Академический Документы

Профессиональный Документы

Культура Документы

Stanley Gibbons Group PLC

Загружено:

Imran WarsiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Stanley Gibbons Group PLC

Загружено:

Imran WarsiАвторское право:

Доступные форматы

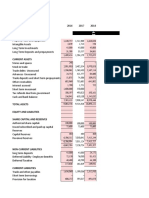

NAME OF COMPANY The Stanley Gibbons Group plc

BALANCE

Date SHEET

of Auditors ANALYSIS SPREAD SHEET

Certificate

Date of balance sheet 31/12/2006 31/12/2007 31/12/2008

(State if qualified) n/q n/q n/q

Currency (in GBP £000's)__________________)

QUICK ASSETS

Cash & bank 3,083 3,013 535

Prepayments 402 606

Other receivables 105 116

Debtors/Accounts Receivable/Bills Receivable 3,254 3,741 3,266

TOTAL QUICK ASSETS 6,337 7,261 4,523

Raw materials & consumables 29 38 33

Work-in-progress 83 80 80

finished goods & goods for resale 5,923 6,991 9,203

investment portfolios of stamps 2,429

TOTAL CURRENT ASSETS 12,372 14,370 16,268

CURRENT LIABILITIES

Trade & Other Payables 1,244 2,536 2,331

Bank loans & overdrafts

Current portion long term loan

Tax & Social Security 196 158 198

Corporation Tax 513 908 656

Derivative financial instruments

Provisions & charges

Accruals and deferred income 257 208 223

Other Current Liabilities 197 216 76

TOTAL CURRENT LIABILITIES 2,407 4,026 3,484

LIQUID SURPLUS/(DEFICIT) 9,965 10,344 12,784

QUICK ASSET SURPLUS/(DEFICIT) 3,930 3,235 1,039

FIXED AND OTHER ASSETS

Property & Leasehold Improvements 228 197 147

F&F + Vehicles 205 169 130

Reference Stamp Collection 601 612 624

Trade & other receivables 610 2,846 2,801

Deferred Income Tax Asset 25 71 21

Computer Software 83 37 64

1,752 3,932 3,787

TERM AND OTHER LIABILITIES

Potential contractual liability 171 300 517

Retirement Benefit Obligation 84 252 75

Defered tax liabilities 179 150 144

Provisions & charges 50 62

TERM & OTHER LIABILITIES 484 764 736

Minority Interests

TOTAL TERM & OTHER LIABILITES 484 764 736

NET TANGIBLE ASSETS - SURPLUS/(DEFIC 11,233 13,512 15,835

Financed by

Share Capital - Issued 251 251 252

Share Premium Account 5,148 5,148 5,195

Capital Reserves 215 220 220

Distributable Reserves 5,619 7,849 10,076

Shares to be issued 44 92

SHAREHOLDERS FUNDS - SURPLUS/(DEFIC 11,233 13,512 15,835

Check line 0 0 0

SUMMARY OF MOVEMENTS IN NTA's

Opening NTA's 9,012 11,233 13,512

PBIT / Operating Profit 3,570 4,361 3,610

Exceptional items

Investment Income and Interest Receivable 176 149 103

Profit Before Interest Paid 3,746 4,510 3,713

(Interest Paid) (2) (12)

Profit Before Tax (PBT) 3,746 4,508 3,701

(Taxation) (972) (1,125) (378)

'Attributable Profit/Loss After Tax (APAT) 2,774 3,383 3,323

(Dividends) (877) (1,068) (1,194)

Residual Profit/Loss 1,897 2,315 2,129

Asset revaluation 47

Taxation adjustment (76) 5

Shares Issued & sold 110 44 96

Pension Fund Adjustment 243 (85) 98

Share based payments (acquisitions/employees)

Sundry matters

NET VARIATION IN SURPLUS/(DEFICIT) 2,221 2,279 2,323

Closing NTA's 11,233 13,512 15,835

Checkline 0 0 0

KEY FIGURES AND RATIOS

Sales 16,684 20,191 19,394

Cost of Goods Sold 8,448 10,815 10,135

Gross Profit 8,236 9,376 9,259

Depreciation 127 197 172

Capital Employed #VALUE! #VALUE! #VALUE!

PROFITABILITY

Gross Profit Margin

(Gross Profit ÷ Sales x 100 49.4 46.4 47.7

Net Profit Margin

(Residual profit ÷ Sales x 100) 11.4 11.5 11.0

Return on Capital Employed

(Profit Before Interest & Tax÷

Capital Employed )x 100) #VALUE! #VALUE! #VALUE!

