Академический Документы

Профессиональный Документы

Культура Документы

Chapter 1 and 2 Additional Problems

Загружено:

Christlyn Joy BaralОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Chapter 1 and 2 Additional Problems

Загружено:

Christlyn Joy BaralАвторское право:

Доступные форматы

Partnership Formation

On January 1, 2020, Len, May and Nancy decided to form a business

partnership to operate supermarket. Len and May both owned a

grocery business with the Statement of Financial Position as of

December 31, 2019:

Len May

Cash 10,000,000 20,000,000

Accounts Receivable 20,000,000 30,000,000

Inventories 70,000,000 40,000,000

Property, plant and

50,000,000 10,000,000

equipment

Accounts payable 40,000,000 20,000,000

Notes payable(Len 10%,May

30,000,000 50,000,000

5%)

Capital 80,000,000 30,000,000

The following additional notes are provided:

1. Len and May will contribute all its assets and liabilities to

the newly formed partnership.

2. The parties agree to provide 10% and 20% allowance for

doubtful accounts to the accounts receivable of Len and May,

respectively.

3. The inventories of Len and May are reported at historical

cost and have net realizable value of Php60M and Php45M,

respectively.

4. The PPE of Len and May have not been depreciated and should

be depreciated by 40% and 30%, respectively.

5. The interest payable on both payable were unrecorded and

unpaid since the date of contract. Len’s note payable is dated

April 1, 2019 while May’s note payable is dated June 30, 2019.

6. Nancy shall have 20% interest in the partnership upon

contribution of sufficient cash.

How much will be the capital of each partner?

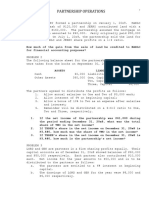

Partnership Operation

Problem 1

On January 1, 2020, Alabo and Hok formed Notpa Partnership and the

articles of co-partnership provides that profit or loss shall be

distributed accordingly:

10% interest on average capital balance

P50,000 and P100,000 quarterly salaries for Alabo and Hok,

Respectively.

The remainder shall be distributed in the ratio of 3:2 for

Alabo and Hok, respectively.

Alabo Hok

January 1, 2020 investment 1,000,000 500,000

March 31, 2020 investment 100,000

July 1, 2020 withdrawal (200,000)

September 30, 2020 withdrawal (200,000)

October 1, 2020 investment 700,000

The chief accountant of the partnership reported net income of

P1,000,000 for year 2020.

What are the capital balances of the partners on December 31, 2020?

Problem 2

On July 1, 2020, Ngot and Bii formed NgalBu Partnership with

initial investment of P1M and P2M, respectively. D is appointed as

the managing partner.

The articles of co-partnership provide that profit or loss shall

be distributed accordingly:

1. 30% interest on original capital contribution ratio

2. Monthly salary of P20,000 and P10,000 respectively for Ngot

and Bii.

3. Ngot shall be entitled to bonus equivalent to 20% of net

income after interest, salary and bonus.

4. The remainder shall be distributed in ration 3:2 for Ngot and

Bii respectively.

For the year ended December 31, 2020, the partnership reported net

income of P750,000.

Compute for the share of net income of Ngot and Bii.

Problem 3

Partners A and B have profit and loss agreement with the following:

salaries P90,000 and P135,000 for A and B, respectively; a bonus

to A of 10% of net income after salaries; an interest of 10% on

average capital balances of P60,000 and P105,000 for A and B,

respectively. One-third of any remaining profits will be allocated

to A and the balance to B.

If the partnership had net income P66,000, how much should be

allocated to each partner assuming that the provisions of the

profit and loss agreement are ranked by order of priority starting

with (1) salaries, (2) interest, (3) bonus and up to the extent of

the ranking only?

END

Вам также может понравиться

- Harvard Case Study - Flash Inc - AllДокумент40 страницHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- 1st PREBOARD EXAMINATION - AFAR STUDENTS PDFДокумент16 страниц1st PREBOARD EXAMINATION - AFAR STUDENTS PDFAAОценок пока нет

- The Crocodile and The Five JudgesДокумент4 страницыThe Crocodile and The Five JudgesChristlyn Joy BaralОценок пока нет

- Partnership Operations Enabling AssessmentДокумент6 страницPartnership Operations Enabling AssessmentVon Andrei MedinaОценок пока нет

- Parcor CaseletsДокумент13 страницParcor CaseletsErika delos Santos100% (2)

- Class 12 Accounts CA Parag GuptaДокумент368 страницClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Activity 1.2.1Документ1 страницаActivity 1.2.1De Nev OelОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Chapter 5 The Production Process and CostsДокумент6 страницChapter 5 The Production Process and CostsChristlyn Joy BaralОценок пока нет

