Академический Документы

Профессиональный Документы

Культура Документы

Multinationals, Monopsony, and Local Development: Evidence From The United Fruit Company

Загружено:

Cato InstituteОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Multinationals, Monopsony, and Local Development: Evidence From The United Fruit Company

Загружено:

Cato InstituteАвторское право:

Доступные форматы

Research Briefs

IN ECONOMIC POLICY

April 15, 2020 | Number 210

Multinationals, Monopsony, and

Local Development

Evidence from the United Fruit Company

By Esteban Méndez-Chacón, Central Bank of Costa Rica; and Diana Van Patten,

T

University of California, Los Angeles

he top 1 percent of the largest firms in emerg- function as a local monopsonist.

ing economies account for more than half We find that households living within the former UFCO

of local exports and are primarily foreign regions have had better economic outcomes (housing, sani-

owned. Despite their central role in develop- tation, education, and consumption capacity) and were

ing countries, the extent to which host econ- 26 percent less likely to be poor than households living out-

omies benefit from these enterprises is widely debated. On side those regions. This effect is persistent over time: since

the one hand, monopsony power and the extractive activi- the UFCO closed, the treated and untreated regions have

ties of these foreign companies may explain why some places converged slowly, with only 54 percent of the income gap

remain persistently poorer than others. On the other hand, closing over the following three decades.

new technologies and capital injections associated with these Historical data collected from primary sources sug-

firms can positively affect long-term growth. The empirical gest that investments in local amenities carried out by the

evidence, however, remains scarce. In fact, it is challenging UFCO—including hospitals, schools, and roads—are the

to estimate the causal effects of these firms on local develop- main drivers of our results. For instance, we document that

ment and follow their evolution over time. investments per student and per patient in UFCO-operated

Our work studies the effects of large foreign investment schools and hospitals were significantly larger than in local

projects on local economic development. We also explore schools and hospitals run by the government, and sometimes

the role of monopsony power and of the spatial structure even twice as large. Access to these investments was restrict-

of the labor market in determining the direction and per- ed, for the most part, to UFCO workers, who were required

sistence of these effects. To do so, we use evidence from to live within the plantation, which might explain the sharp

one of the largest multinationals of the 20th century: the discontinuity in outcomes right at the boundary. We do not

United Fruit Company (UFCO), the infamous firm hosted find evidence of other channels, such as selective migration

by the so-called banana republics. This American firm was or negative spillovers on the control group, as potential driv-

given a large land concession in Costa Rica and was the ers of the gaps in outcomes.

only employer in this region—where it required workers to Why were these investments in local amenities higher

live—from 1889 to 1984. In this sense, the firm appeared to than in other amenities in the rest of the country? While the

Editor, Jeffrey Miron, Harvard University and Cato Institute

2

company might have invested in hospitals to have healthier make workers more productive.

workers, it is less clear why it would have benefited from more We find that after accounting for general equilibrium ef-

schooling. Evidence from archival company annual reports fects, the company’s effect over the country’s aggregate wel-

suggests that these investments were induced by the need to fare is also positive, but this positive welfare effect depends

attract and maintain a sizable workforce, given the initially crucially on worker mobility. The intuition behind this result

high levels of worker turnover. For instance, after describ- is that if workers are less mobile, their outside options de-

ing annual turnovers of up to 100 percent per year, the 1922 crease, and the company can reduce their compensation. In

report states, “These migratory habits do not permit them the extreme case of immobile workers, the company could

to remain in the plantation from one year to the next, and as potentially not pay for the labor input, thereby negatively af-

soon as they become physically efficient in our methods and acquire fecting workers’ welfare.

money, they either return to their homes or migrate elsewhere and The result of this counterfactual analysis—that the firm

must be replaced.” Later, the 1925 report states: could have had a large negative impact on welfare if workers

were relatively immobile—allows us to reconcile our results

We recommend a greater investment in corporate with findings from a growing body of literature that analyzes

welfare beyond medical measures. An endeavor the long-term impact of colonial and historical institutions

should be made to stabilize the population. . . . We on economic development. We complement previous studies

must provide measures for taking care of families of by shedding light on the importance of workers’ outside op-

married men, by furnishing them with garden facilities, tions in determining the direction of this effect.

