Академический Документы

Профессиональный Документы

Культура Документы

Accounting Entries For Intercompany Transaction

Загружено:

Umer Aziz0 оценок0% нашли этот документ полезным (0 голосов)

36 просмотров1 страницаThe document provides an example of consolidation accounting for intercompany sales and the sale of a plant between subsidiaries. It shows the calculation of cost of goods sold of $10,600 relating to goods sold between subsidiaries L Ltd. and J Ltd. and between Jordan Ltd. and Laila Ltd. It also shows the accounting entry to eliminate a $500,000 plant sale between subsidiaries, recognizing a $50,000 loss on sale and $10,000 reduction in accumulated depreciation.

Исходное описание:

Learn about intercompany transactions of plant & Machinary

Оригинальное название

Accounting Entries for Intercompany Transaction

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThe document provides an example of consolidation accounting for intercompany sales and the sale of a plant between subsidiaries. It shows the calculation of cost of goods sold of $10,600 relating to goods sold between subsidiaries L Ltd. and J Ltd. and between Jordan Ltd. and Laila Ltd. It also shows the accounting entry to eliminate a $500,000 plant sale between subsidiaries, recognizing a $50,000 loss on sale and $10,000 reduction in accumulated depreciation.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

36 просмотров1 страницаAccounting Entries For Intercompany Transaction

Загружено:

Umer AzizThe document provides an example of consolidation accounting for intercompany sales and the sale of a plant between subsidiaries. It shows the calculation of cost of goods sold of $10,600 relating to goods sold between subsidiaries L Ltd. and J Ltd. and between Jordan Ltd. and Laila Ltd. It also shows the accounting entry to eliminate a $500,000 plant sale between subsidiaries, recognizing a $50,000 loss on sale and $10,000 reduction in accumulated depreciation.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

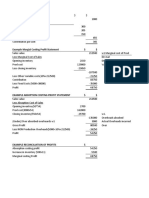

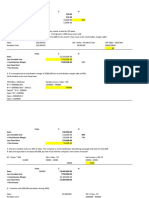

Consolidation Accounting Example

Cost of Goods sold to be Reported relating to the relevant intra-group sales

Sale from L Ltd. to J Ltd.

Portion of Inventory sold in 2017 = 80%

Cost of Inventory sold in 2017 = 9600 X (1-16.67%) 6,800

Sale from Jordan Ltd. to Laila Ltd.

Portion of Inventory sold in 2017 = 80%

Cost of Inventory sold in 2017 = 6000 X 80% / (1+20%) 4200

Cost of Goods sold relating to the relevant intra-group

10,600

sales

Accounting Entry ntercompany Sale of Plant

Amount

S.No. Date Particulars Amount $

$

1 Elimination Entry

30-Jun-17 Plant 500,000

Depreciation Expense 100,000

Loss on Sale of Plant 500000

Accumulated Depreciation 100000

Working:

Loss on Sale of Plant: Carrying Value - Sale Proceeds

Loss on Sale of Plant: 200000 - 150000 = 50000

Decrease in depreciation Charged:

Previous depreciation: 200000 / 5 = 40000

New Depreciation : 150000 / 5 = 30000

Decrease in depreciation Charged = 40000 - 30000 = 10000

Вам также может понравиться

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- CVP ExercisesДокумент10 страницCVP ExercisesDaiane AlcaideОценок пока нет

- Sri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vi (UNIT-IV)Документ7 страницSri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - Vi (UNIT-IV)Jaya BharneОценок пока нет

- Chap 008Документ34 страницыChap 008alishamrozОценок пока нет

- Solution Post-Test4Документ5 страницSolution Post-Test4Shienell PincaОценок пока нет

- 15 Marginal CostingДокумент14 страниц15 Marginal CostingHaresh KОценок пока нет

- 15 Marginal Costing PDFДокумент14 страниц15 Marginal Costing PDFSupriyoОценок пока нет

- 18-3-SA-V1-S1 Solved Problems RaДокумент34 страницы18-3-SA-V1-S1 Solved Problems RaRajyaLakshmiОценок пока нет

