Академический Документы

Профессиональный Документы

Культура Документы

Performance of Butler Lumber:: Year 1989

Загружено:

Talha Siddiqui0 оценок0% нашли этот документ полезным (0 голосов)

14 просмотров2 страницыОригинальное название

Butler_cs 1.docx

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

14 просмотров2 страницыPerformance of Butler Lumber:: Year 1989

Загружено:

Talha SiddiquiАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

PERFORMANCE OF BUTLER LUMBER:

The performance of the company is analyzed by calculating several different factors

that is Ratio analysis, Common Size Analysis, Liquidity analysis from cash flows and

ratios both, and Du Pont analysis.All the calculation has been provided in the given

EXHIBIT. The first step in the ratio is to identify the:

Financial Strength:

The quick ratio of the company in the year 1988 is 1.5 as compare to the year

1989 having 1.2 quick ratios and the ratio of in 1989 and 1990 is equal to 1.2. The

first quarter of 1991 shows further deterioration of the quick ratio to 0.9. The quick

ratio identifies the situation of the company with respect to the payment of its

liabilities against the cash which quickly convertible which means the inventory

needs to be excluded from that. The quick ratio shows a downward position the

industrial benchmark for this ratio is 1. So, in the year 1988 to 1990 Butler Lumber

is meeting the standards for industry but adverse results in the 1 st qtr of 1991.The

current ratio is also in a downward trend, declining from 1.8 in 1988 to 1.4 in the

1st quarter of 1991. This describes the situation that company will be short of cash

in the coming years if the problem remains unsolved.

The debt to total equity ratio is currently quite low 11% in 1988 and further

declined to 4% in 1st quarter of 1991. Company is more relying on equity which is

also not positive because it will increase their risk due to increase in cost of capital.

The optimal structure should include at least 40% debt. The interest cover is

also lowering down from 3.8 to 2.1 in the 1 st quarter of 1991. This means that

despite of low debts its capability to pay the interest is in declining phase which

means their profits are in declining phase.

Management Effectiveness:

The management effectiveness has been evaluated by using the return on asset

and equity formula. The analysis of these figures shows that management is

looking competent and is able to manage the company. The return on asset

and equity both are inclining. The return on asset has been inclined from 8% in

1988 to 9%, while the return on equity is moved from 11% to 13%.

The above results doesn’t include their performance of 1 st quarter of 1991 as it is

still in progress so evaluating these figure in terms of return might not be suitable.

Profitability:

The Gross Margin and operating of the company is looking stable that is good point

for the company in terms of required rate of return from the shareholder’s

perspective. However, steps need to be taken in order further grow their revenue

as they heavily relying on the equity currently, then it may be possible shareholder’s

will ask for the greater returns in the future. The operating margin is 3% in all 3

years and also in 1st quarter of 1991 and gross profit margin around 28% in all 3

years. The only concern they should have is to increase the net profit percentage

which is quite too low (3%) and this means their growth in sales as compare to the

operational cost is lower.

Efficiency:

The efficiency ratios for the 3 years showing acceptable results except inventory

turnover which is due the storing of excess inventory or either the demand of there

is currently limited. The receivable turnover is increasing but the increase of

payable turnover is greater than the receivable turnover which is a positive point as

the company is delaying his payments more than the receipts of sales. The increase

in both the turnover is also not very much positive. This must be stable so that both

customers and vendors make satisfactory comments towards company’s

performance. The industry average for the receivable turnover is net 30 days and

45 days for payable turnover. As per these figures both efficiency ratios shows

negative results. Receivable turnover is in between 35 to 40 days while Payable

turnover is in between 45 to 50 days.

Setting up fake worker failed: "Cannot load script at: https://www.thecasesolutions.com/wp-

content/cache/autoptimize/js/autoptimize_22969f2f65e9a6aa5f971a13abbc00aa.worker.js".

Overall Performance:

The overall performance of Butler Lumber with respect to stability and growth is

not very much effective as the company is currently heavily relying on equity which

has increased the overall risk and put pressure on the management which may

result in the creative accounting by the management of the company. The net profit

margin is also too low which has restricted their growth. The efficiency of inventory

management is also very inefficient. Despite of their net credit 30 terms for sales

the receivable turn shows greater value than this. The position of the regarding the

current aspect is normal but from the future perspective, the management needs

to be more efficient to provide company with sufficient growth

opportunities..............................

