Академический Документы

Профессиональный Документы

Культура Документы

Raya University Financial Accounting Module

Загружено:

Fantay0 оценок0% нашли этот документ полезным (0 голосов)

141 просмотров4 страницыОригинальное название

Financial Accounting Course Outline

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

141 просмотров4 страницыRaya University Financial Accounting Module

Загружено:

FantayАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

Raya University

College of Business and Economics

Department of Accounting and Finance

Module M8. Financial Accounting and Reporting

Number/Title

Objective of the Upon the successful completion of this module, students should be able to:

module understand financial accounting concepts and IFRS as they apply for

external financial reporting purpose

understand the nature of financial statements and the inherent limitations

in their preparation and use

explain the application of international financial reporting standards in the

recognition, measurement, and reporting of assets, liabilities,

shareholders’ equity, and lease operation

Prepare statement of cash flows based on complex business transactions

Analyze and correct the effects of accounting changes and errors

Total ETCTS and ETCTS: 12

Credit Hours of Credit Hours: 8

the module

Courses of the Module

Course Number Course Name Cr. Hr CP/ETCTS

AcFn 2081 Financial Accounting I 4 6

AcFn 2082 Financial Accounting II 4 6

Course Information

Course Number AcFn 2081

Course Title Financial Accounting I

Degree Program BA Degree in Accounting and Finance

Module Financial accounting and reporting

Module

Coordinator

Lecturer Fantaye A.

ETCTS Credits 6

Contact Hours 4

(per week)

Course Objectives The course is designed to give students a thorough understanding of the

& Competences to framework, concepts and techniques of accounting that the students will need to

be Acquired proceed with upper level courses in financial accounting.

Upon the successful completion of this course, the students will be expected to:

have an understanding of financial accounting concepts and IFRS as they

apply to the topics covered in this course;

Demonstrate an awareness of the substance of and the standard-setting

process for international accounting standards;

Perform the accounting functions of analyzing, recording and reporting as

accomplished by the accounting cycle and the preparation of the primary

financial statements

Be able to explain and discuss the fundamentals of financial reporting

Understand the nature of financial statements and the inherent limitations in

their preparation and use

Develop professional judgment in analyzing accounting issues and

recommending accounting policies;

Develop skill in applying accounting standards to situations and problems;

Demonstrate the recognition, measurement, and reporting of cash,

receivables, and inventories

Course Description This course presupposes the students’ equipped with knowledge for basic level of

Accounting principles. In this course, emphasis is made on accounting theory of

financial statements, recognition criteria, measurement, also reporting

requirements of the elements of financial statements are covered. Treatment of

income, expense and the current assets, with respect to the above, form the central

objective of this course.

