Академический Документы

Профессиональный Документы

Культура Документы

MUMBAI: The Reserve Bank of India (RBI) On Friday Made Temporary Changes

Загружено:

Vbs Reddy0 оценок0% нашли этот документ полезным (0 голосов)

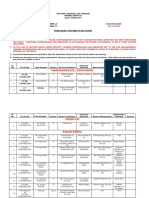

28 просмотров2 страницыThe Reserve Bank of India made temporary changes to its asset classification norms to offer relief to borrowers during the coronavirus pandemic. It said the non-performing asset classification period would exclude the three-month loan moratorium period, effectively changing the NPA recognition period to 180 days from 90 days. Additionally, banks will have to maintain higher provisioning of 10% on all accounts under the moratorium, spread over two quarters, to ensure adequate buffers against future asset quality issues. The RBI also extended the deadline for resolution of stressed assets by 90 days to give banks extra time amid current volatility.

Исходное описание:

Оригинальное название

NEW NPA NORMS

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe Reserve Bank of India made temporary changes to its asset classification norms to offer relief to borrowers during the coronavirus pandemic. It said the non-performing asset classification period would exclude the three-month loan moratorium period, effectively changing the NPA recognition period to 180 days from 90 days. Additionally, banks will have to maintain higher provisioning of 10% on all accounts under the moratorium, spread over two quarters, to ensure adequate buffers against future asset quality issues. The RBI also extended the deadline for resolution of stressed assets by 90 days to give banks extra time amid current volatility.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров2 страницыMUMBAI: The Reserve Bank of India (RBI) On Friday Made Temporary Changes

Загружено:

Vbs ReddyThe Reserve Bank of India made temporary changes to its asset classification norms to offer relief to borrowers during the coronavirus pandemic. It said the non-performing asset classification period would exclude the three-month loan moratorium period, effectively changing the NPA recognition period to 180 days from 90 days. Additionally, banks will have to maintain higher provisioning of 10% on all accounts under the moratorium, spread over two quarters, to ensure adequate buffers against future asset quality issues. The RBI also extended the deadline for resolution of stressed assets by 90 days to give banks extra time amid current volatility.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Borrowers to skip NPA tag even as banks set aside more provisions

Updated: 17 Apr 2020, 04:48 PM IST

• The non-performing asset classification norm would exclude the three-month

moratorium period, the RBI governor said

• Banks classify accounts as standard, substandard and doubtful, based on the

number of days their payments are delayed

MUMBAI : The Reserve Bank of India (RBI) on Friday made temporary changes

to its asset classification norms in a balancing act between offering reprieve to

borrowers and ensuring adequate risk buffers for banks.

Addressing media over a video-conference, RBI governor Shaktikanta Das said

that the non-performing asset (NPA) classification norm would exclude the three-

month moratorium period, for those borrowers who have availed of it. This

effectively changes the NPA recognition period for such loans to 180 days from

due date, instead of the extant norm of 90 days.

“There will be an asset classification standstill for all such accounts from 1 March

to 31 May 2020," Das said. On 27 March, the RBI had permitted lenders to give a

3-month moratorium beginning 1 March to borrowers owing to difficulties faced

during the coronavirus pandemic.

Banks classify accounts as standard, substandard and doubtful, based on the

number of days their payments are delayed. Borrowers turn non-performing only

after 90 days of overdue and are classified as standard prior to that,

notwithstanding any delay in repayments.

“It is recognized that the onset of covid-19 has also exacerbated the challenges for

such borrowers even to honour their commitments fallen due on or before 29

February, 2020 in standard accounts," said Das.

According to a senior banker from State Bank of India (SBI), the mention of 29

February in the speech has created some speculation whether the moratorium or

the standstill clause could be applicable to borrowers stressed even before 1 March.

The central bank had earlier rejected bankers’ request to allow some leeway to

borrowers stressed before the cut-off date of 1 March.

Moreover, to ensure that the banking system has sufficient buffers against future

asset quality woes, the central bank has mandated additional provisions on all these

moratorium accounts.

“With the objectives that banks maintain sufficient buffers and remain adequately

provisioned to meet future challenges they will have to maintain a higher provision

of 10% on all such accounts under the standstill spread over two quarters, March

2020 and June 2020. These provisions can be adjusted later on against the

provisioning requirements for actual slippage in such accounts," said Das.

