Академический Документы

Профессиональный Документы

Культура Документы

Apollo Hospitals Enterprise LTD (Apollohosp) : Financial and Strategic SWOT Analysis Review

Загружено:

akumar4uОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Apollo Hospitals Enterprise LTD (Apollohosp) : Financial and Strategic SWOT Analysis Review

Загружено:

akumar4uАвторское право:

Доступные форматы

Apollo Hospitals Enterprise Ltd

(APOLLOHOSP)

Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Company Snapshot

Ali Towers III Floor, No.55, Greams Road Phone +91 44 28290956 Revenue 96,174.37 (million INR)

Chennai, Tamil Nadu Fax +91 44 28290956 Net Profit 2,360.46 (million INR)

www.apollohospitals.co

600006 Website Employees 54,698

m

APOLLOHOSP [National Pharmaceuticals &

India Exchange Industry

Stock Exchange of India] Healthcare

Company Overview

Apollo Hospitals Enterprise Ltd (Apollo Hospitals) is a healthcare service provider. It offers healthcare services, clinical and diagnostic

services, medical business process outsourcing, third party administration services and health insurance. The company also provides

services to support business, telemedicine services, education, training programs and research services and other non-profit projects.

Apollo Hospitals specializes in cardiology, orthopedics, spine, cancer care, gastroenterology, neurosciences, nephrology and urology,

critical care and preventive health care. Apart from India, it operates through hospitals in Dhaka, Mauritius and the UK.

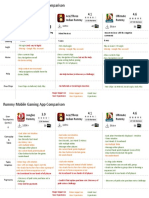

Key Executives SWOT Analysis

Name Title Apollo Hospitals Enterprise Ltd, SWOT Analysis

Prathap C. Reddy Chairman Strengths Weaknesses

Sangita Reddy Director

Business Performance : Capital Requirement

Suneeta Reddy Director Standalone Pharmacies (SAP)

Preetha Reddy Vice Chairperson

Operational Network

Vinayak Chatterjee Director

Source: Annual Report, Company Website, Primary and Secondary

Research, GlobalData Opportunities Threats

Share Data

Strategic Collaborations Dearth of Healthcare

Apollo Hospitals Enterprise Ltd

Professionals

Share Price (INR) as on 07-Feb- 1,663.15 Expansion Initiatives

2020 Competition

EPS (INR) 16.97

Market Cap (million INR) 231,386 Source: Annual Report, Company Website, Primary and Secondary Research,

GlobalData

Enterprise Value (million INR) 265,921

Shares Outstanding (million) 139

Source: Annual Report, Company Website, Primary and Secondary

Research, GlobalData

Financial Performance Recent Developments

Nov 13,2019 Maastricht partners with Apollo – Microsoft

Cardiac Global Data Consortium to expand AI

Network for cardiology in Europe

Oct 22,2019 Apollo Hospitals' unique initiative to provide

best treatment plan for cancer patients

May 15,2019 Apollo Proton Cancer Centre, Chennai performs

India's first total marrow irradiation procedure

Apr 24,2019 Apollo Hospitals, Chennai successfully

performed TAVR on an 82-year-old Ex-Army

Major General and helped him cast a vote in Lok

Sabha Elections

Source: Annual Report, Company Website, Primary and Secondary Research,

GlobalData

Source: Annual Report, Company Website, Primary and Secondary

Research, GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 2

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Table of Contents

Table of Contents............................................................................................................................................................................... 3

List of Tables.................................................................................................................................................................................. 5

List of Figures ................................................................................................................................................................................ 5

Section 1 - About the Company ......................................................................................................................................................... 6

Apollo Hospitals Enterprise Ltd - Key Facts........................................................................................................................................ 6

Apollo Hospitals Enterprise Ltd - Key Employees .............................................................................................................................. 7

Apollo Hospitals Enterprise Ltd - Key Employee Biographies ............................................................................................................ 8

Apollo Hospitals Enterprise Ltd - Major Products and Services......................................................................................................... 9

Apollo Hospitals Enterprise Ltd - History ......................................................................................................................................... 10

Apollo Hospitals Enterprise Ltd - Company Statement.................................................................................................................... 13

Apollo Hospitals Enterprise Ltd - Locations And Subsidiaries .......................................................................................................... 15

Head Office.................................................................................................................................................................................. 15

Other Locations & Subsidiaries ................................................................................................................................................... 15

Joint Venture ............................................................................................................................................................................... 17

Section 2 – Company Analysis.......................................................................................................................................................... 19

Company Overview .......................................................................................................................................................................... 19

Apollo Hospitals Enterprise Ltd - Corporate Strategy ...................................................................................................................... 20

Apollo Hospitals Enterprise Ltd - Business Description ................................................................................................................... 21

Business Segment: Healthcare Services ........................................................................................................................................... 22

Healthcare Services - Overview ....................................................................................................................................................... 22

Healthcare Services - Performance .................................................................................................................................................. 22

Healthcare Services - Key Stats ........................................................................................................................................................ 22

Apollo Hospitals Enterprise Ltd, Healthcare Services, Revenue Performance INR (m) .................................................................. 23

Business Segment: Other Segment .................................................................................................................................................. 24

Other Segment - Overview .............................................................................................................................................................. 24

Business Segment: Retail Pharmacy ................................................................................................................................................ 24

Retail Pharmacy - Overview ............................................................................................................................................................. 24

Retail Pharmacy - Performance ....................................................................................................................................................... 24

Retail Pharmacy - Key Stats.............................................................................................................................................................. 24

Apollo Hospitals Enterprise Ltd, Retail Pharmacy, Revenue Performance INR (m) ........................................................................ 25

Apollo Hospitals Enterprise Ltd - SWOT Analysis ............................................................................................................................. 26

SWOT Analysis - Overview ............................................................................................................................................................... 26

Apollo Hospitals Enterprise Ltd - Strengths ..................................................................................................................................... 26

Apollo Hospitals Enterprise Ltd - Weaknesses ................................................................................................................................. 27

Apollo Hospitals Enterprise Ltd - Opportunities .............................................................................................................................. 28

Apollo Hospitals Enterprise Ltd - Threats ........................................................................................................................................ 29

Apollo Hospitals Enterprise Ltd - Key Competitors .......................................................................................................................... 30

Section 3 – Company Financial Ratios ............................................................................................................................................. 31

Financial Ratios - Capital Market Ratios........................................................................................................................................... 31

Financial Ratios - Annual Ratios ....................................................................................................................................................... 32

Performance Chart ........................................................................................................................................................................... 35

Financial Performance ..................................................................................................................................................................... 35

Financial Ratios - Interim Ratios ...................................................................................................................................................... 36

Financial Ratios - Ratio Charts.......................................................................................................................................................... 37

