Академический Документы

Профессиональный Документы

Культура Документы

Franchise Accounting Problem I

Загружено:

Darius DelacruzИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Franchise Accounting Problem I

Загружено:

Darius DelacruzАвторское право:

Доступные форматы

FRANCHISE ACCOUNTING

Problem I

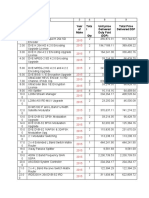

On December 31, 2020, Mack Do authorized to grant Michael & Company to operate as a franchisee for an initial

fee of P150,000. Of this amount, P60,000 was received upon signing the agreement and the balance, represented

by a note, is due in three annual payments of P30,000 each beginning December 31, 2021. The present value on

December 31, 2020 of the three annual payments appropriately discounted is P72,000. According to the

agreement, the non-refundable down payment represents a fair measure of the services already performed by

Mack Do; however, substantial future services are required of Mack do. Collectability of the note is reasonably

certain.

Mack Do's December 31, 2020 Balance Sheet, unearned franchise fees should be reported as

Problem II

December 31, 2020 The Fast Track, Inc. charges an initial franchise fee of P4,500,000 for the right to operate as

a franchise fee of Fast Track. Of this amount, 1,500,000 is collected. The balance is collectible in four annual

Installments of P1,000,000 each every December 31, starting 2021. The PV of 1 for 4 periods at 10% is .6830

while the PV of an annuity of 1 for 4 periods at 10% is 3.1699.

January 2021 - The franchisor visited the proposed site and gave the go signal to start the construction of the

building

June 1, 2021 - Started training the manpower

July 1, 2021 - The franchise started its operation.

December 31, 2021 - The first annual payment was received and the franchisee reported total sales of

P2,500,000.

The franchisor incurred P250,000 in relation to this franchise. Other terms of the agreement include a continuing

royalty fee equal to 5% of annual gross sales.

1. The entry to record the above activity on December 31, 2020 was:

2. Assuming the initial down payment is not refundable, and the collectability of the note is assured, the amount

of revenue recognized on December 31, 2020 is:

3. The total revenue to be recognized by Fast Track, Inc on December 31, 2021 assuming the collectability of the

note is reasonably assured amounted to:

Problem III

Lighthouse Company sells a franchise that requires an initial franchise fee of P70,000. A down payment of

P20,000 cash is required with the balance covered by the issuance of a P50000, 10% notes payable by the

franchisee in five annual equal installments.

All the material services have been substantially performed by the franchisor, and the refund period has expired,

but the collectability of the note is not reasonably assured.

The (1) earned and (2) unearned franchise revenue at the opening of the outlet is

Вам также может понравиться

- Activity 6 - Accounting For Franchise OperationsДокумент3 страницыActivity 6 - Accounting For Franchise OperationsSharon AnchetaОценок пока нет

- Advance Financial Accounting and Reporting: Franchise IAS 18Документ4 страницыAdvance Financial Accounting and Reporting: Franchise IAS 18Roxell CaibogОценок пока нет

- Quiz No. 3Документ4 страницыQuiz No. 3abbyОценок пока нет

- Cpa Review School of The Philippines ManilaДокумент4 страницыCpa Review School of The Philippines Manilaxara mizpahОценок пока нет

- Franchise Problems For DiscussionДокумент4 страницыFranchise Problems For DiscussionRAGASA, John Carlo R.Оценок пока нет

- Franchise AccountingДокумент2 страницыFranchise AccountingChristopher NogotОценок пока нет

- CE On FranchiseДокумент2 страницыCE On FranchisealyssaОценок пока нет

- FranchiseДокумент4 страницыFranchiseAivan De LeonОценок пока нет

- Franchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFДокумент1 страницаFranchise Accounting (Franchisor) Problems: CMPC 131 Franchise Accounting Notes (CC 1331) Sy 2019-2020 First Sem RLFAllyssa ThalliaОценок пока нет

- Adjusting EntriesДокумент6 страницAdjusting EntriesJanna PleteОценок пока нет

- Module 5 Franchise Sales Assignments 2bac May 2023Документ6 страницModule 5 Franchise Sales Assignments 2bac May 2023Aaron OsmaОценок пока нет

- FRANCHISEДокумент2 страницыFRANCHISELayla SimОценок пока нет

- AFARicpaДокумент23 страницыAFARicpaRegine YbañezОценок пока нет

- Midterm - Seatwork No. 2 (FRANCHISE OPERATIONS)Документ2 страницыMidterm - Seatwork No. 2 (FRANCHISE OPERATIONS)CaliОценок пока нет

