Академический Документы

Профессиональный Документы

Культура Документы

Quiz 1

Загружено:

Catherine Dela VegaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Quiz 1

Загружено:

Catherine Dela VegaАвторское право:

Доступные форматы

Quiz 1

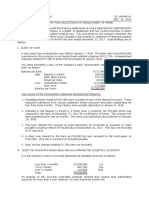

The accountant for BSA Company prepares the following condensed balance sheet:

BSA Company

Condensed Balance Sheet

December 31, 2018

Current Assets P 53,415

Less: Current Liabilities 29,000

Working Capital P 24,415

Add: Other Assets 75,120

P 99,535

Less: Other Liabilities 3,600

Investment in Business P 95,935

A review of the account balances disclosed the following data:

a) An analysis of the current asset grouping revealed the following:

Cash P 10,600

Accounts receivable (fully collectible) 12,500

Notes receivable* 1,000

Investment securities - trading, at cost (Market value, P2,575) 4,250

Inventory 20,965

Cash surrender value of life insurance on officer’s lives 4,100

Total current assets P 53,415

*notes of customer who has been declared bankrupt and is unable to pay

anything on the obligations

The inventory account was found to include supplies costing P425, a

delivery truck acquired at the end of 2018 at a cost of P2,100, and fixtures at a

depreciated value of P10,400. The fixtures had been acquired in 2012 at a cost of

P12,500.

b) The total for other assets was determined as follows”

Land and buildings at cost of acquisition, July 1, 2016 P 92,000

Less balance due on mortgage, P16,000, and accrued

interest on mortgage, P880** 16,880

Total other assets P 75,120

**mortgage is payable in annual installments of P4,000 on July 1 of each

year together with interest for the year at that time at 11%

It was estimated that the land at the time of the purchase was worth

P30,000. Buildings as of December 31, 2018 were estimated to have a remaining

life of 17 ½ years.

c) Current liabilities represented balances that were payable to trade creditors.

d) Other liabilities consisted of withholding, payroll, real estate, and other taxes

payable to the national and local governments. However, no recognition was

given the accrued salaries, utilities and other miscellaneous items totaling P350.

e) The company was originally organized in 2011 when 5,000 shares of no-par with

a stated value of P5 per share were issued in exchange for business assets that

were recognized on the books at their fair market value of P55,000.

Required: Prepare a corrected balance sheet with the items properly classified.

Вам также может понравиться

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionОт EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionРейтинг: 2.5 из 5 звезд2.5/5 (2)

- 2019 Completing The Audit Financial Statements PDFДокумент2 страницы2019 Completing The Audit Financial Statements PDFNics VenturaОценок пока нет

- Activity 1 PartnershipДокумент4 страницыActivity 1 PartnershipJanet AnotdeОценок пока нет

- GEN009 - q2Документ14 страницGEN009 - q2CRYPTO KNIGHTОценок пока нет

- Dapitan Corporation general ledger trial balance analysisДокумент6 страницDapitan Corporation general ledger trial balance analysisLyka Kristine Jane PacardoОценок пока нет

- Acc 113day 23sasdocx PDF FreeДокумент6 страницAcc 113day 23sasdocx PDF FreeMariefel OrdanezОценок пока нет

- Audit Cash ShortageДокумент8 страницAudit Cash ShortageEISEN BELWIGANОценок пока нет

- Advac 103 Partnership and Corporate LiquidationДокумент3 страницыAdvac 103 Partnership and Corporate Liquidationellie MateoОценок пока нет

- Audit Charles Corporation FinancialsДокумент20 страницAudit Charles Corporation FinancialsMa. Hazel Donita DiazОценок пока нет

- Jon Snow Corp quiz on SOFPДокумент2 страницыJon Snow Corp quiz on SOFPJao FloresОценок пока нет

- Tiger Corporation (Contributed by Oliver C. Bucao)Документ4 страницыTiger Corporation (Contributed by Oliver C. Bucao)Pia Corine RuitaОценок пока нет

- Business Combination Practical Accounting 2 Date of AcquisitionДокумент6 страницBusiness Combination Practical Accounting 2 Date of AcquisitionEdi wow WowОценок пока нет

- Module 4 - Problem B - SFP - For UploadДокумент4 страницыModule 4 - Problem B - SFP - For UploadLuisa Janelle BoquirenОценок пока нет

- Module 10 Financial StatementsДокумент17 страницModule 10 Financial StatementsChristine CariñoОценок пока нет

- Pamantasan NG CabuyaoДокумент2 страницыPamantasan NG CabuyaoHhhhhОценок пока нет

- Premium Co. Statement of Financial Position DECEMBER 30, 2020 Assets NoteДокумент3 страницыPremium Co. Statement of Financial Position DECEMBER 30, 2020 Assets NoteJessica EntacОценок пока нет