CONTROL/LIQUIDITY

Credit Given

(Debtors ÷ Sales x 360) 70 67 61

Credit Taken

(Creditors ÷ Cost of Goods Sold x 360) 53 84 83

Stock Turnover

(Stock ÷ Cost of Goods Sold x 360) 257 237 331

Current Ratio

(Current Assets ÷ Current Liabilities) 5.1 3.6 4.7

Liquid Ratio

(Quick Assets ÷ Current Liabilities) 2.6 1.8 1.3

GEARING AND SOLVENCY

Gross Gearing

(Total Borrowings ÷ Surplus) 0.00 0.00 0.00

Net Gearing

(Net Borrowings ÷ Surplus)

Gearing (Total Liabilties)

OTHER KEY FIGURES

Capital Expenditure (per cash flow statement) 145 95 122

Capital Commitments: Contracted 0 0 0

Authorised 0 0 0

Contingent Liabilities: Guarantess 0 0 107

Other 0 0

Leasing Obligations 180 192 193

Directors Remuneration 479 478 523

Вам также может понравиться

- Colgate ModelДокумент19 страницColgate ModelRajat Agarwal100% (1)

- Pet Kingdom IncДокумент20 страницPet Kingdom Incjessica67% (3)

- A. Change Analysis Apple Blossom Cologne Company Working Trial Balance - Balance Sheet 12-31-03 Per Audit 12-31-02 Per Books 12-31-03 Dollar ChangeДокумент6 страницA. Change Analysis Apple Blossom Cologne Company Working Trial Balance - Balance Sheet 12-31-03 Per Audit 12-31-02 Per Books 12-31-03 Dollar ChangeLintang UtomoОценок пока нет

- Sedania Innovator Berhad - 2Q2022Документ19 страницSedania Innovator Berhad - 2Q2022zul hakifОценок пока нет

- 4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014Документ8 страниц4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014mustiОценок пока нет

- Business ForecastingДокумент6 страницBusiness ForecastingRahat Mahmud ShoebОценок пока нет

- Financial Analysis Hewlett Packard Corporation 2007Документ24 страницыFinancial Analysis Hewlett Packard Corporation 2007SAMОценок пока нет

- Robinsons-1DY (Recovered)Документ19 страницRobinsons-1DY (Recovered)Dyrelle ReyesОценок пока нет

- H1 Consolidated FS 2023 FinalДокумент21 страницаH1 Consolidated FS 2023 FinalHussein BoffuОценок пока нет

- Announcement of Annual Results For The Year Ended 30 September 2021 2021120601652Документ23 страницыAnnouncement of Annual Results For The Year Ended 30 September 2021 2021120601652l chanОценок пока нет

- AGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKДокумент30 страницAGTL - 2009 Al Ghazi Tractors Limited OpenDoors - PKMubashar TОценок пока нет

- Solutions Worksheets - Chapt 3Документ35 страницSolutions Worksheets - Chapt 3Nam PhươngОценок пока нет

- 2006 BafДокумент3 страницы2006 BafGulraiz HanifОценок пока нет

- Ezz Steel Ratio Analysis - Fall21Документ10 страницEzz Steel Ratio Analysis - Fall21farahОценок пока нет

- Session 6Документ4 страницыSession 6samuel tabotОценок пока нет

- M4 Example 2 SDN BHD FSAДокумент38 страницM4 Example 2 SDN BHD FSAhanis nabilaОценок пока нет

- January-December. All Values PHP MillionsДокумент19 страницJanuary-December. All Values PHP MillionsJPIA Scholastica DLSPОценок пока нет

- FM204Документ8 страницFM204Vinoth KumarОценок пока нет

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Документ201 страницаAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- Case 9Документ11 страницCase 9Nguyễn Thanh PhongОценок пока нет

- Financial MStatements Ceres MGardening MCompanyДокумент11 страницFinancial MStatements Ceres MGardening MCompanyRodnix MablungОценок пока нет

- Balance Sheet of Maple Leaf: AssetsДокумент12 страницBalance Sheet of Maple Leaf: Assets01290101002675Оценок пока нет

- 2006 2007 June 2008Документ18 страниц2006 2007 June 2008Rishabh GigrasОценок пока нет

- Acct 401 Tutorial Set FiveДокумент13 страницAcct 401 Tutorial Set FiveStudy GirlОценок пока нет