Section 4 – Company’s Mergers & Acquisitions, Capital Raising and Alliances ............................................................................... 38

Apollo Hospitals Enterprise Ltd, Transactions by Year, 2014 to YTD 2020 ...................................................................................... 38

Apollo Hospitals Enterprise Ltd, Transactions by Type, 2014 to YTD 2020 ..................................................................................... 39

Apollo Hospitals Enterprise Ltd, Transactions by Region, 2014 to YTD 2020 .................................................................................. 40

Apollo Hospitals Enterprise Ltd, Recent Transactions Summary ..................................................................................................... 41

Acquisition ....................................................................................................................................................................................... 42

Apollo Hospitals Enterprise May Acquire 50% Stake in Apollo Gleneagles Hospitals from Parkway Pantai ................................... 42

Apollo Hospitals Acquires 51% stake in Assam Hospitals for USD9 Million ..................................................................................... 43

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 3

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Sanofi-Synthelabo Acquires 20% Stake in Apollo Sugar Clinics for USD14.6 Million ....................................................................... 44

Apollo Hospital Acquires Nova Specialty Hospitals.......................................................................................................................... 45

Netcare and Reliance Foundation May Acquire Sevenhills Healthcare ........................................................................................... 46

Asset Transactions ........................................................................................................................................................................... 48

Reliance Foundation May Acquire Seven Hills Hospital ................................................................................................................... 48

Apollo Hospitals May Acquire Assets of SevenHills Healthcare (SevenHills Hospital) ..................................................................... 50

Apollo Hospitals Plans to Acquire Healthcare Facility ..................................................................................................................... 51

Partnerships ..................................................................................................................................................................................... 52

Microsoft Intelligent Enters into Agreement with Apollo Hospitals ................................................................................................ 52

Apollo Hospitals Plans to Form Joint Venture with Sanofi............................................................................................................... 53

Section 5 – Company’s Recent Developments ................................................................................................................................ 54

Oct 22, 2019: Apollo Hospitals' unique initiative to provide best treatment plan for cancer patients ........................................... 54

May 15, 2019: Apollo Proton Cancer Centre, Chennai performs India's first total marrow irradiation procedure ........................ 55

Apr 24, 2019: Apollo Hospitals, Chennai successfully performed TAVR on an 82-year-old Ex-Army Major General and helped him

cast a vote in Lok Sabha Elections ................................................................................................................................................... 56

Mar 11, 2019: Apollo Hospitals Group and Zebra Medical Vision (Zebra-Med) collaborate to validate and deploy AI (artificial

intelligence) based screening tools across India .............................................................................................................................. 57

Feb 22, 2019: Apollo Hospitals, Chennai has successfully performed India's first minimally invasive Robotic Hybrid

Revascularisation surgery on a 63-year-old female patient ............................................................................................................ 58

Section 6 – Appendix ....................................................................................................................................................................... 59

Methodology ............................................................................................................................................................................... 59

Ratio Definitions .......................................................................................................................................................................... 59

About GlobalData ........................................................................................................................................................................ 63

Contact Us ................................................................................................................................................................................... 63

Disclaimer .................................................................................................................................................................................... 63

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 4

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

List of Tables

Apollo Hospitals Enterprise Ltd, Key Facts......................................................................................................................................... 6

Apollo Hospitals Enterprise Ltd, Key Employees................................................................................................................................ 7

Apollo Hospitals Enterprise Ltd, Key Employee Biographies ............................................................................................................. 8

Apollo Hospitals Enterprise Ltd, Major Products and Services .......................................................................................................... 9

Apollo Hospitals Enterprise Ltd, History .......................................................................................................................................... 10

Apollo Hospitals Enterprise Ltd, Other Locations ............................................................................................................................ 15

Apollo Hospitals Enterprise Ltd, Subsidiaries................................................................................................................................... 16

Apollo Hospitals Enterprise Ltd, Joint Venture ................................................................................................................................ 17

Apollo Hospitals Enterprise Ltd, Healthcare Services, Revenue Performance INR (m) .................................................................. 23

Apollo Hospitals Enterprise Ltd, Retail Pharmacy, Revenue Performance INR (m) ........................................................................ 25

Apollo Hospitals Enterprise Ltd, Key Competitors ........................................................................................................................... 30

Apollo Hospitals Enterprise Ltd, Ratios based on current share price ............................................................................................. 31

Apollo Hospitals Enterprise Ltd, Annual Ratios................................................................................................................................ 32

Apollo Hospitals Enterprise Ltd, Annual Ratios (Cont...1)................................................................................................................ 33

Apollo Hospitals Enterprise Ltd, Annual Ratios (Cont...2)................................................................................................................ 34

Apollo Hospitals Enterprise Ltd, Interim Ratios ............................................................................................................................... 36

Apollo Hospitals Enterprise Ltd, Transactions by Year, 2014 to YTD 2020 ...................................................................................... 38

Apollo Hospitals Enterprise Ltd, Transactions by Type, 2014 to YTD 2020 ..................................................................................... 39

Apollo Hospitals Enterprise Ltd, Transactions by Region, 2014 to YTD 2020 .................................................................................. 40

Apollo Hospitals Enterprise Ltd, Recent Transactions Summary ..................................................................................................... 41

Currency Codes ................................................................................................................................................................................ 59

Capital Market Ratios....................................................................................................................................................................... 59

Equity Ratios .................................................................................................................................................................................... 60

Profitability Ratios............................................................................................................................................................................ 60

Cost Ratios ....................................................................................................................................................................................... 61

Liquidity Ratios................................................................................................................................................................................. 61

Leverage Ratios ................................................................................................................................................................................ 62

Efficiency Ratios ............................................................................................................................................................................... 62

List of Figures

Apollo Hospitals Enterprise Ltd, Healthcare Services, Revenue Performance INR (m) .................................................................. 23

Apollo Hospitals Enterprise Ltd, Retail Pharmacy, Revenue Performance INR (m) ........................................................................ 25

Apollo Hospitals Enterprise Ltd, Performance Chart (2015 - 2019) ................................................................................................. 35

Apollo Hospitals Enterprise Ltd, Ratio Charts .................................................................................................................................. 37

Apollo Hospitals Enterprise Ltd, Transactions by Year, 2014 to YTD 2020 ...................................................................................... 38

Apollo Hospitals Enterprise Ltd, Transactions by Type, 2014 to YTD 2020 ..................................................................................... 39

Apollo Hospitals Enterprise Ltd, Transactions by Region, 2014 to YTD 2020 .................................................................................. 40

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 5

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Section 1 - About the Company

Apollo Hospitals Enterprise Ltd - Key Facts

Apollo Hospitals Enterprise Ltd, Key Facts

Corporate Address Ali Towers III Floor, No.55, Ticker Symbol, Exchange APOLLOHOSP [National Stock

