Академический Документы

Профессиональный Документы

Культура Документы

Finance Equations. Calculates Ratios. Irr - NPV

Загружено:

Jab Abu SheikhaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Finance Equations. Calculates Ratios. Irr - NPV

Загружено:

Jab Abu SheikhaАвторское право:

Доступные форматы

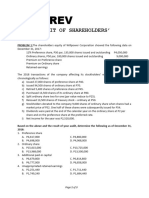

PRINCIPLES OF MANAGERIAL FINANCE

PMF PROBLEM SOLVER

Index By Category

Bond and Stock Valuation Cost of Capital

Basic Bond Valuation After Tax Cost of Debt

Book Value Cost of Common Stock

Liquidation Value Cost of Preferred Stock

P/E Multiplier Weighted Avg. Cost of Capital

Constant Growth Weighted Mrg Cost of Capital

Financial Statements Capital Budgeting

All Ratios Net Present Value

Liquidity Internal Rate of Return

Activity Payback Period

Debt Annualized Net Present Value

Profitability Initial Investment

Time Value of Money General Budgeting

PV - Single Amount Cash Budget

PV - Mixed Stream

PV - Annuity

FV - Single Amount

FV - Annuity

Deposits to a Sum

Alphabetical Index

Activity Initial Investment

After Tax Cost of Debt Internal Rate of Return

All Ratios Liquidation Value

Annualized Net Present Value Liquidity

Basic Bond Valuation Net Present Value

Book Value P/E Multiplier

Cash Budget Payback Period

Constant Growth Profitability

Cost of Common Stock PV - Annuity

Cost of Preferred Stock PV - Mixed Stream

Debt PV - Single Amount

Deposits to a Sum Weighted Avg. Cost of Capital

FV - Annuity Weighted Mrg Cost of Capital

FV - Single Amount

© 2003 by Addison Wesley Longman.

Copyright © 2003 KMT Software, Inc. All Rights Reserved.

© 2003 by Addison Wesley Longman Printed: 01/20/2011

Basic Bond Valuation

Par Value of the Bond $1,000

Years to Maturity 10

Required Rate of Return 12.000%

Coupon Rate of Bond 10.000%

Payment of interest:

Annual ● Semi-annual ●

Value of the bond is: $885.30

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Book Value

Total Assets $6,000,000

Total Liabilities $4,500,000

Number of Common Shares Outstanding 100,000

The book value per share is: $15.00

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Price/Earnings (P/E) Multiple

Average P/E Ratio for Firms in the Industry 7.0

Earnings per Share $2.60

The value per share is: $18.20

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Liquidation Value

Liquidation Value of Assets $5,250,000

Total Liabilities $4,500,000

Book Value of Preferred Stock 0

Number of Common Shares Outstanding 100,000

The liquidation value per share is: $7.50

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Constant Growth

Estimated Dividend per Share $1.50

Expected Annual Growth Rate of Dividends 7.00%

Investor's Required Rate of Return 15.00%

The value per share is: $18.75

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Financial Ratios (All)

Income Statement

Revenue (Sales) $3,074

Less: Cost of goods sold 2,088

Gross profits $986

Less: Operating Expenses

Selling expense $100

General and administrative 194

Lease expenses 35

Depreciation expense 239

Other

Total operating expenses $568

Operating profits $418

Less: Interest expense 93

Net profits before taxes $325

Less: Taxes 94

Net profits after taxes $231

Less: Preferred stock dividends 10

Earnings available for common stockholders $221

Balance Sheet

Assets

Current assets

Cash $363

Marketable securities 68

Accounts receivable 503

Inventories 289

Other

Total current assets $1,223

Gross Fixed assets (at cost)

Land and buildings $2,072

Machinery and equipment 1,866

Furniture and fixtures 358

Vehicles 275

Other 98

Total gross fixed assets $4,669

Less: Accumulated depreciation 2,295

Net fixed assets $2,374

Total assets $3,597

Liabilities and Stockholders' Equity

Current liabilities

Accounts payable $382

Notes payable 79

Accruals 159

Other

Total current liabilities $620

Long-term debts $1,023

Total liabilities $1,643

Stockholders' equity

Preferred stock $200

Common stock 191

Paid-in capital 428

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Retained earnings $1,135

Total stockholders' equity $1,954

Total liabilities and stockholders' equity $3,597

Additional Data Needed for Ratios

Principal Payments made during period $71

Lease Payments made during period $35

Tax Rate 29%

Common Shares Outstanding (in 000s) 76

Market Price per Share of Common Stock $32.25

Liquidity Analysis and Ratios

Net Working Capital $603

Current Ratio 1.97

Quick Ratio 1.51

Activity Ratios

Inventory Turnover 7.22

Average Collection Period 58.91

Fixed Asset Turnover 1.29

Total Asset Turnover 0.85

Debt Ratios

Debt Ratio 45.7%

Debt-equity Ratio 52.4%

Times Interest Earned 4.5

Fixed-payment Coverage Ratio 1.9

Profitability Ratios

Gross Profit Margin 32.1%

Operating Profit Margin 13.6%

Net Profit Margin 7.5%

Return on Assets (ROA) 6.4%

Return on Equity (ROE) 11.8%

Earnings Per Share (EPS) $2.90

Price/Earnings (P/E) Ratio 11.1

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Liquidity Analysis and Ratios

