Академический Документы

Профессиональный Документы

Культура Документы

Power of The Companies To Borrow - Exemptions and Exclusion - Lenders' Responsibilities - Effect of Doctrine of Indoor Management" - Case Laws

Загружено:

Vinay YerubandiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Power of The Companies To Borrow - Exemptions and Exclusion - Lenders' Responsibilities - Effect of Doctrine of Indoor Management" - Case Laws

Загружено:

Vinay YerubandiАвторское право:

Доступные форматы

Debt Funding

So far, we studied:

• Power of the companies to borrow

• Exemptions and Exclusion

• Lenders’ Responsibilities

• Effect of ‘Doctrine of Indoor Management”

• Case Laws

In Krishnan Kumar Rohatgi and Others v. State Bank of India and Others,

(1980):

• The company borrowed Rs. 5 lakhs from the Bank under a Promissory Note.

• The repayment was guaranteed by a person by executing a guarantee in favor of

the company.

• The company used to make payments towards loan and the promissory note used

to be renewed from time to time.

In the suit for recovery, the company contended that:

• The pro-note was executed by the Chairman

• Without there being a resolution of the Board of Directors authorizing the

Chairman to execute the pro-note

• As required under Sec 292(1)(c) of the Act,1956 and [Sec 179(1)(d) of the

Companies Act, 2013].

• Rejecting these contentions, the Patna High Court held that:

• In cases where the directors borrow funds without their having authorization from

the company and

• If the money has been used for the benefit of the company, the company cannot

repudiate its liability to repay.

Case: What if…

• AoA has fixed the borrowing limit for the Board as INR 100 lakhs.

• Directors borrowed INR 150 lakhs.

• Company refuses to ratify.

• Is lender protected?

Held: Doctrine of Constructive Notice

o MoA and AoA are public documents.

o The contents are deemed to be known by the lenders.

o Lender will have no right of action against the company.

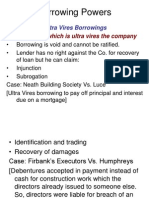

Ultra Vires Borrowing:

• Borrowing without having authority under the AoA or beyond the limits set

out in the AoA, is ultra vires borrowing.

• Ultra vires acts are void.

• The securities given for such ultra-vires borrowing are also void and

inoperative.

• Ultra vires borrowings cannot even be ratified by shareholders.

• Lender cannot sue the company for the return of the loan and enforce any

security granted to him.

• No agent can have a power which is not with the principal.

➢ Therefore, if the borrowing is ultra vires the company so that the company has

no capacity to undertake it, the lender can have no rights at common law.

➢ No debt is created and any security which may have been created in respect of

the borrowing is also void. The lender cannot sue the company for the

repayment of the loan- Held in the case - Sinclain v. Brouguham (1914).

No Bona Fide:

Where the managing agent of a company:

➢ Who is not authorized to borrow,

➢ Has borrowed money

➢ Which is not necessary,

➢ Neither bona fide,

- Nor for the benefit of the company, the company is not liable for the amount

borrowed – held in the case - Equity Insurance Co. Ltd. v. Dinshaw & Co., AIR 1940

Intention to Bind the Company:

Case: L & Co. was in liquidation. ‘P’ the manager borrowed a sum of money from ‘J’

in his own name. In one letter to ‘J’ he indicated that the loan was for a requirement

of L & Co. L & Co had actually benefited.

Held: It was held that there was no intention to bind the company. “The mere fact that

the company had benefited was not in itself sufficient to bind the company” – held in

the case - Suraj Babu v. Jaitly & Co. AIR 1946

Lenders’ Remedies:

o Injunction and Recovery

o Subrogation

o Suit against Directors

Injunction and Recovery:

Under the Equitable Doctrine of Restitution Lender can obtain an Injunction:

o If he can trace and identify the money lent, and

o Any property which the company has bought with it or

o At least prove that the company has been benefited thereby.

Subrogation:

• If the void borrowing was used for repayment of valid borrowing…….

