Академический Документы

Профессиональный Документы

Культура Документы

Administration and Handling of Properties in The Current and Second Marriage

Загружено:

Aiza Cabenian0 оценок0% нашли этот документ полезным (0 голосов)

49 просмотров3 страницыCarlo was previously married to Myrna until she passed away in 2015. He then married Myra but failed to properly liquidate his properties from his first marriage. As a result, a mandatory regime of complete separation of property now governs the administration of Carlo and Myra's properties. Under this regime, each spouse owns, manages and enjoys their own separate estate and earnings without consent from the other. However, both spouses are still jointly and equally responsible for paying family expenses proportionate to their incomes or property values, and are fully liable to creditors for these expenses.

Исходное описание:

Оригинальное название

Administration and handling of properties in the current and second marriage

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документCarlo was previously married to Myrna until she passed away in 2015. He then married Myra but failed to properly liquidate his properties from his first marriage. As a result, a mandatory regime of complete separation of property now governs the administration of Carlo and Myra's properties. Under this regime, each spouse owns, manages and enjoys their own separate estate and earnings without consent from the other. However, both spouses are still jointly and equally responsible for paying family expenses proportionate to their incomes or property values, and are fully liable to creditors for these expenses.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

49 просмотров3 страницыAdministration and Handling of Properties in The Current and Second Marriage

Загружено:

Aiza CabenianCarlo was previously married to Myrna until she passed away in 2015. He then married Myra but failed to properly liquidate his properties from his first marriage. As a result, a mandatory regime of complete separation of property now governs the administration of Carlo and Myra's properties. Under this regime, each spouse owns, manages and enjoys their own separate estate and earnings without consent from the other. However, both spouses are still jointly and equally responsible for paying family expenses proportionate to their incomes or property values, and are fully liable to creditors for these expenses.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

Dear PAO,

My first wife Myrna and I married in 2010. But in 2015, she died of

cancer. Then late last year, I married Myra. Due to the depression

and longing I felt for my first wife back then, however, I was not

able to arrange for the liquidation of our properties. I would like to

be enlightened on the legal effects on my rights as to the

administration and handling of the properties of my current

marriage with Myra. Further, I would like to know how Myra and I

could administer our properties.

Carlo

Dear Carlo,

As a rule, upon termination of the marriage by reason of death, the

community property between spouses should be liquidated.

Considering that you’ve mentioned that you were previously

married to another, and that you failed to settle and liquidate your

conjugal properties after your first wife’s demise, a mandatory

regime of complete separation of property will govern the

administration of your property with Myra, your current and second

wife. This is in accordance with Article 103 of the Family Code

which governs the property relations between spouses, which is

written in this wise:

“Art. 103. Upon the termination of the marriage by death, the

community property shall be liquidated in the same proceeding for

the settlement of the estate of the deceased.

“If no judicial settlement proceeding is instituted, the surviving

spouse shall liquidate the community property either judicially or

extra-judicially within six months from the death of the deceased

spouse. If upon the lapse of the six months period, no liquidation is

made, any disposition or encumbrance involving the community

property of the terminated marriage shall be void.

“Should the surviving spouse contract a subsequent marriage

without compliance with the foregoing requirements, a mandatory

regime of complete separation of property shall govern the property

relations of the subsequent marriage. (n)” (Emphases supplied)

As can be gleaned from the facts given and the aforementioned

provision of law, the community property from a previous marriage

is terminated by death, such as in your case; and is required to be

liquidated in order to identify and separate your share from the

property left by your wife. Prior to the completion of the liquidation

and partition of you and your wife’s community property, any

disposition of the said property is void according to law since you

have yet to physically identify which part specifically belongs to you

or your wife.

Further, it bears stressing that your failure to liquidate your

previous community property causes the application of the regime

of complete separation of property in your second marriage with

Myra. This is required by law in order to protect the unliquidated

properties of your first wife by preventing their inclusion to the

properties of your new marriage.

On the other hand, as to the manner of administration of properties

under this regime of complete separation of property, Article 45 of

the Family Code specifically provides that:

“Art. 145. Each spouse shall own, dispose of, possess, administer

and enjoy his or her own separate estate, without need of the

consent of the other. To each spouse shall belong all earnings from

his or her profession, business or industry and all fruits, natural,

industrial or civil, due or received during the marriage from his or

her separate property. (214a)”

“Art. 146. Both spouses shall bear the family expenses in

proportion to their income, or, in case of insufficiency or default

thereof, to the current market value of their separate properties.

