Академический Документы

Профессиональный Документы

Культура Документы

Assessment Section:: (Can It Be Subject To Advance Notice?)

Загружено:

Hanabishi RekkaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Assessment Section:: (Can It Be Subject To Advance Notice?)

Загружено:

Hanabishi RekkaАвторское право:

Доступные форматы

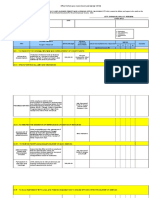

ASSESSMENT SECTION:

Be available on call from 8:00 am to 5:00 pm for any official instruction from the Office

authorized officers. . (Can it be subject to advance notice?)

Conduct audit/evaluation of pending cases base on documents submitted by taxpayer

and prepare report of investigation. LOA

Discuss with the supervisor on-line the result of investigation and make necessary

adjustments, if necessary. LOA

Arrange a day to have the report signed by the supervisor and eventually submit the

same to the Chief of Assessment Section. The Chief of Assessment Section shall arrange

a day that the examiner and/or supervisor shall submit the report to avoid them coming

to Office at the same time. Further, a Revenue Officer is required to submit at least

three (3) cases a week. LOA

Prepare letters/documents incidental to the audit investigation such as First and Final

Notices, request for subpoena duces tecum, Notice of Informal conference, and

payment forms. LOA

Discuss or make follow ups regarding all matters or results of investigation/re-

investigation to the taxpayers thru telephone or other means of online communications

that can provide adequate private meetings/conversations. LOA

Prepare reports on other cases like referrals for closure of business, destruction of

spoiled/obsolete inventories including mission orders. OTHER MATTERS (ONETT)

Monitor assigned TAMP taxpayer and inquire about their tax compliance especially for

any drastic changes, violations for open cases and/or non submission of alphalist and

the likes and make sure they are enrolled and using the EFPS system of filing and

payment of returns. TAMP

Assist TAMP taxpayer in all their concerns with the Bureau of Internal Revenue. TAMP

Send communications to taxpayers as will be required under the assigned projects i.e

new regulations, bank bulletins, appeal letters, and other tax advisories. TAMP

Perform task based on the Projects as assigned.

For group supervisors: Ensure that all the task assigned to the Revenue Officers under

his/her group are efficiently and effectively performed and prepare daily report to the

Chief, Assessment Section.

Notes:

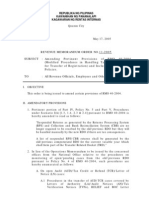

1. All report/accomplishment shall be submitted on line everyday. Revenue Officer

who failed to submit report before 6:00pm of the afternoon shall come to office

and physically report the following day (Monday in case the day failed is Friday).

ALL REVENUE OFFICER – SUBMIT PENDING LOA WITH SPECIFIC STATUS…. WALANG BOLAHAN

PLEASE TAKE SPECIAL TIME TO TAMP. INTRODUCE, GET THE CONTACT PERSON, CONTACT

NUMBER, EMAIL ADDRESS, COMPANY PRESIDENT NAME, CONTACT NUMBER AND EMAIL IF

POSSIBLE. VALIDATE THE EMAIL ADDRESS.. SEND EMAIL TO KNOW IF VALID, WILL IT BOUNCE…

FROM NOW ON.. THE TAMP OFFICER WILL BE ENCHARGE OF THE EMAIL BLAST/INFROMATION

DISSEMINATION. NOT TO OVERLOAD ONE RO’S EMAIL…

SET DEADLINE TO GET COMPLETE INFO OF ALL TAMP. REPORT TO CAS/JACK….

DRASTIC CHANGE… FROM TIME TO TIME… CAS WILL DOWNLOAD DRASTIC CHANGE…

DRASTIC CHANGE OF ALL TAMP… DESSIMINATE TAX NEWS, BANK BULLETINS, NEW

REGULATIONS, APPEAL LETTERS AND OTHER TAX ADVISORIES – KASI HINDI MA-SEND NI CAS

LAHAT KASI MINSAN LIMITED ANG NA SESEND NG ISANG EMAIL ADDRESS.

FORMAT OF REPORT/ACCOMPLISHEMT REPORT?