- Income Statement: Year Ended 31 December 2005Документ19 страницIncome Statement: Year Ended 31 December 2005phckuwaitОценок пока нет

- KrenДокумент2 страницыKrenMaradewiОценок пока нет

- Cashflow Analysis - Beta - GammaДокумент14 страницCashflow Analysis - Beta - Gammashahin selkarОценок пока нет

- 2011 MAS Annual 2Документ9 страниц2011 MAS Annual 2Thaw ZinОценок пока нет

- Ceres SpreadsheetДокумент1 страницаCeres SpreadsheetShannan RichardsОценок пока нет

- United Bank Limited and Its Subsidiary CompaniesДокумент15 страницUnited Bank Limited and Its Subsidiary Companieszaighum sultanОценок пока нет

- BSIS Tesla 2017 2021Документ10 страницBSIS Tesla 2017 2021Minh PhuongОценок пока нет

- 3 - CokeДокумент30 страниц3 - CokePranali SanasОценок пока нет

- Anchor Compa CommonДокумент14 страницAnchor Compa CommonCY ParkОценок пока нет

- Cash Flow SolvedДокумент3 страницыCash Flow SolvedRahul BindrooОценок пока нет

- Assignment FSAДокумент15 страницAssignment FSAJaveria KhanОценок пока нет

- The Boeing Company and Subsidiaries Consolidated Statements of Cash FlowsДокумент1 страницаThe Boeing Company and Subsidiaries Consolidated Statements of Cash Flowsdivineyang05Оценок пока нет

- Balance SheetДокумент6 страницBalance SheetayeshnaveedОценок пока нет

- Hade PDFДокумент2 страницыHade PDFMaradewiОценок пока нет

- Consolidated Statements of Cash Flows (In Millions) : Year Ended December 31, 2014 2015 2016Документ11 страницConsolidated Statements of Cash Flows (In Millions) : Year Ended December 31, 2014 2015 2016Ritu SinghОценок пока нет

- HE 4 Questions - Updated-1Документ13 страницHE 4 Questions - Updated-1halelz69Оценок пока нет

- Tarea Semana 3 Excel FBДокумент14 страницTarea Semana 3 Excel FBNoely EspinalОценок пока нет

- Taliworks - Q4FY23Документ31 страницаTaliworks - Q4FY23seeme55runОценок пока нет

- ABC Limited Income Statement: Particulars Amounts 2016 2017 2018Документ2 страницыABC Limited Income Statement: Particulars Amounts 2016 2017 2018Rezaul KarimОценок пока нет

- Industry Segment of Bajaj CompanyДокумент4 страницыIndustry Segment of Bajaj CompanysantunusorenОценок пока нет

- Starbucks DataДокумент32 страницыStarbucks DatabrainsphereОценок пока нет

- Income Statement - PEPSICOДокумент11 страницIncome Statement - PEPSICOAdriana MartinezОценок пока нет

- Lotus 2017Документ14 страницLotus 2017teingnidetioОценок пока нет

- Marsh MC Lennan 2021-79-83-1-4Документ4 страницыMarsh MC Lennan 2021-79-83-1-4socialsim07Оценок пока нет

- Marsh MC Lennan 2021-79-83Документ5 страницMarsh MC Lennan 2021-79-83socialsim07Оценок пока нет

- PAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedДокумент60 страницPAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedMuhammad SamiОценок пока нет

- CF - Example1Документ8 страницCF - Example1BSHELTON8Оценок пока нет

- Assignment # 4Документ9 страницAssignment # 4Abdul BasitОценок пока нет

- ABC Cement FM (Final)Документ24 страницыABC Cement FM (Final)Muhammad Ismail (Father Name:Abdul Rahman)Оценок пока нет

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Документ2 страницыReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariОценок пока нет

- Finance For Non-Finance: Ratios AppleДокумент12 страницFinance For Non-Finance: Ratios AppleAvinash GanesanОценок пока нет

- Balance Sheet (December 31, 2008)Документ6 страницBalance Sheet (December 31, 2008)anon_14459Оценок пока нет

- Nib Q4 2012Документ77 страницNib Q4 2012MUHAMMAD IQBALОценок пока нет

- MOD Technical Proposal 1.0Документ23 страницыMOD Technical Proposal 1.0Scott TigerОценок пока нет

- Netflix Inc.: Balance SheetДокумент16 страницNetflix Inc.: Balance SheetLorena JaupiОценок пока нет