• The lender of void borrowing would be subrogated to the position of creditor paid

off and to that extent would have the right to recover his loan from the company.

• Since, the total indebtedness of the company remains the same and debt burden

of the company is in no way increased.

Suit against Directors:

• If the void borrowing was used for repayment of valid borrowing…….

• The lender may sue the directors for breach of warranty of authority. This is more

so, if the directors deliberately misrepresented their authority – held in the case -

Executors v. Humphreys (1866).

Types of Borrowing:

• Term

• Security

• Parties

• Private / Public

A. Term

1. Long Term Borrowings:

• Whose term of borrowing is 5+ years,

• Purpose: Big Projects Normally with creation of charge

2. Medium Term Borrowings:

• Whose term of borrowing is 2 to 5 yrs.

• Purpose: Assets Purchase Normally with charge

3. Short Term Borrowings:

• Whose term of borrowing is up to 2 years

• Purpose: Working Capital Hypothecation on stocks and debtors.

B. Security:

• Secured Debts - creditors have recourse to the assets ahead of other

Claims

• Unsecured Debts - creditors DO NOT have recourse to the assets

C. Parties:

1. Syndicated Borrowing: Group of lenders lent under one agreement to the

borrower

2. Bilateral Borrowing: Lending under direct Agreement between lender and

borrower

D. Private / Public:

1. Private borrowing: Lender and borrower are private entities. Lending under a direct

agreement.

2. Public Borrowing: Debentures, Bonds etc., issued to public, freely tradable on a

public exchange or over the counter

Security for Borrowing:

• Mortgage: On immovable property, possession remains with borrower.

• Hypothecation: On movable assets, the possession remains with the borrower

• Lien: Right of detaining the property until the claim be satisfied.

• Pledge: On movable assets, the possession is taken by lender

Guarantee: This is a promise by one party to assume the debt obligation of a

borrower if that borrower defaults.

A loan taken by a company may be secured by any of the following:

a) A legal mortgage of specific part of its property;

b) An equitable mortgage by deposit of title deeds;

c) A mortgage of movable property;

d) Issuing Bonds;

e) Issuing Promissory notes and Bills of Exchange;

f) A charge on uncalled capital;

g) A charge on calls made but not paid;

h) A floating charge on the assets of the company;

Вам также может понравиться

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsОт EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsРейтинг: 5 из 5 звезд5/5 (1)

- Borrowing Powers of CompanyДокумент25 страницBorrowing Powers of CompanySai PhaniОценок пока нет

- Borrowing PowerДокумент36 страницBorrowing PowerUsman VpОценок пока нет

- Borrowing Powers of A Company - PDFДокумент23 страницыBorrowing Powers of A Company - PDFDrRupali GuptaОценок пока нет

- Companies Act Borrowing PowersДокумент11 страницCompanies Act Borrowing PowersSaptak RoyОценок пока нет

- Final PPT Special ContractsДокумент34 страницыFinal PPT Special ContractsMegha Vidhyasagar100% (1)

- Emmanuel Amarfio Mensah, Sem Vi, Section B, Corporate Law 2Документ12 страницEmmanuel Amarfio Mensah, Sem Vi, Section B, Corporate Law 2Emmanuel MensahОценок пока нет

- DEBT CAPITAL 2020 FinalДокумент18 страницDEBT CAPITAL 2020 FinalLaurineОценок пока нет

- Borrowing Power of Company PDFДокумент12 страницBorrowing Power of Company PDFmanishaamba7547Оценок пока нет

- Mode of Creation ChargeДокумент43 страницыMode of Creation ChargeSaurab JainОценок пока нет

- Unit 8Документ4 страницыUnit 82050364 SHREYA SHETTY G RОценок пока нет

- Issue of Debentures Redemption of Debentures UnderwrtingДокумент47 страницIssue of Debentures Redemption of Debentures UnderwrtingKeshav PantОценок пока нет

- Issue of Debentures Redemption of Debentures UnderwrtingДокумент47 страницIssue of Debentures Redemption of Debentures UnderwrtingRAMA ChauhanОценок пока нет

