Академический Документы

Профессиональный Документы

Культура Документы

Midterm Examination: Financial Management I

Загружено:

ROB101512Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Midterm Examination: Financial Management I

Загружено:

ROB101512Авторское право:

Доступные форматы

MIDTERM EXAMINATION: FINANCIAL MANAGEMENT I

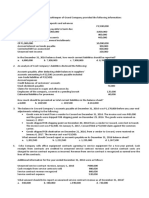

Financial statements for Prasken Company appear below:

Prasken Company

Statement of Financial Position

December 31, Year 2 and Year 1

(Pesos in thousands)

Year 2 Year 1

Current assets:

Cash and marketable securities P130 P120

Accounts receivable, net 180 180

Inventory 170 180

Prepaid expenses 20 20

Total current assets 500 500

Noncurrent assets:

Plant & equipment, net 2,000 1,930

Total assets P2,500 P2,430

Current liabilities:

Accounts payable 130 160

Accrued liabilities 30 60

Notes payable, short term 130 130

Total current liabilities 290 350

Noncurrent liabilities:

Bonds payable 310 300

Total liabilities P600 P650

Stockholders’ equity:

Preferred stock, P10 par, 10% 100 100

Common stock, P10 par 180 180

Additional paid-in capital--common stock 160 160

Retained earnings 1,460 1,340

Total stockholders’ equity 1,900 1,780

Total liabilities & stockholders’ equity P2,500 P2,430

Prasken Company

Income Statement

For the Year Ended December 31, Year 2

(Pesos in thousands)

Sales (all on account) P2,300

Cost of goods sold 1,610

Gross margin 690

Operating expenses 270

Net operating income 420

Interest expense 30

Net income before taxes 390

Income taxes (30%) 117

Net income P 273

Dividends during Year 2 totaled P153 thousand, of which P10 thousand were preferred

dividends. The market price of a share of common stock on December 31, Year 2 was P210.

Required:

Compute the following for Year 2:

36. Earnings per share of common stock.

37. Price-earnings ratio.

38. Dividend payout ratio.

39. Dividend yield ratio.

40. Return on total assets.

41. Return on common stockholders' equity.

MIDTERM EXAMINATION: FINANCIAL MANAGEMENT I

42. Book value per share.

43. Working capital.

44. Current ratio.

45. Acid-test (quick) ratio.

46. Accounts receivable turnover.

47. Average collection period (age of receivables).

48. Inventory turnover.

49. Average sale period (turnover in days).

50. Times interest earned.

MIDTERM EXAMINATION: FINANCIAL MANAGEMENT I

Вам также может понравиться

- Vertical Analysis To Financial StatementsДокумент8 страницVertical Analysis To Financial StatementsumeshОценок пока нет

- Quiz 101Документ1 страницаQuiz 101Mohammad Lomondot AmpasoОценок пока нет

- Total P 1,200,000: Refer PDF Problem 1Документ2 страницыTotal P 1,200,000: Refer PDF Problem 1Joanna Rose DeciarОценок пока нет

- BS Accountancy Sample ThesisДокумент8 страницBS Accountancy Sample ThesisBUENA SANGELОценок пока нет

- Administrative Office ManagementДокумент44 страницыAdministrative Office ManagementLea VenturozoОценок пока нет

- Assignment Business CombinationДокумент4 страницыAssignment Business CombinationLeisleiRagoОценок пока нет

- Chapter13 - Answer PDFДокумент5 страницChapter13 - Answer PDFJONAS VINCENT SamsonОценок пока нет

- Chapter 15-Financial Planning: Multiple ChoiceДокумент22 страницыChapter 15-Financial Planning: Multiple ChoiceadssdasdsadОценок пока нет

- Recourse Obligation.: RequiredДокумент55 страницRecourse Obligation.: RequiredJude SantosОценок пока нет

- Finance An Art or ScienceДокумент17 страницFinance An Art or Sciencegcc vehariОценок пока нет

- Summary of IFRS 3 Business CombinationДокумент5 страницSummary of IFRS 3 Business CombinationAbdullah Al RaziОценок пока нет

- 2 - Special IssuesДокумент18 страниц2 - Special IssuesMoe AdelОценок пока нет

- MidtermExam Fin3 (Prac)Документ10 страницMidtermExam Fin3 (Prac)Raymond PacaldoОценок пока нет

- Nfjpia Nmbe Far 2017 Ans-1Документ10 страницNfjpia Nmbe Far 2017 Ans-1Stephen ChuaОценок пока нет