WEEKS Course Contents Reading

1. Development of Accounting Principles and

Professional Practice

1.1. The environment of Accounting

1.2. Conceptual framework (FASB Vs IFRS)

1.3. Objectives of financial reporting

1.4. Qualitative characteristics of accounting

information

1.5. Elements of financial statements of business

enterprise

1.6. Generally accepted accounting principles.

1.7. Cash flow and income measurement

2. Summary of the Accounting process

2.1. Identifying and journalizing transactions and other

events

2.2. Posting transactions and other events

2.3. Trial Balance Preparation

2.4. Adjusting entries

2.5. Preparation of financial statements

2.6. Closing entries

2.7. Post-closing trial balance preparation

2.8. Reversing entries

3. Income Statement and Related Information

3.1. Usefulness and Limitation of the income statement

3.2. Elements and formats of the income statement

3.3. Retained earnings statement

3.4. Comprehensive income

3.5. Revenue recognition principle

3.6. Revenue recognition before and after delivery

4. Balance Sheet and Statement of Cash Flows

4.1. Usefulness and Limitation of Statement of Balance

Sheet

4.2.Classification in the Statement of Balance Sheet

4.3.Formats of Statement of Balance Sheet

4.4.Purpose of statement of cash flows

4.5.Content and formats of statement of cash flows

4.6.Overview of the preparation of statement of cash

flows

4.7. Usefulness of statement of cash flows

4.8. Financial Statements and Additional Information

5. Cash and receivables

5.1. Nature of cash and Cash control?

5.2. Reporting cash

5.3. Summary of cash-related items

5.4. Recognition and Valuation of accounts receivables

5.5. Recognition and Valuation of notes receivables

5.6. Special Issues Related to receivables

6. Inventories

6.1. Nature and classification of inventories

6.2. Physical goods and costs included in inventory

6.3. Cost flow assumptions

6.4. LIFO, LIFO reserve, LIFO liquidation and Birr-

Value LIFO

6.5. Basis for selection of inventory methods

6.6. LCM and other special valuation methods

6.7. Inventory estimation methods

Teaching & The teaching and learning methodology include lecturing, discussions, problem

Learning solving, and analysis. Take-home assignment will be given at the end of each

Methods/strategy chapter for submission within a week. Solution to the assignments will be given

once assignments are collected. Cases with local relevance will also be given for

each chapter for group of students to present in a class room. The full and active

participation of students is highly encouraged.

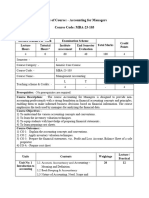

Assessment/Evalu The evaluation scheme will be as follows:

ation Test Test Individual Group Final Total

1 2 Assignment Assignment

15% 15% 10% 10% 50% 100%

Work load in hours Tota ECT

Hours Required

l Hrs S

Self-

Lecture Assessme Tutori Studie Assignm Advisi

s Lab nts als s ent ng

64 - 22 12 64 - - 162 6

Roles of the He/she will come to the class regularly on time and deliver the lecture in a well-

Instructor organized manner. Besides, at the end of each class he/she gives reading

assignment for the next class. He/she will make sure that proper assessments are

given. He/she is also responsible to give feedback for each assessment.

Roles of the students The success of this course depends on the students’ individual and collective

contribution to the class discussions. Students are expected to participate

voluntarily, or will be called upon, to contribute to set exercises and problems.

Students are also expected to read the assigned readings and prepare the cases

before each class so that they could contribute effectively to class discussions.

Students must attempt assignments by their own. Proficiency in this course comes

from individual knowledge and understanding. Copying the works of others is

considered as serious offence and leads to disciplinary actions.

Text and reference Text Book:

books Kieso, D., Weygandt, J., & Warfield, T. (2013). Intermediate

Accounting, 15th Edition: J. Wiley & Sons, Inc.

Reference Books:

1. Annand, D., & Dauderis, H. (2014). Introduction to Financial

Accounting, Second Edition: Valley Educational Services Ltd.

2. Arnold, G. & Kyle, S. (2018). Intermediate financial accounting,

Athabasca University.

3. Hermanson, H., Edwards, J., and Maher, W. (2011). Accounting

Principles: A Business Perspective, Financial Accounting:

Irwin/Mcgraw-Hill.

4. Lunt, H. (2006). Fundamentals of Financial Accounting, first edition:

Elsevier Ltd.

5. Warren, C., Reeve J., & Duchac, J. (2014). Financial and Managerial

Accounting, 12th edition: Cengage Learning.

6. Weygandt, J., Kimmel, P., & Kieso, D. (2014). Financial accounting, 9th

edition: Wiley & Sons, Inc.