Under RBI’s guidelines, banks have to set aside funds as provisions for each loan

they disburse and the amount increases with deteriorating asset quality. The

provision for standard loans ranges between 0.25-1% of the loan and bad loan

provisions start at 15% and can reach up to 100% as it progressively deteriorates.

Das said that NBFCs also have the flexibility to use this dispensation but should

have board-approved guidelines and adhere to advisories of the Institute of

Chartered Accountants of India (ICAI).

Industry experts believe that the proposal for 10% additional provisions on the

accounts under the standstill agreement will significantly increase the credit

provisions for the banks.

“With an estimate of 3-4% of the bank credit being in overdue category of special

mention account 1 (SMA 1) and SMA2, which currently requires provision of only

0.4%, the provisioning requirements of banks can increase by ₹30,000-40,000

crore because of the proposed regulations," said Karthik Srinivasan, group head of

financial sector ratings at ratings agency ICRA.

RBI’s decision to extend the deadline for resolution of stressed assets under its 7

June, 2019,circular has also come as a sigh of relief to bankers staring at huge

provisions in the March quarter. Under RBI’s prudential framework for resolution

of stressed assets -- dated June 7, 2019 -- unresolved stressed assets will attract

extra provision of 20% if not resolved with 210 days of the circular. This meant

that banks need to set aside more provisions in the March quarter for unresolved

stressed assets.

“Recognizing the challenges to resolution of stressed assets in the current volatile

environment, it has been decided that the period for resolution plan shall be

extended by 90 days," it said, which should provide banks with some extra

breathing space.

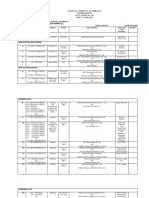

Вам также может понравиться

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)От EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Оценок пока нет

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsОт EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsОценок пока нет

- Key Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020Документ9 страницKey Highlights of 7 Bi-Monthly Monetary Policy 2019-20: IIBF Vision April 2020go4ibibo 15Оценок пока нет

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingДокумент16 страницU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseОценок пока нет

- MSME Business As UnusualДокумент6 страницMSME Business As UnusualPD SankaranarayananОценок пока нет

- Addendum To Bank Audit Guidance NoteДокумент6 страницAddendum To Bank Audit Guidance Notebrat6Оценок пока нет

- CAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020Документ15 страницCAIIB - Advanced Bank Management RBI and Gazette Notifications During The Period 1st January 2020 To 30th June 2020SATISHОценок пока нет

- May 2021Документ10 страницMay 2021Ravi Shankar VermaОценок пока нет

- RBI's Covid-19 Booster Shot: Is It Enough To Rescue Indian Economy From Coronavirus Strike?Документ5 страницRBI's Covid-19 Booster Shot: Is It Enough To Rescue Indian Economy From Coronavirus Strike?KBC KGFОценок пока нет

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingДокумент10 страницU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseОценок пока нет

- COVID19 RegulatorypackageДокумент4 страницыCOVID19 Regulatorypackagevikas bhanvraОценок пока нет

- RBI Issues Circular On NPAsДокумент2 страницыRBI Issues Circular On NPAsshreeya salunkeОценок пока нет

- Changes in Norms Under Shakti Kantha DasДокумент2 страницыChanges in Norms Under Shakti Kantha DasSai Dinesh BilleОценок пока нет

- Bajaj Moratorium Policy v1Документ5 страницBajaj Moratorium Policy v1Vilas_123Оценок пока нет

- COVID19 RegulatorypackageДокумент5 страницCOVID19 RegulatorypackagedebasishОценок пока нет

- End of Loan MoratoriumДокумент1 страницаEnd of Loan MoratoriumNeeraj GargОценок пока нет

- Banking NewsДокумент22 страницыBanking Newsyerra likhitaОценок пока нет

- Bajaj Finance Limited: Moratorium PolicyДокумент5 страницBajaj Finance Limited: Moratorium PolicyhariveerОценок пока нет

- Finance ProjectДокумент13 страницFinance ProjectDarshan DubeОценок пока нет

- Roll No. 286, 378 - Assignment 2Документ5 страницRoll No. 286, 378 - Assignment 2Kathiravan RajendranОценок пока нет