Вам также может понравиться

- Maria Abriel C. Buena Advance II: About IQ OptionДокумент4 страницыMaria Abriel C. Buena Advance II: About IQ Optionlady chase50% (2)

- Bank Is An Agent, Trustee, Executor, Administrator For CustomersДокумент5 страницBank Is An Agent, Trustee, Executor, Administrator For Customersgazi faisalОценок пока нет

- Financial Analysis P&GДокумент10 страницFinancial Analysis P&Gsayko88Оценок пока нет

- Analysis of The ManzanaДокумент24 страницыAnalysis of The ManzanaAnalogic Rome100% (1)

- Butler Lumber Case DiscussionДокумент3 страницыButler Lumber Case DiscussionJayzie Li100% (1)

- Company Valuation and Financial Analysis of Power Root (M) Sdn BhdДокумент35 страницCompany Valuation and Financial Analysis of Power Root (M) Sdn BhdKar EngОценок пока нет

- Assignment Next PLCДокумент16 страницAssignment Next PLCJames Jane50% (2)

- Star River - Sample ReportДокумент15 страницStar River - Sample ReportMD LeeОценок пока нет

- Case Analysis NATOДокумент5 страницCase Analysis NATOTalha SiddiquiОценок пока нет

- Butler Lumber Final First DraftДокумент12 страницButler Lumber Final First DraftAdit Swarup100% (2)

- Financial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosДокумент15 страницFinancial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosdjmondieОценок пока нет

- Estimating Funds Requirements Butler Lumber CompanyДокумент18 страницEstimating Funds Requirements Butler Lumber CompanyNabab Shirajuddoula71% (7)

- Costco Wholesale Corporation Financial AnalysisДокумент14 страницCostco Wholesale Corporation Financial Analysisdejong100% (1)

- INVESTMENT AVENUES BLACK BOOK UpgradedДокумент71 страницаINVESTMENT AVENUES BLACK BOOK UpgradedJack DawsonОценок пока нет

- Star River Assignment-ReportДокумент15 страницStar River Assignment-ReportBlessing Simons33% (3)

- Problem 9-1, 2 & 3Документ3 страницыProblem 9-1, 2 & 3Micah April SabularseОценок пока нет

- Final Project - FA Assignment Financial Analysis of VoltasДокумент26 страницFinal Project - FA Assignment Financial Analysis of VoltasHarvey100% (2)

- Nism 5 A - Mutual Fund Exam - Practice Test 1Документ24 страницыNism 5 A - Mutual Fund Exam - Practice Test 1Aditi Sawant100% (5)

- Butler Lumber Company: Following Questions Are Answered in This Case Study SolutionДокумент3 страницыButler Lumber Company: Following Questions Are Answered in This Case Study SolutionTalha SiddiquiОценок пока нет

- Audit Program Liabilities Against AssetsДокумент11 страницAudit Program Liabilities Against AssetsRoemi Rivera Robedizo100% (3)

- Analysis of Annual Report - UnileverДокумент7 страницAnalysis of Annual Report - UnileverUmair KhizarОценок пока нет

- Auditors Report and Financial Analysis of ITCДокумент28 страницAuditors Report and Financial Analysis of ITCNeeraj BhartiОценок пока нет

- Financial Analysis of Reliance Steel and Aluminium Co. LTDДокумент4 страницыFinancial Analysis of Reliance Steel and Aluminium Co. LTDROHIT SETHIОценок пока нет

- Credit Policy For Tam EnterprisesДокумент3 страницыCredit Policy For Tam Enterprises04Ronita MitraОценок пока нет

- NPV, IRR and Financial Evaluation for Waste Collection ContractДокумент9 страницNPV, IRR and Financial Evaluation for Waste Collection ContractTwafik MoОценок пока нет

- Cases in Finance - FIN 200Документ3 страницыCases in Finance - FIN 200avegaОценок пока нет

- Ratio Analysis of Renata Limited PPPДокумент32 страницыRatio Analysis of Renata Limited PPPmdnabab0% (1)

- Term Paper of Reliance Weaving LTDДокумент12 страницTerm Paper of Reliance Weaving LTDadeelasghar091Оценок пока нет

- International Standard On Auditing: Option .1 Cross Sectional Analysis - Liquidity Ratios:-Current RatioДокумент3 страницыInternational Standard On Auditing: Option .1 Cross Sectional Analysis - Liquidity Ratios:-Current RatioikramunirОценок пока нет