DO WE STILL CONTINUE OPLAN KANDADO? IF NOT, SHALL WE CONTINUE BUILDING CASES OF

OPLAN KANDADO.

DO WE PLAN TO CONTINUE INVENTORY TAKING?

OPLAN PASILIP CRM POS… gs romel

NON-TAMP DRASTIC CHANGE… --- COORDINATE WITH COMPLIANCE

TAXPAYER WHO DID NOT FILE ANNUAL IT RETURN ON 2018 BUT QUALIFIED AS SBWS…

ROHQ

RATE – EFPS WITHOUT CBR

Вам также может понравиться

- Chapter 2 Tax AdministrationДокумент12 страницChapter 2 Tax AdministrationGlomarie GonayonОценок пока нет

- Common Law Copyright NoticeДокумент4 страницыCommon Law Copyright NoticeI Am.100% (2)

- 1901 For Self-Employed, Professional, & Single ProprietorshipДокумент11 страниц1901 For Self-Employed, Professional, & Single ProprietorshipbirtaxinfoОценок пока нет

- 1040 Exam Prep: Module II - Basic Tax ConceptsОт Everand1040 Exam Prep: Module II - Basic Tax ConceptsРейтинг: 1.5 из 5 звезд1.5/5 (2)

- General Rule: Potestas Delegata Non Delegari PotestДокумент3 страницыGeneral Rule: Potestas Delegata Non Delegari PotestHanabishi RekkaОценок пока нет

- REMINDER LETTER Late Filing of Vat ReturnДокумент2 страницыREMINDER LETTER Late Filing of Vat ReturnHanabishi Rekka100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4От EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Оценок пока нет

- Payment Assessment FormДокумент1 страницаPayment Assessment FormHanabishi RekkaОценок пока нет

- BIR Form 1600Документ39 страницBIR Form 1600maeshach60% (5)

- Examination Notes Topa Transfer of Property ActДокумент175 страницExamination Notes Topa Transfer of Property ActAdv Mayur Prajapati97% (32)

- Tax Agents and PractitionersДокумент5 страницTax Agents and PractitionerskawaiimiracleОценок пока нет

- Issues, Problems and Solutions in Tax Audit and Investigation (1-10-13)Документ184 страницыIssues, Problems and Solutions in Tax Audit and Investigation (1-10-13)marygrace_apaitan100% (2)

- Honasan II v. DOJ PanelДокумент5 страницHonasan II v. DOJ PanelC.G. AguilarОценок пока нет

- Account Receivable Team in Backoffice: Radio/Digital - Entry in WO and Monthly Upload in SAPДокумент4 страницыAccount Receivable Team in Backoffice: Radio/Digital - Entry in WO and Monthly Upload in SAPDipesh Jain100% (1)

- TAMP BriefingДокумент17 страницTAMP Briefingdragon 999999100% (1)

- Bir - Webinar - New RegistrantsДокумент107 страницBir - Webinar - New RegistrantsEdward Gan100% (1)

- City Treasurer's Office Cagayan de Oro Citizen's CharterДокумент19 страницCity Treasurer's Office Cagayan de Oro Citizen's CharterJazz AdazaОценок пока нет

- Scardina v. Masterpiece Cakeshop: Defendants' Motion For Summary Judgment OrderДокумент5 страницScardina v. Masterpiece Cakeshop: Defendants' Motion For Summary Judgment OrderMichael_Roberts2019Оценок пока нет

- Constitutional Law 2 Course Outline (Syllabus) John Wesley School of Law and GovernanceДокумент17 страницConstitutional Law 2 Course Outline (Syllabus) John Wesley School of Law and GovernanceHanabishi RekkaОценок пока нет

- Income Payee'S Sworn Declaration of Gross Receipts/SalesДокумент2 страницыIncome Payee'S Sworn Declaration of Gross Receipts/SalesHanabishi RekkaОценок пока нет

- Law On Sales Final Exam First Sem 2020Документ2 страницыLaw On Sales Final Exam First Sem 2020Hanabishi RekkaОценок пока нет

- Antichresis (ARTICLES 2132-2139) : Writing OtherwiseДокумент4 страницыAntichresis (ARTICLES 2132-2139) : Writing OtherwiseLisa Bautista100% (1)