- Audit of Receivables: Problem No. 1Документ6 страницAudit of Receivables: Problem No. 1Kathrina RoxasОценок пока нет

- Practice Problems - Notes and Loans Receivable: General InstructionsДокумент2 страницыPractice Problems - Notes and Loans Receivable: General Instructionseia aieОценок пока нет

- MT - Assignment 01 StudentsДокумент2 страницыMT - Assignment 01 Studentspatburner1108Оценок пока нет

- Financial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)Документ2 страницыFinancial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)ashleydelmundo14Оценок пока нет

- (INTACC2) Sample ProblemsДокумент8 страниц(INTACC2) Sample ProblemsAngelyn AmadorОценок пока нет

- PROBLEM 1. at December 31, 2019, Sally Company's Notes ReceivableДокумент16 страницPROBLEM 1. at December 31, 2019, Sally Company's Notes ReceivableAccounting 201100% (1)

- Franchise QuizДокумент2 страницыFranchise QuizCattleyaОценок пока нет

- FA2Документ2 страницыFA2Jomar VillenaОценок пока нет

- Adjusting Entries Part 1Документ3 страницыAdjusting Entries Part 1Jacob BabaranОценок пока нет

- Final Exam in Advanced Financial Accounting IДокумент6 страницFinal Exam in Advanced Financial Accounting IYander Marl BautistaОценок пока нет

- Module 2 AssignmentДокумент3 страницыModule 2 Assignmentricamae saladagaОценок пока нет

- NOTES PROBLEMS ACCTG-323-newДокумент3 страницыNOTES PROBLEMS ACCTG-323-newJoyluxxiОценок пока нет

- TradesДокумент3 страницыTradesAlber Howell MagadiaОценок пока нет

- Quiz On FranchiseДокумент4 страницыQuiz On FranchiseTin BulaoОценок пока нет

- Intermediate Accounting 2 Prelim Exam Part II PDF FreeДокумент5 страницIntermediate Accounting 2 Prelim Exam Part II PDF FreeShairine AquinoОценок пока нет

- Exercises. Correction of ErrorsДокумент7 страницExercises. Correction of ErrorsGia Sarah Barillo BandolaОценок пока нет

- Homework 6 - Long-Term Financial LiabilitiesДокумент2 страницыHomework 6 - Long-Term Financial LiabilitiesCha PampolinaОценок пока нет

- Buss. Combi PrelimДокумент8 страницBuss. Combi PrelimPhia TeoОценок пока нет

- National College of Business and Arts: Name: Date: Professor: SubjectДокумент8 страницNational College of Business and Arts: Name: Date: Professor: SubjectAngelica CerioОценок пока нет

- Buss. Combi PrelimДокумент8 страницBuss. Combi PrelimPhia TeoОценок пока нет

- Franchise 1Документ1 страницаFranchise 1Kharen SantosОценок пока нет

- Prac 1 Final PreboardДокумент10 страницPrac 1 Final Preboardbobo kaОценок пока нет

- Chapter 18Документ12 страницChapter 18ks1043210Оценок пока нет

- FranchisingДокумент2 страницыFranchisingMangoStarr Aibelle VegasОценок пока нет

- Correct!: Accrued and DisclosedДокумент111 страницCorrect!: Accrued and DisclosedJaeОценок пока нет

- Franchises (Problem 2)Документ1 страницаFranchises (Problem 2)Lee SuarezОценок пока нет

- 5 6079864208529295481Документ4 страницы5 6079864208529295481Razel MhinОценок пока нет

- Quiz 1 - ACPRE3 - 03.01.22Документ4 страницыQuiz 1 - ACPRE3 - 03.01.22Cristal CristobalОценок пока нет

- Midterm Quizzes Compilation - Docx-1Документ91 страницаMidterm Quizzes Compilation - Docx-1Yess poooОценок пока нет

- Notes ReceivableДокумент22 страницыNotes ReceivableYassi Curtis100% (1)

- Prepayments LiabilitesДокумент1 страницаPrepayments LiabilitesKrishele G. GotejerОценок пока нет

- KsadsadsДокумент3 страницыKsadsadsKenneth Bryan Tegerero Tegio0% (1)

- AFAR 2 - FranchiseДокумент1 страницаAFAR 2 - FranchisePanda ErarОценок пока нет

- Ia 2 Compilation of Quiz and ExercisesДокумент16 страницIa 2 Compilation of Quiz and ExercisesclairedennprztananОценок пока нет

- Unit Vi - Audit of Leases - Final - T11415 PDFДокумент4 страницыUnit Vi - Audit of Leases - Final - T11415 PDFSed ReyesОценок пока нет