schools, and some forms of entertainment. In other words, Our work also contributes to three strands of the litera-

we must take an interest in our people if we might hope to ture on the consequences of firms exercising market power.

retain their services indefinitely. First, we explore theoretically and quantitatively how the

degree of labor market power of a firm within a location de-

Quantitative evidence is consistent with the qualita- pends on the mobility of workers across locations. Second,

tive evidence from the company reports. In fact, empiri- we explore how this local monopsony power affects a firm’s

cally, the intensity of the UFCO’s investments in a location incentive to invest in local amenities and consider compen-

is positively correlated with the degree of competition for sation that does not focus only on wages. Third, we study

labor faced by the company. Using suitability to grow cof- long-term outcomes and how persistent these effects can

fee (the main outside option for agricultural workers at the be. Finally, the paper is related to the literature on the effects

time) to explain changes in wages, we find that locations and spillovers of foreign direct investment. We show how,

where workers had a 1 percentage point higher outside op- in a context with high labor mobility, foreign direct invest-

tion in 1973 also had a 2.1 percentage point lower probability ment had positive local and aggregate effects due to the need

of being poor in 2011, on average. to compete for labor, while in cases with low labor mobility,

Our mechanisms suggest that the relationship between both local and aggregate effects can be negative.

labor mobility, monopsony, and investments was crucial in

determining the firm’s effect. In our model, the company is

a local monopsony in one location, while workers are mobile NOTE:

across locations. Thus, as workers become less mobile, the This research brief is based on Esteban Méndez-Chacón

firm has more market power over the labor supply. We as- and Diana Van Patten, “Multinationals, Monopsony, and Lo-

sume that the local monopsonist can choose a combination cal Development: Evidence from the United Fruit Com-

of wages and local amenities as part of the workers’ compen- pany,” January 24, 2019, https://1ac50a88-25ab-4011-94bc-

sation bundle. These local amenities are costly for the firm c9af1856189b.filesusr.com/ugd/27755d_7c9bb51661644273a3041

and depreciate over time but increase workers’ utility and 26f1997ddb1.pdf.

The views expressed in this paper are those of the author(s) and should not be attributed to the Cato Institute, its

trustees, its Sponsors, or any other person or organization. Nothing in this paper should be construed as an attempt to

aid or hinder the passage of any bill before Congress. Copyright © 2020 Cato Institute. This work by Cato Institute is

licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.

Вам также может понравиться

- DVP JMP 011320Документ81 страницаDVP JMP 011320dan sanОценок пока нет

- Corporate Financialization and Worker Prosperity: A Broken LinkДокумент22 страницыCorporate Financialization and Worker Prosperity: A Broken LinkRoosevelt Institute100% (4)

- Literature Review On Capital Market in TanzaniaДокумент4 страницыLiterature Review On Capital Market in Tanzaniaphqfgyvkg100% (1)

- 1: Defining Local Economic Development and Why Is It Important?Документ14 страниц1: Defining Local Economic Development and Why Is It Important?jessa mae zerdaОценок пока нет

- Market Failure Literature ReviewДокумент6 страницMarket Failure Literature Reviewgvzz4v44100% (1)

- Essays On Media InfluenceДокумент6 страницEssays On Media Influenceafibyoeleadrti100% (2)

- Research Paper UnemploymentДокумент7 страницResearch Paper Unemploymentfvgczbcy100% (1)

- Macalinao, Rica Princess L. Project BackgroundДокумент5 страницMacalinao, Rica Princess L. Project BackgroundRica Princess MacalinaoОценок пока нет

- Conditions Affecting Multinational OperationsДокумент2 страницыConditions Affecting Multinational OperationsKimber Palada80% (5)

- State Owned Enterprises and Fiscal Risks in PeruДокумент39 страницState Owned Enterprises and Fiscal Risks in PeruAngeОценок пока нет

