокумент5 страницRAGHU-33: 506-A Advance Accounting-I (835061) Total Pages: 5) Time: 2 Hours Max. Marks: 60 NoteRishikesh KalantriОценок пока нет

- Class 12 AMU Model PapersДокумент77 страницClass 12 AMU Model PapersMohammad FarazОценок пока нет

- Sample Paper - Accountancy XI Term 2Документ3 страницыSample Paper - Accountancy XI Term 2Manaswi WareОценок пока нет

- 12 Accounts 2020 21 Practice Paper 2Документ8 страниц12 Accounts 2020 21 Practice Paper 2Vijey RamalingamОценок пока нет

- 18u3cm06 CC06Документ8 страниц18u3cm06 CC06Manoj MJОценок пока нет

- Accounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Документ12 страницAccounts: (Maximum Marks: 80) (Time Allowed: Three Hours)Badiuz FaruquiОценок пока нет

- Shares & Debentures TestДокумент10 страницShares & Debentures TestAthul Krishna KОценок пока нет

- IPCC Mock Test Taxation - Only Question - 25.09.2018Документ5 страницIPCC Mock Test Taxation - Only Question - 25.09.2018KaustubhОценок пока нет

- CH18601 FM - II Model PaperДокумент5 страницCH18601 FM - II Model PaperKarthikОценок пока нет

- Accountancy Assignment Grade 12Документ4 страницыAccountancy Assignment Grade 12sharu SKОценок пока нет

- Ch3 AssignmentДокумент2 страницыCh3 AssignmentRachit JainОценок пока нет

- MKGM Accounts Question Papers ModelДокумент101 страницаMKGM Accounts Question Papers ModelSantvana ChaturvediОценок пока нет

- Karnataka II PUC Accountancy Model Question Paper 17Документ6 страницKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreОценок пока нет

- Practice Test: Career AvenuesДокумент10 страницPractice Test: Career AvenuesEthan GomesОценок пока нет

- 943 Question PaperДокумент3 страницы943 Question PaperPacific TigerОценок пока нет

- Class Xi Acc QPДокумент7 страницClass Xi Acc QP8201ayushОценок пока нет

- Mca Accounts Model QuestionДокумент2 страницыMca Accounts Model QuestionAnonymous 1ClGHbiT0JОценок пока нет

- Syjc - B. K. - Prelim Exam No. 7Документ4 страницыSyjc - B. K. - Prelim Exam No. 7karkeraadiyaОценок пока нет

- Accountancy QP 3 (A) 2023Документ5 страницAccountancy QP 3 (A) 2023mohammedsubhan6651Оценок пока нет

- Accountancy and Auditing-2010Документ5 страницAccountancy and Auditing-2010Umar ZamarОценок пока нет

- Dileep PreboardДокумент10 страницDileep PreboardmktknpОценок пока нет

- F1 FIOO - L-December-2020Документ8 страницF1 FIOO - L-December-2020Laskar REAZОценок пока нет

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationДокумент5 страницAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Private SectorДокумент4 страницыPrivate SectorM JEEVARATHNAM NAIDUОценок пока нет

- May, 2006 AnswerДокумент17 страницMay, 2006 AnswerM JEEVARATHNAM NAIDUОценок пока нет

- Multinational Corporations (MNC'S) : Meaning and DefinitionДокумент5 страницMultinational Corporations (MNC'S) : Meaning and DefinitionM JEEVARATHNAM NAIDUОценок пока нет

- Vijayam Junior College:: Chittoor: Unior Mec Ii Terminal ExaminationsДокумент2 страницыVijayam Junior College:: Chittoor: Unior Mec Ii Terminal ExaminationsM JEEVARATHNAM NAIDUОценок пока нет

- CD Contents: S.No. Particulars PagesДокумент2 страницыCD Contents: S.No. Particulars PagesM JEEVARATHNAM NAIDUОценок пока нет