Greams Road, Chennai, Tamil Exchange of India]

Nadu, 600006, India

Telephone +91 44 28290956 No. of Employees 54,698

Fax +91 44 28290956 Fiscal Year End March

URL www.apollohospitals.com Revenue (in USD Million) 1,408.8

Industry Pharmaceuticals and Revenue (in INR Million) 96,174.4

Healthcare, Retail, Wholesale &

Foodservice, Telecoms & IT

Locations Bangladesh, India, Mauritius, United Kingdom, United States

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 6

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Key Employees

Apollo Hospitals Enterprise Ltd, Key Employees

Name Job Title Board Level Since Age

Prathap C. Reddy Chairman Executive Board

Sangita Reddy Director, Joint Managing Director Executive Board

Suneeta Reddy Director, Managing Director Executive Board

Preetha Reddy Vice Chairperson Non Executive Board

Vinayak Chatterjee Director Non Executive Board

T. Rajgopal Director Non Executive Board

Murali Doraiswamy Director Non Executive Board

V. Kavitha Dutt Director Non Executive Board

Shobana Kamineni Executive Vice Chairperson Senior Management

Dattatreyudu Nori Director International Director, Senior Management 2019

Apollo Cancer Centres

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 7

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Key Employee Biographies

Apollo Hospitals Enterprise Ltd, Key Employee Biographies

Mr. Prathap C. Reddy is the Founder-Chairman of the company. He was the

Prathap C. Reddy

Chairman of the Confederation of Indian Industry's National Health Council and

Job Title: Chairman

advisor to its committees on Healthcare, Health Insurance, Public Health and

Pharma.

Board Level: Executive Board

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 8

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Major Products and Services

Apollo Hospitals is a healthcare service company. The company's key services include the following:

Apollo Hospitals Enterprise Ltd, Major Products and Services

Services:

Secondary and Tertiary Healthcare

Primary Care

Pharmacy Services

Consulting Services

Health Education

e-Learning

Clinical Research and Site Management

Health Insurance and TPA

Technology Services and Solutions

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 9

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - History

Apollo Hospitals Enterprise Ltd, History

2019 New Products/Services In September, Apollo Hospitals launched Apollo ProHealth, a predictive,

proactive and comprehensive health management program.

2019 Plans/Strategy In February, the company announced its plans to sell its entire holding of 41%

in Apollo Munich Health Insurance Co.

2018 Acquisitions/Mergers/Takeovers In July, the company acquired 50% stake in Medics International Lifesciences

Ltd.

2018 Contracts/Agreements In August, Apollo Hospitals entered into a collaboration with Medics Super

Speciality Hospital to form Uttar Pradesh's largest 330-bedded quaternary

care hospital, ApolloMedics at Lucknow.

2018 Contracts/Agreements In October, the company and Qfix partnered to open proton cancer centre in

Apollo Hospitals India.

2018 Corporate Changes/Expansions In October, Apollo Cradle opened a new pediatric intensive care unit in

Hyderabad, India, to provide intensive care for children with critically-ill

situation.

2017 Plans/Strategy In January, Apollo Hospital Muscat plans to open two super specialty clinics;

Paediatric Urology and Reproductive Medicine.

2016 Contracts/Agreements In May, India-based Apollo Hospitals and Canada's William Osler Health

System partnered together to improve the health and wellness of their

patients.

2016 Corporate Changes/Expansions In November, Apollo Hospitals, Navi Mumbai, opened Apollo Sugar, a Centre

of Excellence for diabetes and endocrine care.

2016 Plans/Strategy In April, Apollo Hospitals and global drug major Sanofi planned to open 30

clinics in five new cities this fiscal.

2015 Acquisitions/Mergers/Takeovers In January, Apollo Hospital acquired Nova Specialty Hospitals for a cash

consideration of INR135-145 crore.

2015 Contracts/Agreements In June, Apollo Hospitals entered into a definitive agreement to acquire 51%

stake in Assam Hospitals Ltd.

2015 Corporate Changes/Expansions In February, the hospital opened a new Apollo speciality hospitals in the IT

corridor of Chennai, India.

2015 Corporate Changes/Expansions In March, Apollo has launched its new hospital at Nellore.

2015 Plans/Strategy In April, Apollo announced its plans of providing proton therapy.

2015 Plans/Strategy In January, the company planned to raise around US$250 million in private

equity financing.

2015 Plans/Strategy In May, the company plans to acquire Healthcare Facility in India.

2014 Contracts/Agreements In July, the company entered into a partnership with Strand Center for

Genomics and Personalized Medicine, to launch of Strand's cutting-edge

clinical genomic tests across its hospital network.

2014 Contracts/Agreements In May, the company formed a joint venture with Saarum Innovations, and

launched the bio-bank.

2014 Contracts/Agreements In November, the company plans to launch 500 Apollo Sugar Clinics in India

and abroad by 2019to spread network of diabetes care program.

2014 Contracts/Agreements In November, the company signed an MoU with Fiji National University to

work together to develop healthcare in Fiji.

2014 Contracts/Agreements In September, the company entered into an agreement with AliveCor, to

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 10

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

tackle the growing problem of heart arrhythmias, by providing an innovative

mobile device to improve access to cardiac screening tools for patients across

India.

2014 Plans/Strategy In August, the company announced plans to expand in smaller towns and

cities of eastern region of India.

2014 Plans/Strategy In December, the company announced plans to construct a medical college

and hospital.

2014 Plans/Strategy In September, the company planned to open 12 more hospitals with a total

bed capacity of 2,175 beds in the country with an investment of INR2,032.7

crore in the next three years.

2014 Plans/Strategy In September, the company planned to open 3 more hospitals with a total

bed capacity of 500 beds in the country with an investment of INR400 crore

in this year.

2014 Plans/Strategy In September, the company plans to acquire pharmacy stores of Hetero Med

Solutions Ltdoperated in Hyderabad for approximately US$23.8 million.

2014 Plans/Strategy In September, the company plans to form a joint venture with Sanofi, to

provide diabetes care programmes under Apollo Sugar Clinics Ltd. (ASCL) in

India.

2013 Contracts/Agreements In October, the company entered into a partnership with Medtronic to

develop a cost-effective and efficient dialysis system in India.

2013 Divestiture In February, Apax Partners LLP, the UK based private equity company

divested 4.3% stake in Apollo Hospitals Enterprise Ltd.

2013 Plans/Strategy In June, IHH Healthcare Bhd announced plans to divest its stake in Apollo

Hospitals.

2012 Plans/Strategy The company announced to form a joint venture with Wal-Mart Stores, Inc,

Walgreen Drugs, and others to enhance its pharmacy business.

