Академический Документы

Профессиональный Документы

Культура Документы

January 09, 2018

Загружено:

Monina JonesОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

January 09, 2018

Загружено:

Monina JonesАвторское право:

Доступные форматы

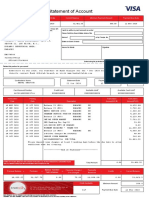

January 2018 Statement Page 1 of 4

Open Date: 12/09/2017 Closing Date: 01/09/2018 Account: 4147 7885 6996 0830

FlexPerks® Travel Rewards Visa Signature® Card Cardmember Service 1-877-978-7446

JAMES E JONES BNK 25 TBO 8 6

MONINA S JONES

Activity Summary

New Balance $999.70 Previous Balance + $617.12

Minimum Payment Due $30.00 Payments - $2,066.65CR

Payment Due Date 02/06/2018 Other Credits $0.00

Purchases + $2,449.23

Late Payment Warning: If we do not receive your Balance Transfers $0.00

minimum payment by the date listed above, you may have

Advances $0.00

to pay up to a $38.00 Late Fee.

Other Debits $0.00

FlexPoints Fees Charged $0.00

Interest Charged $0.00

Earned This Statement* 2,887

Total as of 01/08/2018** 97,151 New Balance = $999.70

*For details, see your Rewards Summary. Past Due $0.00

**Total includes any linked accounts. Minimum Payment Due $30.00

Revolving Line of Credit $25,000.00

Revolving Line Available $24,000.30

Days in Billing Period 32

Payment Mail payment coupon Pay online at Pay by phone Pay at your local

Options: with a check www.flexperks.com 1-877-978-7446 U.S. Bank branch

Please detach and send coupon with check payable to: U.S. Bank

Account Number 4147 7885 6996 0830

Payment Due Date 2/06/2018

24-Hour Cardmember Service: 1-877-978-7446 New Balance $999.70

Minimum Payment Due $30.00

. to pay by phone

. to change your address

Amount Enclosed $

000001625 01 SP 000638771833264 P

JAMES E JONES U.S. Bank

MONINA S JONES

PO BOX 2227 P.O. Box 790408

ETOWAH NC 28729-1927 St. Louis, MO 63179-0408

What To Do If You Think You Find A Mistake On Your Statement

If you think there is an error on your statement, please call us at the telephone number on the front of this statement, or write to us at:

Cardmember Service, P.O. Box 6335, Fargo, ND 58125-6335.

In your letter or call, give us the following information:

Account information: Your name and account number.

Dollar amount: The dollar amount of the suspected error.

Description of Problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake.

You must contact us within 60 days after the error appeared on your statement. While we investigate whether or not there has been an error,

the following are true:

We cannot try to collect the amount in question, or report you as delinquent on that amount.

The charge in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine

that we made a mistake, you will not have to pay the amount in question or any interest or other fees related to that amount.

While you do not have to pay the amount in question, you are responsible for the remainder of your balance.

We can apply any unpaid amount against your credit limit.

Your Rights If You Are Dissatisfied With Your Credit Card Purchases

If you are dissatisfied with the goods or services that you have purchased with your credit card, and you have tried in good faith to correct the

problem with the merchant, you may have the right not to pay the remaining amount due on the purchase.

To use this right, all of the following must be true:

1. The purchase must have been made in your home state or within 100 miles of your current mailing address, and the purchase price must

have been more than $50. (Note: Neither of these are necessary if your purchase was based on an advertisement we mailed to you, or if we

own the company that sold you the goods or services.)

2. You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with a check that accesses

your credit card account do not qualify.

3. You must not yet have fully paid for the purchase.

If all of the criteria above are met and you are still dissatisfied with the purchase, contact us in writing at: Cardmember Service, P.O. Box

6335, Fargo, ND 58125-6335

While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our investigation, we will tell you our

decision. At that point, if we think you owe an amount and you do not pay we may report you as delinquent.