- Class 4 - Co. Law Notes Crash Course - 16.07.2020Документ59 страницClass 4 - Co. Law Notes Crash Course - 16.07.2020Shubham SarkarОценок пока нет

- Unit - 8 CLДокумент3 страницыUnit - 8 CLKanishkaОценок пока нет

- Special Contracts: Basic Elements of Law Relating To Agency, Guarantee and PledgeДокумент15 страницSpecial Contracts: Basic Elements of Law Relating To Agency, Guarantee and Pledgesayush91Оценок пока нет

- Law485 c8 Shares Capital and MaintenanceДокумент16 страницLaw485 c8 Shares Capital and MaintenancendhtzxОценок пока нет

- Bankruptcy Law OutlineДокумент30 страницBankruptcy Law Outlinelcahern100% (2)

- Topic 6 Debenture and LoanДокумент15 страницTopic 6 Debenture and LoanYEOH KIM CHENGОценок пока нет

- Borrowings and Charges: Corporate LawДокумент21 страницаBorrowings and Charges: Corporate LawAyman KhalidОценок пока нет

- Module 1Документ63 страницыModule 1RajnishОценок пока нет

- Law of Contracts II Module 1: Rights of IndemnityДокумент83 страницыLaw of Contracts II Module 1: Rights of Indemnityskkaviya sethilrajakirthikaОценок пока нет

- Legal Aspects of Business - Secured Transactions Chapter 23Документ4 страницыLegal Aspects of Business - Secured Transactions Chapter 23summertimechloeОценок пока нет

- Unit 1 E TrustsДокумент46 страницUnit 1 E TrustsKhanyisile SitholeОценок пока нет

- Contract of IndemnityДокумент40 страницContract of IndemnityAditya D Tanwar100% (1)

- Corporate Law and Corporate Governance: Ummar Ziauddin LLM Berkeley, Barrister of Lincoln's InnДокумент41 страницаCorporate Law and Corporate Governance: Ummar Ziauddin LLM Berkeley, Barrister of Lincoln's InnNooria YaqubОценок пока нет

- Non-Bank Gfis: GoccsДокумент35 страницNon-Bank Gfis: GoccsAnalyn Grace BasayОценок пока нет

- Company Law ExamДокумент15 страницCompany Law ExamHärîsh KûmärОценок пока нет

- Zambia Institute of Advanced Legal Education - Suggested Model Answers - 2018Документ25 страницZambia Institute of Advanced Legal Education - Suggested Model Answers - 2018Leonard TemboОценок пока нет

- Unit 4 Mobilisation of FundsДокумент58 страницUnit 4 Mobilisation of FundsMohit RajputОценок пока нет

- Borrowing Powers of A CompanyДокумент2 страницыBorrowing Powers of A CompanyVikash BhattОценок пока нет

- Borrowing Powers: Ultra Vires BorrowingsДокумент6 страницBorrowing Powers: Ultra Vires BorrowingsTanu BansalОценок пока нет

- BNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityДокумент36 страницBNK602SEM: Legal Aspects of Banking: TOPIC 7: Nature of SecurityaliaОценок пока нет

- Loan Capital NotesДокумент5 страницLoan Capital NotesFrancis Njihia Kaburu100% (1)

- Borrowing Powers of A CompanyДокумент5 страницBorrowing Powers of A CompanyimadОценок пока нет

- Group 2 Presentation - Law of SuretyДокумент91 страницаGroup 2 Presentation - Law of SuretyROMEO CHIJENAОценок пока нет

- Directors of A CompanyДокумент56 страницDirectors of A CompanyZafry TahirОценок пока нет

- Banker Customer RelationshipДокумент12 страницBanker Customer RelationshipPallavi SharmaОценок пока нет

- Rights of Debtors and CreditorsДокумент44 страницыRights of Debtors and CreditorsRentsenjugder NaranchuluunОценок пока нет

- India Bond Market OverviewДокумент15 страницIndia Bond Market OverviewSakshi GuptaОценок пока нет

