Академический Документы

Профессиональный Документы

Культура Документы

Loan Amortization

Загружено:

Ayesha SidiqАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Loan Amortization

Загружено:

Ayesha SidiqАвторское право:

Доступные форматы

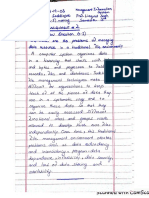

Let Suppose

Jan 1, 2020 Loan obtained from HBL = $6,000

Interest rate = 10% per annum

Loan is payable in 4 equal-annual-end-of-year instalments = $1893

Required: prepare a loan amortization schedule and prepare necessary journal entries to record the

amount of loan.

1893 X 4 = 7572- 6000 = 1572

(1)Instalment (2) Principal at the start Instalment (5) Principal at the

end (2-4)

(3) (4)

Interest Principal

Col 2 X (1-3)

10%

1893 6000 600 1293 4707

1893 4707 471 1422 3285

1893 3285 329 1564 1721

1893 1721 172 1721

Total 1572 6000

Date Description Post Debit Credit

Ref

1 Jan Cash 6000

2020 Loan payable 6000

31 Dec Interest expense 600

2020 Loan payable 1293

Cash 1893

31 Dec Interest expense 471

2021 Loan payable 1422

Cash 1893

31 Dec Interest expense 329

2022 Loan payable 1564

Cash 1893

31 Dec Interest expense 172

2023 Loan payable 1721

Cash 1893

As per explanation given in accounting text books the basic advantage of using the debt is tax

concession

For instance

Company A = using some combination of debt and equity to finance its assets i.e. Assets = Debt + Equity

When a company using fixed cost funds like debt then interest payment is fixed as well as mandatory

thus this company called financially levered firm.

Company B = using only equity to finance its assets i.e. Assets = Equity (So do not believe on fixed cost

funds called financially unlevered firm)

Company Company Difference

A B

(Levered) (Unlevered)

Sales 1,000,000 1,000,000

Cost of goods sold 300,000 300,000

Gross profit 700,000 700,000

Less operating expenses 200,000 200,000

Earnings before interest and 500,000 500,000

taxes

Less Interest expense 200,000 0

Earnings before taxes 300,000 500,000

Less: Taxes @40% 120,000 200,000 80,000*

Profit after taxes 180,000 300,000

*levered company is paying 80,000 less tax than tax paid by unlevered firm. This is called as tax

advantage of using debt.

Moreover, saving in tax lead to reduction in effective cost of debt. For example, if the amount of loan is

2,000,000 and the cost of loan is 10% per annum

Interest = Principal X Rate X Time = 2,0000,000 X 10/ 100 = 200,000

Effective cost of loan = Interest paid – Taxes saved / Principal = (200,000 – 80,000)/ 2000,000 = 0.06 x

100= 6%

So the actual cost bear by the firm is less due to tax-shield benefit on interest payment. So if the amount

of interest is 200,000 the tax saving is 200,000 x 40/100 = 80,000

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- MIS AssignmentДокумент3 страницыMIS AssignmentAyesha SidiqОценок пока нет

- BRM Term ReportДокумент12 страницBRM Term ReportAyesha SidiqОценок пока нет

- Entrepreneurship Assignment 4Документ3 страницыEntrepreneurship Assignment 4Ayesha SidiqОценок пока нет

- International Entrepreneur ASSIGNMENTДокумент3 страницыInternational Entrepreneur ASSIGNMENTAyesha SidiqОценок пока нет

- Problem 7.2Документ4 страницыProblem 7.2Ayesha SidiqОценок пока нет

- Institute of Management SciencesДокумент3 страницыInstitute of Management SciencesAyesha SidiqОценок пока нет

- Institute of Management Sciences: EntrepreneurshipДокумент3 страницыInstitute of Management Sciences: EntrepreneurshipAyesha SidiqОценок пока нет

- University of Central Punjab: Department of Management SciencesДокумент5 страницUniversity of Central Punjab: Department of Management SciencesAyesha SidiqОценок пока нет