- FRA - IV (Tarsons Products)Документ9 страницFRA - IV (Tarsons Products)RR AnalystОценок пока нет

- Ratios NoteДокумент24 страницыRatios Noteamit singhОценок пока нет

- 277 Financial Statement As Management ToolДокумент8 страниц277 Financial Statement As Management ToolkandriantoОценок пока нет

- Finance Henry BootДокумент19 страницFinance Henry BootHassanОценок пока нет

- Ratio AnalysisДокумент13 страницRatio AnalysisBharatsinh SarvaiyaОценок пока нет

- Ratio AnaalysisДокумент10 страницRatio AnaalysisMark K. EapenОценок пока нет

- Engro Foods Engro Foods Engro FoodsДокумент37 страницEngro Foods Engro Foods Engro FoodsAli haiderОценок пока нет

- Final Report On Attock - IbfДокумент25 страницFinal Report On Attock - IbfSanam Aamir0% (1)

- Financial ManagementДокумент6 страницFinancial ManagementNavinYattiОценок пока нет

- Chapter 26 - Analysis of Accounts (EDITED)Документ17 страницChapter 26 - Analysis of Accounts (EDITED)Amour PartekaОценок пока нет

- Analysis of Financial Statement: AFS ProjectДокумент11 страницAnalysis of Financial Statement: AFS ProjectErum AnwerОценок пока нет

- Financial Management (1) (8818)Документ22 страницыFinancial Management (1) (8818)georgeОценок пока нет

- Finance Coursework FinalДокумент7 страницFinance Coursework FinalmattОценок пока нет

- Below Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial StatementsДокумент14 страницBelow Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial StatementsQueen ValleОценок пока нет

- IOCL AnalysisДокумент3 страницыIOCL Analysisprit6924Оценок пока нет

- WCM AnalysisДокумент7 страницWCM AnalysisUtsab SenОценок пока нет

- Financial Statement Analysis ReportДокумент30 страницFinancial Statement Analysis ReportMariyam LiaqatОценок пока нет

- Eng Kah Corporation BerhadДокумент5 страницEng Kah Corporation BerhadNoel KlОценок пока нет

- Financial Statement Analysis: Text Book-Chapter 12Документ13 страницFinancial Statement Analysis: Text Book-Chapter 12anwesh pradhanОценок пока нет

- MANAGERIAL ACCOUNTING INSTRUCTIONAL MATERIAL Chapter 4Документ11 страницMANAGERIAL ACCOUNTING INSTRUCTIONAL MATERIAL Chapter 4gleem.laurelОценок пока нет

- DATE: 12 June 2011: Financial Performance Report For MPLCДокумент20 страницDATE: 12 June 2011: Financial Performance Report For MPLCVinay RamamurthyОценок пока нет

- Profitability AnalysisДокумент9 страницProfitability AnalysisAnkit TyagiОценок пока нет

- Financial Management and Control - AssignmentДокумент7 страницFinancial Management and Control - AssignmentSabahat BashirОценок пока нет

- "Financial Analysis of Kilburn Chemicals": Case Study OnДокумент20 страниц"Financial Analysis of Kilburn Chemicals": Case Study Onshraddha mehtaОценок пока нет

- Documents Tips Pgbm01-Finance-Management PDFДокумент25 страницDocuments Tips Pgbm01-Finance-Management PDFJonathan LimОценок пока нет

- Cognizant Accounts. FinalДокумент9 страницCognizant Accounts. FinalkrunalОценок пока нет

- PIDILITE INDUSTRIES FINANCIAL ANALYSISДокумент2 страницыPIDILITE INDUSTRIES FINANCIAL ANALYSISronaldweasley6Оценок пока нет

- Financial Analysis Report Shell Cluster 7531Документ4 страницыFinancial Analysis Report Shell Cluster 7531Darren MavadyОценок пока нет

- Analysis of Financial Statements: QuestionsДокумент44 страницыAnalysis of Financial Statements: QuestionsgeubrinariaОценок пока нет

- A Project Report On Ratio Analysis at BemulДокумент94 страницыA Project Report On Ratio Analysis at BemulBabasab Patil (Karrisatte)Оценок пока нет