- IIBF Vision February 2016 For WebДокумент8 страницIIBF Vision February 2016 For WebparulvrmОценок пока нет

- Moratorium Clix Capital Services Pvt. Ltd.Документ7 страницMoratorium Clix Capital Services Pvt. Ltd.YogeshОценок пока нет

- CSB Ias Academy: D E M YДокумент2 страницыCSB Ias Academy: D E M Yshinyraj32Оценок пока нет

- Clarification of Regulatory Relief PDFДокумент2 страницыClarification of Regulatory Relief PDFBhavani BhushanОценок пока нет

- Banks Policy On Covid Related Reschedulement of Dues PDFДокумент6 страницBanks Policy On Covid Related Reschedulement of Dues PDFYuva KonapalliОценок пока нет

- What Is The Policy Action Taken by RBI To Counter The Impact of Covid 19 Pandemic?Документ2 страницыWhat Is The Policy Action Taken by RBI To Counter The Impact of Covid 19 Pandemic?nickcrokОценок пока нет

- Tvs Credit Policy On Emi MoratoriumДокумент4 страницыTvs Credit Policy On Emi MoratoriumKumarОценок пока нет

- RBI Master CircularДокумент42 страницыRBI Master CircularDeep Singh PariharОценок пока нет

- Further Regulatory Measures Announced by Rbi: COVID-19Документ4 страницыFurther Regulatory Measures Announced by Rbi: COVID-19Vbs ReddyОценок пока нет

- Monthly News Letter 01.12.10 To 31.12.10Документ6 страницMonthly News Letter 01.12.10 To 31.12.10poojaapandeyОценок пока нет

- Beepedia Monthly Current Affairs (Beepedia) April 2023 PDFДокумент134 страницыBeepedia Monthly Current Affairs (Beepedia) April 2023 PDFSAI CHARAN VОценок пока нет

- Assetclassification PDFДокумент3 страницыAssetclassification PDFKotteswari RajamanickamОценок пока нет

- CCP Rbi Jul-Dec'23Документ21 страницаCCP Rbi Jul-Dec'23RaviTuduОценок пока нет

- Monthly Bee Pedia November 8437Документ119 страницMonthly Bee Pedia November 8437Vikin JainОценок пока нет

- COVID19 Regulatory Package - Asset Classification and ProvisioningДокумент3 страницыCOVID19 Regulatory Package - Asset Classification and ProvisioningChinmoy BaruahОценок пока нет

- Rbi MoratoriumДокумент6 страницRbi Moratoriumunwantedaccountno1Оценок пока нет

- Sample Phase I Ga NotesДокумент8 страницSample Phase I Ga NotesSAI CHARAN VОценок пока нет

- Cbi So Model Paper 2022Документ37 страницCbi So Model Paper 2022himanshu agrawalОценок пока нет

- Recent Important Changes in Banking and Finance Affairs PDFДокумент9 страницRecent Important Changes in Banking and Finance Affairs PDFchiranjeev beheraОценок пока нет

- Oscb Banking Assistant Previous Paper With Solutions PDFДокумент62 страницыOscb Banking Assistant Previous Paper With Solutions PDFRupeshОценок пока нет

- Anant Raj V Yes BankДокумент10 страницAnant Raj V Yes BankRishi SehgalОценок пока нет

- Loans On Debit Cards To Be Governed by Digital Lending GuidelinesДокумент1 страницаLoans On Debit Cards To Be Governed by Digital Lending GuidelinesSrushti BhattОценок пока нет

- 27 08 2021Документ13 страниц27 08 2021Poovizhi RajaОценок пока нет

- SBI EMI Moratorium FAQsДокумент4 страницыSBI EMI Moratorium FAQsCNBCTV18 DigitalОценок пока нет

- SUBJECT: Regulatory Measures and Reliefs Announced by RBI in View of Covid 19 - Bank's Policy For Implementation.-V 2.0Документ7 страницSUBJECT: Regulatory Measures and Reliefs Announced by RBI in View of Covid 19 - Bank's Policy For Implementation.-V 2.0Rishabh VachharОценок пока нет

- Banking & Finance Awareness 2017 by AffairsCloudДокумент78 страницBanking & Finance Awareness 2017 by AffairsCloudjayaОценок пока нет