- 4019 XLS EngДокумент13 страниц4019 XLS EngAnonymous 1997Оценок пока нет

- Corporate Finance Core Principles and Applications 3rd Edition Ross Test BankДокумент65 страницCorporate Finance Core Principles and Applications 3rd Edition Ross Test BankChristopherDyerkczqw100% (20)

- Break Even PointДокумент11 страницBreak Even Pointrahi4ever86% (7)

- IFRS 16 Leases and Its Impact On Company'sДокумент19 страницIFRS 16 Leases and Its Impact On Company'sCamila Gonçalves WernerОценок пока нет

- Salon de Elegance FinalДокумент35 страницSalon de Elegance FinalRon Benlheo OpolintoОценок пока нет

- Temenos T24 IA: User GuideДокумент70 страницTemenos T24 IA: User GuideVincentОценок пока нет

- Afar 01 - Partnership Formation and LiquidationДокумент6 страницAfar 01 - Partnership Formation and LiquidationMarie GonzalesОценок пока нет

- Dokumen - Tips - Chapter 4 Financial Planning and ForecastingДокумент28 страницDokumen - Tips - Chapter 4 Financial Planning and Forecastingadinda nurfitriyanaОценок пока нет

- AFM Formula SheetДокумент15 страницAFM Formula Sheetganesh bhaiОценок пока нет

- Basic Acco FinalsДокумент10 страницBasic Acco FinalsZek DannugОценок пока нет

- Rosewood Hotels & Resorts: Customer Lifetime Value (CLTV) Analysis InputsДокумент3 страницыRosewood Hotels & Resorts: Customer Lifetime Value (CLTV) Analysis InputsVishal GoyalОценок пока нет

- Delta CaseДокумент5 страницDelta Caseday9dreamerОценок пока нет

- Apex Corporation Manufactures Eighteenth Century Classical StylДокумент1 страницаApex Corporation Manufactures Eighteenth Century Classical StylAmit Pandey0% (1)

- Capital vs. Revenue Income/ExpenditureДокумент9 страницCapital vs. Revenue Income/ExpenditureViren DeshpandeОценок пока нет

- FIN 370 Final Exam (29/30 Correct Answers)Документ13 страницFIN 370 Final Exam (29/30 Correct Answers)KyleWalkeer0% (1)

- IAS 29 IllustrationДокумент28 страницIAS 29 Illustrationapi-3828505Оценок пока нет

- The Reporting Entity and The Consolidation of Less-than-Wholly-Owned Subsidiaries With No DifferentialДокумент69 страницThe Reporting Entity and The Consolidation of Less-than-Wholly-Owned Subsidiaries With No DifferentialsresaОценок пока нет

- Absorption and Marginal Costing Multiple Choice Questions: The Difference Between Selling Price and Variable CostДокумент3 страницыAbsorption and Marginal Costing Multiple Choice Questions: The Difference Between Selling Price and Variable CostSuresh SubramaniОценок пока нет

- Mids-Paper Numerical Questions SolutionДокумент16 страницMids-Paper Numerical Questions SolutionBurhan Ahmed MayoОценок пока нет

- Handout For Financial AccountingДокумент9 страницHandout For Financial AccountingBlack ScoopОценок пока нет

- Other Comprehensive IncomeДокумент5 страницOther Comprehensive Incometikki0219Оценок пока нет

- The Key Audit MatterДокумент7 страницThe Key Audit MatterShayal ChandОценок пока нет

- Fin Accounting 3-A1-12-2022Документ4 страницыFin Accounting 3-A1-12-2022Benjamin Banda100% (1)

- Chapter 10 Management of Translation Exposure Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsДокумент18 страницChapter 10 Management of Translation Exposure Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsOyeleye TofunmiОценок пока нет

- Lbo Case StudyДокумент6 страницLbo Case StudyRishabh MishraОценок пока нет

- Multiple Choice - JOCДокумент14 страницMultiple Choice - JOCMuriel MahanludОценок пока нет

- Answer Key Midterm Exam Cost Acounting With Solutions PART IIДокумент7 страницAnswer Key Midterm Exam Cost Acounting With Solutions PART IINoel Carpio100% (1)

- About NPV and CashflowДокумент6 страницAbout NPV and CashflowawaiskbОценок пока нет

- Test Bank Advanced Accounting 3e by Jeter 05 ChapterДокумент22 страницыTest Bank Advanced Accounting 3e by Jeter 05 Chapterkevin galandeОценок пока нет

- Intangible AssetsДокумент10 страницIntangible AssetsMiguel Angelo JoseОценок пока нет