- How State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaОт EverandHow State-owned Enterprises Drag on Economic Growth: Theory and Evidence from ChinaОценок пока нет

- Five Criteria For IMS DecisionsДокумент5 страницFive Criteria For IMS DecisionsKim TranОценок пока нет

- Tax Policy and the Economy, Volume 34От EverandTax Policy and the Economy, Volume 34Robert A. MoffittОценок пока нет

- The Primacy of Institutions: (And What This Does and Does Not Mean)Документ4 страницыThe Primacy of Institutions: (And What This Does and Does Not Mean)Carol StadtlerОценок пока нет

- The Impact of The (COVID-19) On Small and BusinessesДокумент4 страницыThe Impact of The (COVID-19) On Small and BusinessesKristine Marie ParalОценок пока нет

- 1.the Global Environment of Business: New Paradigms For International ManagementДокумент14 страниц1.the Global Environment of Business: New Paradigms For International ManagementManvi AdlakhaОценок пока нет

- Hall & Jones (1999)Документ35 страницHall & Jones (1999)Charly D WhiteОценок пока нет

- The Financialization of America - Project 3 (Final)Документ13 страницThe Financialization of America - Project 3 (Final)Max HallОценок пока нет

- CARES-UI Identification VFДокумент24 страницыCARES-UI Identification VFtriciaОценок пока нет

- Salazar Research#2Документ5 страницSalazar Research#2Darren Ace SalazarОценок пока нет

- The Economic Ripple Effects of COVID 19Документ42 страницыThe Economic Ripple Effects of COVID 19Madster RobertsОценок пока нет

- Employee Views of Leveraged Buy-Out Transactions - 2021Документ65 страницEmployee Views of Leveraged Buy-Out Transactions - 2021Manal AFconsultingОценок пока нет

- Literature Review On Local Government RevenueДокумент8 страницLiterature Review On Local Government Revenueea86yezd100% (1)

- Garcia-Penalosa and Wen (2004) - Redistribution and Occupational Choice in A Schumpeterian Growth ModelДокумент36 страницGarcia-Penalosa and Wen (2004) - Redistribution and Occupational Choice in A Schumpeterian Growth ModelCalixto GarcíaОценок пока нет

- Thesis IUДокумент19 страницThesis IUsneha sОценок пока нет

- 2006-Education, Institutions and Growth - The Role of Entrepreneurus-JDE-FinalДокумент50 страниц2006-Education, Institutions and Growth - The Role of Entrepreneurus-JDE-FinalRodrigo SilvaОценок пока нет

- Public Finance Literature ReviewДокумент8 страницPublic Finance Literature Reviewofahxdcnd100% (1)

- Styles of Writing for Research Papers in Public AdministrationОт EverandStyles of Writing for Research Papers in Public AdministrationОценок пока нет

- Essay Mid TermДокумент5 страницEssay Mid TermHong Hanh PhanОценок пока нет

- Solving The Problems of Economic Development Incentives: ErspectiveДокумент28 страницSolving The Problems of Economic Development Incentives: ErspectiveChris EsposoОценок пока нет

- Diversity in The Workforce - A Research Analysis Abstract: The Importance of DiversityДокумент6 страницDiversity in The Workforce - A Research Analysis Abstract: The Importance of DiversityF.A. AminОценок пока нет

- The Human Capital: Challenges and Perspectives: A Romanian AnalyseОт EverandThe Human Capital: Challenges and Perspectives: A Romanian AnalyseОценок пока нет

- View Issue 14Документ64 страницыView Issue 14abbeydotОценок пока нет

- Research, Quantitative StudyДокумент16 страницResearch, Quantitative StudyhoneydwainecОценок пока нет

- Psychology of Music 1978 Manturzewska 36 47Документ35 страницPsychology of Music 1978 Manturzewska 36 47GrozaIustinaAlexandraОценок пока нет