- Theme 2 - Law of SecurityДокумент11 страницTheme 2 - Law of Securityu22619942Оценок пока нет

- Overview & Principles of Credit Management by Prof. Divya GuptaДокумент28 страницOverview & Principles of Credit Management by Prof. Divya GuptaArun SinghОценок пока нет

- Ship Finance Essentials: Professor Alkis John CorresДокумент41 страницаShip Finance Essentials: Professor Alkis John Corresprafful sahareОценок пока нет

- Banking Endsems NotesДокумент42 страницыBanking Endsems Notesmahiya sОценок пока нет

- Topic 9 Corporate Finance Debentures-1Документ16 страницTopic 9 Corporate Finance Debentures-1Bernard ChrillynОценок пока нет

- Debentures and Debenture Holders ProjectДокумент11 страницDebentures and Debenture Holders Projectdemonlord8850% (2)

- Debt FinancingДокумент16 страницDebt FinancingRAbulОценок пока нет

- Week 10 Lending and SecuritiesДокумент88 страницWeek 10 Lending and Securities2021488406Оценок пока нет

- Banking Law Assignment - ViswanathanДокумент6 страницBanking Law Assignment - ViswanathanViswa NathanОценок пока нет

- Borrowing, Lending, Investments, and Contracts - An OverviewДокумент20 страницBorrowing, Lending, Investments, and Contracts - An OverviewAnshu Kumar023Оценок пока нет

- Borrowing Powers of CompanyДокумент37 страницBorrowing Powers of CompanyRohan NambiarОценок пока нет

- Legal - Borrowing Powers, Majority Powers and Minority RightsДокумент21 страницаLegal - Borrowing Powers, Majority Powers and Minority RightsSailesh NallapothuОценок пока нет

- Company Law and Secreterial Practice-IIДокумент31 страницаCompany Law and Secreterial Practice-IIraghavsairam39Оценок пока нет

- Banker's RightДокумент10 страницBanker's Rightsagarg94gmailcomОценок пока нет

- Debtor, Creditor, Automatic DischargeДокумент7 страницDebtor, Creditor, Automatic DischargeBRIAN KORIRОценок пока нет

- Indemnity & Guarantee: By: Zihadul Islam 074 Md. Ahnaf-Bin-Hasan 076 Kazi Ashif Uz Zaman 083Документ12 страницIndemnity & Guarantee: By: Zihadul Islam 074 Md. Ahnaf-Bin-Hasan 076 Kazi Ashif Uz Zaman 083Tashdeed UthshasОценок пока нет

- An Overview of Banking Law in Bangladesh: Barrister Jennifer AshrafДокумент14 страницAn Overview of Banking Law in Bangladesh: Barrister Jennifer AshrafJennifer AshrafОценок пока нет

- Prospectus and Allotment PRESENTATIONДокумент28 страницProspectus and Allotment PRESENTATIONgondalsОценок пока нет

- Meaning and DefinitionДокумент8 страницMeaning and DefinitionSuit ChetriОценок пока нет

- Statement of Solidarity On Behalf of DSNLUДокумент2 страницыStatement of Solidarity On Behalf of DSNLUVinay YerubandiОценок пока нет

- 6, Vinay Yerubandi, Oral Evidence For Contents of DocumentsДокумент25 страниц6, Vinay Yerubandi, Oral Evidence For Contents of DocumentsVinay YerubandiОценок пока нет

- List of Research Paper Topics - Administartive Law For End SemДокумент4 страницыList of Research Paper Topics - Administartive Law For End SemVinay YerubandiОценок пока нет

- 14 Ind LRev 359Документ21 страница14 Ind LRev 359Vinay YerubandiОценок пока нет

- Research Topics For Interpretation of Statutes For End SemДокумент6 страницResearch Topics For Interpretation of Statutes For End SemVinay YerubandiОценок пока нет

- Daniels v. Smith ruling upholds testimony on loan detailsДокумент4 страницыDaniels v. Smith ruling upholds testimony on loan detailsVinay YerubandiОценок пока нет