Вам также может понравиться

- Fundamentalof Accounting I Course OutlineДокумент3 страницыFundamentalof Accounting I Course OutlineAbdi Mucee TubeОценок пока нет

- Fundamentalof Accounting I Course OutlineДокумент3 страницыFundamentalof Accounting I Course OutlineAbdi Mucee Tube100% (1)

- Acct-2201 Principles of Accounting IДокумент3 страницыAcct-2201 Principles of Accounting IOfgaha AlemuОценок пока нет

- Fundamentals of Accounting-I New Course OutlineДокумент3 страницыFundamentals of Accounting-I New Course OutlineGedion100% (2)

- Course Syllabus-Fundamentals of Accounting IДокумент4 страницыCourse Syllabus-Fundamentals of Accounting ITewodrose Teklehawariat BelayhunОценок пока нет

- Accounting For Managers: Syllabus and Learning OutcomesДокумент3 страницыAccounting For Managers: Syllabus and Learning OutcomesNishant SinghОценок пока нет

- Coures Out Line Principle Accounting -I and IIДокумент4 страницыCoures Out Line Principle Accounting -I and IIAbraham RayaОценок пока нет

- Fundamentals of Accounting I Course OutlineДокумент2 страницыFundamentals of Accounting I Course OutlineDuba JarsoОценок пока нет

- FIN42A - Corporate Finance ModuleДокумент6 страницFIN42A - Corporate Finance ModuleVũ Thị Lan HươngОценок пока нет

- Intermediate Financial Accounting I&II Course OutlineДокумент6 страницIntermediate Financial Accounting I&II Course OutlineTalila Sida100% (2)

- Intermediate Financial Accounting IДокумент4 страницыIntermediate Financial Accounting Isolomon asfawОценок пока нет

- RPS Akuntansi Menengah IIДокумент18 страницRPS Akuntansi Menengah IIAnyaaОценок пока нет

- Depar't of Accounting & Finance: Recognition, Measurement, and Disclosure ConceptsДокумент3 страницыDepar't of Accounting & Finance: Recognition, Measurement, and Disclosure ConceptsHistory and EventОценок пока нет

- b47b7c26 Syllabus CF1 CLCДокумент8 страницb47b7c26 Syllabus CF1 CLCKhánh LyОценок пока нет

- Fin 1 Module Midterm CoverageДокумент67 страницFin 1 Module Midterm CoverageRomea NuevaОценок пока нет

- Financial Accounting 1 Course OutlineДокумент3 страницыFinancial Accounting 1 Course OutlineAbdi Mucee TubeОценок пока нет

- Advanced Financial Accounting and Reporting Course OutlineДокумент3 страницыAdvanced Financial Accounting and Reporting Course Outlineselman AregaОценок пока нет

- Accounting for Managers SyllabusДокумент2 страницыAccounting for Managers SyllabusBibek BasnetОценок пока нет

- Course Outline Intermediate and Advanced Accounting1 Revised 2Документ5 страницCourse Outline Intermediate and Advanced Accounting1 Revised 2Amde GetuОценок пока нет

- Financial ReportingДокумент3 страницыFinancial Reportinggembel mlithiОценок пока нет

- Accounting standards and conceptual frameworkДокумент11 страницAccounting standards and conceptual frameworkAnas Aloyodan60% (5)

- Diploma in International Financial Reporting (Dipifr) : Syllabus and Study GuideДокумент14 страницDiploma in International Financial Reporting (Dipifr) : Syllabus and Study GuideAnil Kumar AkОценок пока нет

- Accounting Theory ConceptsДокумент5 страницAccounting Theory Conceptseny setiawatiОценок пока нет

- Course Outline AIS-112Документ4 страницыCourse Outline AIS-112Gas-B Angelica TuyayОценок пока нет

- DipIFR D24-J25 Syllabus and Study Guide - FinalДокумент15 страницDipIFR D24-J25 Syllabus and Study Guide - FinalFrans R. Calderon MendozaОценок пока нет

- OSU MBA Financial and Managerial Accounting Course OutlineДокумент2 страницыOSU MBA Financial and Managerial Accounting Course OutlineGemechis taОценок пока нет

- Financial Reporting Subject OutlineДокумент6 страницFinancial Reporting Subject OutlineAhmed ThoyyibОценок пока нет