- Statement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTДокумент21 страницаStatement of Comprehensive Income: Irene Mae C. Guerra, CPA, CTTRuaya AilynОценок пока нет

- Chapter 14, Modern Advanced Accounting-Review Q & ExrДокумент18 страницChapter 14, Modern Advanced Accounting-Review Q & Exrrlg4814100% (4)

- Seatwork-Hedging of A Net Investment in Foreign OperationДокумент1 страницаSeatwork-Hedging of A Net Investment in Foreign OperationAnthony Tunying MantuhacОценок пока нет

- Form of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListДокумент4 страницыForm of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListKeanne ArmstrongОценок пока нет

- Chapter 28 AnsДокумент9 страницChapter 28 AnsDave ManaloОценок пока нет

- 2nd Quiz Aud ProbДокумент4 страницы2nd Quiz Aud ProbJohn Patrick Lazaro AndresОценок пока нет

- Chapter 3 Partnership Liquidation and IncorporationДокумент73 страницыChapter 3 Partnership Liquidation and IncorporationHarry J Gartlan100% (1)

- Multiple Choic1Документ4 страницыMultiple Choic1stillwinmsОценок пока нет

- Capital MaintenanceДокумент5 страницCapital MaintenancePj SornОценок пока нет

- Relevant Provision of The Pfrs For SmeДокумент26 страницRelevant Provision of The Pfrs For SmeTheresa MacasiebОценок пока нет

- Chapter 1Документ42 страницыChapter 1harshitОценок пока нет

- 1.2 AudДокумент1 страница1.2 AudLu LacОценок пока нет

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityДокумент5 страницColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezОценок пока нет

- Karkits Corporation PDFДокумент4 страницыKarkits Corporation PDFRachel LeachonОценок пока нет

- CMA2011 CatalogДокумент5 страницCMA2011 CatalogDaryl DizonОценок пока нет

- Case Carolina-Wilderness-Outfitters-Case-Study PDFДокумент8 страницCase Carolina-Wilderness-Outfitters-Case-Study PDFMira miguelito50% (2)

- Ap8501, Ap8502, Ap8503 Audit of ShareholdersДокумент21 страницаAp8501, Ap8502, Ap8503 Audit of ShareholdersRits Monte100% (1)

- English Iii: University of Guayaquil Facultad Piloto de OdontologíaДокумент4 страницыEnglish Iii: University of Guayaquil Facultad Piloto de OdontologíaDianitaVelezPincayОценок пока нет

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Документ20 страницPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Pdf FilesОценок пока нет

- PDF Chapter 9 Audit of Liabilities Roque CompressДокумент77 страницPDF Chapter 9 Audit of Liabilities Roque CompressLovely Dela Cruz GanoanОценок пока нет

- Audit of Receivable Wit Ans KeyДокумент19 страницAudit of Receivable Wit Ans Keyalexis pradaОценок пока нет

- Ms 03 - CVP AnalysisДокумент10 страницMs 03 - CVP AnalysisDin Rose GonzalesОценок пока нет

- Topic 2 - Strategi Marketing BudgetingДокумент30 страницTopic 2 - Strategi Marketing BudgetingCleo Coleen FortunadoОценок пока нет

- Memo To PartnerДокумент1 страницаMemo To PartnerjwagambillОценок пока нет

- Partnership - I: "Your Online Partner To Get Your Title"Документ8 страницPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoОценок пока нет

- Acc 310 - M004Документ12 страницAcc 310 - M004Edward Glenn BaguiОценок пока нет

- PRACTICAL ACCOUNTING 1 Part 2Документ9 страницPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagОценок пока нет

- AainvtyДокумент4 страницыAainvtyRodolfo SayangОценок пока нет

- SHE Exercise 13: Jonalyn Tabo ACT20 1Документ31 страницаSHE Exercise 13: Jonalyn Tabo ACT20 1faye pantiОценок пока нет

- AP - Liabilities - FIN ACC AP - Liabilities - FIN ACCДокумент5 страницAP - Liabilities - FIN ACC AP - Liabilities - FIN ACCAina AguirreОценок пока нет

- CH 021Документ2 страницыCH 021Joana TrinidadОценок пока нет

- 55026RR 14-2010 Accreditation PDFДокумент5 страниц55026RR 14-2010 Accreditation PDFlmin34Оценок пока нет

- CAPMДокумент12 страницCAPMAkash TiwariОценок пока нет

- AP - Liabilities - Without AnswersДокумент2 страницыAP - Liabilities - Without AnswersstillwinmsОценок пока нет