2011 Commercial Operation In February, Apollo Gleneagles Cancer Hospital Launched Eastern India's first

dedicated comprehensive Bone Marrow Transplant Unit.

2011 Commercial Operation In February, Apollo Hospital Chennai launched a special Sunshine Store - a

retailer shop catering to the needs of cancer patients.

2011 Contracts/Agreements In May, Apollo Hospitals launched specialist health services in Tanzania as per

the signing of a Memorandum of Understanding ( MoU ) between India and

Tanzania.

2011 New Product Approvals In July, the organization launched Apollo Day Surgery with a focus on

providing comprehensive healthcare services in Chennai.

2011 New Products/Services In January, Apollo Bramwell Hospital, Mauritius in conjunction with Global

Bio-health Solutions, launched the Stem Cell Therapy Program.

2011 New Products/Services In May, the organization launched multi-vessel beating heart coronary artery

bypass surgery, using Minimally Invasive Cardiac Surgery (MICS) technique in

Ludhiana.

2010 Contracts/Agreements In August, Apollo Hospitals, tied up with US based StemCyte to set up a stem

cell facility besides conducting research development activities at its

Hyderabad centre.

2010 Contracts/Agreements In January, Apollo Hospital and Maldives gonernment signed agreement to

manage the Indira Gandhi Memorial Hospital, Republic of Maldives.

2010 Contracts/Agreements In November, Apollo Hospitals and British Medical Journal Group a tie-up for

mobile health applications for patients and continuous medical education for

doctors and other professionals.

2010 Corporate Awards In December, Apollo Hospitals awarded with the Viewer’s Choice Award

which was announced byCNBC - TV18 and ICICI Health Insurance.

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 11

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

2010 Corporate Awards In January, Chairman Dr. Prathap Reddy awarded with the Padma Vibhushan

award by the Government of India, for his excellence and exceptional service

in the Healthcare industry in the country.

2010 Corporate Awards In November, Apollo Hospitals Group acheived Rank at top position as a best

hospitals in India, by The Week Magazine servey 2010.

2010 New Products/Services Apollo Hospitals Group launched 50th hospital at Secunderabad.

2010 New Products/Services In Suptember, Apollo Hospitals launched the first standalone dialysis centre

in Public Private Partnership with Central Government Health Scheme.

2009 Contracts/Agreements In January, company tied up with Quintiles Mauritius Holdings Inc, to set up a

phase I clinical trial research facility in Hyderabad.

2009 New Products/Services In December, Apollo Hospital launched The 'Apollo Knee Clinic' at Apollo

Hospitals Chennai.

2009 New Products/Services In Suptember, Apollo Hospitals Group introduced the most advanced

CyberKnife Robotic Radio Surgery System in Asia Pacific, the world's first and

only robotic radiosurgery system designed to treat tumors anywhere in the

body with sub-millimeter accuracy.

2008 Acquisitions/Mergers/Takeovers In November, company established joint venture with Medic Vision Limited

to setup medical and surgical skills training centres across India and other

countries.

2008 Spin-off In December, company sold a 49% stake in its pharmacy business to raise

INR6.50 billion, to be used to add hospital beds.

2007 Contracts/Agreements The company formed a joint venture with British American Investment

Company (Mauritius) Ltd to set up a multi-speciality hospital in Mauritius.

1979 Incorporation/Establishment Apollo Hospitals Enterprise Limited was established.

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 12

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Company Statement

A statement by Mr. Prathap C Reddy, the Chairman of Apollo Hospitals Group is given below. The statement has been taken from the

company's 2019 annual report.

Dear Shareholders,

At the outset, allow me to mark the 35-y ear milestone of Apollo Hospitals – a journey that began for me as a mission to bring top quality

equitable healthcare of international standards to Indians. Our commitment to that mission led by consistent and uncompromising standards

in clinical practices, quality measures, and patient centric care, has not only heralded the birth of an industry in the country, but has also

enabled us to set benchmarks in healthcare delivery as a whole. I am proud that Indian private healthcare is able to serve two-thirds of the

Indian population today as well as people from more than 120 countries seeking better healthcare options.

Apollo Hospitals Group is the only global institution with presence in every facet of the healthcare eco-system, encompassing curative health,

pharmacies, retail health, diagnostics, telehealth, home health, as well as preventive health and wellness, medical education and skill

development, not to mention health insurance and over 3,400 pharmacies. We have touched over 120 million people through our eco-system

led by our hallmark clinical excellence tendered with care, compassion and cost benefit – an achievement which no other private institution

can claim. Dr. HJ Morowitz, Professor at the Yale University, analyzed various parts of the body and its functions and pegged the value of its

creation at six trillion dollars. Such a priceless body needs strong guidance to protect its health and well-being.

I feel extremely privileged that in February this year, the Hon’ble Governor of Tamil Nadu, Shri Banwarilal Purohit, launched a Postal Stamp to

mark our pioneering efforts in the area of Preventive Healthcare in India. The Master Health Check which we pioneered is a great tool to help

people in the pursuit of wellness. It can pick up abnormal health parameters and help in early diagnosis of potential health problems. I am

happy to tell you that we have completed over 20 million health checks till date. Over the years, the Postal Department of India has honoured

us with four stamps to mark our achievements-something that no other hospital group in the world can claim.

Non Communicable Diseases or NCDs which include diabetes, cardiac, strokes, infections, and cancer, are soon going to become a major

challenge to the physical health and economic security of many lower and middle income people. I would like to add two recently recognized

conditions to this list—Obesity and Sleeplessness. The World Economic Forum has predicted that 75% of deaths by the end of this decade will

be from NCDs, creating a global cost burden of 30 trillion dollars. India’s share in this will be a staggering 4.8 trillion dollars; more than 50% of

the GDP. I call this a Tsunami. In our experience, we have realized that early detection is important and NCDs can be prevented or reversed.

But we need to take good care of our precious bodies. At Apollo, we have made it our Mission to carry the message of prevention and early

detection countrywide and overseas also.

In this regard we have launched ProHealth, a three-year health and wellness programme for our 60,000 plus members of the Apollo family

and their dependents, a total of 200,000 people. The programme facilitates early detection and healthy living through health guides, online

tools and call doctors. On completion of the program, I plan to send each one a cake to celebrate their health and happiness. I urge captains

of industries to extend this beneficial programme to all their employees so that the community as a whole can celebrate health and

happiness. I firmly believe when India takes the lead, the world will follow.

We have since inception, underpinned our clinical excellence with superior technology in every discipline, comparable to any hospital in the

world. Our most recent addition of the multi-room Proton Centre in Chennai will serve patients not just in India, but also from other countries

that do not have this facility. The credibility of the Apollo brand and the cost of treatment which is less than one-third of international prices,

attract many medical value travelers to our hospitals and our highly skilled team of medical, surgical, and radiation oncologists and physicists.