Important Information Regarding Your Account

1. INTEREST CHARGE: Method of Computing Balance Subject to Interest Rate: We calculate the periodic rate or interest portion of the

INTEREST CHARGE by multiplying the applicable Daily Periodic Rate ("DPR") by the Average Daily Balance ("ADB") (including new

transactions) of the Purchase, Advance and Balance Transfer categories subject to interest, and then adding together the resulting interest

from each category. We determine the ADB separately for the Purchases, Advances and Balance Transfer categories. To get the ADB in

each category, we add together the daily balances in those categories for the billing cycle and divide the result by the number of days in the

billing cycle. We determine the daily balances each day by taking the beginning balance of those Account categories (including any billed but

unpaid interest, fees, credit insurance and other charges), adding any new interest, fees, and charges, and subtracting any payments or

credits applied against your Account balances that day. We add a Purchase, Advance or Balance Transfer to the appropriate balances for

those categories on the later of the transaction date or the first day of the statement period. Billed but unpaid interest on Purchases, Advances

and Balance Transfers is added to the appropriate balances for those categories each month on the statement date. Billed but unpaid

Advance Transaction Fees are added to the Advance balance of your Account on the date they are charged to your Account. Any billed but

unpaid fees on Purchases, credit insurance charges, and other charges are added to the Purchase balance of the Account on the date they

are charged to the Account. Billed but unpaid fees on Balance Transfers are added to the Balance Transfer balance of the Account on the

date they are charged to the Account. In other words, billed and unpaid interest, fees, and charges will be included in the ADB of your

Account that accrues interest and will reduce the amount of credit available to you. Credit insurance charges are not included in the ADB

calculation for Purchases until the first day of the billing cycle following the date the credit insurance premium is charged to the Account. Prior

statement balances subject to an interest-free period that have been paid on or before the payment due date in the current billing cycle are

not included in the ADB calculation.

2. Payment Information: You must pay us in U.S. Dollars with checks or similar payment instruments drawn on a financial institution located

in the United States. We will also accept payment in U.S. Dollars via the Internet or phone or previously established automatic payment

transaction. We may, at our option, choose to accept a payment drawn on a foreign financial institution. However, you will be charged and

agree to pay any collection fees required in connection with such a transaction. The date you mail a payment is different than the date we

receive that payment. The payment date is the day we receive your check or money order at U.S. Bank National Association, P.O. Box

790408, St. Louis, MO 63179-0408 or the day we receive your electronic or phone payment. All payments by check or money order

accompanied by a payment coupon and received at this payment address will be credited to your Account on the day of receipt if received by

5:00 p.m. CT on any banking day. Mailed payments that do not include the payment coupon and/or are mailed to a different address will be

processed within 5 banking days of receipt and credited to your Account on the day of receipt. In addition, if you mail your payment without a

payment coupon or to an incorrect address, it may result in a delayed credit to your Account, additional INTEREST CHARGES, fees, and

possible suspension of your Account. Internet and telephone payment options are available, and crediting times vary (but generally must be

made before 5:00 p.m. CT to 8 p.m. CT depending on what day and how the payment is made). If you are making an internet or telephone

payment, please contact Cardmember Service for times specific to your Account and your payment option. Banking days are all calendar

days except Saturday, Sunday and federal holidays. Payments due on a Saturday, Sunday or federal holiday and received on those days will

be credited on the day of receipt. There is no prepayment penalty if you pay your balance at any time prior to your payment due date.

3. Credit Reporting: We may report information on your Account to Credit Bureaus. Late payments, missed payments or other defaults on

your Account may be reflected in your credit report.