Net Working Capital

Current Assets $1,223,000

Current Liabilities $620,000

The net working capital is: $603,000

Current Ratio

Current Assets $1,223,000

Current Liabilities $620,000

The current ratio is: 1.97

Quick Ratio

Current Assets $1,223,000

Inventory $289,000

Current Liabilities $620,000

The quick ratio is: 1.51

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Activity Ratios

Inventory Turnover

Cost of Goods Sold $2,088,000

Inventory $289,000

The inventory turnover is: 7.22

Average Collection Period

Accounts Receivable $503,000

Annual Sales $3,074,000

The average collection period is: 58.91

Average Payment Period

Accounts Payable $382,000

Annual Purchases $1,461,600

Days in year 360

The average payment period is: 94.09

Total Asset Turnover

Sales $3,074,000

Total Assets $3,597,000

The total asset turnover is: 0.85

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Debt Ratios

Debt Ratio

Total Liabilities $1,643,000

Total Assets $3,597,000

The debt ratio is: 45.7%

Debt-equity Ratio

Long-term debt $1,023,000

Stockholders' Equity $1,954,000

The debt-equity ratio is: 52.4%

Times Interest Earned

Earnings Before Interest and Taxes $418,000

Interest Expense $93,000

The times interest earned ratio is: 4.5

Fixed-payment Coverage Ratio

Earnings Before Interest and Taxes $418,000

Interest Expense $93,000

Principal Payments $71,000

Lease Payments $35,000

Total Preferred Dividends $10,000

Tax Rate 29%

The fixed-payment coverage ratio is: 1.87

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Profitability Ratios

Gross Profit Margin

Sales $3,074,000

Cost of Goods Sold $2,088,000

The gross profit margin is: 32.1%

Operating Profit Margin

Operating profit $418,000

Sales $3,074,000

The operating profit margin is: 13.6%

Net Profit Margin

Net Profits After Taxes $231,000

Sales $3,074,000

The net profit margin is: 7.5%

Return on Assets (ROA)

Net Profits After Taxes $231,000

Total Assets $3,597,000

The return on assets is: 6.4%

Return on Equity (ROE)

Net Profits After Taxes $231,000

Stockholders' Equity $1,954,000

The return on equity is: 11.8%

Earnings Per Share (EPS)

Earnings Available to Common Stockholders' $221,000

Common Shares Outstanding 76,262

The earnings per share are: $2.90

Price/Earnings (P/E) Ratio

Market Price per Share of Common Stock $32.25

Earnings Per Share $2.90

The price/earnings ratio is: 11.1

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Present Value - Single Amount

Future Amount (at the end of n periods) $1,700.00

Number of Periods (n) 8

Interest Rate Per Period (per n periods) 8.00%

The present value is: $918.46

Calculating an Interest Rate

Future Amount (at the end of n periods) $1,700.00

Present Value $918.46

Number of Periods (n) 8

The interest rate per period is: 8.00%

Calculating the Number of Periods

Future Amount (at the end of n periods) $1,700.00

Present Value $918.46

Interest Rate Per Period (per n periods) 8.00%

The number of periods are: 8

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Present Value of a Mixed Stream

Periodic Discount Rate 9.00%

Cash

Period (n) Flow

1 400

2 800

3 500

4 400

5 300

6

7

8

9

10

The present value is: $1,904.76

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Present Value of an Annuity

Choose one of the following options:

Ordinary Annuity Annuity Due

Payment Per Period $700.00

Number of Periods 5

Interest Rate Per Period (per n periods) 8.00%

The present value of the annuity is: $2,794.90

Calculating an Interest Rate

Payment Per Period $700.00

Present Value $2,794.90

Number of Periods (n) 5

The interest rate per period is: 8.00%

Calculating the Number of Periods

Payment Per Period $700.00

Present Value $2,794.90

Interest Rate Per Period (per n periods) 8.00%

The number of periods is: 5

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Future Value - Single Amount

Compounding Choices (select one):

Annual

Semi-annual

Quarterly

Bi-monthly

Monthly

Continuous

Present Value $100.00

Number of Periods (n) 2

Interest Rate Per Period (per n periods) 8.00%

The future value is: $116.64

Calculating an Effective Interest Rate

Compounding Frequency (select one):