- 4 - BDRRMC 2Документ2 страницы4 - BDRRMC 2Robert Tayam, Jr.Оценок пока нет

- Summary NIRCДокумент44 страницыSummary NIRCbebs CachoОценок пока нет

- Lesson 4. Tax Administration.Документ44 страницыLesson 4. Tax Administration.Si OneilОценок пока нет

- Navarro v. Ermita April 12, 2011Документ4 страницыNavarro v. Ermita April 12, 2011Czarina Cid100% (1)

- Sample Bidding Documents For The Procurement of Supply For Janitorial ServicesДокумент95 страницSample Bidding Documents For The Procurement of Supply For Janitorial ServicesAlvin Claridades100% (1)

- Bplo - OpcrДокумент6 страницBplo - OpcrMecs Nid67% (3)

- Manila Tax CodeДокумент502 страницыManila Tax CodeLc Fernandez100% (3)

- Association of Small Landowners in The Philippines v. Honorable Secretary of Agrarian ReformДокумент3 страницыAssociation of Small Landowners in The Philippines v. Honorable Secretary of Agrarian ReformHanabishi RekkaОценок пока нет

- Redeña - RedeñaДокумент3 страницыRedeña - RedeñaGlenz LagunaОценок пока нет

- NSTP Prelim ExamДокумент3 страницыNSTP Prelim ExamLeizl Tolentino100% (3)

- Tax 1 MamalateoДокумент21 страницаTax 1 Mamalateodonsiccuan100% (1)

- TAX PAYER GUIDE MannualДокумент7 страницTAX PAYER GUIDE MannualLevi Lazareno EugenioОценок пока нет

- RMO 11-2005 (Corrected Version)Документ12 страницRMO 11-2005 (Corrected Version)simey_kizhie07Оценок пока нет

- Rmo 41-2011Документ51 страницаRmo 41-2011Christian Albert HerreraОценок пока нет

- 1601 C CompensationДокумент2 страницы1601 C Compensationjon_cpaОценок пока нет

- Large Taxpayer Unit (Ltu) : Concept ofДокумент3 страницыLarge Taxpayer Unit (Ltu) : Concept ofswami_ratanОценок пока нет

- Closure of BusinessДокумент9 страницClosure of BusinessAnonymous uMI5BmОценок пока нет

- RMC 39-2013Документ2 страницыRMC 39-2013Kram Ynothna BulahanОценок пока нет

- 1601C GuidelinesДокумент1 страница1601C GuidelinesfatmaaleahОценок пока нет

- FISCAL PROCEDURE Cameroon TaxationДокумент8 страницFISCAL PROCEDURE Cameroon TaxationAmba FredОценок пока нет

- 12 - New Computerized Accounting SystemsДокумент5 страниц12 - New Computerized Accounting SystemsAris DuroyОценок пока нет

- RP) Recukus: T-R FL ?Документ1 страницаRP) Recukus: T-R FL ?Mary Joyce Carillo GarciaОценок пока нет

- Webinar On How To Deal With Open Cases in The BirДокумент25 страницWebinar On How To Deal With Open Cases in The BirkirkoОценок пока нет

- Guidelines For Appointment of Standing CounselsДокумент16 страницGuidelines For Appointment of Standing CounselsGanesh AnantharamОценок пока нет

- Flow ChartДокумент9 страницFlow ChartbhavanshujОценок пока нет

- BIR - Invoicing RequirementsДокумент17 страницBIR - Invoicing RequirementsCkey ArОценок пока нет

- Steps How To Apply Tax ClearanceДокумент2 страницыSteps How To Apply Tax ClearanceFenny TampusОценок пока нет

- Witholding TaxДокумент68 страницWitholding TaxReynante GungonОценок пока нет

- Sponsored By:: The Chanrobles GroupДокумент9 страницSponsored By:: The Chanrobles Groupbaby.torpee9117Оценок пока нет

- Bir Reg TaxationДокумент7 страницBir Reg TaxationTinkerbelle Nena FatimaОценок пока нет

- Corporate Tax AccountantДокумент2 страницыCorporate Tax AccountantHelvia RahàyuОценок пока нет