- Vijayam Junior College:: Chittoor: I Answer Eight of The Following Questions. 8X5 40Документ2 страницыVijayam Junior College:: Chittoor: I Answer Eight of The Following Questions. 8X5 40M JEEVARATHNAM NAIDUОценок пока нет

- Liabilities Amount Rs. Assets Amount RsДокумент2 страницыLiabilities Amount Rs. Assets Amount RsM JEEVARATHNAM NAIDUОценок пока нет

- Vijayam Junior College ChittoorДокумент1 страницаVijayam Junior College ChittoorM JEEVARATHNAM NAIDUОценок пока нет

- JR Mec Monthly 30.10.18Документ2 страницыJR Mec Monthly 30.10.18M JEEVARATHNAM NAIDUОценок пока нет

- JR Mec Iii Term 06-12-18Документ4 страницыJR Mec Iii Term 06-12-18M JEEVARATHNAM NAIDUОценок пока нет

- JR Mec Monthly Test 15-07-19Документ2 страницыJR Mec Monthly Test 15-07-19M JEEVARATHNAM NAIDUОценок пока нет

- JR Mec Pre Final 2Документ1 страницаJR Mec Pre Final 2M JEEVARATHNAM NAIDUОценок пока нет

- Solutions To Text Book Exercises Average Due Date: Solution - 1Документ11 страницSolutions To Text Book Exercises Average Due Date: Solution - 1M JEEVARATHNAM NAIDUОценок пока нет

- Partnership Accounts - IДокумент23 страницыPartnership Accounts - IM JEEVARATHNAM NAIDU100% (1)

- SUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100Документ3 страницыSUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100M JEEVARATHNAM NAIDUОценок пока нет

- Vijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10Документ1 страницаVijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10M JEEVARATHNAM NAIDUОценок пока нет

- JR Mec Monthly 18-9-17Документ1 страницаJR Mec Monthly 18-9-17M JEEVARATHNAM NAIDUОценок пока нет

- Solutions To Text Book Exercises Partnership Accounts - II: Solution - 1Документ17 страницSolutions To Text Book Exercises Partnership Accounts - II: Solution - 1M JEEVARATHNAM NAIDUОценок пока нет

- Solutions To Text Book Exercises: Rectification of ErrorsДокумент13 страницSolutions To Text Book Exercises: Rectification of ErrorsM JEEVARATHNAM NAIDUОценок пока нет

- Solutions To Text Book Exercises: Non-Trading ConcernsДокумент12 страницSolutions To Text Book Exercises: Non-Trading ConcernsM JEEVARATHNAM NAIDUОценок пока нет

- Solutions To Text Book Exercises: Consignment AccountsДокумент23 страницыSolutions To Text Book Exercises: Consignment AccountsM JEEVARATHNAM NAIDUОценок пока нет

- Bills of ExchangeДокумент18 страницBills of ExchangeM JEEVARATHNAM NAIDUОценок пока нет

- Solutions To Text Book Exercises: 1. Interest Tables Method: Solution - 1Документ10 страницSolutions To Text Book Exercises: 1. Interest Tables Method: Solution - 1M JEEVARATHNAM NAIDUОценок пока нет

- March 2005 Q. P. JRДокумент4 страницыMarch 2005 Q. P. JRM JEEVARATHNAM NAIDUОценок пока нет

- May, 2007Документ6 страницMay, 2007M JEEVARATHNAM NAIDUОценок пока нет

- March, 2007 JRДокумент4 страницыMarch, 2007 JRM JEEVARATHNAM NAIDUОценок пока нет

- Running Head: Problem Set # 2Документ4 страницыRunning Head: Problem Set # 2aksОценок пока нет

- Week 8 - 13 Sale of GoodsДокумент62 страницыWeek 8 - 13 Sale of Goodstzaman82Оценок пока нет

- 1: Identify and Explain The Main Issues in This Case StudyДокумент1 страница1: Identify and Explain The Main Issues in This Case StudyDiệu QuỳnhОценок пока нет