- Entrepreneurship and Innovation - Organizations, Institutions, Systems and RegionsДокумент23 страницыEntrepreneurship and Innovation - Organizations, Institutions, Systems and Regionsdon_h_manzanoОценок пока нет

- Thesis Authorised Corporate DirectorДокумент4 страницыThesis Authorised Corporate Directortammymitchellfortwayne100% (2)

- Literature Review On Unemployment and GDPДокумент4 страницыLiterature Review On Unemployment and GDPgw1g9a3s100% (1)

- David OsbornДокумент9 страницDavid Osborngugoloth shankarОценок пока нет

- Privitization and The Allure of FranchisingДокумент26 страницPrivitization and The Allure of FranchisingZoe KhanОценок пока нет

- Tax Policy and the Economy: Volume 32От EverandTax Policy and the Economy: Volume 32Robert A. MoffittОценок пока нет

- Shyam SunderДокумент20 страницShyam SunderAbhinav JunejaОценок пока нет

- ESCOs Around The WorldДокумент7 страницESCOs Around The WorldAee AtlantaОценок пока нет

- Part AДокумент15 страницPart Asoe sanОценок пока нет

- Unfin 1Документ35 страницUnfin 1Patatri SarkarОценок пока нет

- Read Me - I Am ImportantДокумент56 страницRead Me - I Am ImportantarciblueОценок пока нет

- Global Human Capital TrendsДокумент3 страницыGlobal Human Capital TrendsShivam KashyapОценок пока нет

- MNCs - LaborДокумент39 страницMNCs - LaborGrosaru FlorinОценок пока нет

- Economic GeographyДокумент33 страницыEconomic GeographyfornaraОценок пока нет

- 5c91b93675628 PDFДокумент28 страниц5c91b93675628 PDFsahan bhuiyaОценок пока нет

- Artz 2015Документ24 страницыArtz 2015Thanh PhamОценок пока нет

- Is There A Wage Premium For Public Sector Workers?Документ7 страницIs There A Wage Premium For Public Sector Workers?aidan_gawronskiОценок пока нет

- Generic Steep Factors Specific Macro Local Country Perspective Related To Mission and Vision of Company (Filinvest For Example)Документ3 страницыGeneric Steep Factors Specific Macro Local Country Perspective Related To Mission and Vision of Company (Filinvest For Example)Adrian RuizОценок пока нет

- Engaging Government Employees: Motivate and Inspire Your People to Achieve Superior PerformanceОт EverandEngaging Government Employees: Motivate and Inspire Your People to Achieve Superior PerformanceРейтинг: 5 из 5 звезд5/5 (2)

- Chapter 1 IntroductionДокумент12 страницChapter 1 IntroductionJusteen Rodriguez JuatasОценок пока нет

- Literature Review UnemploymentДокумент6 страницLiterature Review Unemploymentqdvtairif100% (1)

- Speech First v. SandsДокумент21 страницаSpeech First v. SandsCato InstituteОценок пока нет

- Why Legal Immigration Is Nearly ImpossibleДокумент88 страницWhy Legal Immigration Is Nearly ImpossibleCato InstituteОценок пока нет

- A Shaky FoundationДокумент12 страницA Shaky FoundationCato InstituteОценок пока нет

- The Right To Financial PrivacyДокумент24 страницыThe Right To Financial PrivacyCato InstituteОценок пока нет

- Balance of Trade, Balance of PowerДокумент16 страницBalance of Trade, Balance of PowerCato InstituteОценок пока нет

- Advisory Opinion To The Attorney General Re: Adult Personal Use of MarijuanaДокумент30 страницAdvisory Opinion To The Attorney General Re: Adult Personal Use of MarijuanaCato InstituteОценок пока нет

- Coalition For TJ v. Fairfax County School BoardДокумент25 страницCoalition For TJ v. Fairfax County School BoardCato InstituteОценок пока нет

- Keeping North Carolina's Housing AffordableДокумент24 страницыKeeping North Carolina's Housing AffordableCato InstituteОценок пока нет