- Sub Treasury Training ReportДокумент7 страницSub Treasury Training ReportsrmurralitharanОценок пока нет

- 47470rmc No. 51-2009 PDFДокумент5 страниц47470rmc No. 51-2009 PDFEarl PatrickОценок пока нет

- Bir RMC 51-2009Документ5 страницBir RMC 51-2009Reg YuОценок пока нет

- Bureau of Internal Revenue Form 1604e 2016Документ2 страницыBureau of Internal Revenue Form 1604e 2016Lynnard Philip PanesОценок пока нет

- National Taxation (Income & Business Tax) OCTOBER 1, 2014Документ39 страницNational Taxation (Income & Business Tax) OCTOBER 1, 2014Eliza Corpuz GadonОценок пока нет

- Income Taxation Chapter 1 5f420b5e2c985Документ154 страницыIncome Taxation Chapter 1 5f420b5e2c985Kim DiezОценок пока нет

- Memorandum Order No. 2016-003 - PEZAДокумент19 страницMemorandum Order No. 2016-003 - PEZAYee BeringuelaОценок пока нет

- Accounts Payable Year End Procedures 0809Документ5 страницAccounts Payable Year End Procedures 0809Aman Khan Badal KhanОценок пока нет

- 29133rmo 10-2006Документ15 страниц29133rmo 10-2006Denzel Edward CariagaОценок пока нет

- BIR Form 1601 c1Документ2 страницыBIR Form 1601 c1Ver ArocenaОценок пока нет

- Electronic Filing and Payment System (EFPS) eFPS Stands For Electronic Filing and Payment System, and It Refers To The SystemДокумент6 страницElectronic Filing and Payment System (EFPS) eFPS Stands For Electronic Filing and Payment System, and It Refers To The SystemJonathan Isaac De SilvaОценок пока нет

- 0605 (July 1999)Документ1 страница0605 (July 1999)Yulo Vincent Bucayu PanuncioОценок пока нет

- RMO No.46-2018Документ13 страницRMO No.46-2018Bobbit C ArninioОценок пока нет

- RMO No.46-2018 PDFДокумент13 страницRMO No.46-2018 PDFCzarina UmilinОценок пока нет

- Citizens Charter NewДокумент56 страницCitizens Charter NewAlfons Janssen Marcera100% (1)

- Application For Registration UpdateДокумент15 страницApplication For Registration UpdateMcrislbОценок пока нет

- RR 15-2007 PDFДокумент4 страницыRR 15-2007 PDFnaldsdomingoОценок пока нет

- BIR Form 0605 UsesДокумент4 страницыBIR Form 0605 UsesCykee Hanna Quizo LumongsodОценок пока нет

- COIDA-Letters of Good Standing Revised Procedure Feb 2013Документ2 страницыCOIDA-Letters of Good Standing Revised Procedure Feb 2013Durban Chamber of Commerce and IndustryОценок пока нет

- EXPANDEDДокумент2 страницыEXPANDEDJenny BernardinoОценок пока нет

- DTRДокумент4 страницыDTRRonnel Manilag AtienzaОценок пока нет

- Rmo01 04Документ8 страницRmo01 04Eric SavinaОценок пока нет

- Accounts Payable/Payroll ClerkДокумент6 страницAccounts Payable/Payroll ClerkAngyvalerieОценок пока нет

- Civil Service Form NoДокумент3 страницыCivil Service Form NoJhoanna Castro-CusipagОценок пока нет

- 100% CompletedДокумент1 страница100% CompletedHanabishi RekkaОценок пока нет

- Land For The LandlessДокумент1 страницаLand For The LandlessHanabishi RekkaОценок пока нет

- Destruction FormДокумент2 страницыDestruction FormHanabishi RekkaОценок пока нет

- Bid Disqualification LetterДокумент1 страницаBid Disqualification LetterHanabishi RekkaОценок пока нет

- 49 PAID 2016Документ12 страниц49 PAID 2016Hanabishi RekkaОценок пока нет

- VAT LATE FILING 1ST Q AND APRIL 2020 FilteredДокумент13 страницVAT LATE FILING 1ST Q AND APRIL 2020 FilteredHanabishi RekkaОценок пока нет