- Project Topics For Labour Laws-II For End SemДокумент5 страницProject Topics For Labour Laws-II For End SemVinay Yerubandi100% (1)

- Economic Order Quantity Problems PDF 1 5 PDFДокумент2 страницыEconomic Order Quantity Problems PDF 1 5 PDFHarsha VardhanОценок пока нет

- Clinic Paper - II (ADR) Research Papers For End SemДокумент8 страницClinic Paper - II (ADR) Research Papers For End SemVinay YerubandiОценок пока нет

- List of Research Paper Topics - Administartive Law For End SemДокумент4 страницыList of Research Paper Topics - Administartive Law For End SemVinay YerubandiОценок пока нет

- 21 Nigerian LJ308Документ24 страницы21 Nigerian LJ308Vinay YerubandiОценок пока нет

- 24 Intl JLInfo Tech 229Документ23 страницы24 Intl JLInfo Tech 229Vinay YerubandiОценок пока нет

- R Janakiraman V. ST of TNДокумент16 страницR Janakiraman V. ST of TNVinay YerubandiОценок пока нет

- Coonrod v. Madden, 126 Ind. 197 (1890)Документ3 страницыCoonrod v. Madden, 126 Ind. 197 (1890)Vinay YerubandiОценок пока нет

- ICSI Certification for Module 2 Executive ProgrammeДокумент1 страницаICSI Certification for Module 2 Executive ProgrammeVinay YerubandiОценок пока нет

- Delivery - Westlaw IndiaДокумент8 страницDelivery - Westlaw IndiaVinay YerubandiОценок пока нет

- Yoga Day 2020 - PDFДокумент1 страницаYoga Day 2020 - PDFVinay YerubandiОценок пока нет

- Vimal Chand Ghevarchand Jain v. Ramakanth EKnathn Jaalo, (2009) 513 SCC 713Документ15 страницVimal Chand Ghevarchand Jain v. Ramakanth EKnathn Jaalo, (2009) 513 SCC 713Vinay YerubandiОценок пока нет

- Assignment Module I PDFДокумент1 страницаAssignment Module I PDFhuzaifa gadaОценок пока нет

- Assignment Module I PDFДокумент1 страницаAssignment Module I PDFhuzaifa gadaОценок пока нет

- Tax Trail PDFДокумент9 страницTax Trail PDFVinay YerubandiОценок пока нет

- Assignment Module I PDFДокумент1 страницаAssignment Module I PDFhuzaifa gadaОценок пока нет

- Nptel: National Programme On Technology Enhanced LearningДокумент1 страницаNptel: National Programme On Technology Enhanced LearningVinay YerubandiОценок пока нет

- CMA Pre Exam Test PDFДокумент28 страницCMA Pre Exam Test PDFVinay YerubandiОценок пока нет

- Executive Mod 2 Dec Receipt SummaryДокумент1 страницаExecutive Mod 2 Dec Receipt SummaryVinay YerubandiОценок пока нет

- Academic Calender 2019 20.Документ1 страницаAcademic Calender 2019 20.Vinay YerubandiОценок пока нет

- Power of The Companies To Borrow - Exemptions and Exclusion - Lenders' Responsibilities - Effect of Doctrine of Indoor Management" - Case LawsДокумент6 страницPower of The Companies To Borrow - Exemptions and Exclusion - Lenders' Responsibilities - Effect of Doctrine of Indoor Management" - Case LawsVinay YerubandiОценок пока нет

- Receipt summary for ICSI examination fee paymentДокумент1 страницаReceipt summary for ICSI examination fee paymentVinay YerubandiОценок пока нет

- Act With AmendmentДокумент134 страницыAct With AmendmentSowjanya BondaОценок пока нет

- Level Up - Law On Obligations and Contracts Pt1Документ6 страницLevel Up - Law On Obligations and Contracts Pt1azithethirdОценок пока нет

- Ayesha's Intern ReportДокумент85 страницAyesha's Intern Reportatif attariОценок пока нет