Nominal Interest Rate 8.00%

Number of Years 2

The effective rate per period (per n periods) is: 8.24%

Calculating the Number of Periods

Present Value $100.00

Future Value $116.64

Interest Rate Per Period (per n periods) 8.00%

The number of periods is: 2

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Future Value of an Annuity

Choose one of the following options:

Ordinary Annuity Annuity Due

Payment Per Period $1,000.00

Number of Periods 5

Interest Rate Per Period (per n periods) 7.00%

The future value of the annuity is: $5,750.74

Calculating an Interest Rate

Payment Per Period $1,000.00

Future Value $5,750.74

Number of Periods (n) 5

The interest rate per period is: 7.00%

Calculating the Number of Periods

Payment Per Period $1,000.00

Future Value $5,750.74

Interest Rate Per Period (per n periods) 7.00%

The number of periods is: 5.00

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Deposits to a Sum

Select the type of annuity:

Ordinary Annuity Annuity Due

Amount to be Accumulated $100,000

Number of years 10

Annual Interest Rate 9.00%

The periodic deposit is: $6,582.01

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

After Tax Cost of Debt

Par value of bond $1,000

Cash inflow from sale (per bond) $960

Coupon rate 9.00%

Number of periods to maturity 20

Tax rate 40.0%

The approximate cost is: 9.39%

The after tax cost is: 5.63%

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Cost of Common

Constant Growth Model

Current per Share Market Value of Stock $50.00

Dividend per Share 4

Projected Growth Rate of Dividends 5.00%

The cost of common stock is: 13.00%

Capital Asset Pricing Model

Risk Free Rate of Return 7.00%

Market Rate of Return 11.00%

Beta 1.50

The cost of common stock is: 13.00%

Cost of New Issue

Current per Share Market Value of Stock $50.00

Dividend per Share $4.00

Growth Rate of Dividends 5.00%

Flotation Cost per Share $5.50

The cost of common stock is: 13.99%

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Cost of Preferred Stock

Annual Preferred Stock Dividend $8.70

Net Proceeds from Sale of Preferred Stock $82.00

The cost of preferred stock is: 10.61%

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Weighted Average Cost of Capital

Long-term debt proportion 40.00%

Preferred stock proportion 10.00%

Common stock/Equity proportion 50.00%

Cost of debt 5.60%

Cost of preferred stock 10.60%

Cost of equity/stock 13.00%

The weighted average cost of capital is: 9.80%

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Weighted Marginal Cost of Capital

Long-term debt proportion 40.00%

Preferred stock proportion 10.00%

Common stock/Equity proportion 50.00%

Range of New Financing

Lower Upper Source of Weighted

Bound Bound Capital Cost Cost

$0 $600,000 Debt 5.60% 2.24%

Preferred 10.60% 1.06%

Common 13.00% 6.50%

Weighted average cost of capital 9.80%

Lower Upper Source of Weighted

Bound Bound Capital Cost Cost

$600,000 $1,000,000 Debt 5.60% 2.24%

Preferred 10.60% 1.06%

Common 14.00% 7.00%

Weighted average cost of capital 10.30%

Lower Upper Source of Weighted

Bound Bound Capital Cost Cost

$1,000,000 and beyond Debt 8.40% 3.36%

Preferred 10.60% 1.06%

Common 14.00% 7.00%

Weighted average cost of capital 11.42%

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Net Present Value

Initial Investment (enter as positive number) $50,000

Discount Rate 14%

Years Cash Flows

1 30,000

2 25,000

3 20,000

4 15,000

5 -

6

7

8

9

10

11

12

13

14

15

The net present value is: $17,933

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Internal Rate of Return

Years Cash Flows

0 Initial Investment --> ($50,000)

1 20,000

2 18,000

3 17,000

4 15,000

5 -

6

7

8

9

10

11

12

13

14

15

The internal rate of return is: 15.78%

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Payback Period

Years Cash Flows

0 Initial Investment --> ($45,000)

1 1,000

2 1,000

3 1,000

4 1,000

5 1,000

6 1,000

7 40,000

8 6,000

9

10

11

12

13

14

15

The payback period is: 6.975

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Annualized Net Present Value

Discount Rate 10.00%

Number of years 6

Years Cash Flows

0 Initial Investment enter as negative --> ($85,000)

1 35,000

2 30,000

3 25,000

4 20,000

5 15,000

6 10,000

7

8

9

10

11

12

13

14

15

The net present value is: $17,285

The annualized NPV is: $3,969

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Initial Investment

Cost of new asset $380,000

Installation costs 20,000

After-tax proceeds from sale of old asset 280,000

Tax on sale of present machine 84,160

Change in net working 17,000

The initial investment is: $221,160

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Cash Budget

(all numbers in $000)

Oct #VALUE! #VALUE! #VALUE! #VALUE! #VALUE!