- FRA Report: GMR Infrastructure: Submitted To: Submitted byДокумент12 страницFRA Report: GMR Infrastructure: Submitted To: Submitted bySunil KumarОценок пока нет

- Financial Statement Analysis With Ratio Analysis On: Glenmark Pharmaceutical LimitedДокумент41 страницаFinancial Statement Analysis With Ratio Analysis On: Glenmark Pharmaceutical LimitedGovindraj PrabhuОценок пока нет

- Vladi FAF Financial ReportДокумент4 страницыVladi FAF Financial ReportVladi DimitrovОценок пока нет

- Profit standards for residential contractorsДокумент4 страницыProfit standards for residential contractorsKhai08 DenОценок пока нет

- Tunku Puteri Intan Safinaz School of Accountancy Bkal3063 Integrated Case Study FIRST SEMESTER 2020/2021 (A201)Документ14 страницTunku Puteri Intan Safinaz School of Accountancy Bkal3063 Integrated Case Study FIRST SEMESTER 2020/2021 (A201)Aisyah ArifinОценок пока нет

- Profitability Turnover RatiosДокумент32 страницыProfitability Turnover RatiosAnushka JindalОценок пока нет

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Документ40 страницStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamОценок пока нет

- ROIC ChangedДокумент2 страницыROIC ChangedTalha SiddiquiОценок пока нет

- Can Lenovo Regain Past GloryДокумент22 страницыCan Lenovo Regain Past GloryTalha SiddiquiОценок пока нет

- Dyna Tronic SДокумент1 страницаDyna Tronic SPolina TsviyovichОценок пока нет

- Eureka Fair InstructionsДокумент2 страницыEureka Fair InstructionsTalha SiddiquiОценок пока нет

- AT&T vs Verizon Case StudyДокумент9 страницAT&T vs Verizon Case Studyroyal lathОценок пока нет

- TOI-SU20-SAT-EPEP - Prototype Video & Website LinksДокумент1 страницаTOI-SU20-SAT-EPEP - Prototype Video & Website LinksTalha SiddiquiОценок пока нет

- Toi Su20 Sat EpepДокумент5 страницToi Su20 Sat EpepTalha SiddiquiОценок пока нет

- Toi Su20 Sat Epep Term ReportДокумент17 страницToi Su20 Sat Epep Term ReportTalha SiddiquiОценок пока нет

- Dyna Tronic SДокумент1 страницаDyna Tronic SPolina TsviyovichОценок пока нет

- Toi Su20 Sat EpepДокумент5 страницToi Su20 Sat EpepTalha SiddiquiОценок пока нет

- Toi Su20 Sat Epep Term ReportДокумент17 страницToi Su20 Sat Epep Term ReportTalha SiddiquiОценок пока нет

- Toi Su20 Sat Epep Term ReportДокумент17 страницToi Su20 Sat Epep Term ReportTalha SiddiquiОценок пока нет

- Toi Su20 Sat EpepДокумент5 страницToi Su20 Sat EpepTalha SiddiquiОценок пока нет

- Toi Su20 Sat Epep ProposalДокумент7 страницToi Su20 Sat Epep ProposalTalha SiddiquiОценок пока нет

- Aasan Solutions - Home Based Services AppДокумент11 страницAasan Solutions - Home Based Services AppTalha SiddiquiОценок пока нет

- TOI-SU20-SAT-EPEP - Prototype Video & Website LinksДокумент1 страницаTOI-SU20-SAT-EPEP - Prototype Video & Website LinksTalha SiddiquiОценок пока нет

- Competitive Advantage - Revisited Michael PorterДокумент20 страницCompetitive Advantage - Revisited Michael PorterVidya NatawidhaОценок пока нет

- Porter DiamondДокумент8 страницPorter DiamondBayu PrabowoОценок пока нет

- Blueoceanstrategy 100403005918 Phpapp02Документ78 страницBlueoceanstrategy 100403005918 Phpapp02Md Najmus SaquibОценок пока нет

- Butler Lumber Case SolutionДокумент4 страницыButler Lumber Case SolutionMohammad Owais ShaikhОценок пока нет

- Competitive StrategyДокумент9 страницCompetitive StrategyTalha SiddiquiОценок пока нет

- Description: Other Data: Cash Dividend Declared & Paid Rs 20,000Документ6 страницDescription: Other Data: Cash Dividend Declared & Paid Rs 20,000Talha SiddiquiОценок пока нет