- Unit - 4Документ26 страницUnit - 4MOHAIDEEN THARIQ MОценок пока нет

- 202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Документ11 страниц202-0101-001 - ARIF HOSEN - Management Accounting Assignment 1Sayhan Hosen Arif100% (1)

- MAS Hilton Chap07Документ30 страницMAS Hilton Chap07YahiMicuaVillandaОценок пока нет

- Hilton 11e Chap007 StudentsДокумент38 страницHilton 11e Chap007 StudentsMelix SianturiОценок пока нет

- 2 Ratio Analysis Problems and SolutionsДокумент30 страниц2 Ratio Analysis Problems and SolutionsAayush Agrawal100% (3)

- Practical Problems & Solutions Class Work Upto IL.10Документ20 страницPractical Problems & Solutions Class Work Upto IL.10Dhanishta PramodОценок пока нет

- Compute The Correct Amount of Inventory:: Problem 10-1 Amiable CompanyДокумент83 страницыCompute The Correct Amount of Inventory:: Problem 10-1 Amiable CompanyIrish SungcangОценок пока нет

- Answers For Problems On Financial Leverage - 1-4Документ4 страницыAnswers For Problems On Financial Leverage - 1-4jeganrajraj75% (4)

- Assignment 2 ACT502Документ7 страницAssignment 2 ACT502Mahdi KhanОценок пока нет

- Cost-Volume-Profit AnalysisДокумент24 страницыCost-Volume-Profit AnalysisIbrahim ElsayedОценок пока нет

- Jawaban No 4Документ2 страницыJawaban No 4diaheka1712Оценок пока нет

- Ration AnalysisДокумент35 страницRation AnalysisMuhammad EjazОценок пока нет

- ExerciseДокумент7 страницExercisekarthikОценок пока нет

- 管理会计作业-Assignment 1 答案Документ19 страниц管理会计作业-Assignment 1 答案hzznОценок пока нет

- Cost Accounting II - 2Документ6 страницCost Accounting II - 2Koolknight M05Оценок пока нет

- Equation Method: Sales Variable Expenses + Fixed Expenses + Profits (At The Break-Even Point Profits Equal Zero)Документ4 страницыEquation Method: Sales Variable Expenses + Fixed Expenses + Profits (At The Break-Even Point Profits Equal Zero)Aly TerrenalОценок пока нет

- Salma Banu, Department of Commerce and Management, Paper: Cost Accounting Ii, 4 Sem Bcom E SectionДокумент6 страницSalma Banu, Department of Commerce and Management, Paper: Cost Accounting Ii, 4 Sem Bcom E SectionRocky BhaiОценок пока нет

- Chapter Six Ba 315-Lpc Umsl: (Contribution Margin)Документ53 страницыChapter Six Ba 315-Lpc Umsl: (Contribution Margin)NAZHIM KERENОценок пока нет

- CH 8 Part 2Документ15 страницCH 8 Part 2Hanif QusyairyОценок пока нет

- Assignment 02 - SolutionДокумент4 страницыAssignment 02 - SolutionSuman Paul ChowdhuryОценок пока нет

- Abc-Consolidation With Intercompany TransactionsДокумент3 страницыAbc-Consolidation With Intercompany TransactionsLeonardo MercaderОценок пока нет

- IPPTChap 007Документ53 страницыIPPTChap 007Khaled BarakatОценок пока нет

- Midway Greasy 2002 2003 2002 2003Документ6 страницMidway Greasy 2002 2003 2002 2003Pang SiulienОценок пока нет

- Cost Volume Profit Analysis - Chapter 6Документ39 страницCost Volume Profit Analysis - Chapter 6Maria Maganda MalditaОценок пока нет

- Ratio Analysis Solved ProblemsДокумент34 страницыRatio Analysis Solved ProblemsHaroon KhanОценок пока нет

- CVP AnalysisДокумент29 страницCVP Analysishukumsingh01juneОценок пока нет

- 12th CBSE 2021-22 BatchДокумент280 страниц12th CBSE 2021-22 BatchSharanya ShrivastavaОценок пока нет

- Managerial Accounting NotesДокумент6 страницManagerial Accounting NotesMarilou GabayaОценок пока нет