“The liabilities of the spouses to creditors for family expenses shall,

however, be solidary. (215a)” (Emphases supplied)

Applying the foregoing provisions of law in your current situation, it

simply states that under a complete separation of property, you get

to exclusively keep and manage the properties and earnings which

you brought into your current marriage without interference from

your second wife, Myra. However, with regard to the payment of

family expenses, both you and Myra will share on the charges, in

proportion to your income or to the value of your separate

properties. In addition to this, you and Myra will also be solidarily

liable to your creditors with regard to the family expenses.

Simply put, while you and Myra will have a complete separation of

property, you separately enjoy each of your own properties, and

both of you will still share the obligation in the payment and

charges for your family expenses.

We hope that we were able to answer your queries. Please be

reminded that this advice is based solely on the facts you have

narrated and our appreciation of the same. Our opinion may vary

when other facts are changed or elaborated. We hope that we were

able to enlighten you on the matter.

Вам также может понравиться

- Conjugal PropertyДокумент3 страницыConjugal PropertyMa Terresa TejadaОценок пока нет

- Matrix of Property RegimeДокумент10 страницMatrix of Property Regimealyssamaesana100% (4)

- PFR FinalsДокумент64 страницыPFR FinalsnashОценок пока нет

- Bance Notes On Property Relations Art. 88 - Art. 136Документ28 страницBance Notes On Property Relations Art. 88 - Art. 136Maria Stella Tirona HilomenОценок пока нет

- Legal Opinio LEGRESДокумент5 страницLegal Opinio LEGRESJulian Paul CachoОценок пока нет

- Comparative Study On Property Regimes: Regime of Absolute Community of PropertyДокумент5 страницComparative Study On Property Regimes: Regime of Absolute Community of PropertyDah GeeОценок пока нет

- Acp - Dissolution and LiquidationДокумент2 страницыAcp - Dissolution and LiquidationMoon100% (1)

- Leg Writ - Legal OpinionДокумент2 страницыLeg Writ - Legal OpinionPrincess Joan InguitoОценок пока нет

- System of Absolute CommunityДокумент17 страницSystem of Absolute CommunitylitoingatanОценок пока нет

- Persons Digests 6 PDFДокумент34 страницыPersons Digests 6 PDFMyooz MyoozОценок пока нет

- Matrix of Property RegimeДокумент4 страницыMatrix of Property RegimeVince Llamazares Lupango67% (3)

- Malilin V CastilloДокумент2 страницыMalilin V CastilloPraisah Marjorey Casila-Forrosuelo PicotОценок пока нет

- VOluntary SeparationДокумент11 страницVOluntary SeparationMissy VRBОценок пока нет

- Noel Buenaventura vs. Ca and Isabel Lucia Singh BuenaventuraДокумент2 страницыNoel Buenaventura vs. Ca and Isabel Lucia Singh BuenaventuraDowie M. MatienzoОценок пока нет

- Absolute Community of Property (Termination and Dissolution Procedure)Документ3 страницыAbsolute Community of Property (Termination and Dissolution Procedure)Al Marvin SantosОценок пока нет

- Para Sa PowerpointДокумент22 страницыPara Sa PowerpointMemey C.Оценок пока нет

- PERSONS - Digests Part 7Документ2 страницыPERSONS - Digests Part 7Nurlailah AliОценок пока нет

- Family CodeДокумент5 страницFamily CodeAj GuanzonОценок пока нет

- Persons and Family Relations NotesДокумент52 страницыPersons and Family Relations NotesSai100% (1)

- Research Work 2Документ8 страницResearch Work 2Marc CosepОценок пока нет

- Trust Law AssignmentДокумент13 страницTrust Law AssignmentLeslie SibbsОценок пока нет

- System of Absolute CommunityДокумент6 страницSystem of Absolute CommunityAnonymous C6x95STYyОценок пока нет

- Executive No. 209 Family Code of The Philippines: Article 129-138Документ26 страницExecutive No. 209 Family Code of The Philippines: Article 129-138Heart NuqueОценок пока нет

- Encumbrance Shall Be Valid. in Case of Foreclosure of TheДокумент7 страницEncumbrance Shall Be Valid. in Case of Foreclosure of TheChristy Tiu-FuaОценок пока нет

- 4: Arts. 74-162, FC Quiao vs. Quiao, 675 SCRA 642 (2012) - FactsДокумент51 страница4: Arts. 74-162, FC Quiao vs. Quiao, 675 SCRA 642 (2012) - FactsAnonymous 5k7iGyОценок пока нет