- Expansions in Paid Parental Leave and Mothers' Economic ProgressДокумент2 страницыExpansions in Paid Parental Leave and Mothers' Economic ProgressCato InstituteОценок пока нет

- Safeguarding Consumers Through Minimum Quality Standards: Milk Inspections and Urban Mortality, 1880-1910Документ2 страницыSafeguarding Consumers Through Minimum Quality Standards: Milk Inspections and Urban Mortality, 1880-1910Cato InstituteОценок пока нет

- Hobo EconomicusДокумент2 страницыHobo EconomicusCato InstituteОценок пока нет

- Pretrial Juvenile DetentionДокумент3 страницыPretrial Juvenile DetentionCato InstituteОценок пока нет

- The Vagaries of The Sea: Evidence On The Real Effects of Money From Maritime Disasters in The Spanish EmpireДокумент2 страницыThe Vagaries of The Sea: Evidence On The Real Effects of Money From Maritime Disasters in The Spanish EmpireCato InstituteОценок пока нет

- Cato Henderso Eighth Circuit Brief FinalДокумент34 страницыCato Henderso Eighth Circuit Brief FinalCato InstituteОценок пока нет

- Tyler v. Hennepin CountyДокумент30 страницTyler v. Hennepin CountyCato InstituteОценок пока нет

- Netflix v. BabinДокумент48 страницNetflix v. BabinCato InstituteОценок пока нет

- Devillier, Et Al., v. TexasДокумент22 страницыDevillier, Et Al., v. TexasCato InstituteОценок пока нет

- School of The Ozarks v. BidenДокумент31 страницаSchool of The Ozarks v. BidenCato InstituteОценок пока нет

- Moore v. United StatesДокумент27 страницMoore v. United StatesCato InstituteОценок пока нет

- Corner Post v. Board of Governors of The Federal Reserve SystemДокумент29 страницCorner Post v. Board of Governors of The Federal Reserve SystemCato InstituteОценок пока нет

- Moore v. United StatesДокумент23 страницыMoore v. United StatesCato InstituteОценок пока нет

- Biden v. NebraskaДокумент29 страницBiden v. NebraskaCato InstituteОценок пока нет

- Dakota Finance v. Naturaland TrustДокумент23 страницыDakota Finance v. Naturaland TrustCato InstituteОценок пока нет

- Salazar v. MolinaДокумент19 страницSalazar v. MolinaCato InstituteОценок пока нет

- Loper Bright Enterprises v. RaimondoДокумент31 страницаLoper Bright Enterprises v. RaimondoCato InstituteОценок пока нет

- Changizi v. Department of Health and Human ServicesДокумент38 страницChangizi v. Department of Health and Human ServicesCato InstituteОценок пока нет

- Welfare Implications of Electric Bike Subsidies: Evidence From SwedenДокумент3 страницыWelfare Implications of Electric Bike Subsidies: Evidence From SwedenCato InstituteОценок пока нет

- Alvarez v. New YorkДокумент19 страницAlvarez v. New YorkCato InstituteОценок пока нет

- The Human Perils of Scaling Smart Technologies: Evidence From Field ExperimentsДокумент3 страницыThe Human Perils of Scaling Smart Technologies: Evidence From Field ExperimentsCato InstituteОценок пока нет

- An Evaluation of The Paycheck Protection Program Using Administrative Payroll MicrodataДокумент2 страницыAn Evaluation of The Paycheck Protection Program Using Administrative Payroll MicrodataCato InstituteОценок пока нет

- Management AccountingДокумент375 страницManagement Accountingvitabu mingiОценок пока нет

- Workmen's Compensation Act, 1923Документ33 страницыWorkmen's Compensation Act, 1923KNOWLEDGE CREATORS75% (4)

- Final Report MOU ContractДокумент50 страницFinal Report MOU Contractsumanshailendra0% (1)

- Work Balance of Employee Woman Garment Industry Final ProjectДокумент86 страницWork Balance of Employee Woman Garment Industry Final ProjectNafees Khan100% (6)