January 2018 Statement 12/09/2017 - 01/09/2018 Page 2 of 4

JAMES E JONES Cardmember Service 1-877-978-7446

MONINA S JONES

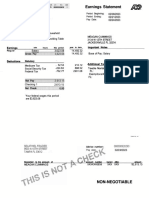

FlexPoints Rewards Summary FlexPoints # 222 853 837 961

This Calendar To Redeem:

Rewards Earned Statement Year to Date Login at usbank.com

Earned Points for Net Purchases 2,449 2,449 or call 1-888-229-8864

Double Points at Grocery Stores 438 438

Learn More:

Total Earned 2,887 2,887 usbank.com/flexperks

As of 01/08/2018, you have 3,530 points expiring at 11PM CT on 03/31/2018.

Net spend this cardmember year: $37,078.19

Your cardmember year begins on the day after the date printed on your MAY statement and ends on the

date of your statement in MAY 12 months later.

Remember to use your FlexPerks Card to earn FlexPoints and be one step closer to award travel.

Calendar Year to Date above refers to FlexPoints posted on statements dated January through December of

the current calendar year.

Important Messages

Paying Interest: You have a 24 to 30 day interest-free period for Purchases provided you have paid your

previous balance in full by the Payment Due Date shown on your monthly Account statement. In order to

avoid additional INTEREST CHARGES on Purchases, you must pay your new balance in full by the

Payment Due Date shown on the front of your monthly Account statement.

There is no interest-free period for transactions that post to the Account as Advances or Balance Transfers

except as provided in any Offer Materials. Those transactions are subject to interest from the date they post

to the Account until the date they are paid in full.

If you believe we have inaccurately reported information to any Consumer Reporting Agency, you may

submit a dispute by writing to us. In order for us to assist you with your dispute, you must provide your

name, address, phone number, account number, the specific information you are disputing, the explanation

of why it is incorrect, and any supporting documentation (e.g., affidavit of identity theft), if applicable, to:

U.S. Bank National Association

Consumer Recovery Department

Attn: CBR Disputes

P.O. Box 108

St Louis, MO 63166-0108

IMPORTANT INFORMATION ABOUT YOUR ACCOUNT TERMS. Please read this notice and keep with

your records. Effective January 15, 2018, the 11th sentence of the "INTEREST CHARGE; Method of

Computing Balance Subject to Interest Rate" section of your Cardmember Agreement is clarified to read as

follows:

To the extent credit insurance charges, overlimit fees, Annual Fees, and/or Travel Membership Fees may be

applied to your Account, such charges and/or fees are not included in the ADB calculation for Purchases

until the first day of the billing cycle following the date the credit insurance charges, overlimit fees, Annual

Fees and/or Travel Membership Fees (as applicable) are charged to the Account

Our records indicate you received a communication from FlexPerks Rewards that may have disclosed

incorrect information regarding the number of FlexPoints in your account as of October 1, 2017. Please visit

the Rewards Center at usbank.com to see the accurate number of points in your account. We apologize for

any inconvenience this may have caused.

For reward program inquiries and redemptions, call 1-888-229-8864 from 8:00 am to 10:00 pm (CST)

Monday through Friday, 8:00 am to 5:30 pm (CST) Saturday and Sunday. Automated account information is

available 24 hours a day, 7 days a week.

Continued on Next Page

January 2018 Statement 12/09/2017 - 01/09/2018 Page 3 of 4

JAMES E JONES Cardmember Service 1-877-978-7446

MONINA S JONES

Important Messages

Shop rates with our 3 preferred car rental partners, National Car Rental(R), Enterprise Rent-A-Car(R) and

Alamo(R) Rent A Car(R). Plus, take advantage of additional offers! Learn more at

flexperkspromos.usbank.com or reserve at partners.rentalcar.com/flexperks.

Explore the FlexPerks PromoSite at flexperkspromos.usbank.com. Discover exclusive FlexPerks events,

learn more about Cardmember benefits and discounts and register for new offers and promotions. New

offers are added regularly, so visit flexperkspromos.usbank.com today and return often to see what's new.

Each time you or a third party on your behalf, pays your bill by personal check, you authorize us to convert

that payment into an electronic debit. If the check is processed electronically, the checking account will be

debited for the amount on the check and the debit will appear on your account statement. If you have any

questions, please contact us at the Inquiries phone number located on this statement.