Total cash receipts $210 $320 $340

Less: Total cash disbursements 213 418 305

Net cash flow ($3) ($98) $35

Add: beginning cash $50 $47 ($51)

Ending cash $47 ($51) ($16)

Less: Minimum cash balance 25 25 25

Required total financing $0 $76 $41

Excess cash balance $22

File: 49961638.xls © 2003 by Addison Wesley Longman Printed: 01/20/2011

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Secrets of Successful Forex Gold Trading - Advanced ForexДокумент3 страницыSecrets of Successful Forex Gold Trading - Advanced ForexMudasir MuhdiОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Ebook Percuma Tfs Price Action TradingДокумент7 страницEbook Percuma Tfs Price Action TradingMUHAMMAD AL AMIN AZMANОценок пока нет

- Questions Time Value of MoneyДокумент3 страницыQuestions Time Value of Moneyarma nadeemОценок пока нет

- Assignment Fiscal Policy in The PhilippinesДокумент16 страницAssignment Fiscal Policy in The PhilippinesOliver SantosОценок пока нет

- Economics of Dr. Ambedkar PDFДокумент9 страницEconomics of Dr. Ambedkar PDFAtul BhosekarОценок пока нет

- Monetary PolicyДокумент23 страницыMonetary PolicyManjunath ShettigarОценок пока нет

- BCG - Thinking Outside The BlocksДокумент48 страницBCG - Thinking Outside The BlocksamrrashedОценок пока нет

- TA DA RulesДокумент54 страницыTA DA RulesSheikh InayatОценок пока нет

- Chaprer III PFS PreparationДокумент63 страницыChaprer III PFS PreparationFrancis Dave Peralta BitongОценок пока нет

- MSC Ariel ZadikovДокумент119 страницMSC Ariel ZadikovAkansha JadhavОценок пока нет

- Sanction Letter MitaBrickДокумент15 страницSanction Letter MitaBricktarique2009Оценок пока нет

- This Study Resource Was: Running Head: CHAPTER 12 CASE STUDY 1Документ4 страницыThis Study Resource Was: Running Head: CHAPTER 12 CASE STUDY 1Ruhul AminОценок пока нет

- Master Thesis Maarten VD WaterДокумент92 страницыMaster Thesis Maarten VD WaterkennemerОценок пока нет

- CEM115-1 Seatwork QuestionsДокумент4 страницыCEM115-1 Seatwork QuestionsYarisse RivasОценок пока нет

- Marginal Costing and Cost Volume Profit AnalysisДокумент5 страницMarginal Costing and Cost Volume Profit AnalysisAbu Aalif RayyanОценок пока нет

- Quiz 9Документ3 страницыQuiz 9朱潇妤100% (1)

- Audit of SheДокумент3 страницыAudit of ShePrince PierreОценок пока нет

- The Finance ResourceДокумент10 страницThe Finance Resourceadedoyin123Оценок пока нет

- CSD PlanДокумент12 страницCSD PlanNargis FatimaОценок пока нет

- Basics of Engineering Economy, 1e: CHAPTER 12 Solutions ManualДокумент15 страницBasics of Engineering Economy, 1e: CHAPTER 12 Solutions Manualttufan1Оценок пока нет

- Lembar - JWB - Soal - B - Sesi 2Документ11 страницLembar - JWB - Soal - B - Sesi 2Sandi RiswandiОценок пока нет

- CRSP Stock Indices Data DescriptionsДокумент148 страницCRSP Stock Indices Data DescriptionsnejisouОценок пока нет

- IB ChallanДокумент1 страницаIB ChallanPrasad HiremathОценок пока нет

- PNB V. Ca, Ibarrola: As Payments For The Purchase of MedicinesДокумент5 страницPNB V. Ca, Ibarrola: As Payments For The Purchase of MedicinesKhayzee AsesorОценок пока нет

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceДокумент2 страницыAccount Statement: Date Value Date Description Cheque Deposit Withdrawal BalancesadhanaОценок пока нет

- Briefer For CREBA Meeting CI JGДокумент3 страницыBriefer For CREBA Meeting CI JGVic CajuraoОценок пока нет

- BPPL Holdings PLCДокумент15 страницBPPL Holdings PLCkasun witharanaОценок пока нет

- Corporate Income Tax ActДокумент59 страницCorporate Income Tax ActMateusz DłużniewskiОценок пока нет

- Course OutlineДокумент217 страницCourse OutlineAðnan YasinОценок пока нет

- Franchise ConsignmentДокумент2 страницыFranchise ConsignmentClarissa Atillano FababairОценок пока нет