- Accounting and Financial Analysis.Документ3 страницыAccounting and Financial Analysis.athirah binti shazaliОценок пока нет

- ACCT 100-Principles of Financial Accounting - Fall 2018-19Документ7 страницACCT 100-Principles of Financial Accounting - Fall 2018-19Qudsia AbbasОценок пока нет

- Principle Course Outline AGRICALTUREДокумент7 страницPrinciple Course Outline AGRICALTUREHussen Abdulkadir100% (1)

- FAR TOS - QUALI Aug 2022Документ5 страницFAR TOS - QUALI Aug 2022Reghis AtienzaОценок пока нет

- FA FFA S24-J25 Syllabus and Study Guide - FinalДокумент18 страницFA FFA S24-J25 Syllabus and Study Guide - FinalCaglar CaferОценок пока нет

- Financial Accounting Theory and Reporting IДокумент16 страницFinancial Accounting Theory and Reporting IKendrick PajarinОценок пока нет

- 1520245287Документ3 страницы1520245287merrylyn vivianОценок пока нет

- ACF 411AC421 - International Accounting Course OutlineДокумент3 страницыACF 411AC421 - International Accounting Course OutlineSimphiwe DlaminiОценок пока нет

- Col For ModuleДокумент26 страницCol For ModuleIfaОценок пока нет

- XFINACR3Документ6 страницXFINACR3Jaffar Macabayao MarandacanОценок пока нет

- AC201 Intermediate Accounting IntroДокумент2 страницыAC201 Intermediate Accounting IntroCosta Nehemia MunisiОценок пока нет

- DCP Financial AccountingДокумент9 страницDCP Financial AccountingIntekhab AslamОценок пока нет

- Lesson Plan LatestДокумент4 страницыLesson Plan LatestNurul AsykinОценок пока нет

- Fall2015-Financial Reporting and AnalysisДокумент8 страницFall2015-Financial Reporting and AnalysisASIMLIBОценок пока нет

- MBA 631rift Valley OutlineДокумент4 страницыMBA 631rift Valley OutlineTatekia DanielОценок пока нет

- Detailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Документ20 страницDetailed Teaching Syllabus (DTS) and Instructor Guide (Ig'S)Blecemie MonteraОценок пока нет

- Course Out Line TalilaДокумент5 страницCourse Out Line TalilatalilaОценок пока нет

- Online - Accounting and Financial ManagementДокумент2 страницыOnline - Accounting and Financial ManagementPranav KompallyОценок пока нет

- Financial Reporting Subject Outline 2Документ6 страницFinancial Reporting Subject Outline 2Gurinder SinghОценок пока нет

- Advanced Financial Accounting TopicsДокумент8 страницAdvanced Financial Accounting TopicsAndualem ZenebeОценок пока нет

- MBA-23-103 Management AccountingДокумент4 страницыMBA-23-103 Management Accountinggadekarganesh977Оценок пока нет

- INS3001 - IFRS Financial Accounting 1Документ6 страницINS3001 - IFRS Financial Accounting 1JF FОценок пока нет

- 28899cpt Fa SM CP InipageДокумент14 страниц28899cpt Fa SM CP InipageDinesh Kumar0% (1)

- Chapter 1Документ90 страницChapter 1Ankit Deshmukh100% (1)

- BFN715Документ244 страницыBFN715Misbah MirzaОценок пока нет

- School of Business & Economics Department of Accounting & FinanceДокумент4 страницыSchool of Business & Economics Department of Accounting & FinanceMd JonaidОценок пока нет

- ACCT 215 - Introductory Financial Accounting I: Course DescriptionДокумент5 страницACCT 215 - Introductory Financial Accounting I: Course DescriptionJayden FrosterОценок пока нет

- Dipifr SG Dec22 Jun23Документ14 страницDipifr SG Dec22 Jun23PAPPU SWAROOP MAHADEV VU21MGMT0300006Оценок пока нет