Our facilities are equipped with the latest technology to enable them in their diagnoses and treatments. This spirit pervades our 70 hospitals.

Our Cardiac Institutes have consistently produced outcomes on par with the best hospitals in the world. The Institutes have completed over

170,000 coronary bypass surgeries and are the single largest establishment for minimally invasive cardiac surgeries. We have completed over

50,000 CABGs just in Chennai.

We continue to focus on growing our Centers of Excellence, with a view to strengthening our leadership position in key specialties in all our

geographies. Neurosciences, Orthopaedics, Emergency and Critical Care are identified as COEs, in addition to Cardiac, Oncology and

Transplants. Our COE focus spans the entire spectrum of care, starting with the best talent, latest technology, cutting-edge protocols,

differentiated product and service portfolio, and benchmarked clinical outcomes.

We opened our 3400th pharmacy store this fiscal. The pharmacy business now contributes 39% to our topline. Our retail business has a

robust network of birthing centres, primary clinics, dental clinics, sugar clinics, dialysis centres and diagnostic labs; we remain the leading

retail healthcare provider in the country.

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 13

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

The Indian government made a landmark move to launch ‘Ayushman Bharat’ — the Universal Health Insurance scheme. This resonates with

my own personal sentiment that “health is a global right and a global duty”. Our PPPs in this regard stand testimony to our commitment to

bring affordable healthcare of superior standards to every fellow Indian. We have partnered with several state governments and leveraged

technology to improve access to healthcare for the under-served in remote rural areas of our country.

Through initiatives like TeleHealth and TeleMedicine, we are able to run diagnostics and provide specialized consultations for appropriate

treatments, creating innovative service delivery models for primary, secondary, and tertiary care.

We piloted our efforts in population health and well-being in Aragonda village, my birth place in Chittoor district (AP) in 2013 to fight the

onset of Non Communicable Diseases. The initiative, Total Health, provides “Holistic Health Care” for the community, starting from birth, into

childhood, adolescence, adulthood and in the later years of life. Today the program covers the whole of Thavanampalle Mandal with 170

hamlets and 60,000 people and the results are extraordinary. I am proud to announce that Apollo Hospitals in Aragonda has performed 150

Knee Replacement surgeries – the first hospital in India to do so in a remote village.

On the 24th of F ebruary, Shri Ram Nath Kovind, the Hon’ble President of India, inaugurated our Multi Specialty Hospital in Lucknow —

ApolloMedics. This marks our 70th Hospital with a capacity of 330 beds.

Our FY 19 results show YOY growth of 17% in Re venue with Healthcare Services contributing 55% and Standalone Pharmacies, 39%. Overall,

the EBITDA stood at INR10,637 mio, a YOY growth of 34%. I am pleased to announce a dividend of INR6 per share.

I am delighted to tell you that this year, we have received 44 awards and accolades in India and abroad, in recognition of our commitment

towards patient centricity, clinical excellence and innovation. We were also awarded the No 1 rank among Indian hospitals, for the 16th year

in a row by The Week magazine, a true testimony to our consistency in delivering superior quality healthcare to or patients.

The future of healthcare is dawning on us. A future in which the global health care systems will focus on keeping people well-not just curing

them when they are ill; where technology-enabled care will be available when and where people need it; where drugs and devices are

personalized and based on an individual’s needs; and where people understand the cost, value, and impact of their options for care. The use

of Artificial Intelligence in diagnostics, for example, genomic sequencing, is fast gaining ground. The opportunity for us to shape this future is

promising and rich. We have partnered with prominent global enterprises to create viable avenues to make healthcare delivery more efficient

and sophisticated, and to cater to the evolving needs of our patients.

The success of Apollo Hospitals has always been about teamwork. We want to place on record my sincere appreciation and gratitude for all

the hard work my Apollo family has put in to bring us to where we are today. We earnestly ask you to continue in that stride for I am

confident that together we can deliver value to all our stakeholders — patients, investors and the community we serve.

I personally place on record my appreciation for our Board Members and investors for the trust they have placed on us. I look forward to that

in the coming y ears as we move forward to achieve our goals.

Our steadfast goal is to bring down the huge burden of NCDs through our comprehensive preventive health programme. Always remember

that your body is priceless and it is your duty to maintain and preserve it, towards your Health and Happiness.

Stay Healthy and my warm personal regards to all of you.