Transactions

Payments and Other Credits

Post Trans

Date Date Ref # Transaction Description Amount

01/02 PAYMENT THANK YOU $2,066.65CR

TOTAL THIS PERIOD $2,066.65CR

Purchases and Other Debits

Post Trans

Date Date Ref # Transaction Description Amount

12/11 12/08 7128 RUSTAN S DEPT STORE A CEBU CITY PH $99.02

5000.00 PHILIPPNE PESO

12/13 12/12 4435 CEBU CLASSIC HOME CEBU CITY PH $626.57

31600.00 PHILIPPNE PESO

12/14 12/13 0044 SHELL CT PRIME MBOLO CEBU CITY PH $371.32

18680.00 PHILIPPNE PESO

12/19 12/16 4362 SM SUPERMKT-CONSOLACIO CEBU PH $143.54

7232.25 PHILIPPNE PESO

12/19 12/17 5971 GUESS AYALA CEBU CEBU CITY PH $53.55

2698.00 PHILIPPNE PESO

12/19 12/17 1383 BERSHKA AYALA CEBU CEBU PH $31.66

1595.00 PHILIPPNE PESO

12/22 12/21 3524 FOREVER 21 SM SRP CEBU CEBU PH $60.09

3014.00 PHILIPPNE PESO

12/22 12/21 5573 COTTON ON SM SEASIDE CEBU PH $63.78

3199.00 PHILIPPNE PESO

01/02 12/29 1025 SM SUPERMARKET SM CEB CEBU CITY PH $294.64

14718.70 PHILIPPNE PESO

01/02 12/29 4422 FOREVER 21-SM CEBU CEBU PH $205.03

10242.00 PHILIPPNE PESO

01/08 01/05 9659 SM DEPT STORE CONSOLAC CEBU PH $500.03

24900.00 PHILIPPNE PESO

TOTAL THIS PERIOD $2,449.23

2018 Totals Year-to-Date

Total Fees Charged in 2018 $0.00

Total Interest Charged in 2018 $0.00

Continued on Next Page

January 2018 Statement 12/09/2017 - 01/09/2018 Page 4 of 4

JAMES E JONES Cardmember Service 1-877-978-7446

MONINA S JONES

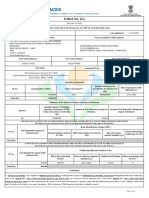

Interest Charge Calculation

Your Annual Percentage Rate (APR) is the annual interest rate on your account.

**APR for current and future transactions.

Balance Annual Expires

Balance Subject to Interest Percentage with

Balance Type By Type Interest Rate Variable Charge Rate Statement

**BALANCE TRANSFER $0.00 $0.00 YES $0.00 14.25%

**PURCHASES $999.70 $0.00 YES $0.00 14.25%

**ADVANCES $0.00 $0.00 $0.00 20.99%

Contact Us

Phone Questions Mail payment coupon Online

with a check

Voice: 1-877-978-7446 Cardmember Service U.S. Bank www.flexperks.com

TDD: 1-888-352-6455 P.O. Box 6352 P.O. Box 790408

Fax: 1-866-568-7729 Fargo, ND 58125-6352 St. Louis, MO 63179-0408

End of Statement

Вам также может понравиться

- Statement Activity and FeesДокумент4 страницыStatement Activity and FeesPatricia100% (1)

- Statement May 2018Документ5 страницStatement May 2018tpsroxОценок пока нет

- KPQooo 001266420000 R 07112758 C846621Документ1 страницаKPQooo 001266420000 R 07112758 C846621Jonathan GutierrezОценок пока нет

- Victorian June 2012Документ10 страницVictorian June 2012Speedy0380100% (1)

- Ternion Pitch Deck A RoundДокумент18 страницTernion Pitch Deck A RoundRish JeyamohanОценок пока нет

- Monthly StatementДокумент2 страницыMonthly StatementYuniioor UrbaezОценок пока нет