- SFAD Week 1Документ4 страницыSFAD Week 1Talha SiddiquiОценок пока нет

- SFAD Week 2Документ10 страницSFAD Week 2Talha SiddiquiОценок пока нет

- Butler Lumber Company Case Solution CasesolДокумент3 страницыButler Lumber Company Case Solution CasesolTalha SiddiquiОценок пока нет

- Malelang, Roseanne Pearl, B. BSA 2-4Документ9 страницMalelang, Roseanne Pearl, B. BSA 2-4RoseanneОценок пока нет

- Bank Reconmciliation ProcessДокумент13 страницBank Reconmciliation ProcessRachelleОценок пока нет

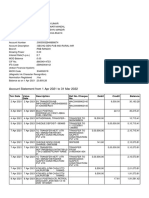

- Account Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент14 страницAccount Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRishav AnandОценок пока нет

- Haskayne Resume Template 1Документ1 страницаHaskayne Resume Template 1Mako SmithОценок пока нет

- E00B0 Credit Risk Management - Axis BankДокумент55 страницE00B0 Credit Risk Management - Axis BankwebstdsnrОценок пока нет

- RockAuto order confirmation for Paul JenkinsДокумент2 страницыRockAuto order confirmation for Paul JenkinsPaul JenkinsОценок пока нет

- Acctg 101 Module 1Документ22 страницыAcctg 101 Module 1Heart SebОценок пока нет

- Studio Renovations: Barbados Community College Division of Fine Arts - Music MathsДокумент10 страницStudio Renovations: Barbados Community College Division of Fine Arts - Music MathsShanice JohnОценок пока нет

- Lembar Kerja UD. Mudah HasilДокумент41 страницаLembar Kerja UD. Mudah HasilRoni NОценок пока нет

- Advacc 1 Answer Key Set AДокумент3 страницыAdvacc 1 Answer Key Set AA BОценок пока нет

- Sample SALN Form Excel FormatДокумент2 страницыSample SALN Form Excel FormatExtreme Fact TVОценок пока нет

- Valuation of SecuritiesДокумент7 страницValuation of SecuritiesEmmanuelОценок пока нет

- Transaction History Reportwellnxtcorporwellnxt Corporation14062019210657Документ2 страницыTransaction History Reportwellnxtcorporwellnxt Corporation14062019210657roda mansuetoОценок пока нет

- NFL Annual Report 2019 Compressed PDFДокумент130 страницNFL Annual Report 2019 Compressed PDFZUBAIRОценок пока нет

- 6409-Article Text-22422-1-10-20120709 PDFДокумент10 страниц6409-Article Text-22422-1-10-20120709 PDFAmosh ShresthaОценок пока нет

- Role of Banking Sector in Indian EconomyДокумент6 страницRole of Banking Sector in Indian EconomySandeep TiwariОценок пока нет

- Act 171 5.1-1 Midterm Exam 2021 NoneДокумент3 страницыAct 171 5.1-1 Midterm Exam 2021 NoneAngeliePanerioGonzagaОценок пока нет

- Transaction: Marathon Futurex, A & B Wing, 12th Floor, N. M. Joshi Marg, Lower Parel, Mumbai - 400013 1800-22-3345Документ21 страницаTransaction: Marathon Futurex, A & B Wing, 12th Floor, N. M. Joshi Marg, Lower Parel, Mumbai - 400013 1800-22-3345Nishant MeghwalОценок пока нет

- Receipt: Received From (Client Name) AmountДокумент1 страницаReceipt: Received From (Client Name) AmountHexel PratamaОценок пока нет

- Form2a Utkarshbnk NRДокумент8 страницForm2a Utkarshbnk NRzalak jintanwalaОценок пока нет

- Chawla Parties Upto 14 Jan-19Документ104 страницыChawla Parties Upto 14 Jan-19mudassar nazarОценок пока нет

- Accounting Cycle Journal Entries With Chart of AccountsДокумент4 страницыAccounting Cycle Journal Entries With Chart of Accountskutsara0300Оценок пока нет

- 8 - Cash Budget FormatДокумент4 страницы8 - Cash Budget Formatnur alia raihanaОценок пока нет

- HDB Enterprise Business Loans - HDBДокумент4 страницыHDB Enterprise Business Loans - HDBhermandeep5Оценок пока нет