- Financial Planning and Forecasting Brigham SolutionДокумент29 страницFinancial Planning and Forecasting Brigham SolutionShahid Mehmood100% (6)

- Module 6 - Worksheet and Financial Statements Part IДокумент12 страницModule 6 - Worksheet and Financial Statements Part IMJ San Pedro100% (1)

- Finals ProblemsДокумент9 страницFinals Problemsr3gjc.nfjpia2223Оценок пока нет

- Partnership Mock ExamДокумент4 страницыPartnership Mock ExamCleo Meguel AbogadoОценок пока нет

- Partnership CE W Control Ans PDFДокумент10 страницPartnership CE W Control Ans PDFRedОценок пока нет

- 2nd Assign Topic2 AdvaccДокумент2 страницы2nd Assign Topic2 AdvaccStella SabaoanОценок пока нет

- Prelim Exam ProblemsДокумент4 страницыPrelim Exam Problemslinkin soyОценок пока нет

- Acccob1 Partnership Operations Additional ExercisesДокумент2 страницыAcccob1 Partnership Operations Additional ExercisesJazehl Joy ValdezОценок пока нет

- Partnership Operations: QuizДокумент8 страницPartnership Operations: QuizLee SuarezОценок пока нет

- Ae100 Partnership Operations Notes and Sample ProblemsДокумент3 страницыAe100 Partnership Operations Notes and Sample ProblemsJrm mendesОценок пока нет

- Session 2 - Partnership Operations - Problems January 29, 2016Документ10 страницSession 2 - Partnership Operations - Problems January 29, 2016Johnny CervantesОценок пока нет

- A 2 OperationsДокумент6 страницA 2 OperationsAngela DucusinОценок пока нет

- 2 OperationsДокумент7 страниц2 Operationsmartinfaith958Оценок пока нет

- Partnership Dissolution: QuizДокумент8 страницPartnership Dissolution: QuizLee SuarezОценок пока нет

- Partnership Dissolution: QuizДокумент5 страницPartnership Dissolution: QuizLee SuarezОценок пока нет

- Partnership Operations ( (Exercise No. 1)Документ1 страницаPartnership Operations ( (Exercise No. 1)Shaira Nicole VasquezОценок пока нет

- Chap 1 Part 4 - Installment Liquidation ProblemsДокумент3 страницыChap 1 Part 4 - Installment Liquidation ProblemsLarpii Moname100% (1)

- Baysas Problems Partnership OperationsДокумент3 страницыBaysas Problems Partnership OperationsHoney MuliОценок пока нет

- Afar 01Документ11 страницAfar 01Raquel Villar DayaoОценок пока нет

- Print SW PartnershipДокумент5 страницPrint SW PartnershipMike MikeОценок пока нет

- Parcor 002Документ17 страницParcor 002Vincent Larrie MoldezОценок пока нет

- P U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Документ10 страницP U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Shaina AragonОценок пока нет

- AFAR-01 PartnershipДокумент6 страницAFAR-01 PartnershipRamainne Ronquillo0% (1)

- Partnership Q5Документ2 страницыPartnership Q5Lorraine Mae RobridoОценок пока нет

- Problem On AdmissionДокумент2 страницыProblem On AdmissionSam Rae LimОценок пока нет

- Practice Sets 3 & 4: Accounting For PartnershipДокумент4 страницыPractice Sets 3 & 4: Accounting For PartnershipRey Joyce AbuelОценок пока нет

- CMPC 131 2-Partneship-OperationsДокумент4 страницыCMPC 131 2-Partneship-OperationsGab IgnacioОценок пока нет

- Partnership Operations (Additional Sample Problems)Документ5 страницPartnership Operations (Additional Sample Problems)Pauline Anne LopezОценок пока нет

- Quiz OperationsДокумент4 страницыQuiz OperationsAngelo VilladoresОценок пока нет

- Partnership Operation 004Документ2 страницыPartnership Operation 004John GacumoОценок пока нет

- 2 Partnership OperationДокумент4 страницы2 Partnership OperationDacanay, Sean Eigencris G.Оценок пока нет

- 1st Evals p2Документ10 страниц1st Evals p2Shiela MayОценок пока нет

- Partnership HCC CttoДокумент7 страницPartnership HCC CttoKenncy100% (1)

- Special Transaction 1Документ7 страницSpecial Transaction 1Josua PagcaliwaganОценок пока нет