- Bankwellsfargooctoberstatement 140618033617 Phpapp02Документ3 страницыBankwellsfargooctoberstatement 140618033617 Phpapp02evanОценок пока нет

- Ally-Bank-Statement - Helen ZhaoДокумент4 страницыAlly-Bank-Statement - Helen ZhaoJonathan Seagull Livingston100% (1)

- Statement PDFДокумент6 страницStatement PDFadam myersОценок пока нет

- Statement 05312019Документ6 страницStatement 05312019Marcus GreenОценок пока нет

- Hilton Honors American Express Ascend Card Statement SummaryДокумент6 страницHilton Honors American Express Ascend Card Statement SummaryMicahОценок пока нет

- Justin Hermanson: 231 Valley Farms Street Santa Monica, CA 90403Документ2 страницыJustin Hermanson: 231 Valley Farms Street Santa Monica, CA 90403Gary Joel Galva BlancoОценок пока нет

- Statement Jan 2010Документ8 страницStatement Jan 2010Bryan HowardОценок пока нет

- Statement 1Документ4 страницыStatement 1donaldlinkous100% (1)

- Receivable and Collections Policy - SampleДокумент10 страницReceivable and Collections Policy - SampleMrLarry168Оценок пока нет

- Manage your credit card statementДокумент1 страницаManage your credit card statementAbdul AleemОценок пока нет

- November 14, 2016Документ4 страницыNovember 14, 2016KenyaReyesОценок пока нет

- Paperless StatementsДокумент4 страницыPaperless StatementsAlamin009Оценок пока нет

- Bank Statement LanayaДокумент3 страницыBank Statement LanayashrondaОценок пока нет

- Christopher Bank StatementДокумент3 страницыChristopher Bank StatementSharon JonesОценок пока нет

- Debit 2021 2 StatementДокумент1 страницаDebit 2021 2 StatementJames DunbarОценок пока нет

- Statements 7344Документ4 страницыStatements 7344Валентина ШвечиковаОценок пока нет

- Real Estate AccountingДокумент47 страницReal Estate AccountingDian Agustian100% (1)

- US Bank Business Statement Mbcvirtual ScaledДокумент1 страницаUS Bank Business Statement Mbcvirtual ScaledTanushОценок пока нет

- September TD Bank BulgariaДокумент1 страницаSeptember TD Bank Bulgariashahid2opuОценок пока нет

- Business For The Arts of Broward IncДокумент2 страницыBusiness For The Arts of Broward Incbg giangОценок пока нет

- BBAV Bank StatementДокумент1 страницаBBAV Bank StatementYouns T100% (1)

- Statement Dec 2011Документ2 страницыStatement Dec 2011Iris KhanashatОценок пока нет

- Statement 0102 0502Документ1 страницаStatement 0102 0502Anonymous pmsSgfОценок пока нет

- Your Business Advantage Checking Bus Platinum Privileges: Account SummaryДокумент1 страницаYour Business Advantage Checking Bus Platinum Privileges: Account SummaryN NОценок пока нет

- Chase bank statement summary for December 2020Документ4 страницыChase bank statement summary for December 2020Kelly WellsОценок пока нет

- Estatement - PDF FebДокумент6 страницEstatement - PDF FebBrian OdomОценок пока нет

- StatementДокумент4 страницыStatementjoan manuel100% (1)

- Credit Card Statement SummaryДокумент2 страницыCredit Card Statement SummaryOliver KlozeoffОценок пока нет

- Gold Business Services Package: Your Business and Wells FargoДокумент5 страницGold Business Services Package: Your Business and Wells FargoM A KhanОценок пока нет

- Your Military - Land Adv Safebalance Banking: Account SummaryДокумент4 страницыYour Military - Land Adv Safebalance Banking: Account SummaryDairin DuarteОценок пока нет

- Reference QB SupportДокумент10 страницReference QB SupportTiffanyОценок пока нет

