Академический Документы

Профессиональный Документы

Культура Документы

Answer Key Problems Q1 PDF

Загружено:

Nonami AbicoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Answer Key Problems Q1 PDF

Загружено:

Nonami AbicoАвторское право:

Доступные форматы

ANSWER KEY QUIZ 1

True or False - False are 2, 3, 4, 7, 8 and 10.

Multiple Choice - A D C E C C B A C B.

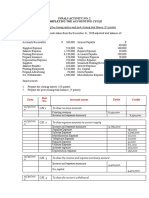

Problem 1 -SIR CHING COMPANY

PATENT A PATENT B PATENT C

Cost 75,000 215,500 167,250

Useful life 20.0 12.5 16.0

Annual amortization 3,750 17,240 10,453

2010 depreciation 3,750 17,240 10,453

1 Total patent amortization for 2010 31,443

PATENT A PATENT B PATENT C

Cost 75,000 215,500 167,250

Annual amortization 3,750 17,240 10,453

2006 amortization 2,813 - -

2007 amortization 3,750 1,437 -

2008 amortization 3,750 17,240 -

2009 amortization 3,750 17,240 5,227

2010 amortization 3,750 17,240 10,453

Carrying value, 12/31/2010 57,188 162,343 151,570

2 Total carrying value, 12/31/2010 371,101

PATENT A PATENT B PATENT C

Cost 75,000 215,500 167,250

Useful life 20.0 12.5 16.0

Annual amortization 3,750 17,240 10,453

PATENT A PATENT B PATENT C

Cost 75,000 215,500 167,250

Annual amortization 3,750 17,240 10,453

2006 amortization 2,813 - -

2007 amortization 3,750 1,437 -

2008 amortization 3,750 17,240 -

2009 amortization 3,750 17,240 5,227

Carrying value, 01/01/2010 60,938 179,583 162,023

Revised useful life 15.00 10.00 12.00

Used up life 3.75 2.083 0.50

Remaining useful life 11.25 7.92 11.50

2010 amortization 5,417 22,684 14,089

3 Total patent amortization for 2010 42,190

Carrying value, 12/31/2010 55,521 156,899 147,934

4 Total carrying value, 12/31/2010 360,354

Problem 2 - HU Company (amount in millions)

5 The investment property is carried at fair value. 300

FV 300.000

Cost:

Downpayment 50.000

PV of installment 40 3.7908 151.632

Direct costs 0.250 201.882

6 Gain on change in FV 98.118

Problem 3 - BELLA Company

PV of installment 400,000 3.8897 1,555,880

2011 400,000 140,029.20 259,970.80 1,295,909

2012 400,000 116,631.83 283,368.17 1,012,541

7 2013 400,000 91,128.69 308,871.31 703,670

8 2014 400,000 63,330.27 336,669.73 367,000

2015 400,000 33,030.00 367,000.00 0

Problem 4 - NATIONAL Company

9 For 2010, the client should recognize the impairment

attributable to the building element; the land element is not

impaired. 12,000,000

10 The insurance claims has not been agreed as of 2010; hence, none

can be recognized. zero

11 The insurance claims is already receivable in 2011; hence, it can now

be recognized. 20,000,000

Land element 28,000,000

Replacement building 16,000,000

12 CV of investment property, 12/31/2011 44,000,000

Problem 5 - LILY Company

Franchise Patent Trademark

Initial fee 150,000 132,000 320,000

PV of annual payments 437,000

CV, before amortization 587,000 132,000 320,000

Useful life 10 8 20

Previous amortizations - - 40,000

CV, 01/01/2010 587,000 132,000 280,000

2010 Amortization 58,700 16,500 16,000

13 to 15 CV, 12/31/2010 528,300 115,500 264,000

16 Total amortization expense for 2010 91,200

Problem 6 - PEPE Company

Redeemable special gifts - 2010 18,750

Special gifts distributed 7,000

11,750

Unit cost 2.75

17 Estimated liability, 2010 32,312.50

Redeemable special gifts - 2010 18,750

Unit cost 2.75

18 Premium expense for 2010 51,562.50

Problem 7 - PILLAR Corporation

B = 5% x (2,800,000 - Tax) + Tax savings

Tax = 30% x (2,800,000 - B)