- ACP - Dissolution and Liquidation - HermosuraДокумент16 страницACP - Dissolution and Liquidation - HermosuraMoonОценок пока нет

- Conjugal Partnership of Gains and Absolute CommunityДокумент11 страницConjugal Partnership of Gains and Absolute CommunityJenny Bihag100% (2)

- 53.1 Domingo Vs Court of Appeals DigestДокумент2 страницы53.1 Domingo Vs Court of Appeals DigestEstel Tabumfama100% (1)

- When Apply?: Difference of Conjugal Partnership From The System of Absolute CommunityДокумент11 страницWhen Apply?: Difference of Conjugal Partnership From The System of Absolute CommunityMemey C.Оценок пока нет

- Pana vs. Heirs of Juanite, Sr. (2012)Документ2 страницыPana vs. Heirs of Juanite, Sr. (2012)xxxaaxxxОценок пока нет

- Annulment of MarriageДокумент10 страницAnnulment of MarriageMichael VicenteОценок пока нет

- Persons and Family RelationsДокумент7 страницPersons and Family RelationsLing EscalanteОценок пока нет

- Property RegimesДокумент3 страницыProperty RegimesJeremy Llanda100% (3)

- Civil Law PersonsДокумент47 страницCivil Law PersonsEmma DanoОценок пока нет

- Legal OpinionДокумент3 страницыLegal OpinionSharon G. Balingit100% (1)

- Making A WillДокумент9 страницMaking A WillKamilla Woźniak-WawrzyniakОценок пока нет

- Property RegimesДокумент4 страницыProperty RegimesmaelynsummerОценок пока нет

- Arts. 88 104 FCДокумент34 страницыArts. 88 104 FCGio RuizОценок пока нет

- Relations Between Husband and WifeДокумент23 страницыRelations Between Husband and WifeMariam BautistaОценок пока нет

- Appellants BriefДокумент3 страницыAppellants BriefKaye Kiikai OnahonОценок пока нет

- Case SynthesisДокумент3 страницыCase Synthesisileen maeОценок пока нет

- Article 74Документ2 страницыArticle 74Charlene Lasala de GuintoОценок пока нет

- Why Do I Need A Will? What Happens If I Die Without A Will?Документ15 страницWhy Do I Need A Will? What Happens If I Die Without A Will?RyОценок пока нет

- Property RelationsДокумент25 страницProperty RelationsNimpa PichayОценок пока нет

- Abalos V Macatangay Digest 1Документ3 страницыAbalos V Macatangay Digest 1Onireblabas Yor OsicranОценок пока нет

- The Law On CONJUGAL PARTNERSHIP of GAINS of Properties in Simple Terms Shall Be Like ThisДокумент6 страницThe Law On CONJUGAL PARTNERSHIP of GAINS of Properties in Simple Terms Shall Be Like ThisfirstОценок пока нет

- Void Marriages in The Philippines: Its Features and ConsequencesДокумент21 страницаVoid Marriages in The Philippines: Its Features and ConsequencesClaire PaloОценок пока нет

- Trial MemorandumДокумент6 страницTrial MemorandumAriane Kae EspinaОценок пока нет

- Property RightsДокумент35 страницProperty Rightshazee100% (1)

- CHP 2 PremaritalagreementportДокумент4 страницыCHP 2 Premaritalagreementportapi-325176204Оценок пока нет

- Property Relations Between Husband and Wife: Title IvДокумент39 страницProperty Relations Between Husband and Wife: Title Ivshirlyn cuyongОценок пока нет

- Pana Vs Heirs of JuaniteДокумент12 страницPana Vs Heirs of JuaniteAngel Pagaran AmarОценок пока нет

- Property Regimes in The PhilippinesДокумент4 страницыProperty Regimes in The PhilippinesJanny Carlo Serrano100% (1)

- Property RegimeДокумент4 страницыProperty RegimeGregOrlandoОценок пока нет

- G.R. No. 164201 December 10, 2012 EFREN PANA, Petitioner, Heirs of Jose Juanite, Sr. and Jose Juanite, JR., RespondentsДокумент49 страницG.R. No. 164201 December 10, 2012 EFREN PANA, Petitioner, Heirs of Jose Juanite, Sr. and Jose Juanite, JR., RespondentsKolyn GervacioОценок пока нет

- FERNANDO, Quinnee Elissa SДокумент11 страницFERNANDO, Quinnee Elissa SQuinnee Elissa FernandoОценок пока нет