- GK Tornado Sbi Clerk Main 2020 Exam 15 Sep To 21st Oct 2020 12Документ56 страницGK Tornado Sbi Clerk Main 2020 Exam 15 Sep To 21st Oct 2020 12Divya Kishore BollaОценок пока нет

- Management of Advance by RBI 2005Документ53 страницыManagement of Advance by RBI 2005Ramkumar SankerОценок пока нет

- Professional Knowledge Questions For Indian Bank So (Credit)Документ28 страницProfessional Knowledge Questions For Indian Bank So (Credit)hermandeep5Оценок пока нет

- News of The Week 2Документ17 страницNews of The Week 2mehtarahul999Оценок пока нет

- Weekly Economic Round Up 37Документ11 страницWeekly Economic Round Up 37Mana PlanetОценок пока нет

- GK Tornado Rbi Assist Main Exams 2020 English 87 PDFДокумент171 страницаGK Tornado Rbi Assist Main Exams 2020 English 87 PDFSindhu ChandranОценок пока нет

- Important General Knowledge GradeupДокумент171 страницаImportant General Knowledge GradeupSunny Dara Rinnah SusanthОценок пока нет

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingДокумент10 страницU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseОценок пока нет

- Weekly Economic Round Up 39Документ14 страницWeekly Economic Round Up 39Mana PlanetОценок пока нет

- Monthly Bee Pedia December 6703Документ142 страницыMonthly Bee Pedia December 6703Vikin JainОценок пока нет

- ABM RBI Jul-Dec'23Документ14 страницABM RBI Jul-Dec'23RaviTuduОценок пока нет

- Beepedia Weekly Current Affairs (Beepedia) 9th-15th June 2023Документ46 страницBeepedia Weekly Current Affairs (Beepedia) 9th-15th June 2023Sahil KalerОценок пока нет

- Articles For PracticalДокумент4 страницыArticles For PracticalAnonymous QX2RDTKiОценок пока нет

- Monthly BeePedia January 2021Документ134 страницыMonthly BeePedia January 2021Anish AnishОценок пока нет

- Insolvency and Bankruptcy Board of India: For New Delhi ZoneДокумент137 страницInsolvency and Bankruptcy Board of India: For New Delhi ZoneVbs ReddyОценок пока нет

- The Great Lockdown - Standstill On Asset Classification - Vinod Kothari ConsultantsДокумент5 страницThe Great Lockdown - Standstill On Asset Classification - Vinod Kothari ConsultantsVbs ReddyОценок пока нет

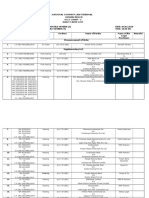

- 4 06.04.2021 Cause List C-IvДокумент7 страниц4 06.04.2021 Cause List C-IvVbs ReddyОценок пока нет

- 4 05.04.2021 Cause List C-IvДокумент8 страниц4 05.04.2021 Cause List C-IvVbs ReddyОценок пока нет

- 3 Cause List As On 06.04.2021Документ6 страниц3 Cause List As On 06.04.2021Vbs ReddyОценок пока нет

- Insolvency and Bankruptcy Board of IndiaДокумент30 страницInsolvency and Bankruptcy Board of IndiaVbs ReddyОценок пока нет

- Video and PPT Links of Master Classes RMLNLU 27.06.2020 To 11.07.2020Документ2 страницыVideo and PPT Links of Master Classes RMLNLU 27.06.2020 To 11.07.2020Vbs ReddyОценок пока нет

- LiquidationДокумент18 страницLiquidationVbs ReddyОценок пока нет

- 2 IIIpiSeries-2BДокумент67 страниц2 IIIpiSeries-2BVbs ReddyОценок пока нет

- 1 E-Booklet PDFДокумент51 страница1 E-Booklet PDFVbs ReddyОценок пока нет

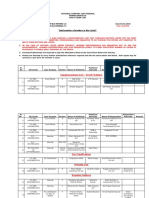

- 4 04.03.2020 Cause List Iv PDFДокумент5 страниц4 04.03.2020 Cause List Iv PDFVbs ReddyОценок пока нет

- 1 Cause List Db-I 05.02.2020Документ6 страниц1 Cause List Db-I 05.02.2020Vbs ReddyОценок пока нет