- Module 2 - AnswersДокумент26 страницModule 2 - AnswersSinghan SОценок пока нет

- B.T. Hernandez CompanyДокумент3 страницыB.T. Hernandez Companylee serojalesОценок пока нет

- Variable Costing and Segment Reporting: Tools For ManagementДокумент20 страницVariable Costing and Segment Reporting: Tools For ManagementFarhan RabbehОценок пока нет

- CVP Analysis: PG D M2 0 21-23 RelevantreadingsДокумент21 страницаCVP Analysis: PG D M2 0 21-23 RelevantreadingsAthi SivaОценок пока нет

- PremiumsДокумент10 страницPremiumsPhoebe Dayrit CunananОценок пока нет

- SolutionДокумент3 страницыSolutionHilary GaureaОценок пока нет

- Class Case 6 - Charmingly, Personalli, YoursДокумент5 страницClass Case 6 - Charmingly, Personalli, Yours9ry5gsghybОценок пока нет

- CVP AnalysisДокумент40 страницCVP Analysissbjafri0Оценок пока нет

- Assign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020Документ12 страницAssign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020mhikeedelantar100% (1)

- Acca Margianl and Absorption Costing SolutionДокумент2 страницыAcca Margianl and Absorption Costing SolutionKiri chrisОценок пока нет

- CVP Question BankДокумент5 страницCVP Question BankTamaraОценок пока нет

- Assignment 1 ACT502Документ6 страницAssignment 1 ACT502Mahdi KhanОценок пока нет

- Zepher MemoДокумент2 страницыZepher Memoewriteandread.businessОценок пока нет

- Segment ReportingДокумент4 страницыSegment ReportingMurshid IqbalОценок пока нет

- Aud1 022424 LectureДокумент1 страницаAud1 022424 LectureJessie PaterezОценок пока нет

- 12th CBSE 2021-22 BatchДокумент253 страницы12th CBSE 2021-22 BatchPriyanshu GehlotОценок пока нет

- Variable Costing and Segment Reporting: Tools For ManagementДокумент20 страницVariable Costing and Segment Reporting: Tools For ManagementAbed Al-Rahman SalehОценок пока нет

- CVP Analysis 2 Amp Ratios ExcelДокумент53 страницыCVP Analysis 2 Amp Ratios ExcelSoahОценок пока нет

- Fin. Anal RafaelДокумент6 страницFin. Anal RafaelMarjonОценок пока нет

- Financial Leverage QuestionДокумент7 страницFinancial Leverage Questionraju kumarОценок пока нет

- Cma CVP 2024Документ49 страницCma CVP 2024rebaonegaleboe01Оценок пока нет

- HW - AFM - E7-25, E7-28, P7-42 - Kelompok 8Документ7 страницHW - AFM - E7-25, E7-28, P7-42 - Kelompok 8swear to the skyОценок пока нет

- Chapter # 8 Exercise & Problems - AnswersДокумент8 страницChapter # 8 Exercise & Problems - AnswersZia UddinОценок пока нет

- Systematic Methods of Community Action in Understanding Community Background Information For LearnersДокумент2 страницыSystematic Methods of Community Action in Understanding Community Background Information For Learnersapollo100% (3)

- Unit 11 - Dealings in CopyrightДокумент34 страницыUnit 11 - Dealings in CopyrightFrancis ChikombolaОценок пока нет

- Digital Fashion Innovations For The Real World and MetaverseДокумент4 страницыDigital Fashion Innovations For The Real World and MetaverseVladimir FontouraОценок пока нет

- The Six Basic Leadership Rules Jack Welch Lives byДокумент4 страницыThe Six Basic Leadership Rules Jack Welch Lives byhussein helalОценок пока нет

- Processsafetykpi 12750516909647 Phpapp02Документ17 страницProcesssafetykpi 12750516909647 Phpapp02Baâddi AyoubОценок пока нет

- 3 & 4 The Demand CurveДокумент4 страницы3 & 4 The Demand CurveAdeeba iqbalОценок пока нет

- Chapter 36Документ20 страницChapter 36Flores Renato Jr. S.Оценок пока нет

- CRS WFCS 594092 AДокумент4 страницыCRS WFCS 594092 ADiego Rosa de OliveiraОценок пока нет

