Академический Документы

Профессиональный Документы

Культура Документы

Finance Project Report On Associated Cement Companies

Загружено:

Akshay JadavОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Finance Project Report On Associated Cement Companies

Загружено:

Akshay JadavАвторское право:

Доступные форматы

S.K.

PATEL INSTITUTE OF

MANAGEMENT & COMPUTER SUDIES.

M.B.A. – 1

TRIMESTER - II

GROUP - 11

Project 2

PROJECT REPORT ON PROJECTION OF GROWTH & FUTERE PRICE ON

“ASSOCIATED CEMENT COMPANIES” OF NIFTY

Submitted to:

Prof. Sandhya Harkawat

DATE: 29/12/2008.

MONDAY.

Submitted by:

PANKAJ GURJAR (34)-

AKSHAY JADAV (38)

SWAPNIL KHARPATE (47)

DHARA MODI (59)

ASSOCIATED CEMENT COMPANYS 1

INDEX

Preface

Acknowledgement

Company history

Company’s dividend history

Projection of future price

Bibliography

ASSOCIATED CEMENT COMPANYS 2

PREFACE

This report is about projection of dividend discount and projection of future price of

dividend . There are details of 10 years dividend provided by the annual report of

“associated cement companys”,with those data we have calculated dividend dividend

discount with the help of dividend discount model.There are 10 years dividend data is

given in this report .Most of the discussion on dividend policy and firm value assumes

that the investment decision of a firm is independent of its dividend decision however

there are some models which assume that investment and dividend decision are related.

ASSOCIATED CEMENT COMPANYS 3

Acknowledgement

We are feeling great pleasure in submitting this report and it is our

great opportunity to convey thanks to all of them who have helped us in

completing this report. There are many people who play a very vital role in our

achievements but giving a vote of thanks to that great people is also one

achievement. And this opportunity I have got at a time of submitting this report.

We are thankful to my college authority and especially my

project guide Prof. Sandhaya Harkawat for continuous encouragement and

guidance.

And lastly, We are thankful to all my friends and others who have

helped us in completing this report.

Thanking you.

ASSOCIATED CEMENT COMPANYS 4

Company history

Associated Cement Companies the single largest producer in the country and part of the

Holcim-Gujarat Ambuja combine, has posted excellent results for the first quarter ended

31 march 2006. The company’s performance has been aided by higher cement prices

during the quarter because of sustained growth in demand.

On a consolidated basis, ACC has reported a net profit of Rs 231.34 crore for the quarter,

an increase of 26.94 percent as compared to the Rs 182.24crore reported for the same

quarter of previous year. Total revenue for the quarter increased by 13.35 percent to Rs

1,389.91 crore from Rs 1,226.19 crore.

The results are not strictly comparable with the previous year’s quarter as the company

had undertaken major restructuring exercise recently.it sold off the refactory business to

private equity investors last year. Asbestos sheet manufacturer Everest industries,which

was a subsidiary of ACC,was also sold off.

The company merged two cement manufacturing unitd,Bargarh Cement and Damodar

Cement,with itself during the year.

As compared to net profit of Rs 192.48crore,or Rs10.46per equity share reported for the

quarter ended December 2005,profit for the march 2006quarter on a stand alone basis has

increased by 22.34 percent to Rs235.48crore were higher by 24.87percent from

theRs1,106.61crore reported for the December 2006quarter.

The company has sold its real estate in Delhi for a consolidation of Rs 140.2 crore this

month. The profit from this sale would be reflected in the results for the second quarter

ending June2008

ASSOCIATED CEMENT COMPANYS 5

COMPANY’S DIVIDEND HISTORY

Accordingly, the Company allotted 1,63,124 Equity Shares of the face value of Rs 10

each to these bondholders at the conversion price of Rs 374.42 per share. With this, the

entire Foreign Currency Convertible Bonds issued bythe Company in 2004 stands

converted. Further, the Company allotted 1,83,172 Equity Shares of the face value of Rs

10 each consequent to exercise of stock options by its employees.93.62 percentage of the

Equity Shares of the Company have been dematerialized as at December 31, 2007.

In august 2007 company paid an interim dividend of Rs10 per share which involved an

outgo (including the dividend distribution tax) of Rs219.25crore.

Directors now recommend a final dividend of Rs 10 per equity share of Rs16 each .Thus,

the total dividend for the year 2007 would be Rs20 per share (200%on the par value of

Rs10) as against Rs15 per equity share for the year ended December 31,2006.The total

dividend outgo for the current fiscal would amount to Rs438.78 crore including dividend

distribution tax of Rs63.74 crore including dividend distribution tax of Rs39.40crore in

the previous year.