- Practice Problems 2Документ10 страницPractice Problems 2Luigi NocitaОценок пока нет

- Budgeted Income Statement and Balance SheetДокумент5 страницBudgeted Income Statement and Balance SheetNeil De LeonОценок пока нет

- Far - BS - Is - Rak N' KollДокумент4 страницыFar - BS - Is - Rak N' Kollshe kioraОценок пока нет

- Working Trial Balance Audit AdjustmentsДокумент4 страницыWorking Trial Balance Audit Adjustments김우림0% (3)

- Intermediate Accounting 3 Handout 1 Total Current AssetsДокумент5 страницIntermediate Accounting 3 Handout 1 Total Current AssetsJane GavinoОценок пока нет

- PRTC Practial Accounting 1Документ56 страницPRTC Practial Accounting 1Pam G.71% (21)

- Cash and Cash Equivalents - ProblemsДокумент47 страницCash and Cash Equivalents - Problemscommissioned homeworkОценок пока нет

- INSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetДокумент13 страницINSTRUCTIONS: Select The Best Answer For Each of The Following Attempted. Mark Only One Answer For Each Item On The Answer SheetMac Ferds100% (2)

- Auditing ProblemsДокумент6 страницAuditing ProblemsMaurice AgbayaniОценок пока нет

- Income Statement, Oener's Equity, PositionДокумент4 страницыIncome Statement, Oener's Equity, PositionMaDine 19Оценок пока нет

- P 1Документ13 страницP 1Ryan Joseph Agluba DimacaliОценок пока нет

- Auditing Practice Problem 4Документ4 страницыAuditing Practice Problem 4Jessa Gay Cartagena TorresОценок пока нет

- Home Work Dec 26 2018Документ5 страницHome Work Dec 26 2018shejaguarОценок пока нет

- 1365464987statement of Financial Positio 3Документ1 страница1365464987statement of Financial Positio 3Glen JavellanaОценок пока нет

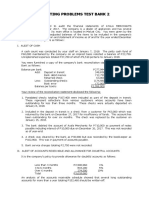

- Auditing Problems Test Bank 2Документ10 страницAuditing Problems Test Bank 2Ne BzОценок пока нет

- Auditing Problems Test Bank 2Документ15 страницAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- October 2016 Auditing Problems Final Pre BoardДокумент13 страницOctober 2016 Auditing Problems Final Pre BoardJeanette FormenteraОценок пока нет

- Quiz 1 - Business CombiДокумент6 страницQuiz 1 - Business CombiKaguraОценок пока нет

- IA 3 Final Assessment PDFДокумент5 страницIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Financial Accounting and Reporting Problems Freebie PDFДокумент46 страницFinancial Accounting and Reporting Problems Freebie PDFC/PVT DAET, SHAINA JOYОценок пока нет

- Balance SheetДокумент18 страницBalance SheetAndriaОценок пока нет

- FAR - Midterms and FinalsДокумент14 страницFAR - Midterms and FinalsShanley Vanna EscalonaОценок пока нет

- ReSA B45 FAR Final PB Exam Questions, Answers SolutionsДокумент21 страницаReSA B45 FAR Final PB Exam Questions, Answers SolutionsKeith Clyde Lagapa MuycoОценок пока нет

- Chin Figura - Unit IV Learning ActivitiesДокумент7 страницChin Figura - Unit IV Learning ActivitiesChin FiguraОценок пока нет

- Problem 1: Comprehensive Examination Applied Auditng Name: Score: Professor: DateДокумент17 страницProblem 1: Comprehensive Examination Applied Auditng Name: Score: Professor: Dateaccounts 3 lifeОценок пока нет

- Acctg336 - Opening CaseДокумент6 страницAcctg336 - Opening CaseSheila DominguezОценок пока нет

- 5rd Batch - P1 - Final Pre-Boards - EditedДокумент11 страниц5rd Batch - P1 - Final Pre-Boards - EditedKim Cristian Maaño0% (1)

- CHAPTER 10 - Pre-Board Examinations-1Документ35 страницCHAPTER 10 - Pre-Board Examinations-1Mr.AccntngОценок пока нет

- Problem C - SFP For UploadДокумент4 страницыProblem C - SFP For UploadLuisa Janelle BoquirenОценок пока нет

- Mendoza - UNIT 1 - Statement of Financial PositionДокумент14 страницMendoza - UNIT 1 - Statement of Financial PositionAim RubiaОценок пока нет

- Partnership Questions Problems With Answers PDF FreeДокумент11 страницPartnership Questions Problems With Answers PDF FreeJoseph AsisОценок пока нет

