Академический Документы

Профессиональный Документы

Культура Документы

MKT17 - 0309 - First Housing - F2a - tcm55-16531

Загружено:

ee s0 оценок0% нашли этот документ полезным (0 голосов)

13 просмотров1 страницаОригинальное название

MKT17_0309_First Housing _F2a_tcm55-16531

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

13 просмотров1 страницаMKT17 - 0309 - First Housing - F2a - tcm55-16531

Загружено:

ee sАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

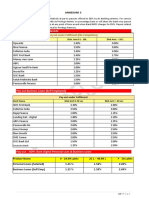

PROFILE OF CUSTOMERS WHO TOOK THEIR FIRST MCB HOUSING LOAN (2011-2016)

80% 70% 30%

of customers took loans of home loans of home loans

for their first property were taken out jointly were taken out by a sole borrower

with men accounting for 70% of single loans

Age distribution for first-time MCB borrowers

≤30 30-40 40-50 50+

25% 36% 22% 17%

single

married

one out of three

borrowers under 30

are single men

15+

years

≤Rs. 2M

68%

of housing loans 75%

had an initial of housing loans

repayment period were under Rs. 2M

of 15 years or more

60% of borrowers have a monthly

household income under Rs. 50K

30% 30% 15% 25%

<25K 25K-50K 50K-75K 75K+

For most borrowers, the monthly repayment on their housing loan

represents ≤30% of their monthly household income

Service and manual Clerical and technical Managers and

workers workers professionals

40% 20% 27%

of main borrowers of main borrowers of main borrowers

avg. housing loan amount900K avg. housing loan amount 1.5M avg. housing loan amount 3.3M

avg. monthly household income 34K avg. monthly household income 52K avg. monthly household income 120K

avg. monthly repayment 9K avg. monthly repayment 13K avg. monthly repayment 28K

Discover more

Data Source: MCB data base

Вам также может понравиться

- Home Purchase Plot Purchase + Construction Home Construction Home RenovationДокумент5 страницHome Purchase Plot Purchase + Construction Home Construction Home RenovationAliОценок пока нет

- Analysis and FindingsДокумент16 страницAnalysis and FindingsSimreen HuddaОценок пока нет

- ARM Versus Fixed-Rate Mortgage Comparison: Amount of LoanДокумент3 страницыARM Versus Fixed-Rate Mortgage Comparison: Amount of LoanDery YanwarОценок пока нет

- 2017 Planning & Progress Study: The Debt DilemmaДокумент9 страниц2017 Planning & Progress Study: The Debt DilemmaZerohedgeОценок пока нет

- City Bank Limited, The: Update To Credit AnalysisДокумент10 страницCity Bank Limited, The: Update To Credit AnalysisJannatun NayeemaОценок пока нет

- (FiinRatings) Corporate BondsДокумент31 страница(FiinRatings) Corporate BondsTrần Thị Hà MyОценок пока нет

- Default Bank LoansДокумент12 страницDefault Bank LoansMohammed Akhtab Ul HudaОценок пока нет

- DOL Privilege Partner New PayoutДокумент6 страницDOL Privilege Partner New PayoutDigi CreditОценок пока нет

- Housing Loan - Marketing KitДокумент15 страницHousing Loan - Marketing Kitsanty86Оценок пока нет

- Inflation & Your LoanДокумент11 страницInflation & Your LoanmalvikasinghalОценок пока нет

- Inflation & Your Loan - 2023Документ12 страницInflation & Your Loan - 2023AR HemantОценок пока нет

- Dena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)Документ24 страницыDena Niwas Housing Loan: (To Be Reset at The End of Every 3 Years)asdОценок пока нет

- Mid-Size Bank Coalition of America: ResearchДокумент7 страницMid-Size Bank Coalition of America: Researchdhruv_prakash@hotmail.comОценок пока нет

- Documentation Needed To Apply For An Corporation Bank Home LoanДокумент4 страницыDocumentation Needed To Apply For An Corporation Bank Home LoanKeerthana PadmakumarОценок пока нет