- Partnership Operation Part 1 PDFДокумент2 страницыPartnership Operation Part 1 PDFazzenethfaye.delacruz.mnlОценок пока нет

- Partnership MyДокумент13 страницPartnership MyHoneylyne PlazaОценок пока нет

- ACC 1802 Partneship OperationsДокумент3 страницыACC 1802 Partneship OperationsronnelОценок пока нет

- Jeremeh V Querol Bachelor of Science in Tourism ManagementДокумент8 страницJeremeh V Querol Bachelor of Science in Tourism ManagementJasmine ActaОценок пока нет

- Dissolution Reviewees Copy1100Документ6 страницDissolution Reviewees Copy1100Jose Mariano Melendez0% (1)

- Advanced Financial Accounting and Reporting Accounting For PartnershipДокумент6 страницAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceОценок пока нет

- 2122 1st AC - FAR Act. 05Документ2 страницы2122 1st AC - FAR Act. 05Airish GeronimoОценок пока нет

- Toaz - Info Far Vol 2 Chapter 22 25docx PRДокумент22 страницыToaz - Info Far Vol 2 Chapter 22 25docx PRVivialyn PalimpingОценок пока нет

- If The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnДокумент2 страницыIf The Profits After Salaries and Bonuses Are To Be Divided Equally, and The Profits OnJoana TrinidadОценок пока нет

- Combined Quiz No. 1 ACCO 30013 Accounting For Special TransactionsДокумент11 страницCombined Quiz No. 1 ACCO 30013 Accounting For Special TransactionsYes ChannelОценок пока нет

- Prequalifying ExaminationДокумент7 страницPrequalifying Examinationablay logeneОценок пока нет

- There Is Revaluation of Assets Equal To P50,000Документ2 страницыThere Is Revaluation of Assets Equal To P50,000Joana TrinidadОценок пока нет

- Problem - Set - 1 - Partnership - Distribution - Mandatory Assessment (021922)Документ9 страницProblem - Set - 1 - Partnership - Distribution - Mandatory Assessment (021922)dimitriv7209Оценок пока нет

- Partnership Operations Enabling AssessmentДокумент3 страницыPartnership Operations Enabling AssessmentVon Andrei MedinaОценок пока нет

- Partnership Operations Lecture Problem and QuizzerPDFДокумент6 страницPartnership Operations Lecture Problem and QuizzerPDFjanefern49Оценок пока нет

- Partnership Q4Документ2 страницыPartnership Q4Lorraine Mae Robrido100% (1)

- Partnership Dissolution Practice Problems 1Документ1 страницаPartnership Dissolution Practice Problems 1Ciana SacdalanОценок пока нет

- Partnership Formation and Operation.Документ4 страницыPartnership Formation and Operation.May RamosОценок пока нет

- 1st Year ExamДокумент9 страниц1st Year ExamMark Domingo MendozaОценок пока нет

- Partnership Operations 2Документ2 страницыPartnership Operations 2Anne AlagОценок пока нет

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020От EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Оценок пока нет

- Overcoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyОт EverandOvercoming COVID-19 in Bhutan: Lessons from Coping with the Pandemic in a Tourism-Dependent EconomyОценок пока нет

- Chapter 1 Approaches To OaДокумент5 страницChapter 1 Approaches To OaChristlyn Joy BaralОценок пока нет

- Chapter 2 Business ProcessesДокумент2 страницыChapter 2 Business ProcessesChristlyn Joy BaralОценок пока нет

- Chapter 3Документ11 страницChapter 3Christlyn Joy BaralОценок пока нет

- Building The Control ModelДокумент9 страницBuilding The Control ModelChristlyn Joy BaralОценок пока нет

- AIS Chapter 5Документ34 страницыAIS Chapter 5Christlyn Joy BaralОценок пока нет

- Unclaimed BalancesДокумент2 страницыUnclaimed BalancesChristlyn Joy BaralОценок пока нет

- AIS Chapter 5Документ34 страницыAIS Chapter 5Christlyn Joy BaralОценок пока нет

- Chapter 7 The Nature of IndustryДокумент6 страницChapter 7 The Nature of IndustryChristlyn Joy BaralОценок пока нет

- Transaction Processing in The AISДокумент20 страницTransaction Processing in The AISChristlyn Joy BaralОценок пока нет

- Chapter 6 The Organization of The FirmДокумент2 страницыChapter 6 The Organization of The FirmChristlyn Joy BaralОценок пока нет

- Aud. Quiz#2Документ8 страницAud. Quiz#2Christlyn Joy BaralОценок пока нет

- Heading 1 Heading 1 TitleДокумент4 страницыHeading 1 Heading 1 TitleChristlyn Joy BaralОценок пока нет