Tax savings = (30% x 2,800,000) - (30% x (2,800,000 - B)) = .30B

19 Simplifying, bonus will be 143,066

Net income before bonus and tax 2,800,000

Less:

Bonus 143,066

Tax 797,080 940,146

20 Net income after bonus and tax 1,859,854

PTS

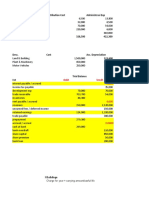

1 BIYAYA Diversified Enterprises

Schedule of Analysis of Intangible Asset

31-Dec-10

Patent Franchise Org Costs Goodwill

Unadjusted balances, 12/31/2010 550,000 95,000 102,000 345,000

Adjustments:

2 1. Cost of improvement (52,500)

2 2. Royalty paid to franchisor (45,000)

2 3. Amortization of org costs (102,000)

2 4. Legal expenses (45,000)

2 5. Advertising expense (100,000)

Net adjustments (52,500) (45,000) (102,000) (145,000)

Adjusted balances before amortization 497,500 50,000 - 200,000

1 1 1 1

Вам также может понравиться

- Durant Trails Hoa, Inc. 2010 BUDGET VS 2009Документ3 страницыDurant Trails Hoa, Inc. 2010 BUDGET VS 2009duranttrailsОценок пока нет

- Assignment 1Документ6 страницAssignment 1Nichole TumulakОценок пока нет

- Sharon PLC (Long Question)Документ4 страницыSharon PLC (Long Question)Jimmy LimОценок пока нет

- Far Situational Solution-1Документ6 страницFar Situational Solution-1Baby BearОценок пока нет

- FM Model - Coffee ParlorДокумент11 страницFM Model - Coffee ParlorPRITESH PATILОценок пока нет

- Fa July2023-Far210-StudentДокумент9 страницFa July2023-Far210-Student2022613976Оценок пока нет

- Chapter 7 Up StreamДокумент14 страницChapter 7 Up StreamAditya Agung SatrioОценок пока нет

- FAR Problem Quiz 2Документ3 страницыFAR Problem Quiz 2Ednalyn CruzОценок пока нет

- Far410 - SS - Feb 2022Документ9 страницFar410 - SS - Feb 2022AFIZA JASMANОценок пока нет

- Answers - Chapter 2 Vol 2 RvsedДокумент13 страницAnswers - Chapter 2 Vol 2 Rvsedjamflox100% (3)

- JAIBB Accounting Solution - Final AccountingДокумент6 страницJAIBB Accounting Solution - Final AccountingShakil MahmodОценок пока нет

- Adobe Scan 01-Nov-2022Документ5 страницAdobe Scan 01-Nov-2022Suthersan SoundarrajОценок пока нет

- Trial Balance CompletedДокумент1 страницаTrial Balance CompletedapachemonoОценок пока нет

- AP Review NotesДокумент2 страницыAP Review NotesCattleyaОценок пока нет

- Reinforcement Activity 2 Part BДокумент21 страницаReinforcement Activity 2 Part BmattbtaitОценок пока нет

- Format IS and BSДокумент2 страницыFormat IS and BSckyn greenleafОценок пока нет

- Ceci TEAMWORK HW - Case - New and Repaired FurnaceДокумент14 страницCeci TEAMWORK HW - Case - New and Repaired FurnaceMarcela GzaОценок пока нет

- Answer KeyДокумент17 страницAnswer KeyRaymund Christian Ong AbrantesОценок пока нет

- QuizДокумент4 страницыQuizRinconada Benori ReynalynОценок пока нет

- Chapter 06 - AdjustmentsДокумент26 страницChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- AE121-PPE Lecture Prob SolДокумент7 страницAE121-PPE Lecture Prob SolGero MarinasОценок пока нет

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Документ31 страницаIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaОценок пока нет

- Bài tập về nhà - Trang tính1Документ3 страницыBài tập về nhà - Trang tính1namhua54Оценок пока нет