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 14

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Locations And Subsidiaries

Head Office

Apollo Hospitals Enterprise Ltd

Ali Towers III Floor

No.55, Greams Road

Chennai

Tamil Nadu

600006

India

Tel: +91 44 28290956

Fax: +91 44 28290956

Other Locations & Subsidiaries

Apollo Hospitals Enterprise Ltd, Other Locations

Plot No: 251, Old Sainik School Road No.12, C P Ramaswamy Road

Alwarpet

Unit-15 Chennai

Bhubaneswar 600018

India

751005

Tel: +91 44 24672200

India

Tel: +91 674 6661016

154/11 Opposite IIM B Sherpur Chowk GT Road

Bannerghatta Road Ludhiana

Bangalore 141003

560076 India

India Tel: +91 161 5037777

Tel: +91 80 40304050 Fax: +91 161 5088568

Fax: +91 80 41463151

AB Road Aragonda Village

Near L.I.G Square Tavanampalli Mandal

Indore Chittoor

452008 517129

India India

Tel: +91 731 2549095 Tel: +91 8573 283221

Fax: +91 8573 283223

Hyderabad Road Waltair Main Road

Raichur Visakhapatnam

584102 530002

India India

Tel: +91 8532 236201 Tel: +91 891 2727272

Fax: +91 891 2560858

Seepat Road Plot: 81, Block: E, Bashundhara R/A

Bilaspur Dhaka

495001 1229

India Bangladesh

Tel: +91 7752 24830006 Tel: +880 2 9891661

Fax: +880 2 9896834

Adhichunchanagiri Road 32 Sassoon Road

Kuvempunagar Pune

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 15

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Mysore 411001

570023 India

India Tel: +91 20 26122551

Tel: +91 821 2568888 Fax: +91 20 26050866

Fax: +91 821 2460870

Lake View Road

K.K. Nagar

Madurai

625020

India

Tel: +91 452 2580892

Fax: +91 452 2580199

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

Apollo Hospitals Enterprise Ltd, Subsidiaries

Indraprastha Medical Corp Ltd Apollo Pharmaceuticals USA Inc

Suite 102

Sarita Vihar,, Delhi-Mathura Road 4400 PGA Blvd

New Delhi Palm Beach Gardens

FL

Delhi

33410

110076 United States

India Tel: +1 561 4699058

Fax: +1 561 7278943

Tel: +91 11 29872126

Url: apollopharmainc.com

Url: www.apollohospdelhi.com

CHL-Apollo Hospitals Ltd Unique Home Health Care Limited

AB Road, Near LIG Square 320 Anna Salai, Nandanam,

Indore Chennai

Madhya Pradesh Tamil Nadu

452008 600035

India India

Tel: +91 731 2549090 Fax: +91 24341750

Fax: +91 731 2549095

Url: www.chl-apollo.com

Ab Medical Centres Limited Samudra Healthcare Enterprises Limited

Chennai 13 - 1 - 3, Main Road

Tamil Nadu Kakinada

India Andhra Pradesh

India

Tel: +91 0884 2345900

Apollo Hospital (UK) Limited Apollo Health and Lifestyle Limited

First floor, karkland House 1-10-60/62, 5Th Floor

11-15 PETERBOROUGH ROAD Ashoka Raghupati Chambers

HARROW Hyderabad

ENG Telangana

United Kingdom 500016

India

Alliance Medicorp (India) Limited Nova Specialty Hospitals

India R-2, Nehru Enclave, Near Okhla Flyover on the Outer Ring road,

South

New Delhi

Delhi

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 16

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

110019

India

Tel: +91 11 66297500

Fax: +91 11 66297600

Apollo Specialty Cancer Hospital Pinakini Hospitals Limited

New No:6 India

Cenotaph Road

Chennai

Tamil Nadu

600035

India

Url: www.apollohospitals.com

Apollo Cosmetic Surgical Centre Private Limited ISIS HealthCare India Private Limited

India India

Mera HealthCare Private Limited Western Hospitals Corporation Pvt. Limited

India India

Indraprastha Apollo Hospitals Apollo Cosmetic Surgical Centre

Delhi Mathura Road India

New Delhi

Delhi

110076

India

Tel: +91 11 26925858

Url: delhi.apollohospitals.com

Imperial Hospitals & Research Samudra Health Care Enterprise Limited

India India

SPS Apollo Hospital Apollo Hospitals Bilaspur

Sherpur Chowk Seepat Road

G.T. Road

Ludhiana Bilaspur

Punjab Chhattisgarh

141003 495006

India India

Tel: +91 161 6617111 Tel: +91 7752 24830006

Fax: +91 161 6617171 Url: www.apollohospitals.com

Url: www.spsapollo.com

Assam Hospitals Ltd Imperial Hospital and Research Centre Ltd

Lotus Tower, G S Road Shastri Nagar

Guwahati Jaipur

Assam Rajasthan

781005 302016

India India

Tel: +91 0361 2347700 Tel: +91 0149 4246733

Fax: +91 0149 4246736

Url: www.nissinkogyo.co.jp

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

Joint Venture

Apollo Hospitals Enterprise Ltd, Joint Venture

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 17

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

StemCyte India Therapeutics Pvt Ltd Apollo Hospitals International Ltd

Plot No.1 A, Bhat GIDC Estate

Ahmedabad

Gujarat Gandhinagar

Gujarat

India

382428

India

Tel: +91 79 66701800

Fax: +91 79 66701843

Url: apolloahd.com

Apollo Gleneagles Hospitals Ltd

58, Canal Circular Road

Kolkata

West Bengal

Alliance Dental Care Private Limited

700054

India

India

Tel: +91 33 23203040

Fax: +91 33 23205184

Url: www.apollohospitals.com

Apollo Munich Health Insurance Co Ltd

1st Floor, SCF-19

Sector-14

Gurugram

Apollo Gleneagles PET-CT Private Limited Haryana

India 122001

India

Tel: +91 124 4584333

Fax: +91 124 4584111

Url: www.apollomunichinsurance.com

Sapien Biosciences

Hyderabad

Apollo Lavasa Health Corporation Limited

Telangana

India

India

Url: sapienbio.com

"Qunitiles Phase One Clinical Trials India Western Hospital Corporation Limited

India India

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 18

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Section 2 – Company Analysis

Company Overview

Apollo Hospitals Enterprise Ltd (Apollo Hospitals) is a healthcare service provider. It offers healthcare services, clinical and diagnostic services,

medical business process outsourcing, third party administration services and health insurance. The company also provides services to

support business, telemedicine services, education, training programs and research services and other non-profit projects. Apollo Hospitals

specializes in cardiology, orthopedics, spine, cancer care, gastroenterology, neurosciences, nephrology and urology, critical care and

preventive health care. Apart from India, it operates through hospitals in Dhaka, Mauritius and the UK. Apollo Hospitals is headquartered in

Chennai, Tamil Nadu, India.

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 19

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Corporate Strategy

Apollo Hospitals is a leading healthcare services provider in India, catering to the primary, secondary and tertiary health requirements of

individuals. The company also offers services in its interrelated businesses of retail pharmacies, clinical and diagnostic services, medical BPO

services, health insurance services and third party administrator services. The company’s strategic intent focuses on maintaining its leading

position in the Indian healthcare market domain by leveraging on its clinical and technological excellence, care, compassion & commitment,

and cost benefits.

The company’s key strategic priorities includes strengthening its presence in its key strategic markets (Chennai, Hyderabad, Delhi, Kolkata,

Ahmedabad, Mumbai and Bangalore), expansion of owned hospitals, with a plan to increase its beds; focus on Apollo REACH initiative, to

address the growth markets in Tier II and Tier III cities.

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 20

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Business Description

Apollo Hospitals Enterprise Ltd (Apollo Hospitals) provides end-to-end services to patients. As of March 31, 2019 the company operated a

network of hospitals with 12,000 beds across 71 locations, 3,428 pharmacies, 240 primary care and diagnostics clinics and over 110

telemedicine units.

The company classifies its services under two reportable segments, namely, Healthcare Services and Retail Pharmacy.

The company conducts research activities in the areas of investigation of disease pathogenesis, therapeutic trials, and discovery-oriented

basic science.

The company has hospitals in Ahmedabad; Bengaluru; Chennai; Delhi; Hyderabad; Kolkata; Aragonda; Bacheli; Bellary; Bhubaneshwar;

Bilaspur; Goa; Kakinada; Karur; Lavasa; Ludhiana; Madurai; Mysore; Pune; Ranchi; Ranipet; Tiruvannamalai; Trichy and Visakhapatnam. It also

extends its international presence through hospitals in Dhaka and Mauritius.

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 21

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Business Segment: Healthcare Services

Healthcare Services - Overview

Provides primary, secondary and tertiary care services for the treatment of acute and chronic diseases.

- Apollo Hospitals established Centers of Excellence in its key focus areas of cardiology, oncology, neurology, gastroenterology, organ

transplantation, emergency, nephrology and urology, spine surgery, preventive medicine and critical care.