- 1.2 Assignment Audit of Cash and Cash Equivalents 2Документ3 страницы1.2 Assignment Audit of Cash and Cash Equivalents 2ORIEL RICKY IGNACIO GALLARDOОценок пока нет

- JPIA-MCL Academic-EventsДокумент17 страницJPIA-MCL Academic-EventsJana BercasioОценок пока нет

- AUDIT Journal 16Документ9 страницAUDIT Journal 16Daena NicodemusОценок пока нет

- Weston Corporation Has An Internal Audit Department Operating OuДокумент2 страницыWeston Corporation Has An Internal Audit Department Operating OuAmit PandeyОценок пока нет

- Suzette Washington CaseДокумент30 страницSuzette Washington CaseMary Queen Ramos-Umoquit100% (1)

- Intangible MCДокумент49 страницIntangible MCAnonymous zpUO2SОценок пока нет

- AUDIT - An OverviewДокумент34 страницыAUDIT - An OverviewMara Shaira SiegaОценок пока нет

- Financial-Management 345Документ1 страницаFinancial-Management 345khurramОценок пока нет

- Ratio Analysis: FM1 Activities and Quizzes Page 1Документ3 страницыRatio Analysis: FM1 Activities and Quizzes Page 1132345usdfghjОценок пока нет

- Ratio Analysis Activity - Answer KeyДокумент4 страницыRatio Analysis Activity - Answer KeyLysss Epssss100% (1)

- Quiz 1.1Документ2 страницыQuiz 1.1Annalie Cono0% (1)

- Instructions: Financial Accounting and Reporting IIДокумент2 страницыInstructions: Financial Accounting and Reporting IIROB101512Оценок пока нет

- Current LiabilitiesДокумент3 страницыCurrent LiabilitiesROB101512Оценок пока нет

- CCE Form - 7th CycleДокумент5 страницCCE Form - 7th CycleROB101512Оценок пока нет

- Objective of PAS 1Документ8 страницObjective of PAS 1ROB101512Оценок пока нет

- Pas 10 Events After Reporting PeriodДокумент2 страницыPas 10 Events After Reporting PeriodROB101512100% (1)

- Merchandising FinalsДокумент3 страницыMerchandising FinalsROB101512Оценок пока нет

- PAS 8 Accounting Policies, Changes in Accounting Estimates and ErrorsДокумент5 страницPAS 8 Accounting Policies, Changes in Accounting Estimates and ErrorsROB101512Оценок пока нет

- Financial Accounting and Reporting-Theoretical The Conceptual FrameworkДокумент2 страницыFinancial Accounting and Reporting-Theoretical The Conceptual FrameworkROB101512Оценок пока нет

- Notes To The Financial StatementsДокумент4 страницыNotes To The Financial StatementsROB101512Оценок пока нет

- Conceptual Framework For Financial Reporting 2018Документ11 страницConceptual Framework For Financial Reporting 2018ROB101512Оценок пока нет

- Merchandising FinalsДокумент3 страницыMerchandising FinalsROB101512100% (1)

- Midterm Exam in FMДокумент10 страницMidterm Exam in FMROB101512Оценок пока нет

- AUDITING THEORY Quiz No. 3Документ3 страницыAUDITING THEORY Quiz No. 3ROB101512Оценок пока нет

- Theory of AccountsДокумент4 страницыTheory of AccountsROB101512Оценок пока нет

- QUIZ WCM StudentДокумент1 страницаQUIZ WCM StudentROB101512Оценок пока нет

- Quiz - WCMДокумент1 страницаQuiz - WCMROB101512Оценок пока нет

- Quiz - WCMДокумент1 страницаQuiz - WCMROB101512Оценок пока нет

- PRACTICAL ACCOUNTING I Quiz No. 2Документ6 страницPRACTICAL ACCOUNTING I Quiz No. 2ROB1015120% (2)

- Solution - PPE Nad IntangiblesДокумент1 страницаSolution - PPE Nad IntangiblesROB101512Оценок пока нет

- AUDITING THEORY Quiz No. 3Документ3 страницыAUDITING THEORY Quiz No. 3ROB101512Оценок пока нет

- Management Accounting 2Документ3 страницыManagement Accounting 2ROB101512Оценок пока нет

- Management Advisory Services - MidtermДокумент7 страницManagement Advisory Services - MidtermROB101512Оценок пока нет