- Microsoft Word - Unit 2 Understanding Statement of Financial PositionДокумент17 страницMicrosoft Word - Unit 2 Understanding Statement of Financial PositionKamille C. CerenoОценок пока нет

- PARTNERSHIP Questions Problems With AnswersДокумент11 страницPARTNERSHIP Questions Problems With AnswersFlor Danielle Querubin100% (5)

- Problem A - SFP For UploadДокумент3 страницыProblem A - SFP For UploadLuisa Janelle Boquiren50% (2)

- FAR 3 Homework No. 03 PDFДокумент5 страницFAR 3 Homework No. 03 PDFAisah ReemОценок пока нет

- Audit ProbДокумент16 страницAudit ProbJewel Mae Mercado100% (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideОт EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideОценок пока нет

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1От EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1Оценок пока нет

- Internal Control of Fixed Assets: A Controller and Auditor's GuideОт EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideРейтинг: 4 из 5 звезд4/5 (1)

- Afar 2701 PartnershipДокумент57 страницAfar 2701 PartnershipJoshmyrrh Richwel GammadОценок пока нет

- 3B Intangible AssetsДокумент28 страниц3B Intangible AssetsCatherine Dela VegaОценок пока нет

- Chapter 12 RaibornДокумент20 страницChapter 12 RaibornSuzette Estipona100% (1)

- Chapter 3Документ54 страницыChapter 3Enges Formula100% (1)

- Chap. 12 - VAT - Tabag - 2019 Ed.Документ27 страницChap. 12 - VAT - Tabag - 2019 Ed.Catherine Dela VegaОценок пока нет

- Job OrderДокумент9 страницJob OrderMaybelleОценок пока нет

- Ast TX 1001 Capital Assets (Batch 22)Документ3 страницыAst TX 1001 Capital Assets (Batch 22)CeciliaОценок пока нет

- FAR Test BankДокумент36 страницFAR Test BankMangoStarr Aibelle VegasОценок пока нет

- Chap. 13 - Remedies - Tabag - 2019 Ed PDFДокумент7 страницChap. 13 - Remedies - Tabag - 2019 Ed PDFCatherine Dela VegaОценок пока нет

- Memory Aid in TaxДокумент128 страницMemory Aid in TaxCatherine Dela VegaОценок пока нет

- Practical Accounting 1Документ3 страницыPractical Accounting 1Angelo Otañes GasatanОценок пока нет

- CH 01 IM11 eДокумент13 страницCH 01 IM11 eJessel Ann MontecilloОценок пока нет

- Chapter 2 - Cost Terminology and Cost Behaviors: LO1 LO2 LO3 LO4 LO5Документ29 страницChapter 2 - Cost Terminology and Cost Behaviors: LO1 LO2 LO3 LO4 LO5Chem Mae100% (4)

- Types of LiabilitiesДокумент11 страницTypes of LiabilitiesJayson Manalo GañaОценок пока нет

- PRELIMS (09062020) NameДокумент1 страницаPRELIMS (09062020) NameCatherine Dela VegaОценок пока нет

- University Organizational Structure ChartДокумент1 страницаUniversity Organizational Structure ChartCatherine Dela VegaОценок пока нет

- Oblicon DrillsДокумент9 страницOblicon DrillsCatherine Dela VegaОценок пока нет

- Cost Concepts ExplainedДокумент2 страницыCost Concepts ExplainedCatherine Dela VegaОценок пока нет

- PRELIMS (09062020) Name: - Multiple ChoiceДокумент1 страницаPRELIMS (09062020) Name: - Multiple ChoicekylaОценок пока нет

- Accounting Process & - Accounting Process & Working P Working Paper Prepar Aper Preparation AtionДокумент51 страницаAccounting Process & - Accounting Process & Working P Working Paper Prepar Aper Preparation AtionCatherine Dela VegaОценок пока нет

- Memory Aid in TaxДокумент128 страницMemory Aid in TaxCatherine Dela VegaОценок пока нет

- UST Golden Notes 2011 - Partnership and Agency PDFДокумент42 страницыUST Golden Notes 2011 - Partnership and Agency PDFVenus Leilani Villanueva-Granado100% (11)

- Intangible and Other AssetsДокумент7 страницIntangible and Other AssetsHope Joy Velasco AprueboОценок пока нет

- En PDFДокумент1 страницаEn PDFCatherine Dela VegaОценок пока нет

- Ast TX 501 Individual, Estate and Trust Taxation (Batch 22)Документ7 страницAst TX 501 Individual, Estate and Trust Taxation (Batch 22)Herald Gangcuangco100% (1)

- Banks and Other Financial IntermediariesДокумент59 страницBanks and Other Financial IntermediariesCatherine Dela VegaОценок пока нет