- Acct 221 Principles of Accounting 1 OutlineДокумент3 страницыAcct 221 Principles of Accounting 1 OutlineKwabena GyaduОценок пока нет

- 511 Ac & Finance For ManagersДокумент3 страницы511 Ac & Finance For ManagersYonasОценок пока нет

- 01 CHED COURSE OUTLINE Acctg 15AДокумент3 страницы01 CHED COURSE OUTLINE Acctg 15APat TabujaraОценок пока нет

- Complete Set 3Документ1 страницаComplete Set 3Kylie TarnateОценок пока нет

- Logistic RegressionДокумент11 страницLogistic RegressionFantayОценок пока нет

- Cash vs Accrual AccountingДокумент11 страницCash vs Accrual AccountingAbdirahmanОценок пока нет

- Worksheet For Financial Acc. IДокумент5 страницWorksheet For Financial Acc. IFantay100% (1)

- Unit 7Документ29 страницUnit 7FantayОценок пока нет

- Notes 08Документ11 страницNotes 08FantayОценок пока нет

- Financial Accounting 1 Unit 10Документ21 страницаFinancial Accounting 1 Unit 10chuchuОценок пока нет

- PD2004 9Документ26 страницPD2004 9FantayОценок пока нет

- Ec408 Topic 2 SlidesДокумент36 страницEc408 Topic 2 SlidesFantayОценок пока нет

- Unit 11Документ30 страницUnit 11FantayОценок пока нет

- CONTENTSДокумент4 страницыCONTENTSFantayОценок пока нет

- Unit 2Документ25 страницUnit 2FantayОценок пока нет

- SPM Slides 10Документ28 страницSPM Slides 10FantayОценок пока нет

- Job Order CostingДокумент21 страницаJob Order CostingFantayОценок пока нет

- Analysis and Impact of LeverageДокумент88 страницAnalysis and Impact of LeveragePines MacapagalОценок пока нет

- CH 01 Revised Financial Management by IM PandeyДокумент28 страницCH 01 Revised Financial Management by IM PandeyAnjan KumarОценок пока нет

- Portfolio ManagementДокумент125 страницPortfolio Managementsathishm85Оценок пока нет

- Distinguishing Characteristics of Governmental and NotДокумент9 страницDistinguishing Characteristics of Governmental and NotFantayОценок пока нет

- Introduction To Accounting IДокумент30 страницIntroduction To Accounting IRiz KhanОценок пока нет

- Business Research Methods 9th Edition ZiДокумент26 страницBusiness Research Methods 9th Edition ZiFantayОценок пока нет

- Less Than Wholly Owned REPORTДокумент40 страницLess Than Wholly Owned REPORTrichelledelgadoОценок пока нет

- RESMETH1Документ26 страницRESMETH1vedashreeОценок пока нет

- Special Income ItemsДокумент11 страницSpecial Income ItemsFantayОценок пока нет

- Needles ch06Документ36 страницNeedles ch06Catherine Joy VasayaОценок пока нет

- Teknik PersampelanДокумент31 страницаTeknik PersampelanzackquanОценок пока нет

- Descriptions of ICДокумент2 страницыDescriptions of ICFantayОценок пока нет

- Res MethДокумент35 страницRes MethFantayОценок пока нет

- IllustrationДокумент3 страницыIllustrationFantayОценок пока нет

- Accounting Methods For BCДокумент7 страницAccounting Methods For BCFantayОценок пока нет

- Information Often ConfirmedДокумент1 страницаInformation Often ConfirmedFantayОценок пока нет

- Test Bank For Entrepreneurial Finance 6th Edition Kindle EditionДокумент11 страницTest Bank For Entrepreneurial Finance 6th Edition Kindle Editioncharlesbatessartmycdwj100% (29)

- Royal Bank of ScotlandДокумент34 страницыRoyal Bank of ScotlandPrakarti AgarwalОценок пока нет