- Andres Pou: Miami - Dade Community CollegeДокумент2 страницыAndres Pou: Miami - Dade Community CollegeChandra SimsОценок пока нет

- Alpha Graphics CompanyДокумент2 страницыAlpha Graphics CompanyMira FebriasariОценок пока нет

- Chapter 1 Cost Accounting 2020Документ21 страницаChapter 1 Cost Accounting 2020magdy kamelОценок пока нет

- Acc117 Group AssignmentДокумент15 страницAcc117 Group AssignmentMUHAMMAD HIFZHANI AZMANОценок пока нет

- ZTBL Internship ReportДокумент33 страницыZTBL Internship Reportmuhammad waseemОценок пока нет

- Cash Disbursement RegisterДокумент2 страницыCash Disbursement RegisterLucile Flores0% (1)

- Instruction For Trust Account: Aristocapital New Account ContactДокумент11 страницInstruction For Trust Account: Aristocapital New Account ContactАлександр ЛебедевОценок пока нет

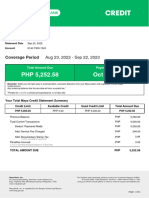

- MayaCredit SoA 2023SEPДокумент3 страницыMayaCredit SoA 2023SEPjepoy palaruanОценок пока нет

- Urban Water Tariff GhanaДокумент15 страницUrban Water Tariff GhanaBonzibit ZibitОценок пока нет

- New Zealand 2009 Financial Knowledge SurveyДокумент11 страницNew Zealand 2009 Financial Knowledge SurveywmhuthnanceОценок пока нет

- Course Content and Objectives: ACCT 151 Introduction To Financial Accounting FALL 2014 Professor BrodishДокумент18 страницCourse Content and Objectives: ACCT 151 Introduction To Financial Accounting FALL 2014 Professor BrodishzeroyopОценок пока нет

- Lords of Finance - Liaquat Ahamed PDFДокумент12 страницLords of Finance - Liaquat Ahamed PDFasaid100% (2)

- BBMF1823 CW2 - 202309 - Group 6Документ36 страницBBMF1823 CW2 - 202309 - Group 6HOO VI YINGОценок пока нет

- A Company Is An Artificial Person Created by LawДокумент5 страницA Company Is An Artificial Person Created by LawNeelabhОценок пока нет

- 2009 CFA Level 1 Mock Exam MorningДокумент38 страниц2009 CFA Level 1 Mock Exam MorningForrest100% (1)

- Contract of LeaseДокумент2 страницыContract of LeaseElain OrtizОценок пока нет

- ISA 315 & ISA 240 (Fraud and Risk)Документ54 страницыISA 315 & ISA 240 (Fraud and Risk)Joe SmithОценок пока нет

- Silabus Cgc. FixДокумент5 страницSilabus Cgc. FixTeguh PurnamaОценок пока нет

- Analysis On Financial Health of HDFC Bank and Icici BankДокумент11 страницAnalysis On Financial Health of HDFC Bank and Icici Banksaket agarwalОценок пока нет

- Crime Insurance Marsh PDFДокумент2 страницыCrime Insurance Marsh PDFSyaeful Aziz ZОценок пока нет

- Effects of InflationДокумент3 страницыEffects of InflationonenumbОценок пока нет

- Account Statement BY90MTBK30140008000003271543Документ1 страницаAccount Statement BY90MTBK30140008000003271543savasdvsdavsadvdОценок пока нет

- AACAP - Exercise 2Документ4 страницыAACAP - Exercise 2sharielles /Оценок пока нет

- Technical Analysis of MahindraДокумент3 страницыTechnical Analysis of MahindraRipunjoy SonowalОценок пока нет

- Computer Literacy Test 3Документ9 страницComputer Literacy Test 3Xavier MundattilОценок пока нет

- Acctg7 - CH 2Документ33 страницыAcctg7 - CH 2Jao FloresОценок пока нет

- A Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachДокумент8 страницA Case Study of Luntian Multi-Purpose Cooperative in Barangay Lalaig, Tiaong, Quezon, Philippines: A Vertical Integration ApproachJedd Virgo100% (2)

- Total 1 473 900.00 1 473 900.00Документ4 страницыTotal 1 473 900.00 1 473 900.00Angela GarciaОценок пока нет

- ACCO320Midterm Fall2013FNДокумент14 страницACCO320Midterm Fall2013FNzzОценок пока нет

- Treasury Bond Claim Form Sav1048Документ7 страницTreasury Bond Claim Form Sav1048aplaw100% (1)