- C.T.E SMC StrategyДокумент5 страницC.T.E SMC Strategyhlapisiathrop0% (1)

- Christopher John Iwaki - MSДокумент1 страницаChristopher John Iwaki - MSMadison ArtitaОценок пока нет

- Asaad M Farahat IT - CVДокумент3 страницыAsaad M Farahat IT - CVssm535Оценок пока нет

- Raana Kazemi CV2020Документ2 страницыRaana Kazemi CV2020Ardakan MehrniaОценок пока нет

- Digital HR Transformation at WorkplaceДокумент3 страницыDigital HR Transformation at Workplaceharmain khalilОценок пока нет

- Business Research Report - Impact of Packaging On Consumer BehaviourДокумент42 страницыBusiness Research Report - Impact of Packaging On Consumer BehaviourAditi SinghОценок пока нет

- Quintanar v. Coca Cola Bottlers Philippines IncДокумент2 страницыQuintanar v. Coca Cola Bottlers Philippines IncBert NazarioОценок пока нет

- BUS 5040 - Milestone 1Документ10 страницBUS 5040 - Milestone 1Hafsat SaliuОценок пока нет

- IT Act NotesДокумент43 страницыIT Act NotesSrr Srr100% (2)

- Sales TrainingДокумент9 страницSales TrainingVahid MohammadiОценок пока нет

- Surat NDAДокумент7 страницSurat NDABayu BayouОценок пока нет

- Banggawan 13 15b TFДокумент10 страницBanggawan 13 15b TFEarth PirapatОценок пока нет

- Cemco Holdings, Inc., G.R. No. 171815Документ17 страницCemco Holdings, Inc., G.R. No. 171815JaylordPataotaoОценок пока нет

- Blakely Sarah Word 04 Sfarmers HW 2Документ2 страницыBlakely Sarah Word 04 Sfarmers HW 2api-663020388Оценок пока нет

- 11 AppendixДокумент5 страниц11 AppendixkkkkОценок пока нет

- Distributed Ledger Identification Systems in The Humanitarian SectorДокумент42 страницыDistributed Ledger Identification Systems in The Humanitarian SectorSamir BennaniОценок пока нет

- AIPM - Part D - Certified Practising Senior Project ManagerДокумент29 страницAIPM - Part D - Certified Practising Senior Project ManagerMauricio Rodriguez PeñaОценок пока нет

- Payguides - MA000012 - 1 July 2023Документ21 страницаPayguides - MA000012 - 1 July 2023mahmoudadel6363Оценок пока нет

- Foundations of Information Systems in BusinessДокумент28 страницFoundations of Information Systems in BusinessRaheel PunjwaniОценок пока нет

- Profit GambitДокумент4 страницыProfit GambitJenine YamsonОценок пока нет

- Bayer Group Management Report 2013 en PDFДокумент180 страницBayer Group Management Report 2013 en PDFChahat JauraОценок пока нет

- Unusual Entrepreneurs1Документ52 страницыUnusual Entrepreneurs1amulya200Оценок пока нет

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (15)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОт EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesОценок пока нет

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!От EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Рейтинг: 4.5 из 5 звезд4.5/5 (14)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookОт EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookРейтинг: 5 из 5 звезд5/5 (4)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeОт EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeРейтинг: 4 из 5 звезд4/5 (21)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОт EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsОценок пока нет

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОт EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyОценок пока нет

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)От EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Рейтинг: 4 из 5 звезд4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОт EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineОценок пока нет

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessОт EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessРейтинг: 4.5 из 5 звезд4.5/5 (28)

- Beyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!От EverandBeyond the E-Myth: The Evolution of an Enterprise: From a Company of One to a Company of 1,000!Рейтинг: 4.5 из 5 звезд4.5/5 (8)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetОт EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetРейтинг: 4.5 из 5 звезд4.5/5 (14)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceОт EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceРейтинг: 4 из 5 звезд4/5 (1)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCОт EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCРейтинг: 5 из 5 звезд5/5 (1)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingОт EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingРейтинг: 4.5 из 5 звезд4.5/5 (760)

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsОт EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookОт EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookОценок пока нет

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОт EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessОценок пока нет