- Further Regulatory Measures Announced by Rbi: COVID-19Документ4 страницыFurther Regulatory Measures Announced by Rbi: COVID-19Vbs ReddyОценок пока нет

- Insolvency and Bankruptcy Board of India Examinations DivisionДокумент1 страницаInsolvency and Bankruptcy Board of India Examinations DivisionVbs ReddyОценок пока нет

- 5 Cause List 04.03.2020 NCLT On Court 5 PDFДокумент3 страницы5 Cause List 04.03.2020 NCLT On Court 5 PDFVbs ReddyОценок пока нет

- 3 05.02.2020 NCLT Court No - IiiДокумент2 страницы3 05.02.2020 NCLT Court No - IiiVbs ReddyОценок пока нет

- 4 05.02.2020 Cause List IvДокумент5 страниц4 05.02.2020 Cause List IvVbs ReddyОценок пока нет

- 2 05.02.2020 - NCLT Single BenchДокумент4 страницы2 05.02.2020 - NCLT Single BenchVbs ReddyОценок пока нет

- 1 Cause List Db-I 04.03.2020 PDFДокумент6 страниц1 Cause List Db-I 04.03.2020 PDFVbs ReddyОценок пока нет

- 3 04.03.2020 NCLT Court No - Iii PDFДокумент5 страниц3 04.03.2020 NCLT Court No - Iii PDFVbs ReddyОценок пока нет

- 2 04.03.2020 Cause List Ii PDFДокумент6 страниц2 04.03.2020 Cause List Ii PDFVbs ReddyОценок пока нет

- 3 04.02.2020 NCLT Court No - IiiДокумент3 страницы3 04.02.2020 NCLT Court No - IiiVbs ReddyОценок пока нет

- 1 Cause List Db-I 04.02.2020 - 0Документ9 страниц1 Cause List Db-I 04.02.2020 - 0Vbs ReddyОценок пока нет

- 4 04.02.2020 Cause List IvДокумент5 страниц4 04.02.2020 Cause List IvVbs ReddyОценок пока нет

- 5 Cause List 03.03.2020 NCLT On Court 5Документ4 страницы5 Cause List 03.03.2020 NCLT On Court 5Vbs ReddyОценок пока нет

- 5 Cause List 04.02.2020 NCLT On Court 5Документ4 страницы5 Cause List 04.02.2020 NCLT On Court 5Vbs ReddyОценок пока нет

- 4 03.03.2020 Cause List IvДокумент5 страниц4 03.03.2020 Cause List IvVbs ReddyОценок пока нет

- 2 04.02.2020 - NCLT Single BenchДокумент6 страниц2 04.02.2020 - NCLT Single BenchVbs ReddyОценок пока нет

- 3 03.03.2020 NCLT Court No - IiiДокумент4 страницы3 03.03.2020 NCLT Court No - IiiVbs ReddyОценок пока нет

- Deed of Real Estate Mortgage: Mortgagor ID No. - Mortgagor ID No.Документ2 страницыDeed of Real Estate Mortgage: Mortgagor ID No. - Mortgagor ID No.Danielle Edenor Roque PaduraОценок пока нет

- Manarang v. Ofilada, 99 Phil. 108 - PROPERTYДокумент6 страницManarang v. Ofilada, 99 Phil. 108 - PROPERTYUriko LabradorОценок пока нет

- Gmath Report Group 6Документ19 страницGmath Report Group 6DreiОценок пока нет

- CIVLTD 2017 (GR. No. 206343 Land Bank vs. Musni)Документ2 страницыCIVLTD 2017 (GR. No. 206343 Land Bank vs. Musni)Michael Parreño VillagraciaОценок пока нет

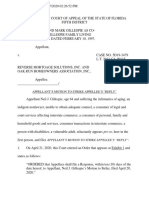

- Appellant's Motion To Strike Appellee's Reply, Case No 5D19-3479Документ58 страницAppellant's Motion To Strike Appellee's Reply, Case No 5D19-3479Neil GillespieОценок пока нет

- Barerra V Lorenzo - ValixДокумент2 страницыBarerra V Lorenzo - ValixVon Lee De LunaОценок пока нет