- PrudentialДокумент3 страницыPrudentialGiaKhươngTrầnОценок пока нет

- Plan Central Vermont: Safe & Affordable Housing ElementДокумент40 страницPlan Central Vermont: Safe & Affordable Housing ElementShailja SinglaОценок пока нет

- Lending Products Pricing Structure (Effective From May 01, 2022)Документ1 страницаLending Products Pricing Structure (Effective From May 01, 2022)Ahsan JamshaidОценок пока нет

- NMHYDWM006Документ33 страницыNMHYDWM006SHAWKATMANZOORОценок пока нет

- Fresno County 2021 Affordable Housing Needs Report: Key FindingsДокумент4 страницыFresno County 2021 Affordable Housing Needs Report: Key FindingsCassandra GaribayОценок пока нет

- ICICI Housing LoansДокумент3 страницыICICI Housing LoansAdv Sheetal SaylekarОценок пока нет

- Final Report - Real Estate - Div C - PGDM10Документ20 страницFinal Report - Real Estate - Div C - PGDM10DIVYANSHU SHEKHARОценок пока нет

- Computation SHEET DBP Loans NewДокумент2 страницыComputation SHEET DBP Loans NewKRYSTEL JUMANOYОценок пока нет

- The Jammu & Kashmir Bank LTD: AccountДокумент5 страницThe Jammu & Kashmir Bank LTD: AccountĒxçlūsìvē SympãthētìçОценок пока нет

- Residential Forum NARДокумент32 страницыResidential Forum NARNational Association of REALTORS®Оценок пока нет

- Independence Community Development Plan Analysis Review MeetingДокумент57 страницIndependence Community Development Plan Analysis Review MeetingconfluencescribdОценок пока нет

- RCLCO Report For YVHAДокумент13 страницRCLCO Report For YVHAreporter.tballantyneОценок пока нет

- Ii, Making LoansДокумент10 страницIi, Making LoansNguyen Ha TrangОценок пока нет

- Project 1 Mortgage CalculationsДокумент3 страницыProject 1 Mortgage CalculationsJulius Hörner100% (1)

- Age (Years) : Access To Information About HLДокумент11 страницAge (Years) : Access To Information About HLSimreen HuddaОценок пока нет

- FinanceДокумент2 страницыFinanceRobert RamirezОценок пока нет

- Time Value of Money1Документ57 страницTime Value of Money1Kamisetty SudhamshОценок пока нет

- QuotesДокумент1 страницаQuotesJohn Carlos Montes RodriguezОценок пока нет

- Group 2 - Credit ScoringДокумент3 страницыGroup 2 - Credit ScoringPhạm Quỳnh TrangОценок пока нет

- SBR 1 Group 2Документ6 страницSBR 1 Group 2Ankit JindalОценок пока нет

- Housing Loan ExerciseДокумент11 страницHousing Loan ExerciseMuskan RaghuwanshiОценок пока нет

- Credit Scoring ModelДокумент1 страницаCredit Scoring ModelPankaj MaryeОценок пока нет

- Lender 1cqhdubbv - 478333Документ45 страницLender 1cqhdubbv - 478333DGLОценок пока нет

- Digital Consumer Lending - August 2019Документ22 страницыDigital Consumer Lending - August 2019Radha Madhuri100% (1)

- TejbirДокумент1 страницаTejbirTejbir SinghОценок пока нет

- Construction Spending November2008Документ1 страницаConstruction Spending November2008International Business TimesОценок пока нет

- Fix or Evict? Loan Modifications Return More Value Than ForeclosuresДокумент21 страницаFix or Evict? Loan Modifications Return More Value Than ForeclosuresForeclosure FraudОценок пока нет