- 07-17-2015Документ4 страницы07-17-2015Gabriel AlmeidaОценок пока нет

- Donnina Halley v. Printwell IncorporationДокумент2 страницыDonnina Halley v. Printwell IncorporationKayee KatОценок пока нет

- Amex STMTДокумент1 страницаAmex STMTMark GalantyОценок пока нет

- Statement Jun 2019Документ12 страницStatement Jun 2019Mike Schmoronoff100% (1)

- USA SunTrust Bank StatementДокумент1 страницаUSA SunTrust Bank StatementLiam AbreuОценок пока нет

- BANK DRAFT-DOA中英文 - KusnadiДокумент30 страницBANK DRAFT-DOA中英文 - Kusnadiselfiani67% (3)

- BB&T Bank StatementДокумент7 страницBB&T Bank StatementBraeylnn bookerОценок пока нет

- Aliyu STTMNTДокумент2 страницыAliyu STTMNTShelvya ReeseОценок пока нет

- Equity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Документ5 страницEquity Home: Karen Li Daniel Lee 2615 S. Union Ave. Apt 2F Chicago Il 60616-2534Test000001Оценок пока нет

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeОт EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeОценок пока нет

- By Phone: Telecommunications Device For The Deaf: Internet: To Contact U.S. BankДокумент2 страницыBy Phone: Telecommunications Device For The Deaf: Internet: To Contact U.S. BankSteven LinОценок пока нет

- ListДокумент2 страницыListRichrad SmithОценок пока нет

- Acc106 AssignmentДокумент16 страницAcc106 AssignmentNNNAJ89% (94)

- Contract To SellДокумент2 страницыContract To SellDeyL Lntoc100% (2)

- Frazier0224 PDFДокумент1 страницаFrazier0224 PDFshani ChahalОценок пока нет

- Savings Summary: We'Re Updating Our AtmsДокумент2 страницыSavings Summary: We'Re Updating Our AtmsJP Ramos DatinguinooОценок пока нет

- List PDFДокумент4 страницыList PDFPam Welch HeuleОценок пока нет

- YearEndSummary PDFДокумент10 страницYearEndSummary PDFAnonymous Pq2iqJk2bОценок пока нет

- Lyndsie Barnes BankДокумент4 страницыLyndsie Barnes BankJaram JohnsonОценок пока нет

- May StatementДокумент30 страницMay Statementkleveland100% (1)

- Your Chase bank statement summary for April-May 2021Документ4 страницыYour Chase bank statement summary for April-May 2021Mel GrizzleОценок пока нет

- Summary of SikoPilДокумент9 страницSummary of SikoPilKyra RMОценок пока нет

- Gitman-Working Capital & Current AssetДокумент64 страницыGitman-Working Capital & Current AssetSugim Winata EinsteinОценок пока нет

- AMEX Statement SummaryДокумент3 страницыAMEX Statement SummaryrubhakarОценок пока нет

- Account Summary Portfolio AllocationДокумент4 страницыAccount Summary Portfolio AllocationLoydОценок пока нет

- CIVIL LIBERTIES UNION Vs EXECUTIVE SECRETARY Case DigestДокумент3 страницыCIVIL LIBERTIES UNION Vs EXECUTIVE SECRETARY Case DigestMonina Jones0% (1)

- D VPFWRNL HH77 H IQqДокумент13 страницD VPFWRNL HH77 H IQqManoj Kumar SinghОценок пока нет

- Dinalupihan Water District Smart BillДокумент2 страницыDinalupihan Water District Smart BillDinalupihan Water District100% (1)

- CD 6 Cawad vs. Abad Et Al. G.R. No. 207145 July 28 2015Документ2 страницыCD 6 Cawad vs. Abad Et Al. G.R. No. 207145 July 28 2015Mae BecherОценок пока нет

- Statement of Account: Credit Limit Rs Available Credit Limit RsДокумент2 страницыStatement of Account: Credit Limit Rs Available Credit Limit RsIqbal MohammadОценок пока нет