- Poverty: Its Illegal Causes and Legal Cure: Lysander SpoonerОт EverandPoverty: Its Illegal Causes and Legal Cure: Lysander SpoonerОценок пока нет

- Assigned Topics in Remedial LawДокумент3 страницыAssigned Topics in Remedial LawAiza CabenianОценок пока нет

- LABORДокумент5 страницLABORAiza CabenianОценок пока нет

- Communication LetterДокумент1 страницаCommunication LetterAiza CabenianОценок пока нет

- 2023 Political LawДокумент18 страниц2023 Political LawAiza Cabenian100% (1)

- Aiza - Narrative Accomplishment Report (August 16-31, 2023)Документ2 страницыAiza - Narrative Accomplishment Report (August 16-31, 2023)Aiza CabenianОценок пока нет

- Reader's Digest On Political Law 2023Документ3 страницыReader's Digest On Political Law 2023Aiza CabenianОценок пока нет

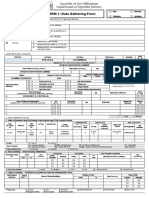

- Certifacate of Appearance Form (DARMO)Документ1 страницаCertifacate of Appearance Form (DARMO)Aiza CabenianОценок пока нет

- Crim Pro. Flow ChartДокумент1 страницаCrim Pro. Flow ChartAiza CabenianОценок пока нет

- 2023 BAR SYLLABUS TRACKER - XLSX - Remedial LawДокумент5 страниц2023 BAR SYLLABUS TRACKER - XLSX - Remedial LawAiza CabenianОценок пока нет

- Article ViiiДокумент2 страницыArticle ViiiAiza CabenianОценок пока нет

- Judgment and Final Orders Subject To Appeal: Collateral Attack On JudgmentДокумент3 страницыJudgment and Final Orders Subject To Appeal: Collateral Attack On JudgmentAiza CabenianОценок пока нет

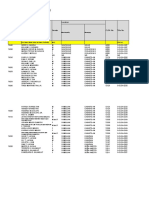

- Supportlist Templates: LocationДокумент14 страницSupportlist Templates: LocationAiza CabenianОценок пока нет

- Transmittal LetterДокумент3 страницыTransmittal LetterAiza CabenianОценок пока нет

- Last Page For Brgy Sawang, FVRДокумент2 страницыLast Page For Brgy Sawang, FVRAiza CabenianОценок пока нет

- (AIZA) 4th Last Word of JesusДокумент1 страница(AIZA) 4th Last Word of JesusAiza CabenianОценок пока нет

- Rule 37 New Trial or Reconsideration New TrialДокумент4 страницыRule 37 New Trial or Reconsideration New TrialAiza CabenianОценок пока нет

- UntitledДокумент2 страницыUntitledAiza CabenianОценок пока нет

- RecomendationsДокумент5 страницRecomendationsAiza CabenianОценок пока нет

- Certification-Rev 05Документ5 страницCertification-Rev 05Aiza CabenianОценок пока нет

- RemДокумент5 страницRemAiza CabenianОценок пока нет

- Action For Rescission of Partition On Account of LesionДокумент2 страницыAction For Rescission of Partition On Account of LesionAiza CabenianОценок пока нет

- Arb Carding T Cloa 1080 1Документ2 страницыArb Carding T Cloa 1080 1Aiza CabenianОценок пока нет

- ROsario CaseДокумент22 страницыROsario CaseAiza CabenianОценок пока нет

- Sample Bar NotesДокумент36 страницSample Bar NotesAiza CabenianОценок пока нет

- Remedial Law Case DigestДокумент24 страницыRemedial Law Case DigestAiza Cabenian100% (1)

- Republic of The Philippines Municipal Circuit Trial Court of Pambujan-Silvino LobosДокумент6 страницRepublic of The Philippines Municipal Circuit Trial Court of Pambujan-Silvino LobosAiza CabenianОценок пока нет

- Eneral Rinciples OF Axation F P T: TaxationДокумент39 страницEneral Rinciples OF Axation F P T: TaxationAiza CabenianОценок пока нет

- Complaint SampleДокумент6 страницComplaint SampleAiza CabenianОценок пока нет

- Judicial-Affidavit-Plaintiff SampleДокумент5 страницJudicial-Affidavit-Plaintiff SampleAiza Cabenian100% (2)

- Corpo AssignmentДокумент13 страницCorpo AssignmentAiza CabenianОценок пока нет

- Top 50 World Pharma 2001Документ11 страницTop 50 World Pharma 2001Juraj KubáňОценок пока нет