- Nilo Mercado vs. Ca and Aurea Mercado: Owner of The Land, With My Sister Aurea."Документ3 страницыNilo Mercado vs. Ca and Aurea Mercado: Owner of The Land, With My Sister Aurea."Rae Marie Cadeliña ManarОценок пока нет

- Case DigestДокумент39 страницCase DigestErisa RoxasОценок пока нет

- Ruloans Distribution Services PVT LTD - BengaluruДокумент1 страницаRuloans Distribution Services PVT LTD - Bengalurumychannel 360 degreeОценок пока нет

- Fidelity MMFДокумент8 страницFidelity MMFOkan AladağОценок пока нет

- Decatur ResolutionДокумент29 страницDecatur ResolutionZachary HansenОценок пока нет

- Financial Institution, Financial Instruments and Financial MarketsДокумент60 страницFinancial Institution, Financial Instruments and Financial MarketsMarkus Bernabe DaviraОценок пока нет

- Credit Transaction CasesДокумент7 страницCredit Transaction CasesSamKris Guerrero MalasagaОценок пока нет

- U2D Maritime Reading NotesДокумент116 страницU2D Maritime Reading NotesLeila AlexanderОценок пока нет

- Lecture 1 Business LawДокумент35 страницLecture 1 Business LawPeter John SabasОценок пока нет

- Palileo vs. Cosio: 920 Philippine Reports AnnotatedДокумент5 страницPalileo vs. Cosio: 920 Philippine Reports AnnotatedAlexiss Mace JuradoОценок пока нет

- The Following Is The Unadjusted Trial Balance For Rainbow LodgeДокумент3 страницыThe Following Is The Unadjusted Trial Balance For Rainbow LodgeCharlotteОценок пока нет

- TEMPLATE - Deed of Sale With Assumption of MortgageДокумент3 страницыTEMPLATE - Deed of Sale With Assumption of MortgageMi Chelle90% (10)

- 09 First Marbella Condominium Association, Inc - vs. GatmaytanДокумент11 страниц09 First Marbella Condominium Association, Inc - vs. GatmaytanyassercarlomanОценок пока нет

- Internship Report On SME Banking of Jamuna Bank Limited: Submitted ToДокумент68 страницInternship Report On SME Banking of Jamuna Bank Limited: Submitted ToMahmud HossainОценок пока нет

- Home First Finance CompanyДокумент12 страницHome First Finance CompanyJ BОценок пока нет

- EMILIO GONZALEZ LA O, Plaintiff and Appellee, vs. THE YEK TONG LIN FIRE & MARINE INSURANCE Co., LTD., Defendant and Appellant.Документ14 страницEMILIO GONZALEZ LA O, Plaintiff and Appellee, vs. THE YEK TONG LIN FIRE & MARINE INSURANCE Co., LTD., Defendant and Appellant.ailynvdsОценок пока нет

- GCR Rating Report - Zedcrest Capital LimitedДокумент10 страницGCR Rating Report - Zedcrest Capital LimitedTolulopeОценок пока нет

- Farm Loans and Credit Covid19 Letter To USDAДокумент5 страницFarm Loans and Credit Covid19 Letter To USDAHonolulu Star-AdvertiserОценок пока нет

- uprtmt Qeourt: First DivisionДокумент13 страницuprtmt Qeourt: First DivisionEarl TabasuaresОценок пока нет

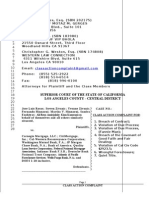

- Class Action ComplaintДокумент50 страницClass Action ComplaintlegalremedyllcОценок пока нет

- Property Law - Complete Final - 18.12.18Документ115 страницProperty Law - Complete Final - 18.12.18Niraj PandeyОценок пока нет

- Miranda Joseph, Debt To Society: Accounting For Life Under Capitalism (2014, Univ of Minnesota Press)Документ242 страницыMiranda Joseph, Debt To Society: Accounting For Life Under Capitalism (2014, Univ of Minnesota Press)Amrit TrewnОценок пока нет

- Insurance Midterms ReviewerДокумент28 страницInsurance Midterms ReviewerMichaela SarmientoОценок пока нет

- Loan Agreement Blank FormДокумент2 страницыLoan Agreement Blank FormMaria Tereza PilapilОценок пока нет