- Sample StatementДокумент1 страницаSample StatementShahzad YounasОценок пока нет

- Christopher Collins January Bank StatementДокумент2 страницыChristopher Collins January Bank StatementJim Boaz100% (1)

- Account summary and transaction historyДокумент3 страницыAccount summary and transaction historyTaylor LynnОценок пока нет

- Frequently Asked Questions On Electronic Clearing ServiceДокумент7 страницFrequently Asked Questions On Electronic Clearing Serviceravi150888Оценок пока нет

- Checking Summary: 000000968891432 Customer Service InformationДокумент2 страницыChecking Summary: 000000968891432 Customer Service Informationahmed4_chatОценок пока нет

- Election Dates: Federal Elections Deadlines - North CarolinaДокумент4 страницыElection Dates: Federal Elections Deadlines - North CarolinaMonina JonesОценок пока нет

- New Applicant Petition for 2024 Bar ExamsДокумент3 страницыNew Applicant Petition for 2024 Bar ExamsMonina JonesОценок пока нет

- School of Law and Governance: Ycartiaga@usc - Edu.phДокумент7 страницSchool of Law and Governance: Ycartiaga@usc - Edu.phMonina JonesОценок пока нет

- Legal Research NotesДокумент4 страницыLegal Research NotesMonina JonesОценок пока нет

- Exercise For VariationsДокумент3 страницыExercise For VariationsMonina JonesОценок пока нет

- Instructions:: Non-Business UseДокумент7 страницInstructions:: Non-Business UseMonina JonesОценок пока нет

- Module 2 PersonsДокумент31 страницаModule 2 PersonsMonina JonesОценок пока нет

- Stat Con Oral Recits Module 1Документ15 страницStat Con Oral Recits Module 1Monina JonesОценок пока нет

- 3,15 Email 1Документ1 страница3,15 Email 1Monina JonesОценок пока нет

- Chocobather Nut SoapДокумент1 страницаChocobather Nut SoapMonina JonesОценок пока нет

- AP Stat Test 1 - 2004-2005Документ5 страницAP Stat Test 1 - 2004-2005Monina JonesОценок пока нет

- AP Stat Test 1 - 2004-2005Документ5 страницAP Stat Test 1 - 2004-2005Monina JonesОценок пока нет

- Oposa Vs Factoran 224 SCRA 792 Case Digest by SHELAN TEHДокумент5 страницOposa Vs Factoran 224 SCRA 792 Case Digest by SHELAN TEHJake AquinoОценок пока нет

- Studying Tips For YOU: All You Need Is Patience, Determination, and FocusДокумент3 страницыStudying Tips For YOU: All You Need Is Patience, Determination, and FocusMonina JonesОценок пока нет

- Exercise For EductionДокумент2 страницыExercise For EductionMarioОценок пока нет

- Reaction Paper #3: Nonverbal CommunicationДокумент4 страницыReaction Paper #3: Nonverbal CommunicationMonina JonesОценок пока нет

- Reaction Paper #1: Understanding AutismДокумент3 страницыReaction Paper #1: Understanding AutismMonina JonesОценок пока нет

- Differential Diagnosis: Distinguishing ASD from ADHDДокумент1 страницаDifferential Diagnosis: Distinguishing ASD from ADHDMonina JonesОценок пока нет

- HbojeueifgДокумент3 страницыHbojeueifgMonina JonesОценок пока нет

- Matrix On Somatic Disorders: Luzenne Sanchez Jones PSYC 118X Clinical Psyc TTH 4:30-6:00 March 12, 2020Документ5 страницMatrix On Somatic Disorders: Luzenne Sanchez Jones PSYC 118X Clinical Psyc TTH 4:30-6:00 March 12, 2020Monina JonesОценок пока нет

- Play Therapy and Behavior Modification in ChildrenДокумент4 страницыPlay Therapy and Behavior Modification in ChildrenMonina JonesОценок пока нет