- Advance Networkin1 (Repaired)Документ6 страницAdvance Networkin1 (Repaired)Ayesha SidiqОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Ra 8181Документ5 страницRa 8181Cons BaraguirОценок пока нет

- 1 - Solution 2013Документ10 страниц1 - Solution 2013Yamer YusufОценок пока нет

- Score Booster For All Bank Prelims Exams - Day 29Документ28 страницScore Booster For All Bank Prelims Exams - Day 29bofeniОценок пока нет

- ReportДокумент37 страницReportshahidibrarОценок пока нет

- Jamaican Citizenship by NaturalizationДокумент2 страницыJamaican Citizenship by Naturalizationtricia0910Оценок пока нет

- Part 1-FinObj MCQДокумент21 страницаPart 1-FinObj MCQdigitalbooksОценок пока нет

- Banking Memory AidДокумент10 страницBanking Memory AidEdz Votefornoymar Del RosarioОценок пока нет

- Residential Rent AgreementДокумент4 страницыResidential Rent AgreementArnisha DasОценок пока нет

- History of The Republic of The United States of America VOL 6 - John C Hamilton 1857Документ648 страницHistory of The Republic of The United States of America VOL 6 - John C Hamilton 1857WaterwindОценок пока нет

- 6Документ10 страниц6ampfcОценок пока нет

- A747 308 81 41 37195 - Rev 1Документ1 страницаA747 308 81 41 37195 - Rev 1Shaik AbdullaОценок пока нет

- Annual Equivalent MethodДокумент6 страницAnnual Equivalent Methodutcm77100% (1)

- Remic Guide As Explained To Investors - Easy To UnderstandДокумент7 страницRemic Guide As Explained To Investors - Easy To Understand83jjmackОценок пока нет

- Financial Accounting Information For Decisions 6th Edition Wild Solutions ManualДокумент44 страницыFinancial Accounting Information For Decisions 6th Edition Wild Solutions Manualfinnhuynhqvzp2c100% (23)

- Keys in Manacc Seatwork - BUDGETINGДокумент2 страницыKeys in Manacc Seatwork - BUDGETINGRoselie Barbin50% (2)

- Mexico Country Partnership FrameworkДокумент129 страницMexico Country Partnership FrameworkFungsional PenilaiОценок пока нет

- A 4Документ5 страницA 4Thùy NguyễnОценок пока нет

- Course Outline (Laws and Tax Management) PGDMДокумент2 страницыCourse Outline (Laws and Tax Management) PGDMAmritaОценок пока нет

- 9 Investing Secrets of Warren BuffettДокумент31 страница9 Investing Secrets of Warren BuffettTafadzwa96% (26)

- Presentation On Secondary MarketДокумент18 страницPresentation On Secondary MarketAnonymous fxdQxrОценок пока нет

- P1 Day1 RM2020Документ5 страницP1 Day1 RM2020P De GuzmanОценок пока нет

- Ch09.doc (2) Joint CostingДокумент37 страницCh09.doc (2) Joint CostingAnna CabreraОценок пока нет

- Diary of A FraudДокумент22 страницыDiary of A FraudAndreas AbrahamОценок пока нет

- Stop HuntingДокумент3 страницыStop HuntingManuel Mora100% (2)

- Revitalization of Shahjahanabad (Walled City of Delhi) : - Project Concept ProposalДокумент98 страницRevitalization of Shahjahanabad (Walled City of Delhi) : - Project Concept ProposalVismay WadiwalaОценок пока нет

- LIM GAW Vs CIRДокумент7 страницLIM GAW Vs CIRMarion JossetteОценок пока нет

- Financial Planning and ForecastingДокумент25 страницFinancial Planning and ForecastingAhsan100% (2)

- Feb 2021Документ2 страницыFeb 2021AjayОценок пока нет

- The Sales ProcessДокумент19 страницThe Sales ProcessHarold Dela FuenteОценок пока нет

- UK Student Visa PresentationДокумент44 страницыUK Student Visa PresentationNavjeet NayyarОценок пока нет