- The segment also has healthcare facilities under its Apollo REACH initiative to provide healthcare services in Tier-II and Tier-III cities.

Apollo Reach Hospitals are available in Karaikudi and Karimnagar.

The segment aims to strengthen its presence in key strategic markets by focusing on geographic expansion through setting up hospitals in Tier

II and in Tier III cities; increasing patient touch points; focus on a portfolio of high value clinical specialties and life enhancing procedures and

elective surgeries.

Healthcare Services - Performance

Reported revenue of INR44,514.1 million for FY2019, which grew 13.7% YoY (2019 vs 2018). The segment accounted for 53.4% of the

company's revenue in FY2019.

Healthcare Services - Key Stats

No. of Beds: 12,000

No. of Hospitals: 71

- 9,233 beds located in 65 owned hospitals

- 185 beds in 12 cradles centers

- 934 beds are in 5 managed hospitals

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 22

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd, Healthcare Services, Revenue Performance INR (m)

Apollo Hospitals Enterprise Ltd, Healthcare Services, Revenue Performance INR (m)

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

Apollo Hospitals Enterprise Ltd, Healthcare Services, Revenue Performance INR (m)

Year Revenue

2016 32,667.51

2017 35,165.25

2018 39,147.85

2019 44,514.12

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 23

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Business Segment: Other Segment

Other Segment - Overview

Provides consulting services (pre-commissioning consultancy services, feasibility studies and infrastructure consultation); medical business

process outsourcing; clinical research & site management; e-Learning; health education; technology services and solutions; health insurance

and third party administration services.

Business Segment: Retail Pharmacy

Retail Pharmacy - Overview

Provides retail pharmacy services, by offering medicines, hospital consumables, surgical and health products, and general over the counter

products.

Retail Pharmacy - Performance

Reported revenue of INR38,860.4 million for FY2019, which grew 18.9% YoY (2019 vs 2018). The segment accounted for 46.6% of the

company's revenue in FY2019.

Retail Pharmacy - Key Stats

No. of Pharmacies: 3,428

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 24

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd, Retail Pharmacy, Revenue Performance INR (m)

Apollo Hospitals Enterprise Ltd, Retail Pharmacy, Revenue Performance INR (m)

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

Apollo Hospitals Enterprise Ltd, Retail Pharmacy, Revenue Performance INR (m)

Year Revenue

2016 23,219.71

2017 27,852.45

2018 32,688.75

2019 38,860.38

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 25

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - SWOT Analysis

SWOT Analysis - Overview

Apollo Hospitals Enterprise Ltd (Apollo Hospitals) is a healthcare services provider in India, catering to the primary, secondary and tertiary

health requirements of individuals. The company leverages its extensive range of services and its widespread operational network to fuel its

business growth. However, intense competitive factors in the industry and the dearth of healthcare professionals could affect its growth

prospects in the long run.

Apollo Hospitals Enterprise Ltd - Strengths

Strength - Business Performance : Standalone Pharmacies (SAP)

Apollo Hospitals has built and sustained a strong leadership brand position over 35 years of its existence. The company is India’s foremost

integrated healthcare provider. This position is due to the pioneering spirit and its effort to be at the cutting edge of clinical protocols and

technology. Apollo Hospitals has taken the initiative to bring many Firsts to India, including First MRI, First PET CT, First Proton Therapy among

others thereby ensuring that Indian patients have accessibility to world-class healthcare. The reputation and trust built by the company is a

strong asset, and continues to help the company attract large numbers of patients, as well as the talented clinicians and staff.

Strength - Operational Network

The company maintains an extensive network of hospitals and healthcare facilities, and pharmacies to across India to tap the immense market

potential in the healthcare domain. The company provides healthcare services, catering to the primary, secondary and tertiary health

requirements of individuals. As of March 31, 2019, the company had about 10,167 beds across 70 locations, 3,428 pharmacies and more than

110 telemedicine units. It also offers health insurance services and global consultancy projects. It operates academic institutions and a

Research Foundation with a focus on global clinical trials, epidemiological studies, stem-cell and genetic research. Six of the company’s

hospitals hold accreditations from the Joint Commission International, USA (JCI) and 14 hospitals hold certification from National

Accreditation Board for Hospitals and Healthcare Providers (NABH). The company operates hospitals in various locations across India including

Ahmedabad; Bengaluru; Chennai; Delhi; Hyderabad; Kolkata; Aragonda; Bacheli; Bellary; Bhubaneshwar; Bilaspur; Goa; Kakinada; Karur;

Lavasa; Ludhiana; Madurai; Mysore; Pune; Ranchi; Ranipet; Tiruvannamalai; Trichy and Visakhapatnam. It also extends its international

presence through hospitals in Dhaka and Mauritius. The company also established hospitals under its Apollo Reach initiative to provide

affordable healthcare services and medical facilities to semi-urban and rural. As a part of this initiative the company constructed hospitals in

Kakinada, Karimnagar, Bhubaneswar, Karaikudi, Madurai, Karur, Vanagaram, Trichy, Nellore and Nashik.

Strength - Integrated Business Model

The company offers integrated healthcare services in every possible healthcare delivery format. It plays a key role in providing quality service

at different touch points and fulfills every patient’s basic healthcare requirement. It ensures that the patient receives the highest possible

quality of care so as to halt the increasing complexity of the ailment at the earliest possible opportunity. The integrated offering enables the

company to handle the patient care processes in multiple stages resulting in better outcomes. This also results in an enhanced value

proposition both for the patient as well as the service provider. Apollo Hospitals has been the frontrunner in adopting new technology for the

medical procedures. It invests in cutting edge technology to enhance treatment procedures, reduce recovery time and enhance healthcare

outcomes.

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 26

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Weaknesses

Weakness - Capital Requirement

The healthcare sector is highly capital-intensive due to high costs of land and building, construction costs for interiors, regularly upgrading

medical equipment and for obtaining various licenses & approvals costs, which creates a significant barrier to entry and expansion. In addition

to this, maintenance of healthcare equipment also requires considerable expenditure and significant resources are expended on skilled

manpower which includes doctors, nurses, lab technicians, radiographers and therapists. This increases the basic cost of setting up and

running a hospital with a corresponding increase in break-even levels which stretches economic viability.

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 27

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Opportunities

Opportunity - Strategic Collaborations

The company entered into strategic agreements to improve its market presence and operational performance. In July 2019, Apollo Hospitals

in collaboration with Samsung India Electronics has launched Samsung-Apollo Mobile Clinic to provide access to quality, preventive healthcare

against growing non-communicable diseases to the less privileged. With this, the organisations aim to leverage technology to ensure that

citizens in rural areas have access to healthcare when in need. In June 2019, Apollo Hospitals signed an agreement with Nirali Memorial

Medical Trust (NMMT) for the operation and management of first multispecialty hospital in Navsari, Gujarat. The setting up of multispeciality

hospital is a step ahead in the direction of extending affordable healthcare to all.