- Specialtopics ASSIGNMENTДокумент1 страницаSpecialtopics ASSIGNMENTMonina JonesОценок пока нет

- Form 2 (Protocol Review Assessment Form) NEWДокумент4 страницыForm 2 (Protocol Review Assessment Form) NEWMonina JonesОценок пока нет

- Specialtopics ETHICSДокумент1 страницаSpecialtopics ETHICSMonina JonesОценок пока нет

- SurveydraftДокумент7 страницSurveydraftMonina JonesОценок пока нет

- APA Ethics Code PDFДокумент18 страницAPA Ethics Code PDFAlicia SvetlanaОценок пока нет

- Task and Activities - Reflection (February 10-February 14, 2020)Документ2 страницыTask and Activities - Reflection (February 10-February 14, 2020)Monina JonesОценок пока нет

- Tally 9.0 Multiple Choice Questions MCQ QuizДокумент15 страницTally 9.0 Multiple Choice Questions MCQ QuizRAKESH MESHRAMОценок пока нет

- Fee Structure Sentinel Kabitaka 2022Документ2 страницыFee Structure Sentinel Kabitaka 2022TaongaОценок пока нет

- Updated billing statement and payment optionsДокумент3 страницыUpdated billing statement and payment optionsiNeko FriesОценок пока нет

- SBD Dts 3 Badami KerurДокумент191 страницаSBD Dts 3 Badami KerurNaveen NagisettiОценок пока нет

- AMA PenFed Platinum Cash Rewards-Pricing List InfoДокумент4 страницыAMA PenFed Platinum Cash Rewards-Pricing List InfomattermarkusОценок пока нет

- 00 Edition 8 Catalog All PagesДокумент404 страницы00 Edition 8 Catalog All PagesRadovan KnezevicОценок пока нет

- Re-Visiting Total v. Akinpelu - Filling The Gaps To Build The Taxpayer's Haven by Bidemi Olumide OlowosileДокумент8 страницRe-Visiting Total v. Akinpelu - Filling The Gaps To Build The Taxpayer's Haven by Bidemi Olumide Olowosilerichdaniels100% (1)

- Form No. 16A: From ToДокумент2 страницыForm No. 16A: From ToDevasyrucОценок пока нет

- SAP ERP Financials: Value Date Calculation Logic During Automatic Payment Process (APP)Документ10 страницSAP ERP Financials: Value Date Calculation Logic During Automatic Payment Process (APP)Sisir PradhanОценок пока нет

- Muñasque vs. Court of AppealsДокумент9 страницMuñasque vs. Court of AppealsAaron CariñoОценок пока нет

- Understanding Business Taxes and VAT in the PhilippinesДокумент4 страницыUnderstanding Business Taxes and VAT in the PhilippinesAnamir Bello CarilloОценок пока нет

- Income Tax For IndividualsДокумент90 страницIncome Tax For IndividualsRubyjane KimОценок пока нет

- HKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyДокумент25 страницHKB 05TechRiskMgmtpolicyPreshipCreditForeignCurrencyParamu NatarajanОценок пока нет

- Ts & Cs - PDF NEW NewДокумент4 страницыTs & Cs - PDF NEW NewElias ManyiseОценок пока нет

- 11101174-0 MTF1500-320editionS PDFДокумент11 страниц11101174-0 MTF1500-320editionS PDFAnonymous f3LUQEdFОценок пока нет

- Polarion SLAДокумент10 страницPolarion SLAgooglemohanОценок пока нет

- PGBP Charts PDFДокумент7 страницPGBP Charts PDFJITENDRA HEGDEОценок пока нет

- Payflowgateway GuideДокумент256 страницPayflowgateway GuidejojofunОценок пока нет

- Product Knowledge - AOTGAДокумент191 страницаProduct Knowledge - AOTGATun JatupatsakunОценок пока нет

- BP 22 Law GuideДокумент42 страницыBP 22 Law GuidefocusedkheyОценок пока нет