- AuditДокумент10 страницAuditChristlyn Joy BaralОценок пока нет

- Corporate Governance Perspectives: 2.1 The Agency ConceptДокумент2 страницыCorporate Governance Perspectives: 2.1 The Agency ConceptChristlyn Joy BaralОценок пока нет

- Week 4 Vietnam Discussion PointsДокумент1 страницаWeek 4 Vietnam Discussion PointsChristlyn Joy BaralОценок пока нет

- Audit 2Документ5 страницAudit 2Christlyn Joy BaralОценок пока нет

- Article 1196Документ17 страницArticle 1196Christlyn Joy BaralОценок пока нет

- Article 1211Документ10 страницArticle 1211Christlyn Joy BaralОценок пока нет

- Spaniards Wrought Fundamental Changes in The Live Ofn The IndiosДокумент1 страницаSpaniards Wrought Fundamental Changes in The Live Ofn The IndiosChristlyn Joy BaralОценок пока нет

- Viva On Project and CfsДокумент7 страницViva On Project and CfsCrazy GamerОценок пока нет

- ZS13 G L Account Hierarchy 29072022Документ24 страницыZS13 G L Account Hierarchy 29072022nawairishfaqОценок пока нет

- Module 5Документ11 страницModule 5Jacqueline OrtegaОценок пока нет

- Working Paper-Chapters 1-4 Naser AbdelkarimДокумент5 страницWorking Paper-Chapters 1-4 Naser AbdelkarimHasan NajiОценок пока нет

- Raport 2006Документ156 страницRaport 2006Cristina RotariОценок пока нет

- Chapter 4Документ73 страницыChapter 4Queenie RanqueОценок пока нет

- Accounts Receivables QuestionsДокумент3 страницыAccounts Receivables QuestionsAlishba KhanОценок пока нет

- Cash Flow Excercise Questions-Set-2Документ2 страницыCash Flow Excercise Questions-Set-2AgAОценок пока нет

- RWJ Chapter 2 Financial Statements and Cash FlowsДокумент39 страницRWJ Chapter 2 Financial Statements and Cash FlowsAshekin MahadiОценок пока нет

- Name: Jean Rose T. Bustamante Bsma-3: Let's CheckДокумент10 страницName: Jean Rose T. Bustamante Bsma-3: Let's CheckJean Rose Tabagay BustamanteОценок пока нет

- T.L.E. IV: Accounting Elements AssetsДокумент5 страницT.L.E. IV: Accounting Elements AssetsMavic Escuadro LaraОценок пока нет

- Master Budget QuestionsДокумент19 страницMaster Budget QuestionsSwathi Ashok100% (2)

- Siemens Balance SheetДокумент4 страницыSiemens Balance SheetRutvik HОценок пока нет

- Dec 2012Документ49 страницDec 2012Saroj ShresthaОценок пока нет

- "Financial Statment Analysis": Dessrtion Report OnДокумент51 страница"Financial Statment Analysis": Dessrtion Report Onpunny27100% (1)

- Income Statement and Balance SheetДокумент8 страницIncome Statement and Balance SheetMyustafizzОценок пока нет

- InternshipДокумент3 страницыInternshipYASHASVI SHARMAОценок пока нет

- DocxДокумент17 страницDocxVy Pham Nguyen KhanhОценок пока нет

- Quiz 3Документ14 страницQuiz 3K L YEOОценок пока нет

- E5-4 Assessing Receivable and Inventory Turnover Aicpa AdaptedДокумент6 страницE5-4 Assessing Receivable and Inventory Turnover Aicpa AdaptedDylan AdrianОценок пока нет

- Company Performance - Comuicare in Afaceri in Limba EnglezaДокумент10 страницCompany Performance - Comuicare in Afaceri in Limba EnglezaMincu IulianОценок пока нет

- Financial Mangement-Midterm ExamДокумент12 страницFinancial Mangement-Midterm ExamChaeminОценок пока нет

- ZhulianДокумент98 страницZhulianJames WarrenОценок пока нет

- Tutorial 2 - Principles of Capital BudgetingДокумент3 страницыTutorial 2 - Principles of Capital Budgetingbrahim.safa2018Оценок пока нет

- Chapter I - INTERNAL Auditing: By: Dennis F. GabrielДокумент27 страницChapter I - INTERNAL Auditing: By: Dennis F. GabrielJasmine LeonardoОценок пока нет

- Project FinancingДокумент32 страницыProject FinancingJamie MorienОценок пока нет