Opportunity - Expansion Initiatives

The company focuses on the expansion of its business operations through new facilities. In September 2019, Apollo Hospitals Group launched

Apollo ProHealth Program, a first-of-its-kind, predictive, proactive and comprehensive health management program powered by pHRA

(personalised Health Risk Assessment), enabled by Artificial Intelligence. ProHealth empowers individuals & businesses with actionable health

analytics, to know & eradicate health risks, thereby enabling them to lead healthier & happier lives. The program brings technology & human

elements together by providing a personal Health Mentor to guide each individual to stay focused on health track and gain better health.

Opportunity - Medical Tourism in India

The company can leverage the emerging growth opportunities related to the emerging field of medical tourism in India. The medical tourism

domain in India is among the emerging segment in the country’s healthcare sector, as this domain is receiving boost mainly due to the high

treatment cost in the development nations (mainly the US and the UK), which are driving patients towards more cost effective treatment

destinations such as India. In addition, the domain is also receiving a boost due to the emergence of recognized private sector players, well

trained healthcare staff, diagnostic conveniences, and others. In addition, the Indian private healthcare services providers holds expertise in

advanced treatments such as cardiology, joint replacement, orthopedic surgery, gastroenterology, ophthalmology, transplants and urology.

Apollo Health City received International recognition for excellence in customer service, by winning the prestigious “International Medical

Tourism Award”.

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 28

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Threats

Threat - Dearth of Healthcare Professionals

The country is facing a shortage related to the trained healthcare professionals in the healthcare services domain, and as a major private

player in the domain Apollo is no exception to that. According to the World Health Organization’s (WHO) Heath Statistics, the country

maintains one of the largest medical workforces with almost 660,000 doctors and over 1.3 million nursing force, there is still a shortage of

professionals in the industry. The figures revealed that, the country’s ratio of physicians per 10,000 individuals is six compared to a global

median of 14, and the ratio of nursing and midwifery professionals per 10,000 individuals stands at 13, compared to the global median of 29.

The government of India has taken various initiatives to address issues such as relation of regulations and permission to private players to set

up educational institutions; however these are not enough to cater to the high demand.

Threat - Competition

The company operates in a highly competitive healthcare services domain in India and faces stiff competition from various public and private

players. In the large private hospital market the main competition for the organization is from India based hospital chains, which are

effectively and efficiently managed in terms of area coverage, common resources and networks, economies of scale, patient referrals, and

widely recognized brands. Few of the major competitors of the group include CARE Hospitals, FORTIS Hospitals, MAX Healthcare, and Sterling

hospital group. In addition, continuous development of medium sized hospitals, and specialized centers or disease specific centers also poses

significant competition to the company. Furthermore, the organization directly or indirectly competes with other major healthcare

organizations including preferred provider organizations (PPOs), independent practitioner associations (IPAs), TPAs, multi-disciplinary medical

groups, and other specialty healthcare and managed care services providers. In addition, due to the emergence of the healthcare sector of

India and the ample of opportunities in the market could drive multinational healthcare chains to foray in the Indian market, and poses

significant threat for the company in terms of competition. The entry of or expansion by any of these competitors could increase the

competitive pressure on the company and limit its ability to maintain or increase its price levels. The competitors of the company may have

greater experience, operational capabilities, marketing, financial, and managerial resources, and can pose a substantial threat to the

company’s business in the long run.

Threat - Industry Regulations

The company operates in the healthcare industry, and has to comply with various governmental regulations. In the domestic market of India

the company has to comply with the regulatory requirements of the Medical Council of India, and other related bodies. All the healthcare

facilities should meet these regulation requirements and inspection laws to be certified as a healthcare facility and qualified to participate in

government health programs. These requirements relate to the adequacy of medical care, personnel, equipment, operating policies and

procedures, hospital use, maintenance of adequate records, rate-setting, environmental protection laws and compliance with building codes.

If the organization fails to comply with applicable laws and regulations, it is subject to penalties and civil sanctions, and the hospital can lose

its licenses and also lose the ability to participate in the programs. The existing government regulations could change, which will result in

changes in the facilities, personnel, equipment, and services. The federal, state, and local authorities may inspect the hospitals to determine

compliance with applicable regulations and requirements necessary for licensing and certification. Failure to comply with these industry

regulations could result in uneven effect on the business.

NOTE:

* Sector average represents top companies within the specified sector

The above strategic analysis is based on in-house research and reflects the publishers opinion only

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 29

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Apollo Hospitals Enterprise Ltd - Key Competitors

Apollo Hospitals Enterprise Ltd, Key Competitors

Name Headquarters Revenue (US$ m)

Amrita Institute of Medical Sciences and Research India

Centre

Care Hospitals India

Fortis Healthcare Ltd India 668

Image Hospitals India

Sterling Hospitals Ltd India

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 30

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Section 3 – Company Financial Ratios

Financial Ratios - Capital Market Ratios

Apollo Hospitals Enterprise Ltd, Ratios based on current share price

Key Ratios 07-Feb-2020

P/E (Price/Earnings) Ratio 98.03

EV/EBITDA (Enterprise Value/Earnings Before Interest, Taxes, Depreciation and Amortization) 24.78

Enterprise Value/Sales 2.76

Enterprise Value/Operating Profit 39.26

Enterprise Value/Total Assets 2.90

Dividend Yield 0.36

Note: Above ratios are based on share price as of 07-Feb-2020, the above ratios are absolute numbers

Source: Annual Report, Company Website, Primary and Secondary Research GlobalData

© GlobalData 2020. This product is licensed and is not to be photocopied. Page 31

Apollo Hospitals Enterprise Ltd (APOLLOHOSP) - Financial and Strategic SWOT Analysis Review

Report Code: GDPH34828FSA

Published: February 2020

Financial Ratios - Annual Ratios

Apollo Hospitals Enterprise Ltd, Annual Ratios

Key Ratios Unit/Currency 2015 2016 2017 2018 2019

Equity Ratios

EPS (Earnings per Share) INR 24.43 16.99 15.88 8.44 16.97

Dividend per Share INR 5.75 6 6 5 6

Dividend Cover Absolute 4.25 2.83 2.65 1.69 2.83

Book Value per Share INR 236.02 239.43 238.15 233.71 239.60

Cash Value per Share INR -0.16

Profitability Ratios

Gross Margin % 50.16 50.84 50.40 51.08 51.54

Operating Margin % 10.43 7.36 5.88 5.40 7.04

Net Profit Margin % 6.56 3.80 3.05 1.42 2.45

Profit Markup % 100.62 103.44 101.61 104.42 106.34