- Sub Contract Agreement TabukДокумент7 страницSub Contract Agreement TabukHanabishi RekkaОценок пока нет

- RBR Builders & Ready Mix Concrete: Cell # 09228390603 / TELEFAX (044) 940-4005Документ1 страницаRBR Builders & Ready Mix Concrete: Cell # 09228390603 / TELEFAX (044) 940-4005Hanabishi RekkaОценок пока нет

- Wesleyan Law Course Guide For Negotiable Instruments LawДокумент20 страницWesleyan Law Course Guide For Negotiable Instruments LawHanabishi RekkaОценок пока нет

- Land Titles and Deeds Module 1Документ2 страницыLand Titles and Deeds Module 1Hanabishi RekkaОценок пока нет

- Sales Midterm ExamДокумент2 страницыSales Midterm ExamHanabishi Rekka100% (1)

- John Louie Esguerra Constitutional Law I Midterm (October 31, 2020)Документ2 страницыJohn Louie Esguerra Constitutional Law I Midterm (October 31, 2020)Hanabishi RekkaОценок пока нет

- Land Titles and DeedsДокумент8 страницLand Titles and DeedsHanabishi RekkaОценок пока нет

- Republic Vs Nolasco - G.R. No. 155108. April 27, 2005Документ16 страницRepublic Vs Nolasco - G.R. No. 155108. April 27, 2005Ebbe DyОценок пока нет

- CIRTEKДокумент11 страницCIRTEKMIKAELA THERESE OBACHОценок пока нет

- Chapter 2 Taxes Tax Laws and Tax AdministrationДокумент29 страницChapter 2 Taxes Tax Laws and Tax Administrationdexter padayaoОценок пока нет

- Chapter 4 2021 NteboДокумент16 страницChapter 4 2021 NteboNaya Naledi MokoanaОценок пока нет

- WP-326-22.doc: Digitally Signed by Balaji Govindrao Panchal Date: 2022.10.15 14:28:22 +0530Документ4 страницыWP-326-22.doc: Digitally Signed by Balaji Govindrao Panchal Date: 2022.10.15 14:28:22 +0530SHAURYASINGH CHOWHANОценок пока нет

- Family Cemetery Trust ConstitutionДокумент4 страницыFamily Cemetery Trust Constitutionbull kitiibwaОценок пока нет

- Executive Branch Legislative Branch How A Bill Becomes and LawДокумент48 страницExecutive Branch Legislative Branch How A Bill Becomes and LawPenta PointОценок пока нет

- Vehicle Lease AgreementДокумент7 страницVehicle Lease Agreementidrishahmed23Оценок пока нет

- 78 (2a) PR eДокумент5 страниц78 (2a) PR eAvuyile TshofutiОценок пока нет

- DocumentДокумент5 страницDocumentCanapi AmerahОценок пока нет

- Conciliation and Mediation ProcedureДокумент1 страницаConciliation and Mediation ProcedureKhen NeteОценок пока нет

- Reyes v. Spartanburg County Detention Center Et Al - Document No. 5Документ6 страницReyes v. Spartanburg County Detention Center Et Al - Document No. 5Justia.comОценок пока нет

- LegCo - Restorative Justice For Juvenile OffendersДокумент6 страницLegCo - Restorative Justice For Juvenile OffendersLam ChitОценок пока нет

- SampleДокумент12 страницSampleabdulrehman786Оценок пока нет

- de Castro vs. EcharriДокумент3 страницыde Castro vs. EcharriLance Christian ZoletaОценок пока нет

- People Vs CabarrubiasДокумент5 страницPeople Vs CabarrubiasAnne Camille SongОценок пока нет

- CIC - BIM Protocol (2013)Документ15 страницCIC - BIM Protocol (2013)Stanciu OanaОценок пока нет

- Batas Pambansa Bilang 391Документ11 страницBatas Pambansa Bilang 391daydreamer5256Оценок пока нет

- NCW & Isf - Mentoring Program: Application & DeclarationДокумент2 страницыNCW & Isf - Mentoring Program: Application & DeclarationAnup JoshiОценок пока нет

- The Gift Tax Act 1990Документ6 страницThe Gift Tax Act 1990mislam_888881848Оценок пока нет