- Audit QuizДокумент5 страницAudit QuizCatherine Dela VegaОценок пока нет

- FAR Test BankДокумент36 страницFAR Test BankMangoStarr Aibelle VegasОценок пока нет

- PRTC1PB AudДокумент16 страницPRTC1PB AudCatherine Dela VegaОценок пока нет

- Remnan TIIДокумент68 страницRemnan TIIJOSE MIGUEL SARABIAОценок пока нет

- Boeing 7E7 - UV6426-XLS-ENGДокумент85 страницBoeing 7E7 - UV6426-XLS-ENGjk kumarОценок пока нет

- SWSP6033 00 2022T3 V1.0-1Документ14 страницSWSP6033 00 2022T3 V1.0-1ayman.abaidallah1990Оценок пока нет

- Modern Dental Assisting 11Th Edition Bird Test Bank Full Chapter PDFДокумент37 страницModern Dental Assisting 11Th Edition Bird Test Bank Full Chapter PDFRichardThompsonpcbd100% (9)

- Biochemical Aspect of DiarrheaДокумент17 страницBiochemical Aspect of DiarrheaLiz Espinosa0% (1)

- Self Respect MovementДокумент2 страницыSelf Respect MovementJananee RajagopalanОценок пока нет

- Data Report Northside19Документ3 страницыData Report Northside19api-456796301Оценок пока нет

- Junior Instructor (Computer Operator & Programming Assistant) - Kerala PSC Blog - PSC Exam Questions and AnswersДокумент13 страницJunior Instructor (Computer Operator & Programming Assistant) - Kerala PSC Blog - PSC Exam Questions and AnswersDrAjay Singh100% (1)

- Metabolic Pathway of Carbohydrate and GlycolysisДокумент22 страницыMetabolic Pathway of Carbohydrate and GlycolysisDarshansinh MahidaОценок пока нет

- Enneagram Type-2Документ18 страницEnneagram Type-2pundirОценок пока нет

- Research Paper 1 Eng Lang StudiesДокумент4 страницыResearch Paper 1 Eng Lang Studiessastra damarОценок пока нет

- BSP Memorandum No. M-2022-035Документ1 страницаBSP Memorandum No. M-2022-035Gleim Brean EranОценок пока нет

- IAS 8 Tutorial Question (SS)Документ2 страницыIAS 8 Tutorial Question (SS)Given RefilweОценок пока нет

- Ass. No.1 in P.E.Документ8 страницAss. No.1 in P.E.Jessa GОценок пока нет

- Preterite vs Imperfect in SpanishДокумент16 страницPreterite vs Imperfect in SpanishOsa NilefunОценок пока нет

- Minotaur Transformation by LionWarrior (Script)Документ7 страницMinotaur Transformation by LionWarrior (Script)Arnt van HeldenОценок пока нет

- SOG 5 Topics With SOPДокумент2 страницыSOG 5 Topics With SOPMae Ann VillasОценок пока нет

- What Would Orwell Think?Документ4 страницыWhat Would Orwell Think?teapottingsОценок пока нет

- GST Project ReportДокумент29 страницGST Project ReportHENA KHANОценок пока нет

- Heritageoil Corporategovernance AwДокумент68 страницHeritageoil Corporategovernance AwbeqsОценок пока нет

- An Empirical Study of Car Selection Factors - A Qualitative & Systematic Review of LiteratureДокумент15 страницAn Empirical Study of Car Selection Factors - A Qualitative & Systematic Review of LiteratureadhbawaОценок пока нет

- The Big Banana by Roberto QuesadaДокумент257 страницThe Big Banana by Roberto QuesadaArte Público Press100% (2)

- Subject Object Schede PDFДокумент28 страницSubject Object Schede PDFanushhhkaОценок пока нет

- Marketing Strategy of Singapore AirlinesДокумент48 страницMarketing Strategy of Singapore Airlinesi_sonet96% (49)

- 5.2.1 1539323575 2163Документ30 страниц5.2.1 1539323575 2163Brinda TОценок пока нет

- Course Title: Cost Accounting Course Code:441 BBA Program Lecture-3Документ20 страницCourse Title: Cost Accounting Course Code:441 BBA Program Lecture-3Tanvir Ahmed ChowdhuryОценок пока нет

- U1 Presantation-MAK 032021Документ15 страницU1 Presantation-MAK 032021MD ANAYET ALI KHANОценок пока нет

- The Mckenzie MethodДокумент24 страницыThe Mckenzie MethodMohamed ElMeligieОценок пока нет

- Mar 2021Документ2 страницыMar 2021TanОценок пока нет

- Application of Neutralization Titrations for Acid-Base AnalysisДокумент21 страницаApplication of Neutralization Titrations for Acid-Base AnalysisAdrian NavarraОценок пока нет