- Bank Loan OffersДокумент11 страницBank Loan OffersAnandОценок пока нет

- CCPL MidДокумент7 страницCCPL MidMuhammad AliОценок пока нет

- House LoanДокумент4 страницыHouse LoanRamana GОценок пока нет

- Mgac 1Документ7 страницMgac 1Yah yah yahhhhhОценок пока нет

- Collections 3.0: Bad Debt Collections: From Ugly Duckling To White SwanДокумент16 страницCollections 3.0: Bad Debt Collections: From Ugly Duckling To White SwanGarimaОценок пока нет

- CUA Interest RatesДокумент1 страницаCUA Interest Ratescrazy_babaОценок пока нет

- Current Developments in Real Estate FinanceДокумент26 страницCurrent Developments in Real Estate Financeyaseen_shathaОценок пока нет

- LiquiLoans - Monthly Portfolio Factsheet - As On 30th April 2023Документ2 страницыLiquiLoans - Monthly Portfolio Factsheet - As On 30th April 2023Raghuraman SelvamaniОценок пока нет

- Wealth Academy Training-Debt ManagementДокумент16 страницWealth Academy Training-Debt ManagementEze FoncardasОценок пока нет

- Mutual FundДокумент5 страницMutual FundMunaj AzharОценок пока нет

- Fees and Charges: 1. Home Mortgage Loan/ Home Equity LoanДокумент1 страницаFees and Charges: 1. Home Mortgage Loan/ Home Equity LoanThành Nguyễn MinhОценок пока нет

- Your Reverse Mortgage Summary: You Could GetДокумент11 страницYour Reverse Mortgage Summary: You Could GetPete Santilli100% (1)

- NMHYDWM072Документ18 страницNMHYDWM072SHAWKATMANZOORОценок пока нет

- 2.1q Classwork Questions On Financial PlanningДокумент4 страницы2.1q Classwork Questions On Financial PlanningARYA SHETHОценок пока нет

- 2.1 Casswork Questions On Financial PlanningДокумент3 страницы2.1 Casswork Questions On Financial PlanningYash DedhiaОценок пока нет

- Charlottesville Americas Alliance MarketBeat Office Q32020Документ1 страницаCharlottesville Americas Alliance MarketBeat Office Q32020Kevin ParkerОценок пока нет

- The Global Financial Crisis: Module 3 Housing and MortgagesДокумент30 страницThe Global Financial Crisis: Module 3 Housing and MortgagesAlanОценок пока нет

- Loan ProductsДокумент2 страницыLoan ProductsArlien GerosanibОценок пока нет

- Asia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyОт EverandAsia Small and Medium-Sized Enterprise Monitor 2021 Volume III: Digitalizing Microfinance in Bangladesh: Findings from the Baseline SurveyОценок пока нет

- Recipe Guide by ZeroДокумент23 страницыRecipe Guide by Zeropeter.lustig.1983Оценок пока нет

- Report of Sectoral Committee On Emerging Sectors: October 2007Документ23 страницыReport of Sectoral Committee On Emerging Sectors: October 2007ee sОценок пока нет

- Building A Sustainable and Profitable Defi NetworkДокумент15 страницBuilding A Sustainable and Profitable Defi Networkee sОценок пока нет

- PMA PCCI CerealsДокумент3 страницыPMA PCCI Cerealsee sОценок пока нет

- Antier Hybrid SolutionДокумент19 страницAntier Hybrid Solutionee sОценок пока нет

- Sustainability 11 03173 v2Документ12 страницSustainability 11 03173 v2ee sОценок пока нет

- The Return Should Reach Mra Electronicallt at Latest On 15 October 2020Документ7 страницThe Return Should Reach Mra Electronicallt at Latest On 15 October 2020ee sОценок пока нет

- Semaris Business-Plan-FinalДокумент18 страницSemaris Business-Plan-Finalee sОценок пока нет

- 10 Event Trends v3Документ39 страниц10 Event Trends v3ee sОценок пока нет

- Sampling Acquisition Letter FormatДокумент1 страницаSampling Acquisition Letter Formatee sОценок пока нет