- A Repurchase AgreementДокумент10 страницA Repurchase AgreementIndu GadeОценок пока нет

- Why Some Platforms Thrive and Others Don'tДокумент11 страницWhy Some Platforms Thrive and Others Don'tmahipal singhОценок пока нет

- Mangalore Electricity Supply Company Limited: LT-4 IP Set InstallationsДокумент15 страницMangalore Electricity Supply Company Limited: LT-4 IP Set InstallationsSachin KumarОценок пока нет

- Sample OTsДокумент5 страницSample OTsVishnu ArvindОценок пока нет

- Dawah Course Syllabus - NДокумент7 страницDawah Course Syllabus - NMahmudul AminОценок пока нет

- EDUC - 115 D - Fall2018 - Kathryn GauthierДокумент7 страницEDUC - 115 D - Fall2018 - Kathryn Gauthierdocs4me_nowОценок пока нет

- Gwinnett Schools Calendar 2017-18Документ1 страницаGwinnett Schools Calendar 2017-18bernardepatchОценок пока нет

- Questionnaires in Two-Way Video and TeleconferencingДокумент3 страницыQuestionnaires in Two-Way Video and TeleconferencingRichel Grace PeraltaОценок пока нет

- Securities and Exchange Board of India Vs Kishore SC20162402161639501COM692642Документ14 страницSecurities and Exchange Board of India Vs Kishore SC20162402161639501COM692642Prabhat SinghОценок пока нет

- Human Resource ManagementДокумент39 страницHuman Resource ManagementKIPNGENO EMMANUEL100% (1)

- Lecture 1Документ12 страницLecture 1asiaОценок пока нет

- Berkshire Hathaway Inc.: United States Securities and Exchange CommissionДокумент48 страницBerkshire Hathaway Inc.: United States Securities and Exchange CommissionTu Zhan LuoОценок пока нет

- Pronunciation SyllabusДокумент5 страницPronunciation Syllabusapi-255350959Оценок пока нет

- Youtube/Ydsatak Tense Ders 1Документ9 страницYoutube/Ydsatak Tense Ders 1ArasIlgazОценок пока нет

- Final Project Report - Keiretsu: Topic Page NoДокумент10 страницFinal Project Report - Keiretsu: Topic Page NoRevatiОценок пока нет

- MOP Annual Report Eng 2021-22Документ240 страницMOP Annual Report Eng 2021-22Vishal RastogiОценок пока нет

- I.T. Past Papers Section IДокумент3 страницыI.T. Past Papers Section IMarcia ClarkeОценок пока нет

- 21 Century Literature From The Philippines and The World: Department of EducationДокумент20 страниц21 Century Literature From The Philippines and The World: Department of EducationAoi Miyu ShinoОценок пока нет

- Master ClassesДокумент2 страницыMaster ClassesAmandeep KumarОценок пока нет

- 2b22799f-f7c1-4280-9274-8c59176f78b6Документ190 страниц2b22799f-f7c1-4280-9274-8c59176f78b6Andrew Martinez100% (1)

- Scupin and DeCorse Chapter 20Документ29 страницScupin and DeCorse Chapter 20Sana FarshbafiОценок пока нет

- Completed Jen and Larry's Mini Case Study Working Papers Fall 2014Документ10 страницCompleted Jen and Larry's Mini Case Study Working Papers Fall 2014ZachLoving100% (1)

- ACR Format Assisstant and ClerkДокумент3 страницыACR Format Assisstant and ClerkJalil badnasebОценок пока нет

- Verka Project ReportДокумент69 страницVerka Project Reportkaushal244250% (2)

- Total Gallium JB15939XXДокумент18 страницTotal Gallium JB15939XXAsim AliОценок пока нет

- Beaconhouse National University Fee Structure - Per Semester Year 2017-18Документ1 страницаBeaconhouse National University Fee Structure - Per Semester Year 2017-18usman ghaniОценок пока нет

- Aims of The Big Three'Документ10 страницAims of The Big Three'SafaОценок пока нет