- BP - ProblemsДокумент3 страницыBP - ProblemsNhel AlvaroОценок пока нет

- Assignment No. 5 Hoba Franchising Joint ArrangementsДокумент4 страницыAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoОценок пока нет

- Acctg 205A Midterm Exam 1st Sem 20-21Документ3 страницыAcctg 205A Midterm Exam 1st Sem 20-21Darynn F. LinggonОценок пока нет

- Cfas Fs PreparationДокумент3 страницыCfas Fs PreparationEvelina Del RosarioОценок пока нет

- Quiz - (Evening Class)Документ4 страницыQuiz - (Evening Class)JeonОценок пока нет

- 2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)Документ2 страницы2,436,630 (General Instruction: Use 4-Decimal PVF Use Separator, No Space, Round Off Final Answer To Whole Number)max pОценок пока нет

- 1Документ76 страниц1darlene floresОценок пока нет

- Accountancy Philippines Daily Review For Far June 05 2020: Question No. 1Документ10 страницAccountancy Philippines Daily Review For Far June 05 2020: Question No. 1Danna NuquiОценок пока нет

- Far Compre DraftДокумент27 страницFar Compre DraftMika MolinaОценок пока нет

- Homework 5 - Current Liabilities - RevisedДокумент3 страницыHomework 5 - Current Liabilities - RevisedalvarezxpatriciaОценок пока нет

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)От EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Рейтинг: 5 из 5 звезд5/5 (1)

- Paul Laurence C. Dela RosaДокумент2 страницыPaul Laurence C. Dela RosaDarius DelacruzОценок пока нет

- Year of Make Tota L Qty Unit Price Delivered Duty Paid (DDP) Total Price Delivered DDPДокумент2 страницыYear of Make Tota L Qty Unit Price Delivered Duty Paid (DDP) Total Price Delivered DDPDarius DelacruzОценок пока нет

- 2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Документ3 страницы2.4 Exercises - Job Oder Costing - Straight Problems (NEW) 1Darius Delacruz50% (2)

- HXC-FB80: Three 2/3-Inch Exmor ™ CMOS Sensor HD Colour Studio CameraДокумент10 страницHXC-FB80: Three 2/3-Inch Exmor ™ CMOS Sensor HD Colour Studio CameraDarius DelacruzОценок пока нет

- BADVAC1X - MOD 6 TemplatesДокумент16 страницBADVAC1X - MOD 6 TemplatesDarius DelacruzОценок пока нет

- BADVAC1X - Quiz 2 Finals: (1 Point)Документ9 страницBADVAC1X - Quiz 2 Finals: (1 Point)Darius DelacruzОценок пока нет

- 3 PDFДокумент4 страницы3 PDFDarius DelacruzОценок пока нет

- Population DensityДокумент4 страницыPopulation DensityDarius DelacruzОценок пока нет

- Vii - TechnologicalДокумент1 страницаVii - TechnologicalDarius DelacruzОценок пока нет

- The Country Project: International BusinessДокумент3 страницыThe Country Project: International BusinessDarius DelacruzОценок пока нет

- QUESTIONS FOR MICROWAVE-PREBID-.docx 7-24-19.docxsДокумент2 страницыQUESTIONS FOR MICROWAVE-PREBID-.docx 7-24-19.docxsDarius DelacruzОценок пока нет

- Year of SaleДокумент12 страницYear of SaleDarius DelacruzОценок пока нет

- Accounting 7 Instructions: Choose The Most Correct Answer For Each of The Following Questions. Write The Letter of YourДокумент43 страницыAccounting 7 Instructions: Choose The Most Correct Answer For Each of The Following Questions. Write The Letter of YourIzzy B100% (2)

- November 6 - CorporationsДокумент2 страницыNovember 6 - CorporationsDarius DelacruzОценок пока нет

- October 27 - Special DeductionsДокумент3 страницыOctober 27 - Special DeductionsDarius DelacruzОценок пока нет

- Complaint Form: Kilusang Kooperatiba NG PTV (PTVKO)Документ6 страницComplaint Form: Kilusang Kooperatiba NG PTV (PTVKO)Darius DelacruzОценок пока нет

- Abe Post QualДокумент3 страницыAbe Post QualDarius DelacruzОценок пока нет

- 0619F TM2 Apr2020 PDFДокумент1 страница0619F TM2 Apr2020 PDFDarius DelacruzОценок пока нет

- Final Tax Rates Notes: General CoverageДокумент3 страницыFinal Tax Rates Notes: General CoverageDarius DelacruzОценок пока нет

