Академический Документы

Профессиональный Документы

Культура Документы

Tax Assignment 28 July 2020 PDF

Загружено:

Muhammad Hassan Ahmad Madni0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров2 страницыОригинальное название

Tax assignment 28 july 2020.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров2 страницыTax Assignment 28 July 2020 PDF

Загружено:

Muhammad Hassan Ahmad MadniАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

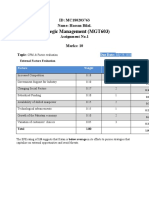

Virtual University of Pakistan

Semester “SPRING 2020”

TAXATION MANAGEMENT (FIN623)

Assignment 01 Marks: 20

“Taxable Income and Tax Liability”

Question

Mr. Anees, the employee of the Federal Government of Pakistan had been deputed on the official

task in Malaysia in 2018. He returned to Pakistan on March 2020 and remained in Pakistan for the

period of 7 months. For the tax year 2020, following are the details of his incomes and other

particulars:

Rs.

1. Monthly basic salary 100,000

2. Bonus 60,000

3. Overtime payment 30,000

4. Furnished accommodation provided by employer 150,000

5. Utilities paid by employer 60,000

6. Monthly medical allowance 50,000

7. Additional allowance paid by the employer 50,000

8. Conveyance provided for personal use

Value of car purchased by the employer 1,150,000

9. Interest-free loan taken from employer 2,000,000

10. Zakat paid 100,000

Requirement:

For the tax year 2020, determine for Mr. Anees’s:

a) Residential status (3 Marks)

b) Taxable income (12 Marks)

c) Tax liability (5 Marks)

You MUST provide all the calculations in DETAIL as each

calculation carry marks.

You MUST mention the relevant section/clause of the ITO 2001

and Income Tax Rules 2002 for the tax year 2020 to support

your answer and calculations as these carry marks.

IMPORTANT

24 hours extra / grace period after the due date is usually available to overcome uploading

difficulties. This extra time should only be used to meet the emergencies and above mentioned

due dates should always be treated as final to avoid any inconvenience.

IMPORTANT INSTRUCTIONS/ SOLUTION GUIDELINES/ SPECIAL

INSTRUCTIONS

BE NEAT IN YOUR PRESENTATION

OTHER IMPORTANT INSTRUCTIONS:

DEADLINE:

Make sure to upload the solution file before the due date on VULMS.

Any submission made via email after the due date will not be accepted.

FORMATTING GUIDELINES:

Use the font style “Times New Roman” or “Arial” and font size “12”.

Do not add watermarks, backgrounds, page colors, page borders, and etcetera.

It is advised to compose your document in MS-Word format ONLY.

You may compose your assignment in Open Office format.

Use black and blue font colors only.

RULES FOR MARKING:

Please note that your assignment will NOT be graded or graded as Zero (0), if:

It is submitted after the due date.

The file you uploaded does not open or is corrupt.

It is in any format other than MS-Word, Excel, or Open Office; e.g. PowerPoint, PDF, etc.

It is cheated or copied from other student(s), internet, given article, books, journals, etc.

Note related to load shedding: Please be proactive

Dear Students,

As you know that load shedding problem is prevailing in our country, therefore,

you all are advised to post your activities as early as possible without waiting for

the due date. For your convenience; activity schedule has already been uploaded on

VULMS for the current semester, therefore no excuse will be entertained after due

date of assignment.

BEST OF LUCK

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- SK NEW FORMS (BARANGAY FINANCIAL MANAGEMENT) Prizes For Barangay Day CelebrationДокумент27 страницSK NEW FORMS (BARANGAY FINANCIAL MANAGEMENT) Prizes For Barangay Day CelebrationBai Nilo100% (6)

- Your Ultimate Guide To 1099sДокумент9 страницYour Ultimate Guide To 1099sKierra Dunbar100% (3)

- FSRA Question Bank - MBA Sem 1Документ98 страницFSRA Question Bank - MBA Sem 1Ankush NimjeОценок пока нет

- Cash 10,000 Inventory Trade Receivables 3,000: 25,000 Balancing FigureДокумент2 страницыCash 10,000 Inventory Trade Receivables 3,000: 25,000 Balancing FigureMuhammad Hassan Ahmad MadniОценок пока нет

- Spring 2020 - ECO404 - 1 (3) .PDF NewДокумент3 страницыSpring 2020 - ECO404 - 1 (3) .PDF NewMuhammad Hassan Ahmad MadniОценок пока нет

- Pak Suzuki Motor Company Limited: Internship ReportДокумент29 страницPak Suzuki Motor Company Limited: Internship ReportMuhammad Hassan Ahmad Madni100% (1)