- AccountsДокумент4 страницыAccountsVencint LaranОценок пока нет

- PDE4232 Individual Coursework - 2023-24 UpdatedДокумент5 страницPDE4232 Individual Coursework - 2023-24 UpdatedTariq KhanОценок пока нет

- Finance Lease Exercise 1Документ13 страницFinance Lease Exercise 1Jenyl Mae NobleОценок пока нет

- Midterm Ifrs - Data Sheet - Workings and RulesДокумент11 страницMidterm Ifrs - Data Sheet - Workings and RulesHuong LanОценок пока нет

- ACCT1200 (20) Additional P&L Account and Balance Sheet QuestionДокумент2 страницыACCT1200 (20) Additional P&L Account and Balance Sheet QuestionTaleh HasanzadaОценок пока нет

- Error and Corrections Solutionpa CheckДокумент5 страницError and Corrections Solutionpa Checkmartinfaith958Оценок пока нет

- MBA104 - Almario - Parco - Case Study LGAOP02Документ25 страницMBA104 - Almario - Parco - Case Study LGAOP02Jesse Rielle CarasОценок пока нет

- J. Projects Limited: /iapariaДокумент4 страницыJ. Projects Limited: /iapariaShyam SunderОценок пока нет

- AA Chapter2Документ6 страницAA Chapter2Nikki GarciaОценок пока нет

- Answer Key Final Exam IA 2Документ4 страницыAnswer Key Final Exam IA 2Carlos arnaldo lavadoОценок пока нет

- Club A/c's: TopicДокумент16 страницClub A/c's: TopicJames KAGWAPEОценок пока нет

- Rama Raju Final Workings 30.08.2020Документ2 страницыRama Raju Final Workings 30.08.2020Varma RebalОценок пока нет

- Equity MethodДокумент2 страницыEquity MethodJeane Mae BooОценок пока нет

- BUS 402 - Assignment 4 - Supply Chain Management and Financial Plan - Course HeroДокумент6 страницBUS 402 - Assignment 4 - Supply Chain Management and Financial Plan - Course Herowriter topОценок пока нет

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditДокумент2 страницыTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaОценок пока нет

- IA2 Ch. 5 6Документ12 страницIA2 Ch. 5 6JessaОценок пока нет

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Документ3 страницыNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Lembar JWB PD ANGKASAДокумент53 страницыLembar JWB PD ANGKASAernyОценок пока нет

- JournalДокумент7 страницJournalathierahОценок пока нет

- Accounting 10 ColumnsДокумент2 страницыAccounting 10 ColumnsTRIXIEJOY INIONОценок пока нет

- Income Based Valuation Unit Exam Answer Key NewДокумент6 страницIncome Based Valuation Unit Exam Answer Key NewAMIKO OHYAОценок пока нет

- Jawaban Soal UTS Akuntansi Keu - MenengahДокумент4 страницыJawaban Soal UTS Akuntansi Keu - MenengahJessinthaОценок пока нет

- Cash Flow Tutorial QnsДокумент13 страницCash Flow Tutorial QnsCristian Renatus100% (1)

- Img 20210330 0003 NewДокумент4 страницыImg 20210330 0003 NewDheeraj GuptaОценок пока нет

- Pt. Balqis Istana Furnitures Balance Sheet As On December 31, 2010 Account No Description Debet CreditДокумент8 страницPt. Balqis Istana Furnitures Balance Sheet As On December 31, 2010 Account No Description Debet CreditKim JunОценок пока нет

- Chandragiri 071-072 ProvsionalДокумент9 страницChandragiri 071-072 ProvsionalBright Tone Music InstituteОценок пока нет

- Gov't Grant, Depreciation, Revaluation and ImpairmentДокумент6 страницGov't Grant, Depreciation, Revaluation and Impairment夜晨曦Оценок пока нет

- Trial Balance FinalДокумент2 страницыTrial Balance FinalsenbrosОценок пока нет

- Seatwork No. 2 (Sanguine) AnswerДокумент1 страницаSeatwork No. 2 (Sanguine) AnswerJohn Paul Cristobal0% (1)