- Module 1 - General Principles PDFДокумент19 страницModule 1 - General Principles PDFDarius Delacruz100% (1)

- Final Tax Rates Notes: General CoverageДокумент3 страницыFinal Tax Rates Notes: General CoverageDarius DelacruzОценок пока нет

- Proposed Facilities Rental Rates 2019 Version2Документ5 страницProposed Facilities Rental Rates 2019 Version2Darius DelacruzОценок пока нет

- Gabay Sa Kalamboan Microfinance CooperativeДокумент2 страницыGabay Sa Kalamboan Microfinance CooperativeRamer LabajoОценок пока нет

- Istilah Akuntansi Di Awali Huruf AДокумент21 страницаIstilah Akuntansi Di Awali Huruf ArantosbОценок пока нет

- Module 12Документ35 страницModule 12Alyssa Nikki VersozaОценок пока нет

- Branding The ManifestoДокумент15 страницBranding The ManifestocolinvandenbroekОценок пока нет

- Concrete Cutting & Drilling in Brisbane 1Документ1 страницаConcrete Cutting & Drilling in Brisbane 1amelia.smith1277Оценок пока нет

- Unit - 2 Study Material ACGДокумент18 страницUnit - 2 Study Material ACGAbhijeet UpadhyayОценок пока нет

- Distribution Channel Literature ReviewДокумент7 страницDistribution Channel Literature Reviewc5g10bt2100% (1)

- F.7.f.2. Central Bank v. BancoДокумент2 страницыF.7.f.2. Central Bank v. BancoPre Pacionela100% (2)

- B. Fidic Emerald Book For Non Recourse Finance HPP EngelstadДокумент24 страницыB. Fidic Emerald Book For Non Recourse Finance HPP EngelstadJaime CasafrancaОценок пока нет

- The Sale of Goods ActДокумент19 страницThe Sale of Goods Actdee deeОценок пока нет

- Xoy ResumeДокумент2 страницыXoy ResumexoyaihОценок пока нет

- FACTORS Affecting The Entrepreneurial DynamicsДокумент4 страницыFACTORS Affecting The Entrepreneurial DynamicsAzraОценок пока нет

- Business Plan of Electronic BicycleДокумент9 страницBusiness Plan of Electronic BicycleSabdi AhmedОценок пока нет

- A Case Analysis On "Litter Ridder"Документ4 страницыA Case Analysis On "Litter Ridder"Darwin Dionisio ClementeОценок пока нет

- Department of Construction Technology and Management: Specification and Quantity SurveyingДокумент17 страницDepartment of Construction Technology and Management: Specification and Quantity Surveyingsamrawit aysheshimОценок пока нет

- Chapter 5 Princing PolicyДокумент45 страницChapter 5 Princing PolicyDavid S.Оценок пока нет

- Fintech in The Middle EastДокумент22 страницыFintech in The Middle Eastfrances bobbiОценок пока нет

- Non Conformity Process Flow ChartДокумент1 страницаNon Conformity Process Flow ChartHermenegildo ChissicoОценок пока нет

- Working Captal ManagementДокумент42 страницыWorking Captal Managementjonna mae rapanutОценок пока нет

- SMM PanelДокумент6 страницSMM PanelAneesh SharmaОценок пока нет

- Financial and Managerial Accounting 15Th Edition Carl S Warren Full ChapterДокумент67 страницFinancial and Managerial Accounting 15Th Edition Carl S Warren Full Chaptercharles.chapman882100% (18)

- Journal of Business Strategy: Article InformationДокумент6 страницJournal of Business Strategy: Article InformationWilliam YamadaОценок пока нет

- SalesДокумент1 623 страницыSalesTARUN PRASADОценок пока нет

- Strategi Manajemen Human Capital: Meeting 1Документ18 страницStrategi Manajemen Human Capital: Meeting 1Devi Tirta MaulanaОценок пока нет

- Important Definitions Igcse BusinessДокумент19 страницImportant Definitions Igcse BusinessBigBoiОценок пока нет

- Module 3 Learner GuideДокумент228 страницModule 3 Learner Guidealex.cooney4Оценок пока нет

- Bintai AR 22 - FinalДокумент146 страницBintai AR 22 - FinalFintanОценок пока нет

- DPR For CIF in Minor Forestry ProducesДокумент15 страницDPR For CIF in Minor Forestry ProducesMuani HmarОценок пока нет

- Idm 2024 Illustrator RFPДокумент10 страницIdm 2024 Illustrator RFPErina EkaОценок пока нет

- PWC Global Annual Review 2013Документ60 страницPWC Global Annual Review 2013hermesstrategyОценок пока нет