- Pacific Merchandising V Consolacion InsuranceДокумент6 страницPacific Merchandising V Consolacion InsuranceJoem MendozaОценок пока нет

- Bahria University, Islamabad Campus: C. Line ManagersДокумент4 страницыBahria University, Islamabad Campus: C. Line ManagersIfrah BashirОценок пока нет

- Practical Accounting P-2Документ7 страницPractical Accounting P-2KingChryshAnneОценок пока нет

- Investment MGMT - CH1Документ13 страницInvestment MGMT - CH1bereket nigussieОценок пока нет

- Accounts Nov 22 SuggestedДокумент29 страницAccounts Nov 22 SuggestedShailjaОценок пока нет

- Financi Al Instrum Ents: Financial Market: Trends and IssuesДокумент41 страницаFinanci Al Instrum Ents: Financial Market: Trends and IssuesEunice Dimple CaliwagОценок пока нет

- Contributor: Atty. Mendoza, B. Date Contributed: March 2011Документ8 страницContributor: Atty. Mendoza, B. Date Contributed: March 2011Darynn LinggonОценок пока нет

- Macro To Upload Data From Excel To Oracle FormsДокумент223 страницыMacro To Upload Data From Excel To Oracle Formshafeez72Оценок пока нет

- Abacus Securities v. AmpilДокумент11 страницAbacus Securities v. AmpilTESDA MIMAROPAОценок пока нет

- Chapter 6 EBPA (ING)Документ66 страницChapter 6 EBPA (ING)Yovie SantriaОценок пока нет

- 4B Compiled Oblicon ReviewerДокумент73 страницы4B Compiled Oblicon ReviewerLenier SanchezОценок пока нет

- Financial Services: Ca Final - Financial Reporting Tayal InstituteДокумент11 страницFinancial Services: Ca Final - Financial Reporting Tayal InstituteJatinkatrodiyaОценок пока нет

- Accounting Module OverviewДокумент23 страницыAccounting Module OverviewMa Leah TañezaОценок пока нет

- Merchant of Venice Casket Test SummaryДокумент3 страницыMerchant of Venice Casket Test Summaryoshi adikaramОценок пока нет

- Credit Repair Guide: Restore Your Credit RatingДокумент28 страницCredit Repair Guide: Restore Your Credit RatingWill Crawford0% (1)

- Ifr Magazine 2019 No 2289 June 22 PDFДокумент114 страницIfr Magazine 2019 No 2289 June 22 PDFИрина ДубовскаяОценок пока нет

- Exam Preperation V2Документ75 страницExam Preperation V2carla grieselОценок пока нет

- Kasapreko PLC Prospectus November 2023Документ189 страницKasapreko PLC Prospectus November 2023kofiatisu0000Оценок пока нет

- Chapter 06: Money Markets: Page 1Документ22 страницыChapter 06: Money Markets: Page 1AS SAОценок пока нет

- Corporate Law MCQsДокумент33 страницыCorporate Law MCQsSalman AliОценок пока нет

- Ulearn Notes Geb2102 Entrepreneurship - Business Finance May 2020 Sem 001 PDFДокумент30 страницUlearn Notes Geb2102 Entrepreneurship - Business Finance May 2020 Sem 001 PDFgazileОценок пока нет

- MathДокумент35 страницMathbritaniaОценок пока нет

- Cash Payment JournalДокумент44 страницыCash Payment JournalReza RomadhonaОценок пока нет

- General Mathematics - Module 6 - Math of InvestmentДокумент52 страницыGeneral Mathematics - Module 6 - Math of InvestmentReaper Unseen100% (4)

- Revising For Your Strategic Business Reporting (SBR) ExamДокумент9 страницRevising For Your Strategic Business Reporting (SBR) ExamMyo NaingОценок пока нет

- FIN302 FinalДокумент17 страницFIN302 FinalMohsin KhanОценок пока нет

- Loan Application FormДокумент1 страницаLoan Application FormMukalele RogersОценок пока нет

- Mortgage vs AntichresisДокумент3 страницыMortgage vs AntichresisFred GoОценок пока нет