- Yolanda Reality Work Sheet For The Month Ended April 2020Документ2 страницыYolanda Reality Work Sheet For The Month Ended April 2020Hannah DimalibotОценок пока нет

- Angelica S. Rubios: Problem 10-19Документ4 страницыAngelica S. Rubios: Problem 10-19Angel RubiosОценок пока нет

- Cestrum BS-Mar 23 ConsolДокумент35 страницCestrum BS-Mar 23 Consolprimestuff09Оценок пока нет

- Karkits Corporation Excel Copy PasteДокумент2 страницыKarkits Corporation Excel Copy PasteCoke Aidenry SaludoОценок пока нет

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Документ17 страницMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoОценок пока нет

- Accounting LesseeДокумент7 страницAccounting Lesseeangelian bagadiongОценок пока нет

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- MINITAB Tip Sheet 7: One, Two and Paired Sample T-TestsДокумент6 страницMINITAB Tip Sheet 7: One, Two and Paired Sample T-TestsNonami AbicoОценок пока нет

- TOA DLSU Revdevt Lecture 1 - Intro To PFRS (2TAY1415)Документ12 страницTOA DLSU Revdevt Lecture 1 - Intro To PFRS (2TAY1415)Nonami AbicoОценок пока нет

- MINITAB Tip Sheet 10: Test of One or Two ProportionsДокумент4 страницыMINITAB Tip Sheet 10: Test of One or Two ProportionsNonami AbicoОценок пока нет

- The Book of Sand: Jorge Luis BorgesДокумент4 страницыThe Book of Sand: Jorge Luis BorgesNonami AbicoОценок пока нет

- Humalit c33 - MH - 800-930 - v405Документ3 страницыHumalit c33 - MH - 800-930 - v405Nonami AbicoОценок пока нет

- REVDEVT TOA Quizzer 1 Introduction To PFRS RevisedДокумент5 страницREVDEVT TOA Quizzer 1 Introduction To PFRS RevisedNonami AbicoОценок пока нет

- The Open Window - H. H. MunroДокумент3 страницыThe Open Window - H. H. MunroNonami AbicoОценок пока нет

- SUMMER - AY0910 - Final GradesДокумент2 страницыSUMMER - AY0910 - Final GradesNonami AbicoОценок пока нет

- Answer Key Q2 PDFДокумент6 страницAnswer Key Q2 PDFNonami AbicoОценок пока нет

- Petitioner,: Republic of The Philippin Court of Tax Appeal Quezon CitДокумент25 страницPetitioner,: Republic of The Philippin Court of Tax Appeal Quezon CitNonami AbicoОценок пока нет

- Deans List 1314 PDFДокумент76 страницDeans List 1314 PDFNonami AbicoОценок пока нет

- Answer Key Q1 PDFДокумент4 страницыAnswer Key Q1 PDFNonami AbicoОценок пока нет

- ACOFINДокумент1 страницаACOFINNonami AbicoОценок пока нет

- Straman Grades t1k3x BreakdownДокумент1 страницаStraman Grades t1k3x BreakdownNonami AbicoОценок пока нет

- Prepare BIR Income Tax Return For CHRISTMAS Corporation, A Domestic CorporationДокумент2 страницыPrepare BIR Income Tax Return For CHRISTMAS Corporation, A Domestic CorporationNonami AbicoОценок пока нет

- ALS LegTech - Moot Court Regulations - 2017 PDFДокумент9 страницALS LegTech - Moot Court Regulations - 2017 PDFNonami AbicoОценок пока нет

- 6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Документ3 страницы6 - Kiid - Uitf - Eq - Bpi Eq - Jun2015Nonami AbicoОценок пока нет

- IRC Codes and RegulationsДокумент34 страницыIRC Codes and RegulationsWilly BeaminОценок пока нет

- Challan No. ITNS 280Документ2 страницыChallan No. ITNS 280RAHUL AGARWALОценок пока нет