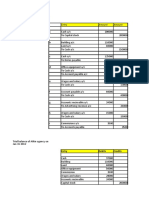

Dividend(crore) year

23 98-99

19 99-00

38 00-01

51 01-02

48 02-03

80 03-04

143 04-05

169 05-06

322 06-07

439 07-08

On dividend company has spent 438.92 crore which is 5.36% of total investment.

ASSOCIATED CEMENT COMPANYS 6

PROJECTION OF FUTURE PRICE

Price- Dividend table

Year Dividend Growth Rate of Price

(EPS) rate % return (Rs)

(g1) %

(r)

2000 3.35 - - -

2001 4.1 30 32 82

2002 4.5 25 30 152

2003 4.8 40 44 192

2004 5.25 70 73 237.67

2005 6.53 107.3 110 241.8

2006 10.62 62.33 66 312.3

2007 21.27 100.28 104 531.7

2008 32.9 54.67 57.6 709

2009 51.0 55 59.7 1085

Calculation:-

Expected growth rate (g1) = 59.7%

Expected rate of return (r) = 55%

Expected dividend = D0 (1+g1)

= 32.9(1+.55)

=51.0

Price of share = Dividend

r- g

= 51.00

0.597-0.55

ASSOCIATED CEMENT COMPANYS 7

= 1085.1 Rs

Conclusion

Associated cement companys has high growth of its earnings and

variation in its growth rate because of its expansion plan which is

adding more revenue and profit to its balance sheet. From above

table we can see that growth of its dividend on that basis we have

found the expected price for the year 2009 which comes to Rs.

1085.1

ASSOCIATED CEMENT COMPANYS 8

BIBLIOGRAPHY

• www.acc.com

• Reference of Financial management : Prasanna Chandra

• Press notes and The Annual report of the company

• WWW.

ASSOCIATED CEMENT COMPANYS 9

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- On of Soul in Gita WayДокумент15 страницOn of Soul in Gita WayAkshay JadavОценок пока нет

- Project Report On Capital Structure of RanbaxyДокумент27 страницProject Report On Capital Structure of RanbaxyAkshay Jadav80% (5)

- Social Project Presentation On Mahila Housing Sewa Trust Mht-SewaДокумент44 страницыSocial Project Presentation On Mahila Housing Sewa Trust Mht-SewaAkshay JadavОценок пока нет

- Social Project On Mahila Housing Sewa TrustДокумент50 страницSocial Project On Mahila Housing Sewa TrustAkshay JadavОценок пока нет

- Organizational Behaviour About PowerДокумент13 страницOrganizational Behaviour About PowerAkshay JadavОценок пока нет

- Organizational Behaviour Presentation On Power (22!1!2009) 2Документ31 страницаOrganizational Behaviour Presentation On Power (22!1!2009) 2Akshay JadavОценок пока нет

- Essar PresentationДокумент27 страницEssar PresentationAkshay JadavОценок пока нет

- Human Resource Information SystemДокумент20 страницHuman Resource Information SystemAkshay JadavОценок пока нет

- Major Project Report Retailers Questionnair For Pepsi and Cocacola DistributionДокумент3 страницыMajor Project Report Retailers Questionnair For Pepsi and Cocacola DistributionAkshay Jadav100% (1)

- On of Soul in Gita WayДокумент15 страницOn of Soul in Gita WayAkshay JadavОценок пока нет

- FINAL MAJOR (Compatitive Ion of Soft Drink Industry)Документ98 страницFINAL MAJOR (Compatitive Ion of Soft Drink Industry)Akshay Jadav100% (1)

- A Capstone Project Presentation On A Competitive Comparison of Soft Drink Industry in India in Context of PepsiCo and Coca Cola Ent - Inc.Документ60 страницA Capstone Project Presentation On A Competitive Comparison of Soft Drink Industry in India in Context of PepsiCo and Coca Cola Ent - Inc.Akshay JadavОценок пока нет

- Essar PresentationДокумент27 страницEssar PresentationAkshay JadavОценок пока нет

- Entry Strategies in Market M.E.Документ44 страницыEntry Strategies in Market M.E.Akshay JadavОценок пока нет

- A Present at in On Capital Structure of RanbaxyДокумент37 страницA Present at in On Capital Structure of RanbaxyAkshay JadavОценок пока нет

- Boiler House Costing: Presented byДокумент8 страницBoiler House Costing: Presented byAkshay JadavОценок пока нет

- Legal Affairs. Contests. Cricket. FinanceДокумент28 страницLegal Affairs. Contests. Cricket. FinanceAkshay JadavОценок пока нет

- A Project On Hardware IndustryДокумент29 страницA Project On Hardware IndustryAkshay JadavОценок пока нет

- S.K. Patel Institute of Management and Computer Studies: Assignment On Calculation ofДокумент8 страницS.K. Patel Institute of Management and Computer Studies: Assignment On Calculation ofAkshay JadavОценок пока нет