- Cases Part 2Документ109 страницCases Part 2owenОценок пока нет

- Bonus Act, 2030 (1974) Last AmendmentsДокумент11 страницBonus Act, 2030 (1974) Last AmendmentsDeep JoshiОценок пока нет

- Sibal V Notre DameДокумент3 страницыSibal V Notre DameIda Chua100% (1)

- Longevity and Productivity: Experiences From Aging AsiaДокумент116 страницLongevity and Productivity: Experiences From Aging AsiaDanaa BayantsetsegОценок пока нет

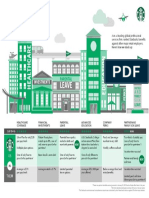

- Starbucks Partner Investments 2018Документ1 страницаStarbucks Partner Investments 2018Circa NewsОценок пока нет

- ACC349 - Week 4 - DQ'sДокумент3 страницыACC349 - Week 4 - DQ'sShelly ElamОценок пока нет

- Economics NotesДокумент80 страницEconomics Notesgavin_d265Оценок пока нет

- Accenture C&BДокумент53 страницыAccenture C&Bvikassingh_ab56Оценок пока нет

- Questions 1-5 Refer To The Following Memo, Job Advertisement and E-MailДокумент3 страницыQuestions 1-5 Refer To The Following Memo, Job Advertisement and E-MailJonny SleemanОценок пока нет

- Free Payslip Open Office TemplateДокумент1 страницаFree Payslip Open Office TemplateSurializa RamliОценок пока нет

- G.R. No. L-31832 (SSS v. SSS Supervisors' Union Cugco and CIR)Документ2 страницыG.R. No. L-31832 (SSS v. SSS Supervisors' Union Cugco and CIR)Pepper PottsОценок пока нет

- Paper CupsДокумент13 страницPaper CupsVeena KohliОценок пока нет

- Continental Marble Vs NLRC 161 SCRA 151Документ5 страницContinental Marble Vs NLRC 161 SCRA 151Mariel D. PortilloОценок пока нет

- Contract For Hiring Workmen For HousekeepingДокумент19 страницContract For Hiring Workmen For HousekeepingYashodeep Kale PatilОценок пока нет

- Quiz 510Документ8 страницQuiz 510Haris NoonОценок пока нет

- Atributos Empleados Data SourceДокумент3 страницыAtributos Empleados Data SourceJulio Rafael Olivos PuenteОценок пока нет

- Model of HRAДокумент5 страницModel of HRAArghya D PunkОценок пока нет

- Unit 2-Human Resource Procurement: - Job Analysis and Design - Human Resource Planning - Recruitment - Selection ProcessДокумент56 страницUnit 2-Human Resource Procurement: - Job Analysis and Design - Human Resource Planning - Recruitment - Selection Processkaruna1323Оценок пока нет

- Tata SteelДокумент4 страницыTata SteelAnkit VermaОценок пока нет

- Diamond Farms Inc (Dfi) v. Spfl-Workers Solidarity.Документ2 страницыDiamond Farms Inc (Dfi) v. Spfl-Workers Solidarity.Bert NazarioОценок пока нет

- Portals/0/WO - RCC - Building Work, Only Labour With Shuttering - SAMPLEДокумент12 страницPortals/0/WO - RCC - Building Work, Only Labour With Shuttering - SAMPLEyogiforyou100% (1)

- SAIN SamajДокумент44 страницыSAIN Samajsateesh chandОценок пока нет

- A Study On Payroll Management 123Документ71 страницаA Study On Payroll Management 123Harsha HarshaОценок пока нет

- Surprise Test 2 Shivani Joshi 2k20/umba/38 Ans 1 - Job Based CompensationДокумент4 страницыSurprise Test 2 Shivani Joshi 2k20/umba/38 Ans 1 - Job Based CompensationshivaniОценок пока нет

- Additional QuestionsДокумент57 страницAdditional QuestionsNadil NinduwaraОценок пока нет

- HR Compliance LawsДокумент1 страницаHR Compliance LawsKabeer SharmaОценок пока нет