- Credit Process TATA Motors FinanceДокумент27 страницCredit Process TATA Motors FinanceAnkanksha Sharda100% (1)

- DIY Discharge Debt GuideДокумент4 страницыDIY Discharge Debt GuideAnthony VinsonОценок пока нет

- Estatement 2023.01Документ11 страницEstatement 2023.01pese022Оценок пока нет

- Babasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceДокумент8 страницBabasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceShivani ShuklaОценок пока нет

- MeezanДокумент6 страницMeezanZeeshan_Akram01Оценок пока нет

- Claims Application FormДокумент2 страницыClaims Application FormGerman AcevedoОценок пока нет

- Evolution of Indian Financial SystemДокумент2 страницыEvolution of Indian Financial SystemvivekОценок пока нет

- Problem On AdmissionДокумент2 страницыProblem On AdmissionSam Rae LimОценок пока нет

- Business FinanceДокумент22 страницыBusiness FinanceMoonprideloverОценок пока нет

- A Development Bank Is A Polygonal Development Finance Institution Devoted To Improving The Social and Monetary Development of Its Associate NationsДокумент2 страницыA Development Bank Is A Polygonal Development Finance Institution Devoted To Improving The Social and Monetary Development of Its Associate NationsAjay SolankiОценок пока нет

- Understanding invoices and statementsДокумент12 страницUnderstanding invoices and statementsRonainda AritonangОценок пока нет

- Shifting BranchДокумент39 страницShifting Branchaniket_kulal29Оценок пока нет

- Hippocrates Health Institute, Inc.Документ2 страницыHippocrates Health Institute, Inc.bg giangОценок пока нет

- Module 1 - Non-Financial LiabilitiesДокумент12 страницModule 1 - Non-Financial LiabilitiesKim EllaОценок пока нет

- LIC AAO 2010 Solved Question PaperДокумент9 страницLIC AAO 2010 Solved Question PapersurajОценок пока нет

- Cash and Cash Equivalents: Answer: CДокумент142 страницыCash and Cash Equivalents: Answer: CGarp BarrocaОценок пока нет

- Standard Charge Sheet SummaryДокумент26 страницStandard Charge Sheet SummaryAnonymous ameerОценок пока нет

- Presented Below Is Information Pertaining To Delsnyder Specialty Foods AДокумент1 страницаPresented Below Is Information Pertaining To Delsnyder Specialty Foods ALet's Talk With HassanОценок пока нет

- Financial Statement Analysis Discussion MaterialДокумент3 страницыFinancial Statement Analysis Discussion MaterialMargin Pason RanjoОценок пока нет

- I. True or False (40 PTS) II. Stem Options (50 Points)Документ4 страницыI. True or False (40 PTS) II. Stem Options (50 Points)first unaОценок пока нет

- Journal Entries in The Books of RG Company: Date ParticularsДокумент6 страницJournal Entries in The Books of RG Company: Date ParticularsRohit GoyalОценок пока нет

- Ch. 4 LoansandannuitiesДокумент40 страницCh. 4 LoansandannuitiesayaanОценок пока нет

- Apply Bank Loan Less 40 CharactersДокумент2 страницыApply Bank Loan Less 40 CharactersCaro Valbuena100% (1)

- Group 6Документ80 страницGroup 6Jewelyn CioconОценок пока нет

- 19510100000753Документ2 страницы19510100000753Afshan MojahidОценок пока нет

- IAS 16 Property, Plant and EquipmentДокумент7 страницIAS 16 Property, Plant and EquipmentEric Agyenim-BoatengОценок пока нет

- Mashreq BankДокумент4 страницыMashreq BankBD Mahamud50% (2)

- A1c019112 Jeremy Christ Manuel AklДокумент21 страницаA1c019112 Jeremy Christ Manuel AklJeremy Christ ManuelОценок пока нет