- Covid-19 Questionnaire: AnswerДокумент2 страницыCovid-19 Questionnaire: Answeree sОценок пока нет

- CF - Business Plan QuestionnaireДокумент9 страницCF - Business Plan Questionnaireee sОценок пока нет

- Ocorian A Guide To Family Offices 180920Документ19 страницOcorian A Guide To Family Offices 180920ee s100% (1)

- LIST101 IBC Pitch DeckДокумент17 страницLIST101 IBC Pitch Deckee sОценок пока нет

- MIT Bitcoin Expo 2021Документ3 страницыMIT Bitcoin Expo 2021ee sОценок пока нет

- 2019 Full Price List TIOTДокумент11 страниц2019 Full Price List TIOTee sОценок пока нет

- Lumic AI Camera Product InfoДокумент12 страницLumic AI Camera Product Infoee sОценок пока нет

- Elevated Complete Bus Plan 1.2Документ15 страницElevated Complete Bus Plan 1.2ee sОценок пока нет

- Set The Stage For Your Episode. Give Your Listeners A Brief Overview of What You Plan To Cover and What They Can ExpectДокумент2 страницыSet The Stage For Your Episode. Give Your Listeners A Brief Overview of What You Plan To Cover and What They Can Expectee sОценок пока нет

- Getting Started in Online Real Estate InvestingДокумент11 страницGetting Started in Online Real Estate Investingee sОценок пока нет

- Anern Wall-Mounted LiFePO4 Solar Battery Specification & Price List-202006 (3265)Документ1 страницаAnern Wall-Mounted LiFePO4 Solar Battery Specification & Price List-202006 (3265)ee sОценок пока нет

- Acrylic Series Big Catalog 20124Документ113 страницAcrylic Series Big Catalog 20124ee sОценок пока нет

- Future of Construction CasesДокумент6 страницFuture of Construction CasesMohammed JanuОценок пока нет

- Davido Hospitality Rider 2024Документ2 страницыDavido Hospitality Rider 2024ee sОценок пока нет

- Gas Express Technoly ForecastДокумент10 страницGas Express Technoly Forecastee sОценок пока нет

- Activities in Mauritius - ReWorkrte 2021Документ4 страницыActivities in Mauritius - ReWorkrte 2021ee sОценок пока нет

- Market Study of The Construction Industry in Mauritius - CCM Preliminary ReportДокумент57 страницMarket Study of The Construction Industry in Mauritius - CCM Preliminary ReportION News100% (1)

- SLS in Manufacturing Sector-7thProofДокумент90 страницSLS in Manufacturing Sector-7thProofVashish RamrechaОценок пока нет

- TheEmpireofBusiness 10006341bcДокумент418 страницTheEmpireofBusiness 10006341bcee sОценок пока нет

- Web YRF 2019 Important NotesДокумент2 294 страницыWeb YRF 2019 Important Notesee sОценок пока нет

- 0 042010 Notes - Brandon AdamsДокумент17 страниц0 042010 Notes - Brandon AdamsCK in DC100% (5)

- ICARE Preweek RFBT Preweek 4Документ14 страницICARE Preweek RFBT Preweek 4john paulОценок пока нет

- Interest Rate Swap ThesisДокумент5 страницInterest Rate Swap Thesisdwham6h1100% (2)

- 2022 People of The State of V People of The State of Letter Correspond 1681Документ12 страниц2022 People of The State of V People of The State of Letter Correspond 1681Ann DwyerОценок пока нет

- Indian Institute of Banking & FinanceДокумент90 страницIndian Institute of Banking & Financegopalmeb67% (3)

- 03 Audit Item Lembaran ImbanganДокумент26 страниц03 Audit Item Lembaran Imbanganathirah jamaludinОценок пока нет

- Fixed Income InvestingДокумент6 страницFixed Income InvestingHajjiОценок пока нет

- Summer Internship Project at ICICI BankДокумент81 страницаSummer Internship Project at ICICI BankNeha Vora100% (3)