- A Competitive Comparison of Soft Drink Industry in India in Context of Pepsico and Coca Cola Ent - IncДокумент35 страницA Competitive Comparison of Soft Drink Industry in India in Context of Pepsico and Coca Cola Ent - IncAkshay JadavОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- 01 Quilvest Familiy Office Landscape PDFДокумент16 страниц01 Quilvest Familiy Office Landscape PDFJose M AlayetoОценок пока нет

- Organizational PlanДокумент23 страницыOrganizational PlanYacir HussainОценок пока нет

- JSW Steel LTD PDFДокумент10 страницJSW Steel LTD PDFTanzy SОценок пока нет

- Project Topic - Company Law-I, Batch 2018-23Документ26 страницProject Topic - Company Law-I, Batch 2018-23Fagun SahniОценок пока нет

- Journal Entry For Atkin AgencyДокумент4 страницыJournal Entry For Atkin AgencySamarth LahotiОценок пока нет

- Non-Current Assets Held For Sale and Discontinued OperationsДокумент63 страницыNon-Current Assets Held For Sale and Discontinued OperationsElegbede Mariam GbolasieОценок пока нет

- Company Law II ProjectДокумент6 страницCompany Law II ProjectSatvisa PattanayakОценок пока нет

- Unit 2 Objectives VipulДокумент7 страницUnit 2 Objectives Vipulamrutapillai06Оценок пока нет

- Ias 20 - Gov't GrantДокумент19 страницIas 20 - Gov't GrantGail Bermudez100% (1)

- Sasse - Roofing - Financial - Books (1) (Trial Balance)Документ4 страницыSasse - Roofing - Financial - Books (1) (Trial Balance)Jennette Solano100% (1)

- Generally Accepted Accounting PrinciplesДокумент3 страницыGenerally Accepted Accounting Principlesameena salimОценок пока нет

- Financial Accounting Sem 2 (2019-2020) Lecturer: Mr. Vu Tuan Anh, CMA, MSA Email: (Preferred) Tutor: Ms. Tran My HaДокумент73 страницыFinancial Accounting Sem 2 (2019-2020) Lecturer: Mr. Vu Tuan Anh, CMA, MSA Email: (Preferred) Tutor: Ms. Tran My HaTrâm PhạmОценок пока нет

- Cma Data PDFДокумент14 страницCma Data PDFMonika ShuklaОценок пока нет

- 11 7110 22 FP Webonly AfpДокумент89 страниц11 7110 22 FP Webonly AfpAminaarshadwarriachОценок пока нет

- Isa 810Документ18 страницIsa 810baabasaamОценок пока нет

- Cpale Simulation ExamДокумент12 страницCpale Simulation ExamGenivy SalidoОценок пока нет

- ICICI Prudential Life Insurance ProspectusДокумент616 страницICICI Prudential Life Insurance ProspectusshamruthaОценок пока нет

- Portfolio Management Through Mutual FundsДокумент14 страницPortfolio Management Through Mutual FundsMedha SinghОценок пока нет

- Fonderia Di Torino SДокумент15 страницFonderia Di Torino SYrnob RokieОценок пока нет

- Lecture Guide No. 2 AE19.ChuaДокумент5 страницLecture Guide No. 2 AE19.ChuaJonellОценок пока нет

- Sample Woksheet For Service ConcernДокумент1 страницаSample Woksheet For Service ConcernEzekiel LapitanОценок пока нет

- Aa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerДокумент6 страницAa, Capital First Cash Available To Priority 1-CC Total Cash Payment To PartnerGarp BarrocaОценок пока нет

- University of Perpetual Help System DaltaДокумент31 страницаUniversity of Perpetual Help System DaltaDerick Ocampo FulgencioОценок пока нет

- The Truth About The Stock MarketДокумент4 страницыThe Truth About The Stock MarketGoliardo100% (1)

- Fa Xla GL DeprnДокумент2 страницыFa Xla GL Deprnsrains123Оценок пока нет

- Defensive Strategies AssignmentДокумент3 страницыDefensive Strategies AssignmentSaqib LiaqatОценок пока нет

- 01 07 2019to30 09 2019Документ8 страниц01 07 2019to30 09 2019Moneytap RblОценок пока нет

- Nfjpia Nmbe Auditing 2017 AnsДокумент9 страницNfjpia Nmbe Auditing 2017 AnsBriana DizonОценок пока нет

- Solution Manual For Financial Accounting 9th Edition by LibbyДокумент33 страницыSolution Manual For Financial Accounting 9th Edition by Libbya84964899460% (5)

- Dhanuka Agritech LTDДокумент57 страницDhanuka Agritech LTDSubscriptionОценок пока нет