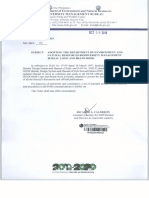

- Biodiversity Management Bureau: Repucjuf The Philippines Department of Environment and Natural ResourcesДокумент36 страницBiodiversity Management Bureau: Repucjuf The Philippines Department of Environment and Natural ResourcesMarijenLeañoОценок пока нет

- Tactical Radio BasicsДокумент46 страницTactical Radio BasicsJeff Brissette100% (2)

- Epsilon Range Bomba HorizontalДокумент8 страницEpsilon Range Bomba HorizontalsalazarafaelОценок пока нет

- St10 Flasher DLL: Stmicroelectronics ConfidentialДокумент10 страницSt10 Flasher DLL: Stmicroelectronics Confidentialeshwarp sysargusОценок пока нет

- T BeamДокумент17 страницT BeamManojОценок пока нет

- Winter 2016 QP3 Spreadsheet QuestionДокумент2 страницыWinter 2016 QP3 Spreadsheet Questioneegeekeek eieoieeОценок пока нет

- Green Tyre TechnologyДокумент4 страницыGreen Tyre TechnologyAnuj SharmaОценок пока нет

- 9 PNB V Andrada Electric & Engineering Co., GR No. 142936, April 17, 2002Документ9 страниц9 PNB V Andrada Electric & Engineering Co., GR No. 142936, April 17, 2002Edgar Calzita AlotaОценок пока нет

- Quick Commerce:: The Real Last MileДокумент9 страницQuick Commerce:: The Real Last MileChhavi KhandujaОценок пока нет

- Ap Human Geography Unit 5Документ4 страницыAp Human Geography Unit 5api-287341145Оценок пока нет

- Pecson Vs CAДокумент3 страницыPecson Vs CASophiaFrancescaEspinosaОценок пока нет

- Ems Accounting Term 2Документ39 страницEms Accounting Term 2Paballo KoopediОценок пока нет

- 03 Zero Emissions and Eco-Town in KawasakiДокумент21 страница03 Zero Emissions and Eco-Town in KawasakiAlwi AmarОценок пока нет

- a27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eДокумент762 страницыa27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eRed DiggerОценок пока нет

- Bảo MậtДокумент2 страницыBảo MậtMinh Nghia PhamОценок пока нет

- M.Tech VLSI SyllabusДокумент10 страницM.Tech VLSI SyllabusAshadur RahamanОценок пока нет

- 02 - STD - Bimetal Overload Relay - (2.07 - 2.08)Документ2 страницы02 - STD - Bimetal Overload Relay - (2.07 - 2.08)ThilinaОценок пока нет

- Allama Iqbal Open University, Islamabad Warning: (Department of Secondary Teacher Education)Документ2 страницыAllama Iqbal Open University, Islamabad Warning: (Department of Secondary Teacher Education)Tehmina HanifОценок пока нет

- An Introduction To SAP Business One CloudДокумент14 страницAn Introduction To SAP Business One CloudBharathkumar PalaniveluОценок пока нет

- TUF-2000M User Manual PDFДокумент56 страницTUF-2000M User Manual PDFreinaldoОценок пока нет

- PF2579EN00EMДокумент2 страницыPF2579EN00EMVinoth KumarОценок пока нет

- ACCA P5 GTG Question Bank - 2011Документ180 страницACCA P5 GTG Question Bank - 2011raqifiluz86% (22)

- 2 SpecificationДокумент20 страниц2 Specificationprithvi614710Оценок пока нет

- Sub Clause 1.15 Limitation of Liability PDFДокумент4 страницыSub Clause 1.15 Limitation of Liability PDFBogdanОценок пока нет

- 150 67-Eg1Документ104 страницы150 67-Eg1rikoОценок пока нет

- U90 Ladder Tutorial PDFДокумент72 страницыU90 Ladder Tutorial PDFMarlon CalixОценок пока нет

- FBL ManualДокумент12 страницFBL Manualaurumstar2000Оценок пока нет

- Standard Operating Procedure Template - Single PageДокумент1 страницаStandard Operating Procedure Template - Single PagetesОценок пока нет

- Eligibility To Become IAS Officer: Career As A IAS Officer About IAS OfficerДокумент4 страницыEligibility To Become IAS Officer: Career As A IAS Officer About IAS Officersamiie30Оценок пока нет