- GTPL Apr 2022Документ1 страницаGTPL Apr 2022Rutvik JaniОценок пока нет

- GST NotesДокумент361 страницаGST NotesDamodar SejpalОценок пока нет

- BookingTaxInvoice GOHTLDANDLWWHXHU PDFДокумент2 страницыBookingTaxInvoice GOHTLDANDLWWHXHU PDFIshaОценок пока нет

- 2003 Bosi-Giarda-Onofri OverviewBudgetPolicy WPДокумент22 страницы2003 Bosi-Giarda-Onofri OverviewBudgetPolicy WPAntonio Annicchiarico RenoОценок пока нет

- Tax 2 - Output VAT (Regular Sales) .PPTX Version 1Документ38 страницTax 2 - Output VAT (Regular Sales) .PPTX Version 1EmersonОценок пока нет

- Taranam Naveed W/O Naveed Ahmad Ch. 229-Blk-G Jowar Town: Web Generated BillДокумент1 страницаTaranam Naveed W/O Naveed Ahmad Ch. 229-Blk-G Jowar Town: Web Generated BillMuhammad Irfan ButtОценок пока нет

- Airbnb Travel Receipt RCBND8DMQM-2Документ1 страницаAirbnb Travel Receipt RCBND8DMQM-2Josiah Emmanuel CodoyОценок пока нет

- Chapter-8 Bbs 2 NDДокумент32 страницыChapter-8 Bbs 2 NDmagardiwakar11Оценок пока нет

- Invoice No.1197Документ2 страницыInvoice No.1197LL Lawwise Consultech India Pvt LtdОценок пока нет

- 208 Wise V MeerДокумент1 страница208 Wise V Meeragnes13Оценок пока нет

- City Treasury Office: Togan, Juliet PДокумент1 страницаCity Treasury Office: Togan, Juliet PJerik ElesioОценок пока нет

- Income From House PropertyДокумент26 страницIncome From House PropertySuyash Patwa100% (1)

- Ayslip For The Month of OV: No.184, Aveda Meta, Bangalore - 38Документ1 страницаAyslip For The Month of OV: No.184, Aveda Meta, Bangalore - 38HanumanthОценок пока нет

- Nutriarc: Tax InvoiceДокумент1 страницаNutriarc: Tax InvoiceARC FitnessОценок пока нет

- ABILITY TO PAY THEORY (1) FiscalДокумент12 страницABILITY TO PAY THEORY (1) FiscalSubbuLakshmi SivakumarОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Gopal SОценок пока нет

- Act 902Документ4 страницыAct 902BernetAnimОценок пока нет

- Stripe Tax Invoice I8FO4O6T-2021-11Документ1 страницаStripe Tax Invoice I8FO4O6T-2021-11medОценок пока нет

- Flipkart Clothes - 27823Документ1 страницаFlipkart Clothes - 27823raghuveer9303Оценок пока нет

- Classification of Taxes: A. Domestic CorporationДокумент5 страницClassification of Taxes: A. Domestic CorporationWenjunОценок пока нет

- Final Computaion For Government OfficeДокумент24 страницыFinal Computaion For Government OfficeGagan Deep PathakОценок пока нет

- Tips To Legally Avoid Paying BIR Penalties During Tax MappingДокумент2 страницыTips To Legally Avoid Paying BIR Penalties During Tax MappingLevi Lazareno EugenioОценок пока нет

- 2307 For EBS Private Individual Percenateg TaxДокумент4 страницы2307 For EBS Private Individual Percenateg TaxAGrace MercadoОценок пока нет

- Income TaxДокумент195 страницIncome TaxAleti NithishОценок пока нет

- Via Afrika Accounting Gr11 Study Guide-1Документ155 страницVia Afrika Accounting Gr11 Study Guide-1Tlotlang MoalosiОценок пока нет

- Sample IRSTax Return TranscriptДокумент6 страницSample IRSTax Return TranscriptnowayОценок пока нет

- ACC2054 Tutorial 4Документ3 страницыACC2054 Tutorial 4Euvan KumarОценок пока нет

- Simple Personal BudgetДокумент3 страницыSimple Personal BudgetFAKHA ANDTERОценок пока нет