- 8909 - Special LawsДокумент30 страниц8909 - Special LawsElaine Joyce GarciaОценок пока нет

- A Summer Internship Report ON Security Analysis and Portfolio Management AT "India Infoline Limited " (Iifl India)Документ34 страницыA Summer Internship Report ON Security Analysis and Portfolio Management AT "India Infoline Limited " (Iifl India)deepak tejaОценок пока нет

- Mortgage Lab Signature AssignmentДокумент2 страницыMortgage Lab Signature Assignmentapi-285508405Оценок пока нет

- Spanish Market InfrastructureДокумент13 страницSpanish Market InfrastructureIra IdroesОценок пока нет

- Sea Haven Inc V Dyrud FINAL 02 11 11 - Formal Contracts CaseДокумент21 страницаSea Haven Inc V Dyrud FINAL 02 11 11 - Formal Contracts CaseDarian SammyОценок пока нет

- Chapter-1-An Overview of The Financial SystemДокумент10 страницChapter-1-An Overview of The Financial SystemHussen AbdulkadirОценок пока нет

- Recovery Department, Zonal Office: Delhi 4 Floor, Rajendra Bhawan, Rajendra Place, New Delhi-110125 PHONE: 011-25716386, E-MailДокумент4 страницыRecovery Department, Zonal Office: Delhi 4 Floor, Rajendra Bhawan, Rajendra Place, New Delhi-110125 PHONE: 011-25716386, E-MailAbhishekh GuptaОценок пока нет

- Surviving The Final Bubble by Charles HayekДокумент29 страницSurviving The Final Bubble by Charles HayekMichael RosesthereОценок пока нет

- Reviewer 2Документ4 страницыReviewer 2Shaina LimОценок пока нет

- A STUDY ON LOAN MANAGEMENT OF NEPAL BANK LIMITED AND AGRICULTURAL DEVELOPMENT BANK LIMITED1stДокумент7 страницA STUDY ON LOAN MANAGEMENT OF NEPAL BANK LIMITED AND AGRICULTURAL DEVELOPMENT BANK LIMITED1stOmisha KhatiwadaОценок пока нет

- Depreciation and AmortisationДокумент2 страницыDepreciation and AmortisationShweta BajpaiОценок пока нет

- Law 21-45Документ13 страницLaw 21-45AlezandraОценок пока нет

- Final Project TybmsДокумент57 страницFinal Project TybmsAnkit Chaurasiya50% (2)

- The Ultimate Budget Routine - Budget With Rachel 2 PDFДокумент23 страницыThe Ultimate Budget Routine - Budget With Rachel 2 PDFDianeОценок пока нет

- Sun and Earth Corporation: Notes To The Financial Statements-AmendedДокумент57 страницSun and Earth Corporation: Notes To The Financial Statements-AmendedBeatrice ReynanciaОценок пока нет

- Apar 2005 2006Документ63 страницыApar 2005 2006RamaОценок пока нет

- Financial Markets Assignment 1Документ2 страницыFinancial Markets Assignment 1Mary Joy SameonОценок пока нет

- Financial Markets and Institutions Test Bank (031 040)Документ10 страницFinancial Markets and Institutions Test Bank (031 040)Thị Ba PhạmОценок пока нет

- Dickson Motors Limited: Cor. Edmonton and GrahamДокумент1 страницаDickson Motors Limited: Cor. Edmonton and GrahamhladyОценок пока нет

- Chapter 1 - Current LiabilitiesДокумент25 страницChapter 1 - Current LiabilitiesKathleen MarcialОценок пока нет

- Kryss-Mark-Francisco Module 4 and 5 IOMДокумент24 страницыKryss-Mark-Francisco Module 4 and 5 IOMChellemark FranciscoОценок пока нет

- Chapter5 Bubbles Panics Crashes and CrisesДокумент34 страницыChapter5 Bubbles Panics Crashes and CrisesAllen Uhomist AuОценок пока нет