- Honda Atlas 2020Документ180 страницHonda Atlas 2020Muhammad Hassan Ahmad MadniОценок пока нет

- MGT 603 Assignment. Hassan BilalДокумент4 страницыMGT 603 Assignment. Hassan BilalMuhammad Hassan Ahmad MadniОценок пока нет

- Online Classes Assessment Date: 15 July 2020Документ1 страницаOnline Classes Assessment Date: 15 July 2020Muhammad Hassan Ahmad MadniОценок пока нет

- Microsoft Word - Examiner's Report PM D18 FinalДокумент7 страницMicrosoft Word - Examiner's Report PM D18 FinalMuhammad Hassan Ahmad MadniОценок пока нет

- Lecture 4 TAXES AND THE MARGINAL INVESTORДокумент14 страницLecture 4 TAXES AND THE MARGINAL INVESTORAshiv MungurОценок пока нет

- Sepco Online BilllДокумент1 страницаSepco Online Billlshaikh_piscesОценок пока нет

- 301 303 305 307 309 - QB 2019 - Bba V-Done-1Документ145 страниц301 303 305 307 309 - QB 2019 - Bba V-Done-1Parveen SiwachОценок пока нет

- Kenny Chacon Accounting 212 Sweats Galore, IncДокумент27 страницKenny Chacon Accounting 212 Sweats Galore, IncKenneth ChaconОценок пока нет

- Discussions Questions Donor S TaxДокумент5 страницDiscussions Questions Donor S TaxMary DenizeОценок пока нет

- Tax - Income Tax Individuals (Easy)Документ28 страницTax - Income Tax Individuals (Easy)Kristine Lirose BordeosОценок пока нет

- TAX Chapter 6Документ4 страницыTAX Chapter 6Myz MessyОценок пока нет

- Taxflash: New Foreign Tax Credit RulesДокумент6 страницTaxflash: New Foreign Tax Credit RulesKojiro FuumaОценок пока нет

- Annex B-2Документ1 страницаAnnex B-2Von Virchel VallesОценок пока нет

- Deduction From Gross Total IncomeДокумент23 страницыDeduction From Gross Total IncomeSaranya RathinavelОценок пока нет

- Chapter 8 - Income TaxesДокумент6 страницChapter 8 - Income TaxesHaddy GayeОценок пока нет

- San Paolo Development Corporation V CRДокумент1 страницаSan Paolo Development Corporation V CRAnton GabrielОценок пока нет

- Adjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiДокумент6 страницAdjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiZaheer SwatiОценок пока нет

- For Resident Companies Registering For Tax in Ireland: General Details Part AДокумент8 страницFor Resident Companies Registering For Tax in Ireland: General Details Part ANaitik singalОценок пока нет

- ITLP Question BankДокумент9 страницITLP Question BankRitik SinghОценок пока нет

- Resident Income Tax Return Resident Income Tax ReturnДокумент6 страницResident Income Tax Return Resident Income Tax ReturnlooseshengjiОценок пока нет

- Adjustments in Preparation of Financial StatementsДокумент30 страницAdjustments in Preparation of Financial StatementsAvirup ChakrabortyОценок пока нет

- Tax Computation 10 2021Документ2 страницыTax Computation 10 2021prashanth kumarОценок пока нет

- Johnson - Cassandra - AC556 Assignment Unit 6Документ9 страницJohnson - Cassandra - AC556 Assignment Unit 6ctp4950_552446766Оценок пока нет

- Form 16Документ1 страницаForm 16tdsbolluОценок пока нет

- Business Tax ReviewerДокумент15 страницBusiness Tax ReviewermeowОценок пока нет

- CIR Vs Batangas Transpo CompanyДокумент2 страницыCIR Vs Batangas Transpo CompanyBam BathanОценок пока нет

- Accounting For Income Taxes Accounting For Income TaxesДокумент41 страницаAccounting For Income Taxes Accounting For Income TaxesankitmogheОценок пока нет

- 16434489691643448625CA Inter DT MCQ Book MN22Документ198 страниц16434489691643448625CA Inter DT MCQ Book MN22Piyush JainОценок пока нет

- 2020 Tax Return Documents (KELLY DAVID F - Client Copy)Документ5 страниц2020 Tax Return Documents (KELLY DAVID F - Client Copy)Toomuch0% (1)

- Income Tax Calculator For MaleДокумент10 страницIncome Tax Calculator For MaleSri GuganОценок пока нет

- Deferred TaxДокумент3 страницыDeferred Taxমোঃ মাহফুজুর রহমান রাকিবОценок пока нет